January 2025

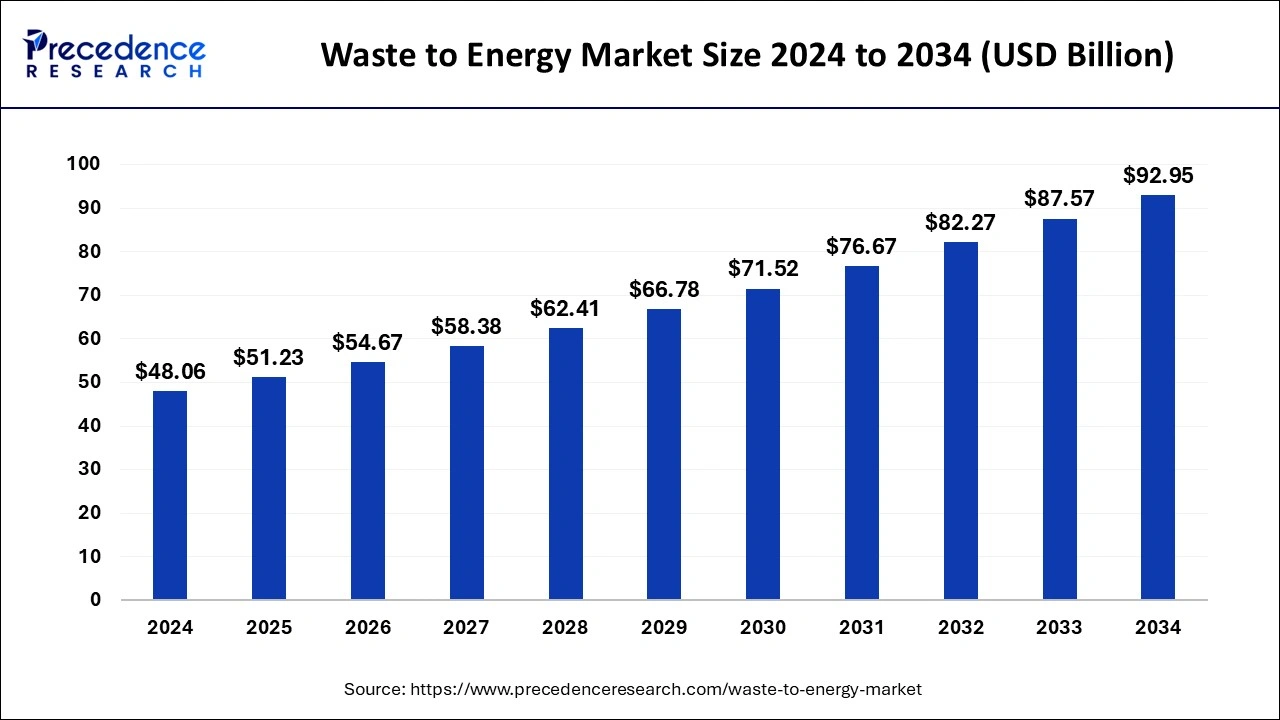

The global waste to energy market size is estimated at USD 51.23 billion in 2025 and is predicted to reach around USD 92.95 billion by 2034, accelerating at a CAGR of 6.81% from 2025 to 2034. The Europe waste to energy market size surpassed USD 21.52 billion in 2025 and is expanding at a CAGR of 6.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global waste to energy market size was estimated for USD 48.06 billion in 2024 and is anticipated to reach around USD 92.95 billion by 2034, growing at a CAGR of 6.81% from 2025 to 2034. Growing awareness about the benefits of waste-to-energy technologies in energy recovery, rising concerns about environmental sustainability, and a strong focus on landfill gas recovery and the conversion of non-recyclable waste into usable forms of energy boost the growth of the market during the forecast period.

The emergence of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is revolutionizing the market. These technologies help to streamline the processes of waste-to-energy conversion. AI can identify and sort several waste materials by achieving precision and ensuring optimal resource utilization. Integrating cameras and multiple sensors equipped with AI algorithms in waste processing facilities aids in analyzing and processing real-time data about waste materials.

