January 2025

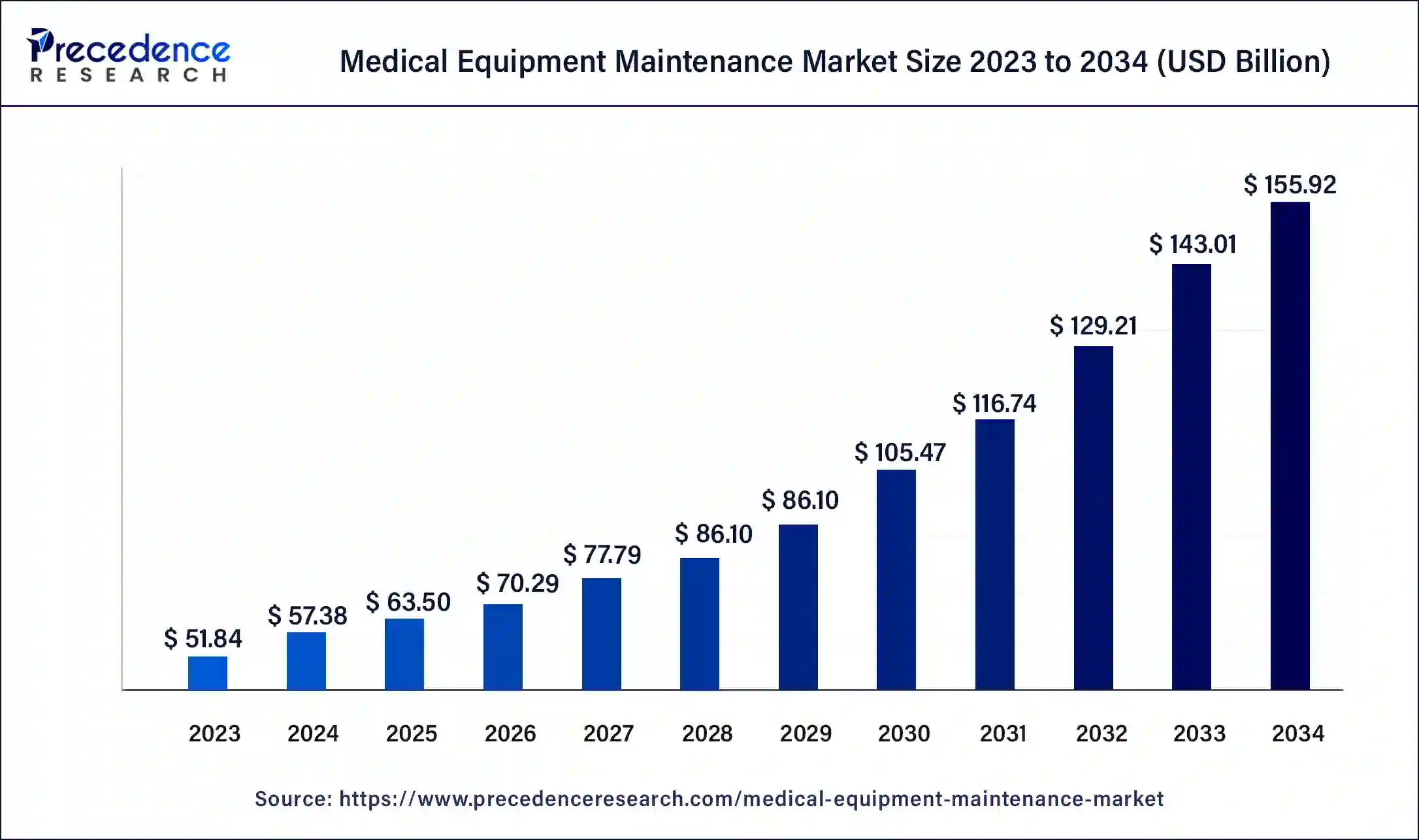

The global medical equipment maintenance market size was USD 51.84 billion in 2023, estimated at USD 57.38 billion in 2024 and is anticipated to reach around USD 155.92 billion by 2034, expanding at a CAGR of 10.51% from 2024 to 2034.

The global medical equipment maintenance market size accounted for USD 57.38 billion in 2024 and is predicted to reach around USD 155.92 billion by 2034, growingat a CAGR of 10.51% from 2024 to 2034.

