March 2025

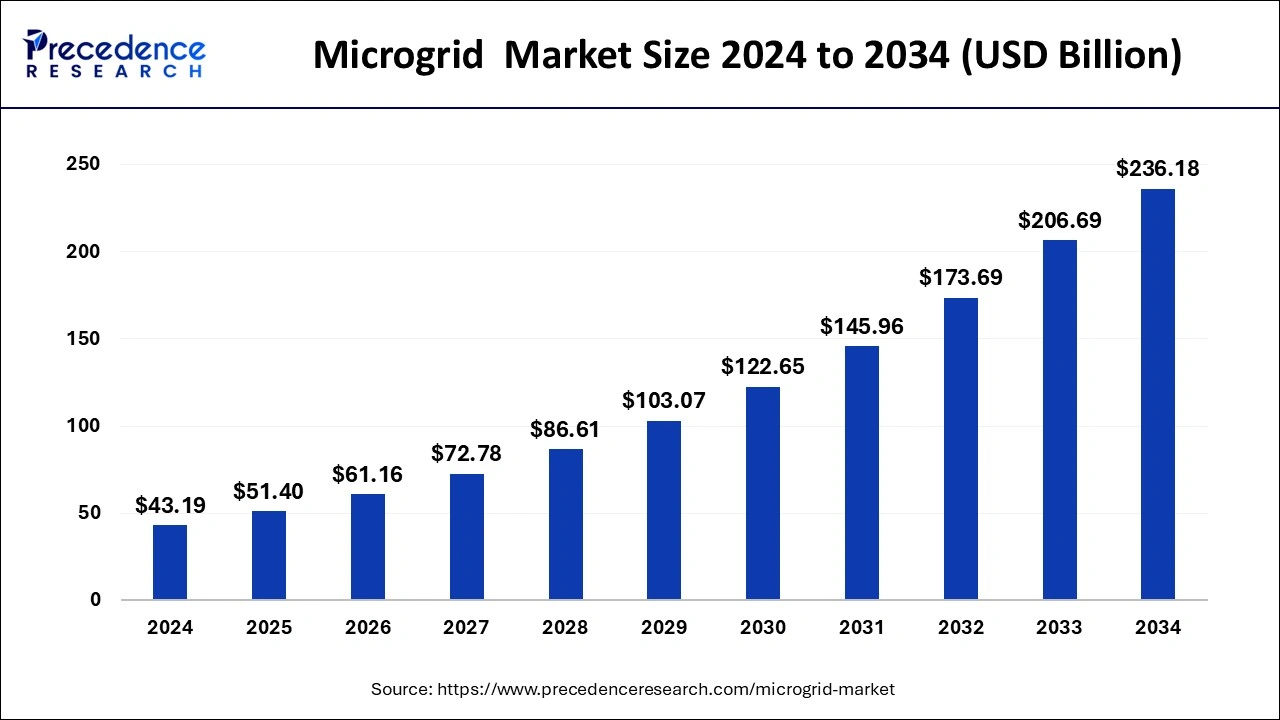

The global microgrid market size is accounted at USD 51.40 billion in 2025 and is forecasted to hit around USD 236.18 billion by 2034, representing a CAGR of 18.52% from 2025 to 2034. The North America market size was estimated at USD 17.71 billion in 2024 and is expanding at a CAGR of 18.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microgrid market size was calculated at USD 43.19 billion in 2024 and is predicted to reach around USD 236.18 billion by 2034, expanding at a CAGR of 18.52% from 2025 to 2034.