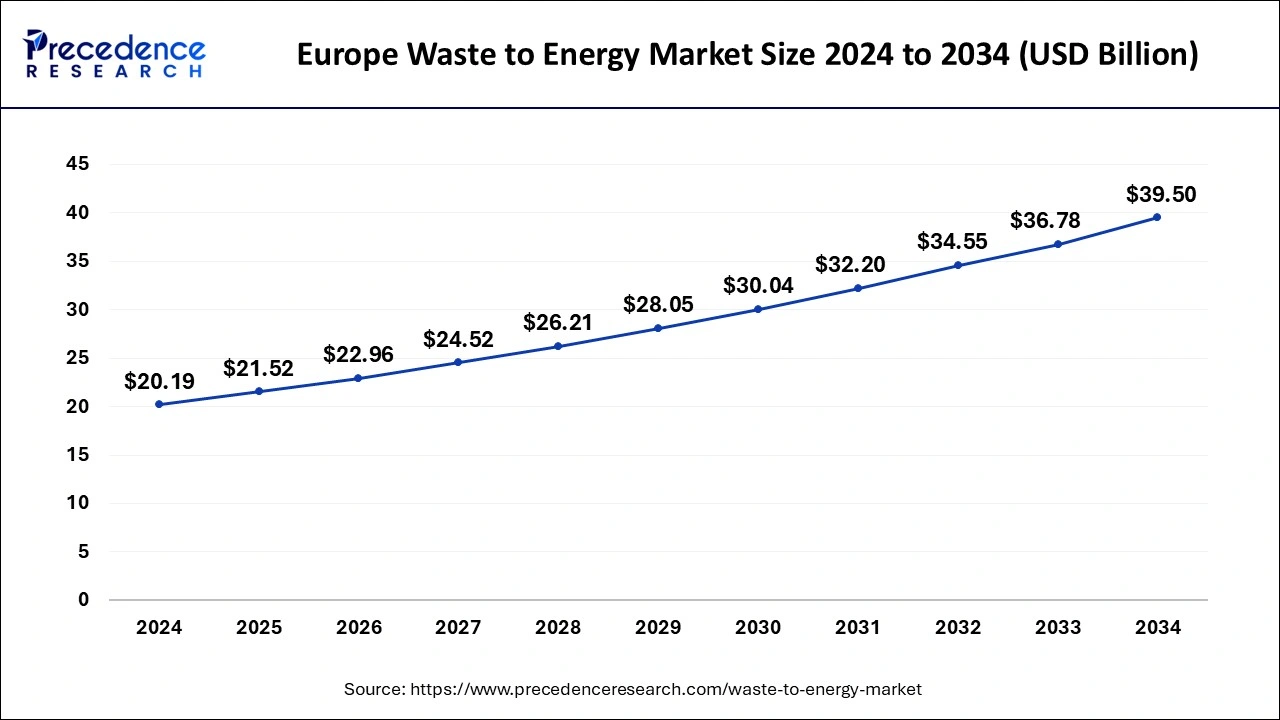

The Europe waste to energy market size was estimated at USD 20.19 billion in 2024 and is anticipated to be surpass around USD 39.50 billion by 2034, rising at a CAGR of 6.94% from 2025 to 2034.

