January 2025

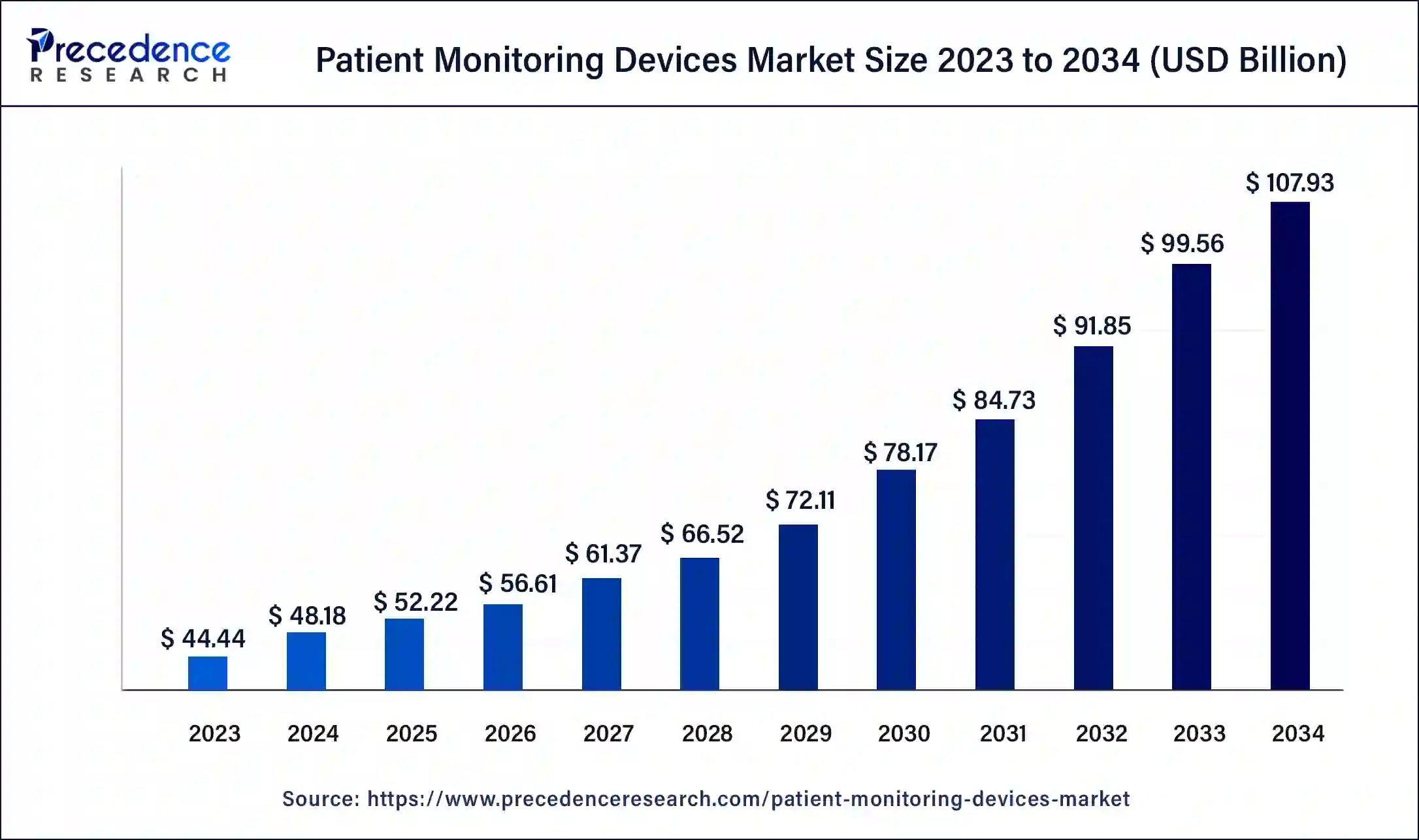

The global patient monitoring devices market size is estimated at USD 52.22 billion in 2025 and is predicted to reach around USD 107.93 billion by 2034, accelerating at a CAGR of 8.40% from 2025 to 2034. The North America patient monitoring devices market size surpassed USD 20.72 billion in 2024 and is expanding at a CAGR of 8.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global patient monitoring devices market size was estimated at USD 48.18 billion in 2024 and is predicted to increase from USD 52.22 billion in 2025 to approximately USD 107.93 billion by 2034, expanding at a CAGR of 8.40% from 2025 to 2034.

