January 2025

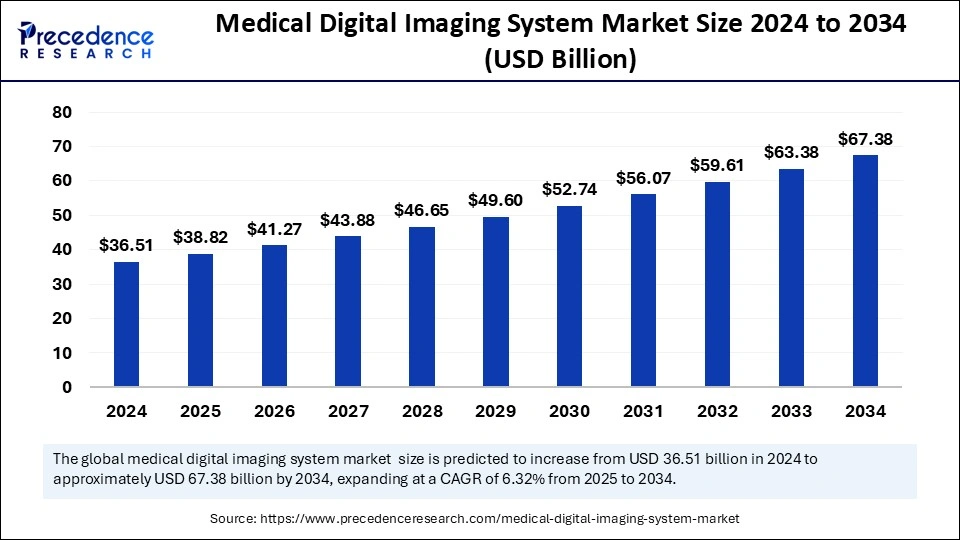

The global medical digital imaging system market size is calculated at USD 38.82 billion in 2025 and is forecasted to reach around USD 67.38 billion by 2034, accelerating at a CAGR of 6.32% from 2025 to 2034. The North America market size surpassed USD 12.78 billion in 2024 and is expanding at a CAGR of 6.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical digital imaging system market size was estimated at USD 36.51 billion in 2024 and is predicted to increase from USD 38.82 billion in 2025 to approximately USD 67.38 billion by 2034, expanding at a CAGR of 6.32% from 2025 to 2034. The increasing prevalence of chronic diseases globally, rising healthcare spending, rapid technological innovation in 3D and 4D imaging, and a surge in the aging population are among several factors expected to drive the growth of the medical digital imaging system market throughout the projection period.

In recent years, with the rapid evolution of digitalization in healthcare, artificial intelligence (AI) has emerged as a driving force in the medical digital imaging system market. Combining cutting-edge AI techniques in medical digital imaging profoundly impacts medical diagnosis and patient care, and it continues to shape the future of the healthcare industry. AI algorithms effectively analyze imaging data from CT scans, X-rays, and Magnetic Resonance Imaging (MRIs) and assist in detecting abnormalities and chronic diseases, including cancer, at an early stage. Harnessing the power of AI in medical digital imaging provides substantial benefits to the healthcare industry. AI can improve diagnostic accuracy by rapidly and precisely analyzing massive amounts of imaging data, detecting abnormalities that can be overlooked by the human eye. Therefore, the integration of AI has great potential to reshape the future of medical digital imaging, enabling healthcare professionals to reduce and address complexities in diagnostics, streamline workflows, and improve patient outcomes.