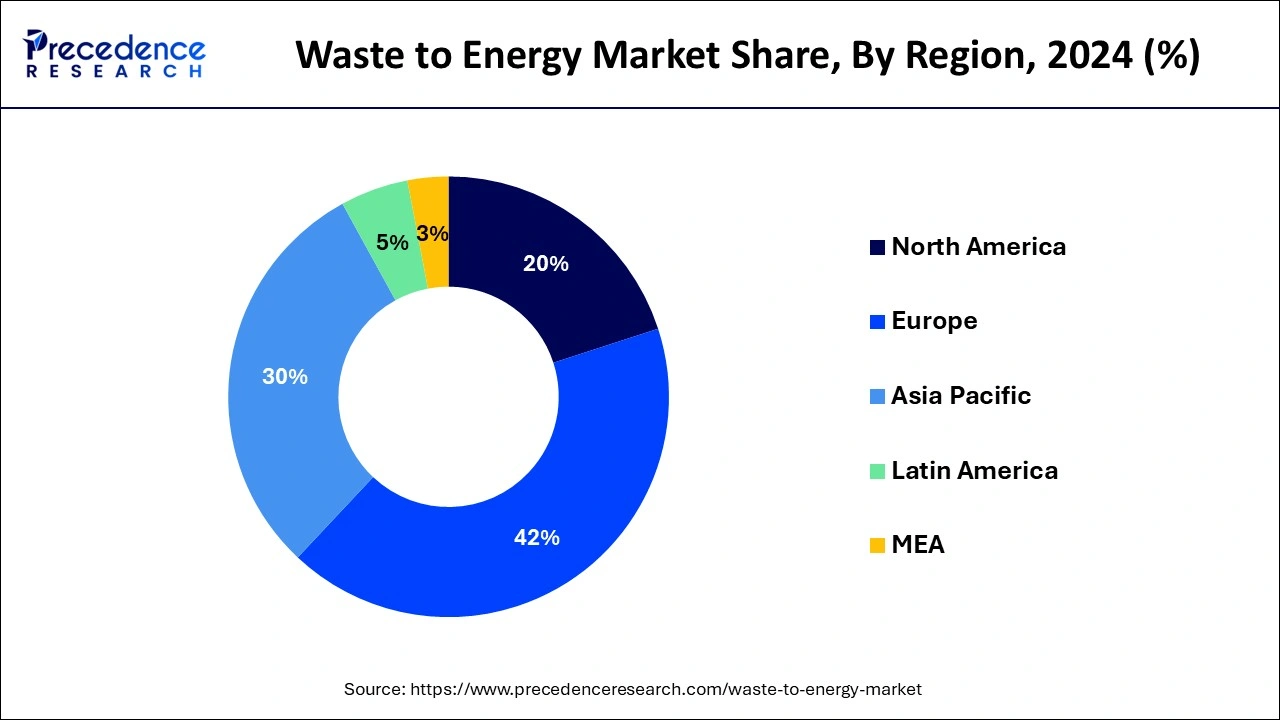

Europe led the global waste to energy market with the largest market share of 42% in 2024. The growth is majorly attributed to the presence of several top market players such as Veolia, EQT AB, Suez, and Ramboli Group A/S. The strict government regulations pertaining to the carbon emissions, environment protection, and waste disposal has played a prominent role in the growth of the Europe waste to energy market. Moreover, the implementation of strict carbon tax, landfill taxes, and direct subsidies and incentives to the waste to energy plants have bolstered the growth of the waste to energy market in Europe.

North America held the second largest position in the global waste to energy market in 2024. The rapidly surging awareness regarding the climate change and environment protection has supported market growth in North America. The growing government initiatives to integrate and enhance the utilization of clean energy generation sources are anticipated to drive the growth of the market. As per the data of Energy Information Administration, about 29.5 million tons of municipal solid waste was utilized in around 68 U.S. waste to energy plants that generated approximately 14 billion kWh of electricity, in 2018. Further, the higher demand for the eco-friendly and advanced technologies in North America has contributed exponentially towards the growth of the market in the past few years.

Asia Pacific is estimated to observe the fastest expansion during the forecast period. The rapid industrialization and rapid urbanization has resulted in the generation of huge volume of domestic and industrial wastes. Moreover, the increasing number of households and industrial units in the region is boosting the demand for energy across Asia Pacific region. The rising air pollution level due to greenhouse gases and carbon emission has forced the government to adopt environment protection measures and to dispose the large volume of wastes, the government is focusing on the deployment of waste to energy plants. The government spending for the municipal solid waste management program along with the surging popularity of the waste to energy plants in several economies such as India, Thailand, Singapore, and Indonesia is expected to boost the growth of the waste to energy market in the Asia Pacific region. Therefore, the government is expected to focus more on the deployment of the advanced waste to energy plants with the rising industrialization and urbanization of the rural areas in the developing economies of Asia Pacific region.