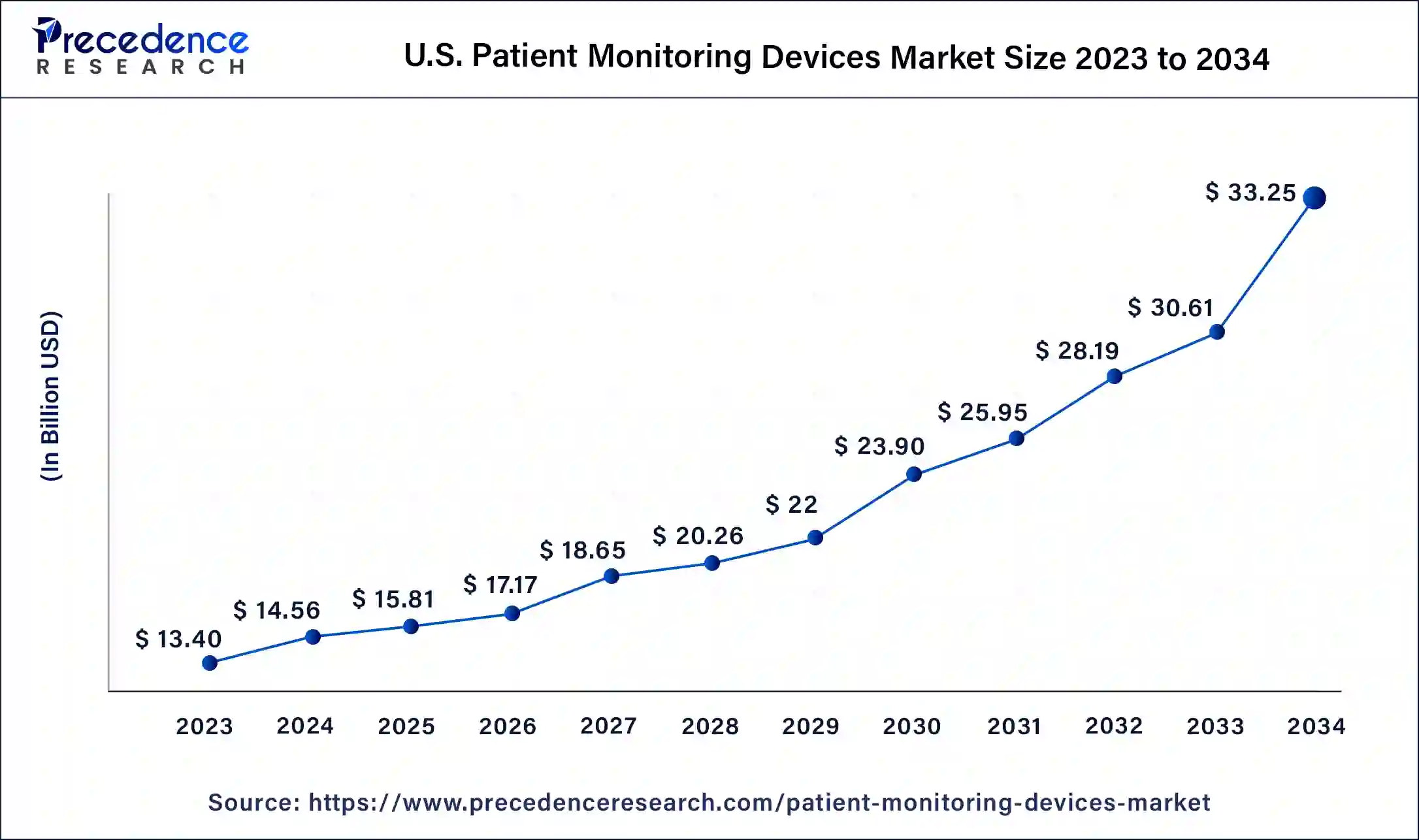

The U.S. patient monitoring devices market size was estimated at USD 14.56 billion in 2024 and is predicted to be worth around USD 33.25 billion by 2034, at a CAGR of 8.61% from 2025 to 2034.

