January 2025

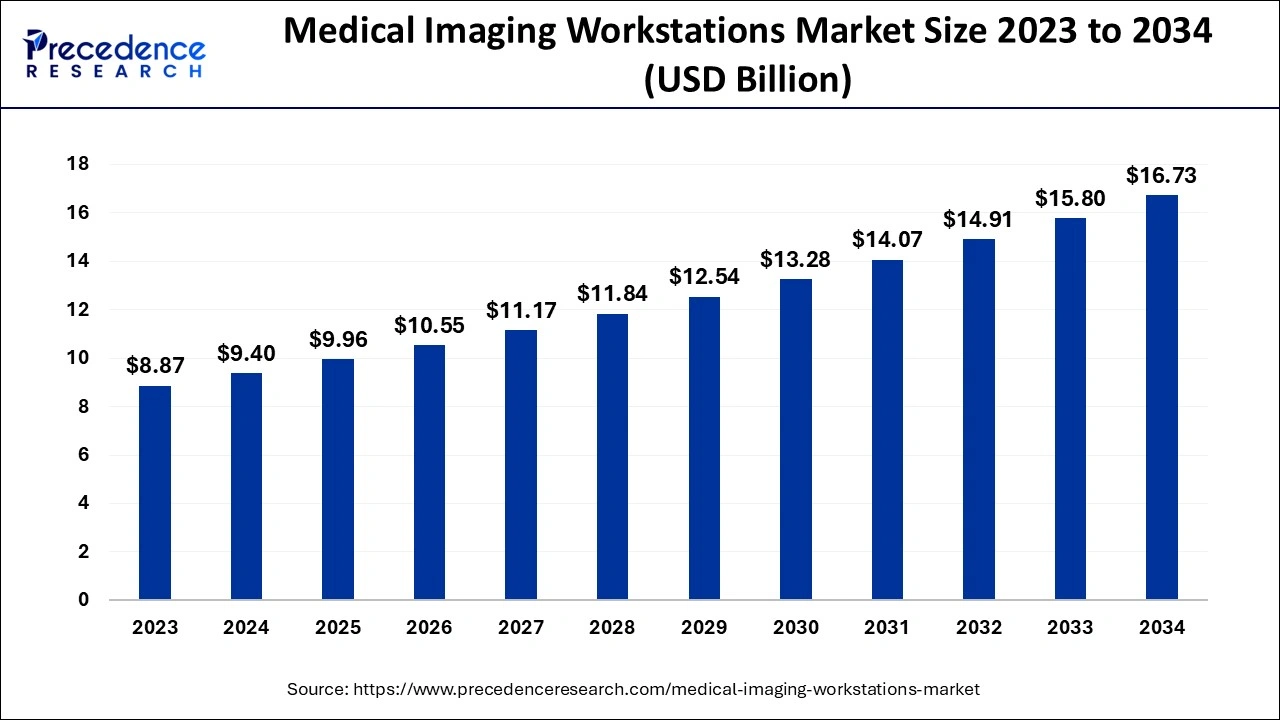

The global medical imaging workstations market size accounted for USD 9.40 billion in 2024, grew to USD 9.96 billion in 2025 and is expected to be worth around USD 16.73 billion by 2034, registering a CAGR of 5.94% between 2024 and 2034. The North America medical imaging workstations market size is calculated at USD 3.48 billion in 2024 and is expected to grow at a CAGR of 6.07% during the forecast year.

The global medical imaging workstations market size is calculated at USD 9.40 billion in 2024 and is predicted to reach around USD 16.73 billion by 2034, expanding at a CAGR of 5.94% from 2024 to 2034. The medical imaging workstations market is rapidly growing because of the development in techniques related to imaging, the increasing rates of chronic diseases, the increased aging population, AI in imaging, telemedicine, upgrades in healthcare facilities, and the increased spending on healthcare demands for better diagnostic tools.

