List of Contents

Micronutrients Fertilizers Market Size and Forecast 2025 to 2034

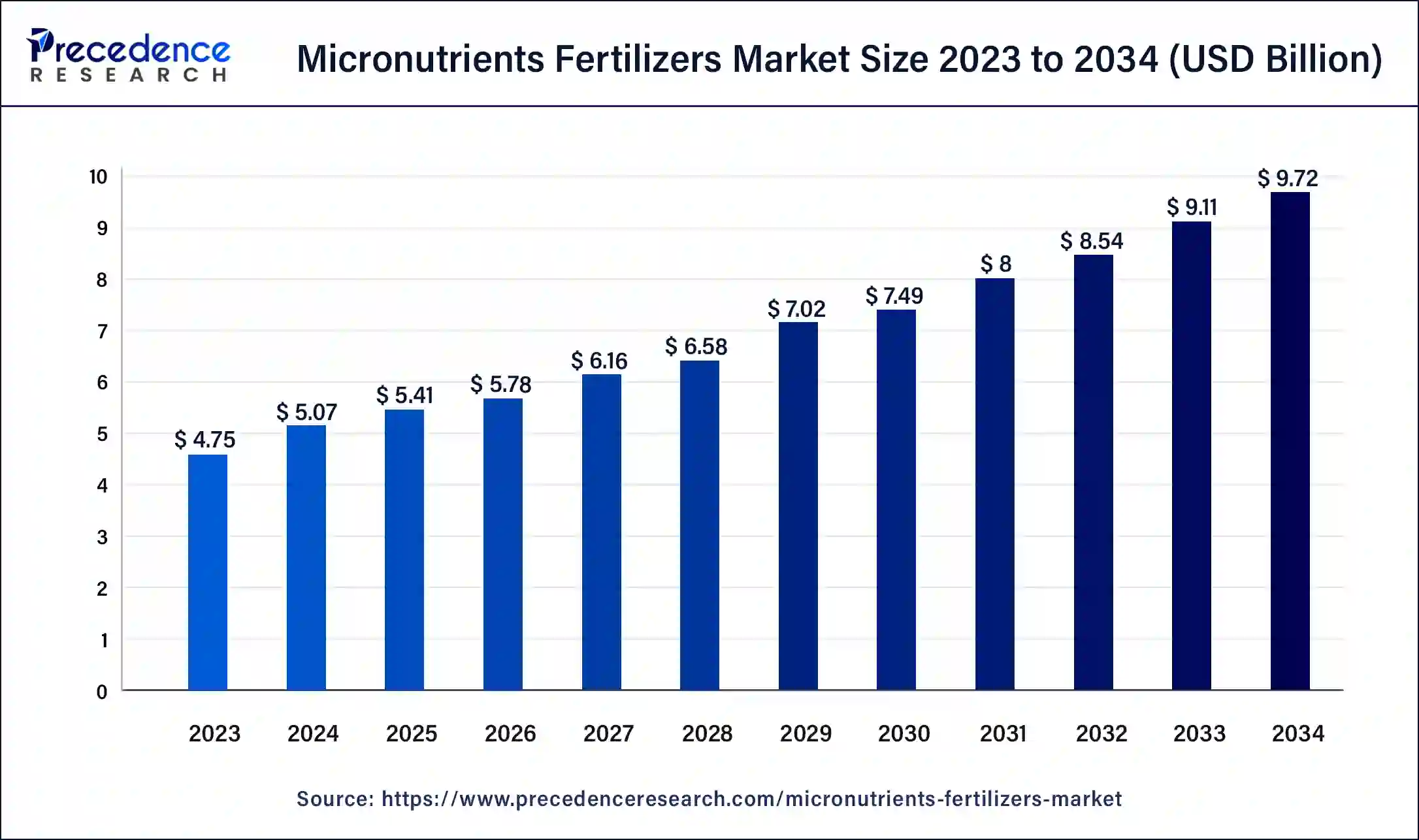

The global micronutrients fertilizers market size was calculated at USD 5.07 billion in 2024 and is anticipated to reach around USD 9.72 billion by 2034, growing at a CAGR of 6.72% from 2025 to 2034. The micronutrients fertilizers market is driven by boosting the growth and development of plants by enhancing immunity and providing adequate nutrients.