Waste-to-energy refers to a combination of several technologies that help convert non-recyclable waste into usable forms of energy like heat, fuels, and electricity. These waste treatment processes or technologies include incineration, gasification, pyrolysis, and anaerobic digestion. The U.S. Energy Information Administration highlighted that waste-to-energy plants help to burn municipal solid waste and produce steam in a boiler, which is then used to power an electric generator turbine. The mass-burn system is the most common waste-to-energy system in the U.S., which allows the burning of unprocessed municipal solid waste in a large incinerator in a generator and a boiler to produce electricity.

| Report Coverage | Details |

| Market Size in 2025 | USD 51.23 Billion |

| Market Size by 2034 | USD 92.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.81% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Form, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising production of biofuel

The global demand for biofuels for multiple purposes is rapidly growing. According to the International Energy Agency, in 2024, biofuels represented approximately 3.5% of global transport energy demand, especially for road transport. This demand is expected to grow in the upcoming years, which is the major element to drive the growth of the market.

Biofuel is formed by transforming biomass and wastes into productive energy. Waste-to-energy facilities can utilize organic waste materials, such as agricultural residues and food waste, as feedstock to produce biofuels like biogas or bioethanol. The availability of such feedstock increases with the demand for biofuels, making waste-to-energy a viable and sustainable option. Biofuels can serve as an alternative and renewable source of energy, reducing dependency on fossil fuels. Waste-to-energy technologies can play a role in supplying the energy needed for biofuel production, enhancing energy security. Combining waste-to-energy with biofuel production contributes to a circular economy by utilizing organic waste streams that would otherwise end up in landfills. This reduces waste and greenhouse gas emissions, aligning with sustainability goals. Thus, the rising production of biofuel is expected to boost the growth of waste to energy market.

Regulatory hurdles

The approval of products made from urban, agriculture or animal waste is generally a time-consuming process. Moreover, multiple environment-related regulations make the approval process even more complicated. This factor can limit the entry of manufacturers or even researchers to invest in the waste to energy market. In addition, multiple legal and administrative hurdles are introduced to the waste to energy market that create a major obstacle for the market to grow. Considering the emergence of waste to energy solutions, regulatory bodies are prone to fluctuate guidelines associated with production or manufacturing. This can lead to skepticism for manufacturers and investors. Thus, regulatory hurdles are observed to create a restraint for the market.

Government support

According to the Ministry of New and Renewable Energy (India), the ministry has launched multiple initiatives under the National Bioenergy Program. The program by Indian ministry supports setting up plants for biogas/power from CNG production from urban and agriculture waste. The ministry has also offered substantial financial assistance for the program.

Rising support from governments across the globe offers a significant opportunity for the waste to energy market to grow. Governments often incentivize the production of biofuels and the reduction of organic waste through policies and subsidies. This support can stimulate the growth of both the biofuel and waste-to-energy sectors. Many governments set renewable energy targets to reduce greenhouse gas emissions. Waste-to-energy can contribute to these targets by converting waste into clean energy, and government support can help meet these goals. Governments establish regulatory frameworks that govern waste management and energy production. Clear and favorable regulations can streamline the permitting process and provide certainty to investors, making it easier to attract private investment in waste-to-energy projects. Thus, such initiatives and even financial support from government are observed to offer opportunity for the market.

High expenses for waste management

The process of achieving waste to energy requires a strong and precise waste management system. Waste incineration or waste management can be a major challenge for manufacturers. Plants or firms associated with waste to the energy industry require regular maintenance of the plant. The overall disposal cost can fluctuate according to government regulations. Moreover, a serious shortfall of infrastructure area can also create a significant challenge for the market’s expansion by limiting growth.

