November 2024

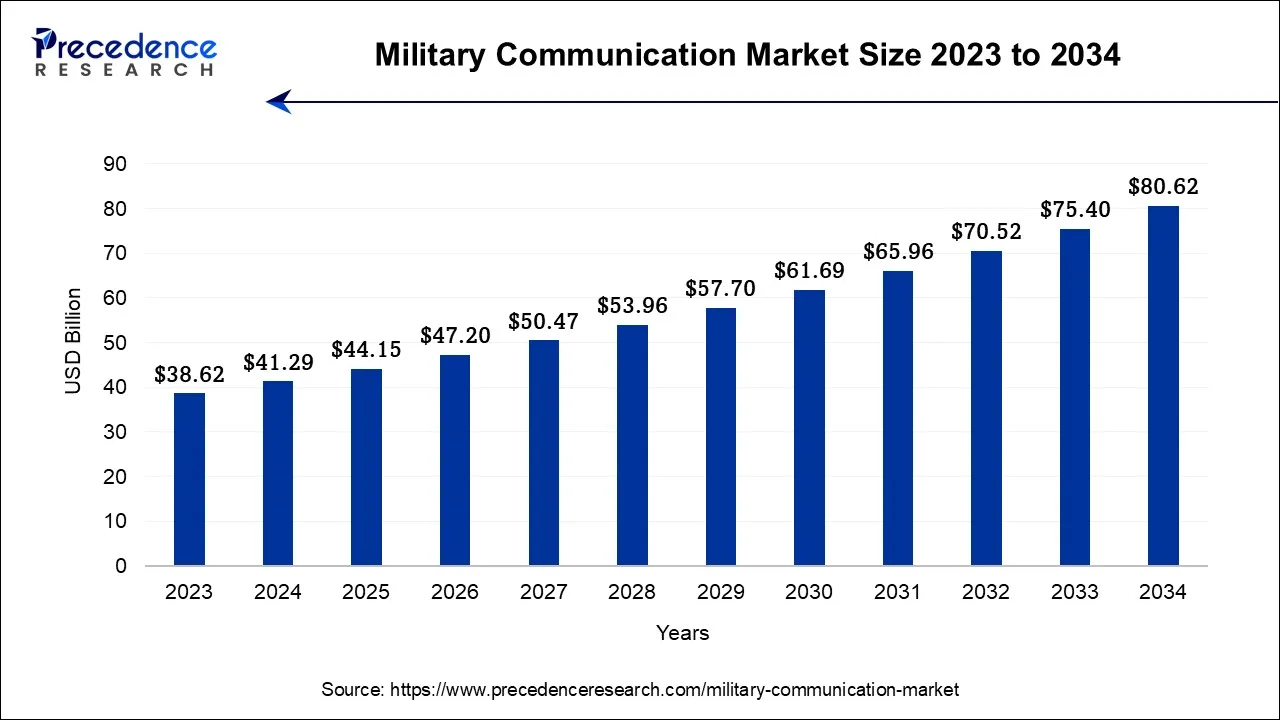

The global military communication market size is calculated at USD 41.29 billion in 2024, grew to USD 44.15 billion in 2025, and is predicted to hit around USD 80.62 billion by 2034, poised to grow at a CAGR of 6.92% between 2024 and 2034. The North America military communication market size accounted for USD 14.86 billion in 2024 and is anticipated to grow at the fastest CAGR of 7.07% during the forecast year.

The global military communication market size is expected to be valued at USD 41.29 billion in 2024 and is anticipated to reach around USD 80.62 billion by 2034, expanding at a CAGR of 6.92% over the forecast period from 2024 to 2034.

