January 2025

Packaging Machinery Market (By Machine-type: Filling, Labeling, Form-Fill-Seal, Cartoning, Wrapping, Palletizing, Bottling Line, Others; By End-user: Beverages, Food, Chemicals, Personal Care, Pharmaceuticals, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

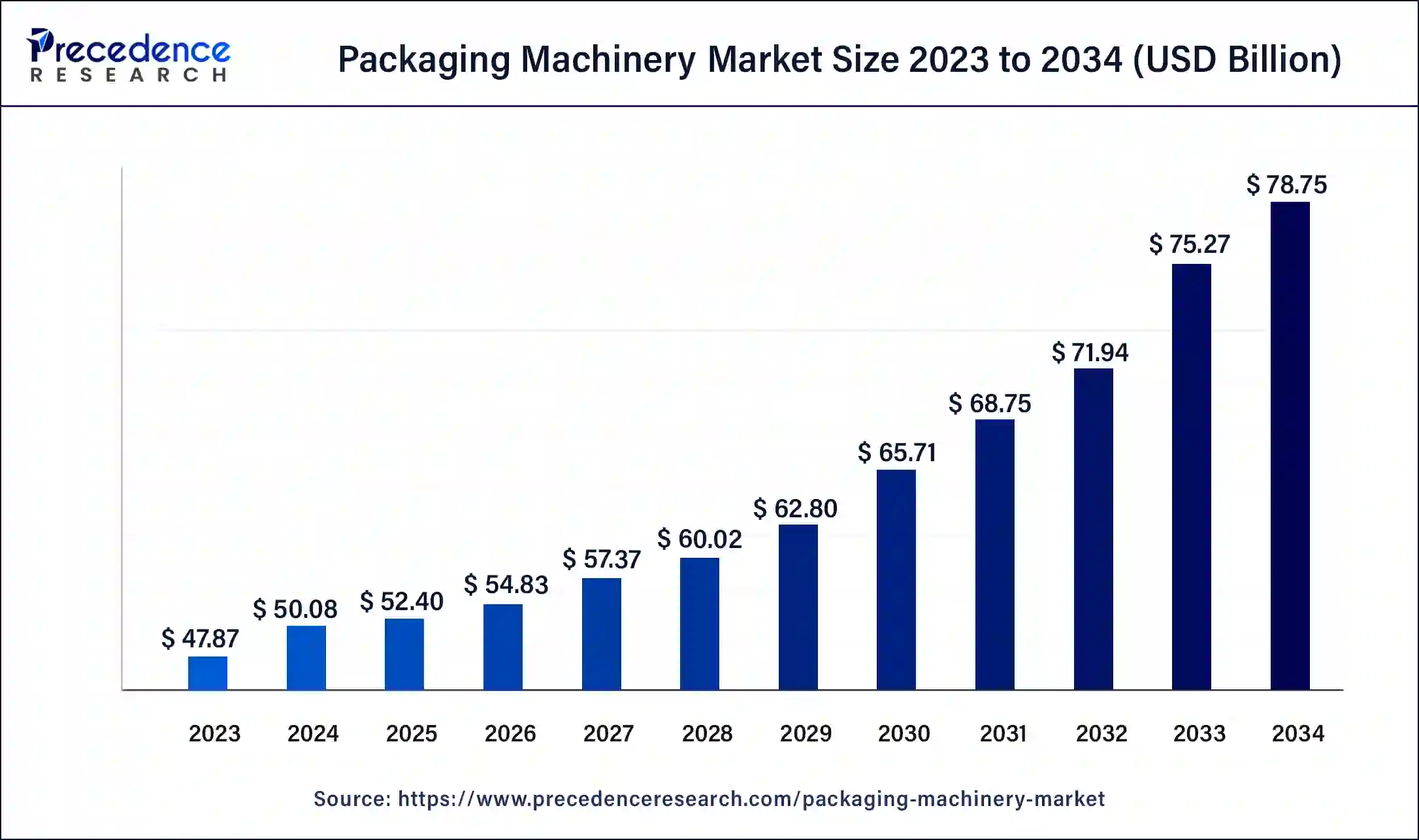

The global packaging machinery market size was USD 47.87 billion in 2023, calculated at USD 50.08 billion in 2024 and is expected to reach around USD 78.75 billion by 2034, expanding at a CAGR of 4.63% from 2024 to 2034. The rise in e-commerce is contributing towards the market growth.

