May 2025

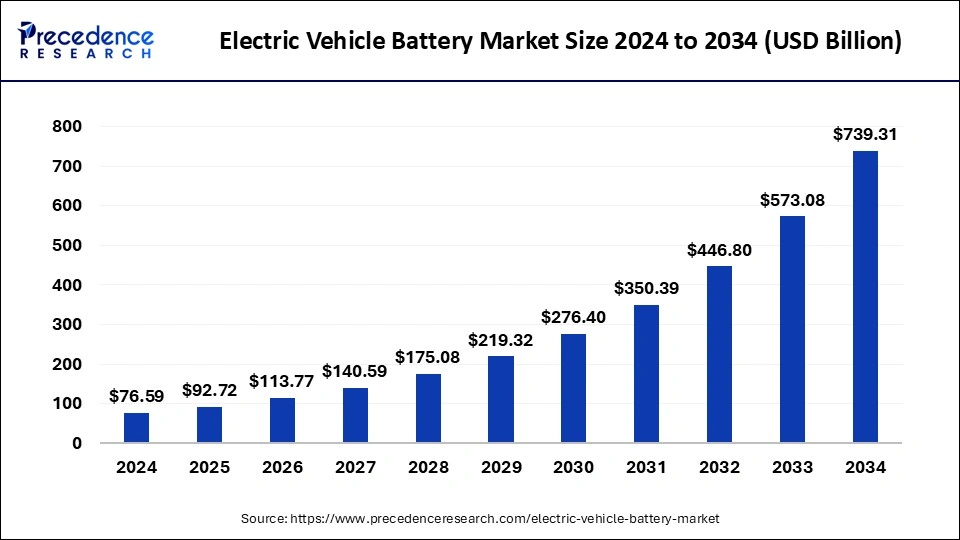

The global electric vehicle battery market size accounted for USD 76.59 billion in 2025 and is forecasted to hit around USD 739.31 billion by 2034, representing a CAGR of 25.95% from 2025 to 2034. The Asia Pacific market size was estimated at USD 271.33 billion in 2024 and is expanding at a CAGR of 26.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric vehicle battery market size accounted for USD 76.59 billion in 2024 and is predicted to increase from USD 92.72 billion in 2025 to approximately USD 739.31 billion by 2034, expanding at a CAGR of 25.95% from 2025 to 2034. The electric vehicle battery market is driven by rising fuel prices, increasing environmental awareness, a global push for sustainable transportation, government incentives and policies, and advancements in battery technology.

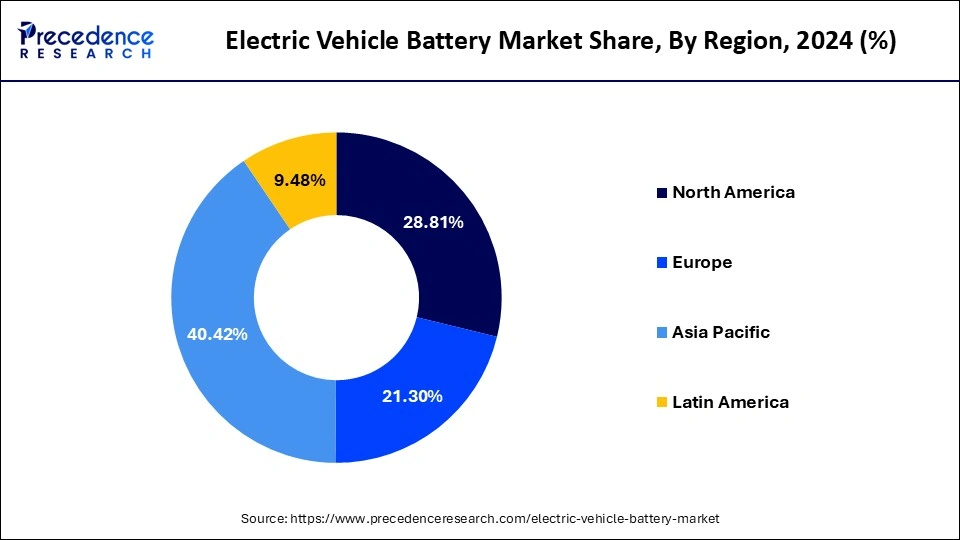

The Asia Pacific electric vehicle battery market size was exhibited at USD 22.06 billion in 2024 and is projected to be worth around USD 271.33 billion by 2034, growing at a CAGR of 26.20% from 2025 to 2034.

