January 2025

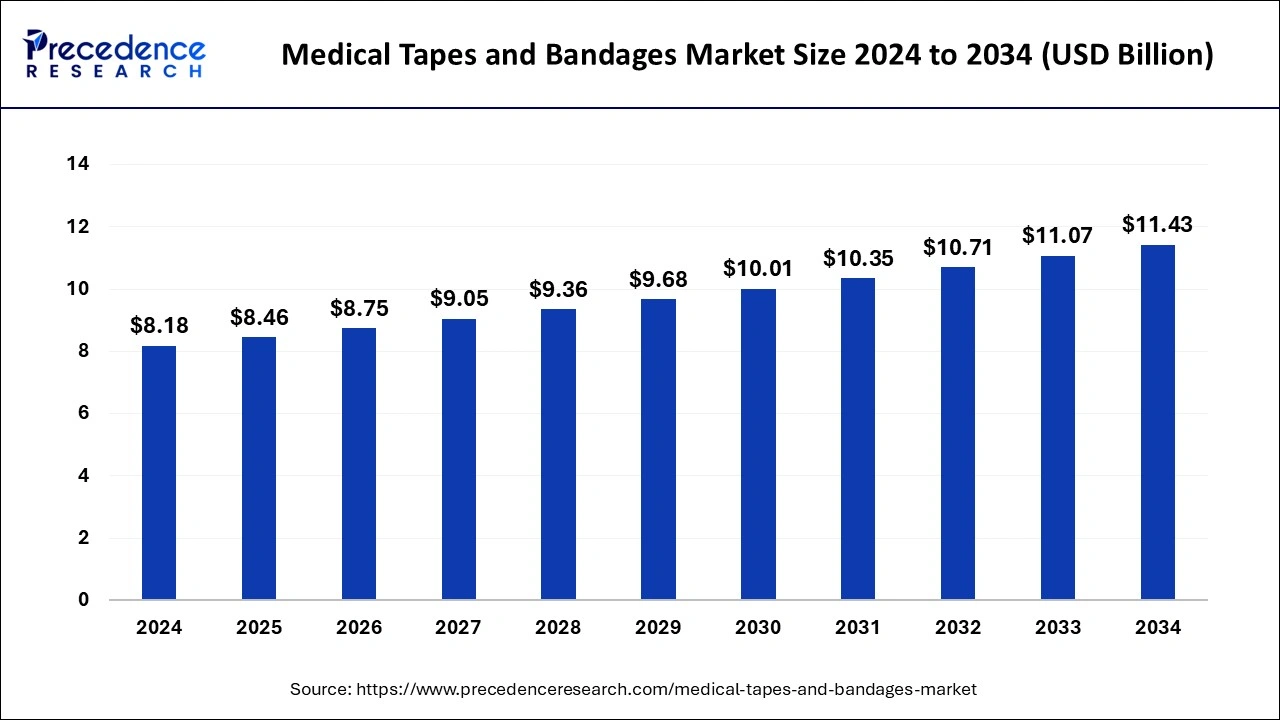

The global medical tapes and bandages market size is calculated at USD 8.46 billion in 2025 and is forecasted to reach around USD 11.43 billion by 2034, accelerating at a CAGR of 3.40% from 2025 to 2034. The North America medical tapes and bandages market size surpassed USD 3.76 billion in 2024 and is expanding at a CAGR of 4.42% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical tapes and bandages market size was calculated at USD 8.18 billion in 2024 and is expected to reach around USD 11.43 billion by 2034, expanding at a CAGR of 3.40% from 2025 to 2034. The increasing number of cases like accidents, chronic wound infections, and others are driving the growth of the market.

AI technologies help researchers develop new formulations by analyzing material properties and adhesion characteristics. This further helps to develop customized wound care solutions. Manufacturers use AI technologies to create medical bandages and tapes that stick well, breathe well, and control moisture better. Using AI in wound monitoring tools helps doctors monitor wound healing and get better treatment information. Moreover, AI helps develop smart wound care solutions by analyzing wound conditions and skin types.

