January 2025

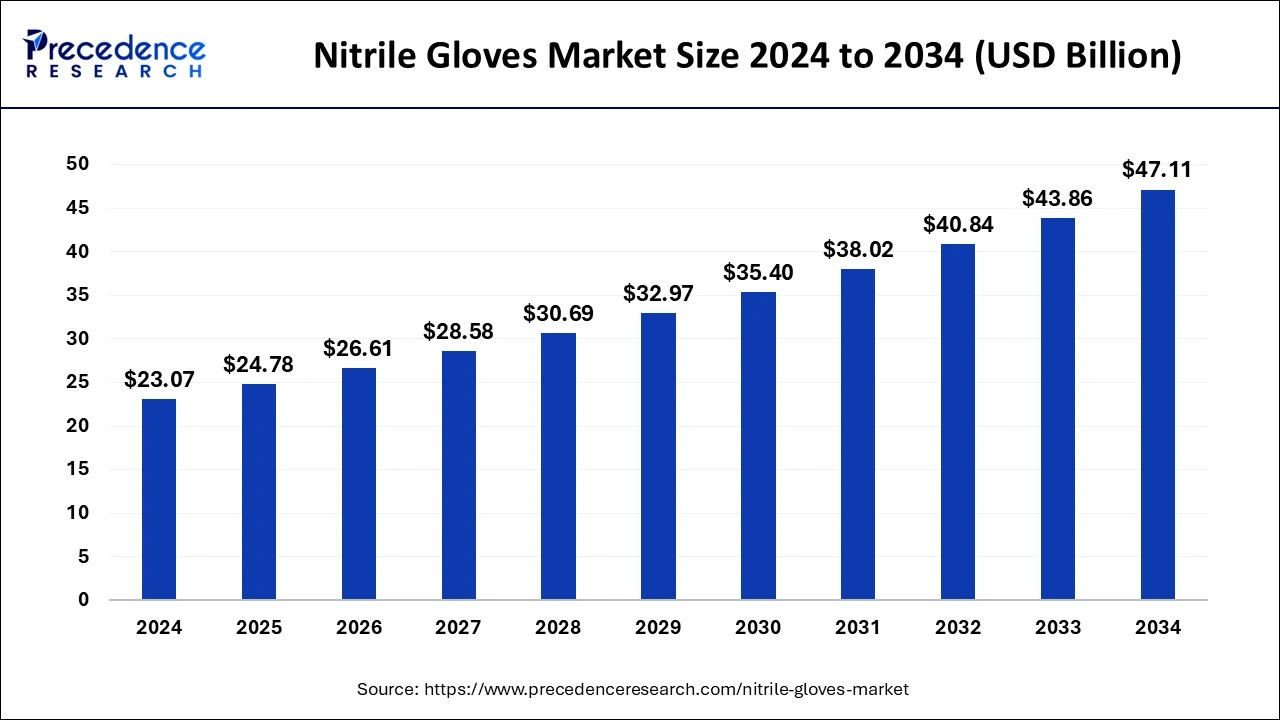

The global nitrile gloves market size is calculated at USD 24.78 billion in 2025 and is projected to surpass around USD 47.11 billion by 2034, expanding at a CAGR of 7.40% from 2025 to 2034. The North America nitrile gloves market size reached USD 8.54 billion in 2024 and is expanding at a CAGR of 7.45% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nitrile gloves market size accounted for USD 23.07 billion in 2024 and is expected to be worth around USD 47.11 billion by 2034, at a CAGR of 7.40% from 2025 to 2034.

