List of Contents

What is the Medical Device Testing Market Size?

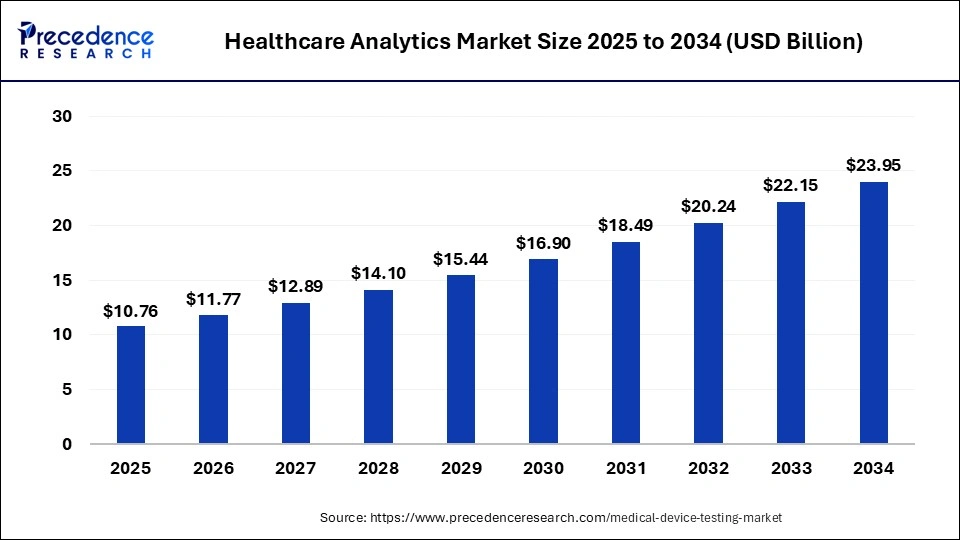

The global medical device testing market size is calculated at USD 10.76 billion in 2025 and is predicted to increase from USD 11.77 billion in 2026 to approximately USD 23.95 billion by 2034, expanding at a CAGR of 9.31% from 2025 to 2034. Due to strict regulations and the rising need for dependable and high-quality medical equipment, the global medical device testing market is expanding significantly.

Medical Device Testing Market Key Takeaways

- The global medical device testing market was valued at USD 9.83 billion in 2024.

- It is projected to reach USD 23.95 billion by 2034.

- The market is expected to grow at a CAGR of 9.31% from 2025 to 2034.

