November 2024

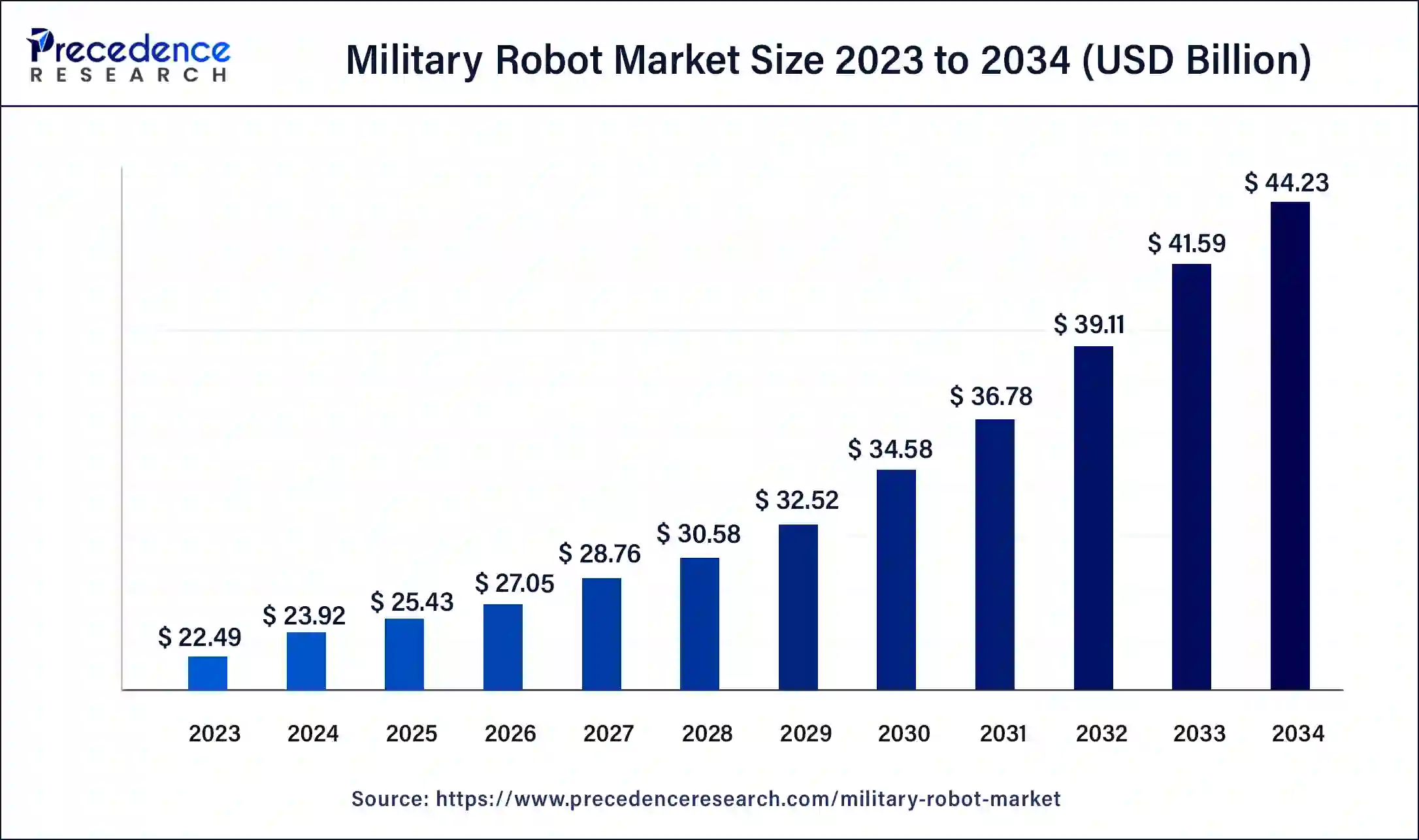

The global military robot market size surpassed USD 22.49 billion in 2023 and is estimated to increase from USD 23.92 billion in 2024 to approximately USD 44.23 billion by 2034. It is projected to grow at a CAGR of 6.34% from 2024 to 2034.

