February 2025

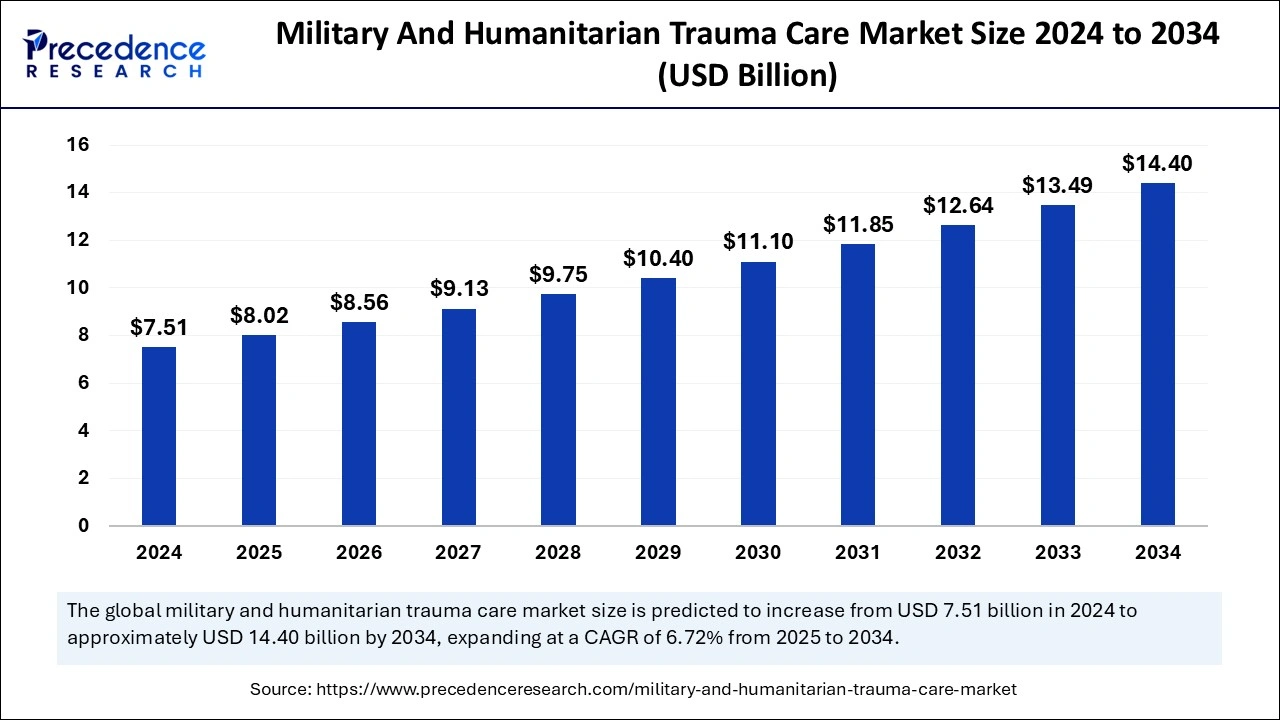

The global military and humanitarian trauma care market size is accounted at USD 8.02 billion in 2025 and is forecasted to hit around USD 14.40 billion by 2034, representing a CAGR of 6.72% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global military and humanitarian trauma care market size was calculated at USD 7.51 billion in 2024 and is predicted to reach around USD 14.40 billion by 2034, expanding at a CAGR of 6.72% from 2025 to 2034. The demand for emergency medical response has increased in military forces; as a result, the military and humanitarian trauma care segment is boosting. The demands for telemedicine and automation in trauma care are driving the military and humanitarian trauma care market. Additionally, rising government spending on military and humanitarian services is projected to boost the market in the forecast period.

Artificial Intelligence integration is significantly transforming the market by offering accurate and faster diagnoses to improve patient outcomes. The ability of AI to provide predictive analytics, machine learning, and deep learning plays a significant role in transforming the military and humanitarian trauma care market. With the integration of AI, it has become easier to identify areas that need help and access to remote or resource-limited environments.

