April 2025

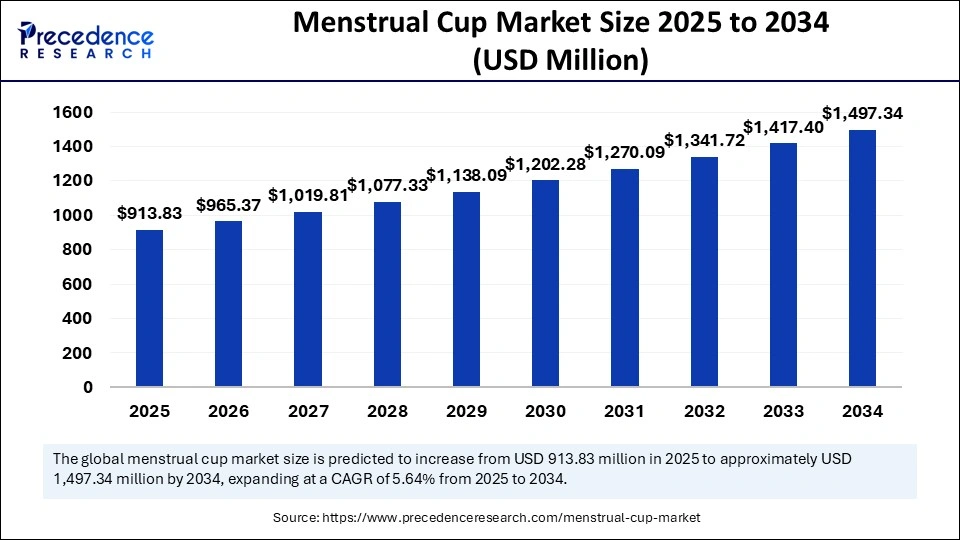

The global menstrual cup market size is calculated at USD 913.83 million in 2025 and is forecasted to reach around USD 1,497.34 million by 2034, accelerating at a CAGR of 5.64% from 2025 to 2034. The North America market size surpassed USD 371.97 million in 2024 and is expanding at a CAGR of 5.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global menstrual cup market size was estimated at USD 865.04 million in 2024 and is predicted to increase from USD 913.83 million in 2025 to approximately USD 1,497.34 million by 2034, expanding at a CAGR of 5.64% from 2025 to 2034. The growth of the market is attributed to the rising demand for sustainable feminine hygiene products, increased health consciousness, and growing acceptance of reusable menstrual care products.

Artificial Intelligence (AI) is revolutionizing menstrual care through the use of technology that embellishes menstrual cups. AI assists consumers in managing their menstrual health by improving the functionality of the menstrual cup to include features such as real-time tracking of menstrual flow, custom cycle analysis, and predictive insights and reporting. Users will have opportunities to access their health information when it is relevant, i.e., alerts, summary data, hygiene reminders, reporting on a mobile app, and reminders on cups to make the practice more informed and user-driven.

AI will also create an opportunity for more effective and thoughtful product design through the aggregate data from user reports and the eventual application of diagnostics in the future. AI-driven tools analyze user preference and feedback and market trends to optimize cup design. In this way, AI creates an opportunity for personalized decision-making about menstrual health, reproductive health, and the associated information in the near future. As technology advances, AI-enabled menstrual cups could represent a new paradigm for supporting comfort, confidence, and wellness during menstruation.

