February 2025

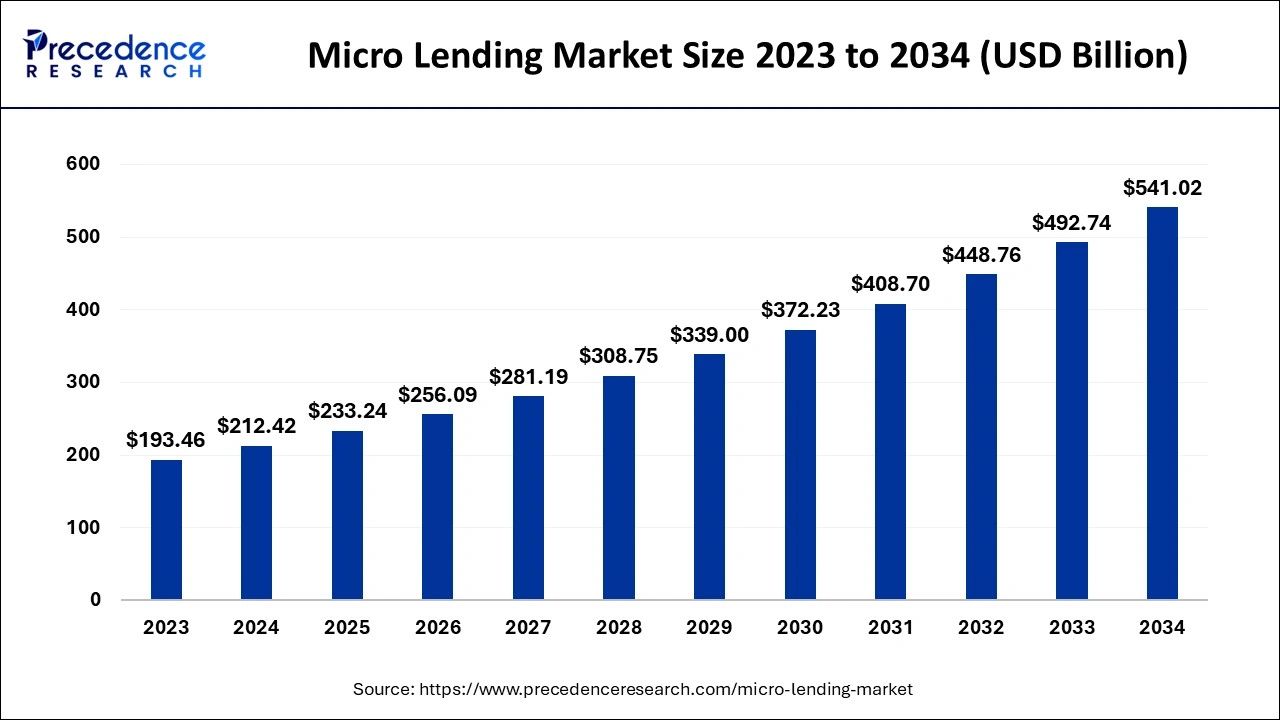

The global micro lending market size is estimated at USD 212.42 billion in 2024, grew to USD 233.24 billion in 2025 and is predicted to surpass around USD 541.02 billion by 2034, expanding at a CAGR of 9.80% between 2024 and 2034.

The global micro lending market size accounted for USD 212.42 billion in 2024 and is anticipated to reach around USD 541.02 billion by 2034, expanding at a CAGR of 9.80% between 2024 and 2034.

The Asia Pacific micro lending market size accounted for USD 65.85 billion in 2024 and is predited to be worth around USD 170.42 billion by 2034, growing at a CAGR of 9.96% between 2024 and 2034.

