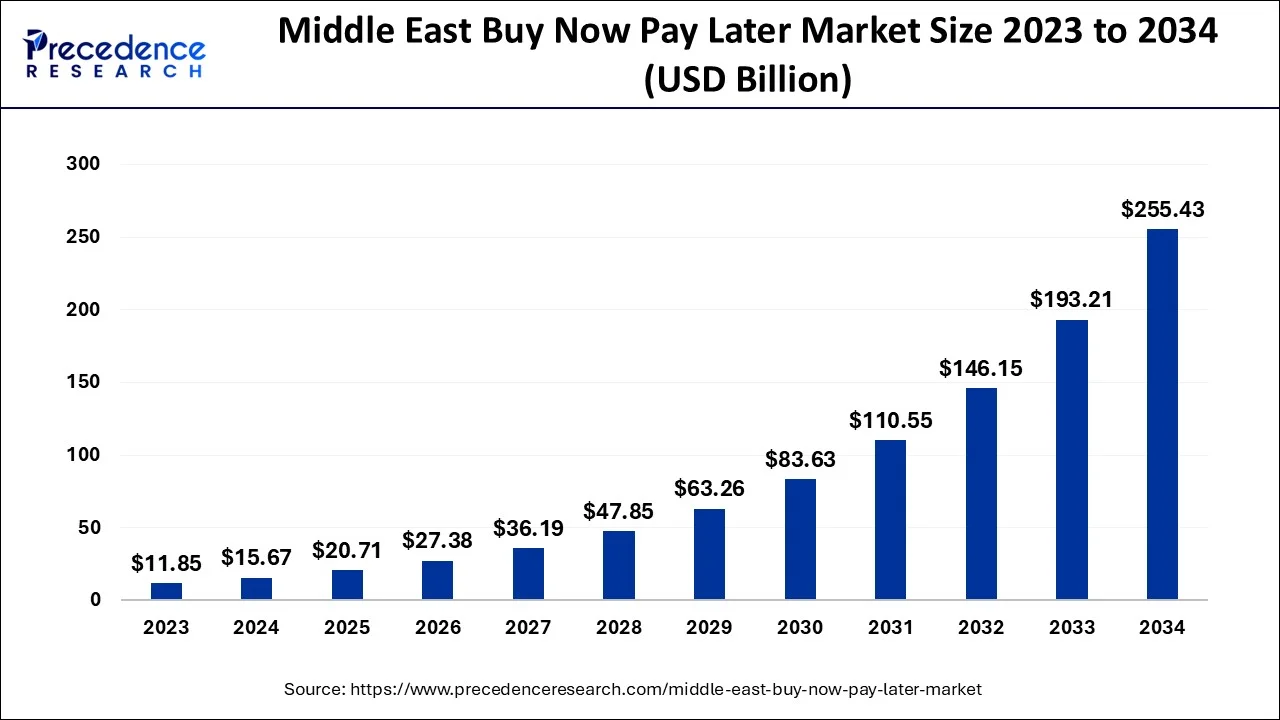

The global middle east buy now pay later market size accounted for USD 15.67 billion in 2024, grew to USD 20.71 billion in 2025 and is predicted to surpass around USD 255.43 billion by 2034, representing a healthy CAGR of 32.20% between 2024 and 2034.

The global middle east buy now pay later market size is accounted for USD 15.67 billion in 2024 and is anticipated to reach around USD 255.43 billion by 2034, growing at a CAGR of 32.20% from 2024 to 2034.

Buy now pay later is an option that helps the consumers to make payments in the future in a shorter period of time instead of making the payments right away. This financing option it's becoming extremely popular as it is almost always free of interest and helps in providing flexibility to the consumers by providing credits. This option can be used to purchase anything from electronics to medicines add food or grocery. In the Middle East region there are many retailers who offer this option of buy now pay later for the purchases that you make. Small amount is taken in the form of down payment and then a schedule for monthly payments or smaller emirs are offered to the consumers. This form of payment is gaining popularity for shopping online. There are different companies that offer the buy now pay later program but it does not have any standard format for operation. About 25% of the amount it's taken as a down payment.

The repayment schedule of buy now pay later markets is fixed and the tenure is a few weeks or sometimes it may extend to a few months. A wide range of purchases are covered under this market but not all the purchases that a consumer makes are eligible for it. Due to an increasing use of the E commerce platforms for various purchases the market for buy now pay later is expected to grow during the forecast period. Although there is no interest charged on most of the platforms that provide the service of buy now pay later but in case a consumer skips one of the payments or exceeds the date he may we charged a late fee. If the consumers skip the payments forest epilated period of time and if it happens very often the credit score of the consumer may be hampered.

