January 2025

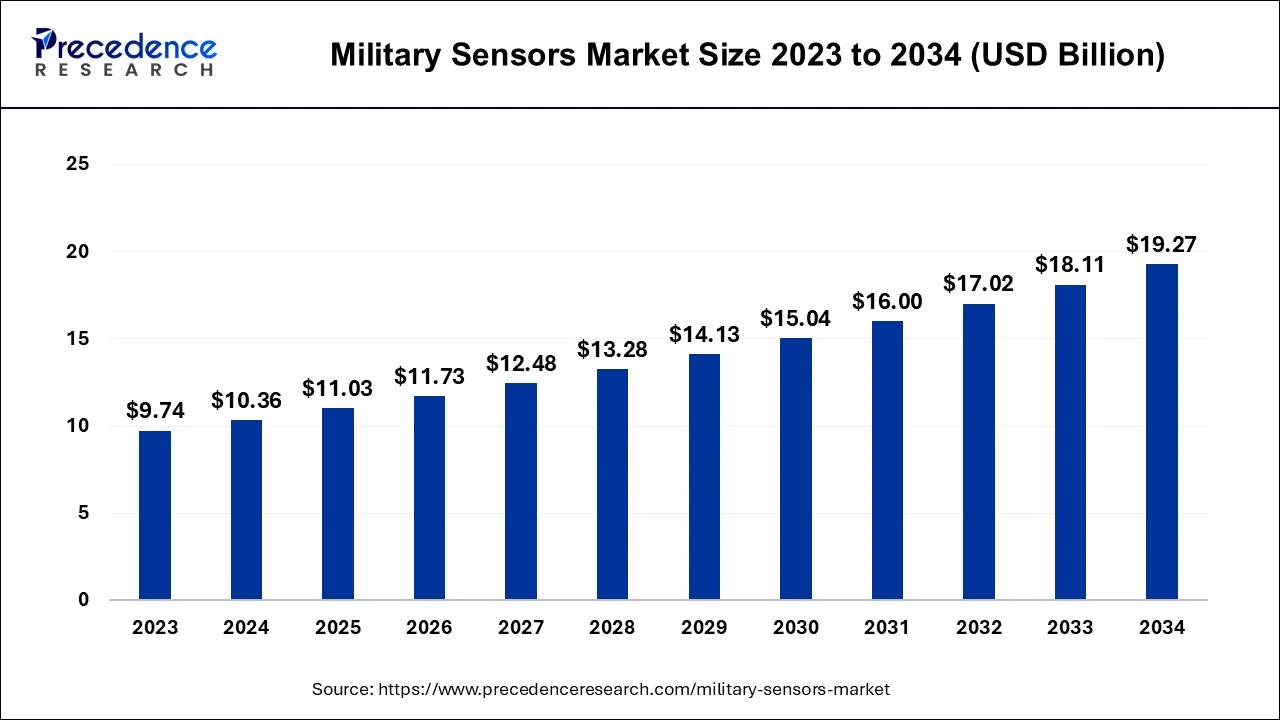

The global military sensors market size is calculated at USD 10.36 billion in 2024, grew to USD 11.03 billion in 2025 and is predicted to surpass around USD 19.27 billion by 2034, expanding at a CAGR of 6.40% between 2024 and 2034. The North America military sensors market size accounted for USD 4.35 billion in 2024 and is anticipated to grow at a fastest CAGR of 6.53% during the forecast year.

The global military sensors market size accounted for USD 10.36 billion in 2024 and is anticipated to reach around USD 19.27 billion by 2034, expanding at a CAGR of 6.40% between 2024 and 2034.