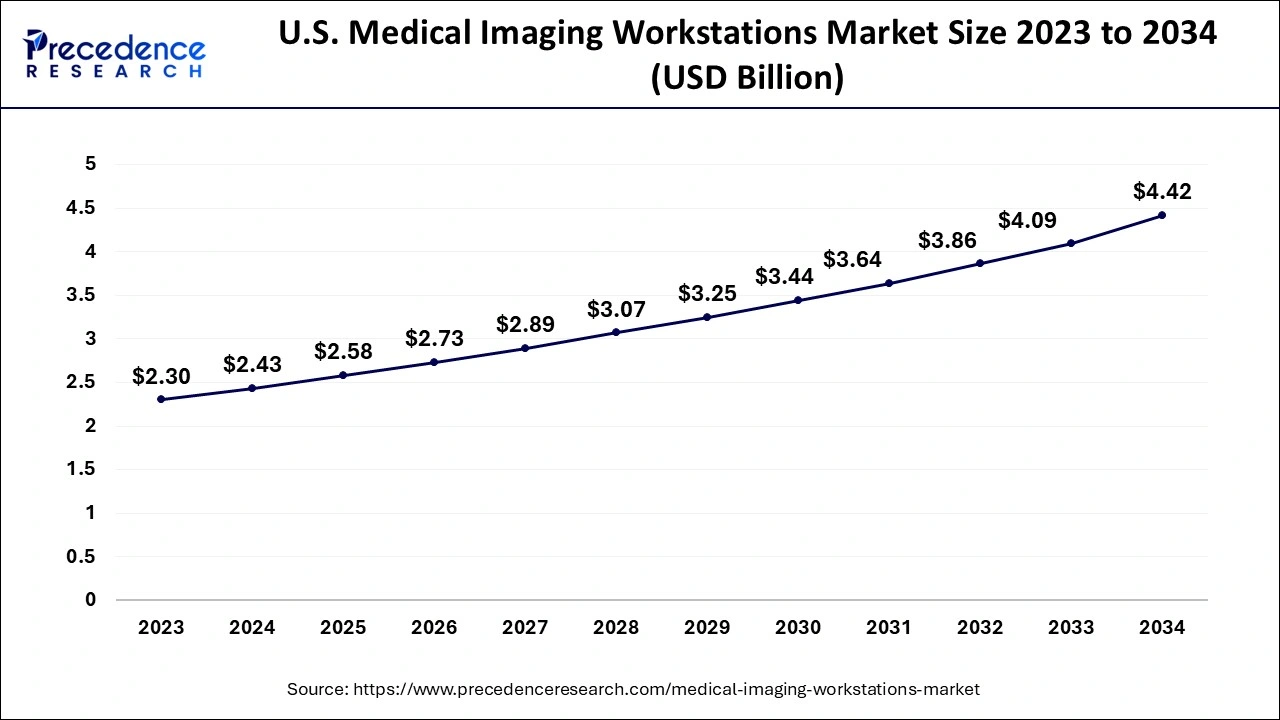

The U.S. medical imaging workstations market size is exhibited at USD 2.43 billion in 2024 and is projected to be worth around USD 4.42 billion by 2034, growing at a CAGR of 6.12% from 2024 to 2034.