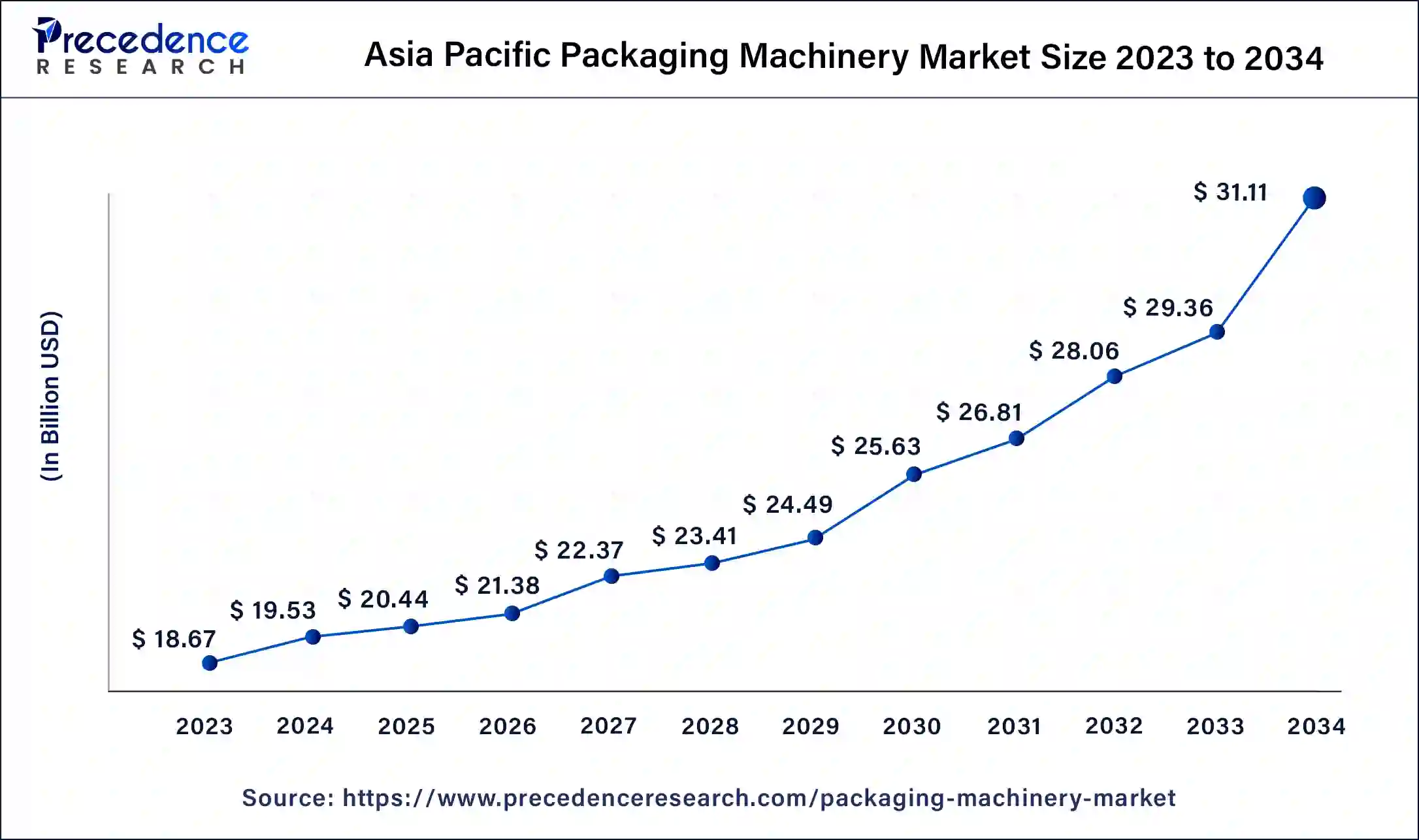

The Asia Pacific packaging machinery market size was exhibited at USD 18.67 billion in 2023 and is projected to be worth around USD 31.11 billion by 2034, poised to grow at a CAGR of 4.75% from 2024 to 2034.