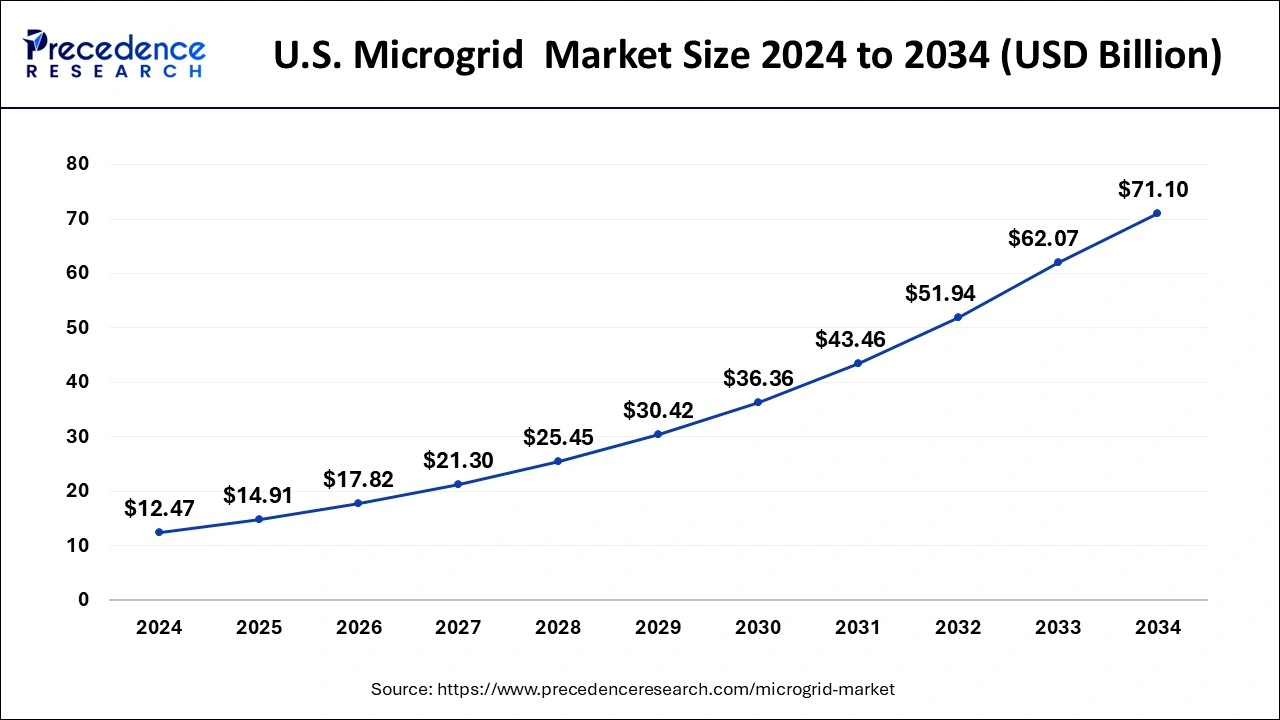

The U.S. microgrid market size was evaluated at USD 12.47 billion in 2024 and is projected to be worth around USD 71.10 billion by 2034, growing at a CAGR of 19.01% from 2025 to 2034.

