January 2025

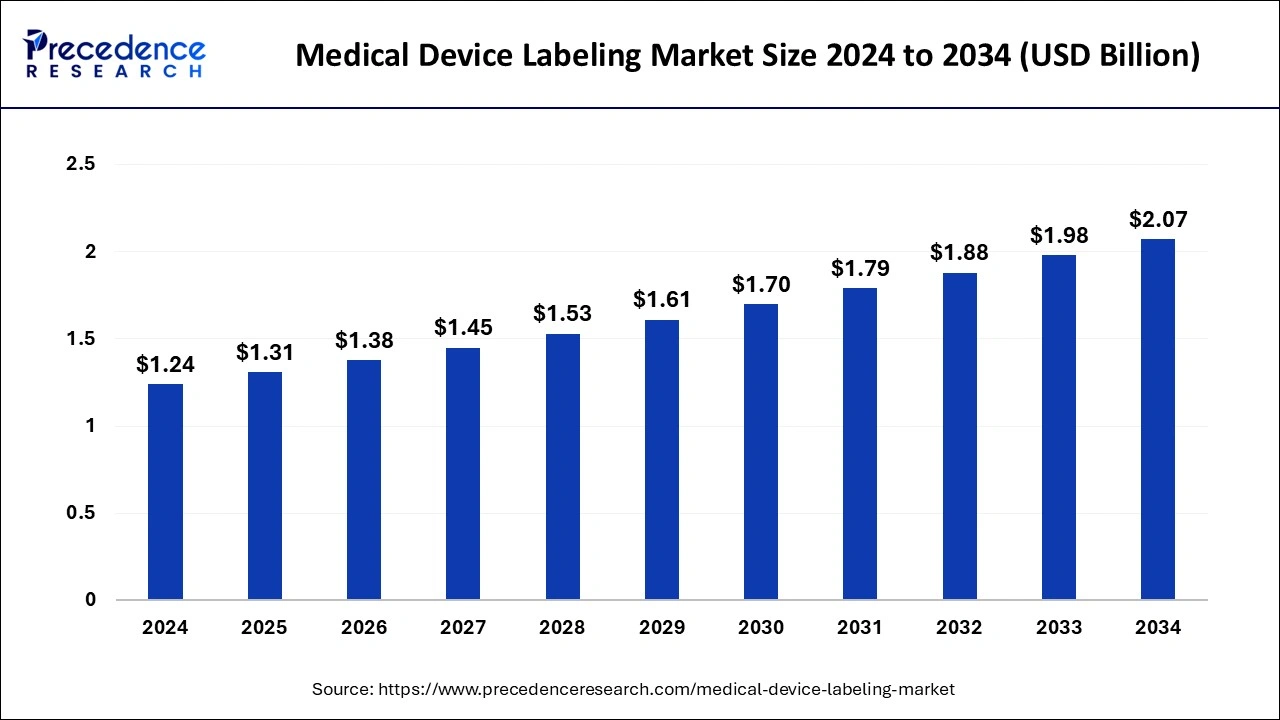

The global medical device labeling market size is calculated at USD 1.31 billion in 2025 and is forecasted to reach around USD 2.07 billion by 2034, accelerating at a CAGR of 5.26% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical device labeling market size was estimated at USD 1.24 billion in 2024 and is predicted to increase from USD 1.31 billion in 2025 to approximately USD 2.07 billion by 2034, expanding at a CAGR of 5.26% from 2025 to 2034. Increasing healthcare expenditure along with stringent regulations to increase the authenticity of healthcare devices are the major factors driving the global market growth.

The medical device labeling market has witnessed significant growth in the past years and is expected to reach its highest due to its necessity and awareness of people before purchasing any kind of medical device. Manufacturers in the medical device market use labeling to describe general and overall information about the products as it enhances authenticity and trustworthiness between manufacturers and consumers. Also, it will be beneficial to brands to showcase a certification with U.S. FDA approval on top.

Medical device labeling has been a crucial part of the labeling market as it involves every step of medical device production and distribution stages. A medical device should have passed through three stages before reaching the end user, which is testing, documentation, and quality control tests in order to properly manage a volume of manufactured devices and their authenticity. Labeling further propels the market by providing information about product status, such as approved, non-approved, and recalled devices. This segregation is the key factor that creates lucrative opportunities in the healthcare sector, particularly for the medical device labeling market.