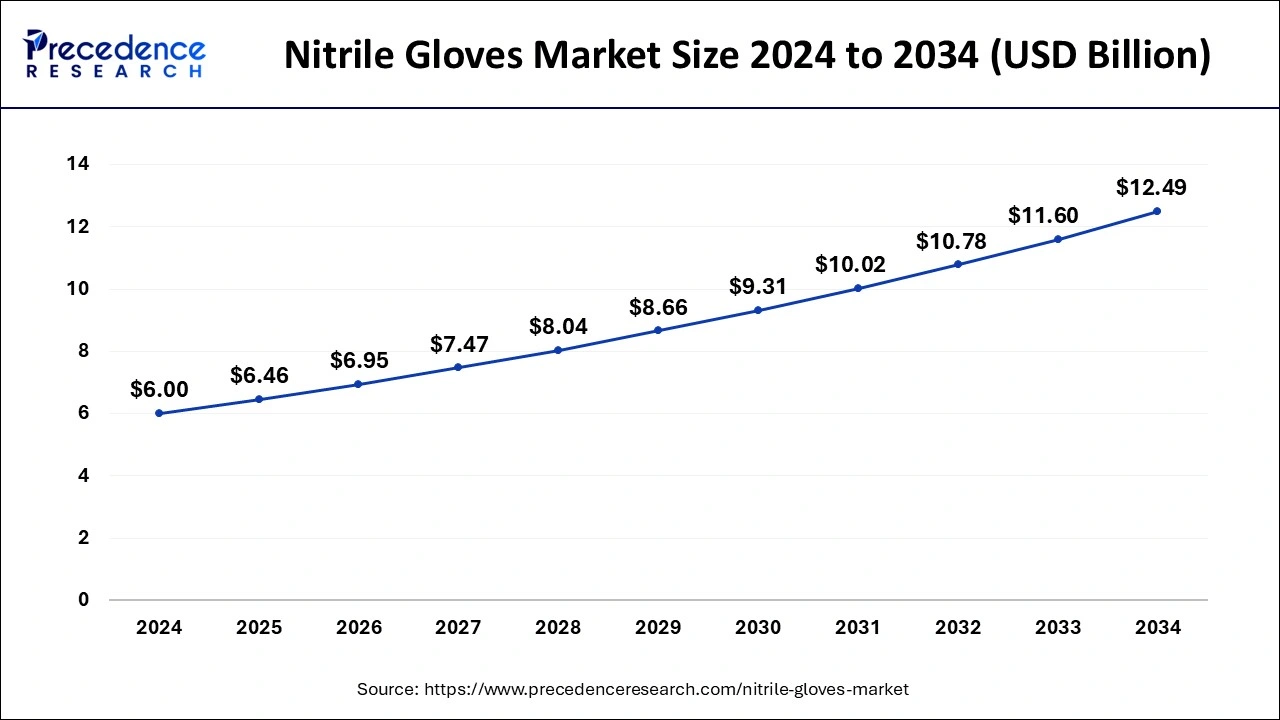

The U.S. nitrile gloves market size was estimated at USD 6 billion in 2024 and is predicted to be worth around USD 12.49 billion by 2034, at a CAGR of 7.60% from 2025 to 2034.

