September 2024

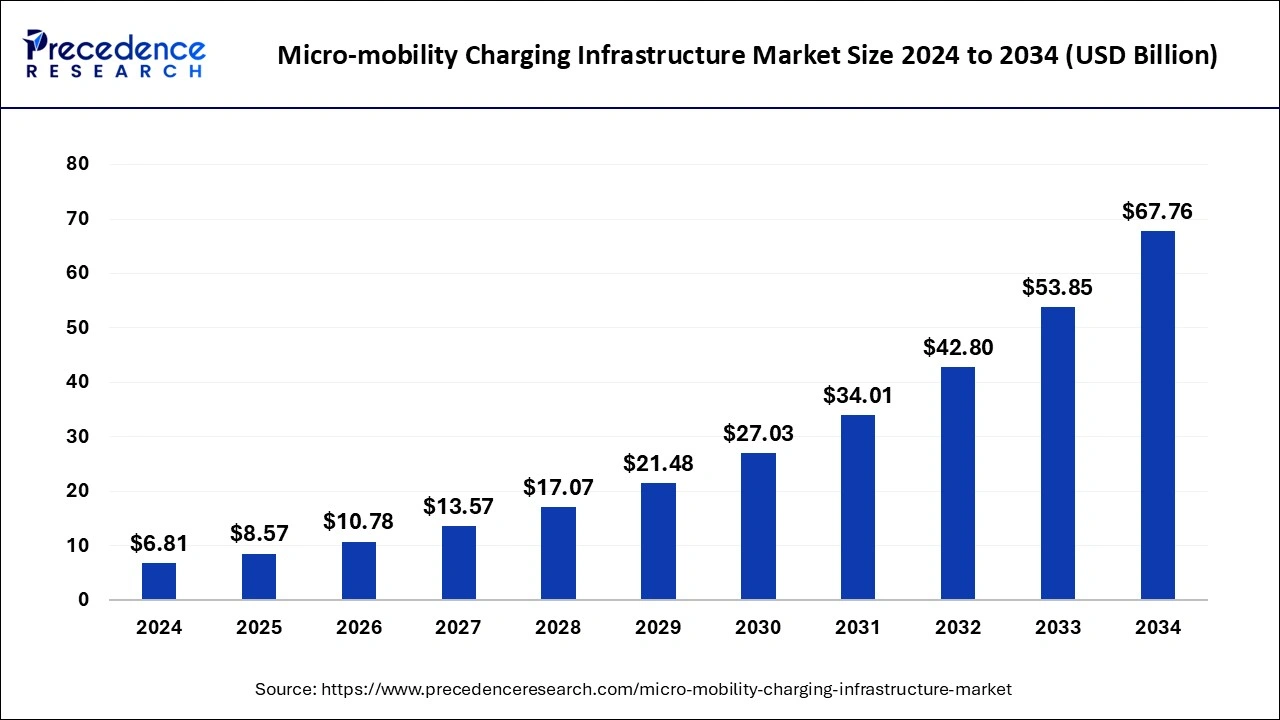

The global micro-mobility charging infrastructure market size is estimated at USD 8.57 billion in 2025 and is predicted to reach around USD 67.76 billion by 2034, accelerating at a CAGR of 25.83% from 2025 to 2034. The Asia Pacific micro-mobility charging infrastructure market size surpassed USD 3.86 billion in 2025 and is expanding at a CAGR of 25.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global micro-mobility charging infrastructure market size was estimated for USD 6.81 billion in 2024 and is anticipated to reach around USD 67.76 billion by 2034, growing at a CAGR of 25.83% from 2025 to 2034. The micro-mobility charging infrastructure market is growing due to the adoption of micromobility electric vehicles.

AI assists in addressing important issues in the micro-mobility sector, including damage detection, pricing schemes, fleet rebalancing, and parking management. AI systems started to optimize charging schedules according to customer preferences, grid capacity, and energy consumption.

Predictive maintenance of charging infrastructure was made possible by machine learning techniques, guaranteeing dependability and effectiveness. The future of micromobility will be more shaped by AI technology as it develops further, propelling the sector toward more intelligent and environmentally friendly urban transportation options.