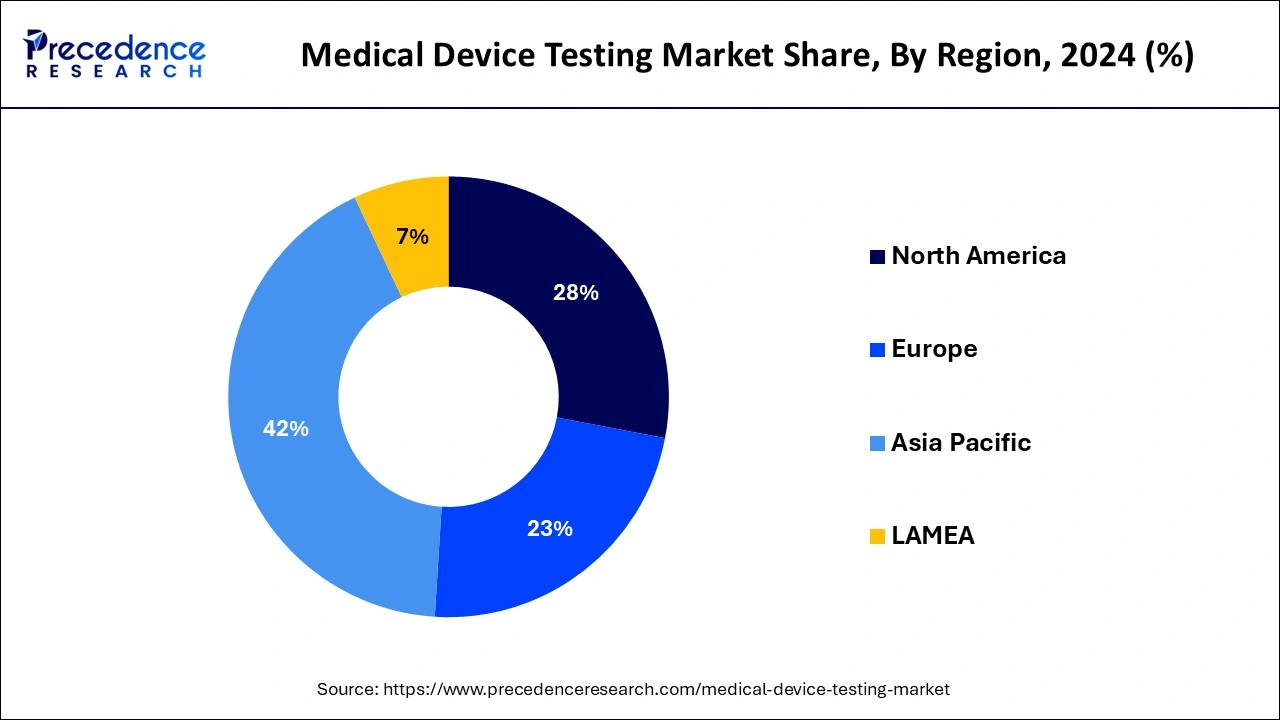

- Asia Pacific dominated the market with the largest revenue share of 42% in 2024.

- North America is estimated to be the fastest-growing during the forecast period of 2025-2034.

- The biocompatibility tests segment dominated the market in 2024.

- The chemistry tests segment is expected to expand at the fastest CAGR of 9.73% during the forecast period.

- The clinical segment led the market with the major revenue share of 60% in 2024.

- The preclinical segment is the fastest-growing during the forecast period.

How is AI Impacting the Market?

It is now more crucial than ever to go beyond automation and begin utilizing AI and ML for medical device testing since the expectations on testing and reliability towards delivery teams have grown significantly over time. Test cases that take into account a variety of characteristics, including functionality, scalability, coverage, and loading, may be automatically produced with the use of AI technologies. AI-driven test controllers may be used to detect test case failures and perform remediation procedures (as well as cover numerous regression cycles) in line with the kind of fault discovered, eliminating the need to run tests and manually resolve issues. When AI is used, the automation coverage is increased by around 30%.

How Does Medical Device Testing Impact Patient Safety?

The medical device testing market is a segment of the healthcare industry that ensures the quality, safety, and efficacy of medical devices before they are marketed. It includes careful testing and certification to meet the regulatory standards and ensure safety and reliability for patients and healthcare professionals. There are many benefits of medical device testing, including ensuring that the medical devices work as planned, are safe for use, and meet regulatory requirements, evaluating many aspects of the medical devices to prevent faulty devices on patients, detecting the defects in the developmental cycle, to improve patient safety, and to reduce liability risks, testing of how the medical device interact with the human body or other medical devices, and identification of medical device potential problems and to make design changes before the production of the mass begins. These benefits help to the growth of the medical device testing market.

Medical Device Testing Market Growth Factors

- Medical device testing helps to ensure that the devices work as planned, meet regulatory requirements, and are safe for use.

- Medical device testing helps to evaluate many sides to prevent faulty devices on patients, detect defects in the development cycle, improve patient safety, and reduce liability risks.

- It helps with the testing of how the medical devices interact with the human body or other medical devices.

- Medical device testing helps to identify potential problems and to make design changes before the mass changes begin. These factors help the growth of the medical device testing market.

Medical Device Testing Market Outlook

- Global Expansion: The expansion led by stringent regulations, technological advancements like AI and IoT, and the rising demand for safer, more reliable devices. In March 2024, Stryker expanded its prototype and testing facility in India.

- Major Investor: Proov raised $10 million in Series A funding for its FDA-authorized at-home progesterone test strips.

- Startup Ecosystem: In May 2024, Achira secured Series B funding to extend its diagnostic medical devices for point-of-care screening, combining disposable components with cloud-connected scanners.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.76 Billion |

| Market Size in 2026 | USD 11.77 Billion |

| Market Size in 2034 | USD 23.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.31% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Phase Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Complexity in product design

Medical devices require specialized testing techniques because they may have intricate software architectures. For medical devices, regulatory compliance is a key factor, and it must meet the standards set by regulatory bodies like the U.S. Food and Drug Administration (FDA) will perform as intended. Medical device testing helps with the evaluation of the performance, safety, and effectiveness of complex medical devices. These factors help the growth of the medical device testing market.