Some prominent and notable changes have been updated in recent years. Medical device providers use a UDI label, which is a unique alphanumeric or numeric code consisting of two major parts- production identifier PI and device identifier DI. Despite this, stringent regulations of the U.S. FDA about compliance with labeling for medical devices might be needed to rework or production loss, which, in turn, is likely to become a hindrance to the growth of the medical device labeling market on a wider scale.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.31 Billion |

| Market Size by 2034 | USD 2.07 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.26% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Label Type, Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Frequent drug discoveries

Rising demand for medical devices, which also help a consumer as a personal protective device, has been a trend for the last few decades owing to the increasing health expenditure as a result of awareness towards preventive health measures, specifically within developing nations and developed regions around the globe. Moreover, the frequency of surgical procedures and diagnostics tests has a rapid surge in the healthcare market, fuelling inpatient admissions and surgical interventions, thus increasing a rapid turnover in the medical device labeling market.

Compliance with regulations such as documentation, quality control, and testing is required as the efficiency of medical devices holds a prominent position in improving patient outcomes and aiding in lowering costs in the healthcare sector. All such steps are essential and, thus, need a labeling unit due to the rise in the number of drug discoveries, and their production will likely augment the growth of the medical device labeling market.

The U.S. FDA continuously updates its code of regulations for printed labels of medical products so that to avoid a false introduction or any kind of scam in the healthcare industry. Medical labelling thus, needs to be upgrade with the time. Medical labelling provides a proper public guideline to the patients, healthcare providers and industrial authorities to execute the smoother operation within medical device labelling market.

Complex regulations

The primary restraining factor for the medical device labeling market is complex rules and regulations, which are upgraded every year by the U.S. FDA to provide safe products for consumers without any misleading information. Despite such noble intent, the regulation becomes complicated to follow by industry players in the healthcare market. For instance, there are different industry standards to comply with regulations like ISO 13485, which states that every manufacturer of medical devices must follow industry and consumer regulations standards set by the U.S. FDA involving production, design, storage method, and mode of distribution of medical devices to mitigate the risk of misleading data about the products.

Medical devices come with a specific purpose, and thus, labeling has become a crucial part of them to avoid mishandling of the products. A label should show every detail to the consumer, such as brand name, unique device identifier UDI, device identifier, storage and handling method, production date and expiry date, etc. Manufacturers then connect their UDI to the global unique device identification database GUDID, which helps the FDA to identify the identity of the product before reaching the market. These are some of the significant rules set by the U.S. FDA for the manufacturers of the market, which are strict and complex in nature to follow and require a huge amount of data processing to meet such compliance and receive approval. Thus, evolving regulations and complex processes are becoming major restraining factors for the medical device labeling market, hindering market growth globally.

Surge in innovative medical devices for personal care

The surge in the number of innovative medical devices due to the increase in awareness about preventive healthcare practices around the globe has become a potential opportunity for the augmentation of the medical device labeling market. Innovative medical devices such as wearable smart watches for workout measurements, home diagnostics kits, and smart health monitoring systems like SPO2 measure devices were seen as hype during the COVID-19 pandemic. After the pandemic, people have become more aware and are trying to be self-sufficient, even in the form of healthcare practices, instead of relying solely on medical professionals. This trend has been captured by healthcare manufacturers and prompted them to launch devices that are precise and comprehensive and can be easily handled by using the guidelines provided.

Such medical devices include a manual for usage and safety plus risk management and are incorporated with labels that provide essential data to integrate with the digital health ecosystem, like QR codes for connectivity to the Apps and real-time data measurement and tracking records. Hence, the rise in consumer health awareness and their shift towards personalized healthcare solutions drives the need for clearer, authentic, and regulatory complaint data on the labels of the products. Moreover, regulatory bodies such as the U.S. FDA and the EU are set to impose strict rules according to the product's complexity and its need in the market to avoid mishandling and misleading data propagation about the product before launching in the market.

