January 2025

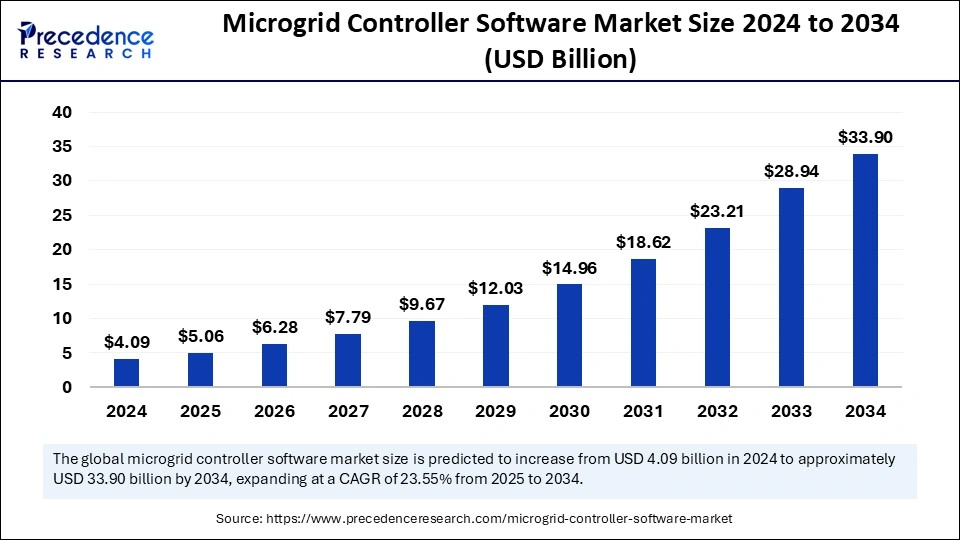

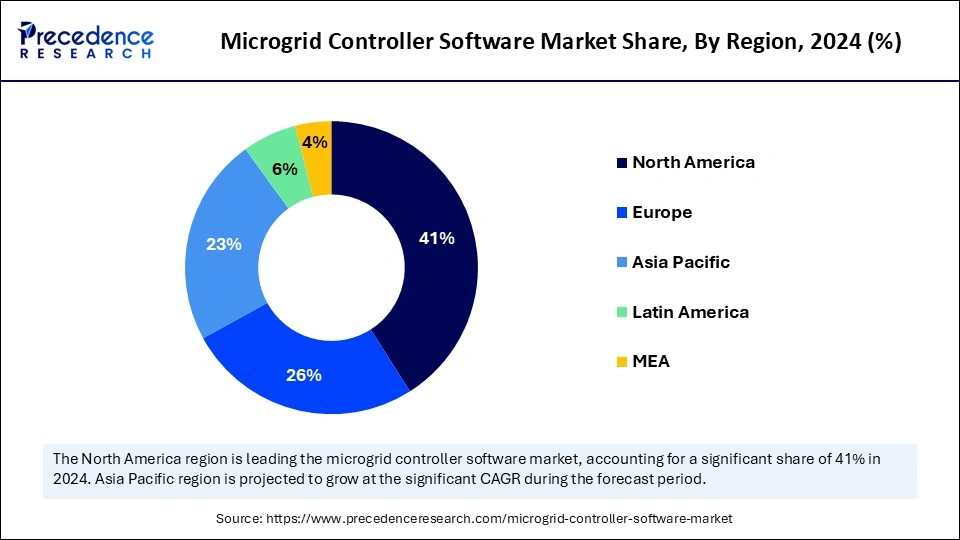

The global microgrid controller software market size is calculated at USD 5.06 billion in 2025 and is forecasted to reach around USD 33.90 billion by 2034, accelerating at a CAGR of 23.55% from 2025 to 2034. The North America market size surpassed USD 1.68 billion in 2024 and is expanding at a CAGR of 23.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microgrid controller software market size accounted for USD 4.09 billion in 2024 and is predicted to increase from USD 5.06 billion in 2025 to approximately USD 33.90 billion by 2034, expanding at a CAGR of 23.55% from 2025 to 2034. The increasing use of renewable energy, the need for effective energy management, and the emphasis on grid reliability are propelling the expansion of the microgrid controller software industry. Advanced technologies such as AI-driven controllers improve sustainability and optimize energy use even more.

