April 2025

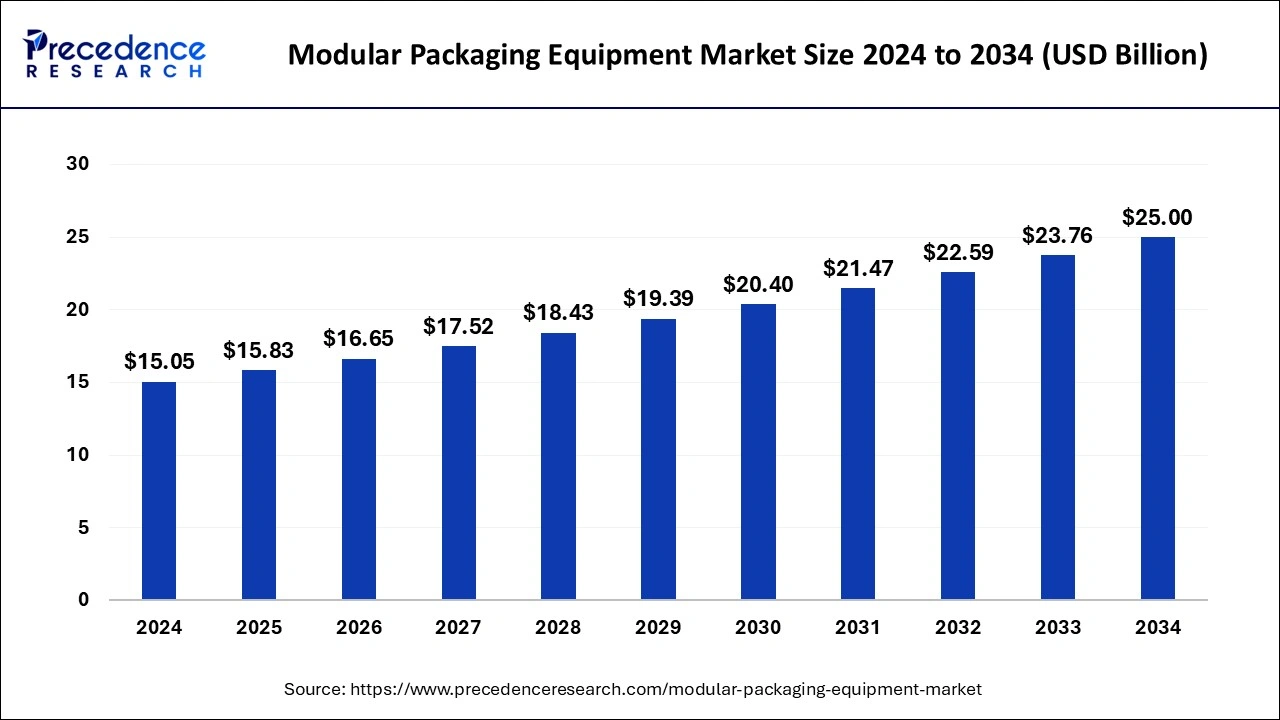

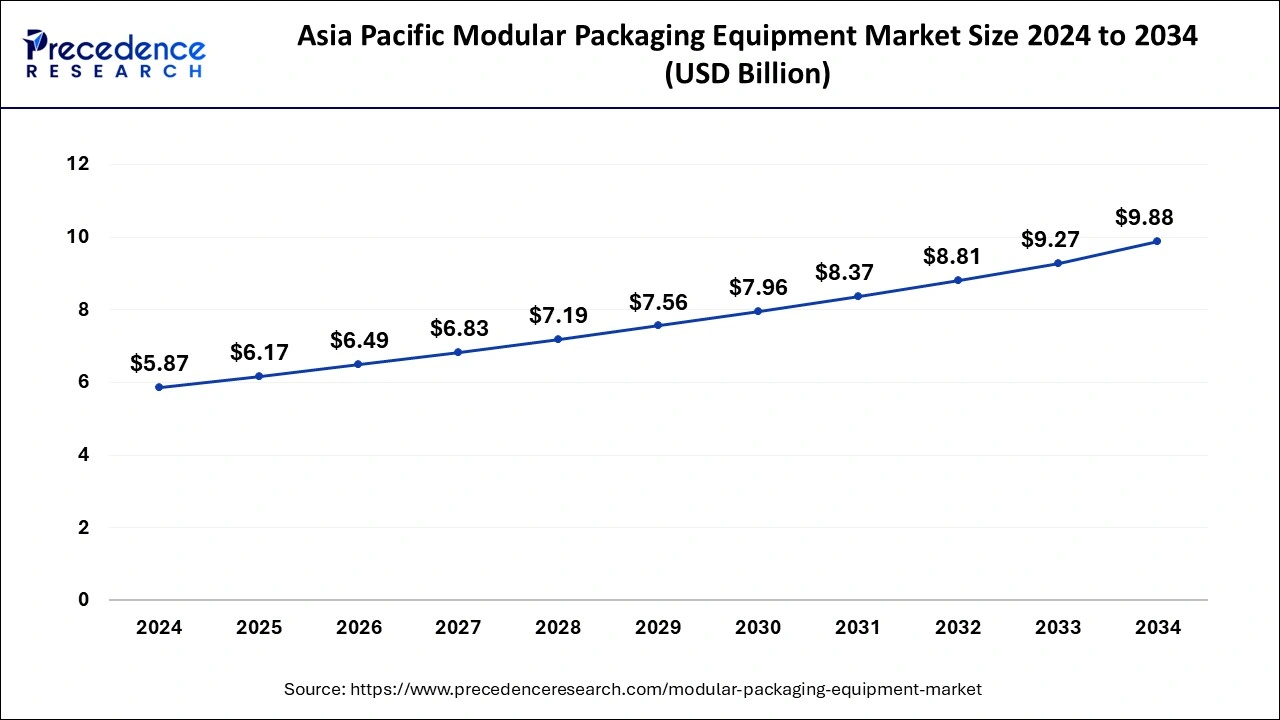

The global modular packaging equipment market size is calculated at USD 15.83 billion in 2025 and is forecasted to reach around USD 25.00 billion by 2034, accelerating at a CAGR of 5.21% from 2025 to 2034. The Asia Pacific market size surpassed USD 5.87 billion in 2024 and is expanding at a CAGR of 5.34% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global modular packaging equipment market size accounted for USD 15.05 billion in 2024 and is expected to exceed around USD 25.00 billion by 2034, growing at a CAGR of 5.21% from 2025 to 2034. The key factor driving the modular packaging equipment market growth is the rising focus on efficiency and flexibility in manufacturing processes. Also, advancements in technology coupled with the increasing emphasis on sustainability can fuel market growth soon.

Artificial Intelligence is the authentic tech to guide the way for the new revolution in the modular packaging equipment market, from manufacturing to packaging to distribution. Rising industry demand for sustainable and paper-based packaging materials, along with eco-friendly consumer goods and services, are key contributors to the adoption of AI in this industry. Furthermore, AI can enhance business processes and workflows in no time.

The Asia Pacific Modular Packaging Equipment market size was exhibited at USD 5.87 billion in 2024 and is projected to be worth around USD 9.88 billion by 2034, growing at a CAGR of 5.34% from 2025 to 2034.