Micronutrients Fertilizers Market Key Takeaways

- The global micronutrients fertilizers market was valued at USD 5.07 billion in 2024.

- It is projected to reach USD 9.72 billion by 2034.

- The micronutrients fertilizers market is expected to grow at a CAGR of 6.72% from 2025 to 2034.

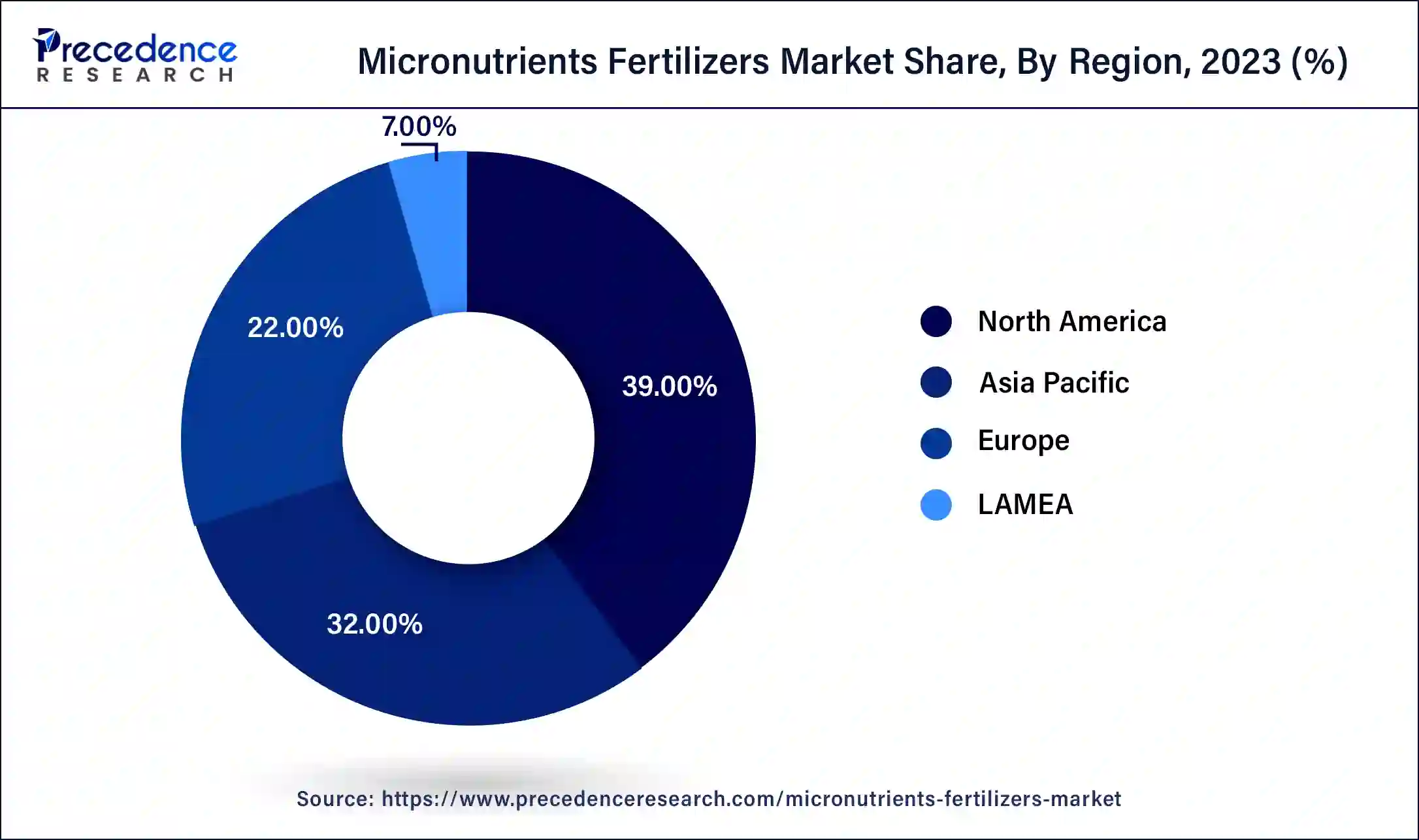

- North America dominated the micronutrients fertilizers market with the largest market share of 39% in 2024.