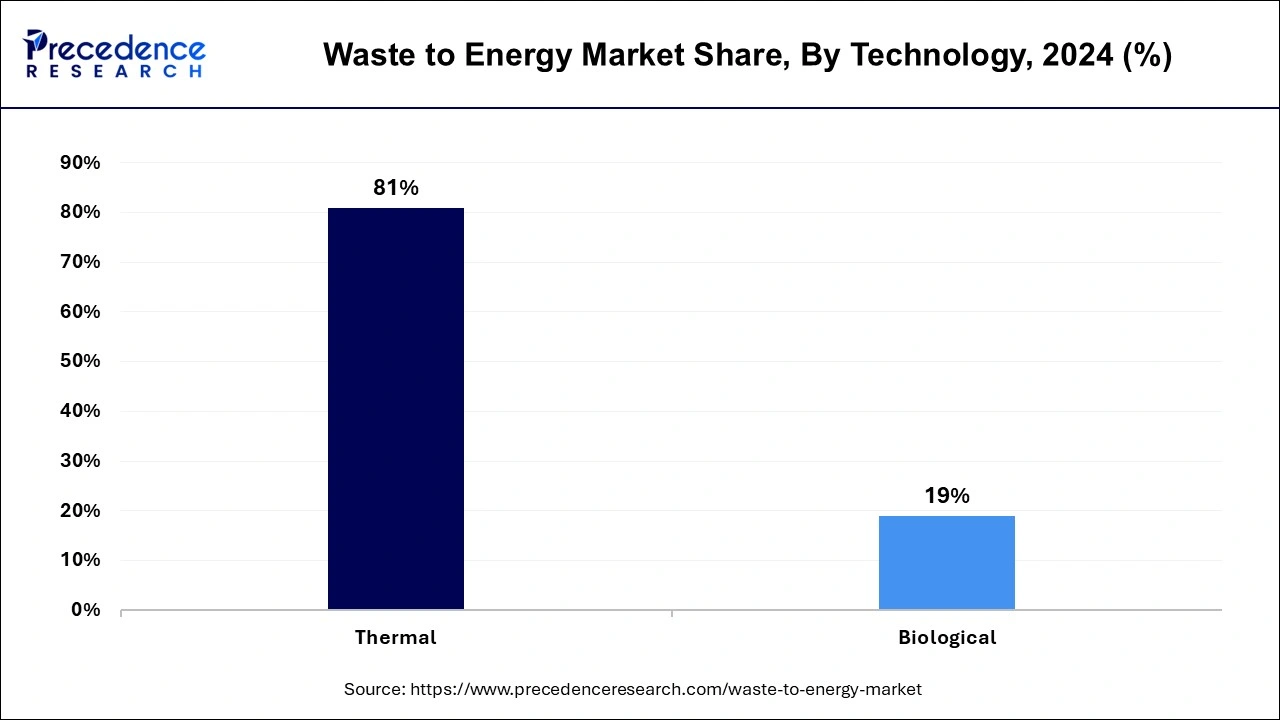

The thermal segment contributed the highest market share of 81% in 2024. The incineration thermal technology was the major revenue contributor in 2024. The ease of operations and simple process of energy generation has led to the significant growth of this segment. The thermal treatment of wastes to generate electricity is considered to be the most eco-friendly technique and is highly adopted in the urban cities. The incineration thermal technology offers various benefits such as limited greenhouse gas emissions, reduction of wastes in terms of volume, and energy preservation that has fostered the demand for the thermal technology. This technology can reduce wastes by 10% of its volume.

The biological segment is expected to expand at the fastest CAGR over the projected period. This growth can be attributed to the rising technological advancements in the anaerobic decomposition technology. The rising government investments in the research and development of anaerobic decomposition technology to enhance the economic viability are driving the growth of this segment. The rising demand for the clean vehicle fuels like biogas and rising environmental concerns are expected to boost its demand during the forecast period.

By Technology

By Form

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

January 2025

January 2025