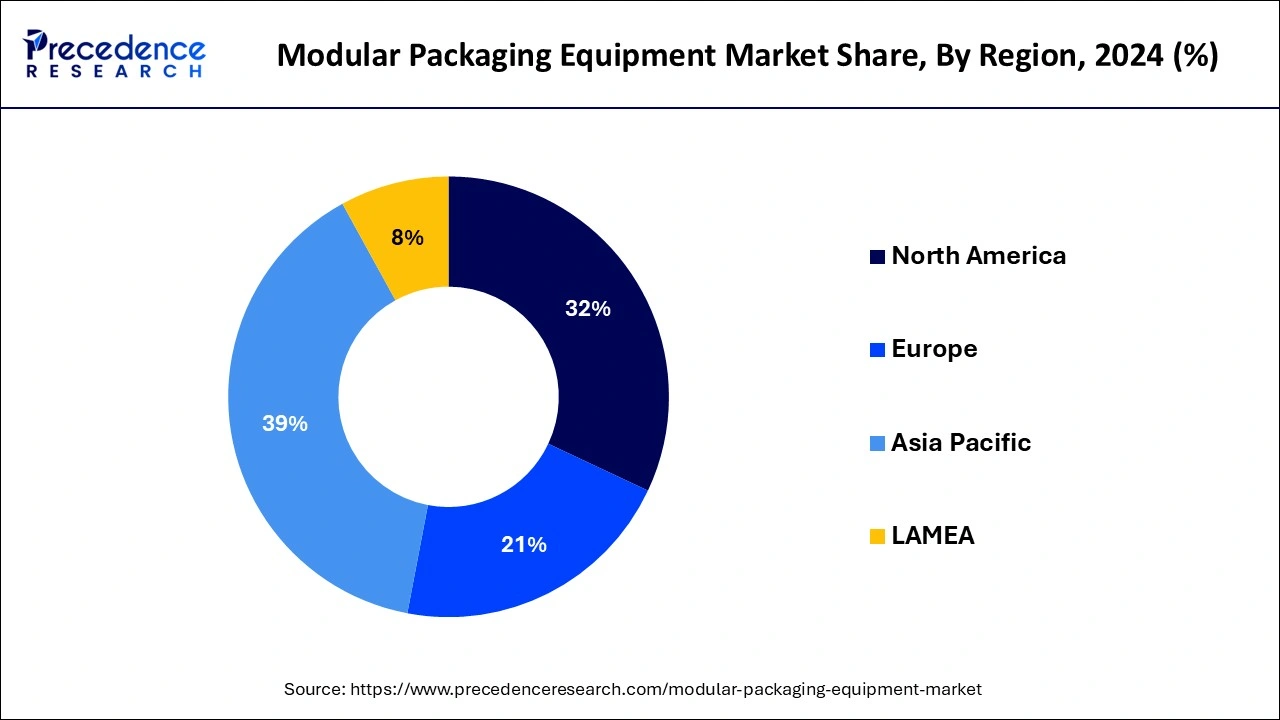

Asia Pacific dominated the modular packaging equipment market in 2024. The growth of the region can be credited to the increasing population and rising consumer purchasing power owing to the high population. Furthermore, in North America, the U.S. led the market due to the strong presence of many multinational food processing companies, which in turn resulted in the growing demand for packaging machinery.

North America is expected to show the fastest growth over the studied period. The dominance of the region can be attributed to the surge in the growth of the e-commerce industry along with the growth in online shopping. Furthermore, companies are confronting growing pressure to fulfill the consumer demand for secure, fast, and cost-effective packaging. Hence, these packaging systems are important in fulfilling these demands as they provide flexibility to pack an extensive range of products.

Modular systems are adaptable systems that enable organizations to rapidly reconfigure their lines of packaging to accommodate production volumes, package sizes, and different products. This factor is especially important for markets like pharmaceuticals, food and beverage, and personal care, where changes in consumer desire with rapid product launches need responses. The modular packaging equipment market offers high scalability, which enables producers to adjust to fluctuations in demand.

| Report Coverage | Details |

| Market Size by 2024 | USD 15.05 Billion |

| Market Size in 2025 | USD 15.83 Billion |

| Market Size in 2034 | USD 25.00 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.21% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Automation level, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing incorporation of automated technologies

The packaging industry, especially food packaging, is bound to stringent government regulations to maintain a hygienic and safe environment in the food packaging process. Also, governments across the globe are deploying many strict laws and regulations regarding food equipment safety and hygiene because of the increasing issues of food-borne disorders. All these regulations will force modular packaging equipment market players to install safe and hygienic food equipment further.

High initial cost

The high initial costs associated with innovative packaging machines are challenging for small market players to afford, which constrained the modular packaging equipment market growth. The rising competition among market players creates a harsh business scenario, which can impact the overall profit rate. Moreover, modular packaging equipment manufacturing requires a big factory setup that can further add to the market cost.

The surge in the number of e-commerce platforms

The tremendous growth of various e-commerce platforms is an important factor fuelling the requirement for the modular packaging equipment market. Online shopping practices are becoming pervasive, which results in the growing demand for packaging solutions that can safeguard products during transportation. Furthermore, automation within this modular packaging equipment optimizes the whole packaging process smoothly.

