November 2024

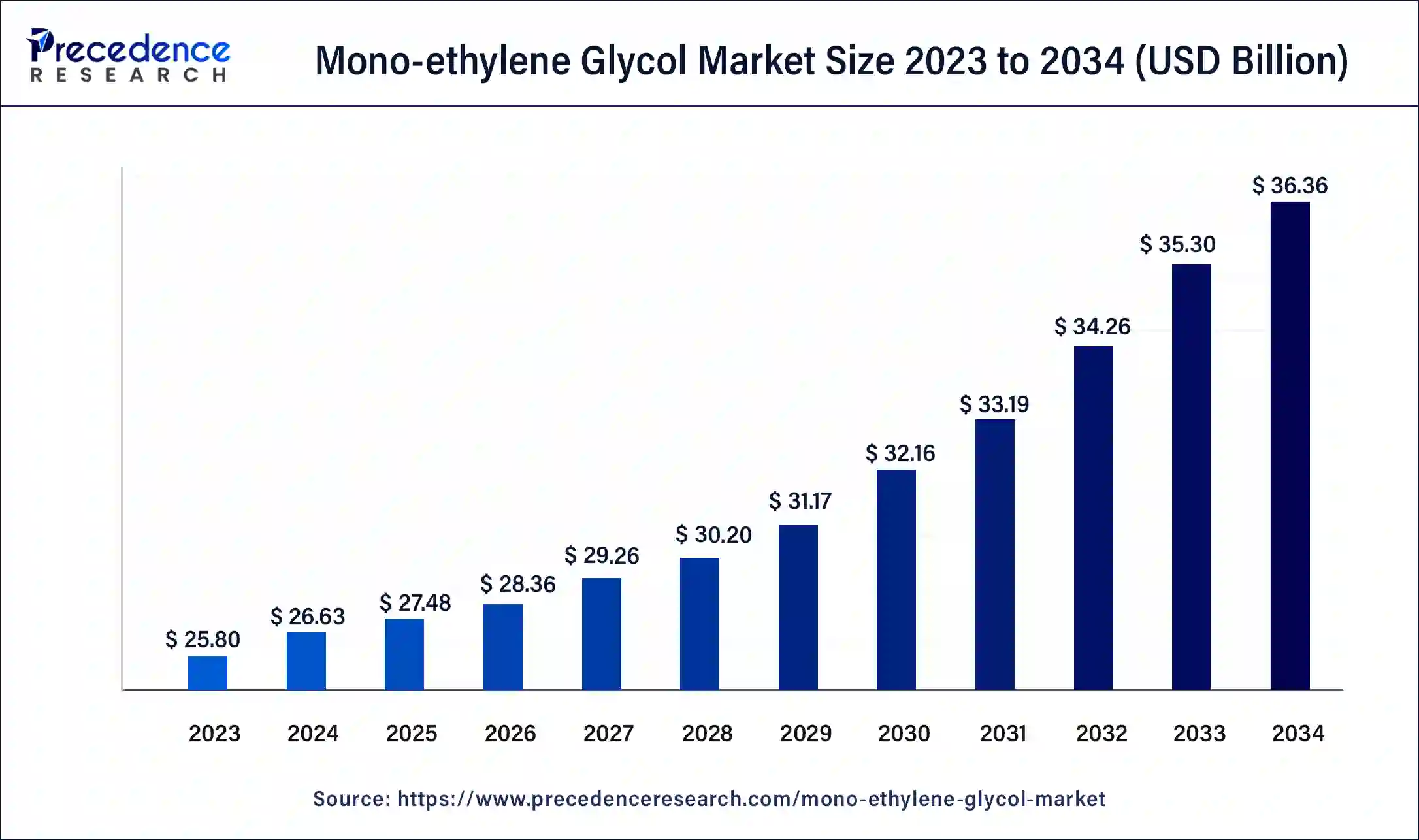

The global mono-ethylene glycol market size was USD 25.80 billion in 2023, estimated at USD 26.63 billion in 2024 and is anticipated to reach around USD 36.36 billion by 2034, expanding at a CAGR of 3% from 2024 to 2034.

The global mono-ethylene glycol market size accounted for USD 26.63 billion in 2024 and is predicted to reach around USD 36.36 billion by 2034, growing at a CAGR of 3% from 2024 to 2034.