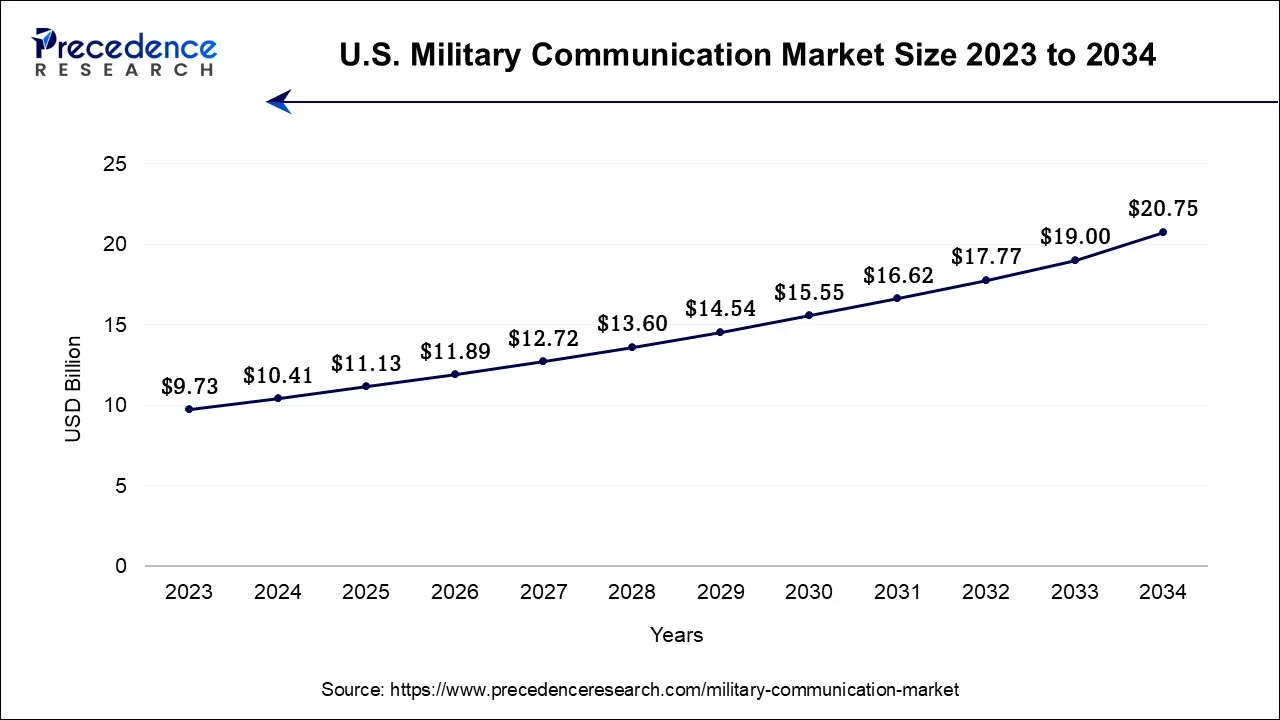

The U.S. military communication market size is accounted for USD 10.41 billion in 2024 and is projected to be worth around USD 20.75 billion by 2034, poised to grow at a CAGR of 7.14% from 2024 to 2034.

