January 2025

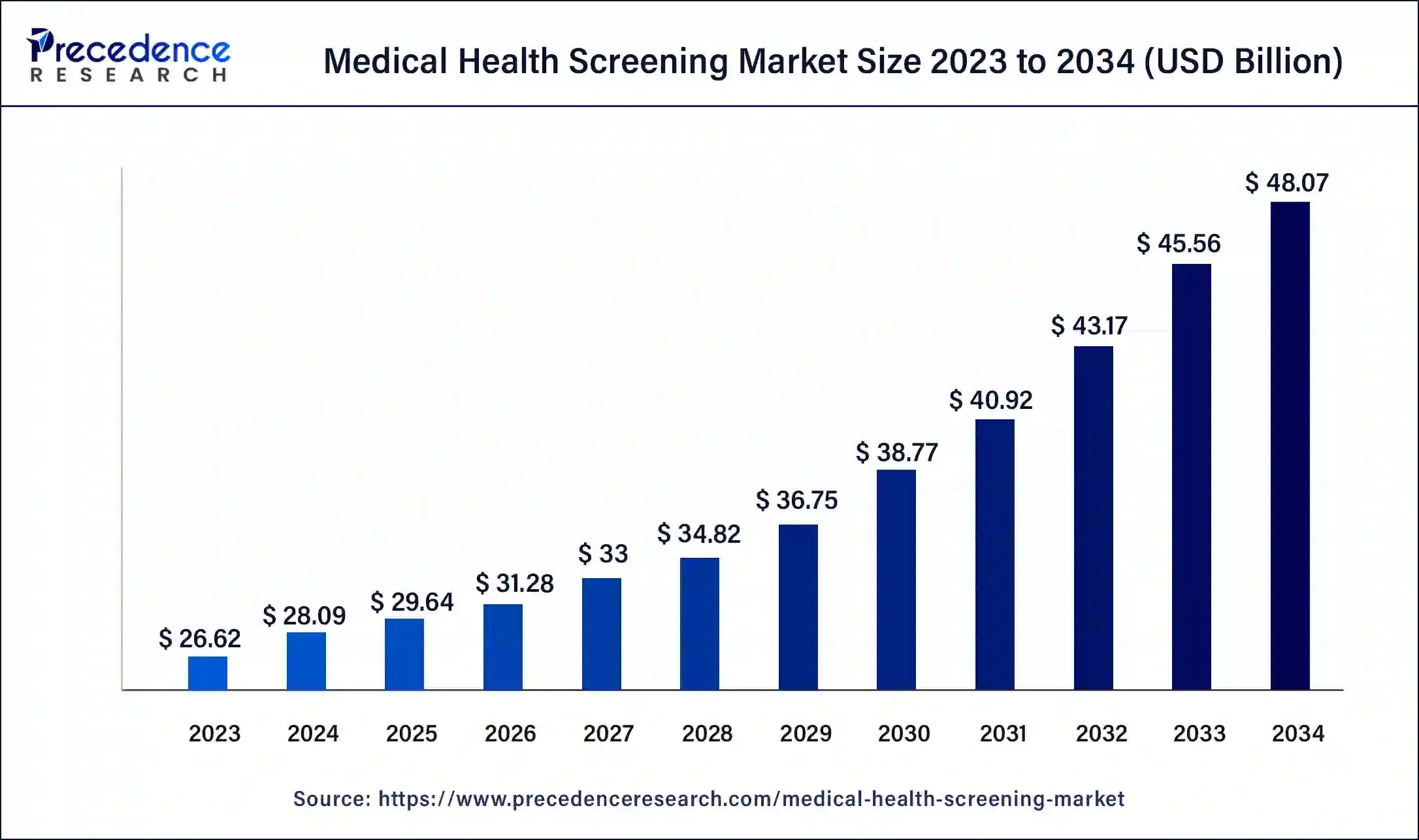

The global medical health screening market size was USD 26.62 billion in 2023, calculated at USD 28.09 billion in 2024 and is expected to be worth around USD 48.07 billion by 2034. The market is slated to expand at 5.52% CAGR from 2024 to 2034.

