January 2025

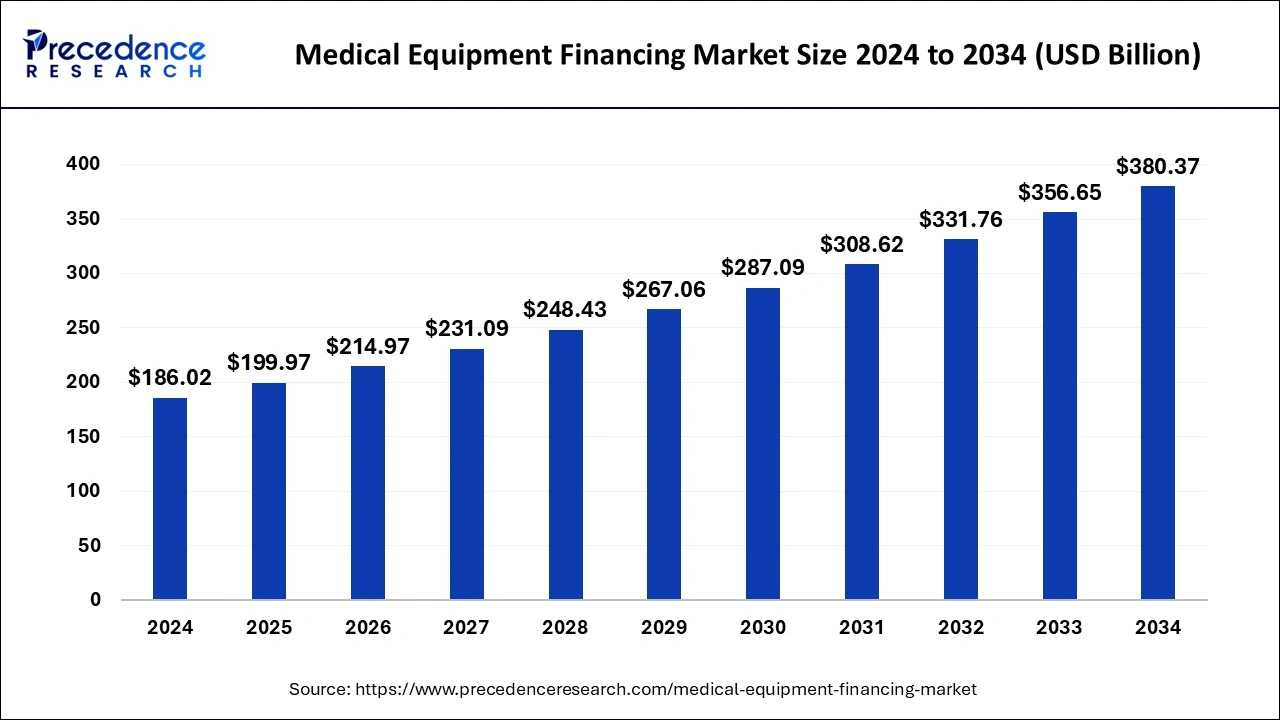

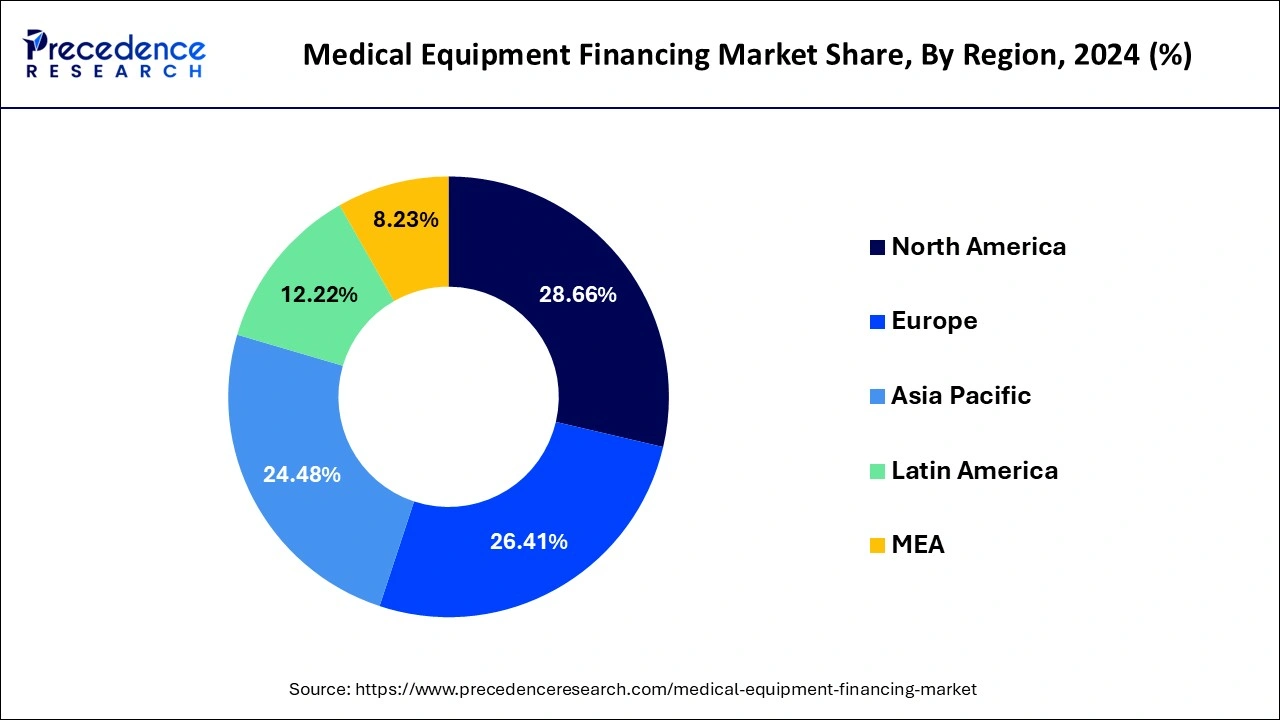

The global medical equipment financing market size is accounted at USD 199.97 billion in 2025 and is forecasted to hit around USD 380.37 billion by 2034, representing a CAGR of 7.41% from 2025 to 2034. The North America market size was estimated at USD 53.31 billion in 2024 and is expanding at a CAGR of 7.42% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical equipment financing market size was calculated at USD 186.02 billion in 2024 and is predicted to reach around USD 380.37 billion by 2034, expanding at a CAGR of 7.41% from 2025 to 2034.