- Asia Pacific is estimated to grow at the fastest rate in the market during the forecast period.

- By nutrient, the Zinc segment generated the biggest market share of 34% in 2024.

- By nutrient, the Manganese segment is anticipated to grow at the fastest rate in the market during the forecast period.

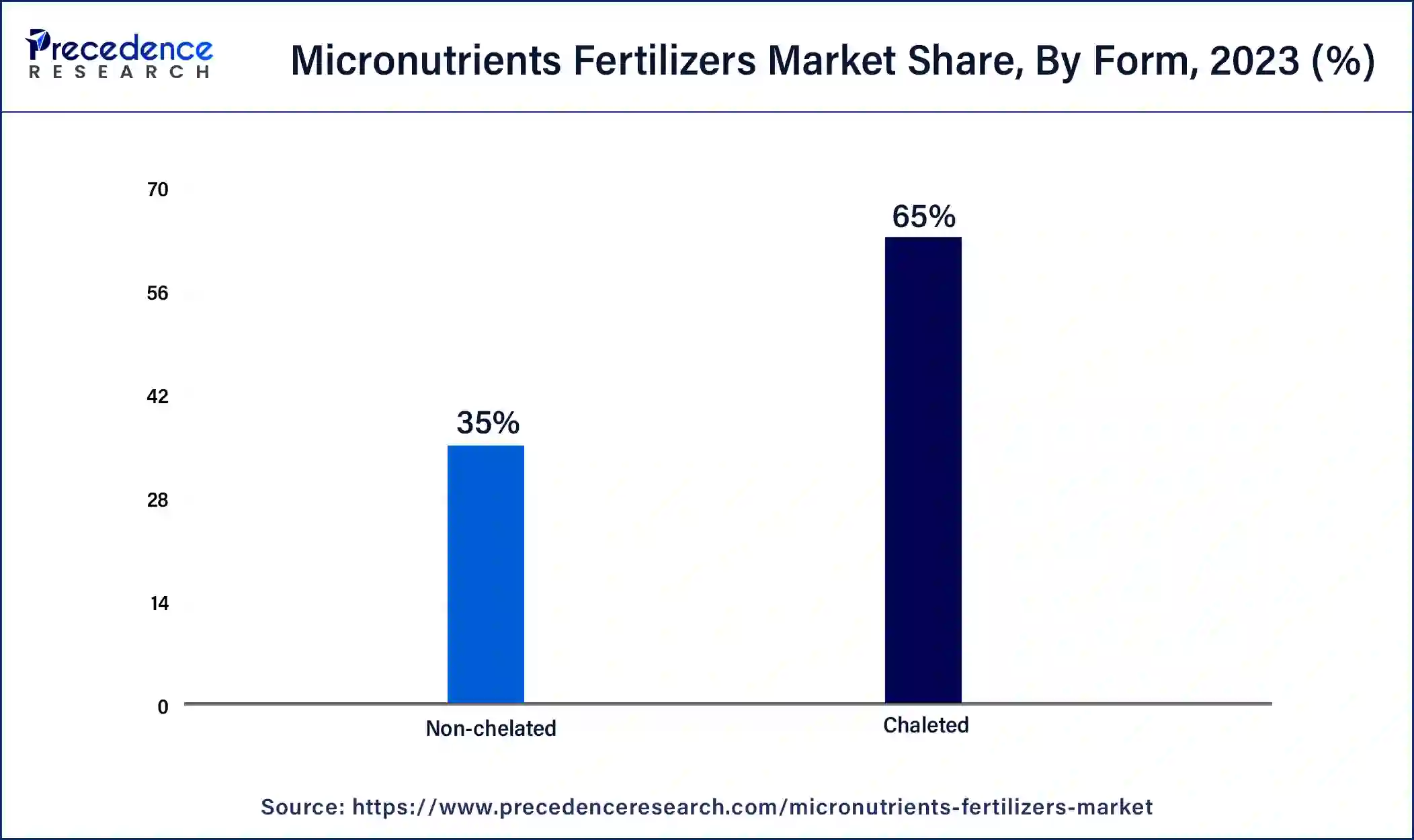

- By form, the chelated segment accounted for the highest market share of 65% in 2024.

- By crop type, the fruits & vegetables segment held the major market share of 36% in 2024.

- By crop type, the grains & cereals segment is expected to grow significantly during the forecast period.

How is AI Changing the Micronutrients Fertilizers Market?

The application of artificial intelligence (AI) and machine learning (ML) in the micronutrients fertilizers market provides data on weather conditions, acidity level, fertilization time, and soil conductivity. It also predicts the nitrogen level over the next 12 days. Excessive utilization of fertilizers causes serious problems to land health, such as polluting the soil and water, destroying the fertility of the soil, and the soil becoming acidic; however, with the help of AI/ML, these problems can be prevented. Scientists from Imperial College London have developed a new predictive testing tool that determines the amount of ammonia and nitrate currently present in the soil and predicts the future amount based on weather conditions so the farmer can customize the fertilization to the specific needs of the soils and crops.

