August 2024

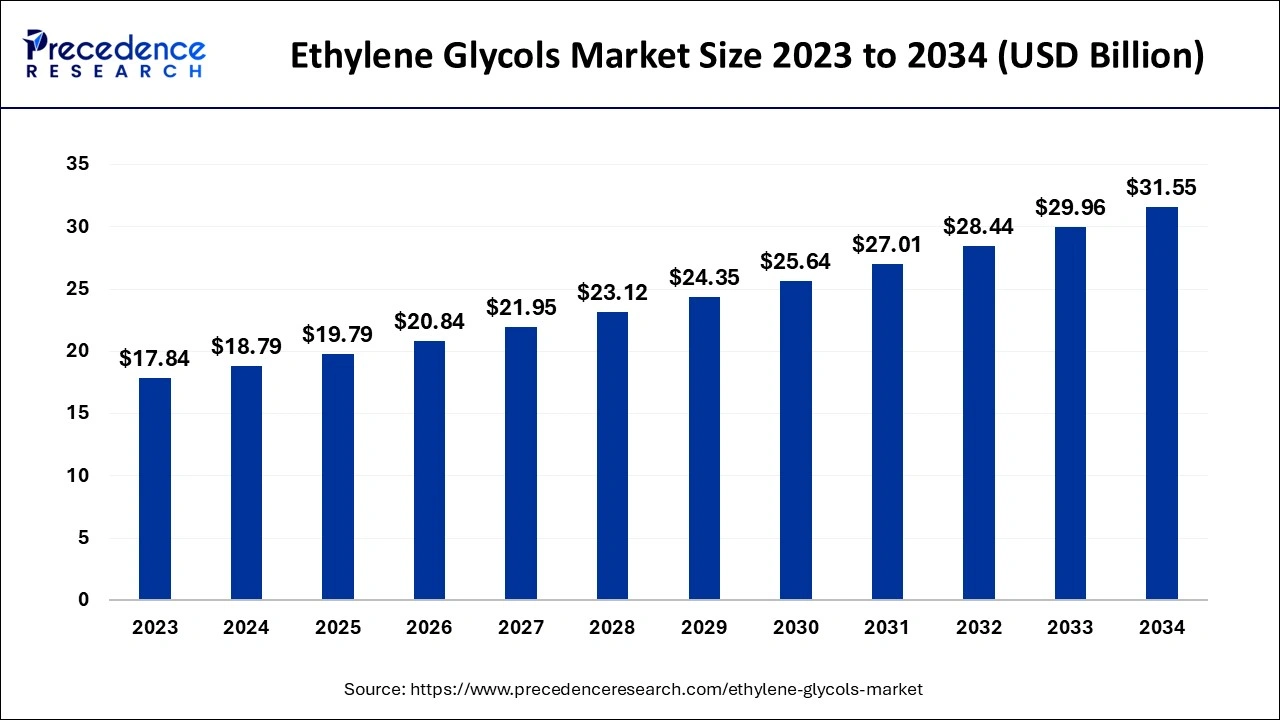

The global ethylene glycols market size accounted for USD 18.79 billion in 2024, grew to USD 19.79 billion in 2025 and is projected to surpass around USD 31.55 billion by 2034, representing a CAGR of 5.32% between 2024 and 2034. The North America ethylene glycols market size is evaluated at USD 7.70 billion in 2024 and is expected to grow at a CAGR of 5.43% during the forecast year.

The global ethylene glycols market size is calculated at USD 18.79 billion in 2024 and is predicted to reach around USD 31.55 billion by 2034, expanding at a CAGR of 5.32% from 2024 to 2034. Increasing demand for ethylene glycols from the textile and automotive industries is the key factor driving the growth of the Ethylene Glycols market. Also, growing PET resin production along with the renewable energy initiatives can fuel market growth further.