Microgrid controller software that incorporates artificial intelligence (AI) is revolutionizing localized energy systems through enhanced energy management, the integration of distributed resources, and adaptive responses to real-time conditions. This technological development enhances the reliability and resilience of microgrids, aiding the shift to sustainable energy solutions. AI predicts energy needs and availability, improves both renewable and traditional energy sources, and strengthens system reliability by identifying issues and facilitating self-corrective measures. This guarantees that microgrid controller software functions dependably and economically by fulfilling contemporary energy grid requirements.

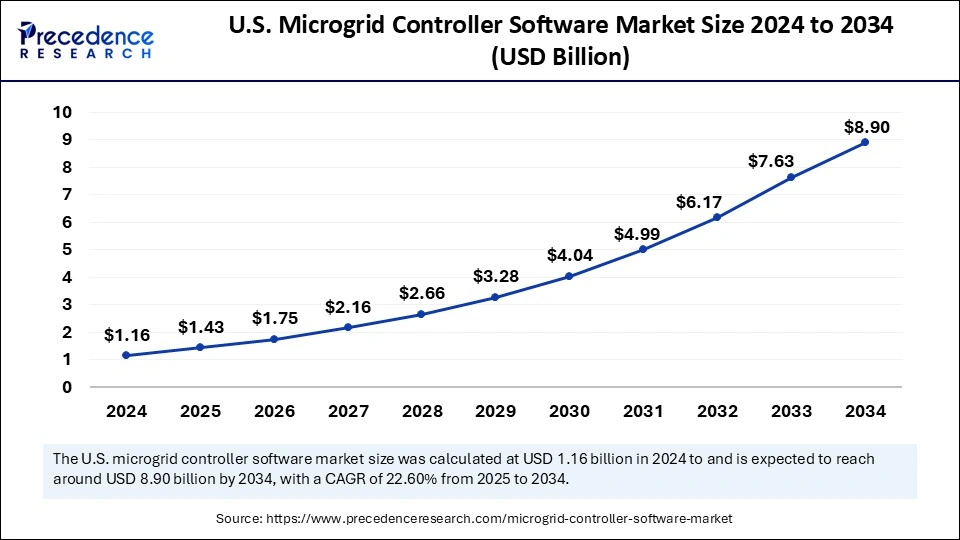

The U.S. microgrid controller software market size was exhibited at USD 1.16 billion in 2024 and is projected to be worth around USD 8.90 billion by 2034, growing at a CAGR of 22.60% from 2025 to 2034.

North America Pioneers Microgrid Innovation and Sustainability

North America dominated the microgrid controller software market in 2024. This is due to robust government Support, technological innovations, and strategic partnerships focused on enhancing energy resilience and sustainability. The emphasis of the region on integrating renewable energy and modernizing the grid has driven the uptake of microgrid technologies. Policies that encourage energy efficiency and carbon reduction, along with significant funding efforts, have fostered a favorable setting for the creation and implementation of microgrid controller solutions. Moreover, robust energy infrastructure and proficiency in adopting innovative technologies of North America further strengthen its top position in the market.

How the U.S. is Influencing the Future of Microgrid Solutions

The United States dominated the market due to government support, investments in renewable energy, and an emphasis on energy resiliency. The aging infrastructure and modernization efforts of the country have accelerated the deployment of microgrids, particularly in areas prone to extreme weather occurrences. Firms such as Schneider Electric have demonstrated market innovation, hence promoting industry growth.

Recent advancements, such as the EcoStruxure Microgrid Flex of Schneider Electric, highlight the significance of the United States in pushing innovative solutions and fostering the global use of microgrid technology.

Asia Pacific: Driving Expansion through Microgrid Innovation

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. This is because rapidly urbanizing, industrializing, and experiencing higher energy demand, resulting in an increase in demand for microgrid controller software. Countries such as India and China are undergoing an economic boom, necessitating novel solutions such as microgrids for reliable power supply.

The varied geographical landscape of the region, which includes isolated and rural areas, demands decentralized energy solutions that operate independently of typical grid infrastructures. Microgrids are being used for rural electrification, renewable energy integration, and technical breakthroughs. Renewable energy technology costs are falling, making solar and wind power more accessible, and developments in modular designs, IoT, and Direct Current architectures are driving efficiency and lowering costs even further.