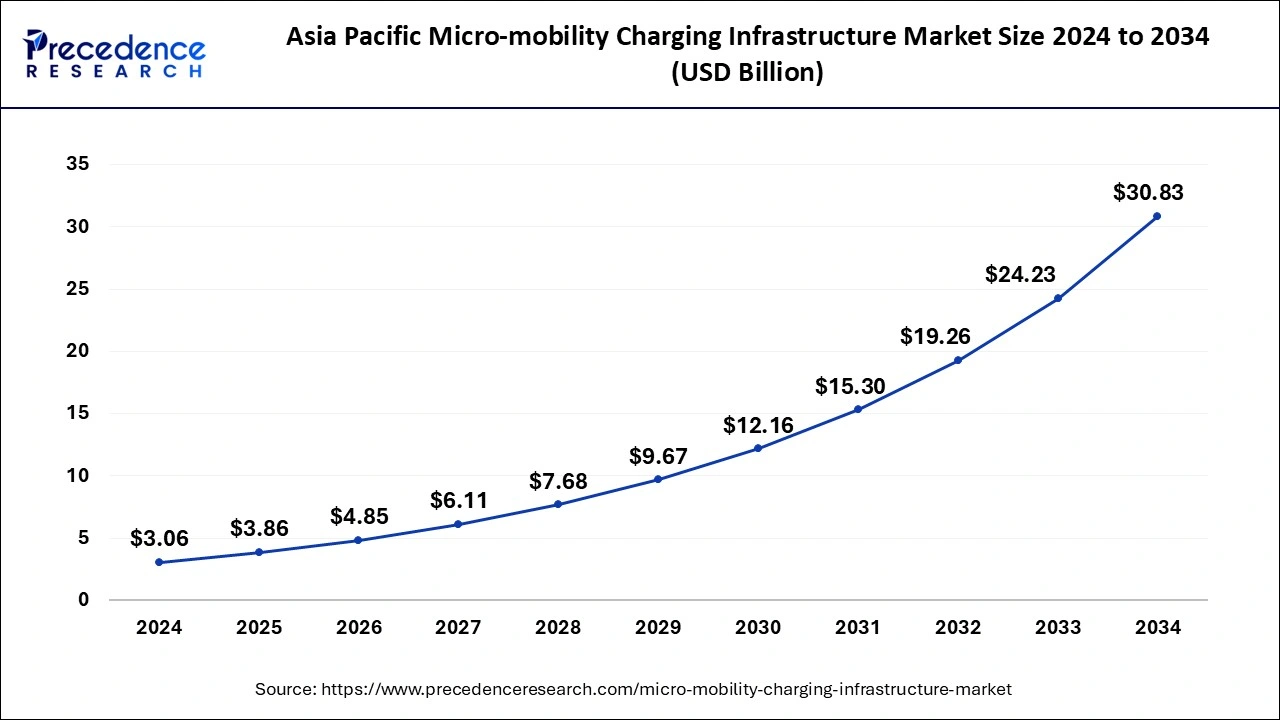

The Asia Pacific micro-mobility charging infrastructure market size was estimated at USD 3.06 billion in 2024 and is anticipated to be surpass around USD 30.83 billion by 2034, rising at a CAGR of 25.98% from 2025 to 2034.