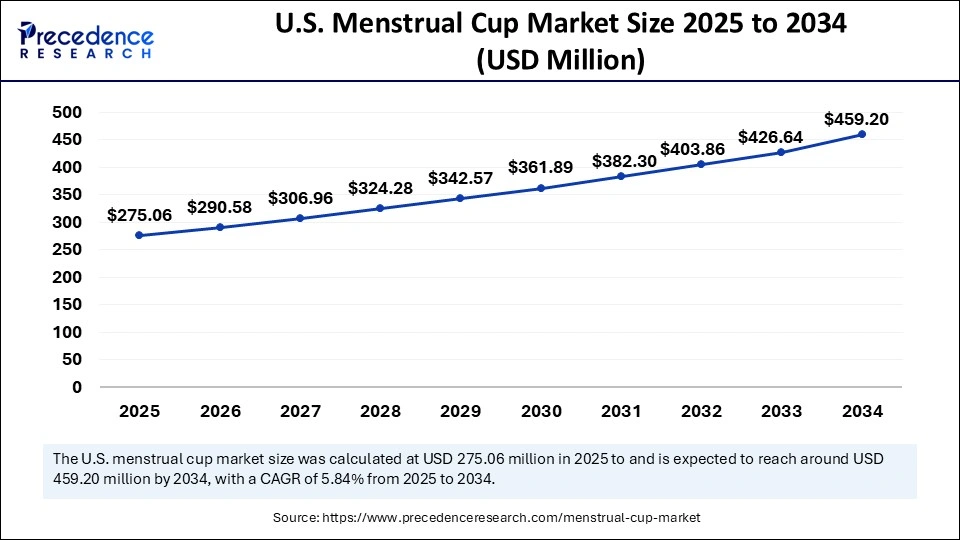

The U.S. menstrual cup market size was exhibited at USD 260.38 million in 2024 and is projected to be worth around USD 459.20 million by 2034, growing at a CAGR of 5.84% from 2025 to 2034.

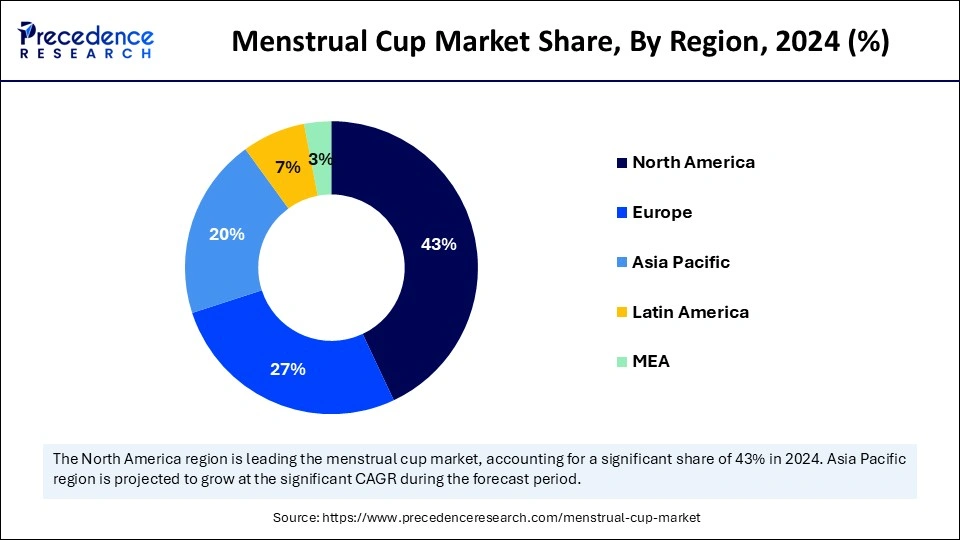

North America dominated the menstrual cup market with the largest share in 2024. This is mainly due to the heightened awareness about the environmental impact of menstrual products. With the heightened awareness of menstrual health and increased government programs and initiatives aiming to promote menstrual health and hygiene, the adoption of menstrual cups has increased. There is high demand for sustainable menstrual products in the region, as women have become more aware of potential health risks associated with chemicals in traditional menstrual products. Menstrual cups are recognized as a sustainable product that can be reused.

The U.S. is a major market for menstrual cup in North America. This is mainly due to the increasing awareness among women about menstrual health and hygiene. Menstrual cups are safer and more hygienic than other menstrual products. Stringent regulations regarding feminine hygiene products further support market growth.

Asia Pacific is expected to witness the fastest growth during the forecast period. The growth of the menstrual cup market in the region is driven by rising government initiatives and health campaigns to spread awareness about menstrual health. With the increasing consumer disposable income, spending on healthcare is rising, contributing to market growth. Several government and health agencies are making efforts to improve access to high-quality menstrual hygiene solutions. The rising concerns about the disposal of sanitary products are boosting the demand for reusable menstrual cups.

