January 2025

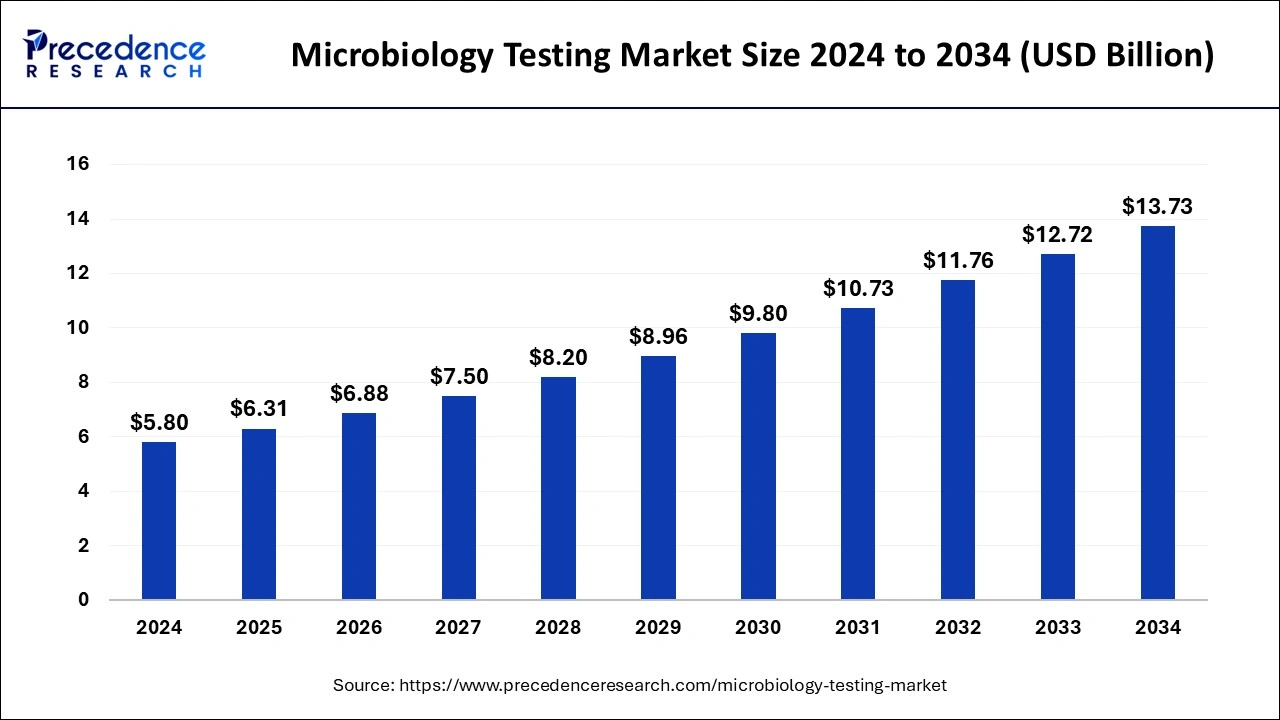

The global microbiology testing market size is calculated at USD 6.31 billion in 2025 and is forecasted to reach around USD 13.73 billion by 2034, accelerating at a CAGR of 9.00% from 2025 to 2034. The North America microbiology testing market size surpassed USD 2.61 billion in 2024 and is expanding at a CAGR of 9.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microbiology testing market size was estimated at USD 5.80 billion in 2024 and is predicted to increase from USD 6.31 billion in 2025 to approximately USD 13.73 billion by 2034, expanding at a CAGR of 9.00% from 2025 to 2034.