Empowering India: Microgrids Closing the Energy Gaps

The microgrid controller software market in India is expanding, driven by the demand for energy access in rural regions, bold renewable energy goals, and government programs. With more than 70 million individuals in isolated regions without dependable electricity, India is utilizing microgrid technologies to close the energy deficit. The National Smart Grid Mission and Saubhagya Scheme by the government encourage the implementation of microgrids and the enhancement of grid systems. In April 2024, Tata Power launched a 5 MW microgrid initiative in Uttar Pradesh, showcasing the dedication of India to energy accessibility and sustainability.

Microgrid of Australia Revolutionizes Renewable Energy

The microgrid controller software market in Australia is expanding because of its emphasis on energy resilience and the integration of renewable energy. The significant use of renewable energy sources in the nation, especially solar energy, propels the implementation of sophisticated microgrid controller software to effectively handle variable energy supplies. Initiatives of the Australian government focus on lowering carbon emissions and improving energy independence, fostering a positive atmosphere for the advancement of microgrids.

Europe: A Key Region for Microgrid Innovation and Growth

Europe in the microgrid controller software market is observed to grow at a considerable rate in the upcoming period because of its strong regulatory support and dedication to integrating renewable energy. The EU has made large investments in modernizing its energy infrastructure, including microgrids, because of its aggressive climate targets. Energy distribution management relies heavily on microgrid controller software, and European nations are pioneers in putting financial schemes and regulatory frameworks in place to hasten the advancement of microgrid technology.

Microgrids are compact energy systems that can function autonomously or alongside the primary electrical grid. Microgrid controllers serve as central management systems that oversee the generation, distribution, and consumption of electricity within a specific local area. The software part of microgrid controllers oversees real-time observation, administration, and enhancement of energy supply and demand.

The microgrid controller software market is a rapidly growing segment in energy management crucial for overseeing localized energy frameworks and enhancing distributed energy assets such as solar panels, wind turbines, and energy storage solutions. This software guarantees effective energy distribution, load balancing, and real-time monitoring, along with preserving system stability, enhancing energy reliability, and fostering grid resilience.

| Report Coverage | Details |

| Market Size by 2034 | USD 33.90 Billion |

| Market Size in 2025 | USD 5.06 Billion |

| Market Size in 2024 | USD 4.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 23.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Connectivity, Offering, End-use, Deployment Mode and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for renewable energy integration

Growing demand for renewable energy integration, fueled by concerns about grid resilience and stability as well as the global shift towards sustainability, is the primary driver of the microgrid controller software market. As towns and organizations integrate renewable energy sources like wind and solar, advanced software is required to optimize and manage these variable energy sources in addition to conventional power-producing techniques. The requirement for sophisticated control systems adds to this demand.

High acquisition and installation cost

The high acquisition and installation costs of establishing microgrid controller software are the main barriers to the microgrid controller software market. For many prospective clients, especially those in underdeveloped countries, these large upfront expenditures, which include hardware, software, and installation costs, can be unaffordable. This underscored the possibility of financial obstacles in implementing microgrid technologies, especially in areas with constrained financial means.

Electrification of isolated and rural areas

Electrifying isolated and rural areas is a significant future prospect in the microgrid controller software market. By offering a practical way to supply dependable energy to areas not linked to the main grid, microgrid controllers enhance energy access and dependability in underserved areas. This is a particularly important opportunity as governments and organizations work to improve sustainability and energy availability.