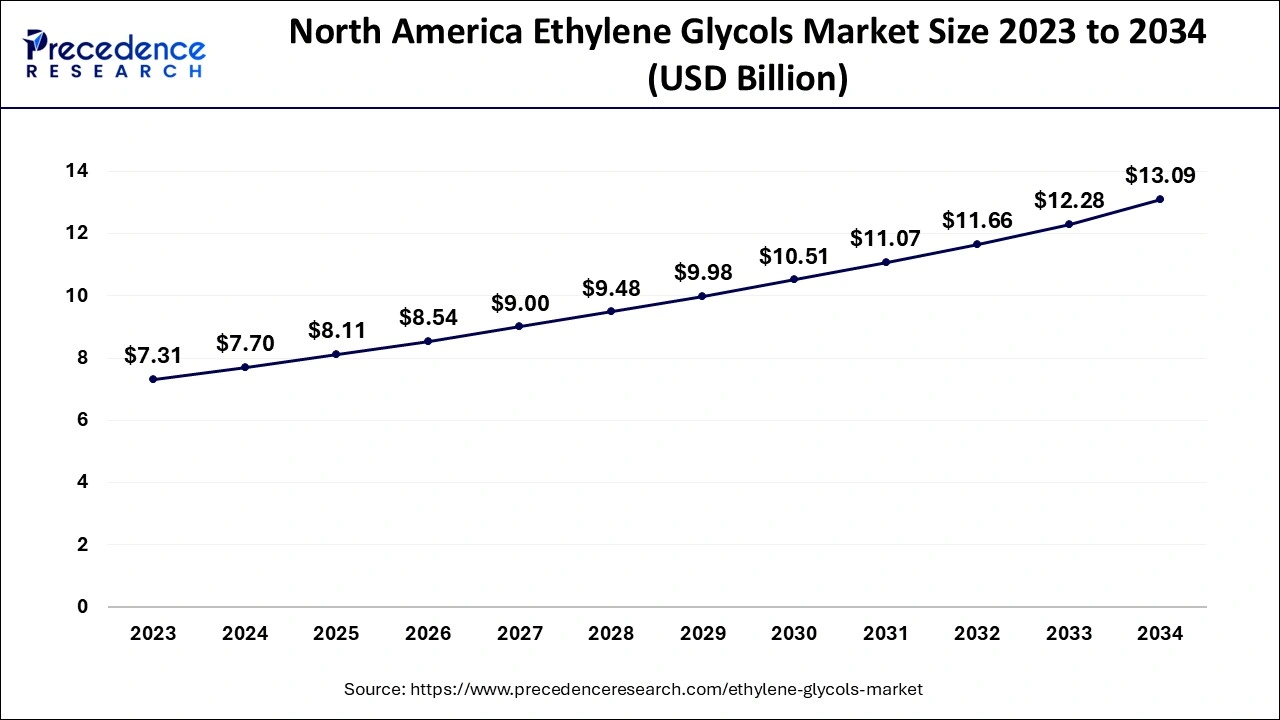

The North America ethylene glycols market size is exhibited at USD 7.70 billion in 2024 and is anticipated to be worth around USD 13.09 billion by 2034, growing at a CAGR of 5.43% from 2024 to 2034.