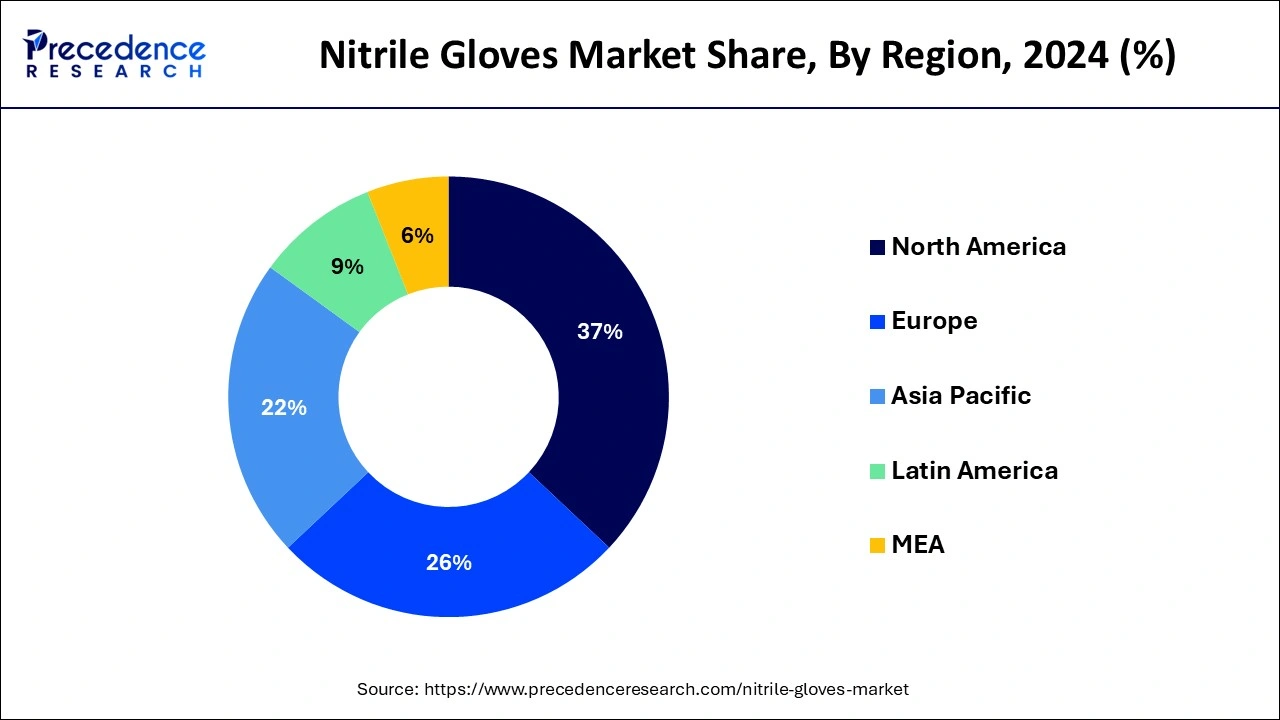

North America led the global nitrile gloves market with a value share of more than 37% in 2024. Further, the demand for nitrile gloves in the region anticipated to register a growth of more than 13% during the upcoming timeframe. Prominent factors that are responsible to drive the growth of the region include increasing elderly population, increasing healthcare expenditure, and rising awareness related to hospital-acquired infections. Additionally, rising incidences of chronic diseases such as obesity, diabetes, cancer, and many others are likely to the market growth in the forthcoming years.

Moreover, the Asia Pacific region estimated to have an attractive growth over the predicted time period because of increasing safety concern in hospitals and medical centers along with rising expenditure in healthcare sector. Apart from healthcare industry, the region is also prominently driven by the rising demand for protective gloves from automotive, food & beverage, and construction industries.

Increasing awareness related to benefits of nitrile gloves in healthcare facilities along with the rise in number of latex allergies expected to propel the market growth over analysis period. Nitrile gloves do not contain latex that increases their adoption among patients suffering from latex allergies. Synthetic rubber is used for the manufacturing of nitrile gloves that further aids them in offering durability, high strength, and enhanced flexibility together with the capability to offer a comfortable fit, reduce hand fatigue, and low friction. Further, the outbreak of COVID-19 pandemic in the early of 2020 anticipated to act as a major driving factor for the demand of nitrile gloves majorly in the countries that are suffering the most. The U.S. is one of the most badly affected countries across the globe by this pandemic situation. Thus, rapid spread of this disease across the country has prominently surged the demand for the product, particularly in the healthcare industry to reduce further transmission.

The nitrile gloves manufacturers are engaged in producing, designing, and supplying the product to various end-use industries by implementing innovative technologies. These manufacturers either use licensed technology provided by other market participants or own their independent proprietary technology. These market players have their manufacturing site dedicate to one location and distribute their products in different region to maintain minimal pricing.

| Report Highlights | Details |

| Market Size in 2024 | USD 23.07 Billion |

| Market Size in 2025 | USD 24.78 Billion |

| Market Size by 2034 | USD 47.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The disposable gloves segment dominate the global nitrile gloves market in 2024 and estimated to grow at the fastest rate over the analysis period. The attractive growth of the segment is mainly attributable to the rising demand for one time usable gloves in different end-use industries after the outbreak of COVID-19 pandemic in the starting of 2020. Additionally, disposable gloves help to prevent the transmission of germs and pathogens at medical centers that further expected to propel the demand for the product in the healthcare and medical industry during the upcoming years.

The durable type of nitrile gloves is designed to suit the harsh environments as well as that they can be used multiple times because of their advantages such as strength, durability, low waste generation, and other environmental benefits. Durable nitrile gloves are thicker compared to disposable gloves that assist them to last longer along with not tear easily this ensures improved protection of hand particularly in a heavy-duty application.

Medical & healthcare emerged as a leading end-use segment and accounted largest market revenue in 2024 because of the wide application of nitrile gloves across the industry as it helps in preventing cross-contamination together with transmission of pathogens during surgeries and medical examination. Furthermore, these gloves help doctors and medical practitioners to protect them against the risks affiliated with the blood-borne pathogens, on-job transmission of germs, and other environmental contaminants.

Apart from this, nitrile gloves are commonly used in the automotive industry because they are produced using synthetic polymers and are also latex-free that reduces the friction as well as increases puncture resistance. Moreover, these gloves provide excellent chemical resistance, mainly to oil, grease, and gasoline that result in their high demand in the automotive industry.

Segments Covered in the Report

By Product

By Type

By Grade

By Texture

By End-Use

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

January 2024