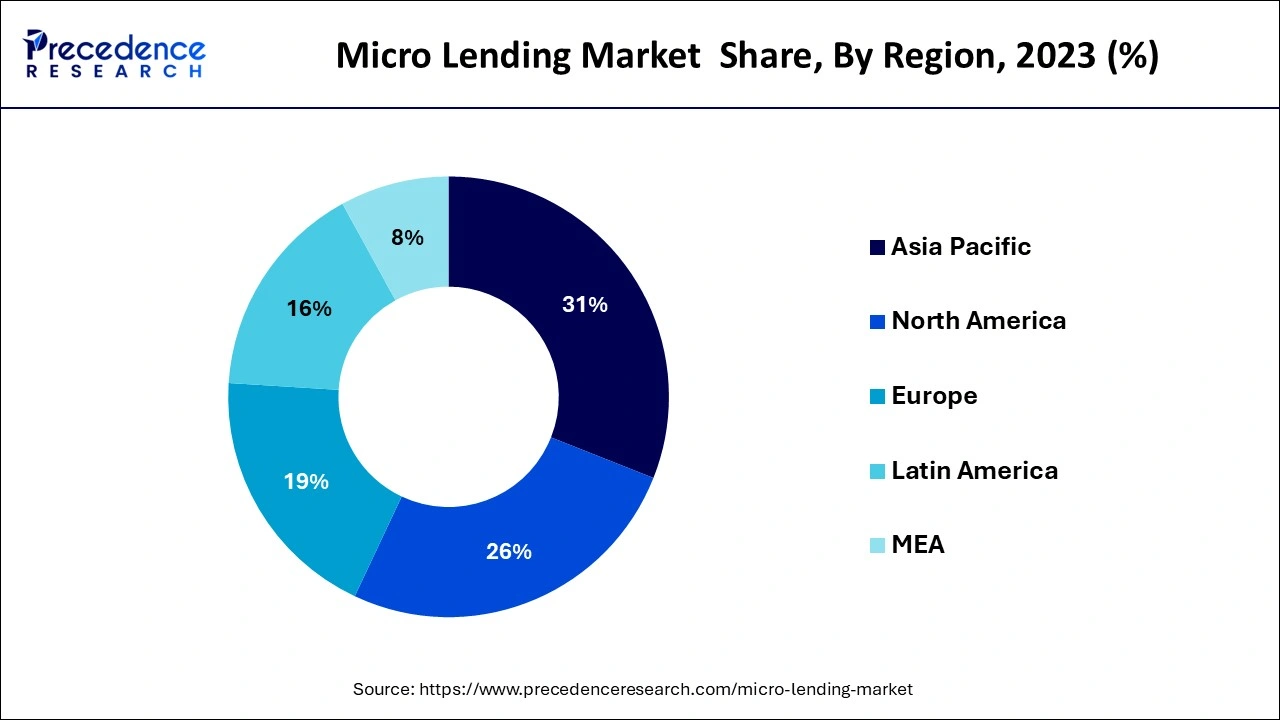

The worldwide microlending market has been divided into five regions based on geography: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific market currently has the largest revenue share in the overall microlending market, and this trend is anticipated to last over the course of the forecast period, with China and India's markets expected to contribute significantly more revenue than those of the other countries in the region. Favorable government policies for microlending facilities, particularly those for people in rural regions in the region's countries, can be credited with the market growth in the Asia Pacific. Over the course of the forecast period, the North American market is anticipated to provide the second-largest revenue share to the worldwide microlending market.

Small company owners and individuals can get funds through microlending to assist in managing their financial operations. Additionally, microlending is crucial for many developing nations since it gives the financially underserved, such as those who are unable to obtain checking accounts, lines of credit, or loans from conventional banks, access to cash. Additionally, governments in a number of developing nations are establishing favorable microloan policies to boost their economies.

The worldwide micro lending market is growing significantly due to the increased acceptance of micro lending in emerging countries for better lifestyles and lower operating and market risk. Additionally, the increased ability of entrepreneurs to establish new enterprises and do so with less financing assistance has a favorable influence on the expansion of the micro lending market. However, it is anticipated that the tiny loan amounts and short payback terms offered by microlenders would restrain market expansion. On the other hand, it is anticipated that the market would benefit financially from the implementation of advanced technologies in microfinance.

The idea of individual money lending with the aim of supporting small company expansion or providing finance for personal necessities is known as micro lending or micro-financing. People in developing nations benefit particularly from micro lending since it gives them access to a variety of job opportunities. Additionally, micro lending programs help low-income families leave the group of people who are poorer than average.

Microloans are currently being substantially digitized to attract new lenders to the market. Borrowers are frequently required to choose a loan purpose and loan amount on private microlending platforms. The lending platform will evaluate the borrower's creditworthiness and set the loan's conditions after receiving the complete application. Before financing the loan, some microloan platforms would look for investments from a range of private investors.