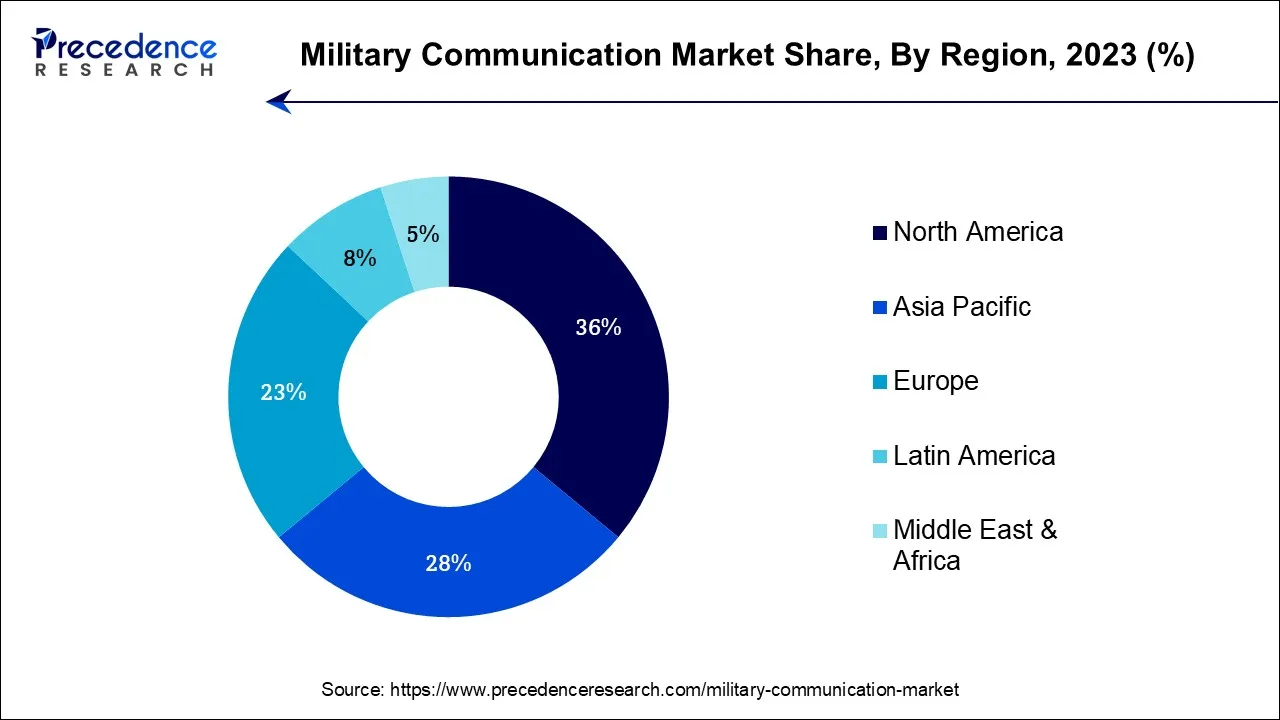

North America dominated the market with the largest market share of 36% in 2023. This is due to the North American countries such as the United States and Canada, has some of the world's largest defense budgets. The significant allocation of funds for defense and military modernization programs allows for substantial investments in advanced communication systems and technologies.

Asia-Pacific is estimated to observe the fastest expansion in the military communication market in 2022. Several countries in the Asia-Pacific region, including China, India, South Korea, and Japan, have been actively modernizing their defense capabilities. This modernization effort includes investments in advanced military communication systems to enhance interoperability, situational awareness, and overall defense capabilities.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.92% |

| Market Size in 2024 | USD 41.29 Billion |

| Market Size by 2034 | USD 80.62 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Technology, By Platform, By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In an increasingly complex and unpredictable global security landscape, the need for secure, reliable, and sophisticated communication solutions is paramount. Geopolitical tensions may involve not only traditional military threats but also asymmetric challenges, including cyberattacks and information warfare. To effectively counter these multifaceted threats, modern armed forces require cutting-edge communication capabilities. In times of heightened conflict, these systems enable military organizations to establish secure lines of communication, ensuring commanders can rapidly disseminate orders and troops can share critical intelligence. Situational awareness, a cornerstone of military effectiveness, relies heavily on real-time data transmission, which advanced communication systems facilitate.

Furthermore, interoperability, especially in multinational coalitions, becomes a strategic imperative. Advanced military communication systems offer standardized protocols and compatibility, enabling seamless collaboration among allied forces. This cooperation enhances the collective defense posture and strengthens deterrence efforts. Moreover, emerging technologies such as artificial intelligence, satellite communication, and advanced encryption are essential components of modern military communication.

For instance, in July 2023, Indian Army signed a contract for the procurement of an remotely piloted aerial vehicle (RPAV). It features various technologies such as communication systems and advanced sensors, that allows it to conduct reconnaissance and surveillance operations with enhanced efficiency and accuracy.

These innovations bolster the capacity to protect sensitive information and ensure effective communication in contested environments. Thus, ongoing geopolitical tensions underscore the indispensable role of advanced military communication systems in safeguarding national security interests and maintaining peace.

Military communication systems are critical for modern defense operations, their upfront expenses can be daunting for governments and military organizations. The research, development, and procurement of advanced military communication systems involve substantial investments in cutting-edge technology. These systems require rigorous testing, integration, and adaptation to meet specific military requirements.

The cost of developing secure and highly resilient communication networks can strain defense budgets. The rapid pace of technological advancement means that military organizations must continually invest in upgrading their communication infrastructure to maintain relevance and effectiveness. This ongoing expenditure can be a financial burden, particularly for governments facing budget constraints or competing defense priorities.