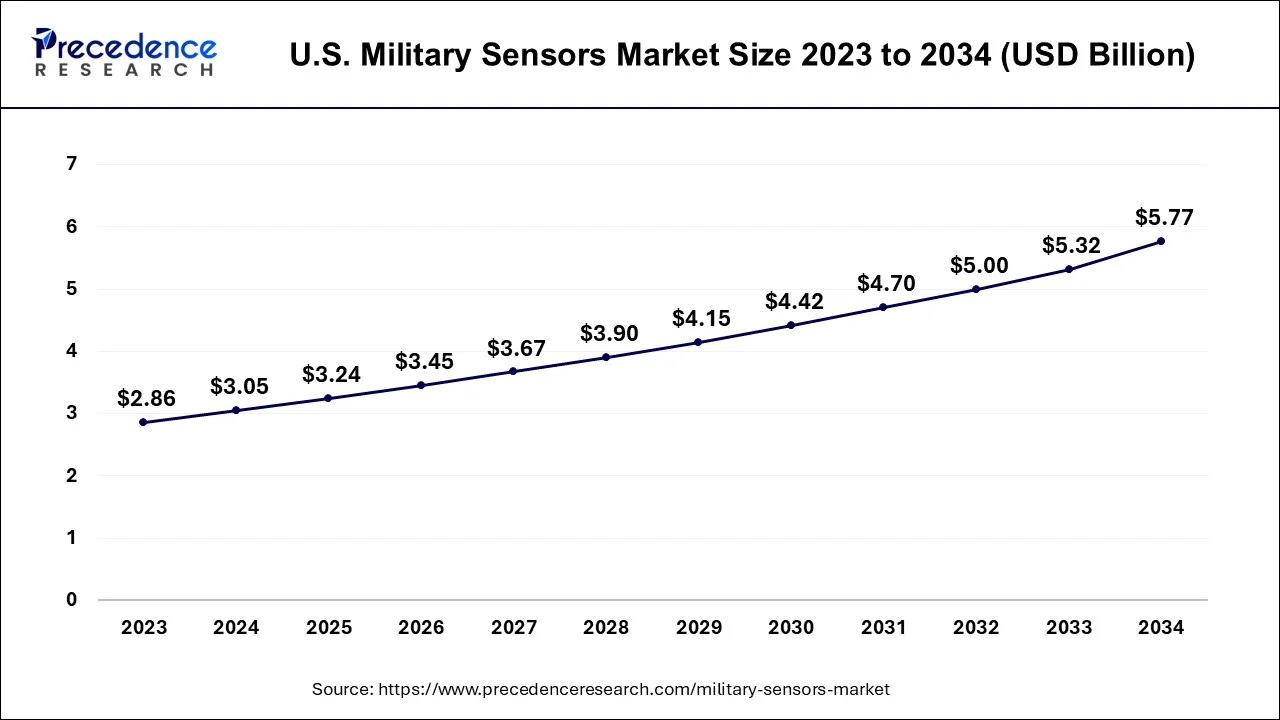

The U.S. military sensors market size is estimated at USD 3.05 billion in 2024 and is expected to be worth around USD 5.77 billion by 2034, growing at a CAGR of 6.58% from 2024 to 2034.