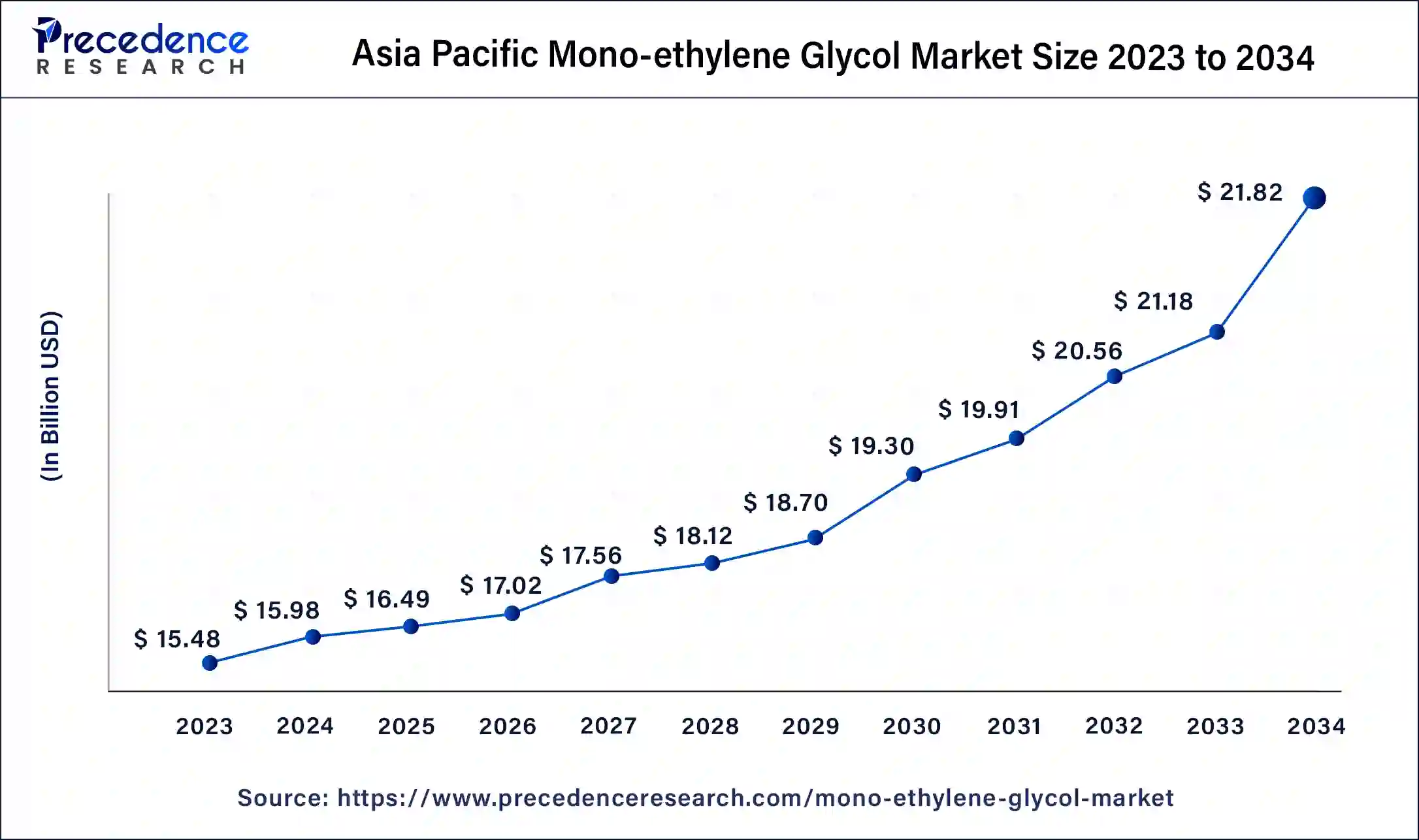

The Asia Pacific mono-ethylene glycol market size was valued at USD 15.48 billion in 2023 and is expected to be worth around USD 21.82 billion by 2034, at a CAGR of 3.16% from 2024 to 2034.

