January 2025

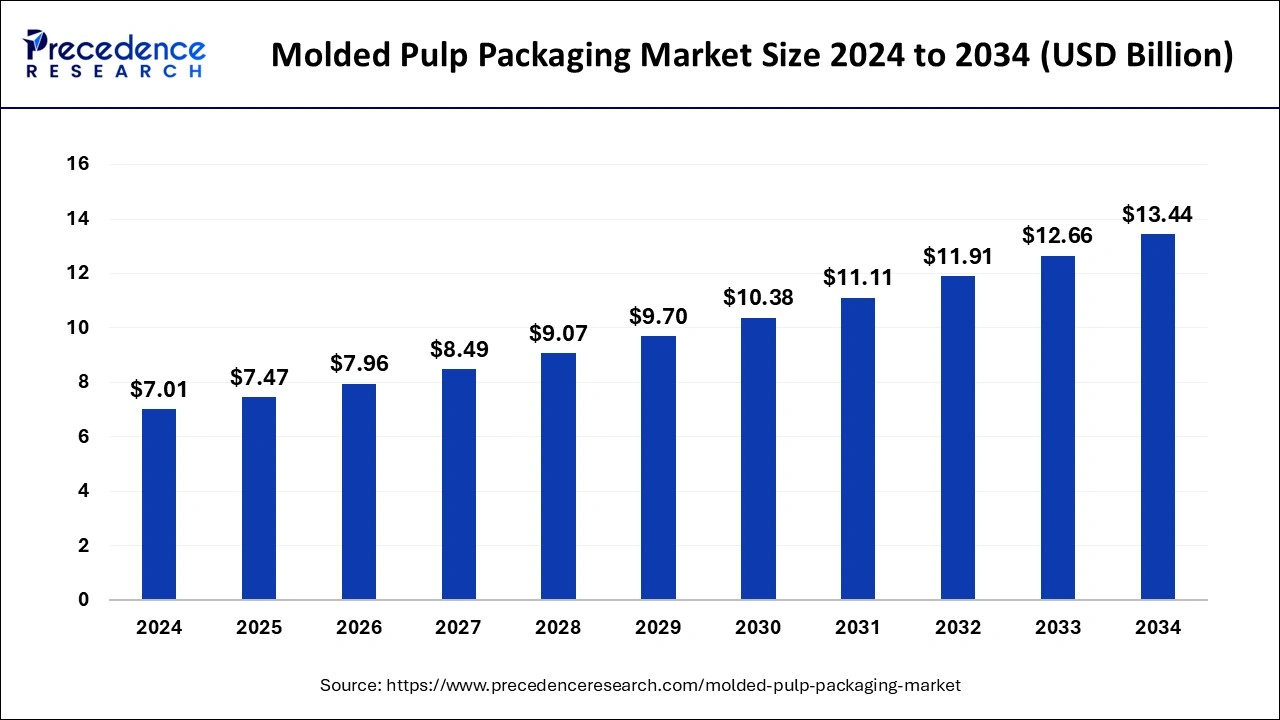

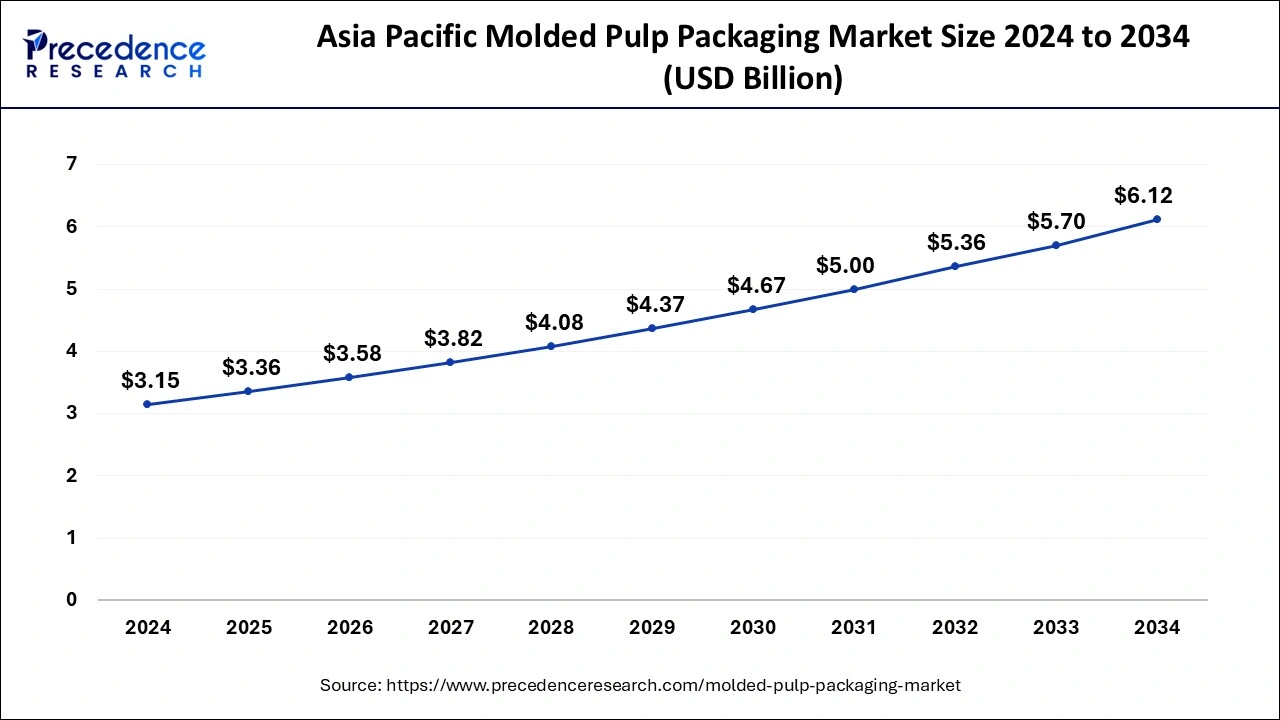

The global molded pulp packaging market size is calculated at USD 7.47 billion in 2025 and is forecasted to reach around USD 13.44 billion by 2034, accelerating at a CAGR of 6.73% from 2025 to 2034. The Asia Pacific molded pulp packaging market size surpassed USD 3.36 billion in 2025 and is expanding at a CAGR of 6.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global molded pulp packaging market size was estimated at USD 7.01 billion in 2024 and is predicted to increase from USD 7.47 billion in 2025 to approximately USD 13.44 billion by 2034, expanding at a CAGR of 6.73% from 2025 to 2034.

The Asia Pacific molded pulp packaging market size was valued at USD 3.15 billion in 2024 and is expected to grow to USD 6.12 billion by 2034, growing at a CAGR of 6.87% from 2025 to 2034.