The major challenge of this market is logistics and transportation, which organizations with the leverage of AI are ensuring. AI-enabled tools are essential for providing optimization treatment solutions that help with fast recovery. Additionally, government policies have indirectly focused on the integration of automation to advance military and humanitarian settings.

Military and humanitarian trauma care forces provide services, solutions, and devices to prevent, diagnose, and treat injuries in military and humanitarian fields. This forces a focus on improving the development and distribution of advanced trauma care solutions for combat zones, disaster areas, sports facilities, and humanitarian operations. The ongoing advancements in fracture management products, orthopedic devices, surgical products, and wound care products are emerging in the military and humanitarian trauma care market. The market is further projected to be highlighted due to the rising demand for preventive care in military and humanitarian settings.

Government spending in military operations, combat readiness, emergency services, and the R&D sector is allowing the development and access of tailored trauma care solutions. Moreover, investment in key manufacturing companies supports the development of innovative technology solutions to advance services. For instance, a mobile training app for Thornhill Medical's MOVES® SLC™ and MADM™ medical devices launched by Allogy, a mobile learning innovator, in April 2022, provides critical information for operating these portable lifesaving systems.

| Report Coverage | Details |

| Market Size by 2024 | USD 7.51 Billion |

| Market Size in 2025 | USD 8.02 Billion |

| Market Size in 2034 | USD 14.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material, Surgical Site, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Collaboration between military and humanitarian organizations

The collaboration between military and humanitarian organizations allows for improvement in expertise, resources, and delivery of trauma care. This collaboration is leading the military and humanitarian trauma care market toward success by enhancing emergency health response solutions. The rising need for trauma care solutions in resource-limited environments and conflict zones is being able to comply thanks to the growing partnership of military forces and humanitarian organizations.

Government funding in medical research and the development of innovative technologies is fueling this collaboration. Investments by non-government organizations or private companies also contribute to the strengthening of collaboration. The collaboration of military and humanitarian organizations is improving practices, training programs, and the quality of trauma care solutions.

Field logistics and transportation

The transportation of trauma care services and devices in resource-limited environments or combat zones is kind of difficult. The limited access to remote areas hampers access to trauma care solutions. Additionally, security concerns related to the safety of medical instruments and personnel cause market restrictions. The challenges of limited storage, inventories, and supplies are further likely to hazard the military and humanitarian trauma care market expansion.

Mobile and portable medical devices

The ongoing developments of lightweight and compact medical devices are improving their transportation and deployments in resource-limited environments. Portable devices are easy to use, which helps the user operate them. Additionally, technological advances and digitalization are making an effort to develop emergency trauma care service apps in consumer electronics. The affordability of portable devices attracts a major adoption rate.

The ability of portable devices to provide exact medical care needs makes them more user-friendly. Advances in telemedicine and remote monitoring are emerging in the military and humanitarian trauma care market. The increased utilization of mobile phones is supportive of delivering emergency medical care. Strategic research and integration of cutting-edge technologies are making possible access to trauma care services on mobiles.

The on-field aid segment held the dominating share of the military and humanitarian trauma care market in 2024. The segment growth is attributed to rapid response and availability of first care for any traumatic injuries. On-field aids include first aid kits, wound dressings, and compression tools, which are designed to be portable and compact. Moreover, easy handling of on-field aid makes them more preferred in the military and humanitarian firms. With the need for emergency and first aid to reduce major complexity and life-threatening risks, the on-field aid segment is projected for steady growth.

On the other hand, the internal fixators will witness rapid growth in the forecast period due to the massive need for orthopedic treatments in military and humanitarian traumatic events. The perfect stabilization of complex fractures with minimally invasive treatment solutions is the key factor driving the segment's growth. Moreover, internal fixators helped to improve mobility and reduce the risk of infections. The ability of internal fixators to provide high-speed recovery makes them popular.

Ceramics held a significant share of the military and humanitarian trauma care market in 2024. Ceramic materials offer high bioavailability, corrosion and moisture resistance properties, and improved scalability. The high strength of ceramics makes them prior preferred in medical devices and trauma care equipment. Additionally, the need for high temperatures and high-impact forces highlights the utilization of ceramics.