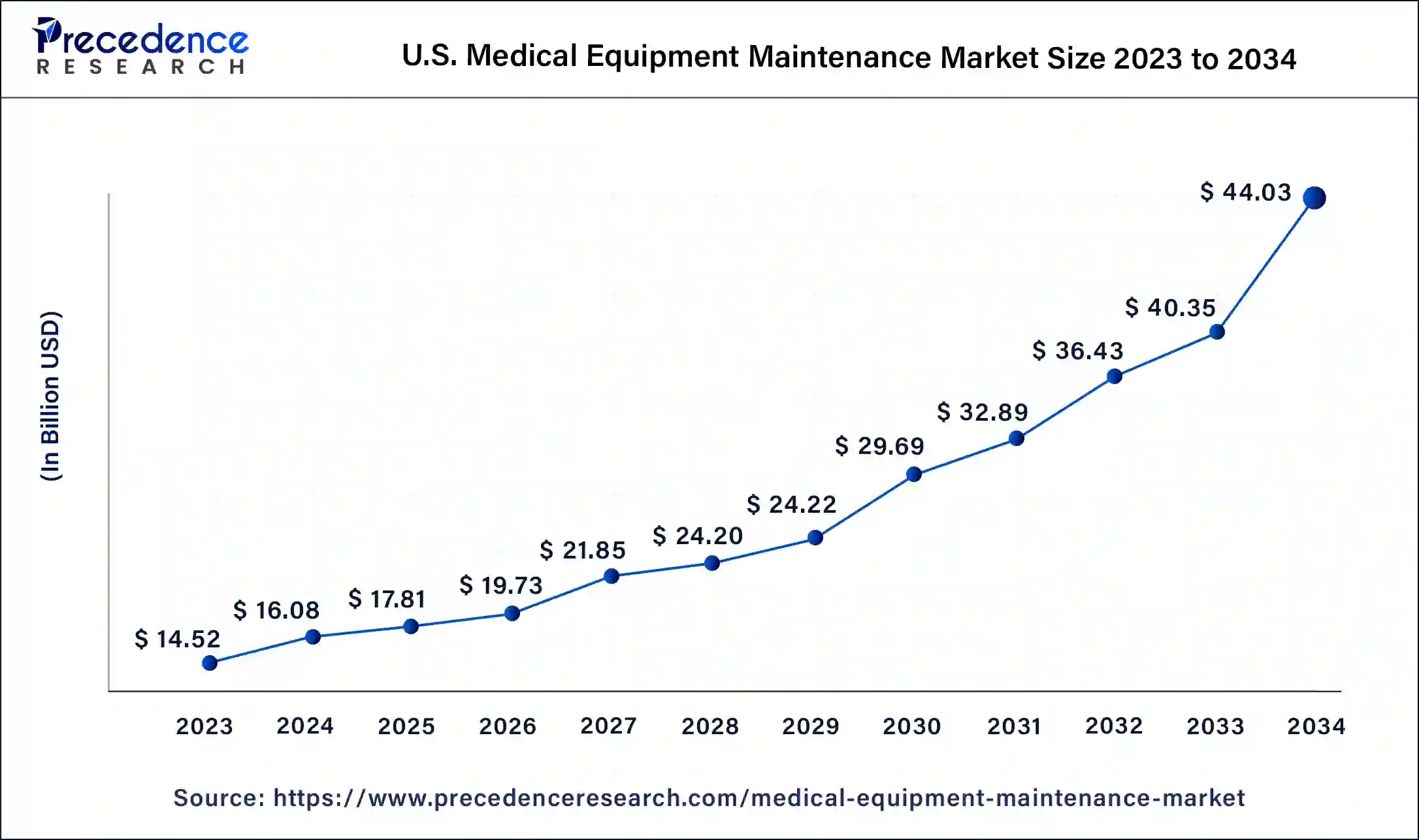

The U.S. medical equipment maintenance market was valued at USD 14.52 billion in 2023 and is expected to be worth USD 44.03 billion by 2034, growing at a CAGR of 11% from 2024 to 2034.

