October 2024

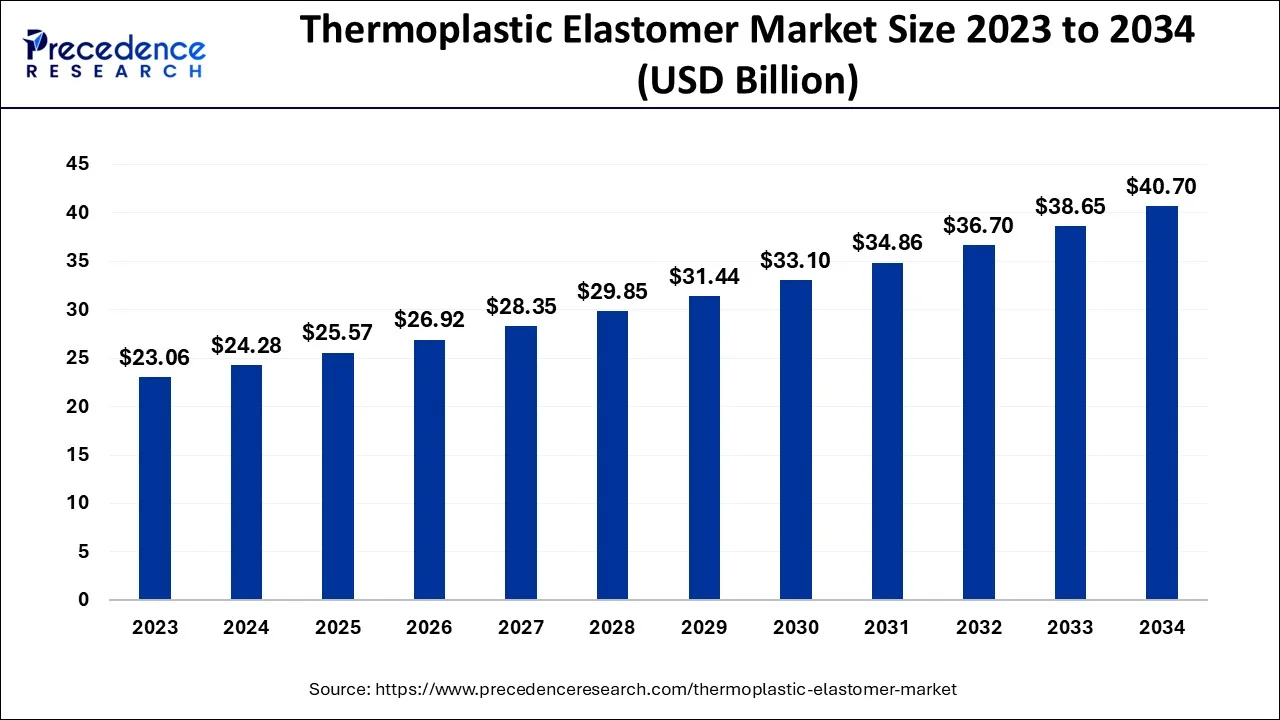

The global thermoplastic elastomer market size accounted for USD 24.28 billion in 2024, grew to USD 25.57 billion in 2025 and is predicted to surpass around USD 40.7 billion by 2034, representing a healthy CAGR of 5.30% between 2024 and 2034. The North America thermoplastic elastomer market size is calculated at USD 8.74 billion in 2024 and is expected to grow at a fastest CAGR of 5.50% during the forecast year.

The global thermoplastic elastomer market size is exhibited at USD 24.28 billion in 2024 and is predicted to surpass around USD 40.7 billion by 2034, growing at a CAGR of 5.30% from 2024 to 2034.