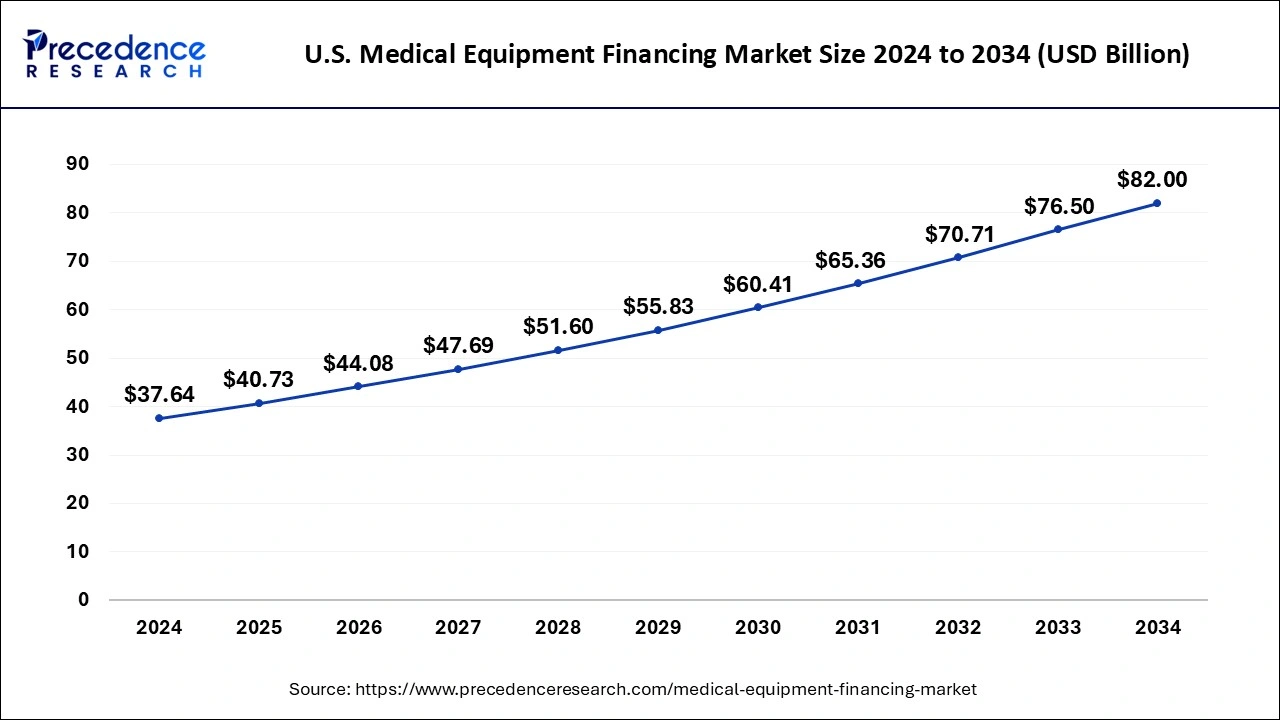

The U.S. medical equipment financing market size was exhibited at USD 37.64 billion in 2024 and is projected to be worth around USD 82.00 billion by 2034, growing at a CAGR of 8.10% from 2025 to 2034.

The market for financing medical equipment in North America has grown to be the largest and was USD 49.60 billion in 2024. The highest financing rate for medical equipment in the area is the main cause of this dominance. The domination of this region has been aided by ongoing medical device advances and expenditures in the medical infrastructure. Additionally, due to the increasing adoption of artificial intelligence technology-based medical equipment finance and expanding expenditures in healthcare infrastructure, Europe has the second position in the industry. In addition, greater knowledge of the finance sector among medical professionals and staff has drawn more clients to the market for equipment financing. Additionally, the industry is anticipated to rise during the forecast period amid a number of Eastern European countries experiencing a solid economy

In contrast, Asia Pacific is anticipated to grow more quickly due to the expansion of the finance sector in the region and the construction of hospitals, cutting-edge laboratories, and diagnostic centers in its developing nations. Government funding commitments to the medical sector would also aid in the expansion of this market. For instance, the Indian finance minister recently announced a $ 9.09 billion commitment to the healthcare sector as part of the country's 2020 budget. The establishment of more hospitals across the nation was the primary goal of the funding. The market size is projected to grow during the forecast period as a result of such investments. In addition, the markets in Latin America, the Middle East, and Africa are expected to expand significantly because fewer people are aware of the financial rules and structures and have poor comprehension of them.

The healthcare financing sector was significantly impacted by COVID-19. During the pandemic, managing the influx of patients was one of the hospitals' initial challenges. There was a lack of beds and ventilators, ambulances were in such great demand that non-ambulance vehicles were outfitted with equipment to provide patient transport, and there was a scarcity of personal protective equipment (PPE). Elective and non-emergency operations were stopped. Examinations for dental, optical, and wellness were rescheduled. Staffing and income were harmed by the loss of routine care. Healthcare companies hurried to create COVID-19 test kits, while pharmaceutical companies switched gears to start working on vaccine development as soon as it was practical. There was a considerable shift in the demand for equipment, according to an August 2020 report titled "COVID-19 and Its Impact on Healthcare Financing." The budgets and equipment needs of DLL's clients, a global asset finance partner, are always shifting. Flexible financing alternatives have been able to quickly deploy critical assets and prepare for an influx of future processes when the economy recovers while minimizing upfront financial limits in response to changing needs. Therefore, such scenarios that produce diverse & adaptable financing solutions are projected to fuel market expansion during the predicted period.

The demand for top-notch healthcare and related services is growing dramatically as incomes rise. Furthermore, being able to provide the most recent medical standards and practices has turned into a must for doctors rather than differentiation. However, upgrading facilities or spending money on state-of-the-art medical technology is not an easy task. This includes significant expenses that are almost unaffordable for the majority of small healthcare service providers. Using available funds to pay for medical equipment could limit working capital and restrict the cash flow required for regular business operations. Therefore, the most economical approach to guarantee that patients have access to the greatest medical care without going bankrupt is to take out a medical equipment loan.