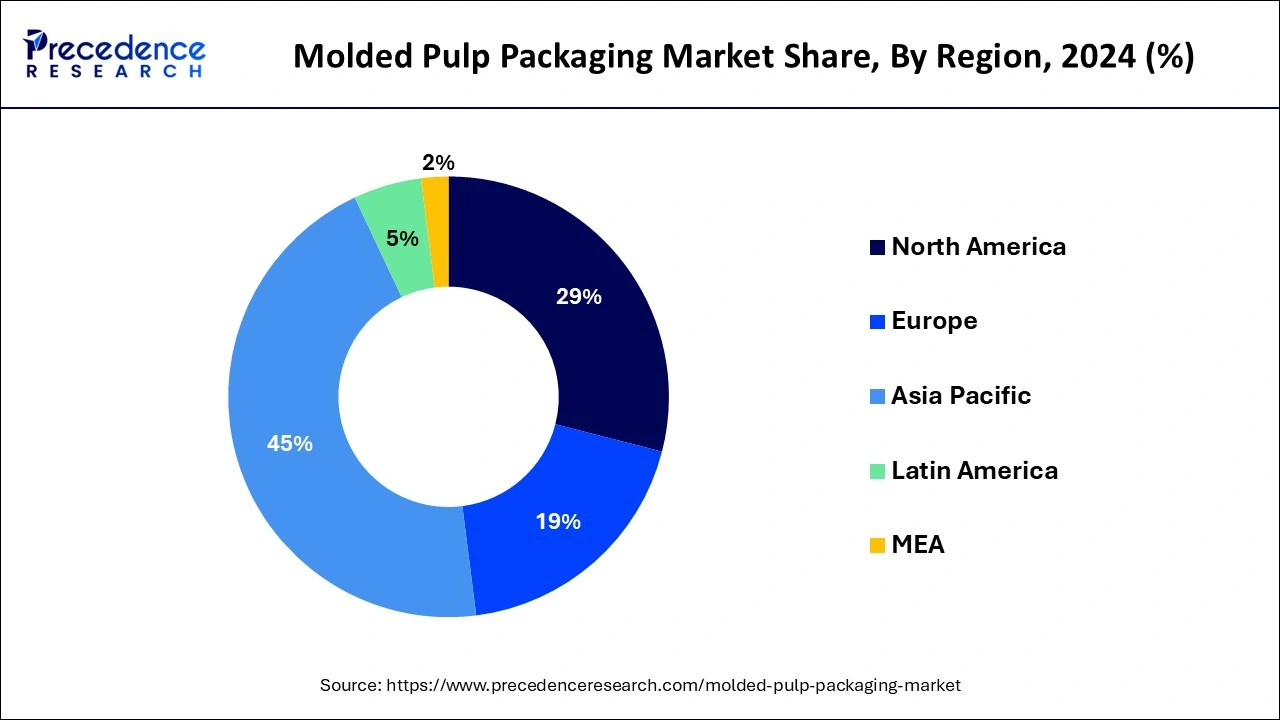

Asia-Pacific held the largest revenue share of 45% in 2024. The Asia-Pacific region is experiencing robust growth in the molded pulp packaging market. Rapid urbanization, a burgeoning middle class, and changing consumer preferences are driving the demand for eco-friendly packaging. The region's strong manufacturing and export sectors further boost the adoption of molded pulp for protecting products during transit. Additionally, innovation in material sourcing and production techniques is making molded pulp packaging more affordable, attracting businesses across various industries. Asia-Pacific's increasing focus on sustainability and the circular economy is set to further accelerate the growth of molded pulp packaging in the region.

Europe is estimated to observe the fastest expansion In the European molded pulp packaging market, sustainability and eco-friendliness are the dominant trends. European consumers and businesses are placing a strong emphasis on environmentally responsible packaging solutions. The molded pulp, with its recyclability, biodegradability, and minimal environmental impact, aligns perfectly with these preferences.

As regulations and policies promoting sustainable packaging practices gain traction, molded pulp is becoming increasingly popular across various industries, including food and beverage, electronics, and healthcare. Europe's commitment to reducing its carbon footprint and promoting circular economy principles continues to drive the growth of molded pulp packaging in the region.

In North America, the molded pulp packaging market is witnessing several notable trends. One of the prominent drivers is the growing awareness of sustainability and environmental responsibility. Consumers and businesses are increasingly favoring eco-friendly packaging solutions, propelling the demand for molded pulp. Additionally, the expansion of e-commerce, particularly during the pandemic, has led to a surge in the use of molded pulp for protective and sustainable packaging in this region. Customization and design innovations are also gaining momentum as companies seek to create unique packaging experiences.

Molded pulp packaging is an environmentally friendly and sustainable packaging material made from recycled paper, cardboard, or other natural fibers. It is created by mixing these fibers with water and forming them into various shapes and sizes using molds and heat. Molded pulp, once dried and solidified, transforms into a rigid and protective packaging material extensively employed for a diverse array of products, spanning electronics, fragile items, foodstuffs, and cosmetics.

Its standout feature lies in its exceptional cushioning abilities and shock-absorbing characteristics, rendering it a top choice for safeguarding delicate items throughout the shipping and transportation process. What sets molded pulp apart is its environmentally responsible nature as it is fully biodegradable, compostable, and recyclable. This aligns seamlessly with the escalating global preference for eco-friendly packaging solutions across various sectors.

Molded pulp packaging has emerged as a sustainable and environmentally responsible packaging solution, leveraging recycled paper materials to create rigid and protective packaging. Molded pulp packaging, known for its versatility, is widely employed in diverse product categories, encompassing electronics, delicate items, food products, and cosmetics. Its standout attribute lies in its exceptional ability to provide cushioning and absorb shocks, rendering it a preferred choice for ensuring the safe transportation of fragile goods. Sets molded pulp apart is its eco-friendliness, as it is biodegradable, compostable, and recyclable.

As the world places a growing emphasis on sustainability, molded pulp packaging aligns perfectly with the increasing demand for eco-friendly packaging options. Two primary factors are driving the growth of the molded pulp packaging market. Firstly, there's a global focus on sustainability and reducing the environmental footprint of packaging materials. Molded pulp's recyclability and biodegradability position it as a sustainable alternative to conventional materials. Secondly, its exceptional protective qualities make it indispensable for ensuring the safe transport of fragile and sensitive products.

The molded pulp packaging market is witnessing several notable trends. Customization and design innovations are on the rise, allowing brands to create packaging that aligns with their identity and appeals to consumers. Furthermore, the rapid growth of e-commerce has bolstered the demand for protective and sustainable packaging materials, making molded pulp an attractive choice.