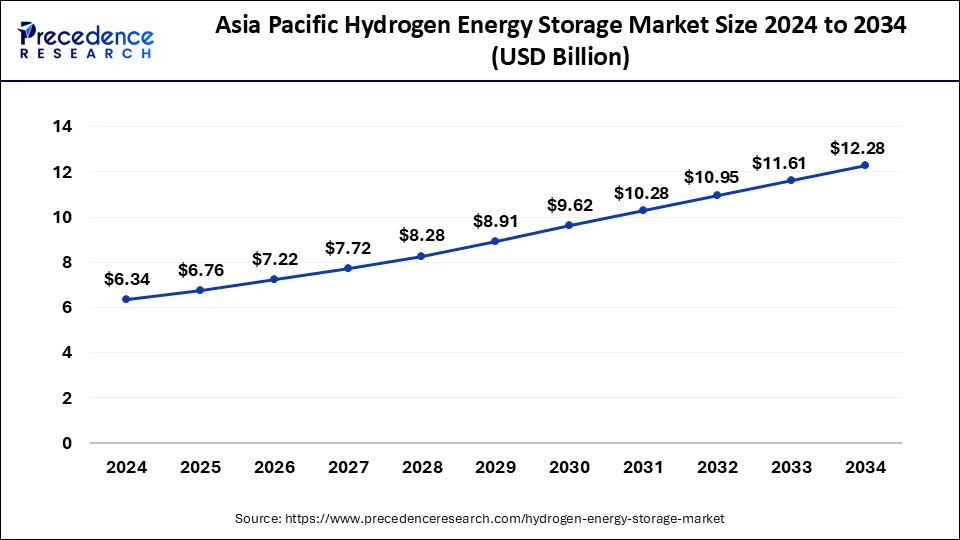

Asia Pacific dominated the EV battery market in 2024. The presence of top manufacturers in the region has facilitated the huge volume production of electric vehicles and EV batteries. The countries like China and India offers cheap labor and other factors of production and the pro-industrial government policies attracts huge investments from the top MNCs. The presence of huge consumer base in the region, growing demand for the electric passenger and commercial vehicles, rising investments in development of charging infrastructure, and growing government initiatives to promote the adoption of the electric vehicles are the prominent drivers of the Asia Pacific EV battery market.

China EV Battery Industry Trends:

China, in particular, has emerged as a dominant force in both electric vehicle and battery production. This region, with rapidly developing economies such as China and India, is witnessing a sharp increase in the demand for innovative transportation solutions and energy systems, including electric vehicles. To facilitate this transition, numerous countries in the Asia-Pacific have implemented comprehensive government policies aimed at promoting both EV adoption and battery production, thus ensuring sustainable growth in this sector.

The North America is expected to witness significant growth during the forecast period. The strict government regulations regarding the emissions and adoption of electric vehicles, high disposable income, and increased consumer awareness regarding the benefits of electric vehicles, high environment consciousness, and presence of top auto manufacturers in the region are the major factors that are expected to have a significant impact on the growth of the EV battery market in the foreseeable future. The increased demand for the sustainable products among the consumers and increased adoption of the advanced technologies is supporting the growth of the market in these regions.

U.S. EV Battery Trends:

North America, and specifically the United States, is also experiencing a vigorous expansion in the electric vehicle battery market. This growth can be attributed to a notable surge in electric vehicle sales, underpinned by the availability of critical raw materials such as cobalt and lithium. Increasing governmental support through incentives like tax credits and rebates is further propelling this market forward. The U.S. is characterized by a substantial increase in consumer interest in electric vehicles, driven by advances in battery technology, the enhancement of charging infrastructure, and a growing preference for zero-emission transportation options.