On the other hand, the metal alloys segment is projected to witness significant growth during the forecast period of 2025 to 2034. The metal alloys, including stainless steel and titanium, are durable, safe, and high strength. Additionally, the corrosion resistance property of metal alloys makes them ideal for medical implants and devices. Metal alloys are utilized in major applications, including orthopedic implants, prosthetic devices, and trauma fixation devices.

Additionally, the polymer segment holds a significant share of the global market. Polymers are biocompatible, flexible, lightweight, and portable. Additionally, they are cost-effective compared to metals and ceramics. Military and humanitarian applications, such as portable kits, occlusion products, custom surgical tools, and wound dressings, are majorly designed with polymers due to their lightweight and biocompatible properties.

The lower extremities segment will dominate the global military and humanitarian trauma care market in 2024. The segment growth is attributed to a higher risk of lower extremity injuries such as knees, legs, and feet. Injuries in explosions and traumatic events cause the incidence of lower extremities. Chances of accidents and natural disasters witness high demands for external fixators and orthopedic implants. Additionally, advancements in internal and external fixation medical devices and prosthetics highlight the lower extremities trauma care services. The need for trauma care solutions to improve physical stress and provide fast recovery is the major factor fueling the segment's growth.

The hospitals segment held the largest share of the military and humanitarian trauma care market in 2024. The segment growth is accounted for by expanding hospital care services and the availability of trained professionals, specialized care, and access to advanced technologies. Hospitals provide long-term rehabilitation and complex surgeries. The need for quick access to combat casualty care, trauma centers, and refugee care makes hospitals the first priority in military and humanitarian trauma care. Access to advanced trauma care is further enhancing the hospital segment.

On the other hand, the ambulatory surgical segment will expand at the fastest rate during the forecast period due to the availability of advanced equipment and trained medical professionals. The need for emergency surgeries and specialized care is easily provided by ambulatory surgical centers. Additionally, the requirement for affordable and fast-track surgical procedures enhances patient enrollment in ambulatory surgical centers.

North America contributed the largest military and humanitarian trauma care market share in 2024 due to the presence of advanced healthcare infrastructure and high military spending, including training, research, and advancements in medical equipment. The availability of several organizations, such as Army Emergency Relief, the Navy-Marine Corps Relief Society, the Air Force Aid Society, and Coast Guard Mutual Assistance, are able to provide quick and extreme trauma care services in military and humanitarian fields.

The United States is leading the regional market due to the availability of expanded advanced healthcare infrastructure and medical technology. The United States is well known for its high military spending. Rising government commitment to improving trauma care facilities is driving market growth in the United States. Government initiatives such as the Department of Defense (DOD) Combat Casualty Care research program are helping to enhance trauma care services for the military and humanitarian in the country. Moreover, government policies, including the Joint Trauma System (JTS), the Trauma Stabilization Point (TSP), the learning trauma care system, and integration with civilian systems, provide extreme activities of emergency resuscitation and stabilization and improve the quality of care of patients in the U.S.

Asia Pacific is observed to witness the fastest expansion in the military and humanitarian trauma care market during the forecast period of 2025 to 2034 due to increased demand for trauma care services in the military and civilian sectors. Growing urbanization and industrialization are leading to several chances of accidents. The rapid growth of road accidents has driven government attention to trauma care solutions. Government spending in healthcare and disaster and defense sectors, research & developments, and emergency services is holding potential for Asia-Pacific to expand the market in the forecast period.

The market is growing due to rapidly expanding healthcare expenditure among countries like India, China, and Japan. India is driving the Asian military and humanitarian trauma care market due to several factors, including growing urbanization, population, risk of road accidents, growing industrialization, expanding healthcare expenditure, and government initiatives. Government initiatives such as the Defence Research and Development Organisation (DRDO) are significant for enhancing medical technologies and trauma care devices. With government investments in pharmaceutical companies and the R&D sector, the advancement of military and humanitarian trauma care services is projected to witness spectacular growth in the forecast period.

By Product Type

By Material

By Surgical Site

By End-Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024

August 2024

September 2024