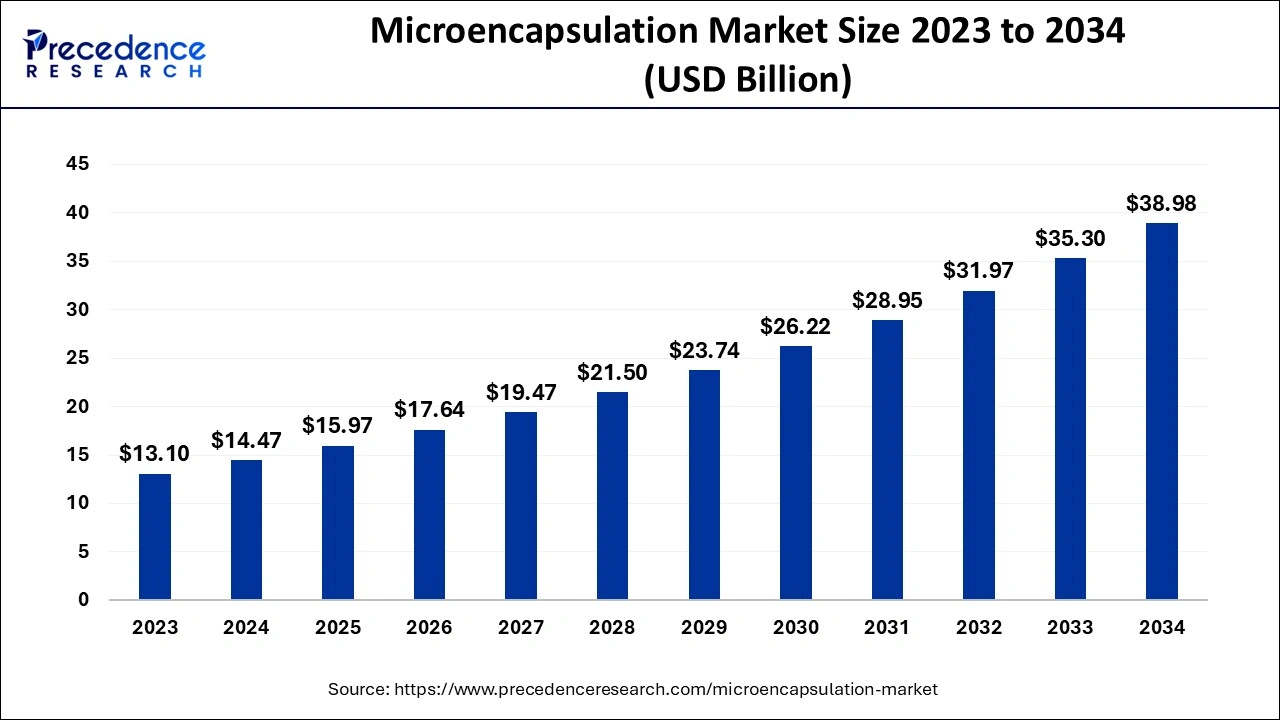

The global microencapsulation market size is calculated at USD 14.47 billion in 2024, grew to USD 15.97 billion in 2025 and is projected to reach around USD 38.98 billion by 2034. The market is expanding at a solid CAGR of 10.42% between 2024 and 2034. The North America microencapsulation market size is evaluated at USD 5.35 billion in 2024 and is expected to grow at a CAGR of 10.55% during the forecast year.

The global microencapsulation market size is worth around USD 14.47 billion in 2024 and is expected to hit around USD 38.98 billion by 2034, growing at a CAGR of 10.42% from 2024 to 2034. The increased attention around microencapsulation technology is the key factor driving the growth of the microencapsulation market. Also, benefits related to microencapsulation coupled with the technology's application offer can fuel market growth further.

Artificial intelligence impacts the microencapsulation market by streamlining manufacturing processes and enhancing the accuracy of the formulation. AI-powered analytics are used to optimize microencapsulation techniques, further reduce production costs, and improve product quality. Furthermore, AI in manufacturing lines facilitates greater efficiency and consistency enabling error-free large-scale production.