The buy now pay later market is expected to grow in the Middle East region as this payment mode has a fast approval method. It does not require a good credit score in order to opt for the service. Another most important reason for the growth of this market is that it offers credit with zero interest or sometimes with an interest which is law as compared to the credit cards. This is the most convenient method for payment which is spread over a period of time with smaller amounts of EMI. The COVID-19 pandemic had disrupted the economic conditions in the Middle East region. There has been a great growth in this market due to an extensive use of online platforms and availability of Internet connection. The increased adoption of the ecommerce platforms in the Middle East region after the pandemic has created a shift in the purchasing behavior. Increase the availability of varied payment solutions has also led to a growth of the buy now pay later market.

The buy now pay later market providers are expected to have better strategic partnerships with the banking institutes in order to provide a more accessible service. After the growing demand for buy now pay later market many new firms are expected to enter this market and the market is expected to grow at a good rate in the coming years. The buy now pay later market is also expected to be regulated by gaining a permit. It is mandatory for the BNPL providers to have a permit as stated by the central bank. The central bank situated in Saudi Arabia has also warned of legal actions in case the providers fail to other to the announcement. During the pandemic there was growth in the use of buy now pay later market as the clients had financial issues but they could still shop using the buy now pay later service.

The Middle East region has grown exponentially during the pandemic due to the increased use of E commerce. As there is a growing awareness about the buy now pay later market in the Middle East regionwhich happens to be an alternate for the payment options this has created a great opportunity for the growth of the market in the coming years. These platforms have helped in creating trust among the consumers. The conditions were not the same before the pandemic people in the Middle East region were fearful of entering their financial data on the websites offered by third party. Even though the cash on delivery option is are offered in this region the market has not grown well in the recent years period the buy now pay later service killed the trust of the consumers and increased it's huge during the pandemic. There's a large number of young population in the Middle East region as this option offers EMI and this happens to be affordable it is expected to gain popularity in the coming years. People are switching from the use of credit cards to buy now pay later market.

| Report Coverage | Details |

| Market Size in 2024 | USD 15.67 Billion |

| Market Size by 2034 | USD 255.43 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 32.20% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Purchase Ticket Size, Business Model, Mode, Vertical, Geography |

On the basis of the size of the enterprises, the market is either large enterprises or small and medium enterprise market. The buy now pay later market is expected to have a good growth in the large enterprises segment. The large enterprise segment is expected to grow well in the coming years period it is expected to have good revenue growth. The large enterprises segment has dominated the market in the past. This segment wide flexible adds cost effective payment options for all the products offered by the large enterprises. As the buy now pay later solution enables the consumers to buy products now and pay later for them is driving the sales of the market.

The buy now pay later solution in the small and medium enterprises is also expected to grow in the coming years. The buy now pay later market in small and medium enterprises is trying to gain a foothold.

The online segment has dominated the market in the past and it is expected to grow well in the coming years. During the forecast period the online segment shall generate large revenue as compared to the other segment. The buy now pay later market is the fastest growing market due to an increased use of online payments. In order to expand the business Uplift, Inc. entered into a partnership with tripster. Trip store is a travel site which is providing vacations to the use of buy now pay later platform where the payments can be made in installments.

The point of sales segment is also expected to have a good growth during the forecast period. Payment method the point of sales segment is also trying to improve its customer base. Due to the use of buy now pay later platform at the point of sales there is a good amount of customers making purchases through these stores.

On the basis of the end user, the fashion and garment segment dominated the market in the recent year period the fashion and garment segmented expected to grow well and have a market share of about 50% in terms of revenue. As the consumers can pay for their purchases in the future the buy now pay later market is gaining popularity. Due to the increased use of this payment mode in the fashion and garment segment as it provides interest free payment option. There's an increasing demand for sportswear as well as D accessories due to the use of buy now pay later platform.

Apart from the fashion and government purchases the market is expected to grow due to the purchases of consumer electronics and also entertainment and leisure products. Buy now pay later option is also helpful in purchases made in the health care segment. The retail stores are also providing the buy now pay later platform for the various purchases made from their shops.

The buy now pay later market is expected to grow at a good rate in the Middle East region. As the Middle East region has a large amount of young population which is under the age of 30 this market is expected to grow. As this option provides affordability the young population is making an increased use of this payment option. As the amount is paid over a period of time which is spread in the form of EMI this market is expected to grow in this region. There's an increased use of buy now pay later option even in the elder population. As this generation does not always have a monthly flow of income, The elder population is also drawn to the use of buy now pay later platform.

In the Middle East region there is an increased use of this platform as the population fears entering their financial information on the third party websites. As by now pay later option is a great alternative for the credit the market is expected to grow well in this region. The various participants in this industry in the Middle East region are trying various partnerships and mergers and acquisitions in order to expand their business. Major market players are also investing a large amount of money in research and development activities which will be helpful in providing better technological aspects to the market.

By Component

By Purchase Ticket Size

By Business Model

By Mode

By Vertical

By Countries

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client