The global military robot market size is worth around USD 23.92 billion in 2024 and is anticipated to reach around USD 44.23 billion by 2034, growing at a CAGR of 6.34% over the forecast period 2024 to 2034. The military robot market growth is attributed to advancements in military technology, rising defense budgets, and increasing geopolitical tensions.

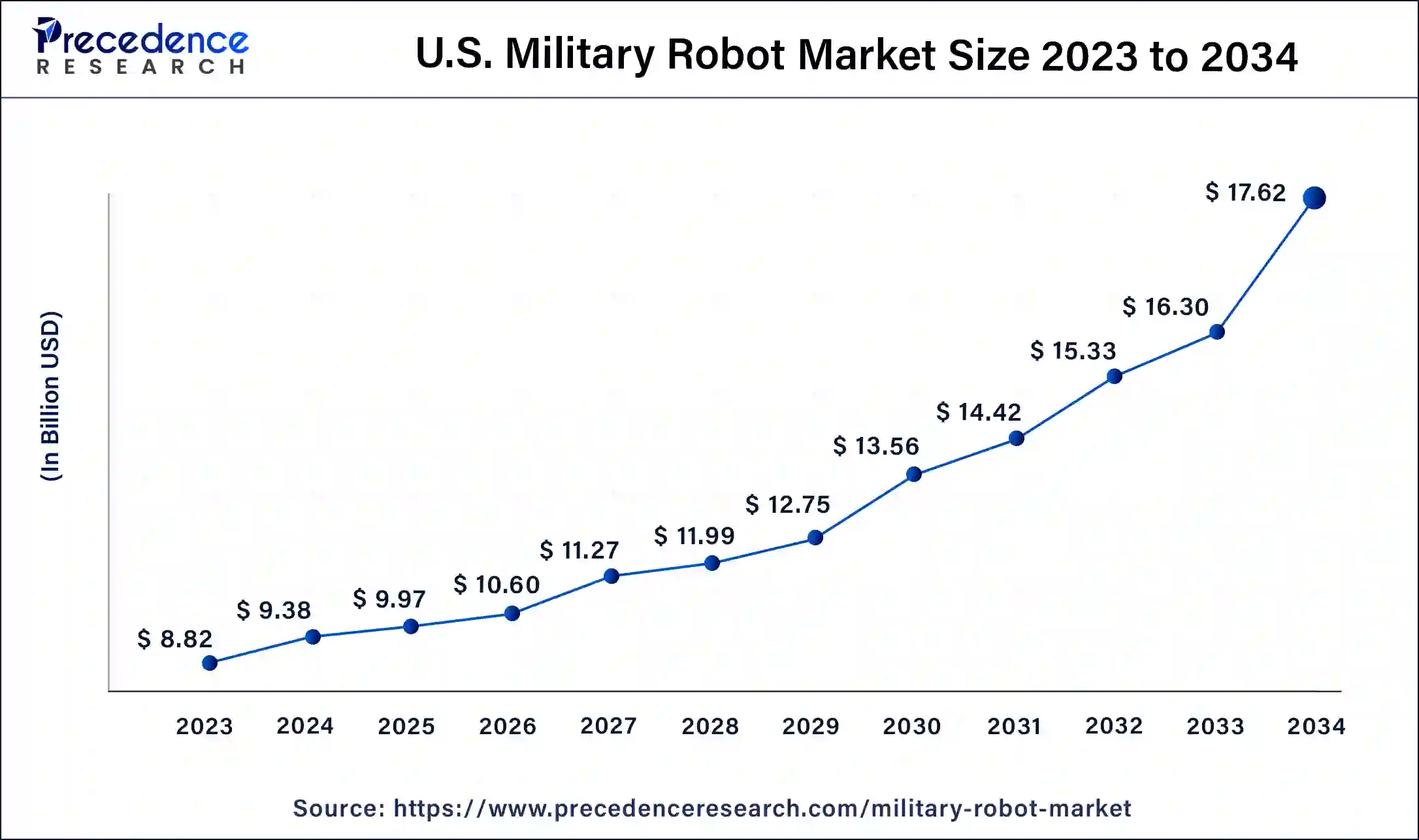

The U.S. military robot market size was exhibited at USD 8.82 billion in 2023 and is projected to be worth around USD 17.62 billion by 2034, poised to grow at a CAGR of 6.49% from 2024 to 2034.