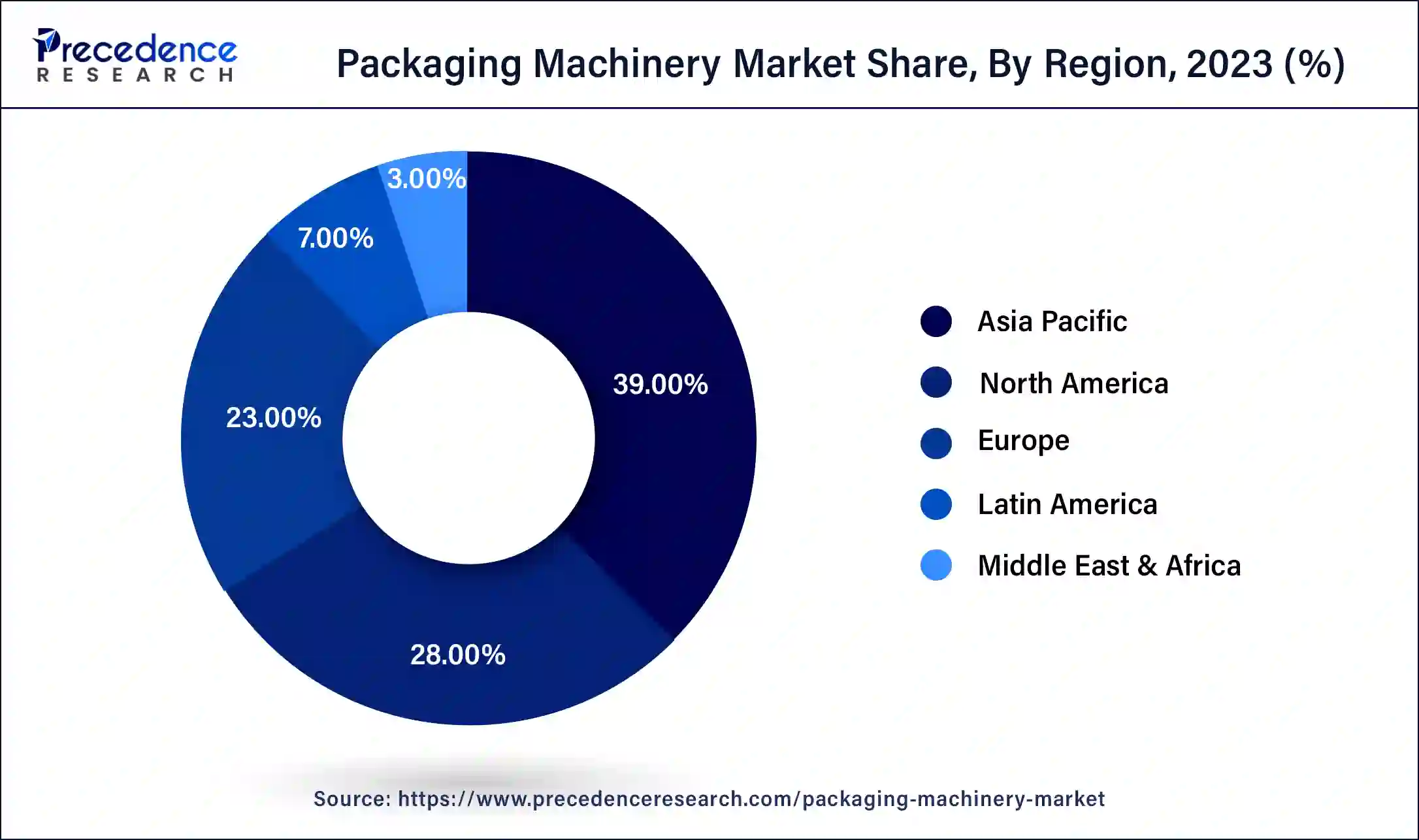

Asia Pacific dominated the global packaging machinery market with the largest share in 2023. The region is observed to sustain the position throughout the forecast period. The rapid increase in the production of packaged goods and items due to increasing e-commerce has led to increasing demand for these machineries. Countries like India and China are witnessing rapid urbanization which increases the demand for packaging machinery in the food and pharmaceutical industry. This expands the manufacturing services in this region which is boosting the growth of the packaging machinery market.

North America is anticipated to register the fastest growth during the forecast period. The reason behind the dominance of North America is their focus on the expansion of healthcare facilities. The regulations in countries like the United States and Canada demand a sustainable and large production of packages which increases the requirement for advanced packaging machinery. This region is one of the largest consumers in packaged foods which has created many opportunities for packaging machinery manufacturing to mark their significance in the market.