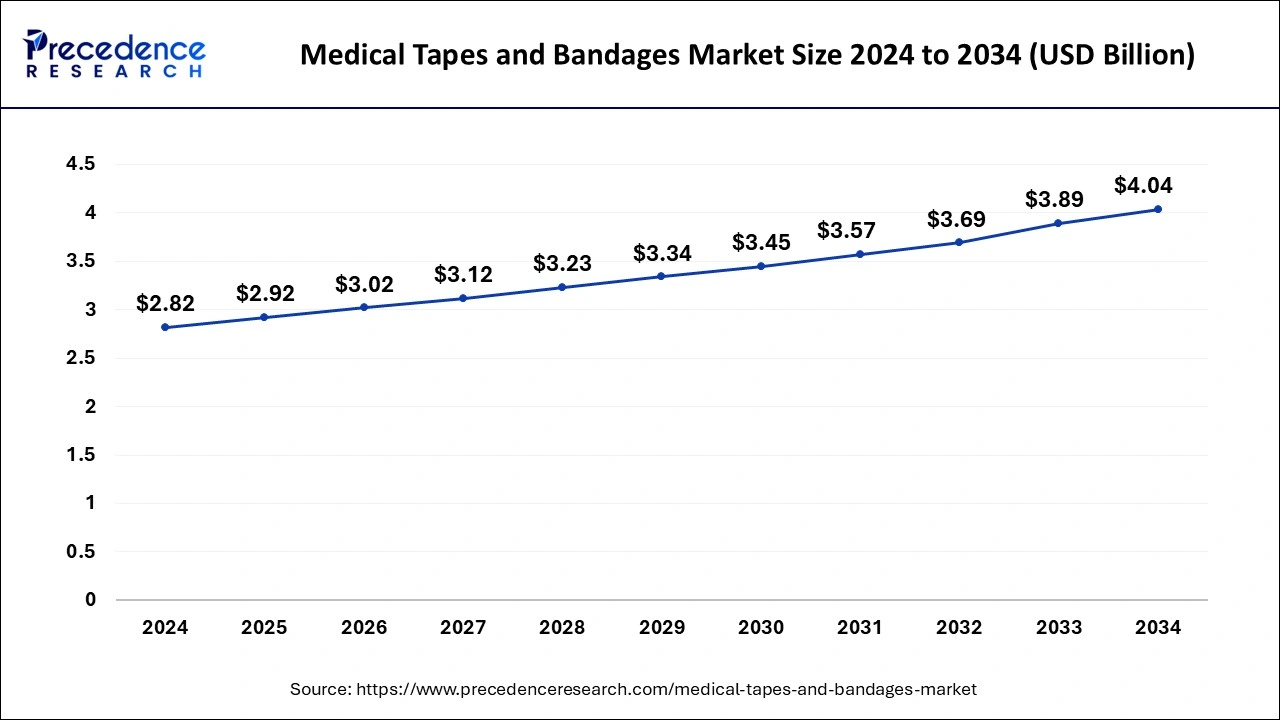

The U.S. medical tapes and bandages market size was exhibited at USD 2.82 billion in 2024 and is projected to be worth around USD 4.04 billion by 2034, poised to grow at a CAGR of 3.66% from 2025 to 2034.