U.S. Micronutrients Fertilizers Market Size and Growth 2025 to 2034

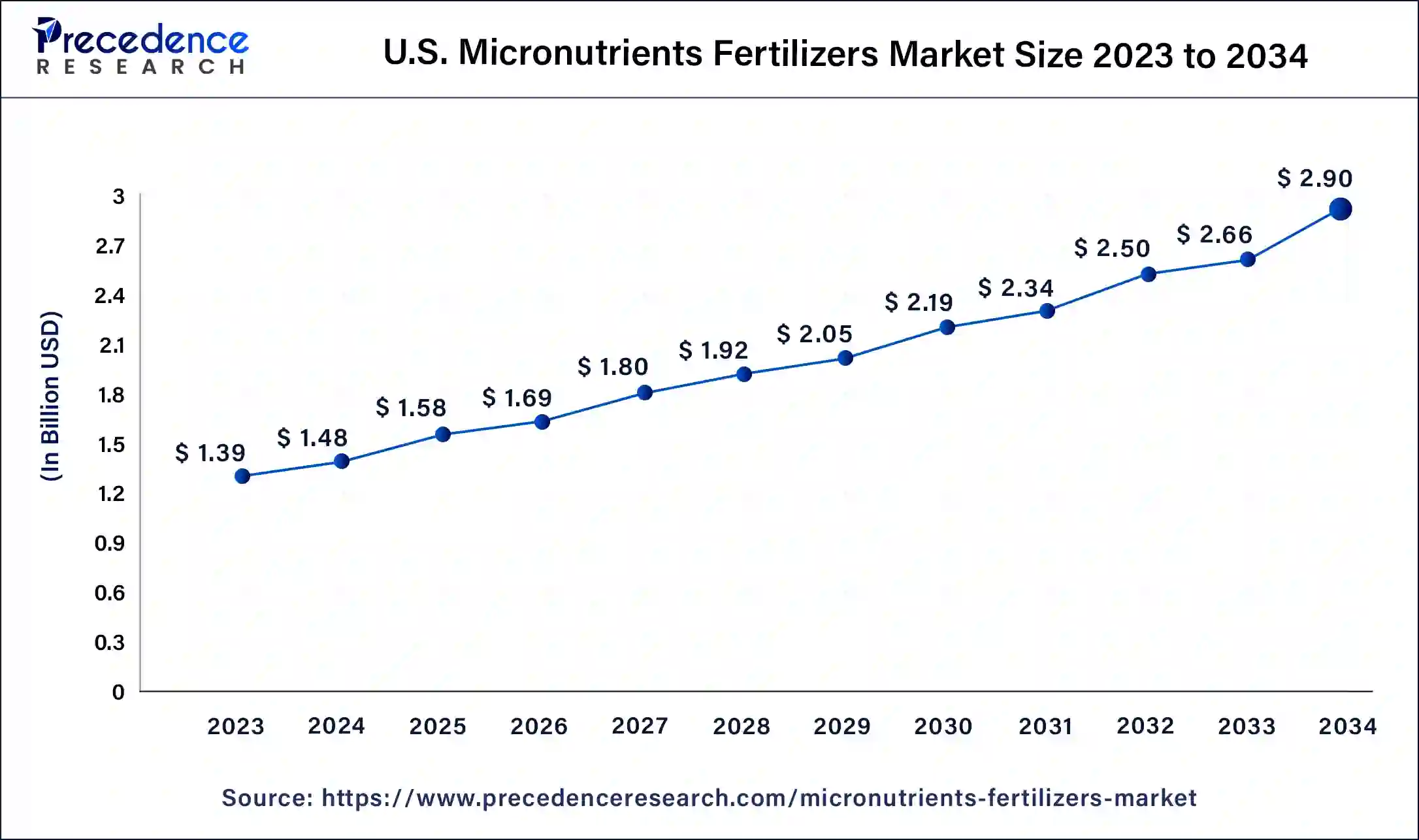

The U.S. micronutrients fertilizers market size was calculated at USD 1.48 billion in 2024 and is projected to surpass around USD 2.90 billion by 2034, growing at a CAGR of 6.96% from 2025 to 2034.

North America dominated the micronutrients fertilizers market in 2024. The rise in market growth in this region is supported by micronutrient management in the U.S., which is highly recommended by local universities, government scientists, and extension agents. The usage of micronutrients in North America has rapidly changed over the last five years. Significant growth in micronutrient application was observed in this region. The crucial driving factors are increasing demand for high-quality and uniform products, modifying agricultural practices, and increasing intensification such as low-till agricultural management, precision agriculture, and usage of genetically modified crops. There has been improvement in recognition of the environmental impact on agriculture and the adoption of strict environmental regulations.

- In May 2024, the FRST (Fertilizer Recommendation Support Tool) project is a collaboration of over 100 soil science and agronomic professionals representing nearly 50 universities, four divisions of the USDA, several not-for-profit organizations, and one private sector partner and launched decision support tool that provides unbiased, science-based interpretations of soil test phosphorus and potassium values for crop fertilization.

Asia Pacific is estimated to grow at the fastest rate in the micronutrients fertilizers market during the forecast period. Asia Pacific is a widespread region for micronutrient fertilizer consumption. The major factor for market growth in this region is due to the large population and suitability of urea for the climate of this region. Major country players in this region are China and India. These countries are major consumers of micronutrient fertilizers for crops such as rice, wheat, and vegetable production. The availability of land in this region is also a driving factor. At the same time, irrigation infrastructure is not that developed. Climate change has an impact on this region, which has a long-term effect. Moreover, technological innovation is widely advancing across this continent, and there is a need for environmental improvement.