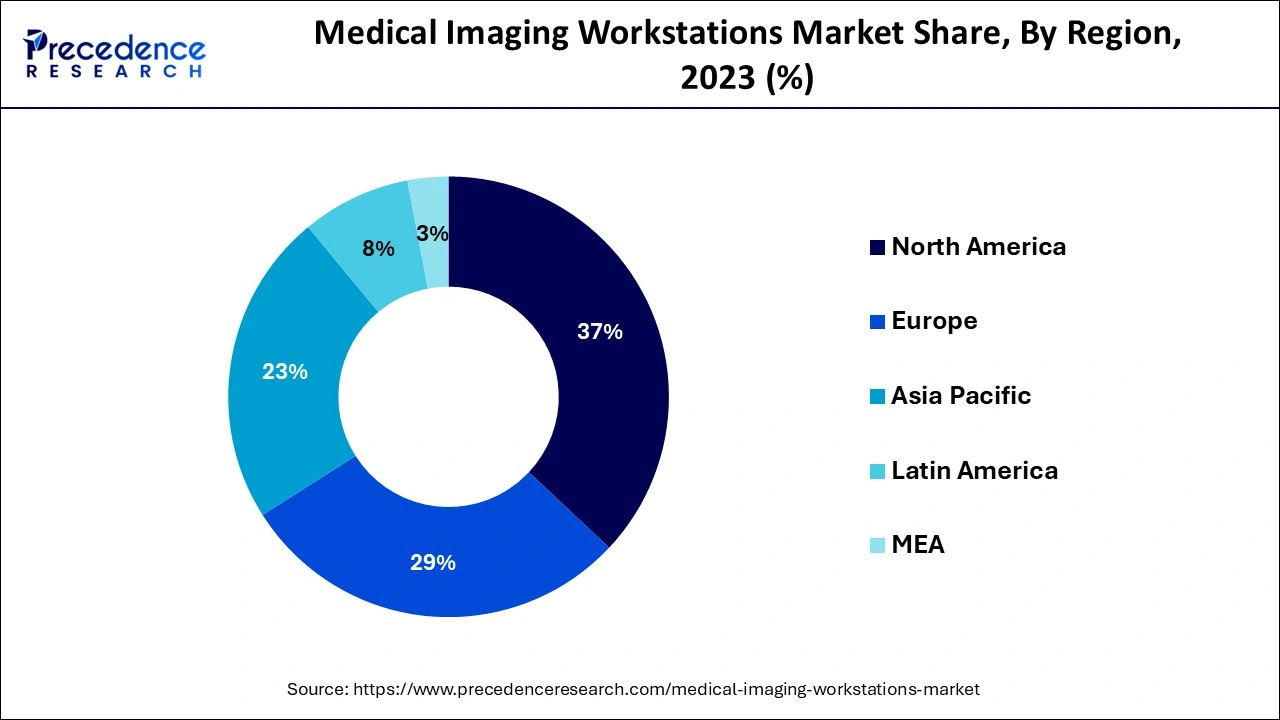

North America accounted for the largest share of the medical imaging workstation market in 2023. The higher spending in the R&D domain for the development of technologically advanced medical devices for the diagnosis of several targeted diseases, and lifestyle disorders, is the key factor for the revenue growth in the North American market. The market in the region is very competitive developed countries like the U.S. and Canada have invested much in research & development (R&D) activities which possess a growth share in the regional market. Also, the rising healthcare industries, availability of experienced professionals, easy access to technologically advanced imaging systems, and highly larger penetration of large numbers of imaging centers and other strategic market players.

Asia Pacific is anticipated to witness the fastest growth in the medical imaging workstations market during the forecasted years. Factors such as a large population growth rate and higher R&D activity in the region are expected to drive market growth. The participation of large market players and expansion of chronic diseases. Furthermore, the new technology used in various medical imaging devices coupled with the rise in the geriatric population and the high incidence of diseases such as cancers will be the major drivers in this market. This has been led by Asia Pacific countries and hence there is a need for low-cost treatment.

Medical imaging workstations are critical components of the system for Digital Image Processing. Integrated software is provided as part of the design of a medical workstation in order to assist these aspects of workflow. With the necessity of greater extents of compatibility, the medical imaging workstations market is emerging.

The Global Medical Imaging Workstations Market is progressing at a rapid rate due to the rise in worldwide prevalence of lifestyle diseases such as COPD, cardiac failure, chronic kidney disease, and others, rising commercialization of products, and increased funding for the development of such products. This is due to enhanced people's understanding of the diseases and possible medical applications, including medical imaging workstations for maintaining healthcare records, information flow, and accurate diagnosis.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.73 Billion |

| Market Size in 2024 | USD 9.40 Billion |

| Market Size in 2025 | USD 9.96 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.94% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Usage Mode, Application, Component, Modality, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Cases of Chronic Illness

An increase in the geriatric population and chronic diseases is the key reason for the growth of medical imaging workstations. The sophisticated diagnosis of conditions like cancer CVD and neurological disorders requires precise and timely diagnoses for effective treatment planning. Medical imaging workstation systems produce images of the human body as a tool through which physicians diagnose diseases and describe medical conditions. The type of imaging used depends on the symptoms and the part of the body being examined. Some common medical imaging techniques include: Radiography also called X-rays, computerized axial tomography (CAT) scan, magnetic resonance imaging (MRI), and ultrasound.

High cost of equipment and maintenance

Medical imaging workstations and equipment tend to be costly to purchase and maintain. These types of integrated medical imaging workstations come at a very high cost that involves procurement, installation, and maintenance costs. The high costs related to these workstations can pose a challenge, especially for healthcare facilities with limited budgets. Also, the necessity for regular upgrades and software updates can add to the overall expenses. However, the market also experiences difficulties such as costs connected with the implementation of the new imaging jobs and the essential demand for qualified specialists to manage these workstations. This cost factor can act as a limiting factor for taking up medical imaging workstations, especially in cases where the health facilities are poorly equipped.