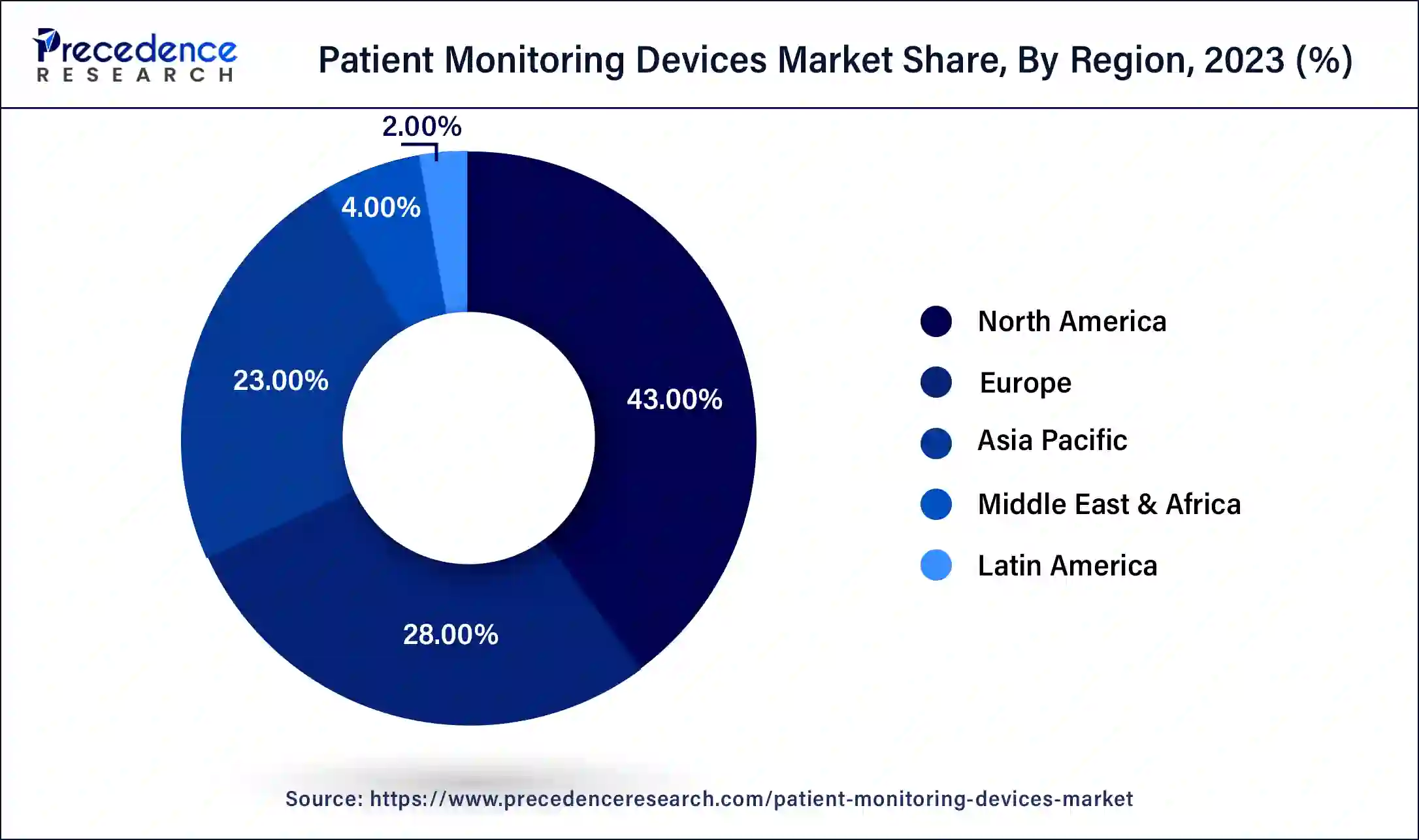

North America is expected to lead the market accounting for largest market share of more than 43% in 2024. The increasing research and developmental activities in this region to develop advanced patient monitoring devices is anticipated to boost the growth of the market. Moreover, the rising infectious disease in the region and the presence major market players in this region will fuel the growth of market.

U.S. Patient Monitoring Devices Market Trends:

The country has seen significant growth in the market, the growth I driven by various drivers due to the growing prevalence of chronic diseases and continuous monitoring of parameters in the aging population, which increases the demand for monitoring devices. Technological advancements for easy handling and patient control system solutions have contributed to the growth of the market and also helped in the expansion of the market in the country.

