January 2025

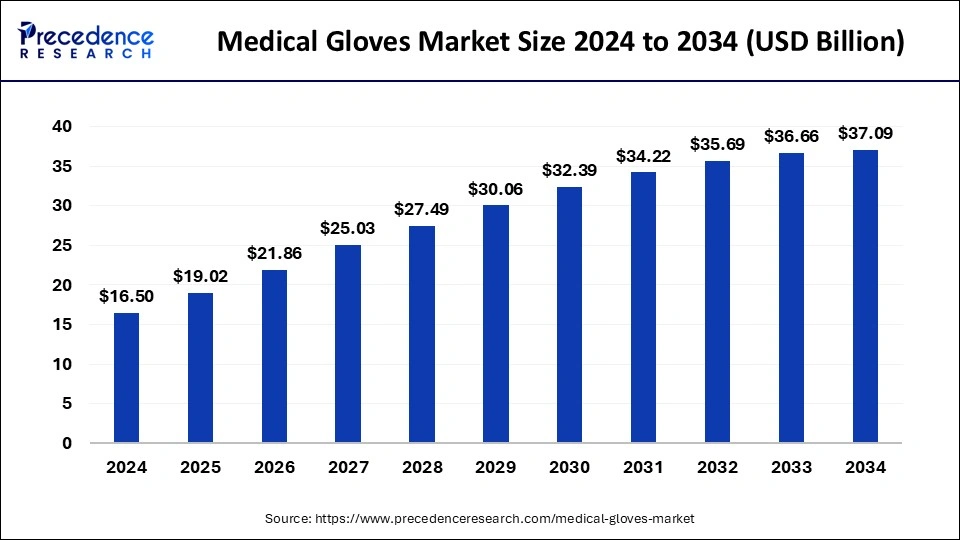

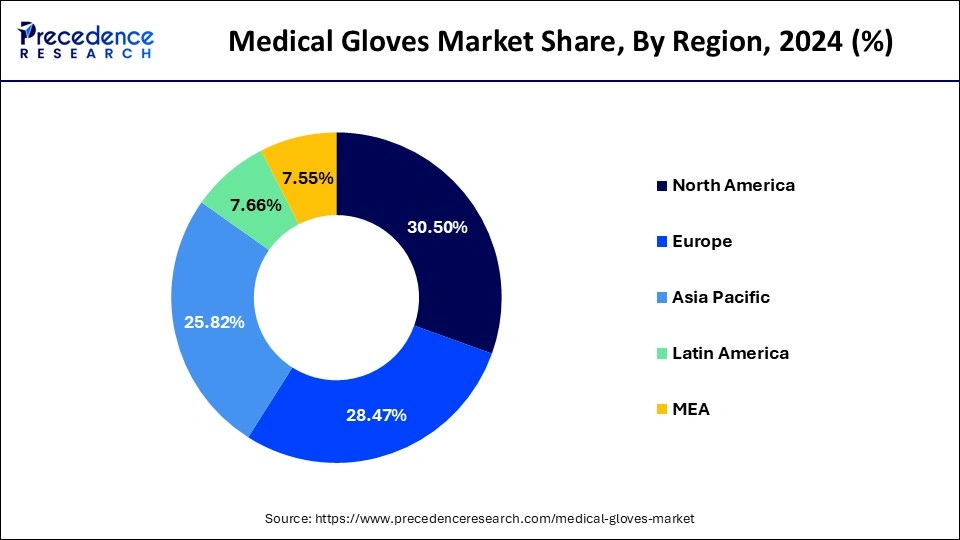

The global medical gloves market size accounted for USD 19.02 billion in 2025 and is forecasted to hit around USD 37.09 billion by 2034, representing a CAGR of 7.70% from 2025 to 2034. The North America market size was estimated at USD 5.03 billion in 2024 and is expanding at a CAGR of 5.67% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical gloves market size was estimated at USD 16.50 billion in 2024 and is predicted to increase from USD 19.02 billion in 2025 to approximately USD 37.09 billion by 2034, expanding at a CAGR of 7.70%. Growing awareness for safety and hygiene among medical professionals and people is anticipated to amplify the growth of the medical gloves market.