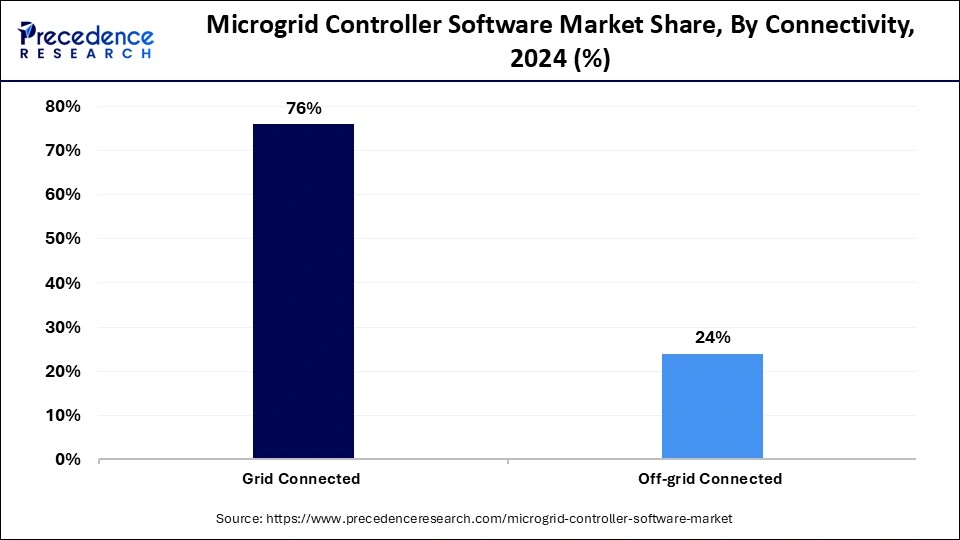

The grid-connected segment held a dominant presence in the market in 2024 due to its capacity to incorporate renewable energy sources, enhance power quality, and increase system resilience. By facilitating bidirectional energy exchange between microgrids and the main electrical grid, these solutions optimize energy utilization and lower carbon emissions. Especially in North America, where investments in distributed energy resources and renewable technologies are essential, they are being used more and more in residential neighborhoods and military installations. With the help of solar photovoltaic technology, grid-connected microgrids provide dependable power generation and are expanding quickly because of dispersed energy plants and falling storage prices.

The off-grid connected segment is projected to expand rapidly in the microgrid controller software market in the coming years, driven by the increasing need for energy autonomy and dependability in remote and underprivileged regions. These systems function autonomously from the primary power grid, supplying electricity to areas where conventional grid access is restricted or unstable. Advancements in renewable energy technologies, like solar and wind, along with falling energy storage costs, are fueling this expansion.

The increasing occurrence of climate-induced disasters has intensified the demand for decentralized energy systems capable of operating during outages, further promoting the implementation of off-grid connected microgrids. These microgrids improve energy reliability, rendering them an essential solution for areas susceptible to disasters or those that are remote.

Microgrid Controller Software Market Revenue, By Connectivity, 2022-2024 (USD Million)

| Connectivity | 2022 | 2023 | 2024 |

| Grid Connected | 2,008.3 | 2,488.2 | 3,085.3 |

| Off-grid Connected | 659.5 | 811.8 | 1,000.1 |

The energy management systems (EMS) segment led the microgrid controller software market in 2024, owing to its function in improving energy use, boosting operational efficiency, and incorporating renewable energy sources. EMS solutions offer tools for tracking, managing, and accessing energy flows within microgrids, ensuring effective energy generation from distributed energy resources. As companies emphasize sustainability and energy efficiency, the need for EMS solutions has increased significantly. These systems enable immediate decision-making, lower operational expenses, and enhance grid dependability, rendering them essential for contemporary microgrid functions.

The advanced distribution management systems (ADMS) segment is projected to grow with the fastest CAGR in the market because it enhances operational efficiency, integrates distributed energy resources (DERs), and boosts grid reliability. ADMS provides real-time monitoring, regulation, and improvement of distribution systems for distributed energy resources such as solar panels and wind turbines. The worldwide transition to smart grid technologies elevates the significance of ADMS since it improves grid stability, boosts operational efficiency, and minimizes power outages during severe weather conditions. Investments in grid and efficiency sustain segment expansion.

Microgrid Controller Software Market Revenue, By Offering, 2022-2024 (USD Million)

| Offering | 2022 | 2023 | 2024 |

| EMS | 1,222.6 | 1,508.1 | 1,871.1 |

| ADMS | 670.7 | 834.9 | 1,040.1 |

| SCADA | 514.3 | 633.6 | 781.9 |

| Others | 260.1 | 323.4 | 392.2 |

The commercial and industrial segments dominated the microgrid controller software market in 2024, owing to the demand for energy efficiency, cost savings, and robustness. Companies are implementing microgrid solutions to control energy expenses, guarantee a steady power supply, and decrease their carbon emissions. The combination of renewable energy resources and the enhancement of energy usage are essential elements for commercial and industrial businesses. This increasing emphasis on sustainability and energy autonomy is leading to considerable investments in microgrid technologies. Microgrids provide immediate energy optimization, integration of renewable sources, enhanced cost control, and support corporate sustainability objectives.