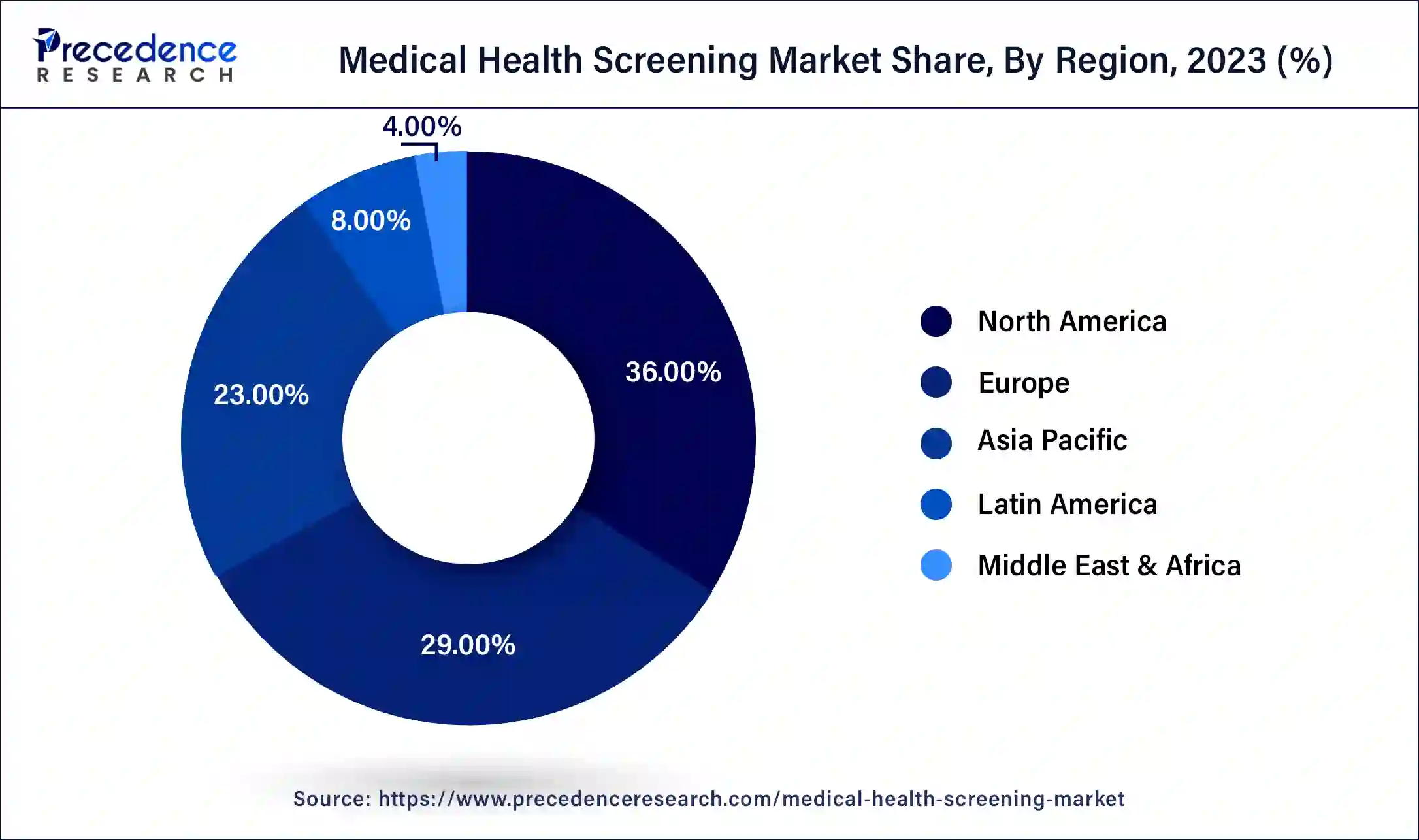

The global medical health screening market size is projected to be worth around USD 48.07 billion by 2034 from USD 28.09 billion in 2024, at a CAGR of 5.52% from 2024 to 2034. The North America medical health screening market size reached USD 9.58 billion in 2023. The rising health geriatric population is contributing to the medical health screening market growth.