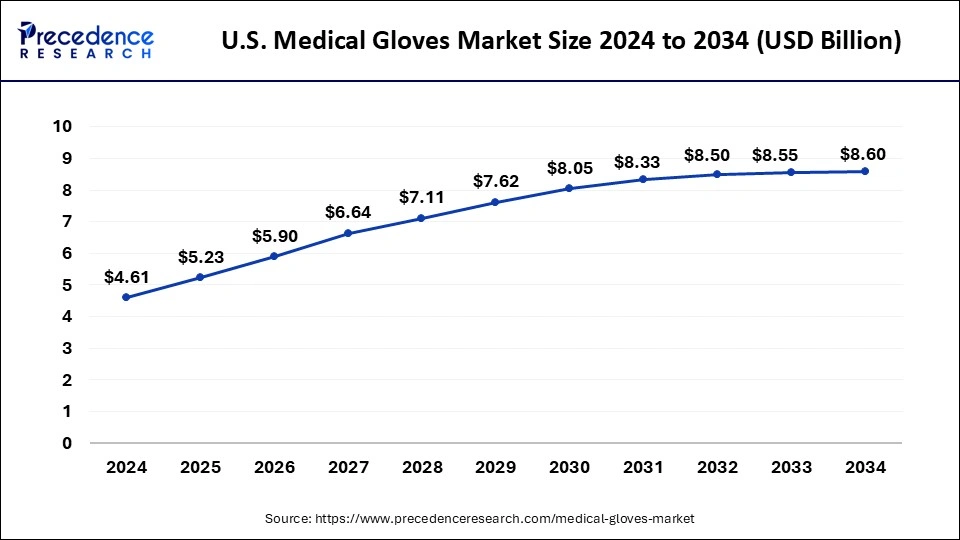

The U.S. medical gloves market size was exhibited at USD 4.61 billion in 2024 and is projected to be worth around USD 8.46 billion by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

North America dominated the global medical gloves market in 2024, with the United States leading in terms of market share. The increasing awareness about the importance of hand hygiene and the rise in healthcare-associated infections are driving the demand for medical gloves in the region. The rising prevalence of infectious diseases is fuelling the market's growth significantly by increasing the demand for medical gloves.

Moreover, the stringent regulations and guidelines set by the Occupational Safety and Health Administration (OSHA) and the Food and Drug Administration (FDA) regarding the use of personal protective equipment in healthcare settings have further boosted market growth. Another key factor contributing to the development of the medical gloves market in North America is the increasing prevalence of chronic diseases such as diabetes and cancer, which has led to a rising number of medical and surgical procedures. This has resulted in a higher demand for medical gloves in hospitals, clinics, and diagnostic laboratories, thereby driving the market growth.

Furthermore, after the COVID-19 pandemic significantly impacted the world widely, the demand for medical gloves in North America has increased. All healthcare professionals are mandatorily required to wear gloves as part of the personal protective layer. According to the National Ambulatory Care Reporting System (NACRS) in Canada, in December 2022, almost 14.0 million unscheduled emergency department visits were registered in Canada during the period of April 2021 to March 2022. Such huge emergency visits in Canada are expected to drive growth in the region due to the increased adoption of medical gloves in emergency.

The Asia Pacific is the fastest-growing region in the medical gloves market. The region is a key player in the global medical gloves market, representing a significant share of the overall market. Several factors contribute to the growth of the market in Asia Pacific, including increasing healthcare expenditure, rising awareness about the importance of hand hygiene, and a growing number of healthcare facilities in the region.

One of the primary drivers of the medical gloves market in Asia Pacific is the increasing focus on infection control and prevention in healthcare settings. With the rise in healthcare-associated infections and contagious diseases, healthcare providers are increasingly adopting stringent measures to ensure the safety of patients and healthcare workers. This has led to a higher demand for medical gloves in hospitals, clinics, and diagnostic laboratories across the Asia Pacific region.

Moreover, the increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer in countries like India and China has resulted in a growing number of medical procedures and surgeries. This has further fuelled the demand for medical gloves in the region, as healthcare professionals need to wear it.