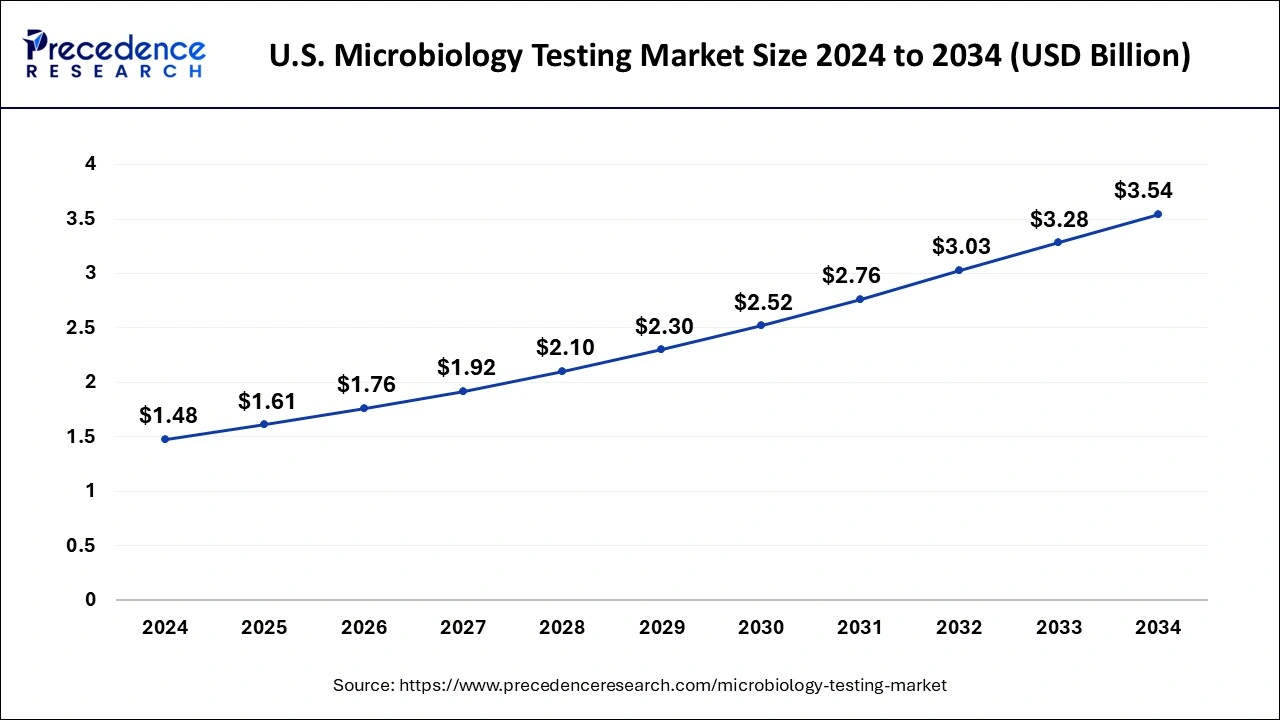

The U.S. microbiology testing market size was valued at USD 1.48 billion in 2024 and is estimated to reach around USD 3.54 billion by 2034, growing at a CAGR of 9.11% from 2025 to 2034.