Market Overview

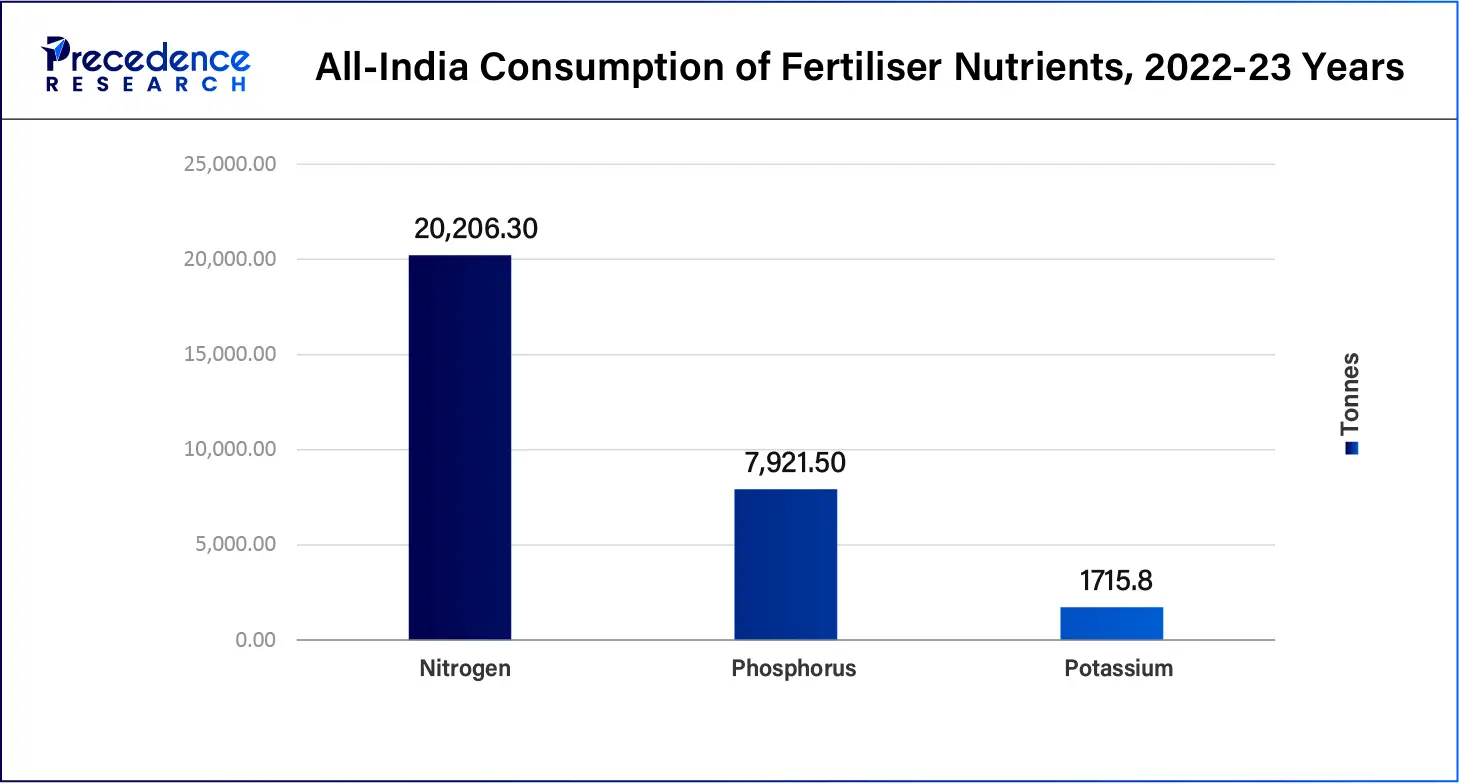

Micronutrient fertilizers are minerals that provide essential plant nutrients that help in the growth and development of a plant. Zinc (Zn), Copper (Cu), Manganese (Mn), Iron (Fe), Boron (B), and Molybdenum (Mo) are some commonly found minerals in micronutrients needed in small quantities, while macronutrients such as nitrogen, phosphorus, and potassium are needed in larger amounts. An adequate micronutrient supply improves the overall yield, fruit size, flavor, and color of the plant and its fruits. Micronutrients are responsible for the development of physiological and biochemical processes in plants, including enzyme activation, photosynthesis, and nutrient absorption. The deficiency of micronutrients could lead to underdeveloped growth, reduction in crop yield, and increased susceptibility to diseases and pesticides.

Micronutrients Fertilizers Market Growth Factors

- Micronutrient fertilizers are essential for plant growth and balance crop nutrition.

- Improves crop quality by promoting better fruit set, size, and color.

- Helps in stress tolerance for plants and environmental challenges such as heat stress, salinity, and drought.