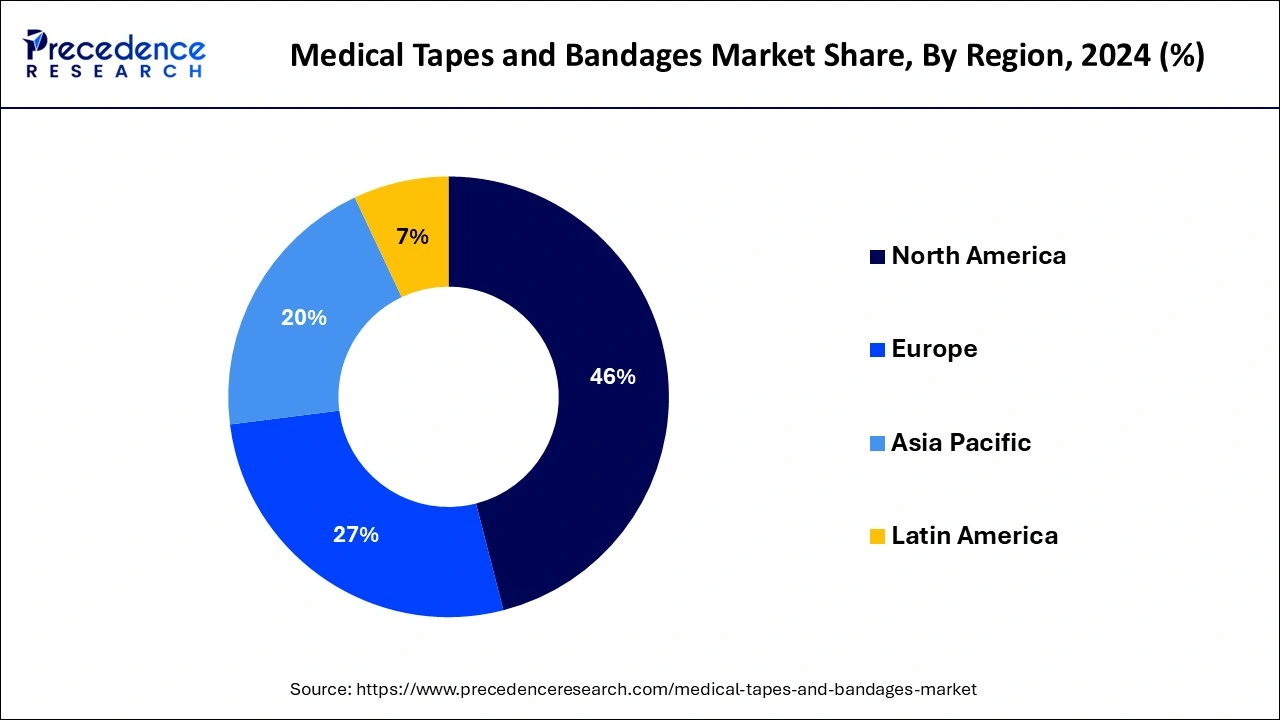

North America led the medical tapes and bandages market with the largest market share in 2024. The growth of the market is attributed to the higher availability of well-developed healthcare infrastructure, and pharmaceutical companies in countries like the U.S. and Canada are driving the growth of the market. The rising prevalence of road accidents is driving the increasing number of surgeries in the region, positively impacting the growth of the market. Additionally, the rising number of diabetes cases in the population due to the changing lifestyle and aging factors that cause ulcers influenced the growth of the medical tapes and bandages market in the region.

The yearly cost of treating injuries in the U.S. is estimated to be over $50 billion.5. Medicare, a health insurance program, reports that the annual cost of wound treatment for its participants ranges from 28.1 to 96.8 billion dollars. The costliest wounds are surgical wounds and diabetic ulcers, at 18.7 billion and 38.3 billion dollars, respectively.

Asia Pacific is expected to witness the fastest growth during the forecast period. The growth of the market in the region is expected to rise due to the rising population and increasing demand for healthcare infrastructure. The rising geriatric population that is more likely to get infected by some infections drives the demand for efficient treatment and medication that positively impacts the growth of the market. Additionally, the rising cases of diabetes in the population of the region, especially in countries like India and China, is anticipated to contribute significantly to the expansion of the medical tapes and bandages market.