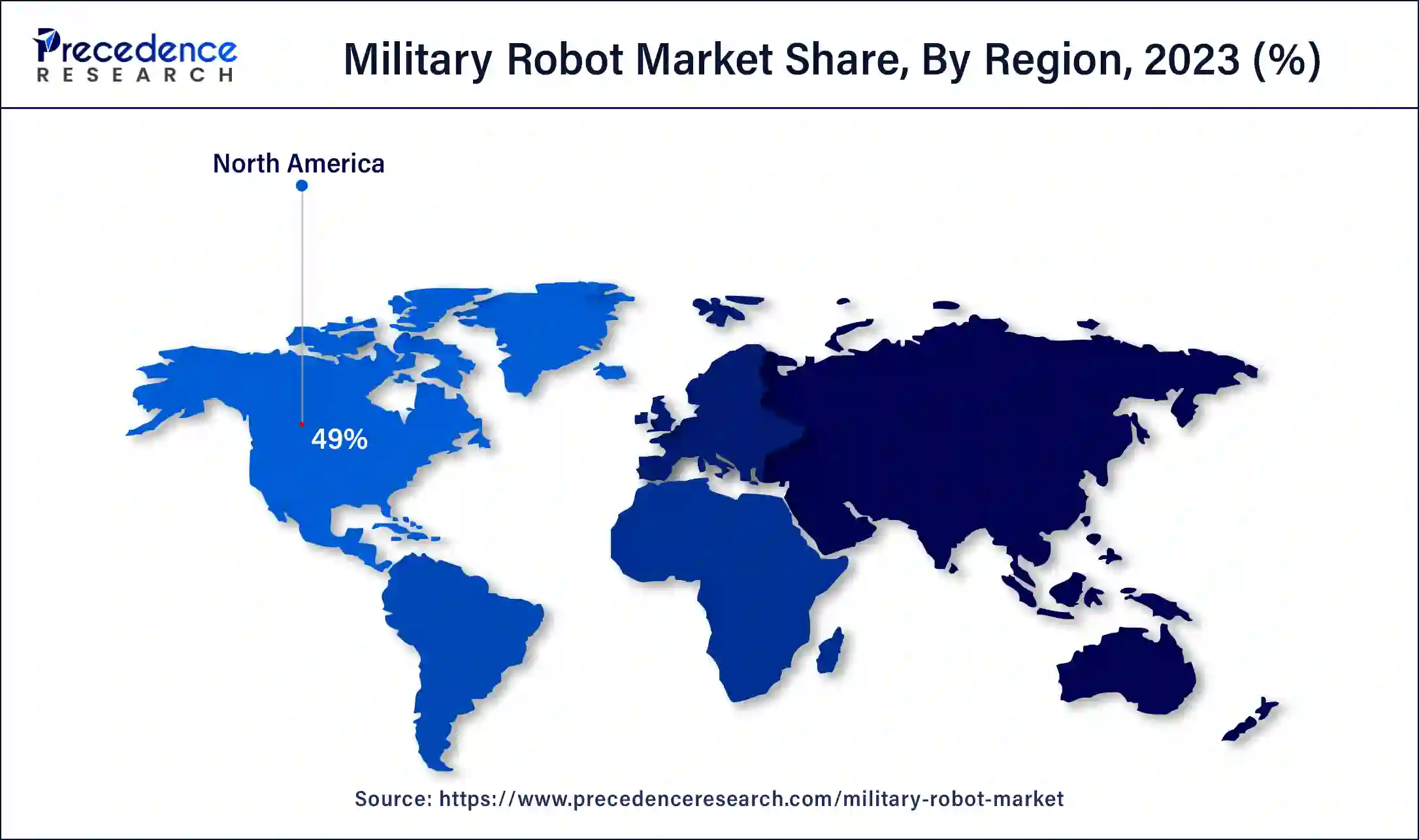

North America dominated the military robots market in 2023. There is technological readiness regarding robotics systems through integrating high infrastructures and competent R&D facilities in the region to sustain innovative systems. Both strategies of North America, in terms of increasing combat efficiency and protecting military personnel, have led to further advancements in different military robots. Government agencies partnering with local tech firms also add to the region’s market growth.

Asia Pacific is expected to grow with the fastest CAGR in the military robot market during the forecast period owing to the rising military spending and the contemporary advancements embarked on by nations including China, India, and South Korea. Being an emerging market of military robots, there is a higher demand for them in the region’s geopolitical tensions and the necessity of an improved weapon system. Concerns with enhancing the security at borders, together with new developments in intelligence, surveillance, and reconnaissance or I-Space, create demand for new military robots. Increasing tactical effectiveness and preparation in the military services further boosts the market in this region.

The military robots market is growing rapidly as a result of new technological solutions and the development of conflicts. There are types of military robots used for various purposes, including ISR, combat support, EOD, mine line clearance, and logistics. These robotic systems improve productivity, minimize the loss of life, and deliver battle advantages.

It is used in areas that are characterized by hostility and danger where the use of human resources proves costly in terms of mission accomplishment and lives. Military robots are more advantageous than traditional manned systems in the long-term aspects, specifically in the case of resource consumption and minimal losses of equipment in combat situations. The use of military robots in the existing framework of defense also helps to include tactical diversification, leading to improved combat preparedness.

Impacts of Artificial Intelligence on the Military Robot Market

Artificial Intelligence plays a crucial role in the improvement of the military robot market. They enhance military robotic operations and decision-making in military robotics. Such AI enables platforms to enhance the understanding of situations during fights, as robots are capable of processing abundant information and making decisions faster. The use of algorithms used by AI systems help locate targets and pursue missions that minimize danger to human soldiers and improve the chances of achieving the mission’s goals.