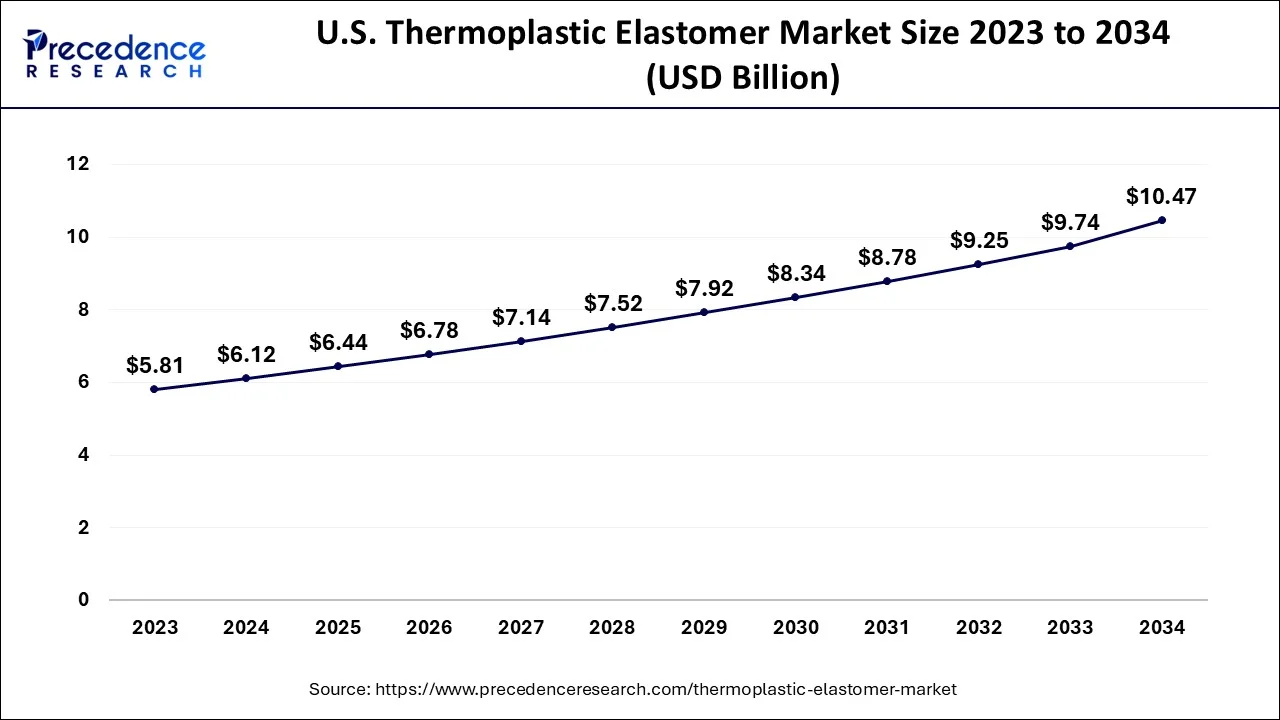

The U.S. thermoplastic elastomer market size is estimated at USD 6.12 billion in 2024 and is expected to be worth around USD 10.47 billion by 2034, rising at a CAGR of 5.50% from 2024 to 2034.