A rechargeable battery powers the electric motors in an electric vehicle or hybrid electric vehicle. Many nations are starting to employ them more frequently. The battery is the key element in electric vehicle technology. Due to their significantly higher energy density as compared to weight, lithium-ion and lithium polymer batteries are typically seen in modern electric vehicles. Lithium, cobalt, manganese, steel, graphite and nickel are the main chemical components needed in lithium-ion batteries. Each of these parts performs a unique function in the conventional electric vehicle battery that enhances efficiency.

The global adoption of EVs is anticipated to be fueled by increased technological developments and falling battery prices. Additionally, the government has been obliged to enact severe rules regarding the reduction of carbon footprint and preservation of the environment due to the rising pollution levels and deteriorating environmental conditions. Therefore, the increased efforts to reduce car emissions are anticipated to increase demand for electric vehicles, which will therefore increase demand for EV batteries.

The global leading automotive manufacturers such as General Motors, BMW, Volkswagen, and Fords Motors are increasing their emphasis on rolling out various types of electric vehicles in the market. The rising awareness regarding the benefits of electric vehicles, surging popularity of the advanced electric vehicles, and the growing production volumes by the top automakers are the prominent factors that are driving the growth of the global EV battery market. The growing government initiatives to promote the adoption of EVs by incentivizing the manufacturers and by offering subsidies to the customers are positively driving the sales of the EVs.

The government policies to promote the establishment of charging stations through public-private partnerships are expected to boost the growth of the market in the forthcoming years. The rising investments in the urbanization and the growing government investments in the infrastructural development is expected to support the growth of the EV battery market in the foreseeable future. The rising advancements in the technologies and the declining battery prices is projected to fuel the adoption of the EVs across the globe.

Moreover, the rising pollution levels and deteriorating environmental conditions has forced the government to adopt strict policies regarding the reduction of carbon footprint and conservation of the environment. Therefore, the rising efforts to control the emission from vehicles are expected to spur the demand for the electric vehicles and subsequently the demand for the EV batteries is expected to grow.

| Report Coverage | Details |

| Market Size in 2025 | USD 92.72 Billion |

| Market Size by 2034 | USD 739.31 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 25.95% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery Type, Vehicle Type, Propulsion, Li-ion Battery Component, Method, Capacity, Battery Form, Material Type, End User, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

INCREASING DEMAND FOR ELECTRIC VEHICLES

Due to the growing need to reduce reliance on imported oil and the quickly diminishing fossil resources, there is an increase in demand for electric vehicles. Oil production costs are increasing, which makes it more expensive to import oil. As a result, countries that rely heavily on oil imports are forced to make substantial investments, placing economic strain on their economies. Because fuel cells, electricity, and batteries power EVs (Electric Vehicles), there is less reliance on foreign oil. Over the next few years, it is anticipated that this factor will accelerate the adoption of EVs. EV adoption is being fueled by their low emission levels, and this trend is anticipated to increase market revenue growth during the projection period.

In urban regions, where daily driving distances are shorter on average, smaller, more fuel-efficient cars are more common. By 2033, it's anticipated that more than 50% of the world's population will reside in urban areas, increasing demand for electric vehicles. The range of electric vehicles expands as battery technology advances. For people who commute a longer distance, EVs with longer range are more feasible. High-speed charging will also become a reality due to charger performance and battery advancements, minimizing downtime while driving. Thus, increasing demand for EVs will drive EV battery market.

FALLING PRICE OF LITHIUM-ION BATTERIES

Lithium-ion batteries are the primary power source for electric vehicles at the moment. Over 70% of the market for rechargeable batteries is made up of Li-ion batteries, according to 2018 research by the US International Trade Commission. Additionally, the cost of batteries per kilowatt-hour (kWh) has decreased to under $200. Battery prices are also predicted to fall below 100 USD/kWh in the upcoming years due to improvements in cell chemistry and battery pack production methods. Therefore, it is projected that a decline in the price of battery packs, which account for between 35% and 45% of the costs associated with making electric vehicles, will fuel the market's expansion.