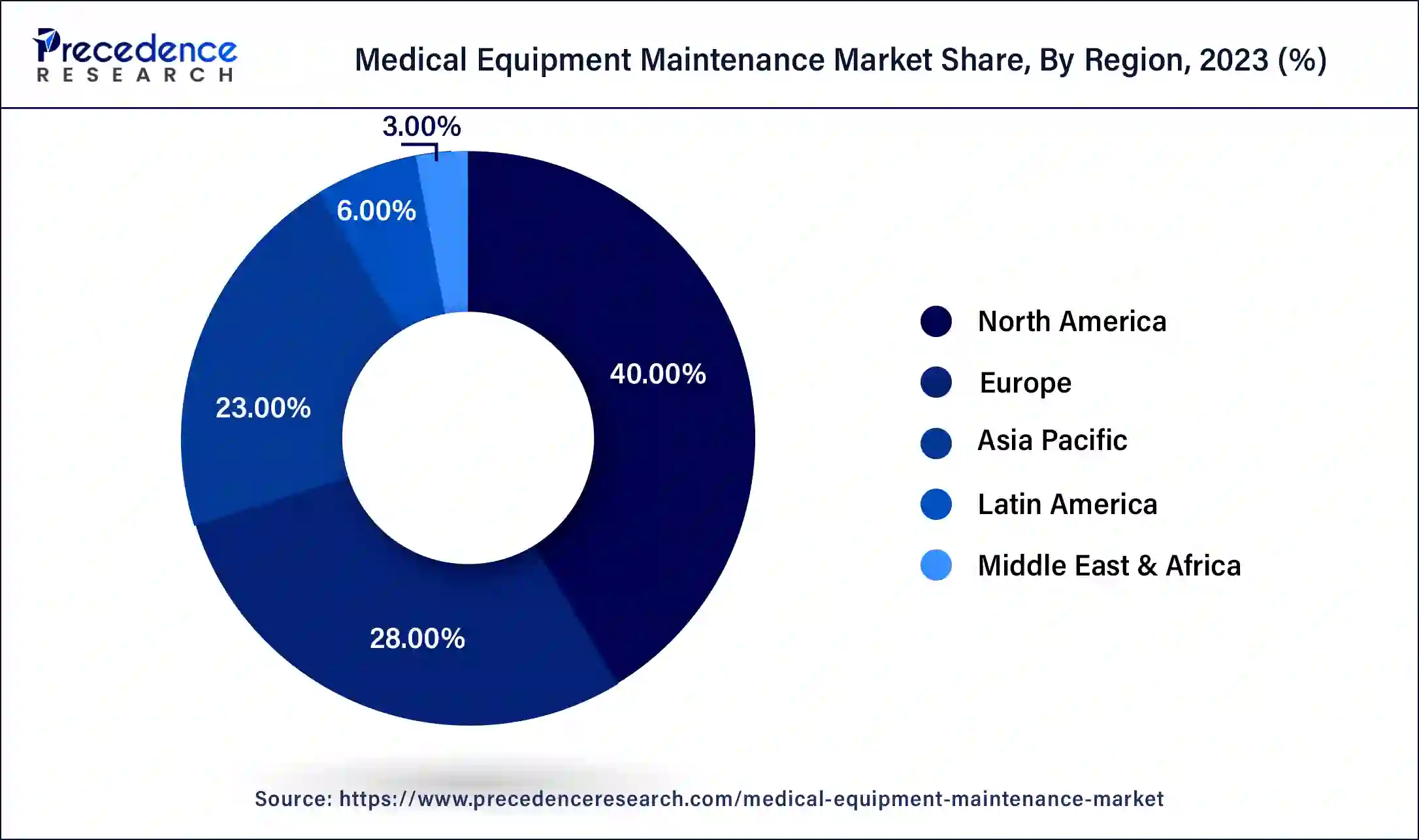

Based on region, North America accounted for 40% of revenue share in 2023 and is expected to remain dominant during the forecast period. The increased adoption of advanced equipment in the healthcare sector, rising investments in the preclinical tests of the latest medical equipment, the growing number of private hospitals and clinics, and rising expenditure of the medical equipment manufacturers to make innovative and efficient equipment are the prominent factors that boost the growth of the medical equipment market in North America.

The Asia Pacific is expected to be the fastest-growing market during the forecast period. The rising government expenditure on the development of healthcare infrastructure, rapid urbanization and increase healthcare spending, rising prevalence of diseases, and growing geriatric population drives the demand for the medical equipment maintenance market. The increasing number of patients in hospital owing to the huge population is driving the demand among the hospital sector and hence this region is expected to grow rapidly in the forthcoming years.

Increasing purchase of renewed medical systems, rising prevalence of diseases leading to higher diagnostic rates, and rising demand for the refurbished medical equipment are the primary factors leading to growth of the medical equipment maintenance market. The rapidly growing medical equipment industries in the developed regions like US and Canada are significantly boosting the demand for the Medical equipment maintenance. The rising prevalence of diseases among the population has a significant role to play in the demand for the medical equipment maintenance. Moreover, the rising investments in the medical devices such as X-ray units, centrifuge, ventilator units, ultrasound, syringe pumps, electrocardiographs, and autoclave are available in the industry. The main objective of the equipment maintenance is to reduce the down time of medical devices in the facility, and this can leads to save cost and provide better services to the customer. Further, the rising adoption of automated technologies to enhance productivity and reduce cost is likely to augment the growth of the market. The key players in the industry are introducing new services in the market to serve the patients. This has led the growth of the market in the coming years.

| Report Highlights | Details |

| Market Size by 2034 | USD 155.92 Billion |

| Market Size in 2023 | USD 51.84 Billion |

| Market Size in 2024 | USD 57.38 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.51% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Equipment, Service, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on equipment, the imaging equipment segment accounted largest revenue share over 36% in 2023. This is attributable to the introduction of new technologies, presence of numerous devices such as Digital X-Ray, ultrasound, MRI, and others in hospitals, and rise in global diagnostic procedures. Moreover, the rising investments in the new innovation in the devices by the healthcare industry players is further boosting the growth of the medical equipment maintenance across the globe, and hence this segment is expected to be the fastest-growing segment during the forecast period.