The primary packaging equipment segment dominated the modular packaging equipment market in 2024. The dominance of the segment can be attributed to the growing consumer preferences for individualized and advanced packaging solutions. As consumers are increasingly seeking personalized and unique products, market players are searching for new ways to provide a wide range of consumer-specific packaging solutions.

The secondary packaging equipment segment is expected to grow at the fastest rate in the modular packaging equipment market over the forecast period. The secondary packaging solutions safeguard the product during the transportation and distribution process. This packaging type enables easy stacking, handling, and storage of multiple units, which makes logistics and transportation more efficient and organized.

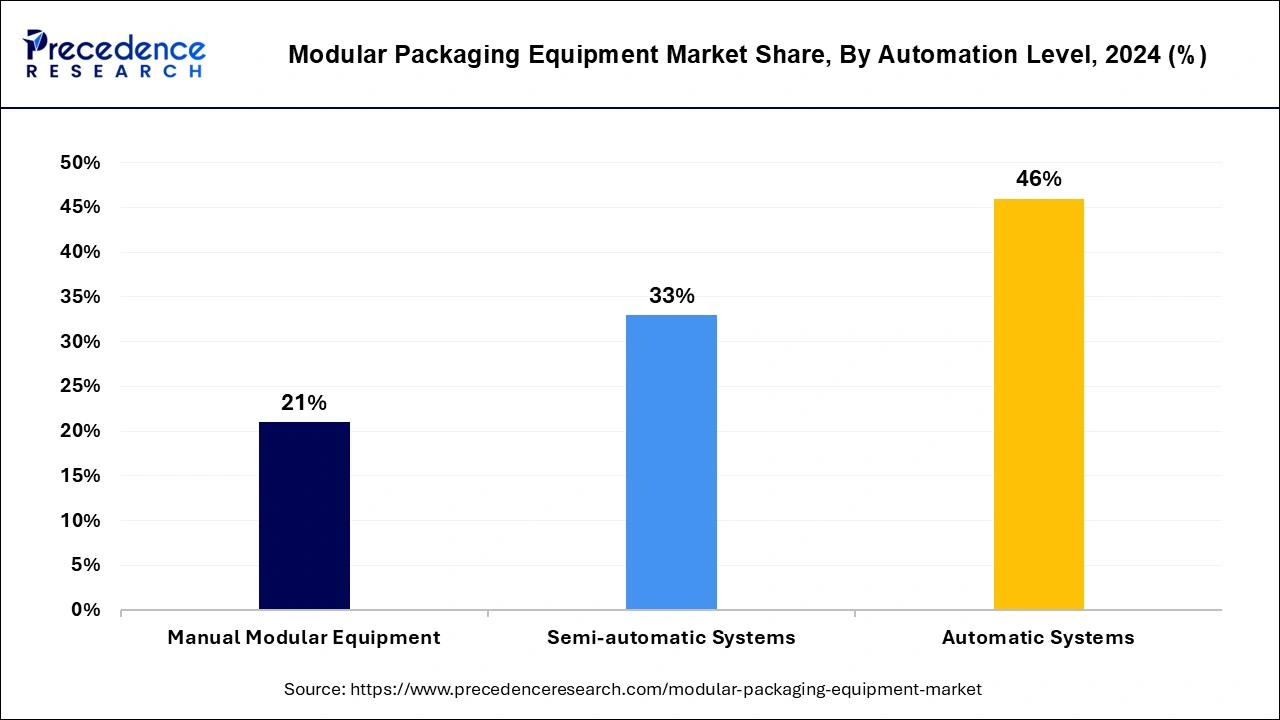

The automatic segment led the global modular packaging equipment market in 2024. The dominance of the segment can be linked to the growing demand for automatic equipment in industries that require high-speed packaging and large-scale production. Industries such as pharmaceuticals, food and beverage, and consumer electronics need large-scale packaging solutions that can monitor huge quantities of products with less or no human intervention. Additionally, this system can substantially raise production speed, enabling efficient packaging operations that are important for mass production.

The semi-automatic segment is expected to grow at the fastest rate in the modular packaging equipment market over the projected period. The growth of the segment can be driven by fewer labor costs required to maintain high-quality output. This system is also less expensive to deploy as compared to other systems. However, a semi-automated system can decrease factory lead times offer faster ROI, and increase production output.

By Type

By Automation Level

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

March 2025