The customization and complexity of military communication systems often lead to higher costs. Tailoring systems to meet the unique needs of different branches of the armed forces and adapting them to diverse operational environments adds to the overall expenses. Moreover, the need to comply with stringent cybersecurity standards and ensure data encryption and protection against cyber threats further inflates development costs. As the threat landscape evolves, ongoing investments are necessary to stay ahead of potential vulnerabilities. Thus, the high initial development cost associated with military communication systems can be a significant deterrent for some governments and organizations.

Satellites have become the strength of modern military communication networks due to their supreme ability to deliver safe, protected and dependable connectivity in any part of the world, including remote and hostile regions. Furthermore, military organizations need satellite-based solutions that supports high bandwidth, low latency, and secure data transmission abilities. This has formed opportunities for satellite communication providers to develop and deliver innovative satellite services tailored to military needs. Moreover, the development of small and microsatellite constellations has transformed satellite communication, making it more agile and cost-effective. These constellations allows real-time global coverage and are valuable for military applications, such as remote sensing, tactical communication, and intelligence gathering.

Evolving technologies including high-frequency (HF) satellite communications and phased-array antennas are improving the abilities of military satellite systems. These advancements and innovations deliver opportunities for companies to create advanced satellite communication hardware and software solutions. Furthermore, the integration of satellite communication with other military systems, such as surveillance, command and control, and navigation, is becoming gradually important. This integration provides opportunities for companies to develop comprehensive, cross-domain communication solutions that enhance the efficiency and effectiveness of military operations. Therefore, the growing reliance on satellite communication in remote and contested areas opens up a wide range of opportunities for companies in the military communication market.

Based on the components, the hardware segment is anticipated to hold the largest market share in 2023. Hardware encryption devices are used to protect sensitive information from interception and unauthorized access. This segment consists a various hardware devices used for military communication, such as antennas, switches, satellite communication terminals, radios, routers, and network infrastructure. Moreover, these devices are designed to enable voice, data, and video communication, both in the field and within command centers.

On the other hand, the software is projected to grow at the fastest rate over the projected period. Military communication software includes applications and protocols designed for secure and efficient data transmission. This software often integrates encryption, authentication, and network management features to ensure the confidentiality and reliability of communication. These software solutions enable military personnel to collaborate effectively, even when geographically dispersed. They may include secure messaging platforms, video conferencing software, and unified communication tools that support real-time communication and information sharing.

According to the technology, the SATCOM technology has held the highest revenue share in 2023. SATCOM involves the use of satellites to enable long-range communication and data transmission for military purposes. It offers global coverage, making it valuable for remote and mobile military operations. SATCOM systems provide high bandwidth, which supports various communication needs, including voice, data, video, and secure military networks.

The data links technology is anticipated to expand at a significant CAGR during the projected period. Data link technology encompasses a range of systems and protocols used for secure and efficient data exchange between military platforms, including aircraft, ships, and ground vehicles. Data links support the transmission of tactical data, sensor information, targeting data, and more, enabling real-time coordination and decision-making.

Application Insights

Based on the application, command & control is anticipated to hold the largest market share in 2023. Command and control (C2) applications encompass the communication systems and technologies used by military commanders and decision-makers to manage and direct military operations. This includes the transmission of orders, tactical information, and strategic directives to ensure coordinated and effective responses to various threats and situations.

On the other hand, the ISR application is projected to grow at the fastest rate over the projected period. The ISR communication networks are vital for real-time data sharing between military assets, such as ground sensors, drones, satellites, and command centers, to improve situational awareness and intelligence analysis.

In 2023, the ground had the highest market share on the basis of the platform industry. Communication systems for ground platforms enable voice and data communication, situational awareness, coordination between units, and connectivity with higher command levels.

The airborne platform is anticipated to expand at the fastest rate over the projected period. Communication systems on airborne platforms are crucial for mission-critical functions such as reconnaissance, air-to-ground and air-to-air communication, surveillance, command and control, and data transmission. It encompasses all forms of military aircraft, including helicopters, transport planes, fighter jets, and unmanned aerial vehicles (UAVs).

Military Communication Market Segments

By Component

By Technology

By Platform

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

October 2024

February 2025