Medical tapes and bandages are medical-grade products that are used to hold the dressing on the wound in place. These products are also used for securing catheters and medical devices. Medical tapes and bandages are available in various types of materials such as cloth, paper, and plastics. It is used to protect the infectious areas of the body from exposure to hazardous materials. It is basically made from a flexible and thin material that can be easily applied and removed from the skin.

The medical tapes and bandages are available at drugstores, online retailers, and supermarkets without a prescription. There are several types of medical tapes available in the market, such as micropore paper tapes, transpore medical tapes, zinc oxide medical tapes, durapore cloth surgical tapes, clear medical tapes, microfoam surgical tapes, waterproof surgical tapes, and others. The increasing cases of infections and wounds are driving the growth of the market.

| Report Coverage | Details |

| Market Size by 2025 | USD 8.46 Billion |

| Market Size in 2034 | USD 11.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increase in diabetes cases

The increasing prevalence of diabetes patients worldwide due to the increasing geriatric population, changing lifestyles, and accepting sedentary lifestyles such as rising consumption of alcohol, smoking, and eating junk are the major factors for the increasing number of diabetes patients. The increasing prevalence of diabetes in people is causing higher chances of getting affected by diabetes ulcers. Diabetic ulcer is most commonly affected by the weight-bearing areas of food, like the ball of the foot and tips of the bent toes. The ulcer is an open wound that is well deep enough to be able to see the underlying tissues and sometimes bone.

Hardening of the skin, swelling, redness around the lesion, presence of pus and drainage, and local pain are some of the signs of diabetes ulcers. Most of the time, doctors prescribe antibiotics for the treatment and healing of wounds, but in some severe cases, surgical treatment should be suggested for the treatment. Thus, the increasing chances of surgical treatment for wound or ulcer healing are driving the demand for medical tapes and bandages in the market.

Higher competition

The rising competition in the pharmaceutical products companies and the increasing participation of new market entrants as well as increasing burden of price sensitivity are restraining the growth of the market.

Technological advancements

Technological integration in healthcare is revolutionizing healthcare products and treatment. The integration of smart technologies in medical tapes and bandages is driving the growth opportunity in the medical tapes and bandages market. The smart bandages use microprocessors, microelectronic sensors, and wireless communication radios to enhance wound treatment and therapies. Smart bandages use various sensors for recording, detecting, and managing physical and chemical elements that affect the speed of wound healing. It uses technology that helps in wound healing and tissue-restoring processes. It also help the physician to remotely diagnose the wound healing by the telehealth features. Moreover, the rising investment in research and development activities in the further innovations and development of medicine and pharmaceutical products are driving the opportunity for the growth of the market.