One challenge faced by the molded pulp industry is the cost factor. While it offers significant benefits, the production of molded pulp packaging can be costlier upfront than some other materials, which can be a deterrent for price-sensitive markets. Despite challenges, there are ample business opportunities in the molded pulp packaging market. Its diverse applications, including in industries such as electronics, healthcare, and automotive, offer room for expansion.

Innovations in material sourcing, focusing on obtaining recycled paper materials more efficiently, can help reduce production costs and enhance the affordability of molded pulp packaging, further driving its adoption. Overall, the market is poised for growth as it aligns with sustainability goals and addresses the evolving packaging needs of various industries.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | AGR of 6.73% |

| Market Size in 2025 | USD 7.47 Billion |

| Market Size by 2034 | USD 13.44 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Source, By Molded Type, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The molded pulp packaging market experiences a substantial surge in demand due to its superior protective properties and the thriving e-commerce boom. Firstly, molded pulp's exceptional cushioning and shock-absorbing capabilities make it an indispensable choice for safeguarding delicate and fragile products during transportation. As consumers increasingly rely on online shopping, ensuring the safe arrival of products at their doorsteps has become a top priority for businesses. Molded pulp's ability to absorb shocks and protect items from damage resonates perfectly with this need, making it a sought-after packaging material for e-commerce companies.

Moreover, the rapid growth of e-commerce, accelerated by the COVID-19 pandemic, has driven the need for protective and sustainable packaging materials. Molded pulp aligns seamlessly with these requirements, offering both eco-friendliness and product safety. As consumers become more environmentally conscious, e-commerce companies are seeking packaging solutions that not only protect their products but also reflect their commitment to sustainability. Consequently, the market experiences heightened demand as businesses recognize molded pulp's ability to cater to both protective and eco-friendly packaging needs in the booming e-commerce landscape.

Production costs and limited material sources

The molded pulp packaging market experiences surges in demand due to several factors, including production costs and limited material sources. First and foremost, as the world shifts its focus towards sustainable packaging solutions, the eco-friendly nature of molded pulp becomes a significant driver. The utilization of recycled paper materials in molded pulp packaging aligns seamlessly with sustainability objectives, effectively diminishing the ecological footprint associated with packaging. This eco-friendliness is further underscored by the packaging's inherent biodegradability and recyclability, rendering it a compelling and appealing choice for both businesses and environmentally conscious consumers.

Additionally, production costs and material source limitations play a role in driving market demand. While the initial costs of producing molded pulp packaging can be relatively higher compared to conventional materials, businesses increasingly recognize its long-term benefits. As economies of scale and production efficiencies improve, the cost gap narrows.

Furthermore, the limited availability of certain traditional packaging materials, driven by environmental concerns and regulatory restrictions, has led companies to seek alternative solutions like molded pulp. This creates a strategic advantage for the molded pulp industry, as it can offer a reliable and sustainable supply of materials to meet the evolving packaging needs of various industries, from electronics to healthcare and beyond.

Expanding applications and innovation in material sourcing

The expanding range of applications for molded pulp packaging is driving its increased demand. Originally known for its protective properties in industries such as electronics, molded pulp is now finding use in an ever-widening array of products. This includes delicate electronics, food and beverage items, cosmetics, pharmaceuticals, and even automotive components. Its versatility and ability to provide exceptional protection make it an attractive choice for industries that prioritize the safe transport of their products. As businesses discover the benefits of molded pulp across these diverse sectors, the demand for this sustainable packaging solution continues to rise.

Moreover, innovation in material sourcing plays a pivotal role in surging demand for molded pulp packaging. Efforts to obtain recycled paper materials more efficiently and cost-effectively are reducing production costs. Additionally, innovations in sourcing practices are enhancing the affordability of molded pulp packaging, making it a more competitive option in the market.

As material sourcing becomes more streamlined and sustainable, businesses are increasingly drawn to the eco-friendly and cost-effective attributes of molded pulp packaging, further fueling its demand across industries and applications. This synergy between expanding applications and innovative material sourcing is poised to continue driving the growth of the molded pulp packaging market.

According to the source, the wood pulp segment has held an 84% revenue share in 2024. Wood pulp, primarily derived from wood fibers, is a traditional and widely used source material in molded pulp packaging. It has been the basis of the molded pulp industry due to its abundant availability and suitability for the manufacturing process. Wood pulp's fibers are processed, mixed with water, and molded into various shapes to create protective and sustainable packaging solutions. The trend in the molded pulp packaging market concerning wood pulp is a growing emphasis on responsible sourcing, with manufacturers seeking sustainable forestry practices and certifications to ensure a long-term, eco-friendly supply of wood pulp.