Using machine learning, military robots improve during their use in specific operations, amending their functionalities in the light of new threats. Furthermore, this technology also optimizes supply chain operations and maintenance, which is done by robots powered by artificial intelligence that undertake predictive maintenance vision to make the assets ready for use for a long duration.

| Report Coverage | Details |

| Market Size by 2034 | USD 44.23 Billion |

| Market Size in 2023 | USD 22.49 Billion |

| Market Size in 2024 | USD 23.92 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.34% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Platform, Mode of Operation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Surging investments in defense modernization

Surging investments in defense modernization programs are likely to spur military robot market growth. High governments fund spending to enhance their strength in the military domain, especially concerning robotics. It finances the production of modern military robots that are to exist in the next generation and serve different functions on the battlefield and otherwise. Modernization processes in the military focus on improving forces’ capabilities, readiness, and operations effectiveness, influencing the desire to implement complex robotic solutions.

The trend towards denoting the majority of resources to retain technological advantage over the opponents also plays a role in enhancing the demand for military robots. Such programs may entail the adoption of AI and machine learning features for armed forces robots to boost self-governing features. Moreover, combined efforts of defense agencies and private tech companies enhance capabilities and orchestrate the implementation of new technologies.

High costs of development and maintenance

High costs of development and maintenance are anticipated to restrain the growth of the military robot market. The design of sophisticated robots and auxiliary systems involves considerable funding for research and production of components and personnel. This is worsened by the fact that it entails constant updating and repair costs, which also classify it under high maintenance and operational costs. Smaller budgets in these countries for defense also prevent them from procuring cutting-edge military robots and, concomitantly, maintaining them. These financial constraints affect the deployment rate and procurement of robotic systems, which further hampers the market in the coming years.