3D imaging technologies

3D Medical Imaging Devices refer to specialized instruments utilized in the process of medical imaging that enable to creation of 3D representations of bodily structures or engineering structures of objects of intra-organism or environmental interest. Moreover, due to a rising number of minimally invasive treatments, higher levels of image detail are required to aid in planning and performing such surgeries or interventions. Thus, they enable physicians to target and treat specific areas with precision, raising risks, and recovery times for patients. Thus, advances such as 3D reconstruction, real-time 3D imaging, and hybrid imaging systems have expanded the range of applications and improved patient care.

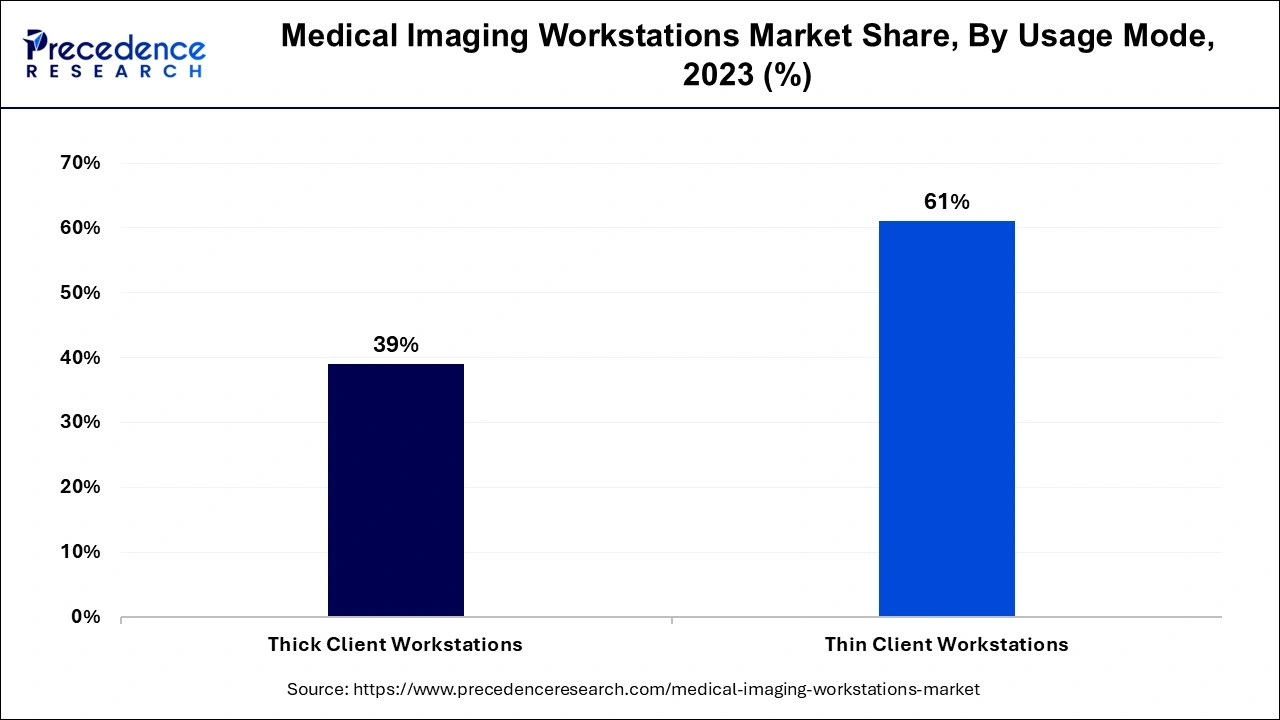

The thin client workstation segment noted the largest share of the medical imaging workstations market in 2023. Thin-client workstations are being driven considerably by the increasing need for early and accurate patient diagnosis and the increasing inclination for remote and multimodal patient monitoring. A thin client-based workstation is preferred in medical imaging workstations because it is inexpensive and can also often lower IT support. Since thin client workstations can be implemented with lesser hardware needs than those of other computers, their manufacturing and purchasing will be cheaper. It also uses less power and is affordable to maintain.

The thick client workstation segment is projected to witness the fastest growth in the medical imaging workstations market during the forecast period. A thick client workstation is a client terminal that can work independently of the server and contains its applications, computational, and storing resources. This permits it to endure working without issues even when offline. Thick client workstations provide offline access to the clinical environment, providing healthcare professionals access to critical information in areas with unreliable or no internet connectivity. This makes it possible to make early decisions. Thick client workstations also offer strong security features to keep sensitive medical imaging data.