Asia Pacific region is also estimated to grow significantly over the forecast period due to the adoption of poor lifestyle such as improper diet, physical inactiveness, high sugar consumption and many others that leads to generation of chronic disease such as obesity, diabetics and others among the people in this region. The chronic disease needs regular monitoring in order to prevent them from becoming fatal for the patients. This attribute is estimated to drive the growth of the market in this region.

India Patient Monitoring Devices Market Trends:

India is experiencing steady growth in the market, driven by rapid growth in the medical devices sector, with a growing population and growing prevalence of chronic diseases, which require regular monitoring. The change in lifestyle preferences and change in eating habits have led to unhealthy norms, which lead to diseases, and this fuels the growth of the market and contributes to the expansion of the market in the country.

The surge in demand for the patient monitoring devices to be used residentially is the primary factor that is expected to drive the growth of the Patient Monitoring Devices Market. Furthermore, the increasing cardiovascular disease across the globe where constant body monitoring is required by the patients is anticipated to fuel the growth of the market.

During the COVID-19 outbreak, the demand for the patient monitoring devices increased in the local hospitals and the healthcare facilities. To meet this demand the manufacturers of the patient monitoring devices fastened the production process for these equipment’s and this attribute is expected to boost the growth of the patient monitoring devices Market. Additionally, the surge in chronic diseases such as cancer, diabetics, cardiac disorders, neurological conditions and others across the world is yet another factor that is anticipated to fuel the growth of the market.

With rapid technological developments, the patient monitoring devices manufacturing companies are innovating new equipment’s that can accurately measure different body parameters. This factor is expected to drive the growth of the market. Furthermore, increasing demand for therapeutic and monitoring devices across the globe is expected to boost the growth of the market.

The surge in older population across the globe is a major factor that is fueling the growth of the patient monitoring devices market. The older generation people usually suffer from chronic diseases that need constant monitoring of their health condition and this boost the demand for the market. Also, the development of technologically advanced patient monitoring devices such as ventilators, nebulizers, oxygen monitors and many othersprovides comfort to the patients and therefore is anticipated to drive the growth of the market.

| Report Coverage | Details |

| Market Size in 2024 | USD 48.18 Billion |

| Market Size in 2025 | USD 52.22 Billion |

| Market Size by 2034 | USD 107.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.40% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Which segment of product type dominated the patient monitoring devices market in 2024?

The cardiac monitoring devices also accounted for a significant revenue share of over 20.1% in 2023. This is due to an increase in cardiovascular disease across the world, leading to stroke and heart attack, and other related diseases. Furthermore, technological developments, Government initiatives, regional expansion, and the presence of major market players contributed to the growth and expansion of the market.

Based on Product, the market is divided into blood glucose monitoring systems, cardiac monitoring devices, multi-parameter monitoring devices, respiratory monitoring devices, temperature monitoring devices, hemodynamic/pressure monitoring devices, fetal & neonatal monitoring devices, neuromonitoring devices, weight monitoring devices and other. The blood glucose monitoring device has contributed significantly towards the growth of the patient monitoring devices owing the rapid increase in diabetics where the constant monitoring of blood sugar level is required.

The cardiac monitoring devices also amounted for a significant revenue share of over 20.1% in 2023 due to increase in cardiovascular disease across the world leading to stroke and heart attack. Furthermore, technological developments, Government initiative, regional expansion and the presence of major market players are estimated to boost the growth of the market.

How did the hospital segment dominate the patient monitoring devices market in 2024?

The hospital segment is estimated to contribute the largest market share of about 52% in 2024. The surge in demand for better quality medical services and effective diagnosis of the disease in hospitals has fueled the growth of the market. The growing prevalence of chronic diseases has also contributed to the growth of the market.

On the basis on End-use, the patient monitoring devices market is categorized into hospitals, ambulatory surgery centers, home care settings and other. The hospital segment is estimate to contribute the largest markets share of about 52% in 2024. The surge in demand for availing better quality medical service and effective diagnosis of the disease in the hospitals has fueledthe growth of the market.

Furthermore, the home care segment is also witnessing a significant demand for the monitoring devices owing to a increase in chronic disease that needs regular monitoring of the patients. This entire factor is expected to drive the growth of the market.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

May 2025

May 2025