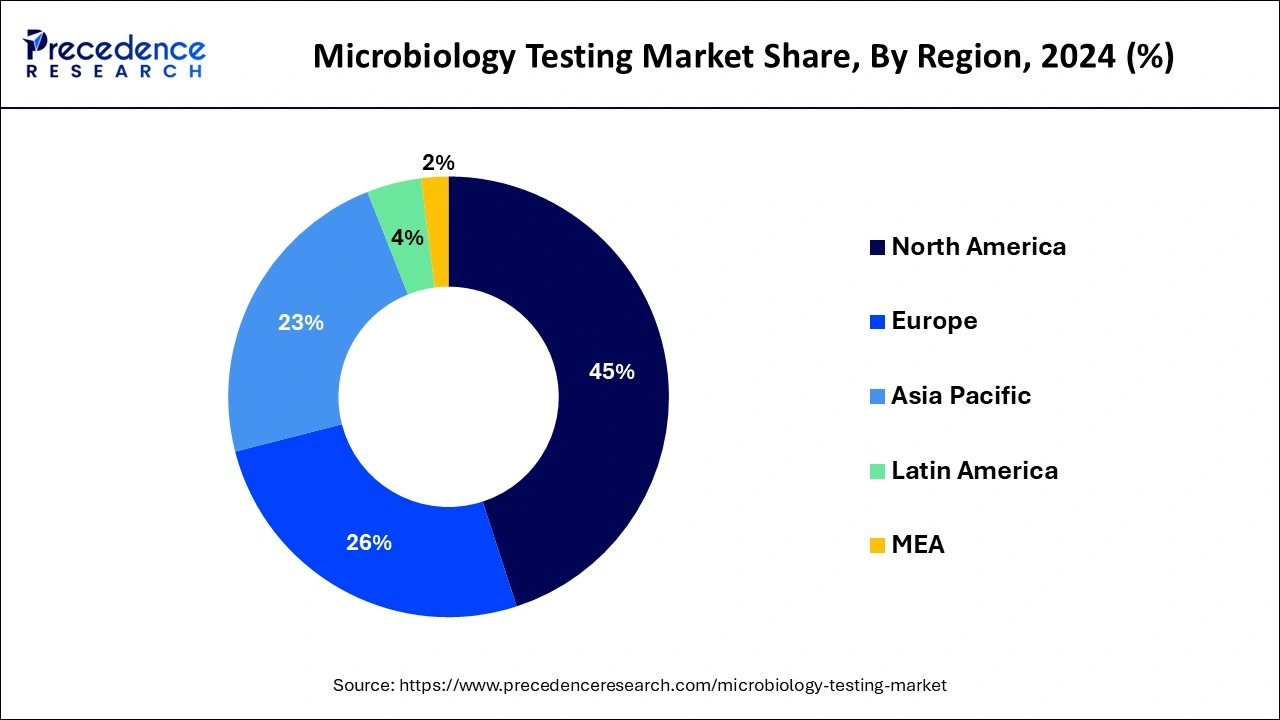

North America has held the largest revenue share 45% in 2024. North America maintains a significant share in the microbiology testing market due to several key factors. The region boasts a robust healthcare infrastructure and stringent regulatory standards, driving demand for microbiology testing in clinical settings and pharmaceutical research. Additionally, North American industries prioritize food safety and environmental monitoring, increasing the need for microbial analysis. The presence of leading market players and extensive research and development activities further contribute to its dominance. Moreover, heightened awareness of infectious diseases and pandemics, as exemplified by COVID-19, has underscored the importance of microbiology testing, sustaining its growth in North America.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific's significant growth in the microbiology testing market can be attributed to several factors. The region's dense population and rising healthcare awareness have spurred demand for microbiology testing in clinical diagnostics. Additionally, growing food safety concerns have driven the adoption of testing in the food and beverage industry. Furthermore, increasing pharmaceutical production and research activities contribute to market growth. As the region continues to invest in healthcare infrastructure and technological advancements, it solidifies its position as a major player in the global microbiology testing market, with substantial opportunities for further expansion and innovation.

The microbiology testing market thrives as an expanding industry dedicated to the examination and characterization of microorganisms, encompassing bacteria, viruses, fungi, and parasites. It assumes a pivotal role across diverse sectors like healthcare, pharmaceuticals, food and beverage, and environmental monitoring.

The market's vitality lies in a spectrum of diagnostic methods, including culture-dependent techniques, molecular biology, and immunological assays, designed to identify and categorize microorganisms. Factors propelling its growth encompass heightened concerns about infectious diseases, evolving food safety standards, and innovations in technology. Consequently, the microbiology testing sector is primed for continuous expansion, driven by the rising demand for precise and swift microbial detection solutions.

The microbiology testing market is in a phase of substantial expansion, underpinned by its pivotal significance in an array of sectors encompassing healthcare, pharmaceuticals, food and beverage, and environmental surveillance. This burgeoning industry revolves around the meticulous scrutiny and characterization of microorganisms, including bacteria, viruses, fungi, and parasites, employing a diverse spectrum of diagnostic modalities. These techniques encompass culture-centric methods, molecular biology, and immunological assays, all of which empower precise and efficient microorganism detection and classification.

A multitude of trends and growth catalysts are propelling the microbiology testing market onward. Escalated concerns regarding infectious maladies have augmented the demand for microbiological testing in clinical realms. Moreover, stringent edicts governing food safety have spurred adoption in the food and beverage sphere, ensuring the safety and quality of products. Furthermore, technological strides, such as automation and expedited testing approaches, have expedited testing procedures, enhancing both efficiency and precision.

The microbiology testing market benefits from myriad growth factors and promising avenues for commerce. The upswing in global healthcare expenditure, coupled with the imperative for rapid diagnostics, has given rise to a substantial market for microbiological testing in clinical settings. The pharmaceutical arena is also teeming with potential, as microbiological testing is instrumental in drug development and quality control. Furthermore, the burgeoning emphasis on environmental surveillance for public well-being has unveiled opportunities for microbiological testing in scrutinizing water and air quality.