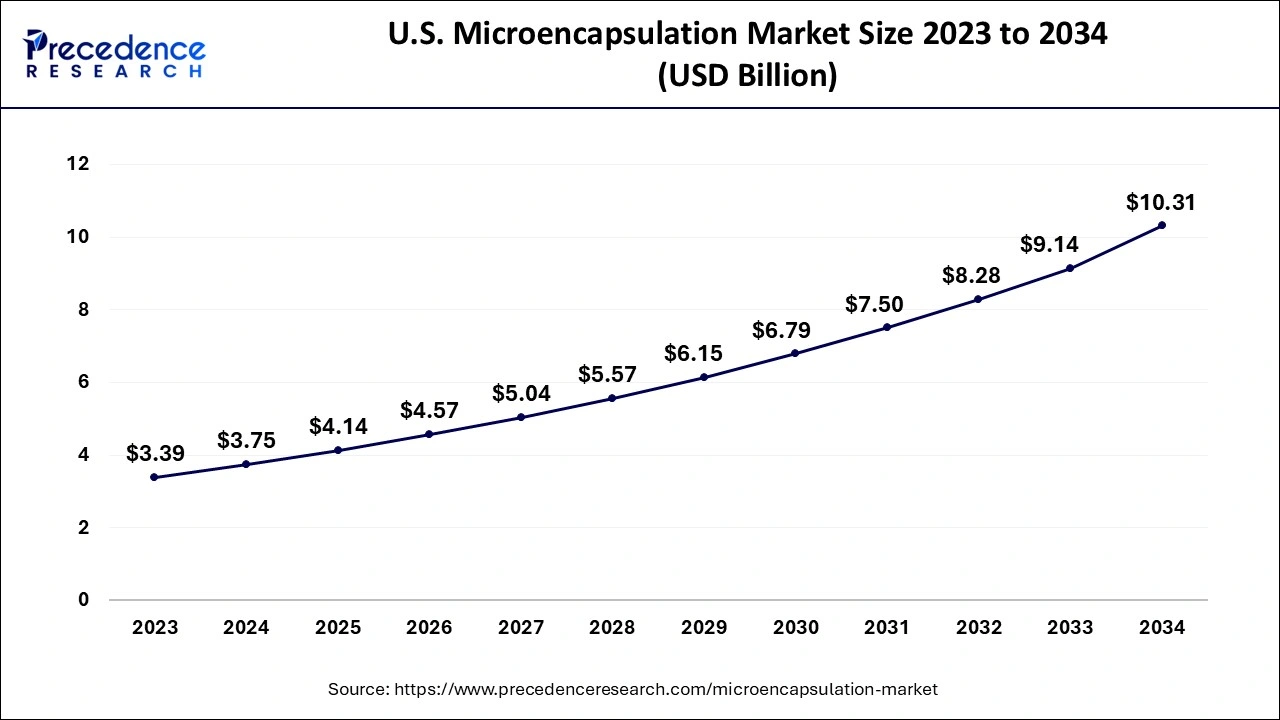

The U.S. microencapsulation market size is evaluated at USD 3.75 billion in 2024 and is projected to be worth around USD 10.31 billion by 2034, growing at a CAGR of 10.64% from 2024 to 2034.

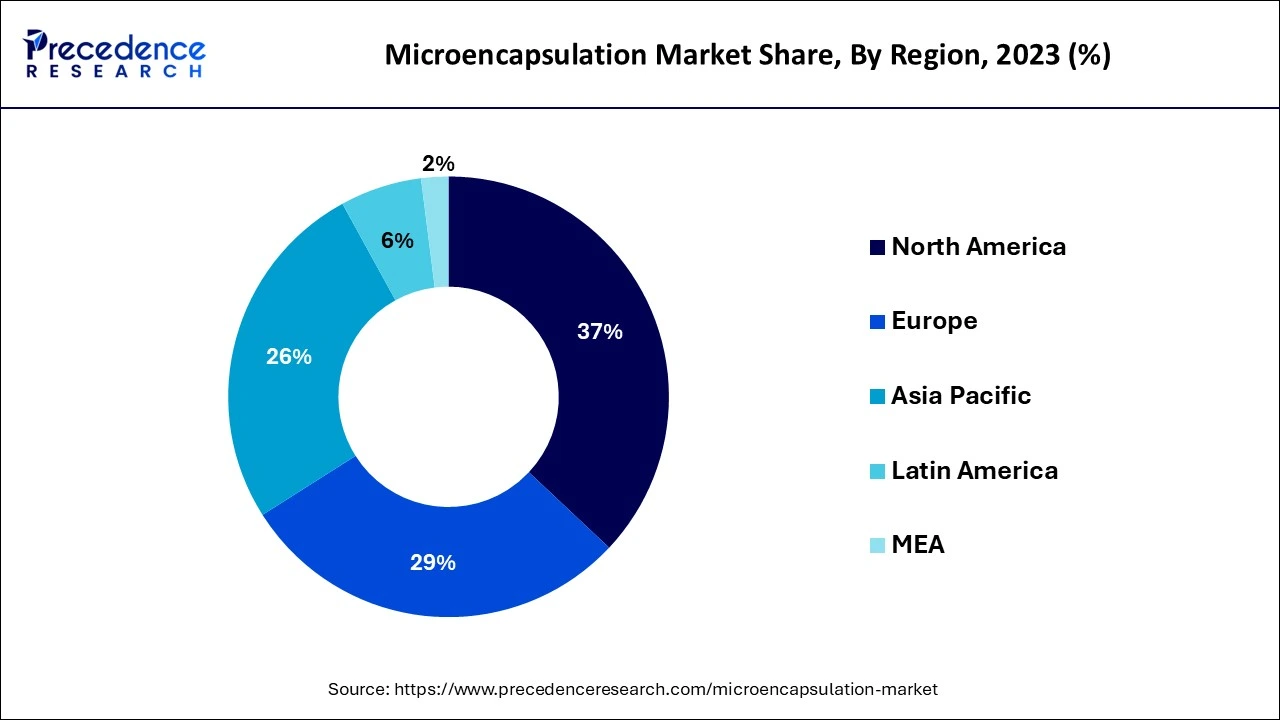

North America dominated the microencapsulation market in 2023. The region's dominance can be attributed to the rising use of microcapsules in the food and beverage industry for colorants, flavors, and fragrances. The region also boasts the presence of major market players such as Pfizer, Merck &Co., and Johnson & Johnson. Within the region, the U.S. leads the market owing to the availability of a highly skilled workforce and growing R&D initiatives in the area.