The rise of Asia Pacific as a major center for global industry has increased the use of tools powered by lithium-ion batteries. In the next ten years, improved battery technology and lower costs will be achieved through continued R&D spending and supply chain capacity increase novel cathode materials and cell production techniques, silicon and lithium metal anodes, solid-state electrolytes, and others, to play a significant part in making these price cuts possible. In 2020, the percentage of electric vehicles (EVs) sold worldwide was only about 3.2%; however, this percentage is expected to rise during the next ten years, partly as a result of declining EV battery prices. Batteries are getting cheaper to build because of increased production and technological advancements, which puts EVs on a par with gas-powered vehicles.

HIGH COST OF ELECTRIC VEHICLES COMPARED TO ICE

The high cost of EV production has posed a serious obstacle to their widespread adoption. The predicted decline in battery costs and R&D spending will likely bring down the overall cost of buying electric hatchbacks, crossovers, or SUVs to levels equivalent to ICL vehicles, which would increase demand for EVs. The price of the cathode has a large impact on battery prices because raw elements like cobalt, nickel, lithium, and magnesium are quite expensive. Due to the costly process involved in manufacturing these vehicles, the cost of EV production is likewise much higher than that of ICE automobiles. Due to the need for batteries with higher specifications, complex technology demanded for manufacture, and extremely expensive components utilized in the vehicles, producing higher range electric vehicles is substantially more expensive.

A study found that building electric vehicles is becoming more expensive. Currently, the cost of each vehicle in raw materials is around $8,255. These expenses include the cobalt, nickel, and lithium needed to make EV batteries. Compared to the $3,381 cost of raw materials for an electric vehicle in March 2020, the price has increased by more than 140%. In the EV industry, ongoing supply chain disruptions and rising raw material prices go hand in hand. Given that Russia exports a sizable amount of some of the metals used to make battery cells, the situation in Ukraine has also added to the price increase.

INTRODUCTION OF THE BATTERY-AS- A-SERVICE MODEL

Businesses are developing business models that enable consumers to switch out EV batteries after they are drained, such as battery swapping and battery-as-a-service (Baas). In contrast to a stationary charging station, where charging batteries takes time and requires expensive infrastructure, a battery-as-a-service model (BaaS) enables customers to swap out batteries quickly. BaaS is an asset-light, inexpensive, and quick-on-its-feet model. The upfront costs of EVs may decrease dramatically as a result of the BaaS model; for example, the expenses for two-wheelers may easily decrease by up to 20%. This reduces the amount of time users must spend charging their batteries, increasing customer happiness and resolving one of the primary barriers to EV adoption. Battery swapping at EV charging stations has increased since it saves EV customers' time from having to charge their batteries.

Despite the fact that the market for EV cars outside of China is still growing, it has demonstrated its potential. For instance, NIO expects to deploy about 4,000 more battery switching stations in China by 2025 after installing over 300 by July 2021. By July 2021, its battery swapping stations would have been used 2.9 million times worldwide, with about 1,000 more units slated for locations outside of China. In November 2021, Shell and NIO entered a contract to work together to build these battery-swapping EV charging stations. As a result, the battery now has a new chance to provide EV charging services.

The lithium-ion segment dominated the global EV battery market in 2024. The higher density of energy and the lightweight of the lithium-ion batteries are the most significant feature that has boosted the adoption of the lithium-ion batteries in the electric vehicles. The lithium-ion batteries are extensively used in the hybrid and electric vehicles across the globe. The rising popularity and growing sales of the hybrid and electric vehicles across the globe has resulted in the dominance of this segment in the global EV battery market.

Lead acid batteries are expected to gain rapid traction during the forecast period. This is attributed to the increasing popularity of the lead acid batteries as these batteries are much more economical as compared to the lithium-ion batteries. Furthermore, a huge cost is involved in the mining and refining of lithium and extensive mining may deplete the lithium resources. Hence, the lead acid batteries can offer a good alternative to the lithium-ion batteries. Therefore, this segment is expected to grow at the highest CAGR.