The medical gloves market thrives and grows due to the increasing demand for healthcare services worldwide. Medical gloves are essential protective material worn by healthcare professionals to prevent the spread of infections and diseases in clinical procedures. They are used during various medical procedures to maintain hygiene and protect both patients and medical staff as well. Several factors, including the rising awareness about infection control and the growing number of surgeries and medical procedures, drive the market for medical gloves. Increasing prevalence of chronic diseases. Since the healthcare industry expands and advancements in medical technology continue, the need for medical gloves is expected to rise steadily.

One significant trend in the medical gloves market is the increasing adoption of disposable gloves over reusable ones. Disposable gloves offer convenience, reduced risk of cross-contamination, and cost-effectiveness, making them the preferred choice for healthcare facilities. This shift towards disposable gloves is expected to fuel market growth in the coming years.

Another key market driver is the stringent regulations and guidelines imposed by regulatory bodies regarding the use of medical gloves in healthcare settings. Compliance with these regulations is essential for healthcare facilities to maintain. High standards of patient care and safety, driving the demand for quality medical gloves that meet regulatory requirements.

The market is also influenced by technological advancements in glove manufacturing, leading to the development of innovative, high-quality gloves that offer improved protection and comfort. Manufacturers are investing in research and development to create gloves with enhanced features such as better grip, flexibility, and sensitivity, catering to the diverse needs of healthcare professionals.

However, the market faces challenges such as fluctuating prices of raw materials, competition among manufacturers, and concerns about the environmental impact of disposable gloves. Sustainability is becoming a growing concern in the healthcare industry, leading to efforts to develop eco-friendly alternatives to traditional disposable gloves.

Overall, the medical gloves market is characterized by steady growth, driven by increasing healthcare needs, technological advancements, and regulatory requirements. With the continuous focus on infection control and patient safety, the demand for high-quality.Medical gloves are expected to remain strong, creating opportunities for manufacturers to innovate and expand their product offerings in the foreseen years.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.70% |

| Market Size in 2025 | USD 19.02 Billion |

| Market Size by 2034 | USD 37.09 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Form, Application, Usage, Sterility, Distribution Channel, and End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Awareness about hygiene practices

The growing demand for healthcare services worldwide is a significant driver for the medical gloves market. As the healthcare industry expands and more medical procedures are conducted, the need for medical gloves to maintain hygiene and prevent infections also increases. Rising awareness about infection control with a greater emphasis on infection control in healthcare settings and the demand for medical gloves as a protective barrier against spreading diseases is growing. Healthcare professionals and facilities are increasingly aware of the importance of using gloves to ensure patient and staff safety.

Fluctuating Prices

The medical gloves market is susceptible to high fluctuations in raw material prices, particularly with materials like latex and nitrile. Price volatility in the medical gloves market on a global level can impact manufacturing costs and profit margins for glove manufacturers, posing a challenge to market growth. The competitive landscape of the medical gloves market can be a hindrance for some manufacturers. Intense competition can lead to price wars, reduced profit margins, and challenges in differentiating product offerings in an overly crowded market.

eco-friendly alternatives

The increasing focus on sustainability and environmental responsibility in the healthcare industry provides opportunities for developing eco-friendly alternatives to traditional disposable gloves. Manufacturers can capitalize on this trend by offering biodegradable or recyclable gloves in the medical gloves market to meet the demand for more sustainable healthcare products. Also, The ongoing technological advancements in glove manufacturing present opportunities for innovation and product differentiation. Manufacturers can develop gloves with enhanced features such as improved grip, flexibility, and sensitivity to fulfil the evolving needs of healthcare professionals due to the ongoing innovative launch of materials for gloves in the global market by several manufacturers.

The nitrile gloves segment held the largest share in 2024. Nitrile gloves offer several benefits along with clinical advantages to medical professionals. Also, it is more helpful to the people who are allergic to the latex material of gloves. As nitrile gloves are latex-free, they promote their use among people and medical professionals to avoid possible allergies due to latex material and reduce the chances of getting affected by allergies.