While the microbiology testing market is flourishing, it confronts its fair share of challenges. One paramount challenge resides in the ever-evolving nature of microorganisms, necessitating continuous refinement and adaptation of testing methodologies. Ensuring the veracity and reliability of test outcomes remains a significant concern, particularly in clinical and pharmaceutical applications, where erroneous results can bear critical ramifications. Additionally, the industry grapples with the imperative to optimize cost-effectiveness to make advanced testing technologies more accessible to a broader array of enterprises and institutions.

In summation, the microbiology testing market is in a state of robust expansion, driven by its pivotal role in diverse sectors and the growing demand for precise and expeditious microbial detection solutions. Industry trends like automation, stringent regulatory frameworks, and technological strides are instigating this surge. Promise-laden opportunities beckon in healthcare, pharmaceuticals, and environmental surveillance. However, grappling with challenges associated with the dynamic nature of microorganisms, accuracy, and cost-efficiency remains indispensable for the enduring success of the microbiology testing domain.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.00% |

| Market Size in 2025 | USD 6.31 Billion |

| Market Size by 2034 | USD 13.73 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Test Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Food safety concerns

Food safety concerns are a potent catalyst for the burgeoning growth of the microbiology testing market. The increasing global awareness of foodborne illnesses and the insistent demand for safe and superior-quality food items have engendered a robust need for microbiology testing within the domain of the food and beverage industry. Microbiology testing assumes a pivotal role in the assurance that food products align with exacting safety and quality standards. It serves as a critical tool in the detection and containment of perilous pathogens like Salmonella, E. coli, and Listeria, all of which pose substantial health hazards upon consumption.

Additionally, it aids in the continuous oversight of food production procedures to forestall contamination and uphold impeccable hygiene criteria. Mandatory regulations and the discerning expectations of consumers regarding food safety have compelled substantial investments by food manufacturers in microbiology testing. This commitment is vital not only to safeguard their brand integrity but also to sustain the trust of consumers.

Furthermore, the unfortunate occurrences of food recalls triggered by contamination incidents accentuate the indispensable necessity for robust testing protocols, further impelling the market's upward trajectory. In summary, the microbiology testing market continues its expansion, primarily within the food and beverage sector, as it fulfills a fundamental role in safeguarding public health and reinforcing consumer assurance in the safety and excellence of food products.

Time-consuming processes

Time-consuming processes serve as a significant restraint on the growth of the Microbiology Testing market. Traditional microbiology testing methods, such as culture-based techniques, often necessitate prolonged incubation periods, ranging from several hours to several days, before producing conclusive results. This inherent delay can be a substantial drawback, particularly in scenarios demanding rapid diagnostics, such as infectious disease outbreaks or food safety emergencies.

The protracted turnaround times can lead to several adverse consequences. First and foremost, delayed results may impede timely patient treatment in clinical settings, potentially exacerbating health risks. In industries like food production, the lengthy testing process can lead to production bottlenecks, wasted resources, and prolonged product recalls in case of contamination.

Moreover, as industries seek more efficient and agile testing solutions, the time-consuming nature of certain microbiology testing procedures becomes a hindrance to meeting evolving demands. In an era when swift and accurate results are paramount, addressing the issue of time-consuming processes is crucial for sustaining the growth and relevance of the microbiology testing market.

Point-of-care testing (POCT)

Point-of-care testing (POCT) is catalyzing significant opportunities within the microbiology testing market by revolutionizing the landscape of microbial analysis. POCT facilitates immediate, on-site testing, eliminating the need for time-consuming laboratory processing and enabling rapid decision-making in various sectors. In healthcare, it allows for quick diagnosis and treatment of infectious diseases, enhancing patient outcomes and reducing the spread of pathogens.

Furthermore, in remote or underserved areas, POCT extends access to essential microbiology testing services. Beyond healthcare, industries such as food production and environmental monitoring benefit from real-time microbial assessment, ensuring product safety and environmental compliance.