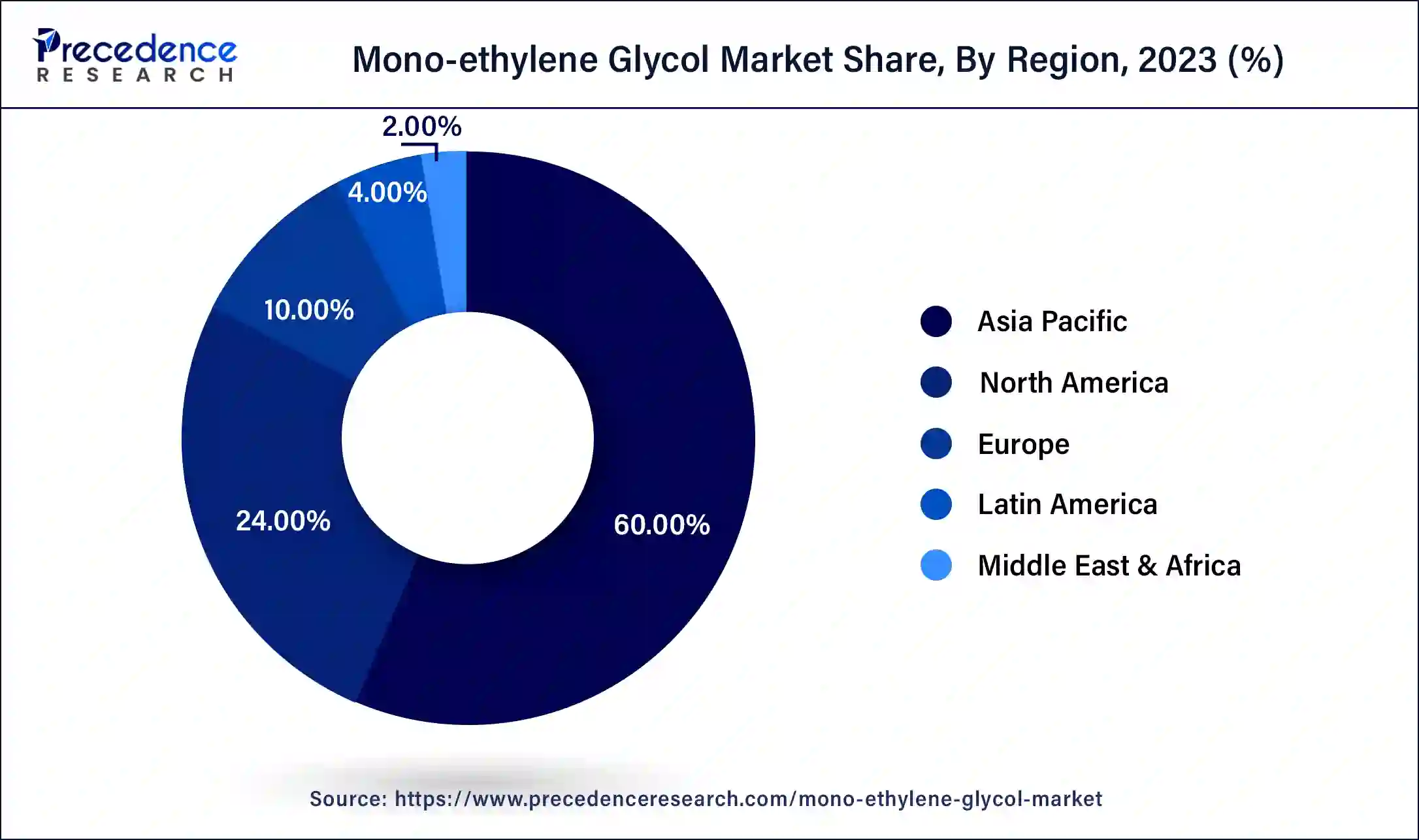

Asia-Pacific dominated the mono-ethylene glycol market in 2023. Several developments in the textile sector will be fueled by fast rising per capita income as well as improving economic conditions in the Asia-Pacific region.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The mono-ethylene glycol market in the Europe region is being driven by the increasing use of bio-polyethylene terephthalate (PET) in packaging industries due to environmental concerns.

The mono-ethylene glycol is primarily made by oxidizing ethylene in the presence of a silver oxide catalyst at a high temperature. Later, the ethylene oxide is hydrated to yield mono-ethylene glycol as well as di and tri ethylene glycols as by-products. The mono-ethylene glycol is an odorless and transparent liquid. The mono-ethylene glycol can be stored in stainless steel and aluminum as well as trucks and lorries. The polyester fibers, polyethylene terephthalate (PET) resins, and engine coolants all require mono-ethylene glycol as a component.

Due to its vast uses in a variety of end use sectors such as automotive, construction, consumer goods, pharmaceuticals, textile, and chemical processing, the global mono-ethylene glycol market is predicted to rise significantly throughout the forecast period. The rising production of mono-ethylene glycol has resulted from increased demand for polyester fiber from the global manufacturing sectors, which is likely to be a major driver of the mono-ethylene glycol market expansion. The demand for mono-ethylene glycol is expected to rise due to the expanding application of polyethylene terephthalate (PET) in several consumer products such as bottles and containers.