The continuing COVID-19 epidemic has had a serious impact on the economies of several nations as well as the global populace. Lending is now necessary because of the losses suffered by several small enterprises. As a result, there would soon be a chance for the worldwide microlending sector to expand.

Over the projected period, the worldwide microlending market is anticipated to expand significantly. The initiatives being pursued by different governments, especially those of emerging economies, to ensure access to capital for the financially underserved, such as those who are unable to obtain lines of credit, checking accounts, or loans from conventional banks; and the policies being drafted by these governments to encourage microlending as part of the economic development are expected to drive the growth of the market over the forecast period.

The industry is expanding as a result of technological developments, ongoing digitization, the widespread use of mobile phones, the popularity of e-wallets, and mobile credit. The ease and hassle-free repayment of loans are made possible in particular by digital technology, which lowers costs and increases efficiency while decreasing cash-related hazards.

| Report Coverage | Details |

| Market Size in 2024 | USD 212.42 Billion |

| Market Size by 2034 | USD 541.02 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.80% |

| Largest Market | Asia Pacific |

| second-largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| By Provider |

|

| By End users |

|

| Regions Covered |

|

The growing use of microlending in developing countries drives market demand

Growth opportunities due to online banking

During the anticipated term, the bank's segment's market share of microlending will expand significantly. Due to the major advantages that microlending institutions provide to low-income groups, demand for microlending is anticipated to rise throughout the projected period. Additionally, the necessity to offer simple credit and give consumers modest loans without any security boosts people's choice for microlending institutions, which in turn spurs the expansion of the target market. The same trend is anticipated in the upcoming years.

There is a clear market trend at the global level. The rise of microlenders aids several emerging nations in eliminating poverty and raising the standard of living for the underprivileged. Due to the region's significant expenditures and development of manufacturing facilities, the consumer finance industry in North America has been growing at a steady rate and is anticipated to continue growing during the projected period.

Government’s initiatives to aid banks in microlending help the sector. In order to follow trends in the microfinance industry, such as disbursements delinquencies, state-wise distribution, top loan types, etc., Small Industries Development Bank of India (SIDBI) and Equifax launched a first-of-its-kind weekly called "Microfinance Pulse." This information will serve as a lighthouse to guide the microfinance sector and regulators through the peaks and valleys of the loan cycle, eventually facilitating responsible lending.

Microfinance for housing is expanding quite quickly. Around the world, there are more organizations offering housing microfinance. About 200 microfinance organizations throughout the world are currently financially sustainable. Microfinance for housing is more widespread in Latin America and growing in Asia and Africa. Additionally, the entire portfolios of microfinance organizations only include a minor portion of housing microfinance. Opportunities for expansion that microfinance institutions had in some areas, such as Bolivia and Bangladesh, have been restricted by rising competition.

The newest magic bullet for eradicating poverty is microcredit. Rich benefactors are committing hundreds of millions of dollars to the microcredit movement, including billionaire George Soros and Pierre Omidyar, co-founder of eBay. Global commercial banks are launching microfinance funds, including Citigroup Inc. and Deutsche Bank AG. Even those with only a few dollars to spare can lend money to Togolian auto mechanics and Ecuadorian rice farmers by visiting microcredit Web sites and clicking their mouse.

Untold billions of dollars have been attracted by all this enthusiasm for microcredit. Over the past ten years, just one microloan provider, Grameen Bank, has issued $4 billion to its 7 million Bangladeshi customers. According to Sanjay Sinha, managing director of Micro-Credit Ratings International in India, 300 commercial banks and roughly 1,000 microcredit groups in India financed $1.3 billion to 17.5 million individuals in the previous year. The State of the Microcredit Summit Campaign Report reveals that 3,133 microcredit institutions worldwide loaned money to 113.3 million customers.

Targeting women is a further innovation that many nonprofit microfinance firms have implemented. Women make up 97 percent of the clientele at Grameen Bank, for instance, since they "have longer vision and desire to transform their lives much more intensely," according to Yunus. Men are, nevertheless, "more ruthless with money,"

There is evidence to support the idea that women who control their microloans spend more on their families welfare, security, and health.

Segment Covered in the Report

By Provider

By End users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

January 2025

August 2024