The demand for portable, user-friendly POCT devices is growing, opening doors for innovation and market expansion. Overall, POCT's ability to deliver fast, accurate, and accessible microbiology testing is a driving force in shaping the future of the microbiology testing market and addressing emerging needs in diverse industries.

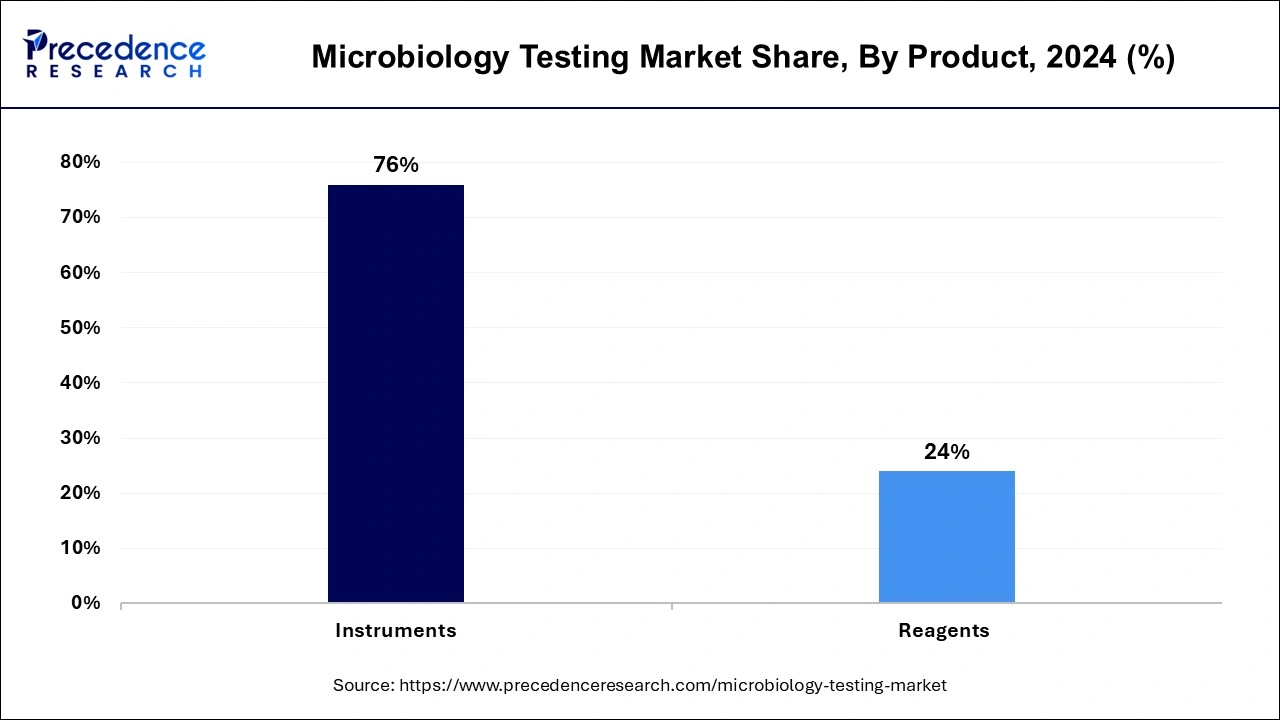

According to the product, the instruments segment has held 76% revenue share in 2024. The Instruments segment holds a substantial share in the microbiology testing market due to the critical role played by advanced equipment and technologies. These instruments, including PCR machines, automated microbial identification systems, and high-throughput testing platforms, enable rapid and accurate analysis of microorganisms.

They are essential in various industries, such as healthcare, pharmaceuticals, and food safety, for efficient testing and diagnosis. Moreover, ongoing technological advancements in microbiology testing instruments continually drive market growth as organizations prioritize automation, precision, and scalability, making this segment a dominant force in the market.

The reagents segment is anticipated to expand at a significant CAGR of 10.7% during the projected period. The reagents segment holds significant growth in the microbiology testing market due to its indispensability in various testing processes. Reagents, including culture media, biochemical reagents, and molecular diagnostic reagents, are essential components for microbial detection and identification. They enable the growth and differentiation of microorganisms in cultures, serve as reaction catalysts, and facilitate nucleic acid amplification. With microbiology testing being a fundamental aspect of clinical diagnostics, pharmaceutical research, food safety, and environmental monitoring, the consistent demand for reagents to perform these tests ensures that this segment retains a substantial portion of the market growth.