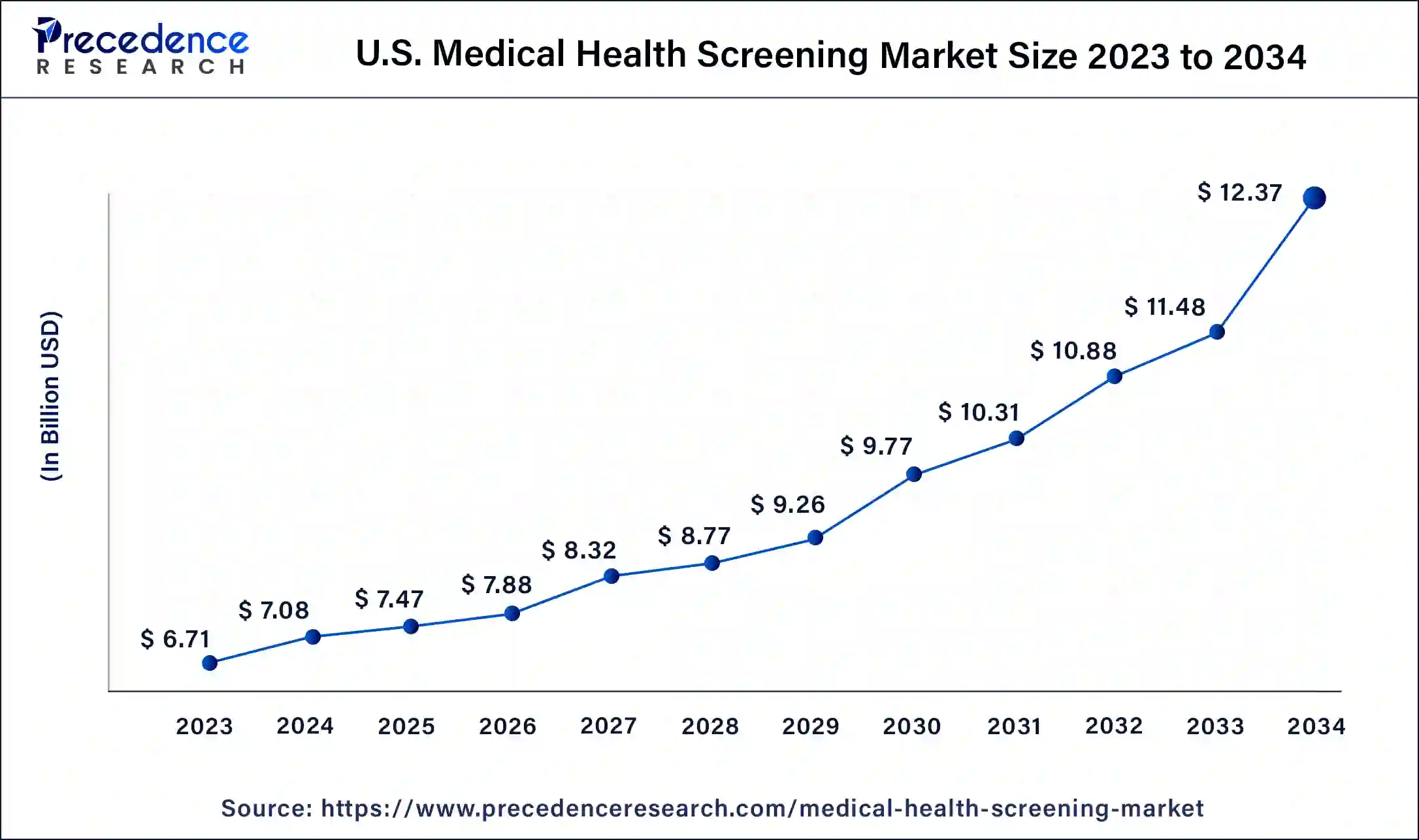

The U.S. medical health screening market size was exhibited at USD 6.71 billion in 2023 and is projected to be worth around USD 12.37 billion by 2034, poised to grow at a CAGR of 5.71% from 2024 to 2034.

North America dominated the global medical health screening market in 2023. The growth of the region is attributed to the increasing health awareness in countries like the United States and Canada. These countries also have a higher number of chronic disease patients, which increases the demand for multiple medical screening tests. The region also has access to advanced technologies, which helps the overall patient experience and attracts more individuals for regular health screening tests. The governments are also focusing on expanding their healthcare infrastructure by increasing funding and carrying out various health screening campaigns for blood pressure, cholesterol, and many more.

Asia Pacific is expected to grow at an exponential CAGR in the medical health screening market during the forecast period. The region is registering significant growth due to the increasing urbanization in countries like China, India, and Japan. These governments are also focusing on improving their healthcare infrastructure by implementing new technologies for medical health screening. The developing areas in these countries are opening several opportunities for new medical professionals and service providers, which will also contribute to the growth of the market.

Medical health screening refers to medical tests executed by doctors as a precautionary measure to detect any medical condition before any signs and symptoms. Undergoing these tests helps the individual detect diseases or health conditions at early stages and carry out a planned treatment program. The screening includes various tests like BMI, blood pressure, cholesterol testing, and many more, which leads to potential risks for the body. These tests can prove beneficial in many ways, such as preventing higher costs by detecting the medical condition at early stages.