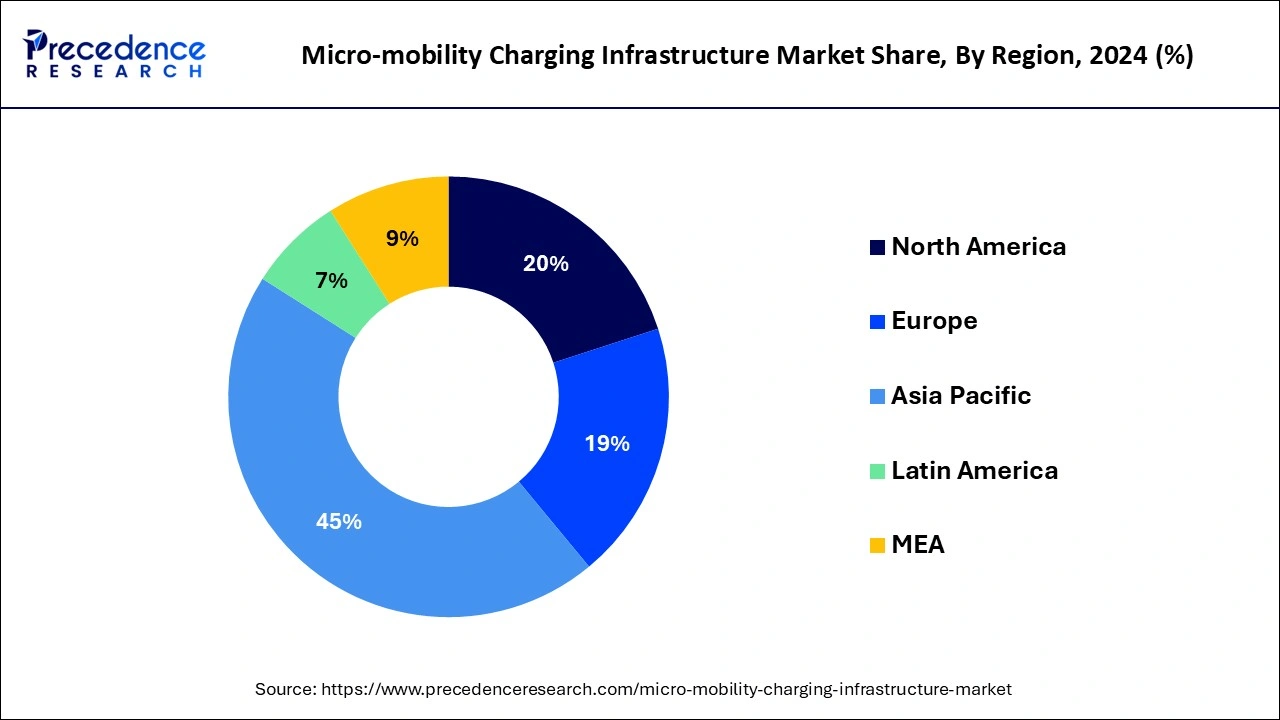

Asia Pacific dominated the global micro-mobility charging infrastructure market with the largest market share of 45% in 2024. The Asia Pacific region being the most congested and having a lot of urban population.

The "New Energy Vehicle Industry Development Plan (2021–2035)" states that plug-in hybrid (including extended-range) cars (PHVs) and pure electric vehicles (EVs) make up the majority of NEVs in China's passenger automobile market. Pure electric car sales are expected to become widespread by 2035, with a 20% sales target by 2025. Therefore, many academics have empirically investigated whether customers are ready to buy NEVs, further examining the audience of NEVs in the passenger automobile industry against the backdrop of significant development potential. According to the recent Automotive Industry Green and Low-Carbon Development Roadmap 1.0, which was created under the direction of China's Ministry of Industry and Information Technology, the country's current momentum in electric car sales has raised expectations that passenger NEV sales could reach a 50% share as early as 2025.

North America is expected to expand at a double digit CAGR of 27.4% during the forecast period. Due to the growing awareness of the environmental issues, there has been a growth in the North American region. As many well known companies related to this market are based in North America, a major increase is expected in this regional market.

A mainstream market for tiny models may develop in the U.S. as a result of changing city demographics and the demand for reasonably priced, effective EVs. The three biggest automobile and electric vehicle markets in the world today, China, Europe, and the U.S. have aggressive goals and plans in place to reach them. The little difference in the sales of electric cars in the STEPS and the APS in 2030 serves as a clear example of this. In fact, the combined sales proportion of electric cars in the STEPS in China, Europe, and the U.S. in 2030 is above 60%, which is comparable to the global sales percentage of electric cars in the NZE Scenario.

The e-scooters or the e-bikes, which is comprise of the micro mobility for sustainable travel mode due to the rising adoption of environmental policies and stringent rules to reduced environmental pollution and improve the mode of transportation. A rise in the market is expected during the forecast. Many companies across the globe are providing potential for this market to flourish. Due to the lockdown during pandemic, the demand for public transportation had declined as people were asked to stay at home. Due to this, the profits have suffered to a large extent. The expected market expansion has also hindered during the forecast period.