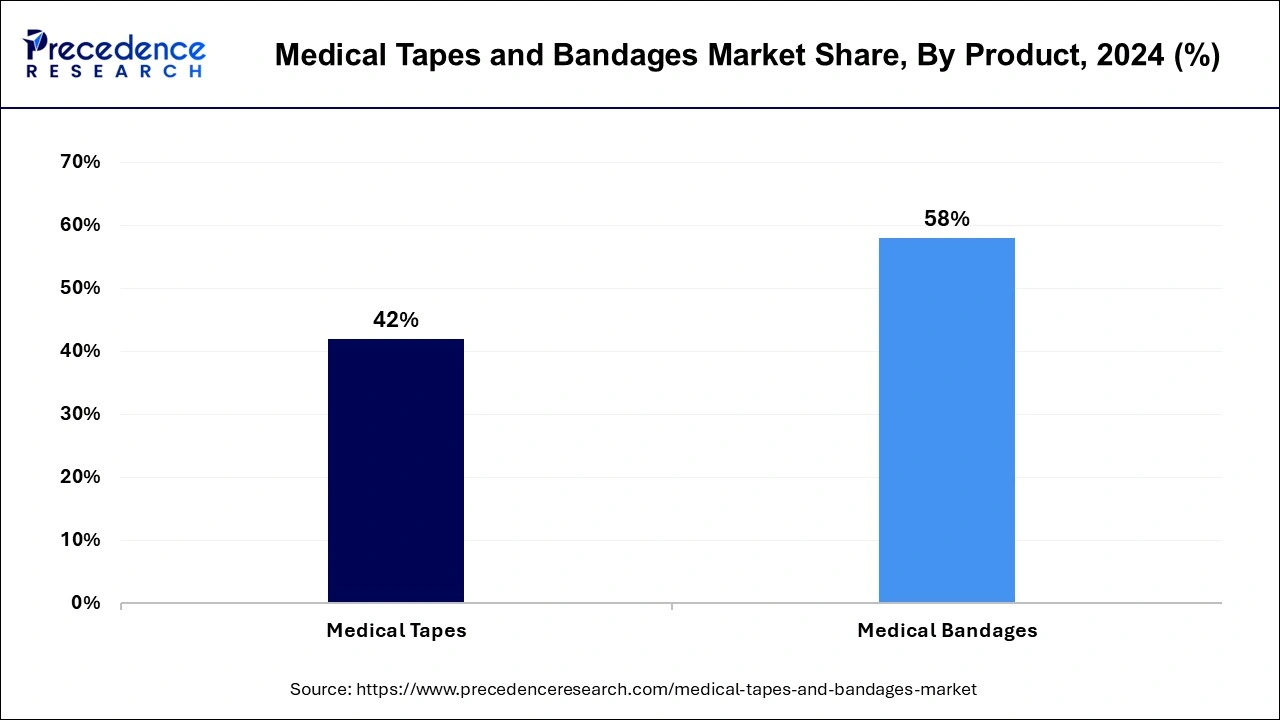

The medical bandages segment dominated the market with the largest share in 2024. Medical bandages are one of the highly used segments in the medical tapes and bandages market. It is a soft, highly absorbent material that is used to hold the dressing on the wound or infection. It helps in immobilizing the wounded body part and compresses a soft tissue injury. There are different types of bandages available as per the requirement and wound, which can easily be applied and removed from the body.

Some of the types of bandages include crepe bandages, compression bandages, snake bit bandages, triangular bandages, tubular bandages, cohesive bandages, and others. The increasing accidental cases and the rising interest of youth towards sports and physical activities have chances of sprain and fracture in the body parts that drive the demand for the medical bandages segment in the medical tapes and bandages market.

The surgical wound segment held the largest revenue share in 2024. The rising demand for medical tapes and bandages in surgical wounds is highly contributing to the increased demand for the medical tapes and bandages market. The increasing prevalence of chronic illnesses or diseases that drive the demand for surgical procedures, as well as the rising cases of road accidents, are contributing to the higher number of surgical operations that cause surgical wounds in the surgical process, which fuels the demand for medical tapes and bandages. There are different types of surgical tape available in the market, including microfoam surgical tape, waterproof surgical tape, and others.

The hospital segment dominated the market in 2024. The growth of the segment is attributed to the higher presence of healthcare facilities like hospitals, clinics, and other diagnostics centers for the treatment of diseases, infections, and other health conditions and the higher preference of the population for hospitals to treat any kind of diseases, wounds, etc. by the healthcare physician. The hospital includes well-trained healthcare professionals with technologically equipped diagnostics equipment, medication, and drugs that drive the demand for wound management in the hospital segment.

In January 2025, MedicosBiotech has been honored with the prestigious CES Innovation Award in the Digital Health category at CES 2025. This accolade highlights the company’s groundbreaking chronic wound care solution, Cure Silk, which combines AI and biotechnology to address critical healthcare needs. "This award reflects MedicosBiotech's commitment to innovation in healthcare," said Soon Cheol Daniel Kim, COO of MedicosBiotech. Cure Silk offers an affordable, easy-to-use solution that improves access to chronic wound care, contributing to a more inclusive and accessible global healthcare system.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025