April 2025

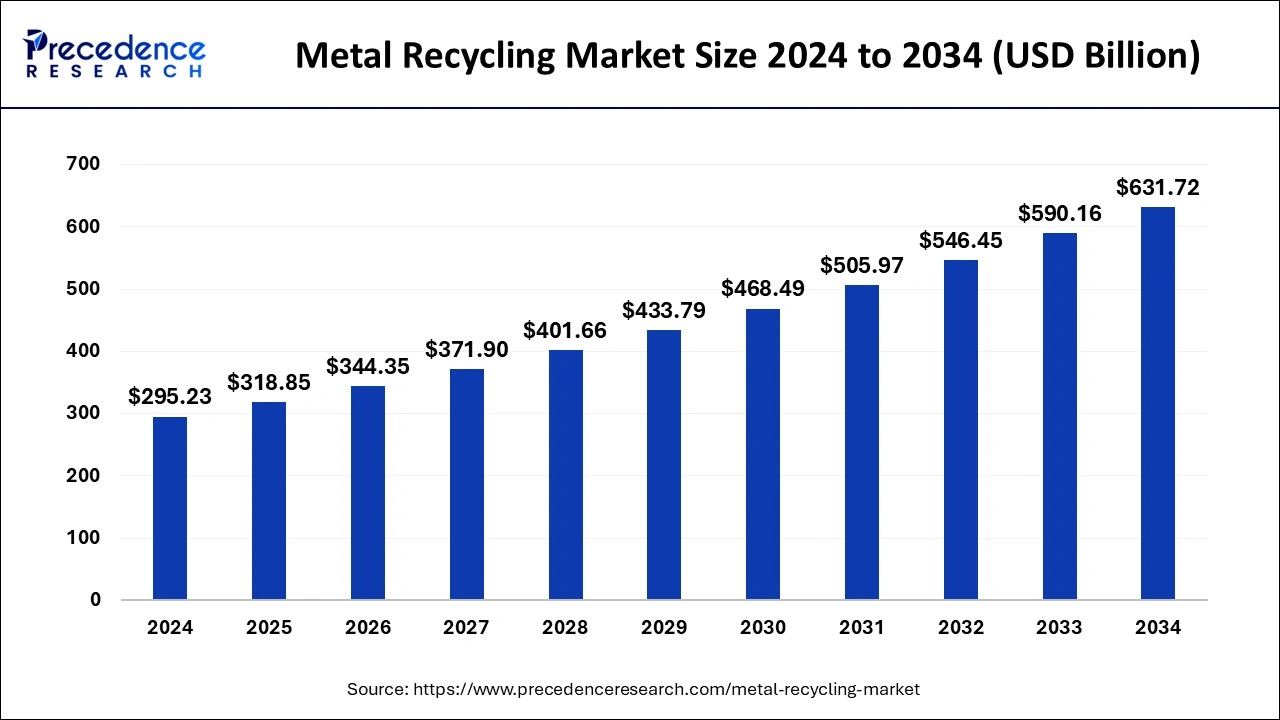

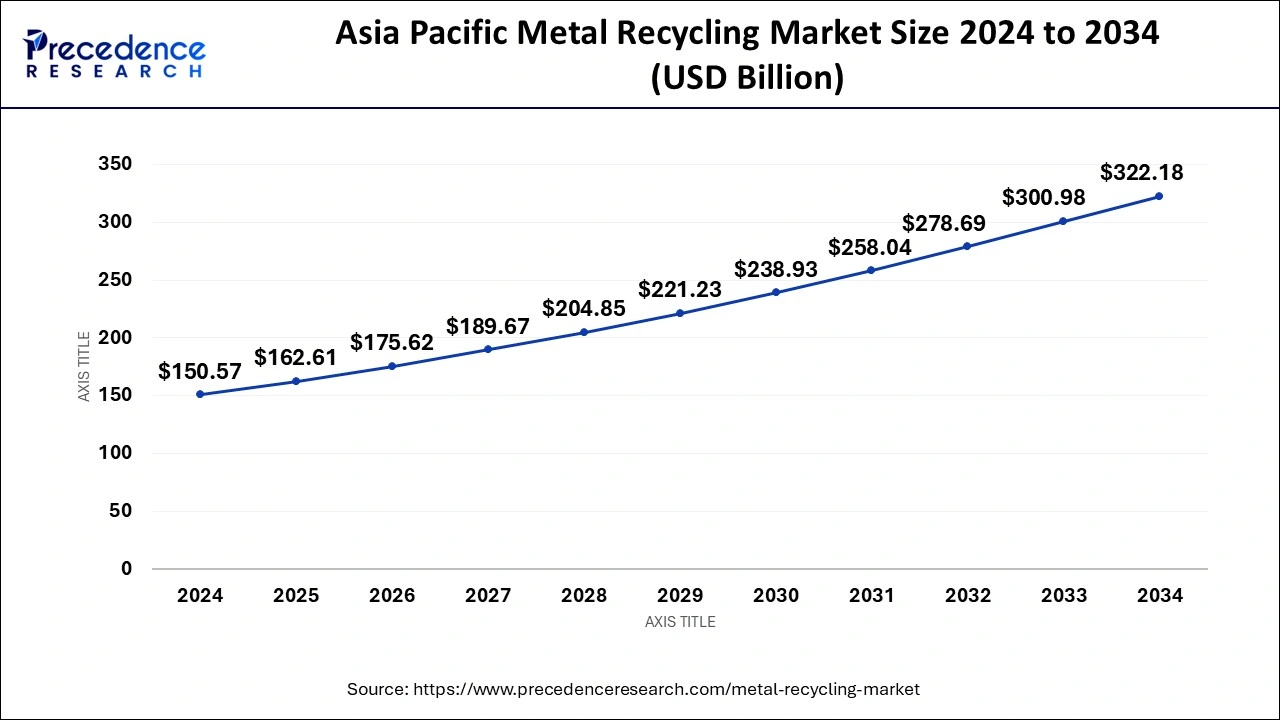

The global metal recycling market size is estimated at USD 318.85 billion in 2025 and is anticipated to reach around USD 631.72 billion by 2034, expanding at a CAGR of 7.90% from 2025 to 2034. The Asia Pacific metal recycling market size was valued at USD 162.61 billion in 2025 and is expanding at a CAGR of 8.15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global metal recycling market size accounted for USD 295.23 billion in 2024 and is predicted to reach around USD 631.72 billion by 2034, expanding at a CAGR of 7.90% from 2025 to 2034. The growing demand for environmental sustainability, the burgeoning automotive sector, and technological advancements drive the metal recycling market.

Artificial intelligence (AI) plays a vital role in the market by revolutionizing the process of recycling. The major challenge is sorting metals that can be reprocessed and reused, requiring highly intensive labor work and time. AI can simplify this process by introducing automation and optimizing the identification and segregation of different metals. This leads to increased efficiency, accuracy, and cost-effectiveness, increasing productivity. Integrating AI, machine learning (ML), and sensors in waste metal sorting significantly reduces contamination, increasing the ultimate value of recycled metals. Apart from sorting, AI can also transform the mining and waste management of metals. Thus, AI changes the operational landscape and paves the way for a more sustainable environment.

The Asia Pacific metal recycling market size was valued at USD 150.57 billion in 2024 and is expected to be worth around USD 322.18 billion by 2034, at a CAGR of 8.15% from 2025 to 2034.