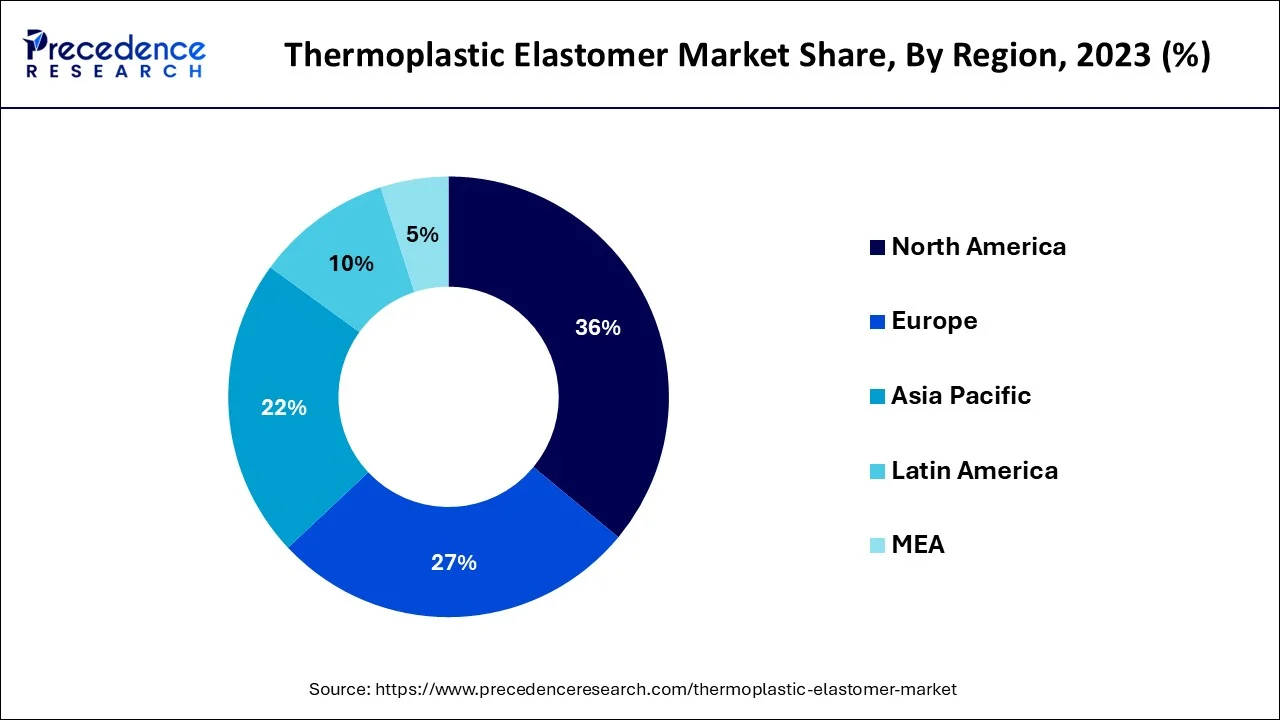

On the basis of geography, the North America region has accounted highest revenue share in the last year. North America is one of the world's top users of plastics as a result of the substantial demand in the automobile, electronics and electronics, packaging, and construction industries. Additionally, thermoplastic elastomers polymers have a wide range of applications in every industry due to their adaptability, simplicity in molding, and ability to generate desired shapes. In addition, the US and Canada are seeing an increase in the market for new electric vehicles with lightweight passenger cars. In order to attain cheap production costs and increase their bottom line, many auto manufacturers choose plastic vehicle parts. The growth of the thermoplastic elastomer market in North America is influenced by these variables.

The second-largest revenue share in 2023 was held by Asia Pacific. The major markets for growth in Asia Pacific are anticipated to be China, India, and Southeast Asia. The need for TPE compounds in the automotive, industrial machinery, packaging, and electrical and electronics industries will be driven by the expanding manufacturing sector. This region has the largest number of customers, and the market is growing at the fastest rate over the projection period.

Thermoplastic elastomers also referred to as plastic wrap, saran wrap, food wrap, and stretch film, are thin transparent plastic films that adhere to each other and to surfaces, and are commonly used to wrap food in containers. High-quality food wrap films made of thermoplastic elastomers keep food fresh, shield it from bugs and microbial contamination, and lengthen its shelf life to lower the risk of food waste. Combining thermoplastic and elastomeric polymers results in thermoplastic elastomers. Many different industries, including the automotive, medical, construction, and packaging sectors, use thermoplastic elastomers. It can be stretched two or three times its original size due to its elastomeric properties, which make it flexible and soft. The most common place that thermoplastic elastomers are used in consumer goods is in headphones as a thin, translucent, flexible material. TPE can also be used to create sealing rings and bottle cap liners.

The thermoplastic elastomer helps improve fuel efficiency in automotive applications by reducing vehicle weight and density by swapping out traditional parts inside and outside the car. Regulating bodies in many different countries have enacted a number of strict regulations in an effort to lessen the negative effects of carbon emissions and greenhouse gases (GHG) on the environment and human health. The need for TPE in the external, interior, sealing systems, and under-the-hood components are also anticipated to increase as a result of the rapidly expanding vehicle markets. Demand for safe, affordable, lightweight MUV/SUV models with excellent fuel efficiency and a focus on comfort and aesthetics is driving the growth of applications in the automobile industry.

According to estimates, the market will increase as more end-user industries, including those in the automotive, building and construction, home appliances, electrical and electronics, medical, adhesives, sealants and coatings, HVAC, footwear, and others, embrace thermoplastic elastomers. Thermoplastic elastomers are widely used in the healthcare sector to produce, among other things, surgical tool grips, catheters, drug delivery tubes, and other implants.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.28 Billion |

| Market Size by 2034 | USD 40.7 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.30% |

| Largest Market | North America |

| Second Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

On the basis of type, the thermoplastic vulcanizates segment is expected to have the largest market share in 2023. The market share is projected to belong to the Thermoplastic Vulcanizates category. They are able to reuse and recycle production refuse and waste, which explains the causes. Ethylene propylene diene monomer (EPDM)/polypropylene thermoplastic vulcanizate is the most used form of thermoplastic vulcanizates (TPV).

On the basis of application, the automotive segment is expected to have the highest revenue share in 2023. In the foreseeable time, the Automotive segment is expected to have the greatest CAGR. Exterior filler panels, wipers, rocker panels, body seals, automotive gaskets, door & window handles, and vibration-damping pads are all made of thermoplastic elastomers.

By Type

By Application

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024