Moreover, the surgical instruments segment is projected to witness the highest CAGR of 8.9% over the forecast period.

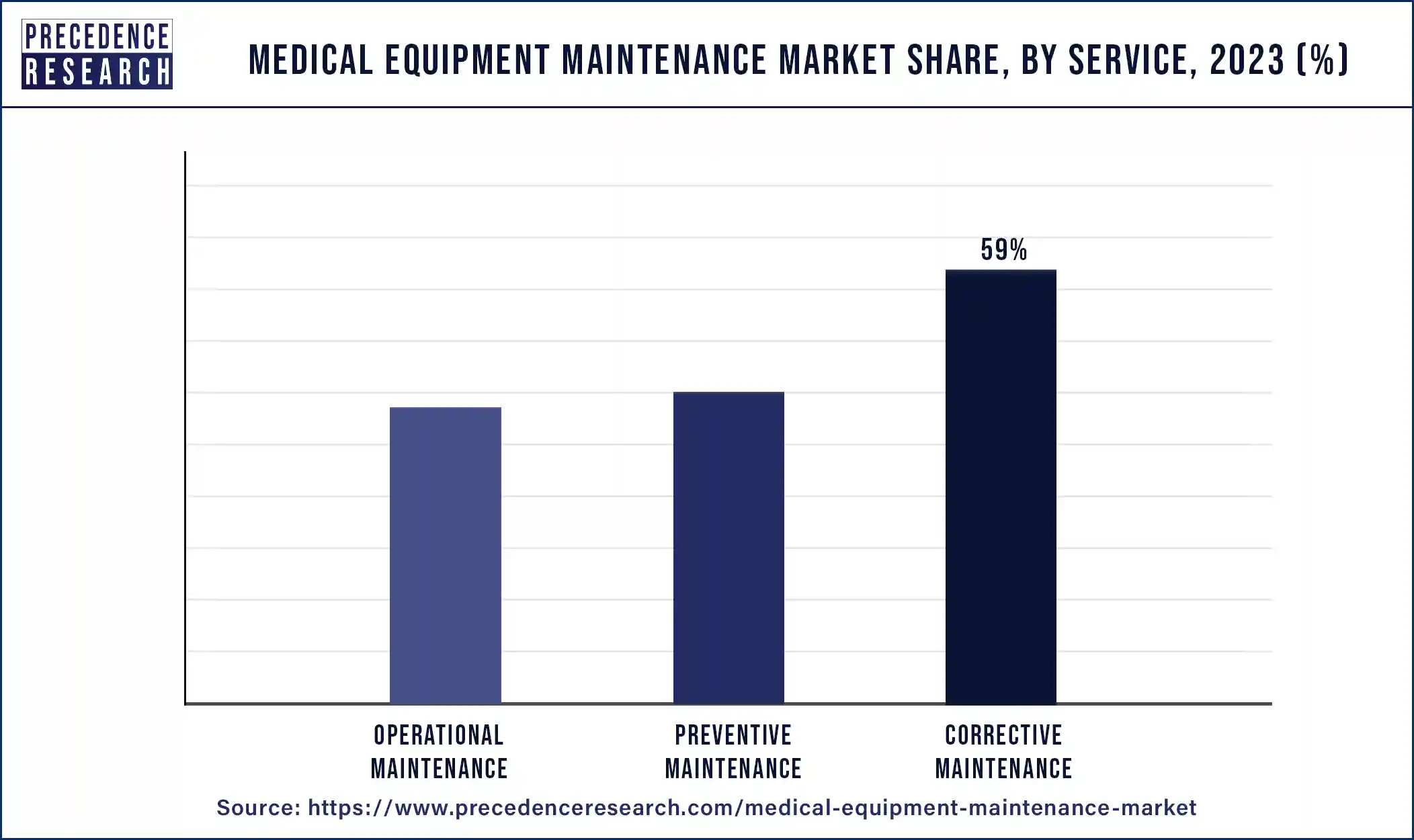

Based on service, the corrective maintenance segment accounted for 59% of revenue share in 2023 and is expected to remain dominant over the forecast period. The increased prevalence of chronic diseases among the population, growing research activities to develop innovative services, and growing demand for the usage of medical equipmentin the hospitals has fostered the growth of this segment in the past few years.

The preventive maintenance segment is expected to witness highest growth during the forecast period as it is gaining prominence as planned inspections to enhance patient safety and care quality.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In July 2018,Koninklijke Philips N.V., is a health technology company focused on improving people's health across the globe, signed two long-term delivery, upgrade, replacement, and maintenance partnership agreements with Kliniken der Stadt Köln. The various developmental strategies like acquisitions and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Equipment

By Service

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025