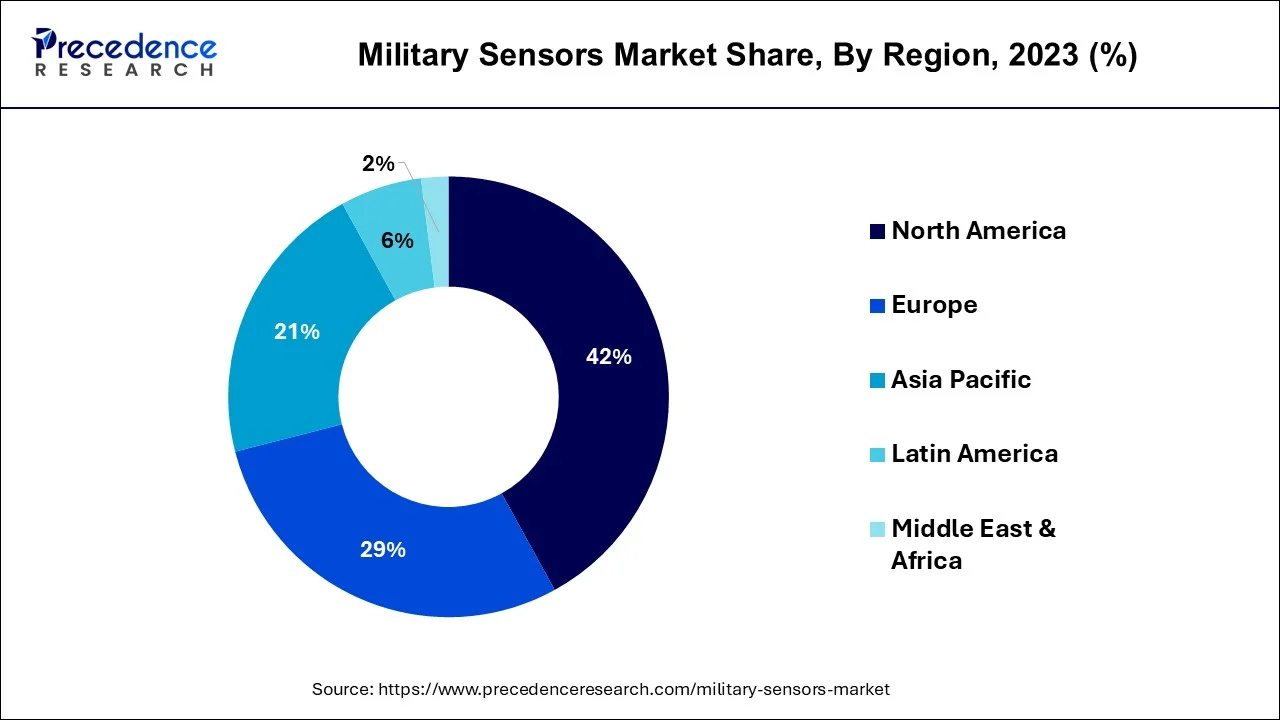

North America has held the largest revenue share 42% in 2023. North America has been a frontrunner in the adoption of advanced military sensors, driven by the continuous modernization efforts of the U.S. Department of Defense. The region has witnessed a growing focus on integrating artificial intelligence and machine learning into military sensor systems, enhancing real-time data processing and threat detection. The U.S. Department of Defense's investments in cutting-edge sensor technologies, including radar, EO/IR, and CBRN sensors, reflect the region's commitment to maintaining military superiority. Furthermore, partnerships with private defense companies for research and development initiatives are fostering innovation.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific is witnessing a significant increase in military expenditures, driven by the growing emphasis on indigenous sensor development to enhance defense capabilities. Geopolitical tensions and territorial disputes have amplified the demand for military sensors, particularly in the context of maritime and border security. Countries such as China, India, and Japan are actively investing in sensor technologies across land, air, and naval applications to fortify their security postures. Consequently, the market has emerged as a burgeoning hub for sensor development and production, presenting substantial growth prospects for both domestic and international sensor manufacturers.

Europe is seeing a steady progression in its military sensor market. Several European nations are investing in advanced sensor technologies, including radar systems and unmanned aerial vehicles (UAVs). Additionally, collaboration on multinational defense projects, such as the Euro drone initiative, is driving innovation in sensor development, further propelling the European military sensor market. The European military sensor market is also addressing emerging threats in the cyber domain, investing in technologies that can counter cyberattacks on defense systems and networks. This holistic approach ensures the region's readiness for modern warfare challenges.

The military sensors market encompasses a wide array of technological devices designed to enhance the capabilities of military forces. These sensors are instrumental in gathering critical data, monitoring the battlefield, and providing intelligence for informed decision-making. The market includes various sensor types, such as radar, sonar, infrared, acoustic, and chemical sensors.

These technologies aid in detecting and tracking threats, protecting military assets, and improving situational awareness. With increasing defense budgets and the need for modernization, the military sensors market is projected for substantial growth, driven by advancements in sensor technologies and evolving defense requirements.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.4% |

| Market Size in 2024 | USD 11.03 Billion |

| Market Size by 2034 | USD 19.27 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Platform, Component, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased defense spending and technological advancements

Increased defense spending and technological advancements are significant drivers that surge the market demand for military sensors. Firstly, increased defense budgets worldwide have a profound impact on the demand for military sensor systems. Nations are allocating substantial funds to bolster their defense capabilities due to growing security concerns and evolving threats. This heightened investment translates into higher procurement of advanced military sensor technologies. The need to modernize and equip armed forces with state-of-the-art sensor systems to maintain national security and strategic superiority is a driving factor.

Moreover, rapid technological advancements play a pivotal role in fueling market demand. Sensor technologies are continuously evolving, leading to the development of more sophisticated and efficient military sensor systems. Innovations in radar, infrared, acoustic, and other sensor types enhance military capabilities for threat detection, surveillance, and reconnaissance. These advancements provide defense forces with a competitive edge, as they can detect and respond to threats more effectively. The demand for cutting-edge sensor systems grows as military organizations seek to stay ahead of adversaries and address emerging security challenges.

Budget constraints and export control regulations

The budget constraints can limit the ability of defense departments to invest in the acquisition and development of advanced sensor technologies. With finite financial resources, defense agencies may prioritize other critical areas of military expenditure, such as personnel, maintenance, and existing equipment, at the expense of investing in new sensors. This budgetary restraint can lead to delays in upgrading sensor capabilities and may limit the acquisition of the latest sensor technologies.

Moreover, export control regulations can pose significant challenges for international sales and collaboration. Many countries have strict export controls in place to protect sensitive defense technologies. These regulations restrict the transfer of military sensor technology to foreign nations, particularly those in regions of geopolitical concern. This can hinder the international expansion of military sensor manufacturers and limit their access to a broader customer base, thus constraining market demand. As a result, companies must navigate complex regulatory processes to gain approval for international sales, which can be time-consuming and expensive. These challenges can deter potential customers and hinder market growth, particularly in the global defense sector.