- Improves protein synthesis and enzyme activity.

- Reduce the active level of toxic elements and promote microbial growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.72 Billion |

| Market Size in 2025 | USD 5.41 Billion |

| Market Size in 2024 | USD 5.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Nutrient, Form, Crop Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increases crop yield

This is the major factor that drives the micronutrients fertilizers market. The adoption of fertilizer by farmers and agriculture is to produce a good crop with the desired quality. Supplying micronutrients to plants enhances their physiological functions, such as helping in chlorophyll production, enzyme activity, and photosynthesis, which results in a healthier and larger quality of production. Micronutrients such as boron and calcium improve the root growth and development. If a plant has stronger roots, the absorption of water and nutrients is achieved without hindrance. Micronutrients also prevent disease by boosting plants' immune systems.

- In February 2023, a study conducted by the Center for Research in Agricultural Genomics (CRAG) states that exposing rice plants to moderately high levels of iron increases resistance to infection. Understanding the supply of nutrients (macronutrients and micronutrients) against pathogens helps in designing new protection strategies against blast disease, minimizing the associated economic losses.

Restraint

Poor communication and awareness

There is a relatively lower awareness of micronutrient fertilizers in the agricultural field than macronutrients. This is mainly due to the developing economy. Farmers and agronomists are not educated enough about the benefits of micronutrients and their barriers to use. Conducting campaigns and spreading more knowledge about the matter can spread the data and resolve challenges. This can be achieved with the support of the government and the launch of a nationwide campaign on balanced soil nutrition that can adapted regionally to increase farmers' awareness. There should be facilitation of limited-term incentives to farmers. This will encourage the usage of micronutrients. For instance, cashback on the purchase of micronutrients and benefits such as free or reduced cost on agriculture inputs or small loans for early adopters.

Opportunity

Bio-activated fertilizer

A new innovative technology that binds the micronutrients with cellulose is adopted in the micronutrients fertilizers market. This allows nutrients to be released slowly through the natural process of soil microbes instead of traditional fertilizers, which release the nutrients all at once. This advancement increases microbial biomass as it provides a carbon source that microbes consume. When the microbes break down into cellulose, they release the micronutrients in a form that plants can easily absorb. This technology helps in regenerative farming, which is helpful when climate changes by improving soil health and isolating carbon. It also offers sustainability and supports both agriculture and environmental health.

Nutrient Insights

The Zinc segment generated the biggest share of the micronutrients fertilizers market in 2024. Zinc is known as the first micronutrient recognized by researchers, and it is essential for plants. Even though Zinc is required in small amounts, a high yield is unfeasible without it. The required amount of Zinc is 1-10 pounds/acre. Zinc helps to improve the growth of the plant, yield, and quality through stimulating chlorophyll production, nutrient uptake, protein biosynthesis, and photosynthetic activity. Zinc fertilizers are available in sulfate and chelated formulations. It is applied by either soil or foliar spray.

- In June 2024, researchers from AARHUS University discovered that Zinc helps in the nitrogen fixation process of legumes. This finding is revolutionizing the legumes-based agriculture industry by optimizing crop efficiency and reducing reliance on synthetic fertilizers.

The Manganese segment is anticipated to grow at the fastest rate in the micronutrients fertilizers market during the forecast period. Manganese (Mn) 's primary function is in the enzyme systems of plants. It activates several vital metabolic reactions and takes part in photosynthesis. Manganese growth in the market is due to its property to accelerate germination and maturity while increasing the availability of phosphorus (P) and calcium (Ca). This form of fertilizer is highly water soluble and suited for soil or foliar application. The soil-based application rate of Manganese is 10-15 pounds/acre.