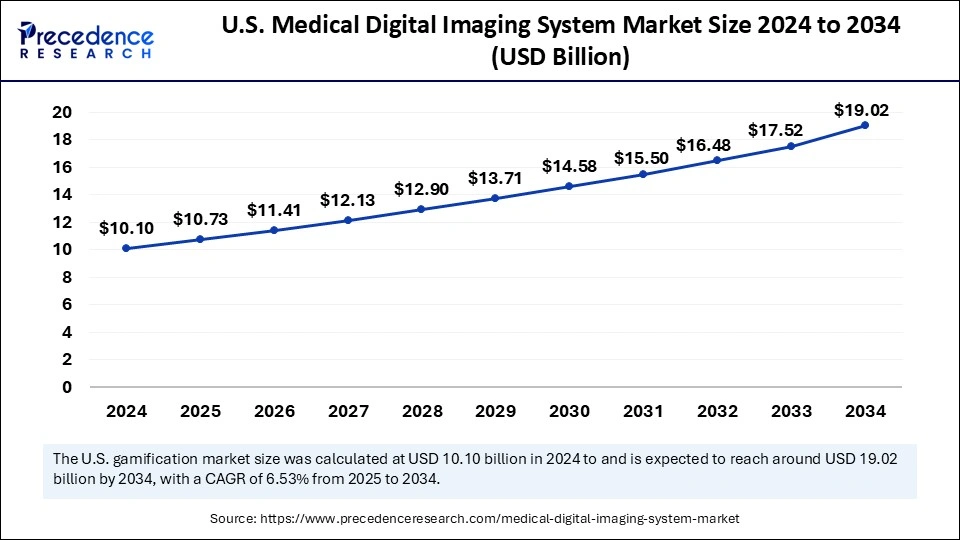

The U.S. medical digital imaging system market size was exhibited at USD 10.10 billion in 2024 and is projected to be worth around USD 19.02 billion by 2034, growing at a CAGR of 6.53% from 2025 to 2034.

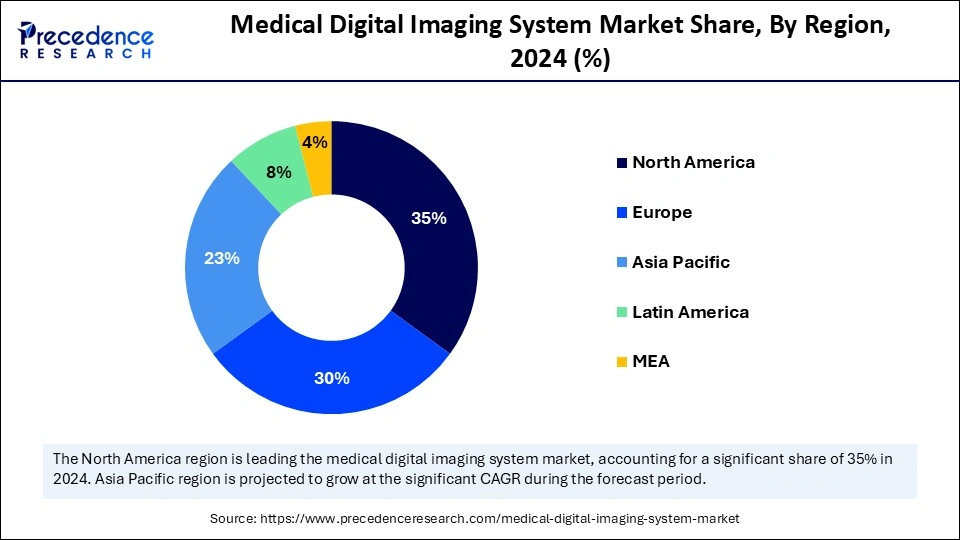

North America held the largest share of the medical digital imaging system market in 2024. This is mainly due to the presence of sophisticated healthcare facilities, the rising incidence of chronic disorders, and the growing geriatric population. There is a high demand for advanced medical imaging due to the heightened awareness among people about the early detection of diseases. The availability of advanced medical digital imaging systems, rapid technological innovation in medical imaging, and the rise in private and public investments to enhance healthcare infrastructure further bolstered the market in the region.

The U.S. is a major contributor to the market owing to the presence of well-established healthcare and diagnostics facilities, rising healthcare expenditure, and favorable reimbursement frameworks. The increasing prevalence of chronic diseases, such as cancer, cardiovascular disorders, and neurological diseases, is expected to boost market growth. In addition, leading healthcare companies in the country are making efforts to develop advanced medical digital imaging solutions.

Asia Pacific is expected to witness the fastest growth during the forecast period. This is mainly due to the rising prevalence of chronic diseases, rising healthcare expenditure, increasing aging population, and rising awareness of early diagnosis of diseases for better treatment outcomes. The rising investments in research and development activities and the increasing demand for early detection technology further support market growth. Moreover, rising government initiatives to improve healthcare and diagnostic facilities are anticipated to fuel the regional market growth during the forecast period.