India is emerging as a focal point for menstrual cup uptake, thanks to active government programs and campaigns. The Indian government’s "Menstrual Hygiene Scheme" supports the distribution of eco-friendly menstrual products in rural areas. Moreover, the “THINKAL” initiative promotes menstrual cup use and awareness among women and girls in India.

Europe is observed to grow at a considerable growth rate in the upcoming period. There is a high acceptance of menstrual cups due to increased awareness about the benefits of sustainable menstrual products. Consumers have become more aware of the negative impact of disposable sanitary products and are willing to shift toward reusable menstruation products. Germany is emerging as a leader in the menstrual cup market in Europe because the German government is actively spreading awareness of women’s health. In 2024, multiple local municipalities in Germany, such as Berlin and Hamburg, began funding free menstrual hygiene subsidy programs for schools and public buildings. This demonstrates Germany's commitment to promoting menstrual health.

The menstrual cup market centers on the manufacturing and distribution of reusable feminine hygiene product that are designed and marketed to collect menstrual fluid. They are made of silicone, rubber, or latex that conform to the medical-grade classification and serve as a sustainable and economical alternative to disposable products like sanitary pads and tampons. These cups are inserted into the vagina and collect rather than absorb menstrual flow and can reuse for several years, making it an environmentally friendly option.

The menstrual cup market is witnessing rapid growth due to the increasing awareness of feminine hygiene. The rapid shift toward sustainable alternatives and increasing demand for long-lasting, economical menstruation products are boosting the growth of the growth. Additionally, better product design, improved comfort, and increased access through online and retail are likely to contribute to market growth. Support from health organizations, combined with reduced stigma and rejection, will help solidify menstruation cups as a feasible and reliable alternative to traditional products.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,497.34 Million |

| Market Size in 2025 | USD 913.83 Million |

| Market Size in 2024 | USD 865.04 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.64% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Tyep, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Government Initiatives

The rising government initiatives to spread awareness among women about the benefits of sustainable menstrual products are a major factor driving the growth of the menstrual cup market. Such initiatives result in increased demand for menstrual cups. In February 2023, the Kerala government launched a campaign to raise awareness and encourage the use of menstrual cups by allotting Rs 10 crore for the public awareness and promotion campaign and by distributing over one lakh menstrual cups to take continued action on the reduction of disposable sanitary products and the disposal of menstrual waste. The success of these campaigns may normalize menstrual cup usage globally and grow the market.

Cultural Stigmas and Unfamiliarity

The stigmatization of periods and limited awareness hamper the growth of the menstrual cup market. Although menstrual cups are cheap and environmentally friendly, many women feel shy to purchase menstrual cups because of cultural taboos and their overall lack of menstrual knowledge. According to a report published in 2024, the cultural stigma and a lack of sex education in schools contribute to the reluctance of women to use menstrual cups, especially in developing regions. Along with cultural stigma, traditional menstrual products, such as pads and tampons, are still popular due to their easy availability and low costs.

Technological Innovations

Technological innovations create immense opportunities in the menstrual cup market. New designs and innovations can enhance comfort and safety. Current developments in period cup technology are capitalizing on health monitoring. The Emm smart menstrual cup, created by a London-based biotech start-up, exemplifies this trend. It incorporates biosensors to track period metrics, including volume of flow, rate of flow, length of cycle, and regularity, and syncs with an app on a mobile device so users can easily understand menstrual health, as well as point of regularity when it is time to empty. It also has a portable UV sanitizing case for convenience and hygiene as well.

While the efficient functions of this updated technology improve the product's user experience, it may have implications other than those attending to hygiene and diagnosing prevalent conditions such as polycystic ovary syndrome and endometriosis. Health tracking technologies are fundamentally changing the scope of a menstrual product, like the Emm smart menstrual cup, from a stand-alone hygiene product to a multi-functional health monitoring device. This new technology offers new pathways to grow the market and, at the same time, reaches more tech-savvy customers who are looking for a multi-functional health product.