Integration with unmanned systems, artificial intelligence and machine learning

Integrating military sensors with unmanned systems, artificial intelligence (AI), and machine learning has become a game-changer in the defense sector, significantly surging the demand for these sensors. Unmanned systems such as drones and autonomous vehicles rely heavily on sensors to gather critical data and enable autonomous decision-making.

Military sensors equip these platforms with advanced situational awareness, enhancing their surveillance, reconnaissance, and target-tracking capabilities. This integration is particularly valuable in intelligence, surveillance, and reconnaissance (ISR) missions, where unmanned systems equipped with sensors can operate in hostile or hard-to-reach environments without exposing human personnel to potential risks.

Furthermore, AI and machine learning algorithms are revolutionizing data analysis and interpretation, making military sensors more intelligent and responsive. These technologies can rapidly process vast datasets, identify patterns, and predict potential threats or anomalies. They enable real-time data fusion from multiple sensor sources, enhancing the accuracy of threat detection and reducing false alarms.

As a result, defense forces are increasingly adopting AI and machine learning-integrated sensor systems to make data-driven decisions, streamline operations, and respond effectively to evolving security challenges. This surge in demand for military sensors is driven by the compelling advantages of improved accuracy, faster decision-making, and enhanced overall situational awareness achieved through this integration.

Impacts of COVID-19

The COVID-19 pandemic has had a notable impact on the military sensors market. At the onset of the pandemic, many defense agencies experienced disruptions in their procurement and modernization programs due to lockdowns, supply chain interruptions, and budget reallocations to address immediate healthcare needs. This led to delays in planned sensor acquisitions and deployments.

Additionally, the pandemic underscored the importance of remote capabilities and unmanned systems, accelerating the development and deployment of autonomous military sensor platforms. The need for contactless and remotely operated solutions became more evident, which influenced the market's direction.

On the economic front, the pandemic's financial repercussions have led to budget constraints in many countries, impacting the funding available for military sensor programs. Despite these challenges, the long-term importance of advanced sensors in enhancing military capabilities and maintaining national security has remained intact, with many defense agencies looking to invest in modernized sensor technologies as a strategic response to evolving security threats.

According to the platform, the land segment has held 40% revenue share in 2023. Land-based military sensors are integral components of modern warfare, providing crucial intelligence, surveillance, and reconnaissance (ISR) capabilities. These sensors are deployed on various platforms, including ground vehicles, fixed installations, and soldier-wearable systems. A trend in this segment is the increasing focus on miniaturization and the integration of sensors into soldier equipment, enhancing individual situational awareness on the battlefield. Furthermore, data fusion and artificial intelligence play a growing role in processing the information gathered by land-based sensors, enabling more effective threat detection and decision-making.

The airborne segment is anticipated to expand at a significantly CAGR of 8.2% during the projected period. Airborne military sensors are pivotal for aerial reconnaissance, target identification, and threat detection. Drones and manned aircraft are equipped with advanced sensors, including radar, electro-optical, and infrared systems. A significant trend in this category is the integration of these sensors into unmanned and autonomous systems, improving the efficiency of reconnaissance and data collection. Additionally, advancements in synthetic aperture radar (SAR) and electronic warfare sensors are enhancing the capabilities of airborne platforms, providing more comprehensive intelligence for military operations.