Additionally, chemical resistance is proven in using nitrile gloves as they provide improved heat dissipation and fewer environmental issues regarding disposal. These gloves are more stretchable and thus provide comfort for professionals to use them efficiently. Manufacturing of nitrile gloves witness a rising Spurr due to its advancements and utility. Market players are focusing on research and development to develop more innovative nitrile gloves for better operation within affordable cost ranges, stimulating the further growth of this segment in the market. And, in turn, fuelling the growth of the medical gloves market on a global scale.

The powder-free gloves segment held the largest market share in 2024 and dominated the medical gloves market globally. Several surgical and non-surgical procedures done with powder-free gloves fuel its demand in the market among healthcare professionals. Powder-free gloves offer numerous health benefits as they do not contain starch powder, but they are associated with many side effects when used for extended periods. Powder-free gloves provide better control, accessibility, and accurate temperature control.

The NIOSH has issued a safety notice- National Institute of Occupational Safety and Health recently, with the rules for using powder-free gloves and how it helps to reduce the allergies that protein-content latex gloves can cause.

The examination gloves segment held the largest share of the medical gloves market in 2024. Owing to the frequent visits to physicians for routine health check-ups and increasing admission of patients in the hospitals. Infectious diseases like viral, bacterial and others growing prevalence has led to spur in the medical examinations for treatment with accurate diagnosis.

The World Health Organization WHO issued several guidelines for medical professionals to treat patients while keeping an appropriate distance for checking and interacting with patients. To achieve this, medical gloves were mandatory for professionals and other medical staff as well. Such guidelines are a reason to augment the growth of the medical market on a global scale.

The disposable gloves segment held the largest market share and dominated the medical gloves market in 2024. The rising number of patients undergoing surgical procedures due to chronic disorders and the increasing prevalence of diseases owing to bacterial and viral infections are propelling the usage of disposable gloves and further fuelling market growth. These gloves are tear-resistant and highly pliable. They act as a barrier against pathogens that spread diseases and other hazardous chemicals.

Disposable gloves are made for single use only to restrict the possibility of contamination from infected ones to other non-infected patients. These gloves help reduce the widespread of microbes that are a potential threat to the doctors and other individuals around them. Hence, all these factors are reasons for further growth of the market.

The non-sterile gloves segment held the most significant market share and dominated the global medical gloves market in 2024. It is projected to expand further at the highest CAGR in the forecast period. Nonsterile gloves are friendly and reliable tools that possess the minimal risk of infections in non-surgical procedures. The rapid use of non-sterile gloves for various treatment and examination reasons in several hospitals, clinics, and ambulatory services is fuelling the market's growth.

Compared to sterile gloves, which are made for single tine, nonsterile gloves can be used multiple times. These gloves are made with latex-free material that possesses antibacterial properties and is more resistant to highly reactive chemicals. Hence, nonsterile gloves provide more comfort and accessibility to the medical faculty. The surge in routine check-ups and medical examinations is a primary reason to drive this segment and help grow the medical gloves market globally.

The brick-and-mortar stores segment held the largest market share in 2024. The brick-and-mortar stores provide better consumer service to remote areas worldwide and are easily accessible as well. These stores have a vast distribution network, which helps them reach the maximum number of consumers.

The hospital segment held the largest share and dominated the medical gloves market in 2024. The segment is observed to sustain the position during the forecast period. People are more inclined towards hospital facilities due to the better-quality treatment and Availability of medical staff for proper care, a broad range of surgical care, and examinations for patients with many disorders fuelling this segment's growth.

Proper sanitization and hygienic situations in hospitals, including the use of gloves, attract people to seek treatment under medical professionals in the hospitals. Hospital staff also deliver the best treatments with the proper training and code of conduct to avoid contamination from infectious patients. Additionally, the Availability of cost-effective and user-friendly gloves in the market motivates professionals to use gloves for safety purposes with every examination. All these reasons are fuelling the hospital segment's growth and, in turn, increasing the turnover of the medical gloves market at a higher rate globally.

By Product

By Form

By Application

By Usage

By Sterility

By Distribution Channel

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025