Asia Pacific is expected to show the fastest growth in the microencapsulation market during the projected period. The growth of the region can be credited to the Favourable initiatives offered by the government to support FDI in the pharmaceutical industry in India and China. Furthermore, the rising R&D expenditure to provide novel drug delivery systems in developed countries such as South Korea and Japan is anticipated to play a significant role in market expansion.

The microencapsulation market encompasses the production, sale, and development of microencapsulation technology. It is a process for coating API in a shell to enhance their stability and manage them properly. Microencapsulation enhances the overall shelf life and stability of the active ingredient by enabling the controlled release of the API. Microencapsulation is utilized in various industries, such as food, agrochemicals, pharmaceuticals, and cosmetics.

Top 5 pharma companies in India by market capitalization in 2022

| Company | Market Capitalization (USD million) |

| Sun Pharmaceutical Industries Ltd | 27,925 |

| Cipla Ltd | 11,039 |

| Dr. Reddy's Laboratories Ltd | 8,830 |

| Torrent Pharmaceuticals Ltd | 6,477 |

| Alkem Laboratories Ltd | 4,807 |

| Report Coverage | Details |

| Market Size by 2034 | USD 38.98 Billion |

| Market Size in 2024 | USD 14.47 Billion |

| Market Size in 2025 | USD 15.97 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Technology, Coating Material, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing demand for microencapsulation in the cosmetics industry

The cosmetics industry is experiencing an increasing demand for microencapsulation market applications, fuelled by growing requirements for product effectiveness and enhanced customer experiences. In addition, this technology allows innovation in product designs, like sustain-release fragrance products and color-changing cosmetics. The appeal to a wide range of consumers searching for highly efficient products with novelty.

High competition for raw materials

Many players in the microencapsulation market are implementing microencapsulation technology in their manufacturing process, which further leads to competition among them for R&D. Moreover, the high cost associated with R&D resources and the need for highly efficient processing technology is raising the overall price of the manufacturing process.

Increased demand for fortified food products

There is an increase in demand for fortified and functional pharmaceutical goods and food, which is making the microencapsulation market more popular. Microencapsulation also enables the incorporation of essential oils, minerals, and vitamins in food products to keep their valuable qualities. Furthermore, microencapsulation technologies offer many benefits to the pharma industry, which in turn increases its adoption in the pharmaceutical market.

The spray segment led the global microencapsulation market in 2023. The dominance of the segment can be driven by the suitability offered by this technology for large-scale industrial processes. The flexibility offered by this segment to create an extensive range of particle sizes is also a crucial factor driving their adoption. Additionally, it gives advantages such as encapsulation and drying efficiency, which makes it a primary choice in many industries.

The emulsion segment is anticipated to grow at the fastest rate in the microencapsulation market over the projected period. The growth of the segment can be linked to the rising penetration of this technique in the pharmaceutical and food industries. The emulsion is the solidification technique of microencapsulation. Also, emulsion technology can enhance the overall stability of products and manage the speed at which the nutrients or drugs are released.

The polymer segment dominated the microencapsulation market. The dominance of the segment is because of the premium quality of these materials. Polymer coating also has superior features, which gives resilience to the volatile environment. Polylactic-co-glycolic acid (PLGA) and Polylactic acid (PLA) have been the preferred coating materials due to their wide use in products like depot formulations and surgical sutures.

The carbohydrate segment is expected to show the fastest growth in the microencapsulation market over the projected period. The growth of the segment can be credited to the biodegradable nature of carbohydrates, which aligns with the growing consumer preference for sustainable and eco-friendly products. Furthermore, Carbohydrates like alginate, starch, and cellulose provide a non-toxic and safe option for the encapsulation of various active ingredients, which makes them suitable for applications in nutraceuticals, food, and pharmaceuticals.

The pharmaceutical & healthcare products segment dominated the microencapsulation market in 2023. The dominance of the segment can be attributed to the microencapsulation techniques and various benefits such as odor and taste masking, as well as the protection from the environment for pharmaceutical products. In addition, this technique also reduces the size of the particle to enhance the solubility of certain less soluble drugs.

The food & beverage segment is anticipated to grow at the fastest rate in the microencapsulation market over the forecast period. The growth of the segment can be credited to the increasing awareness regarding healthy ways of living and preventing illness and other disorders by consuming highly nutritious and functional food. Moreover, the microencapsulation technique can improve the texture, taste, and color of this food product.

By Application

By Technology

By Coating Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client