There has been a strain on the economy and many businesses have come down. Since many people are working from home there's been a decline in the revenue. When covering long distance or for longer drives, charging stations are required. The costs of these charging stations vary some charge by the minute, while others charged by the energy received. Charging racks are set up, which also help in solving the parking situation for scooters and bike. When the vehicles are parked in the charging rack, it reduces the risk of theft. Also, it provides for a fixed location for the customers to look at. The wireless charging system or the charging infrastructure reduces the need for servicing as it eliminates any mechanical wear and tear.

| Report Coverage | Details |

| Market Size by 2034 | USD 67.76 Billion |

| Market Size in 2025 | USD 8.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 25.83% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Power Source, Charger, End User, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing fuel prices

New energy vehicles (NEVs) with cost-effective, energy-efficient, and environmentally friendly characteristics have become popular trends as a result of the automotive industry's success in reforming the sector to address challenges, including environmental pollution, rising gas costs, and the energy crisis. NEV users may feel "superior" in their social circle compared to fuel car users, which might be a result of their favorable reputation and social standing. Additionally, a number of studies demonstrate that people's psychological attitudes toward using NEVs are reflected in their views toward the environment and gasoline prices, with positive sentiments toward NEVs encouraging people to switch from their current fuel-powered vehicles to NEVs.

Range anxiety & other barriers

Consumer concerns about a number of significant battery-related difficulties, including restricted range, lengthy charging times, a shortage of charging stations, and expensive starting costs, pose significant obstacles to the widespread adoption of BEVs. Current approaches to overcoming these obstacles include stationary vehicle-to-vehicle (V2V) charging, expanding battery capacity, and constructing more charging stations.

Better infrastructure development

Although home charging presently satisfies the majority of charging demand, public chargers are becoming more and more necessary to offer the same degree of accessibility and convenience as traditional car refueling. Public PHEV charging should be included in (and encouraged by) policy-making on the adequate availability of charging stations, even if PHEVs are less dependent on public charging infrastructure than BEVs.

The e-scooters segment has held a major market share of 62% in 2024. Many riders have started using more and more scooters, which are easy to park and easy to recharge, so the East Scooter segment has the largest share in the market. The E scooter charging platform helps in reducing the congestion due to traffic and improves the quality of air. The E scooter charging platforms are expected to drive the market.

As there will be more and more infrastructure of E-bike charging in tourist and public places there shall be an increase in the sales too. The E bikes charging infrastructure can be mounted freestanding or on a wall. It provides the benefit of charging multiple E bikes at the same time.