Restraint

Medical device testing risks

Risks of medical device testing include risks during scrapping, component failures, side effects, misuse by users, software bugs, rough handling during shipping, production process failure, and poor design. These factors can hamper the growth of the market. Data integrity or compromised privacy because of unauthorized access to device information or patients. Unauthorized outside parties exploit vulnerabilities and comprise device functions. For the medical device industry, cyber security risks and safety risks are a growing concern. These factors can restrict the growth of the medical device testing market.

Opportunity

Research & development

Integration of advanced technologies in medical devices may help the growth of the market. Advanced technologies like machine learning (ML), artificial intelligence (AI), and the Internet of Things (IoT) used in medical device testing can help the growth of the market. Advanced technologies used in medical device testing are helpful for patients and healthcare professionals by reducing healthcare costs, increasing access to medical services, and for remote patient monitoring. As medical devices and computers become smarter, smaller, and faster, the medical device testing industry and medical device industry are making medical practice easy for doctors, more effective for patients, and with low costs for the entire healthcare system. These factors help the growth of the medical device testing market.

Service Type Insights

The biocompatibility tests segment dominated the medical device testing market in 2024. The biocompatibility test for medical devices is an essential process for the development of the device to ensure that they are effective, safe, and cooperative with the human body. Through comprehensive assessment, medical device manufacturers may identify and reduce potential risks, providing patients with high-quality and innovative medical solutions. The biocompatibility testing of the medical device is necessary to protect the patient from the mutagenic, immunogenic, psychological, or toxic effects of the medical device. Biocompatibility testing plays a key role in medical devices and has many benefits, including ensuring patient safety by identifying adverse reactions and potential risks early in the development process, ensuring the quality of medical devices, and getting regulatory approval for the medical devices. Biocompatibility tests examine many facets, including systematic irritation, sensitization toxicity, and cytotoxicity. This exhaustive evaluation is necessary to ensure the device's effectiveness and device safety. These factors help the growth of the biocompatibility tests service type segment and contribute to the growth of the medical device testing market.

The chemistry tests segment is the fastest-growing during the forecast period. Chemical testing for medical devices refers to identifying, characterizing, and comprehending the chemicals used in the manufacturing process. These chemicals may be referred to as leachable and extractable. The chemistry tests for medical devices have many benefits, including helping to ensure compatibility with disinfectants for the product's lifetime value, biological risks assessment of the medical device, demonstrating compliance with the regulatory requirements that are related to hazardous substances, detecting the potential risks and toxicities and reducing them by ensuring patient safety and health. The medical devices are used for surgeries, diagnosis, and other medical procedures and may cause risks due to involvement in contact with the patient. Chemical testing plays an essential role in the biological risk assessment of the medical device. This helps the manufacturers to meet regulatory standards effectively and to ensure patient safety and patient health. These factors help the growth of the chemistry test service type segment and contribute to the growth of the medical device testing market.

Phase Type Insights

The clinical segment dominated the medical device testing market in 2024. The four phases of the clinical trials for the medical devices are proof/safety of the concept, feasibility, post-marketing surveillance, and pivotal trials. These phases test the efficacy and safety of the medical devices. The clinical phase type of medical device testing includes 3-stages: the pilot stage, the pivotal stage, and the post-market stage. The pivotal stage is to evaluate the advantages and limitations of the device and include product viability or feasibility, preclinical research and prototyping, and product development and testing. The pivotal stage is the second phase of the clinical phase type of medical device to evaluate clinical performance or whether the device is effective and safe for the patients. In the last third post-market stage, the key role is to confirm effectiveness, establish performance, and provide extra information after the approval that includes best use, risk, and benefits. These factors help to the growth of the clinical phase type segment and contribute to the growth of the market.

The preclinical segment is the fastest-growing during the forecast period. In the preclinical phase, the type of medical device testing is to determine whether the device is effective and safe for use, and the steps include bench testing, technical testing, computer simulations, and animal studies. Bench testing is to evaluate the medical device's performance under controlled laboratory conditions. Technical testing is to assess the medical device's durability, biocompatibility evolution, functionality, and other technical features. Computer simulations are to predict device behavior by using computational models. Finally, in animal studies, the preclinical phase type of medical testing is used to understand its effect in animal models. These factors help the growth of the preclinical phase type segment and contribute to the growth of the medical device testing market.