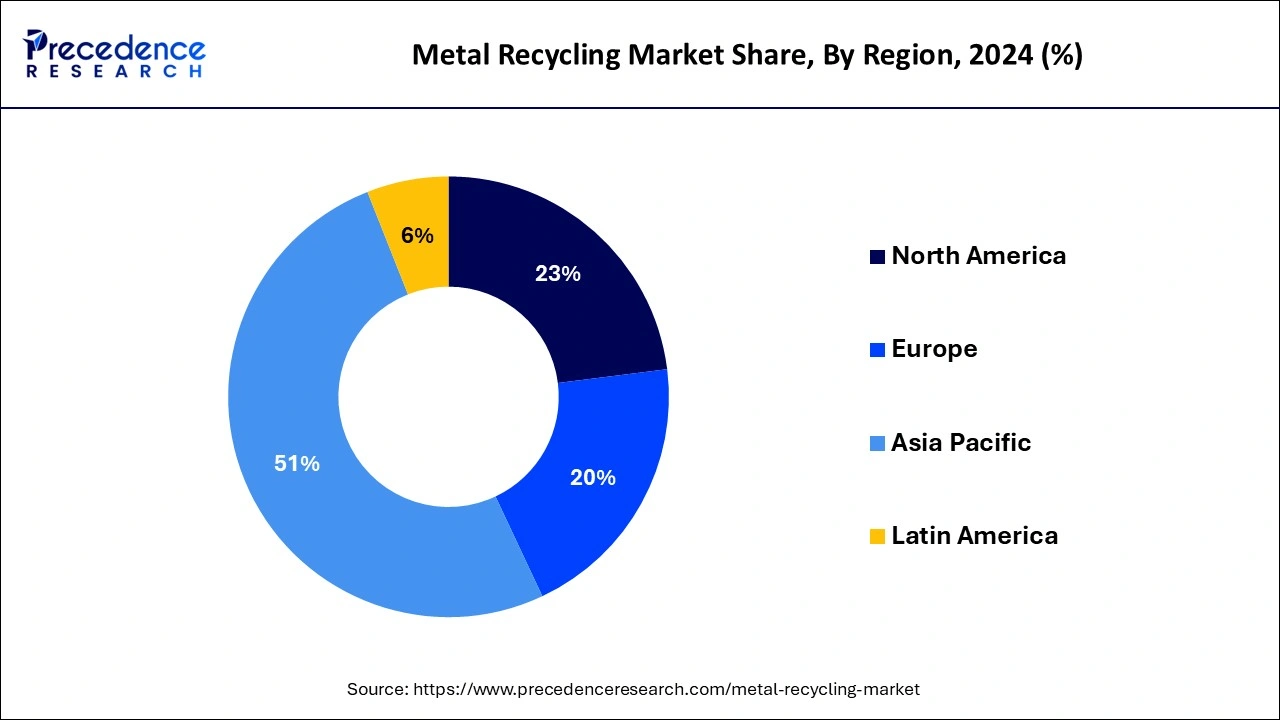

Asia Pacific emerged as the global leader in the metal recycling market with revenue share of 51%. The dominance of the region can be attributed to the high production of metal. For instance, 66% of total primary aluminum and 72% of total steel produced across the world were contributed by the region. Among other Asian countries, China is the front-runner in the global industry in the year 2023. As per the World Steel Association, China is the major producer of steel and produced nearly 1,000 million tons of steel in the year 2023 that is roughly 53% of the total crude steel production. The country sources around 20% of the raw material for steel recycling from metal scrap.

China:

India:

Europe follows the Asia Pacific in terms of metal production. However, the application of recycled scrap in secondary metal production is relatively higher in Europe. Growing emphasis on the circular economy in the region together with stringent government regulations related to energy usage significantly promotes the market growth in the region. Furthermore, notable growth of construction sector in the region again drives the growth of metal recycling in the region owing to high usage of recycled metals in parts and buildings.

Germany:

| Report Coverage | Details |

| Market Size by 2034 | USD 631.72 Billion |

| Market Size in 2025 | USD 318.85 Billion |

| Market Size in 2024 | USD 295.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Steel segment has generated highest revenue share in 2024. Further, the segment expected to maintain its dominance over the forecast timeframe owing to large-scale utilization of the product in automotive, construction, and consumer goods industries. Steel is the most recycled material across the globe and contribute around 40% of the total steel production mainly attributed to the opportunity to recover large structures along with their ease of reprocessing. In addition to this, easy process of steel separation from waste stream is other benefit that drives the steel recycling process.

Aluminum is however another product that offers tremendous benefits for recycling. As per the Aluminum Association, aluminum is among the most recyclable materials across the industry today. The statistics published by the association reveal that the aluminum industry spends approximately USD 800 Million on recycled aluminum cans every year. Major source of raw material for aluminum recycling is from automotive and building parts. Approximately, 90% of the aluminum used in automotive and building parts is recycled at their end of use.

The construction segment dominated the global metal recycling market in 2024. Flourishing growth in urbanization because of rise in the disposable income of consumers particularly in the developing economies is the major factor that propels the demand for recycled steel and aluminum across the construction industry.

Besides this, the automotive industry is the other important segment that uses large amount of metal product in various applications. For instance, body parts, engine components, and various other components that include mufflers, hoods, basic vehicle door frame, and fuel tanks are all made from steel. As per the World Steel Association, around 70% of the weight of an automobile is mainly because of iron and steel. In addition to this, automobile industry registered an increased sale mainly across the developing nations expected to offer lucrative growth opportunities in the forthcoming years.

The global metal recycling industry is largely unorganized and competitive in nature. Increasing emphasis towards sustainable waste management, rising environmental concern, and high demand for recycled metals across various end-use industries encourages manufacturers to sources raw materials at a higher rate compared to past years. Furthermore, growing recycling partnerships in the aluminum industry because of supportive government programs to promote the use of recycled tins and cans expected to flourish the overall market growth.

By Product

By Application

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

September 2024

January 2025