Hence, manufacturers must ensure labels are clean, accurate, well-informed, and up-to-date, which is the reason for boosting personalized labeling solutions. Innovations in smart labels, such as RFID technology, create a lucrative opportunity in the medical device labeling market. Thus, stringent regulatory compliance with the rising trend for tailored healthcare solutions in terms of innovative devices are the factors influencing the growth of the market globally and, therefore, increasing the market’s expansion further.

The pressure-sensitive labels segment dominated the medical device labeling market in 2024. The dominance of this segment is related to pressure-sensitive labels, which offer many advantages, including ease of application process, flexibility, high-quality graphics, and a wide variety of label shapes. Along with these benefits, these labels appear as a unique and professional visual that enhances its look. Therefore, pressure-sensitive labels can be customized as per the client's logo, design, or expectations to attract consumers easily. Moreover, these labels adhere to a variety of surfaces, making them suitable for the medical device labeling process as these labels can withstand heat, abrasion, and moisture fading to ensure long-lasting visibility.

The glue-applied labels segment is anticipated to showcase the fastest growth in the medical device labeling market over the projected period. This labeling method includes applying an adhesive that is made of a water-based glue-like form. These labels are high in bond strength, eco-friendly, and cost-effective as well. Also, these materials used to create a wet glue are abundantly available in the market. Thus, it is a popular method for labeling in various industries, including pharma.

The paper segment accounted for the largest share of the medical device labeling market in 2024. The growth of this segment is attributed to factors such as biodegradability and eco-friendly sustainable options as a packaging requirement in the healthcare market. Paper-based products can be recycled into newer usable products, which in turn reduces the need for raw materials. Paper-based packaging helps with easy branding and customization for clients as it has the high-quality printability to showcase graphics or logos of the specific brand. Other details on the packaging are made captivating by using paper-based packaging. Overall, due to the numerous benefits associated with paper-based packaging, it dominates the market on a broader scale.

The plastics segment is forecasted to witness growth at the fastest rate in the global medical device labeling market in the upcoming years. Plastic labels offer exceptional durability and resistance to any kind of abrasion or climatic changes like moisture, humidity, dry air, chemical exposure, and changing temperature. Such resilience ensures that critical information remains intact throughout the lifecycle of the products, which is crucial for medical device packaging or labels. Furthermore, plastic labels offer superior print quality and aesthetically appealing designs to ensure the brand's logo remains on the front of the products, including details on the label.

The disposable consumables segment dominated the medical device labeling market in 2024. Disposable consumables such as syringes, gloves, masks, and surgical instruments ensure hygiene, which is an essential part of the healthcare sector. Disposable consumables therefore, are used frequently in medical care settings thus driving the growth of the market exponentially as an application segment.

The monitoring & diagnostic equipment segment is showcasing notable growth in the medical device labeling market globally. Continuous innovations in monitoring and diagnostics technologies like wearable devices and advanced imaging systems further propel the growth of this segment.

North America was estimated to hold the largest share of the medical device labeling market in 2024. The growth of this region is attributed to the expansion of healthcare industries, which is owing to the increasing shares in research and development in drug discoveries and approvals. The presence of stringent regulatory bodies such as the FDA in the United States ensures that medical device labeling meets the standard requirements of the regulations they set, such as accuracy, safety, and compliance, to meet the comprehensive solutions for the labeling market in the region. Along with this, major leading players of the market are based in North America, further fueling the growth of the market largely due to the increasing investment in research and developments in the healthcare sector, building a robust ecosystem that drives the market significantly.

Asia Pacific is anticipated to grow at a higher rate in the global medical device labeling market during the forecasted years, owing to the presence of prominent pharmaceutical players in countries such as India and China. Rapid healthcare development across Asian countries is the leading factor driving the growth of the market on a broader scale. The authorities in the Asian countries enforcing stringent regulations for both private and public healthcare sectors to work harmoniously fuels the demand for advanced healthcare solutions in the Asian market. Moreover, growing medical tourism in the region is becoming a norm due to the services and solutions they provide, along with high-quality equipment and facilities due to the rising healthcare expenditure in developing countries as well as developed countries in the Asia Pacific.

By Label Type

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025