Regional Insights

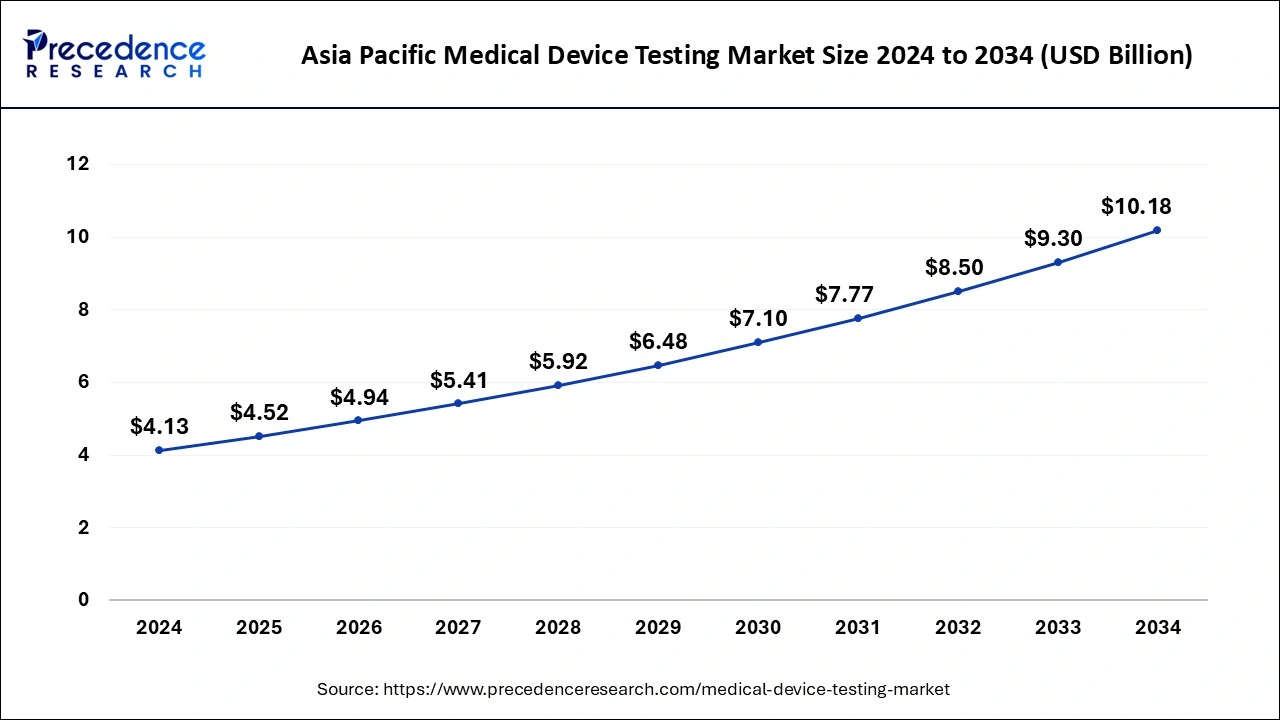

Asia Pacific Medical Device Testing Market Size and Growth 2025 to 2034

The Asia Pacific medical device testing market size is valued at USD 4.52 billion in 2025 and is expected to be worth around USD 10.18 billion by 2034 with a CAGR of 9.44% from 2025 to 2034.

Asia Pacific dominated the medical device testing market in 2024. Medical device companies are high in the Asia Pacific region, which has led to the growth of the market. Investment in healthcare and technology, rapid economic development, and rapid industrialization in the countries of the Asia Pacific region help to the growth of the market. China and India are the leading countries in terms of market growth.

- In January 2024, the National Single Window System (NSWS) was launched by India for medical device management or clinical investigation in a move to streamline the import and testing of medical devices.

- In March 2024, Stryker launched a new facility for the life cycle testing of medical devices for lab expansion in India. This helps to develop medical technologies that comply with the highest regulatory standards and improve patient outcomes. This new lab has several features, including a talented team of microbiologists and engineers, the ability to conduct extensive microbiological testing to ensure the efficacy and safety of the medical devices, prototyping, and product assurance.