Increasing focus on robotics for border security

Increasing focus on robotics for border security is expected to create favorable opportunities for the players competing in the market. The use of security robots at the borders with surveillance and monitoring features increases the identification of any menace. These robots function in tough topography and weather and offer prompt observation, which causes a decrease in the load on humans. The integration of other security systems, including drones and sensors, gives a full network of security along the borders. Here, the government’s funding for technologies related to the security and surveillance of the borders creates the need for better and more efficient robotic solutions, thus boosting the military robot market.

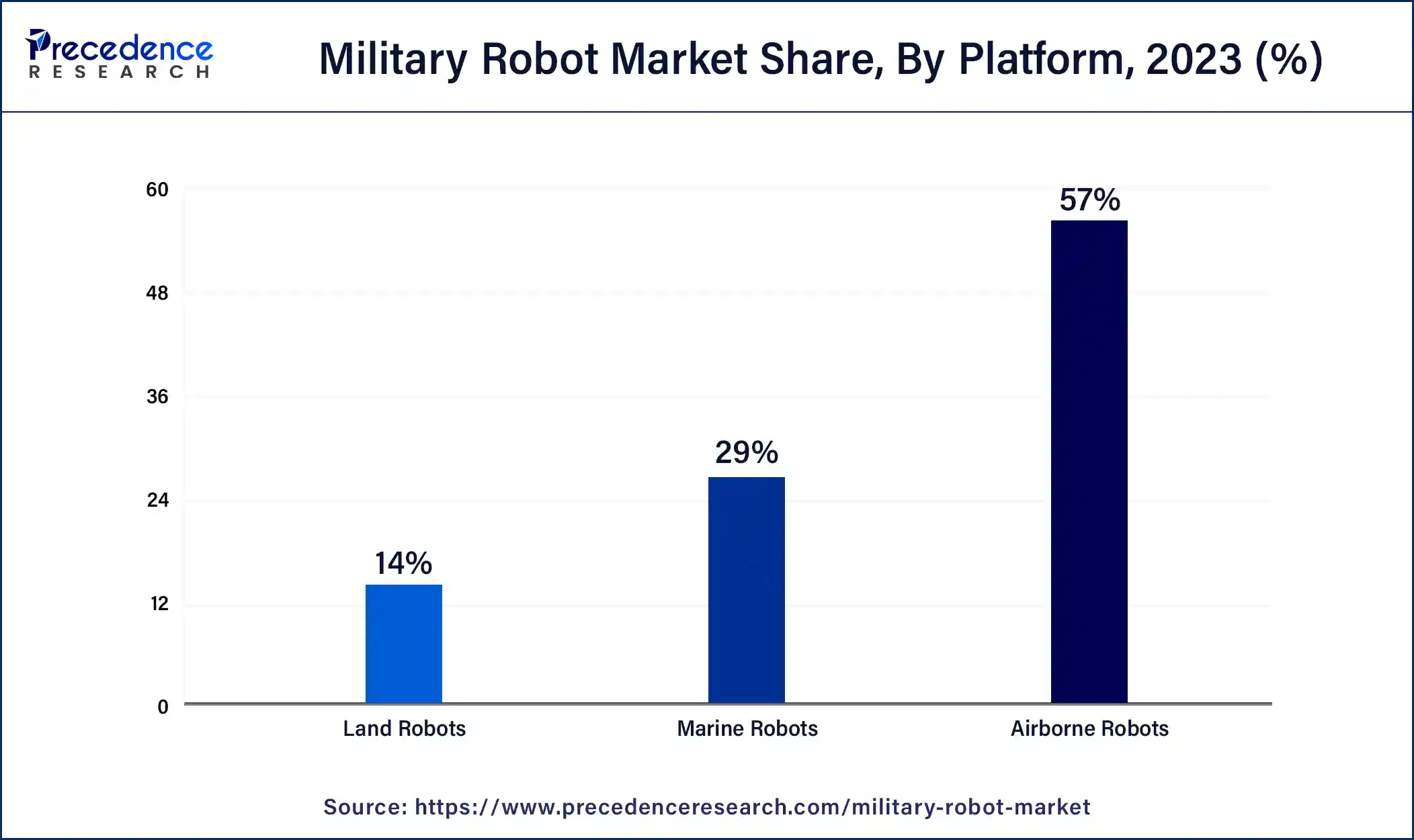

The land segment dominated the military robot market in 2023. These robots are believed to have performed functions, including reconnaissance, surveillance, EOD, and supporting logistics and other functions. Their ability to maneuver in hard-to-access terrains and work in dangerous conditions, they are a vital asset in any armed forces. Improvement in the sensors, artificial intelligence, and self-propelled navigation integration have improved their functionality and flexibility. The shift to ensuring fewer soldiers died and higher mission completion rates also stimulated the use of land robots. Furthermore, increased spending on R&D by military bodies and commercial organizations further propelled the segment.

The airborne segment is projected to expand rapidly in the military robot market in the future years due to their usefulness, especially in modern warfare and ISR operations. The real-time data and imagery obtained from UAVs' high altitudes contribute to improved situational analysis and planning. Increased competence of unmanned aerial vehicle (UAV), for instance, lighter designs, longer flights’ permanency, better stealth, and a variety of payload options to be carried, are likely to foster their usage. The growing role of UAVs in using precision strikes and logistics in conflict areas is just added evidence. Moreover, an increasing number of defense agencies across the globe are harnessing drones, which is also evident by the growing investments in this technology, which supports the demand for airborne robots.