Technological developments in the market and rising patient demand are further factors promoting market progress. The healthcare industry, like any other, needs technology to serve the evolving needs of patients. The technical infrastructure is a key factor in determining the quality of patient care, from computerized medical records to cutting-edge diagnostic tools. The need for cutting-edge equipment has increased dramatically as hospitals, clinics, and other healthcare facilities struggle to gain a competitive edge. The aging population and increased access to healthcare in small towns and rural areas have increased the demand for sophisticated technologies. As a result, this will probably increase demand for medical equipment financing and propel industry expansion.

| Report Coverage | Details |

| Market Size in 2025 | USD 199.97 Billion |

| Market Size in 2024 | USD 186.02 Billion |

| Market Size by 2034 | USD 380.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.41% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment, Type, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising preference for same-day surgery

Businesses' prudent capital expenditure

Technological innovation

In 2024, the market for diagnostic equipment was estimated to be worth USD 48.3 billion. Due to better healthcare infrastructure and a booming healthcare industry, there is a greater need for premium, high-quality, and cutting-edge healthcare facilities in developing countries. Due to the increased demand for technologically enhanced medical care, new and inventive items for providing these treatments, as well as related services, have been developed all of which are relatively expensive to purchase. There is a growing tendency towards the establishment of more diagnostic centers as a result of the rising prevalence of infectious diseases and advancements in diagnostic technology. This, in turn, is to blame for increased funding for diagnostic equipment. Additionally, end users frequently invest in cutting-edge diagnostic and therapeutic equipment, such as dialysis machines, ventilators, and ICU equipment, in order to give the patient the best possible medical treatment. For example, the COVID crisis in 2019 has increased demand for ventilators as well as other diagnostic tools like X-ray scanners and MRI scans. In the upcoming months, this is projected to raise the market value of both the therapeutic and diagnostic sectors. Additionally, hospitals have increased their facility investment due to patient demand for intensive care unit capabilities. Every end user now depends on patient monitoring technology including Electrocardiograph (ECG) monitors, incubators, and EHR systems.

Customers consequently opt to use financing services to buy these diagnostic tools, driving statistics for the diagnostic equipment finance sector category.

In 2024, the market for reconditioned goods was maximum. Medical equipment that has undergone reconditioning or restoration to a workable state without altering its primary purpose or original specifications is referred to as refurbished equipment. Only after complete cleaning, disinfection, and replacement of any worn or broken parts is this equipment utilized. Due to financial constraints, the demand for reconditioned medical equipment is particularly significant in emerging nations.

New medical equipment costs between 30 and 50 percent more than refurbished equipment. Additionally, a number of e-commerce sites are predicted to offer simple ways to buy and sell reconditioned medical equipment. These advantages of used equipment will fuel market expansion on both a segmental and global level.

Creation of diagnostic tools to support the expansion of diagnostic centers and labs. The hospital and clinic industry kept the top spot in the market in 2024. This dominance is attributable to elements like increased investment in infrastructure management and rising demand from patients at clinics and hospitals for surgical operations. Due to the availability of an established medical infrastructure and increased patient preference, hospitals and clinics are seeing tremendous expansion. Due to the quick availability of sufficient finances from finance businesses, hospitals and clinics quickly adapt and install newly introduced medical technologies. The need for therapeutic equipment is also being facilitated by an increase in patient admissions owing to infectious diseases like COVID-19, respiratory problems, cardiology disorders, and others, which is opening up a variety of chances for financial businesses.

The development of diagnostic kits and suitable equipment for patient healthcare, on the other hand, is predicted to lead to a faster increase in the laboratories and diagnostic centers segment over the course of the projection year. For instance, there has been a significant need for diagnostic kits in both diagnostic centers and cutting-edge laboratories due to the present global pandemic emergency of COVID-19. Equipment finance firms are making progress in providing funding for research and development to reduce the danger of pandemics around the world.

By Equipment

By Type

By End User

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2024

August 2024

January 2025