- In April 2024, a probe into China's public procurement of medical devices was launched by the European Commission.

North America is estimated to be the fastest-growing during the forecast period of 2024-2033. In North America, medical device testing is used due to its benefits, including cost-effectiveness and speed with electromagnetic compatibility, electrical, wireless, software, cybersecurity, and Bluetooth testing. These benefits help the growth of the medical device market in the North American region. The U.S. and Canada significantly contribute to the growth of the North American market. The countries are known for advanced healthcare infrastructure and government support.

Emerging Government Initiatives & Digital Revolution: Indian Market Analysis

Extending growth of the market in India is mainly driven by a rise in government support through major policies, such as the Production Linked Incentive (PLI) scheme, and the development of medical device parks. Additionally, India, CDSCO is strengthening the SUGAM portal to simplify the regulatory process with complete digitalization.

AI-Powered Advances & Other Innovations: U.S. Market Analysis

The development of standards for Software as a Medical Device (SaMD) is fostering the need for rigorous validation of AI-enabled diagnostics and treatments. This further consists of post-market surveillance of connected devices to ensure their continued safety and effectiveness. As well as the FDA has also cleared the first 3D-printed PEEK cranial implant system from 3D Systems.

Support Through Guidance on Borderline Products is Propelling Europe

Europe is experiencing a lucrative growth in the medical device testing market, due to certain updated formats. Recently, the Manual on Borderline and Classification has been upgraded (v4, published September 2025) to facilitate clarity on whether a few products (e.g., specific additive solutions or creams) fall under the medical device regulations or are classified as medicinal products.

Raised Emphasis on PMS & UDI: German Market Analysis

Due to the increasing focus on continuous data collection and post-market surveillance (PMS), surging manufacturers to persistently monitoring their device performance after their market availability. Alongside, ongoing launch of the unique device identification (UDI) system, with particular deadlines in 2025 for various device classes, is also encouraging the market growth.

Advancing GMP and Import Rules are Impacting Latin America

Latin American countries are promoting their Good Manufacturing Practices (GMP) and import regulations to accelerate effectiveness and align with global standards. In January 2025, RDC 936/2024, published, which develops new guidelines for health products, emphasising raised standards of safety and efficiency and paving the way for technological innovations.

Brazil's Booming MedTech Check-Up

Driven by increased health regulations and rising healthcare investment, the medical device testing market in Brazil is experiencing robust growth. Local and international firms are expanding facilities to meet strict ANVISA compliance, making it a pivotal time for quality assurance and testing services in the region.

Key Players Offering

- WuXi AppTec- A prominent player offers diverse medical device testing services, such as biocompatibility, chemistry, and microbiology testing.

- Intertek Group Plc- Its provisions primarily cover safety, performance, and compliance for different device types, from electrical and digital equipment to implantable and AI-assisted devices.

- Pace Analytical Services LLC- It enables various types of microbiology testing, functional and physical testing, and analytical chemistry.

- Eurofins Scientific- It is emphasising a new packaging testing lab and has boosted its ability to offer US and Canadian certifications for medical devices.

- North America Science Associates Inc. (NAMSA)- It is expanding its abilities in toxicology and sterility validation to assist the global medical device industry throughout the product lifecycle.

Medical Device Testing Market Companies

- Element Minnetonka

- Charles River Laboratories

- TÜV SÜD

- Nelson Laboratories, LLC

- Laboratory Corporation of America Holdings

- SGS SA

Recent Developments

- In January 2024, a single-window portal or one-stop-shop portal was designed by the IT major TCS (Tata Consultancy Services) and launched by India to streamline the import of medical devices in the country.

- In March 2024, a pilot study for an asthma diagnosis device was launched by the UK-based respiratory device firm TidalSense. This device is used for the testing of respiratory conditions like asthma in children.

- In April 2024, India's first mobile medical devices calibration facility was launched by the Indian Institute of Technology Madras (IIT-M). It helps to ensure the accuracy of medical devices for precise disease diagnosis and effectiveness and to improve healthcare access.

Segments Covered in the Report

By Service Type

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Tests

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

By Phase Type

- Preclinical

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client