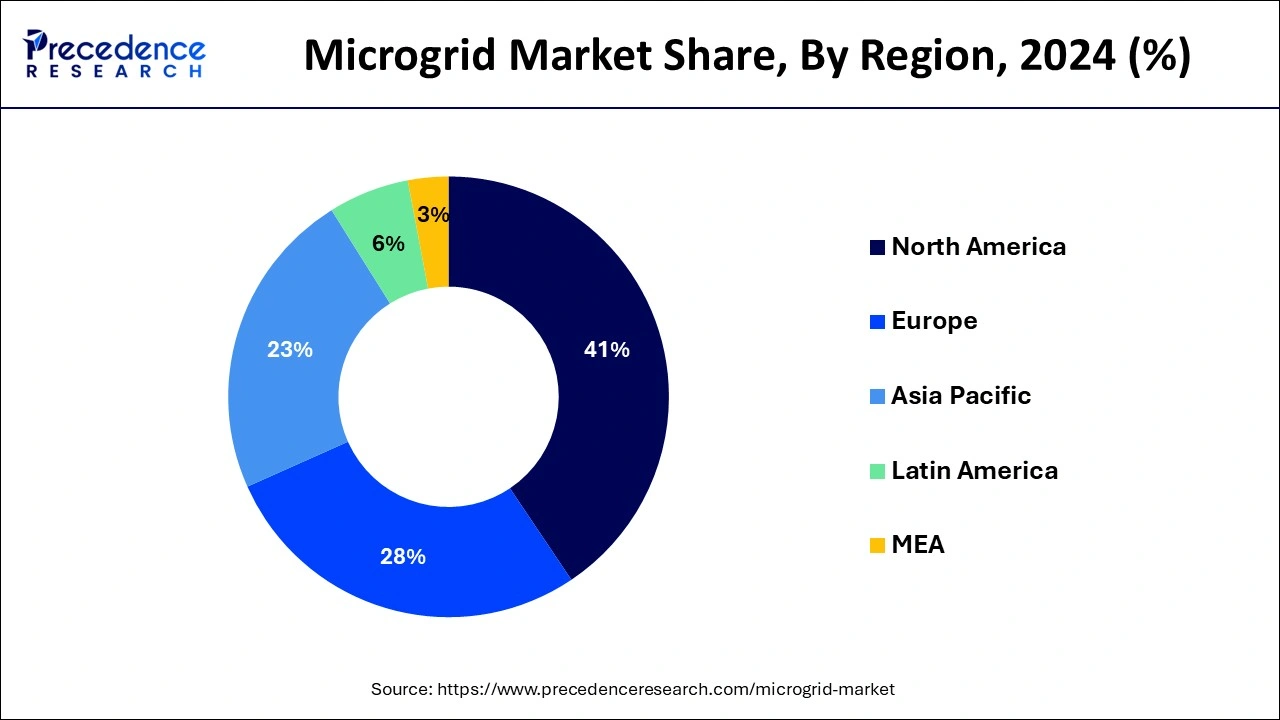

On the basis of geography, North America is expected to continue to be among the most alluring markets, and this region accounted for the majority of revenue share in the market throughout the projection period. The area has gained popularity in the market because of the presence of multiple microgrid companies and government programs, such as the Smart Power Infrastructure Demonstration for Energy Reliability and Security (SPIDERS) program, to encourage the implementation of microgrids. In terms of microgrid development and capacity, North America dominated the microgrid industry in 2024. Numerous fossil-fueled commercial and industrial (C&I) microgrids are being built in North America as resiliency options. Moreover, the dependency of end users on utility systems to provide their energy demands has risen due to the rise in global population and increase in power consumption. By 2040, worldwide energy consumption is predicted to rise by over 56%, according to the U.S. Energy Information Administration (EIA). In addition, the demand for electricity is growing quickly and cannot be fully fulfilled by the main networks because of increased industrialization and urbanization. Hence, this region has a prominent scope in the forecast period.

The Asia Pacific is anticipated to be one of the most appealing regions, accounting for the significance of the market's revenue share throughout the course of the projection year. This is mostly caused by the area's low electrification rate, poor grid connectivity, and high demand for electricity. It is predicted that the Asia Pacific market would grow significantly during the forecast period, largely as a result of the region's quick industrialization and urbanization, particularly in China and India. Additionally, governments in Asia-Pacific nations intend to support distributed energy generation and microgrids in order to provide electricity to their citizens.

A microgrid is an energy system that runs concurrently with or independently from the main power grid and has linked loads and dispersed energy resources. To transfer power from producers to consumers, it mostly comprises fuel cells, battery storage systems, wind turbine generators and microturbines, and solar generators. It enhances the efficiency and stability of the electric grid, lowers peak loads, fuel consumption, and congestion, and boosts dependability and resilience. Microgrids may be coupled with a variety of renewable energy sources, including solar, small hydro, wind, waste-to-energy, geothermal, and combined heat and power systems since they are more efficient than conventional electrical networks. The global consumption of energy is rising as a result of increased construction activity in the residential and commercial sectors. This is one of the main drivers of market growth, coupled with rising public and private agency spending on infrastructure development projects. Furthermore, key businesses in the sector are benefiting financially from the growing emphasis on rural electrification.

In terms of local and national economic gain and improved efficiency, microgrids provide a number of advantages with the worldwide trend toward renewable energy sources to address climate change. A paradigm shift toward the usage of reliable, safe power production units and the ongoing advancement of cutting-edge technologies to provide resilient energy against grid instability are anticipated to complement the market picture.

| Report Coverage | Details |

| Market Size in 2025 | USD 51.40 Billion |

| Market Size in 2024 | USD 43.19 Billion |

| Market Size by 2034 | USD 236.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.52% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Microgrid usage for rural electricity is increasing rapidly

Technological developments in renewable energy

Government mandates to reduce carbon footprint

On the basis of connectivity, the grid-connected connectivity segment is expected to have the largest market share in the coming year period. Grid-connected microgrids are made up of several generators, distribution networks, and sophisticated controllers. These technologies offer several benefits, which enhance demand, in addition to increasing grid resiliency, improving power quality, and lowering their environmental effect.

Global utility-based grid network development and the extensive use of renewable energy sources, such as offshore wind, are two major factors influencing the segment's growth.

On the basis of type, the hybrid segment has accounted largest market share in the coming years period. This rise is related to the rising end-user demand for reliable power supply as well as the ongoing rollout of efficient & optimized energy storage technologies. Product penetration will result from a paradigm shift toward the use of low emission and minimal fuel consumption solutions to give better power quality and greater resilience. Additionally, continued technology developments for efficient remote energy management will have a favorable effect on the dynamics of the sector.

By Connectivity

By Type

By Offering

By Power Source

By Storage Device

By Power Rating

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025