In 2024, the bacterial segment had the highest market share of 34% on the basis of the Application. The dominance of the bacterial segment within the Microbiology Testing market can be attributed to several key factors. Bacterial infections are pervasive and present significant public health challenges, necessitating routine testing for early detection and treatment. Moreover, bacteria have a critical role in various industries, including healthcare, pharmaceuticals, and food production, compelling a continuous demand for microbiology testing.

The emergence of antibiotic-resistant bacterial strains further underscores the urgency for precise and timely bacterial testing. Consequently, substantial investments in bacterial testing methodologies, encompassing both traditional and advanced techniques, have sustained the segment's prominence and market share.

The respiratory diseases are anticipated to expand at the fastest rate over the projected period. The respiratory diseases segment holds a substantial growth in the microbiology testing market due to several key factors. Firstly, the prevalence of respiratory infections and diseases like pneumonia, tuberculosis, and COVID-19 necessitates extensive microbiology testing for accurate diagnosis and treatment. Secondly, the ongoing global health crises, including pandemics and epidemics, have heightened the demand for respiratory pathogen testing, emphasizing its critical role in public health. Furthermore, the development of advanced testing methods and technologies for respiratory pathogens has driven growth in this segment, enabling rapid and precise detection of infectious agents, contributing to its significant market growth.

The gastrointestinal diseases segment held the largest revenue share of 25% in 2024. The prominence of the gastrointestinal diseases segment in the microbiology testing market can be attributed to various compelling reasons. Firstly, the prevalence of gastrointestinal infections and ailments globally ensures a consistent demand for diagnostic tests within this segment. Microbiology testing plays a pivotal role in identifying the diverse pathogens, including bacteria, viruses, and parasites, responsible for these diseases.

Furthermore, continuous innovations in testing methodologies, particularly in the realm of molecular diagnostics, have enhanced the precision and swiftness of detecting gastrointestinal pathogens. Additionally, the segment's significance is underscored by its critical contribution to upholding food safety standards, as numerous foodborne pathogens can induce gastrointestinal illnesses, necessitating rigorous microbiological testing across the food industry.

The respiratory diseases is anticipated to expand at the fastest rate over the projected period. The respiratory diseases segment holds a substantial growth in the microbiology testing market due to several key factors. Firstly, the prevalence of respiratory infections and diseases like pneumonia, tuberculosis, and COVID-19 necessitates extensive microbiology testing for accurate diagnosis and treatment. Secondly, the ongoing global health crises, including pandemics and epidemics, have heightened the demand for respiratory pathogen testing, emphasizing its critical role in public health. Furthermore, the development of advanced testing methods and technologies for respiratory pathogens has driven growth in this segment, enabling rapid and precise detection of infectious agents, and contributing to its significant market growth.

The hospitals segment held the largest revenue share of 34% in 2024. Hospitals hold a significant share in the microbiology testing market due to their central role in healthcare. They perform a wide range of microbiology tests for diagnosing infections, guiding patient treatment, and monitoring disease outbreaks. The demand for microbiology testing in hospitals is consistently high, driven by the need for rapid and accurate diagnostics.

Additionally, the prevalence of healthcare-associated infections necessitates rigorous testing for infection control. The COVID-19 pandemic further elevated the importance of hospitals in microbiology testing, with increased testing volumes. These factors collectively contribute to hospitals maintaining a major share of the market.

The academic and research institutes segment is anticipated to grow at a significantly faster rate, registering a CAGR of 9.9% over the predicted period. Academic and research institutes hold a significant share of the microbiology testing market due to their pivotal role in advancing microbiological knowledge and technology. These institutions drive innovation, developing cutting-edge testing methods and equipment. They also conduct essential research to improve diagnostics, treatment, and understanding of microorganisms. Furthermore, academic collaborations with industries and government agencies foster the development of new testing solutions. Their influence extends to training the future workforce in microbiology testing, ensuring a skilled talent pool. As a result, academic and research institutes play a central role in shaping the microbiology testing market and driving its growth.

By Product

By Test Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

July 2024

March 2025