Europe is anticipated to witness notable growth in the upcoming period. The region boasts advanced medical imaging facilities, along with skilled professionals. There is a high demand for personalized treatment plans, in which medical imaging plays a crucial role. The rising adoption of cloud-based solutions, AI, and mobile technologies to revolutionize medical imaging contributes to regional market growth. Moreover, the rising focus on early disease detection and improving healthcare infrastructure is expected to propel the growth of the medical digital imaging system market in Europe.

Medical digital imaging systems have significantly revolutionized the landscape of the healthcare industry. Medical digital imaging systems are modern medical imaging technologies and devices that are capable of generating visual illustrations of internal body parts for medical intervention and clinical diagnosis. Various types of medical digital imaging are used in the healthcare sector, including ultrasound, radiography, X-rays, CT scans, MRI, and nuclear medicine, which provide invaluable insights to doctors that enhance the chances of successful treatment of patients. The medical digital imaging system market is witnessing rapid growth due to the rising demand for minimally invasive procedures and advancements in imaging technologies.

| Report Coverage | Details |

| Market Size by 2034 | USD 67.38 Billion |

| Market Size in 2025 | USD 38.82 Billion |

| Market Size in 2024 | USD 36.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Modality, Deployment Mode, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. |

Rising Need for Precise and Accurate Diagnosis

The growing need for precise and accurate diagnosis of chronic conditions is driving the growth of the medical digital imaging system market. With the increasing incidence of chronic diseases worldwide, there is a heightened need for precise and accurate diagnosis. Imaging techniques like MRI, CT scans, and X-rays provide faster and more accurate diagnoses as well as improve patient treatment outcomes. Medical digital imaging finds applications in various healthcare departments such as Oncology, Cardiology, Neurology, Gynecology, and others. Medical imaging technology has significantly revolutionized the way doctors diagnose and treat patients. Medical digital imaging systems bring new capabilities and advancements to improve patient care.

High Cost

The high cost associated with medical digital imaging systems is anticipated to hamper the growth of the medical digital imaging system market. The high cost of medical digital imaging systems may result in slow adoption, especially in low-income countries. High costs create barriers for small healthcare organizations due to budget constraints. In addition, the rising concerns regarding the potential health risks associated with continuous exposure to ionizing radiation from imaging tests, including CT scans, limit the growth of the market.

Technological Advancements

Advancements in medical technologies create lucrative growth opportunities in the medical digital imaging system market. A medical digital imaging system plays a crucial role in the accurate and rapid diagnosis of a wide range of chronic diseases. The rapid advancements in medical imaging technology result in more accurate diagnoses and improved treatment outcomes. Some of the significant advancements in medical imaging systems include Magnetic Resonance Imaging (MRI), Computed Tomography (CT) Scanning, Ultrasound Technology, and Positron Emission Tomography (PET) Scanning.

Key players operating in the market are continuously developing and launching innovative products to strengthen their presence and gain a competitive edge.

The hardware segment held the largest share of the medical digital imaging system market in 2024. This is mainly due to the increased adoption of advanced imaging systems in healthcare facilities. Digital imaging systems heavily rely on hardware to enhance efficiency. The evolution of medical digital imaging systems has led to an increased demand for high-performance hardware systems to manage, store, and process massive imaging data.

The software segment is expected to expand at the highest CAGR during the forecast period due to the increasing demand for advanced software solutions for precise and early diagnosis of chronic diseases. Moreover, the demand for advanced software tools, such as Radiology Information Systems (RIS), Picture Archiving and Communication Systems (PACS), and AI/ML-based image analysis tools, is rising to manage and analyze vast amounts of image data. The adoption of these software solutions automates workflows, enhances diagnostic accuracy, and improves patient care.

The computed tomography segment led the medical digital imaging system market with the largest share in 2024. The growth of the segment is driven by the increasing demand for non-invasive diagnostic tools and the rising advancement in CT scanning technology, such as dual-energy CT (DECT) scanning. CT scanning uses X-rays to create clear and detailed images of the inside of the body. CT scans are extensively used in various medical fields, including cardiology, oncology, and other areas, and are crucial for early disease detection and better treatment planning.

The nuclear imaging (PET/SPECT) segment is projected to grow rapidly over the forecast period. This is mainly due to the increasing prevalence of cancer around the world and the growing demand for more precise and non-invasive diagnostic techniques. Nuclear imaging plays a key role in oncology for monitoring treatment response.