Global Electric Vehicle Battery Market Revenue, By Battery Type, 2022-2024 (USD Billion)

| By Battery Type | 2022 | 2023 | 2024 |

| Lead-Acid Battery | 7.57 | 9.08 | 10.99 |

| Lithium-ion Battery | 34.33 | 41.25 | 49.97 |

| Sodium-ion Battery | 5.02 | 5.98 | 7.18 |

| Nickel-Metal Hydride Battery | 3.25 | 3.87 | 4.64 |

| Others | 2.91 | 3.32 | 3.82 |

| Total | 53.08 | 63.51 | 76.59 |

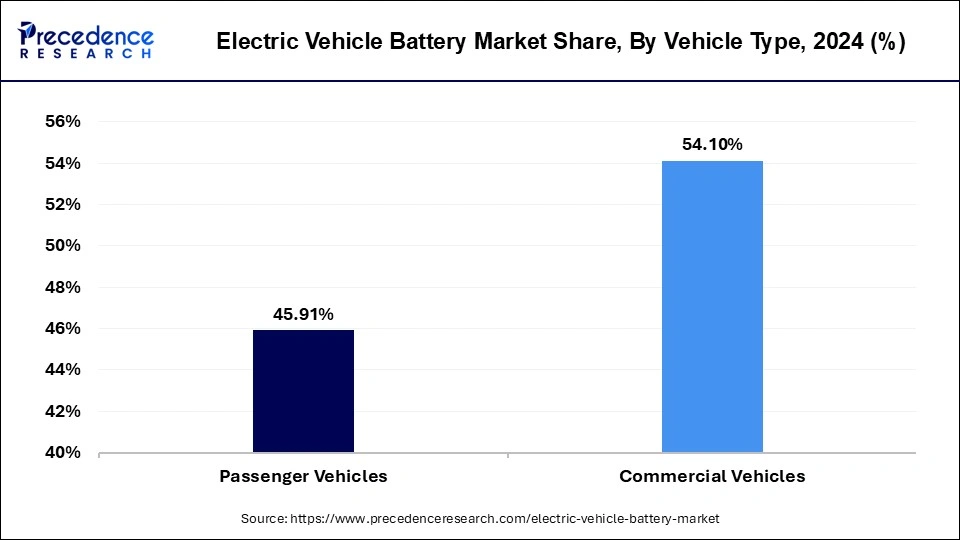

Depending on the vehicle type, the passenger vehicle segment was the largest revenue contributor to the global EV battery market in 2024. The government of various countries like Canada, India, and Japan are offering subsidies to the consumers to encourage the adoption of the electric passenger vehicles. Furthermore, the demand for the passenger vehicles is expected to remain significant during the forecast period owing to the rising awareness regarding the benefits of EV, growing disposable income, improving standard of living, rising demand for personal commute solutions, and growing urbanization. The huge penetration of the passenger electric vehicles across the globe has resulted in the dominance of this segment.

The commercial vehicle is expected to be the most opportunistic segment during the forecast period. There is a rapidly growing demand for the commercial electric vehicles especially in the developing economies. The normal commercial vehicles emission is higher than the passenger vehicles and hence the government are planning to increasing adopt the commercial electric vehicles to reduce carbon emission. The rising efforts to electrify the commercial vehicle segment are expected to foster the growth of this segment during the forecast period.

Global Electric Vehicle Battery Market Revenue, By Vehicle Type, 2022-2024 (USD Billion)