The medical health screening market is gaining significant importance due to increasing health awareness, especially among the aged population. The rising disposable incomes in the urban population also increase the spending on healthcare, which acts as a potential growth factor for the market. This results in the rising need for multiple facilities in the healthcare sector, which leads to multiple investments in improving the healthcare infrastructure.

What is the role of AI in the Medical Screening Industry?

Artificial intelligence is revolutionising the entire medical field, and the medical screening industry is no exception. AI is being deployed in the medical screening space to provide faster and more accurate results at a lower cost. Traditional screening processes are time consuming and require skilled professionals who constantly need to demonstrate a sensitivity of over 80% while identifying medical issues. AI can be trained to identify anomalies in patient scans, X-rays and other medical reports, with algorithms trained to detect potential medical issues.

| Report Coverage | Details |

| Market Size by 2034 | USD 48.07 Billion |

| Market Size in 2023 | USD 26.62 Billion |

| Market Size in 2024 | USD 28.09 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Test Type, Setting Type, Sample Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising prevalence of chronic diseases

The rapid increase in urbanization has changed lifestyle dynamics, severely affecting the health of individuals. Urbanization has led to many health conditions like stroke, diabetes, cancer, and many more. These conditions lead to increasing demand for various medical health screening tests, which would help the individual detect the issue earlier and take precautions to cure it. Additionally, many factors, like increasing consumption of alcohol and cigarettes, are contributing to the growth of the medical health screening market.

Rising geriatric population

The increasing number of individuals aged 65 and above is leading to the demand for medical tests as the risk of diseases increases with increasing age. This population has a higher chance of coming across conditions like diabetes, osteoporosis, and many more. The increasing risk factors lead people to opt for regular health checkups, which can help them improve their quality of life by curing the health problem at an early stage.