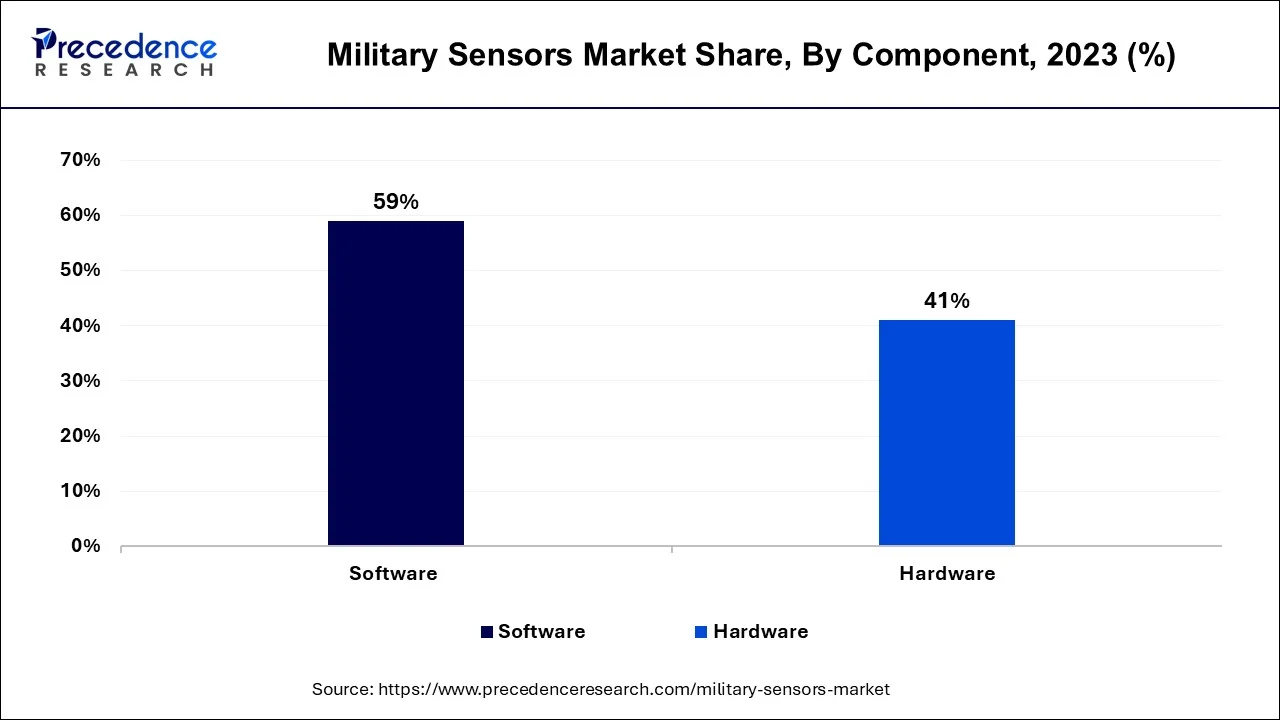

Based on the component, the software segment is anticipated to hold the largest market share of 59% in 2023. In the military sensors market, software plays a critical role in processing, analyzing, and interpreting the vast amount of data collected by various sensor systems. Advanced software solutions enable real-time threat assessment, data fusion from multiple sensors, and enhanced situational awareness. The trend in military sensor software involves the integration of artificial intelligence and machine learning algorithms for more accurate target recognition and reduced false alarms. Cybersecurity is another key focus, as the protection of sensor data and system integrity is of paramount importance, especially in an era of increasing cyber threats.

On the other hand, the hardware segment is projected to grow at the fastest rate over the projected period. Hardware in the military sensors market refers to the physical components of sensor systems, including the sensors themselves, signal processors, and data transmission equipment. In the military sensors market, hardware trends are primarily focused on two key aspects. The first trend emphasizes miniaturization and lightweight design, allowing sensors to be deployed on smaller, more agile platforms such as drones and unmanned vehicles. This miniaturization enables increased mobility and versatility in military operations.

Emerging hardware trends also include the development of multi-sensor platforms that offer versatility and multi-functionality in a single package, reducing the need for multiple standalone sensor systems. Moreover, it enhances the durability and resilience of hardware components to ensure they can withstand the demanding conditions of military use, including extreme environmental factors. This focus ensures that sensors can perform reliably in challenging terrains and adverse weather conditions, contributing to their effectiveness and longevity in the field.

In 2023, the communication and navigation segment had the highest market share of 42% on the basis of the application. Military sensors play a vital role in communication and navigation applications. They facilitate secure and efficient data transfer and positioning for troops and military vehicles. Advanced GPS systems, satellite communication sensors, and secure data links are employed for real-time information sharing, enhancing situational awareness.

In recent trends, there is a growing emphasis on anti-jamming and anti-spoofing technologies to protect communication and navigation systems from hostile interference. The integration of sensors with artificial intelligence (AI) also allows for autonomous navigation and communication capabilities, reducing the reliance on external networks and ensuring operational continuity in challenging environments.

The combat operations segment is anticipated to expand fastest over the projected period. In combat operations, military sensors are integral for threat detection, target acquisition, and battlefield surveillance. These sensors encompass a wide range, including radar systems, infrared sensors, and acoustic devices. Recent trends point towards the development of multi-sensor fusion technologies to provide a comprehensive picture of the battlefield.

Moreover, there is a focus on miniaturization to enable sensors to be deployed on unmanned platforms, increasing reconnaissance capabilities while reducing risks to human soldiers. Enhanced sensor data processing through AI and machine learning is another notable trend, allowing for faster and more accurate threat identification and response in combat scenarios.

Segments Covered in the Report

By Platform

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

July 2024

August 2024