| By Vehicle Type | 2022 | 2023 | 2024 |

| Passenger Vehicles | 23.26 | 28.49 | 35.16 |

| Commercial Vehicles | 29.82 | 35.02 | 41.43 |

| Total | 53.08 | 63.51 | 76.59 |

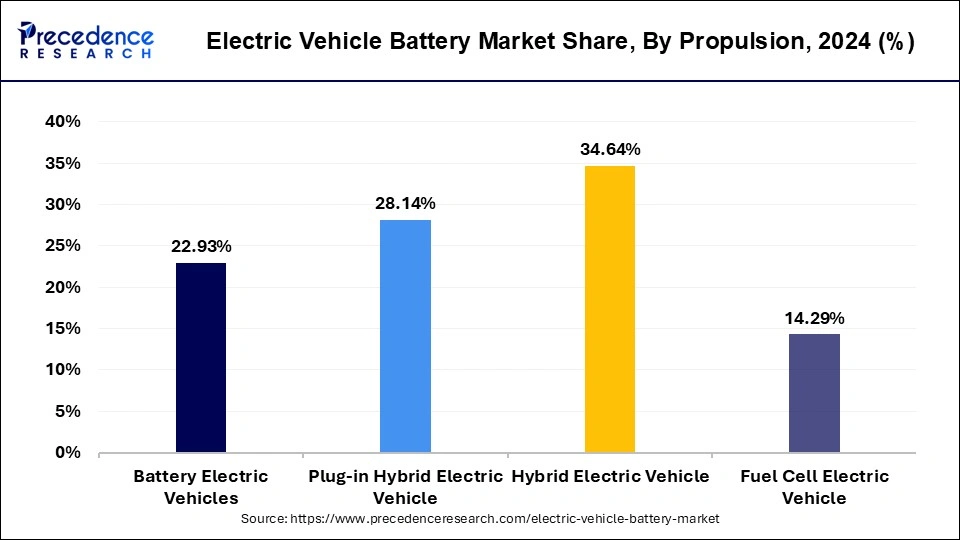

The hybrid electric vehicles segment held the largest share of the electric vehicle battery market in 2024. Compared to conventional cars that only use internal combustion engines, hybrid electric vehicles provide benefits, including increased fuel economy and lower pollutants. Hybrid electric vehicles combine an internal combustion engine with an electric propulsion system. Without the range restrictions of fully electric cars, the hybrid electric vehicle provides some advantages of electric propulsion, such as lower pollutants and increased fuel efficiency. Compared to battery electric vehicles and plug-in hybrid electric vehicles, HEVs usually employ more miniature battery packs. In hybrid electric vehicles, the batteries are engineered to support the internal combustion engine and store energy during regenerative braking. Hybrid electric vehicles frequently employ lithium-ion batteries because of their high power and energy density.

The plug-in hybrid electric vehicles segment is expected to hold the largest share during the forecast period. The need for batteries that can operate in both electric and hybrid modes is exacerbated by PHEVs. These batteries must be solid and efficient to sustain the dual powertrain system, even though they usually have a lower capacity than those in fully electric cars. Advanced battery technologies like lithium-ion batteries are used in plug-hybrid electric vehicles. These batteries balance energy density, weight, and cost. To satisfy customer expectations, PHEV batteries have enough electric-only range and a high-efficiency rate when alternating between electric and combustion modes. Technological advances, alliances with suppliers, and the release of new PHEV models are observed to promote the segment’s growth.

Global Electric Vehicle Battery Market Revenue, By Propulsion, 2022-2024 (USD Billion)

| By Propulsion | 2022 | 2023 | 2024 |

| Battery Electric Vehicles | 12.01 | 14.46 | 17.56 |

| Plug-in Hybrid Electric Vehicle | 15.01 | 17.91 | 21.55 |

| Hybrid Electric Vehicle | 18.34 | 21.97 | 26.53 |

| Fuel Cell Electric Vehicle | 7.72 | 9.16 | 10.95 |

| Total | 53.08 | 63.51 | 76.59 |

The separator segment dominated the electric vehicle battery market by capturing the largest share in 2024 and is expected to grow at the fastest rate in the coming years. The separator is an essential component in Li-ion batteries, as it improves battery performance by separating the anode and cathode and preventing short circuits. As the production of EVs increases, the demand for Li-ion batteries also increases, and so does the need for essential components like separators. Moreover, the increasing focus on improving vehicle performance contributes to segmental growth.