The residential segment is anticipated to grow at the fastest rate in the market during the forecast period, propelled by rising needs for energy autonomy, sustainability, and cost-effectiveness. As energy prices increase and concerns about grid stability grow, an increasing number of homeowners are looking for ways to produce their own electricity, especially using renewable options such as solar panels. Innovations in energy storage and smart home technologies enhance the accessibility and attractiveness of microgrid controller software for residential users.

Microgrid Controller Software Market Revenue, By End-Use, 2022-2024 (USD Million)

| End Use | 2022 | 2023 | 2024 |

| Utility Providers | 873.4 | 1,075.8 | 1,326.1 |

| Commercial and Industrial | 990.0 | 1,227.6 | 1,523.4 |

| Residential | 192.6 | 240.9 | 301.5 |

| Government and Military | 309.7 | 386.1 | 481.7 |

| Educational Institutions | 180.3 | 221.1 | 271.3 |

| Others | 121.6 | 148.5 | 181.4 |

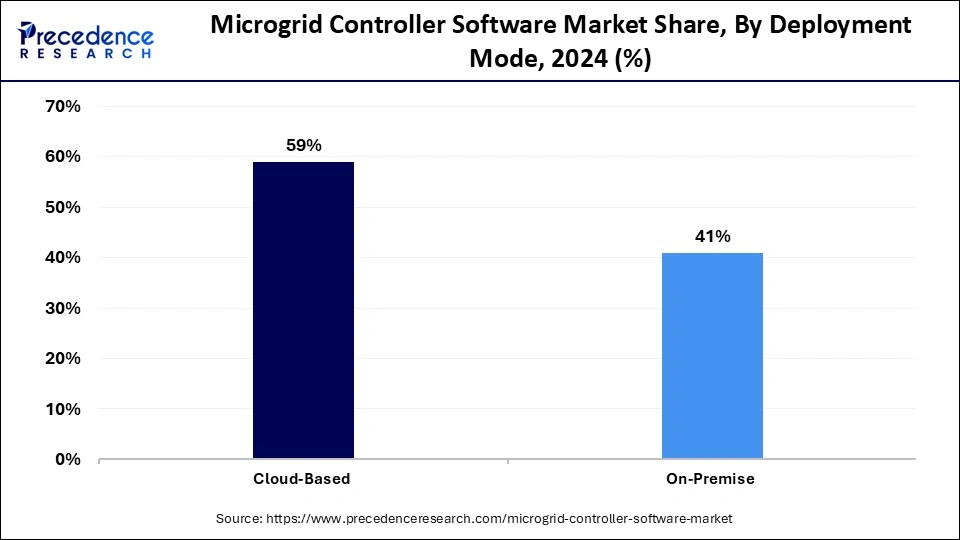

The cloud-based segment held a dominant presence in the market in 2024, providing scalability, adaptability, and affordability. This application allows for real-time oversight and management of distributed energy assets from anywhere, streamlining data integration and promoting advanced analysis. Cloud-based platforms frequently utilize machine learning and artificial intelligence for predictive analysis and automated decision processes. As companies look for effective energy options, the need for cloud-based microgrid controller software keeps increasing.

The on-premise segment is projected to expand rapidly in the market in the coming years, propelled by the need for improved control, security, and personalization. Organizations, particularly in industries such as healthcare, defense, and manufacturing, prefer on-premise solutions to retain control over sensitive data and guarantee adherence to regulations. These implementations enhance integration with current systems, develop customized setups, and provide low latency for effective energy management. The expansion is driven by the demand for immediate oversight and continuous power availability in essential functions.

Microgrid Controller Software Market Revenue, By End-Use, 2022-2024 (USD Million)

| Deployment Mode | 2022 | 2023 | 2024 |

| Cloud-based | 1,556.1 | 1,937.1 | 2,405.1 |

| On-premise | 1,111.6 | 1,362.9 | 1,680.3 |

By Connectivity

By Offering

By End-use

By Deployment Mode

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025