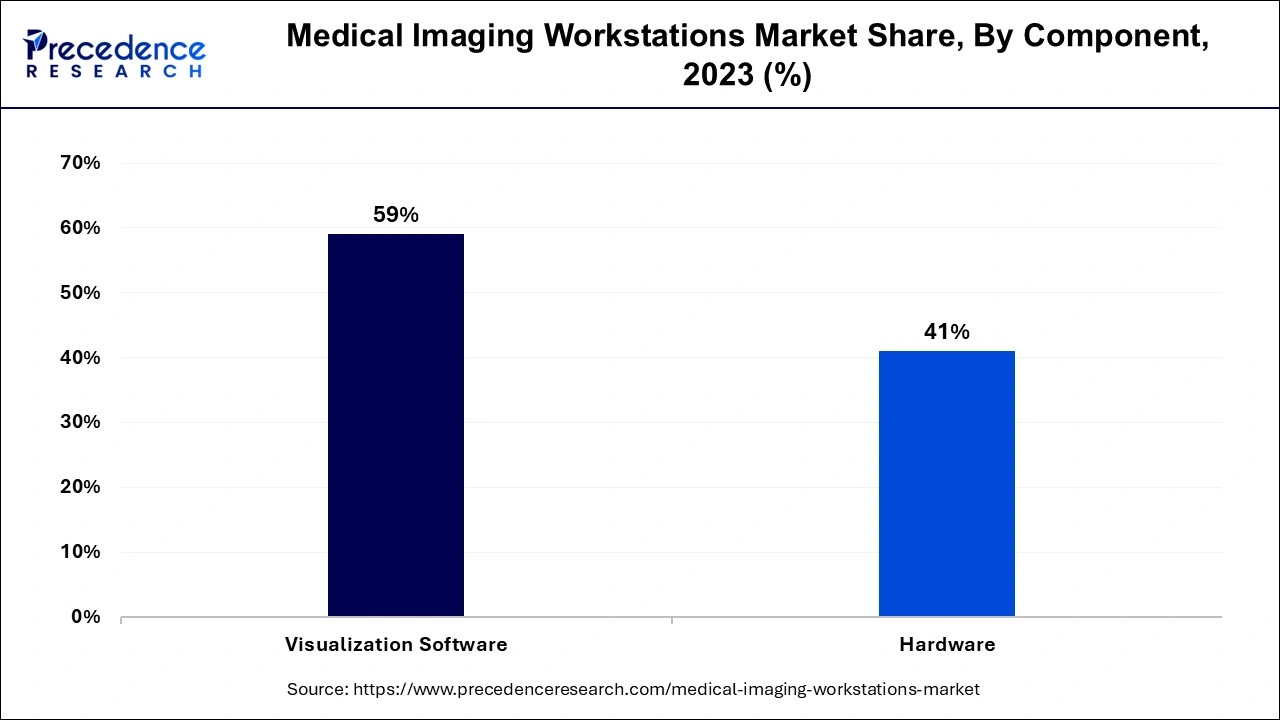

The visualization software segment dominated the global medical imaging workstations market in 2023. Medical image processing and visualization enable doctors and other healthcare providers to make guesses about the actual anatomy of the patient and analyze data from different perspectives. Medical Visualization is defined as a specialized field within scientific visualization that exploits medical image data, models of minimally invasive surgery instruments, and biomedical simulations applied to diagnosis, treatment planning, and medical education. Medical imaging Software is utilized in the different departments of neurology to diagnose and analyze medical images of the brain and nervous system, including CT scans, MRI scans, and PET scans among others.

The hardware segment is projected to witness the fastest growth in the medical imaging workstations market during the forecast period. A medical imaging workstation is a computer that is used to images are loaded, processed, and read in medical applications. They are essential instruments in the diagnostic imaging divisions and can be used for a variety of purposes. However, medical imaging workstations also contain a need for scalable storage and data protection mechanisms. The medical images of high resolutions mean that file sizes and volumes have increased exponentially. Edge and cloud storage architectures are usually used for these applications.

The computed tomography (CT) segment contributed the largest share of the medical imaging workstations market in 2023. Computed tomography is a diagnostic technique that utilizes X-ray and a computer to obtain transverse images of the human body systems. A CT scan is an imaging examination that is used in diagnosing diseases and injuries. It employs a sequence of X-rays and makes use of a computer to produce clear pictures of the bones and the soft tissues of the body. A CT scan is not painful or invasive. This leads to shorter hospital stays and enhanced patient comfort, making CT scans the desired diagnostic tool. Hence, CT treatment owns this market, the constant development is being experienced, and effectively used to positively influence the level of patient satisfaction.