The on-premises segment dominated the medical digital imaging system market in 2024. The growth of the segment is attributed to the increasing preference of healthcare organizations for receiving direct control over their imaging systems, especially in hospitals and diagnostic centers. On-premise solutions are hosted on local servers within the healthcare facility. It assists healthcare providers in having complete control over their data, which is critical for institutions required to follow stringent security requirements.

The cloud-based segment is projected to expand rapidly in the coming years. Cloud-based solutions offer various benefits, such as cost efficiency, remote access to imaging data, and easy scaling of storage capacity. Cloud-based platforms enable secure access to imaging data from any location, facilitating remote consultations and enhancing patient outcomes.

The diagnostic imaging segment accounted for the largest market share in 2024. The growth of the segment is driven by the rising awareness regarding the availability of advanced diagnostic imaging technologies. Diagnostic imaging enables early and accurate disease detection. Diagnostic imaging technologies, including CT, MRI, ultrasound, and X-ray, assist in detecting and treating numerous health conditions. The rise in awareness of early disease detection and prevention further bolstered the segment.

The therapeutic imaging segment is anticipated to grow at the fastest rate in the coming years. Imaging techniques are widely utilized in treatment planning for various medical conditions, such as neurological disorders, oncology, urology, gastroenterology, and cardiovascular diseases. It helps doctors to get a clearer and more detailed picture to treat patients better. Such factors are accelerating the growth of the therapeutic imaging segment during the forecast. Therapeutic imaging helps healthcare professionals to monitor treatment outcomes.

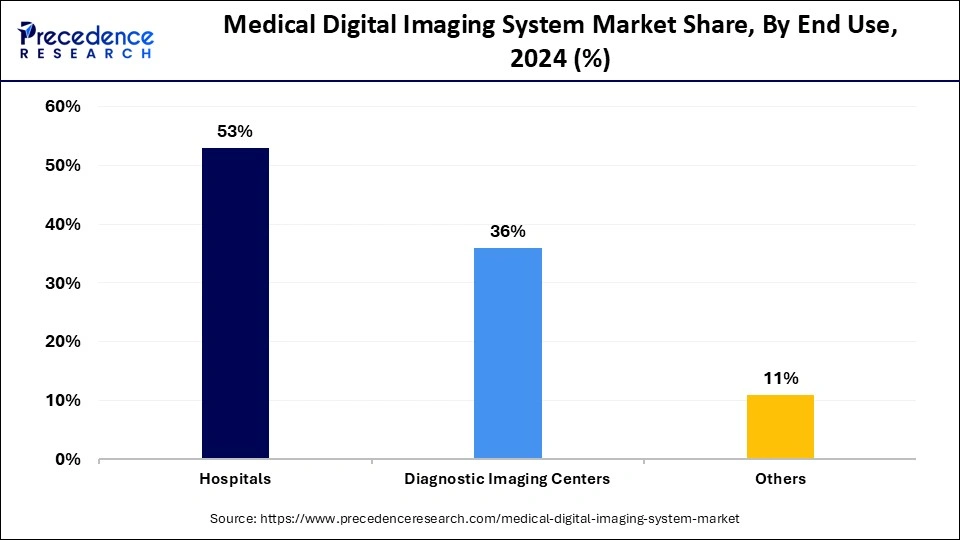

The hospitals segment held the largest share of the medical digital imaging system market in 2024. This is mainly due to the high adoption of medical digital imaging systems by hospitals. Hospitals carry out a wide range of imaging procedures, such as X-rays, CT, ultrasound, and MRI. Hospitals heavily invest in advancing healthcare infrastructure and expanding their imaging and treatment capabilities. The rise in chronic disorders around the world has increased the need for precise and early diagnosis of diseases to improve treatment outcomes. However, the easy availability of a wide range of imaging technologies in hospitals attracts a large patient population.

The diagnostic imaging centers segment is expected to experience the fastest growth during the projection period. Diagnostic imaging centers heavily adopt cutting-edge medical imaging systems, including 3D and 4D imaging, for the precise and early diagnosis of various diseases, such as cancer, heart disease, and neurological disorders. Diagnostic imaging centers offer various imaging techniques like MRI, ultrasound, PET scanning, CT scans, and X-rays for accurate diagnoses, monitoring patient progress in real-time, and executing better treatment plans.

By Component

By Modality

By Deployment Mode

By Application

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025