The key market players of the mono-ethylene glycol market are finding new potential in the plastics and polyester industries. The market players should follow strict handling, distribution, and storage guidelines, as mono-ethylene glycol is not regulated for transportation can be dangerous if consumed in liquid form. As a result, the major market players should adopt safety criteria to increase their trust. The mono-ethylene glycol production is being expanded in order to manufacture packaging materials and polyester films.

| Report Coverage | Details |

| Market Size in 2023 | USD 25.80 Billion |

| Market Size in 2024 | USD 26.63 Billion |

| Market Size by 2034 | USD 36.36 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Grade, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising demand for polyethylene terephthalate (PET) resin, antifreeze, and polyester fibers is a primary factor boosting the mono-ethylene glycol market expansion. The mono-ethylene glycol is also biodegradable substance, which means it has a lower impact on aquatic life. This element is also assisting in the mono-ethylene glycol market’s growth.

On the other hand, the mono-ethylene glycol market’s key factors limiting are high crude oil prices and environmental regulations, which have resulted in a smaller number of permitted chemicals on the market. The mono-ethylene glycol is extremely hazardous to humans; ingestion of mono-ethylene glycol can cause serious damage to the heart and kidney. This aspect is also impeding the mono-ethylene glycol market’s expansion during the forecast period.

The growth of the mono-ethylene glycol market will be boosted by increased demand for the substance in the manufacturing process of polyester fibers. The polyester fibers are the most widely used fibers in the world, accounting for half of all fiber demand. The industrial fabrics and clothing are just a few of the industries where fibers are used on a large scale. The demand for such fabrics originates from some of the benefits they provide such as resistance to stains, oil, moisture, and water. It resists wear and tear as well. The fiber industry will develop in the next years as a result of these attributes, as will the mono-ethylene glycol market.

The mono-ethylene glycol use is said to be strongly dependent on the economics of the countries around the world. While economies are cyclical, the demand for mono-ethylene glycol for applications such as polyester fibers and polyethylene terephthalate (PET) is expected to continue at strong growth rate. Furthermore, the packaging industry’s growth is propelling the mono-ethylene glycol market over the past few years. This has a substantial impact on the mono-ethylene glycol market, which is fueled by urbanization, changing consumer lifestyles, and increased disposable income, among other factors.

The variations in raw materials and the availability of crude oil and other feedstock are one of the notable barriers to the expansion of the mono-ethylene glycol market. Some customers are switching to alternate products that offer better material performance than mono-ethylene glycol because of concerns about its sustainability. Over the projected period, on the other hand, increased acceptance of bio-based mono-ethylene glycol is expected to open up opportunities in the mono-ethylene glycol market.

With numerous market players already active in the creation of environmentally friendly products, research and development (R&D) activities are expected to play a vital role in the mono-ethylene glycol market development and growth over the projection period.

The mono-ethylene glycol market is likely to benefit from surge in demand for polyethylene terephthalate (PET) containers from a variety of industrial and commercial end use markets including packaging due to their improved resistance strength.

In 2023, the polyester segment dominated the mono-ethylene glycol market. Due to its moisture absorption properties, high stability, and a few other characteristics, this grade is mostly used to make polyethylene terephthalate (PET), fiber, and polyester resins. Due to its hygroscopic properties, it is suitable for usage in synthetic rubber, conditioning agents, and other paper products.

The industrial segment, on the other hand, is predicted to develop at the quickest rate in the future years. The industrial grade mono-ethylene glycol is widely used in chemical intermediates, heat transfer agents, solvent pairings, unsaturated polyester resins, and plasticizers will accelerate the growth of the segment during the forecast period.

The polyethylene terephthalate (PET) segment dominated the mono-ethylene glycol market in 2022. Due to its hygroscopic and water and vapor barrier properties, the product’s demand in the packaging industry is increasing. As a result, the widespread use of mono-ethylene glycol in the production of polyethylene terephthalate (PET) will directly boost the mono-ethylene glycol market growth over the forecast period.

The polyester fiber segment is fastest growing segment of the mono-ethylene glycol market during the forecast period. Due to its superior chemical and mechanical properties, polyester fiber is widely used in a variety of end use sectors such as textiles, resins, and electronics, which is expected to drive the segment market growth in near future.

Segments Covered in the Report

By Grade

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

November 2024

October 2024