Higher medical screening costs

The medical health screening market has shown significant progress in developed countries, but there are still growth concerns in underdeveloped regions, which usually have low incomes. These regions still lack developed health infrastructure, making it unaffordable, especially for people without health insurance. Many governments are taking the initiative to work on improving the healthcare system, which would help improve health screening services for patients and contribute towards the growth of the market.

Technological advancements

The emergence of various technologies presents a bright future in multiple sectors, including healthcare. It helps enhance the overall medical process, which provides accuracy in medical tests. Various improvements in tests like MRI, CT scan, and many more provide clear images of the associated problem and help provide enhanced treatment for it. Artificial intelligence also helps store and analyze various patient data, which helps enhance the diagnosis of diseases like cancer and other neurological disorders. This also improves the reliability of these drugs, which helps towards the growth of the medical health screening market.

Increasing government initiatives

Many governments and organizations are working towards the improvement of health infrastructure, which includes several campaigns and funding for improving the health screening process in rural and underdeveloped areas. This regulatory support helps improve the overall health infrastructure and contributes to the growth of the medical health screening market.

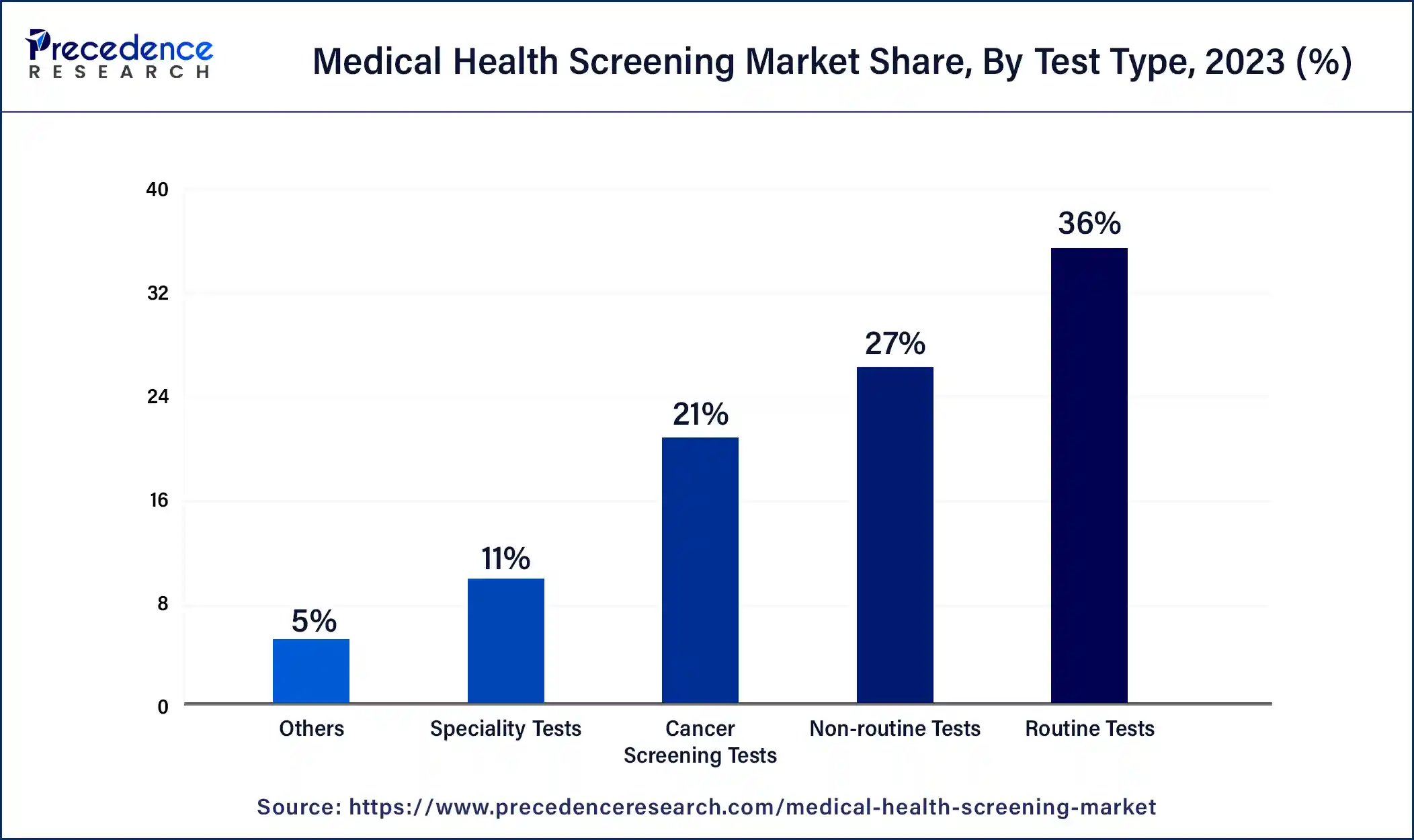

The routine tests segment held the dominant share of the medical health screening market in 2023. These tests are held regularly to monitor and track the patient's health status, which helps them take necessary precautions regarding their diseases. Routine tests are usually blood pressure screening, cholesterol, blood sugar, and others. The increasing prevalence of various health conditions is increasing the demand for more routine setups, which also contributes to the growth of the market.

The non-routine tests segment is anticipated to register the fastest growth in the medical health screening market during the forecast period. Non-routine tests usually are lab tests and specialty care, which include advanced imaging and many more. The laboratory tests may include blood tests for infections like Covid 19, which require specialized screening. Emerging technologies are increasing the efficiency of non-routine tests, which will also contribute to the growth of the overall market.

The cancer screening tests segment is expected to register notable growth in the market between the period of 2024 and 2033. The increasing prevalence of cancer is increasing the demand for various cancer screening tests like PSA, mammograms, and others. Many health organizations and authorities are working towards improving the health screening system for cancer patients. These ongoing initiatives stand as a notable growth factor for the medical health screening market.