Packaging machinery is the equipment used to pack components or products. These machines usually fill, wrap, label, and seal the products. Packaging machinery is mostly required in industries like food, beverage, pharmaceutical, consumer goods and many more. These products are transported to various places which require enhanced packaging of the product. The packaging machinery market has grown significantly due to the increasing demand for enhanced packaging in various industries like the food and pharmaceutical industry. The increasing demand in these industries will improve the significance of packaging machinery in other markets too. The rising trend for global sustainability is also raising the sales of packaging machinery.

| Report Coverage | Details |

| Market Size by 2034 | USD 78.75 Billion |

| Market Size in 2023 | USD 47.87 Billion |

| Market Size in 2024 | USD 50.08 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.63% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Machine-type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

E-commerce expansion

E-commerce has witnessed huge growth in recent years due to the demand for secure packaging. The increasing number of individuals opting for online shopping from various platforms increases packaging standards. The trend of faster delivery among various e-commerce platforms leads to increasing consumer reliability while shopping compared to the traditional way. This has had a significant and positive impact on the packaging machinery market. Additionally, the increasing efficiency and sustainability in the packaging industry is observed to act as a driver for the packaging machinery market.

Rapid Urbanization

The rapid shift in urbanization and busy schedules has led to many changes in the overall lifestyles. The consumer preference for packaged food items has increased which reduces their time for meal preparations. Therefore, many companies are focusing on developing healthy snacks and beverages which maintain health factors and attract a larger audience. These factors lead to increasing investments in the packaging infrastructure which boosts the adoption of packaging machinery, leading to the increasing growth of the packaging machinery market.

Higher Cost

The higher initial costs of advanced packaging machines are difficult for small companies to afford, and this restrains the growth of the packaging machinery market among new market companies. The increasing market competition also creates a tough business environment which may decrease the profit rate. Increasing the manufacturing of these machines in developing areas might help in reducing the purchasing or hiring costs which might help towards the growth of the packaging machinery market

Technological Advancements

The emergence of technologies like artificial intelligence (AI) and machine learning (ML) are leading to many changes in various industries. These technologies improve the overall functioning of the machines, which reduces overall costs associated with production. Robotics are also being implemented in the packaging sector where they are assigned tasks like picking and sorting things. Smart packaging is also gaining importance due to the emergence of these technologies. Blockchain technology is also expected to boost reliability due to its various facilities for tracking and verifying the products. These ongoing technological advancements in the packaging industry help extend the shelf life of the products which will boost the growth of the packaging machinery market.

Rising Emphasis over Sustainable Packaging

The rising environmental awareness is also shifting the consumer preference for eco-friendly packed items. Governments and organizations are also implementing regulations to reduce the waste generated from these packages. It can also help in reducing costs by eliminating the need for waste management. Companies are focused on using recyclable materials which meet the regulations associated with sustainable packaging. This also influences the new emerging companies to opt for eco-friendly packaging solutions which will help them in setting their brand image.

The filling segment dominated the packaging machinery market in 2023. These machines are used for filling liquids like bottles or cold drinks into containers. These machines are popularly used in the beverage and pharmaceutical industries as they offer multiple facilities to cater demands of various products. The ongoing trend for sustainable and hygienic packaging is driving the demand for packaging machines. The integration of advanced technologies into the filling machines for packaging has reduced the labor efforts and time required for the overall processes. These machines are extremely prominent for reliability as they have higher accuracy and maintain product quality. The increasing need for packages is driving the growth of the packaging machinery market.

The form-fill-seal segment is expected to register the fastest growth during the forecast period in the packaging machinery market. The task of these machines is to form, fill and seal the packages in a continuous process. Products like snacks, cookies, medical devices and many more are packed using this machinery. Multiple tasks performed by this machinery help in reducing the manufacturing and overall costs of the product. The increasing demand for packed food products due to the on-the-go preference of consumers is raising the need for this machinery. This machinery helps cater for the current market trends which significantly contributes toward the growth of the packaging machinery market.

The food segment was dominant with the largest shares in 2023. This industry has played a vital role in the development of the packaging machinery market due to the high demand for packaged foods globally. The advancement in machinery also helps various food items of various types, this helps the companies to match the demand by implementing the use of various machines for packaging. Adoption of these machines in the food sector also reduces the labour cost and provides accuracy in the work. The increasing expansion of online delivery of packaged food items is expected to boost the growth of the packaging machinery market.

The pharmaceutical segment is expected to register a notable growth during the forecast period 2024 to 2033. The increasing health problems in various countries are leading towards the expansion of secured packaging in the pharmaceutical industry. Medicines and injections which are sensitive require enhanced packaging, which increases the need for secure packaging. Many new innovative medical drugs are being specially packaged to ensure their safety. The growing demand in the pharmaceutical sector is expected to drive the growth of the packaging machinery market in the upcoming years.

Segments covered in the report

By Machine-type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025