The operated segment held the largest revenue share in the military robot market during the forecasting period. These are quite common in many military operations, as they are simple to use and efficient. They have delivered in sensitive operations, such as EOD, reconnaissance, and support transport. Industrial robots operated by people are preferred for quick reaction time and for their capability of performing highly skilled tasks while being monitored by people. Their modularity and easy-to-use interface, along with the fact that they are cheaper to develop compared to fully autonomous systems, have made them popular. Moreover, modern military facilities and courses are developed for managing human-operated systems, which contributes to their widespread adoption.

Autonomous sub-segment is projected to lead the market in the coming years. These robots have the ability to perform tasks with no supervision, as they have improved efficiency & functionality. Their development of artificial intelligence and machine learning technologies allows them to make decisions on their own based on their surroundings. Their capacity to act autonomously in environments with high predisposition results in improved military objective accomplishment with minimal loss of life. Autonomous robots are also proficient in close surveillance, target identification, and reconnaissance roles. Increasing spending on technologically advanced robots and renewed governmental attempts to upgrade military systems will further enhance the demand for autonomous military robots.

The surveillance & reconnaissance (ISR) segment dominated the global military robot market in 2023. ISR robots give live feeds that are useful in planning missions and making other strategic decisions. Their versatility in performing in different and often extreme conditions and their sophisticated sensor systems are essential components of any contemporary warfare. These robots improve intelligence activity and their effectiveness in estimating threats and conducting further actions. The application of AI and machine learning enhances ISR operations by using the technology to perform data analysis independently.

The others (explosive ordnance disposal (EOD), mine clearance, & firefighting) segment is expected to grow rapidly in the global military robot market over the forecast period. Militaries benefit from EOD robots since lethal objects are dismantled using the robots, which cuts the chances of human lives being lost. Advancements in technology, with their better locomotion, make operation easier in all terrains during EOD. Sophisticated sensors, along with Artificial Intelligence experiences, are helpful in accurately detecting and dealing with explosives. Furthermore, increasing defense expenditure and consistent development in technology applications further boost the market.

Segments Covered in the Report

By Platform

By Mode of Operation

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

October 2024

October 2024