The silicone segment dominated the menstrual cup market with the largest share in 2024. This is mainly due to its excellent flexibility, biocompatibility, and durability. Silicone has traditionally been the preferred choice for customers and manufacturers because of its excellent elasticity, fit, and comfort. Furthermore, medical-grade silicone is non-toxic, hypoallergenic, and can be easily sterilized, making it suitable for menstrual cups.

The thermoplastic segment is expected to expand at a notable CAGR over the projected period. Menstrual cups made from thermoplastic elastomer (TPE) are gaining traction due to their flexibility, elasticity, and softness. TPE can be molded easily, allowing for more possibilities in size and shaped menstrual cups. TPE is a cost-effective material and is also recyclable; this aligns well with sustainability, appealing to consumers looking for sustainable menstrual products.

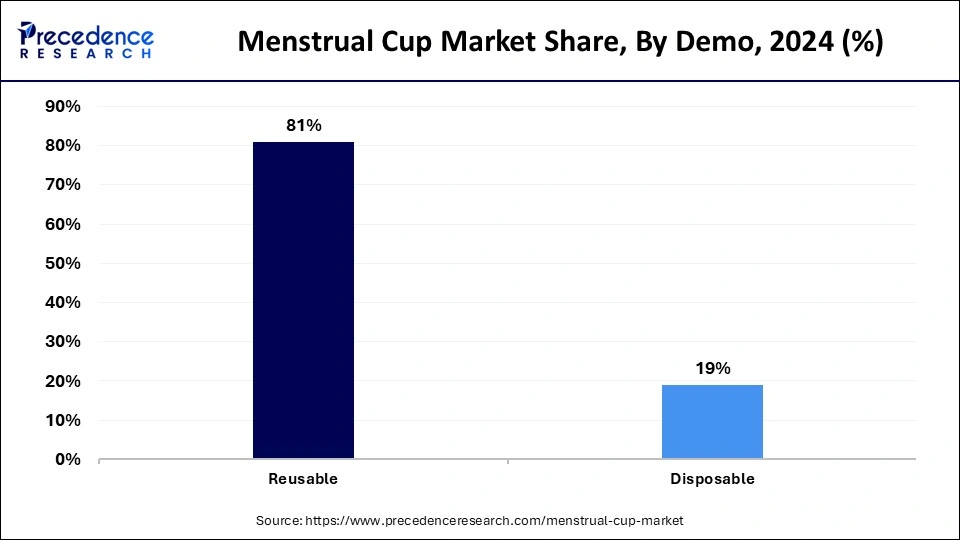

The reusable segment held the largest share of the menstrual cup market in 2024. This is mainly due to the economic and environmental benefits of reusable menstrual cups over the long term. Reusable menstrual cups can be used for up to 10 years, which greatly reduces menstrual waste and monthly product costs. With durability, effectiveness, and long life, reusable menstrual cups are popular among consumers looking for a sustainable menstrual hygiene management solution. Increased education about menstrual health and a movement toward the idea of zero waste further bolstered the segmental growth.

The disposable segment is expected to expand at the fastest rate during the forecast period. Disposable menstrual cups are appealing to consumers who want convenience and hygiene. Disposable menstrual cups are a single-use option that is particularly attractive to travelers and infrequent users or users who do not want to commit to a reusable menstrual product. The increasing concern about hygiene is expected to boost the demand for disposable menstrual cups, bolstering the segment’s growth.

The pharmacies held a considerable share of the menstrual cup market in 2024 and is likely to grow at a steady rate in the upcoming period. Pharmacies often provide detailed information about product use, appealing to consumers, particularly first-time buyers. Pharmacies are readily accessible to consumers and are often perceived as trusted sources for health and wellness products. Moreover, consumers often seek professional advice for health products, making pharmacies a preferred choice.

The online stores segment is anticipated to grow at a remarkable CAGR in the coming years. The rise of e-commerce has made it easier for consumers to access a variety of menstrual cup options from multiple brands. E-commerce sellers provide some of the most comprehensive product descriptions and user reviews, which help consumers make informed decisions. Online platforms provide doorstep delivery and an easy return policy, attracting more consumers.

By Material Type

By Type

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

February 2025