The mammography segment is projected to witness the fastest growth in the medical imaging workstations market during the forecast period. Mammography is a type of medical imaging system with computer-aided image analysis that is designed to screen or image the breast to assess the existence of breast cancer. The exam is known as mammography and can be observed on a digital monitor or printer. It is used as a diagnostic as well as a screening method. This globally increasing experience of breast cancer has been acting as a driving force for products such as mammography workstations.

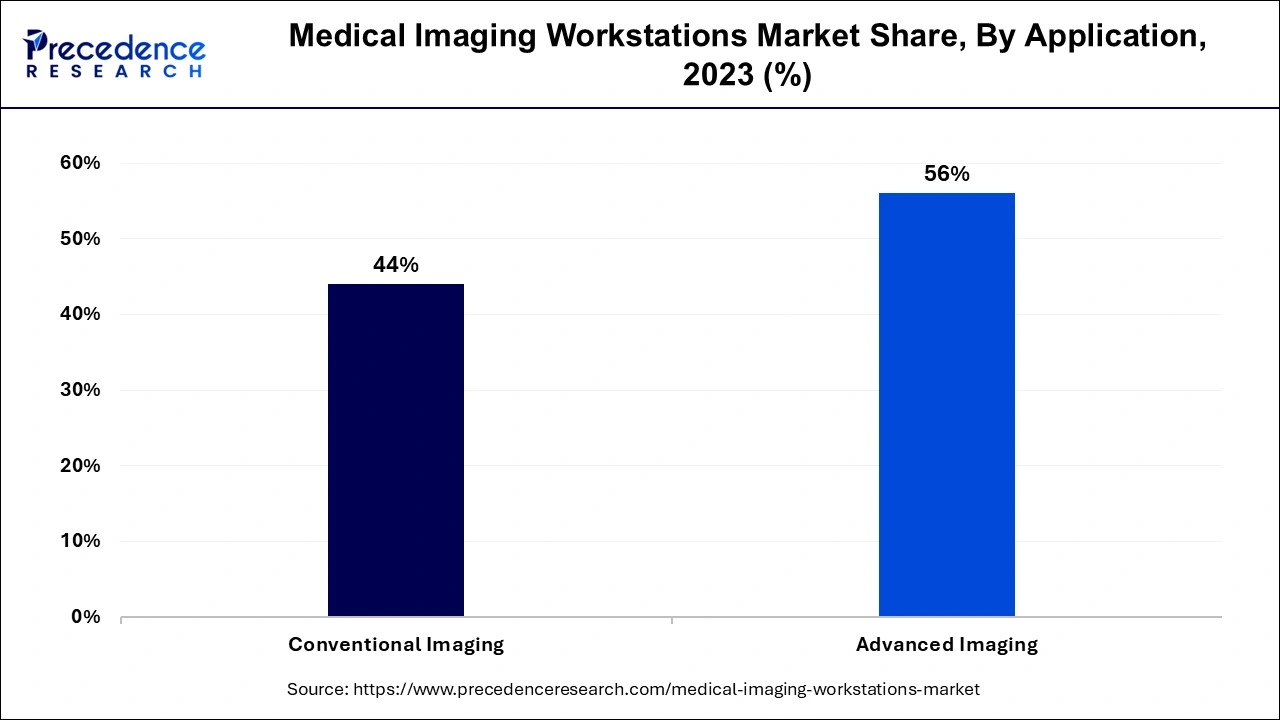

The advanced imaging segment contributed the largest share of the medical imaging workstations market in 2023. Medical image processing tools such as MRI, CT scans, PET scans, ultrasound imaging, and fluoroscopy have not only enriched medical practice but have also offered various non-invasive spectrographic diagnostic choices. Medical imaging workstations and advanced imaging techniques are vital tools for healthcare suppliers to diagnose diseases, monitor patients, and personalize treatment plans.

The conventional imaging segment is projected to witness the fastest growth in the medical imaging workstations market during the forecast period. Medical imaging workstations can be adopted for conventional imaging which is always a cost-effective technique where two-dimensional images of the human body are produced through X-rays. It is also the simplest and cheapest way of imaging patients with rheumatologic disorders of all the methods. X-ray is utilized in the assessment of the presence of fractures, dislocations, and lung infection as well as the evaluation of bone mass.

By Usage Mode

By Application

By Component

By Modality

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025