Form Insights

The chelated segment dominated the global micronutrients fertilizers market in 2024. Chelated comes under the organic material category. Chelated are ring-type chemical structures around the polyvalent metal. Chelated is necessary because it remains soluble for a longer period when applied to the soil and lets the plant absorb the desired nutrients. These complex chemical structure initials of the compounds are linked to the fertilizer's material. Some common chelating agents are EDTA, NTA, DTPA, HEDTA, and EDDHA. Compared to chelated fertilizers, other fertilizers get easily oxidized or precipitated into the soil, resulting in less utility and not too efficient. Chelated fertilizers increase micronutrient utilization efficiency. The metal is unable to be precipitated by phosphates, carbonates, and other soil fertilizer components. Due to its mobile and unfix properties, it moves freely through the soil to uptake the plant root system.

- In August 2024, CHS Inc., a leading global agribusiness owned by farmers, ranchers, and cooperatives in the United States, launched its first six new products to improve the framer's crop yield. Trevar EZ offers a blend of ortho-ortho EDDHA chelated granular micronutrients in the industry. This newly innovated chelate prevents phosphorus from bonding with soil micronutrients and frees more nutrients for growing plants to access.

Crop Type Insights

The fruits & vegetables segment held the largest share of the micronutrients fertilizers market in 2024. Using micronutrient fertilizer on fruits and vegetables improves crop yields, enhances the quality of fruits and vegetables, reduces the risk of diseases and pests, and prevents any deficiency in plants for the complete growth of fruits and vegetables. The three main NPK fertilizers are nitrogen, phosphorus, and potassium. Nitrogen is responsible for chlorophyll production in plants; without it, the plant's growth will be stunted, and yield will be reduced.

Phosphorus plays a part in the development of flowers and fruits. It is used to transfer energy within plants and is necessary for reproductive structure. Potassium promotes overall health and growth. The balanced fertilizer ratio of NPK for vegetables should be 10-10-10 or 5-10-5 for most of the vegetables. However, different fruits and vegetables have different requirements at each growing stage. For instance, tomatoes grow well with a little extra potassium and phosphorus; a 6-12-12 ratio suits this case. For cucumbers and peppers, it's 5-10-10; lettuce is much lower, 5-5-5, and carrots need more potassium and phosphorus for root development, so its ratio is 3-10-10.

The grains & cereals segment is expected to grow significantly in the micronutrients fertilizers market during the forecast period. Micronutrient fertilization on grains and cereals provides a strong root system and a great number of roots. This process helps the roots to spread more into the soil and absorb the required nutrients. Providing the right amount of nitrogen fertilization increases the production of crops. Along with this, the other benefits of micronutrient fertilization on grains and cereals are providing better quality grain protein, improved baking, malting, and feed quality, and increased nitrogen use efficiency.

Micronutrients Fertilizers Market Companies

- CF Industries Holdings, Inc.

- CHS Inc.

- Coromandel International Ltd

- Haifa Group

- ICL GROUP LTD

- Indian Farmers Fertiliser Cooperative Limited

- Rashtriya Chemicals and Fertilizers Limited

- Nouryon

- SABIC Agri-Nutrients

- Sociedad Quimica Y Minera De Chile SA

- The Mosaic Company

- Unikeyterra Chemical

- Yara International ASA

Recent Developments

- In November 2023, Rashtriya Chemicals and Fertilizers Limited participated in the Viksit Bharat Sankalp Yatra campaign along with other fertilizer manufacturing companies. The aim was to educate farmers about flagship schemes of the Government of India in the agricultural sector and inform the balanced use of fertilizers to maintain the proper health of the soil by avoiding excess use of chemical fertilizers.

- In June 2024, Coromandel International Ltd launched a nano fertilizer plant in Andhra Pradesh. The new plant produces a wide range of NPK grades with an annual capacity of 2 million fertilizers and caters to the needs of the farming community across India. The aim is to use energy-efficient technologies and have a fully automated production line, including a robotic arm for bottling operations.

Segments Covered in this Report

By Nutrient

- Zinc

- Manganese

- Copper

- Boron

- Molybdenum

- Iron

- Other Nutrients

By Form

- Chaleted

- Non-Chelated

By Crop Type

- Grains & Cereals

- Pulses & Oilseeds

- Commercial Crops

- Fruits & Vegetables

- Other Crop Types

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client