The hospital/clinical laboratories segment dominated the market in 2023. The primary source of treatment has been hospitals for the past decades. These settings usually have highly qualified professionals to access these technologies. These professionals can use advanced medical technology to examine patients. Some specialists focus on various body parts and are capable of examining and curing the patient according to the problem. This increases the reliability of the individuals, which plays a major role in the development of the medical health screening market. Many large medical organizations are also helping to expand the market reach by carrying out several medical screening campaigns.

The workplaces segment is expected to register the fastest growth in the medical health screening market during the forecast period 2024 to 2033. Many leading companies are focusing on improving the overall health of their employees to tackle issues like disturbed mental health. These initiatives help their company employees to track their health status with convenience and ease.

The blood segment holds a significant share of the global market. The growth of this segment is attributed to the accuracy provided by various blood tests. Blood tests provide insights into glucose levels, kidney and liver function, and many other infections. This has resulted in the need for more professionals who carry blood tests in convenient settings. There are many centers that provide home test facilities, which drive the growth of the medical health screening market.

The urine segment is expected to register the fastest growth in the medical health screening market during the forecast period. This segment is gaining popularity due to the convenience of collecting urine samples, which do not complicate the process and help diagnose various conditions like kidney function and other metabolic disorders. Health insurance companies are providing free services like annual health checkups, which include urine tests, which are helping the growth of the overall market.

The hospitals/clinics diagnostic laboratories segment dominated the medical health screening market in 2023. Hospitals are well-equipped to handle emergencies and critical care needs. When getting a health check-up in a hospital, you can quickly access emergency services if any unforeseen health issues are identified. Additionally, hospital-based laboratories are often connected with other clinical services within the hospital. This connection allows for smooth communication between healthcare providers, ensuring that test results are effectively shared with the relevant medical professionals for further evaluation and decision-making.

Segments Covered in the Report

By Test Type

By Setting Type

By Sample Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025