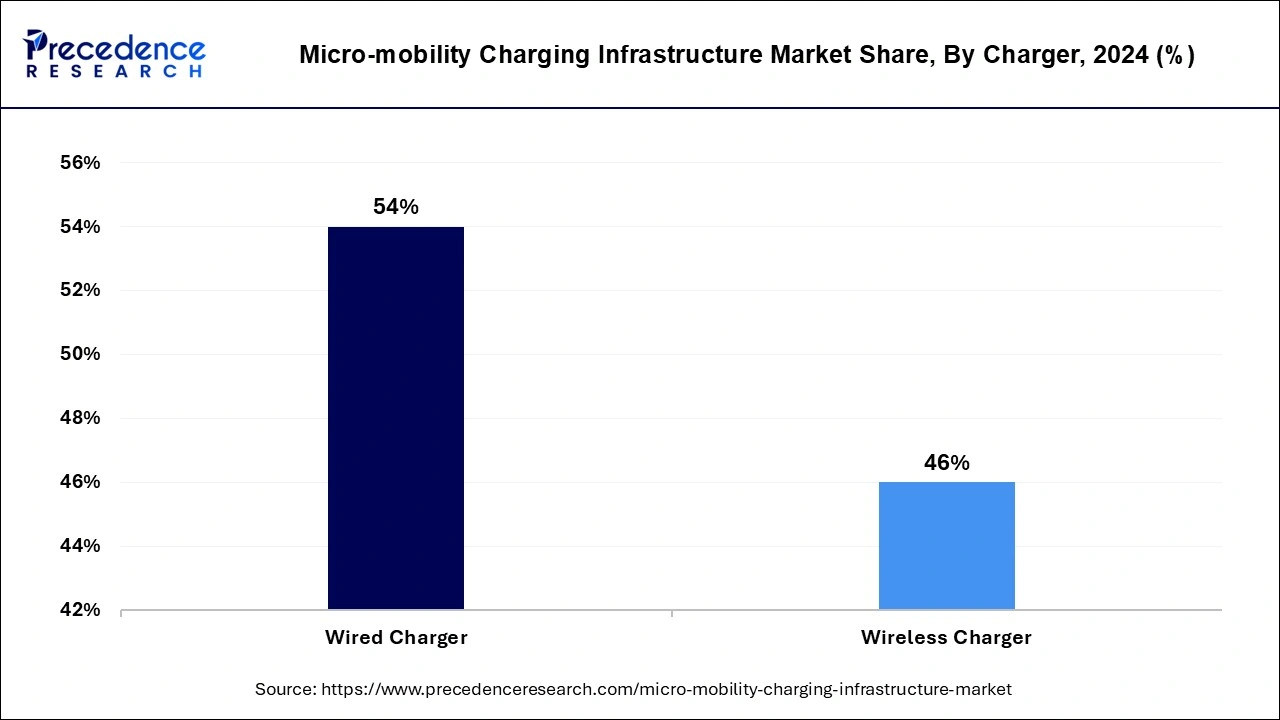

On the basis of charger can be divided into wireless charger and wired charger. The wired segment generated the biggest market share of 54% in 2024. Many companies or various nations are focusing on implementing these charging stations as they are extremely easy to use. As the usage of E scooters and E bikes is increasing it is also expected that the wired charger segment will also grow. The wired charging infrastructure is extremely convenient to use. Is this Michael's are used in logistics by multinational corporations and it is also used in public transport.

The wireless segment is expected to grow at a notable CAGR of 26.6% during the forecast period. The hassles with the plug in devices for charging the vehicles can be avoided by the use of wireless charging stations.