Global Electric Vehicle Battery Market Revenue, By Li-ion Battery Component, 2022-2024 (USD Billion)

| By Li-ion Battery | 2022 | 2023 | 2024 |

| Positive Electrode |

6.28 | 7.50 | 9.04 |

| Negative Electrode |

7.23 | 8.67 | 10.49 |

| Electrolyte |

9.69 | 11.66 | 14.14 |

| Seperator |

11.13 | 13.42 | 16.30 |

| Total | 53.08 | 63.51 | 76.59 |

The 201-300 kWh segment held the dominant share of the market in 2024 due to the increased demand for high-energy-density batteries to improve vehicle performance. The segment is further likely to expand at the fastest rate throughout the forecast period. This is mainly due to the increasing popularity of large vehicles, such as SUVs and XUVs. Higher energy density batteries stand out as unavoidable in addressing range and performance issues. These batteries are ideal for long haul. The growing concerns about frequent recharge during long haul is a major factor boosting the demand for larger capacity batteries, supporting the segment's growth.

Global Electric Vehicle Battery Market Revenue, By Capacity, 2022-2024 (USD Billion)

| By Capacity | 2022 | 2023 | 2024 |

| <50kWh |

8.69 | 10.37 | 12.47 |

| 50-110 kWh |

17.10 | 20.47 | 24.70 |

| 111-200kWh |

10.66 | 12.73 | 15.32 |

| 201-300kWh |

9.17 | 11.06 | 13.44 |

| >300kWh | 7.46 | 8.88 | 10.66 |

| Total | 53.08 | 63.51 | 76.59 |

The pouch segment led the electric vehicle battery market in 2024 by holding the largest share. The segment is projected to continue its dominance over the studied period. With the increasing demand for lightweight vehicles, the acceptance of pouch cells is increasing, which is expected to boost the segment growth. Pouch cells are increasingly preferred due to their design flexibility, lightweight, and portability compared to prismatic and cylindrical cells. They have better thermal performance due to their flat and thin design, dissipating heat during charging and discharging cycles.

Global Electric Vehicle Battery Market Revenue, By Battery Form, 2022-2024 (USD Billion)

| By Battery Form | 2022 | 2023 | 2024 |

| Prismatic | 17.14 | 20.53 | 24.80 |

| Pouch |

22.78 | 27.32 | 33.04 |

| Cylindrical |

13.17 | 15.65 | 18.75 |

| Total | 53.08 | 63.51 | 76.59 |

The lithium segment accounted for the largest market share in 2024 and is likely to grow at the fastest rate in the foreseeable future. The segmental growth is primarily attributed to the increasing demand for Li-ion batteries. Lithium is widely preferred due to its low atomic weight, leading to the overall weight reduction of battery packs and improving vehicle performance. Lithium-ion batteries withstand many charge-discharge cycles, reducing frequent battery replacement.

Global Electric Vehicle Battery Market Revenue, By Material, 2022-2024 (USD Billion)

| By Material | 2022 | 2023 | 2024 |

| Lithium |

18.32 | 22.02 | 26.66 |

| Cobalt |

12.88 | 15.45 | 18.68 |

| Manganese |

13.80 | 16.48 | 19.84 |

| Natural Graphite |

8.07 | 9.56 | 11.41 |

| Total | 53.08 | 63.51 | 76.59 |

Toyota

Partnership- In October 2023, Toyota, a prominent leader in the electric vehicle (EV) market, made headlines by entering into a strategic partnership with Idemitsu Kosan, a key player in the energy and materials sector. This collaboration aims to leverage Idemitsu's expertise in battery technology to enhance the performance and efficiency of EVs.

Stellantis

Innovation- In November 2024, Stellantis is set to introduce a demonstration fleet of electric Dodge Charger Daytona vehicles by the year 2026. This initiative aims to conduct extensive testing of solid-state batteries developed in partnership with Factorial, a company recognized for its innovative approaches to automotive battery technology.

South 8 Technologies

Innovation- In November 2024, South 8 Technologies will pioneer a safer and more efficient battery alternative designed to mitigate the common issues associated with traditional lithium-ion batteries. The company's CEO, Tom Stepien, recently revealed that they have developed an innovative technology known as LiGas®.

By Battery Type

By Vehicle Type

By Propulsion

By Li-ion Battery Component

By Capacity

By Battery Form

By Material Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

January 2025

September 2024