The non-wood pulp segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. Non-wood pulp refers to alternative sources of pulp materials apart from wood fibers. This includes recycled paper, agricultural residues, and various plant-based fibers. The trend regarding non-wood pulp in the molded pulp packaging market is a rising interest in diversifying the source materials to reduce environmental impact. By incorporating non-wood pulp sources, manufacturers aim to enhance the sustainability credentials of molded pulp packaging and cater to the evolving demand for eco-friendly packaging solutions. These non-wood pulp materials offer opportunities for innovation and differentiation in the market, aligning with the broader trend of eco-consciousness and responsible sourcing.

Based on the Molded Type, the transfer molded segment held the largest market share of 61% in 2024. Transfer molded pulp packaging involves a manufacturing process where wet pulp is transferred into individual molds. The excess water is then drained, leaving behind the desired shape. This method is known for producing highly detailed and intricate designs, making it suitable for applications requiring aesthetic appeal and customization.

In the molded pulp packaging market, transfer molded products are witnessing a trend toward increased customization and design sophistication. Brands are leveraging the detailed capabilities of transfer molding to create unique and visually appealing packaging solutions, catering to consumer preferences and brand identity.

On the other hand, the thermoformed segment is projected to grow at the fastest rate over the projected period. Thermoformed molded pulp packaging involves a process where heat and pressure are applied to wet pulp to shape it into the desired form. This method is known for its efficiency and speed in producing large volumes of consistent packaging products. In recent years, thermoformed molded pulp packaging has gained traction due to its efficiency in mass production.

The trend is toward adopting thermoformed molded pulp solutions for high-volume applications, particularly in industries like food and beverage, where speed and scalability are paramount. Additionally, innovations in material sourcing and production technologies are enhancing the cost-effectiveness of thermoformed molded pulp packaging, making it a competitive choice in the market.

In 2024, the trays segment had the highest market share of 57% on the basis of the installation. Trays are a fundamental type of molded pulp packaging, offering a versatile and eco-friendly solution for various industries. They are characterized by their flat, shallow design, which provides a stable and organized platform for products. Trays are commonly used to hold and display items like fruits, electronics, cosmetics, and food products. One of the notable trends in molded pulp trays is the growing emphasis on customization and design. Brands and manufacturers are increasingly opting for trays that not only protect their products but also align with their brand aesthetics and consumer preferences. This trend has led to the development of uniquely shaped and styled trays that enhance the overall packaging experience.

The Clamshells is anticipated to expand at the fastest rate over the projected period. Clamshells represent a distinct category of molded pulp packaging known for their hinged, two-part design. These containers provide excellent visibility of the enclosed product while ensuring its protection during transportation and display. Clamshells are widely used for items such as electronics, small appliances, personal care products, and even food items like berries and baked goods.

In the molded pulp packaging market, a prominent trend for clamshells is the focus on product visibility and consumer convenience. Brands are opting for designs that showcase the enclosed product attractively while allowing consumers easy access. Additionally, clamshells are evolving to accommodate a broader range of products and are increasingly designed with sustainability in mind, aligning with the market's eco-friendly demands.

The Food packaging segment held the largest revenue share of 49% in 2024. Food packaging in the molded pulp packaging market refers to the use of molded pulp materials to protect and preserve various food items during storage and transportation. This application has gained prominence due to its eco-friendliness and ability to ensure food safety. A key trend in food packaging is the development of custom-shaped, biodegradable molded pulp trays and containers that enhance the presentation of fresh produce, eggs, and other perishables. Additionally, molded pulp's insulating properties make it ideal for takeaway containers, aligning with the growing demand for sustainable food service packaging.

The electronics packaging segment is anticipated to grow at a significantly faster rate, registering a CAGR of 8.6% over the predicted period. Electronics packaging in the molded pulp packaging market involves using molded pulp to safeguard electronic components and devices during shipping. A notable trend in this sector is the use of molded pulp trays designed to fit electronic devices precisely, reducing the need for additional packaging materials. This customization minimizes waste and enhances product presentation. Moreover, molded pulp's ability to absorb shocks and protect delicate electronics aligns with the rising demand for eco-friendly and secure packaging solutions in the electronics industry.

By Source

By Molded Type

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025