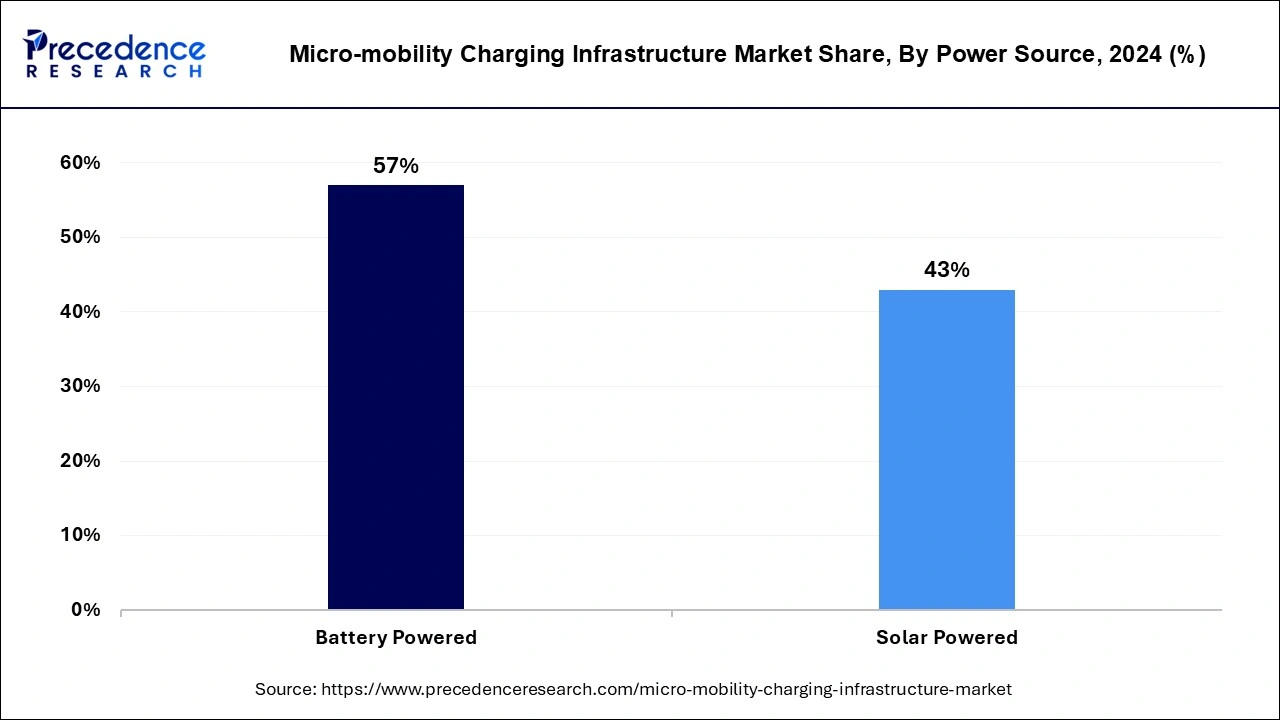

The battery powered segment accounted for the highest market share of 57% in 2024. The battery powered stations can charge many stations at the same place, so the battery powered segment is expected to have a larger market share compared to the other segment. Battery powered, micro mobility charging infrastructure can be installed for personal use in the private parking lots and garages. But since the solar type infrastructure requires less maintenance as compared to that of the battery type, this market is also expected to grow.

The solar-powered segment is projected to grow at a significant CAGR of 27% over the forecast period.

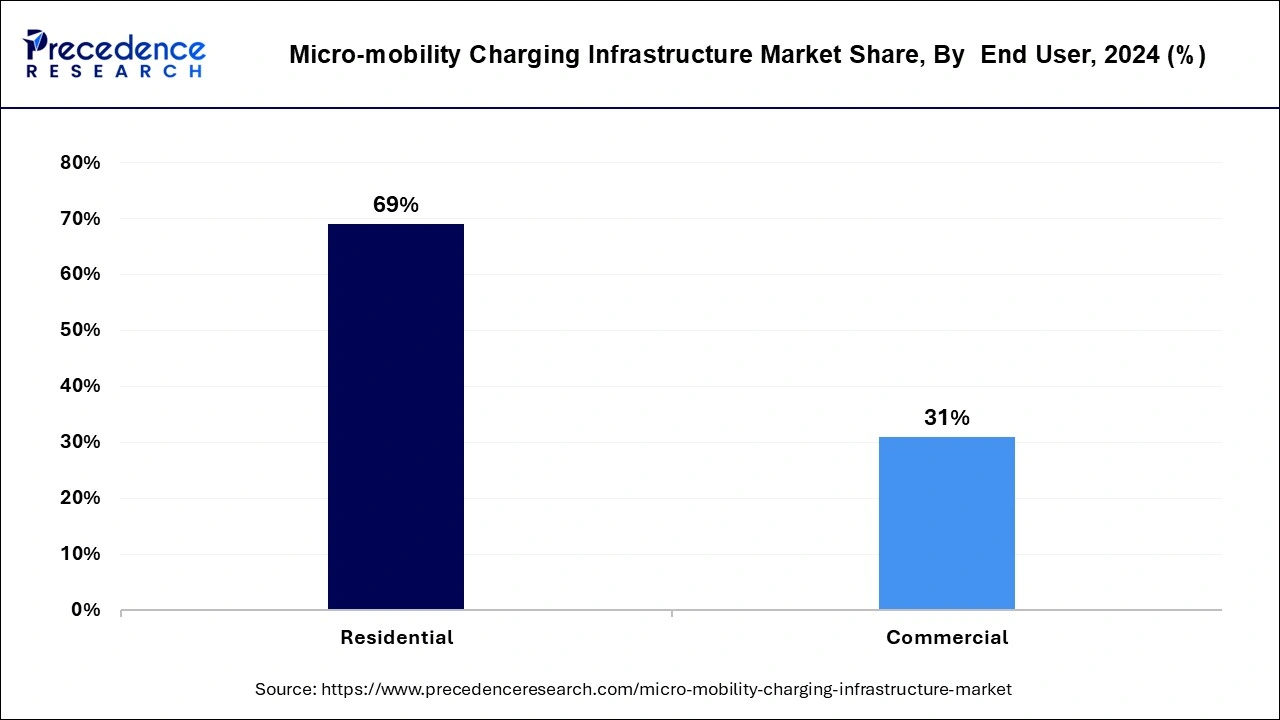

The end user segment can be divided into residential and commercial sub segments. The residential segments have a dominant market share because increased awareness and urbanization, and also a needed solution for growing traffic congestion.

The residential segment contributed the highest market share of 69% in 2024. The commercial segment is projected to grow at a solid CAGR during the forecast period.

By Vehicle type

By Charger

By Power Source

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

April 2025

December 2024