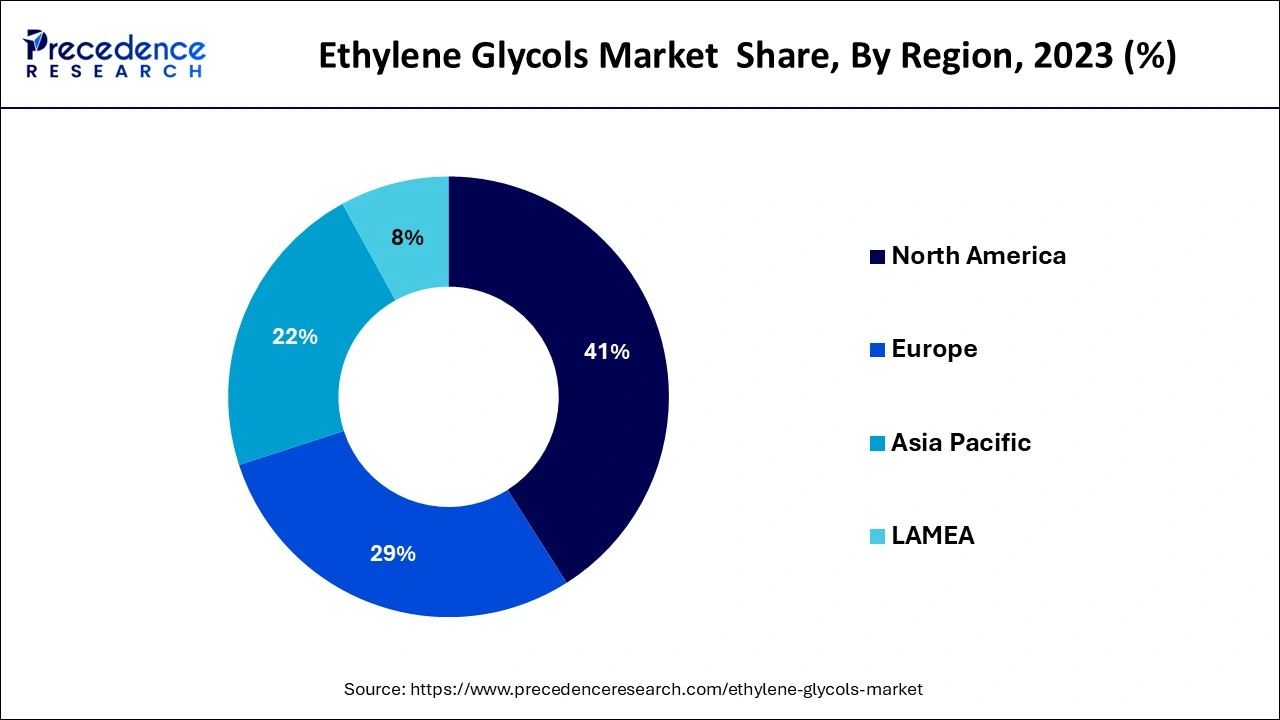

North America dominated the Ethylene Glycols market in 2023. The dominance of the region can be attributed to the increasing demand for packaged goods and the surge in industries like paints. The region is also a hub for major automotive players, which can create a positive outlook on the market. Furthermore, the region is led by major market players like Exxon Mobil Corp, Dow Chemicals, and LyondellBasell Industries, which have a wide presence and experience in the regional market.

Asia Pacific is expected to show the fastest growth in the Ethylene Glycols market over the projected period. The growth of the region can be linked to the rapid urbanization, and industrialization in the region along with the increasing utilization of ethylene glycol from end-user industries such as textiles, automotive, and others. Moreover, because of growing consumption and demand for MEG, most manufacturers are increasing their manufacturing capacity in the region.

Ethylene glycol is an organic compound that is utilized as a raw material in the manufacturing of polyester fiber. It is also used as a coolant in the vehicle engine. Polyester fiber can act as a heat transfer agent. The combination of ethylene glycol and water offers the advantages of preventing corrosion, resistance to certain bacteria, and acid degradation. In addition, MEG-based PET is utilized in the production of drinking water bottles, food packages, and carbonated drinks.

Top Five Exporters of Woven Fabrics of Polyester Staple Fibers

| Reporter | Trade Value 1000 USD | Quantity |

| China | 175,608.47 | 11,692,400 |

| European Union | 79,965.23 | 3,118,090 |

| Turkey | 41,444.91 | 1,501,630 |

| India | 36,067.36 | 1,200,410 |

| Portugal | 35,489.59 | 1,136,600 |

Impact of AI on the Ethylene Glycols Market

Artificial intelligence (AI) is making a significant impact on the Ethylene Glycols market. Guided process optimization and predictive maintenance are improving operational efficiencies and decreasing overall production costs. Furthermore, AI streamlines the production process, leading to consistent quality and higher productivity of ethylene glycol products, and also enhances the sustainability of the manufacturing process.

| Report Coverage | Details |

| Market Size by 2034 | USD 31.55 Billion |

| Market Size in 2024 | USD 18.79 Billion |

| Market Size in 2025 | USD 19.79 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Derivative Type, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing demand for non-ionic surfactants

Ethylene glycol is an important element in the production of non-ionic surfactants, which are necessary for different products such as emulsifiers, detergents, and wetting agents. Non-ionic surfactants, because of their non-reactive nature and stability, are preferred in various consumer products. Additionally, the increasing disposable income of consumers, growing awareness about hygiene, and increasing urbanization led to the creation of new and enhanced formulations.

Lack of global regulations

The lack of regulations governing ethylene glycol production and application across the globe can impact market growth negatively. The regulations and laws governing the use of ethylene glycol are changing in every country. However, companies find it difficult to deal with these national laws and mandates. This can lower the investment in the Ethylene Glycols market.

Growing utilization of ethylene glycol in polyester and PET resin production

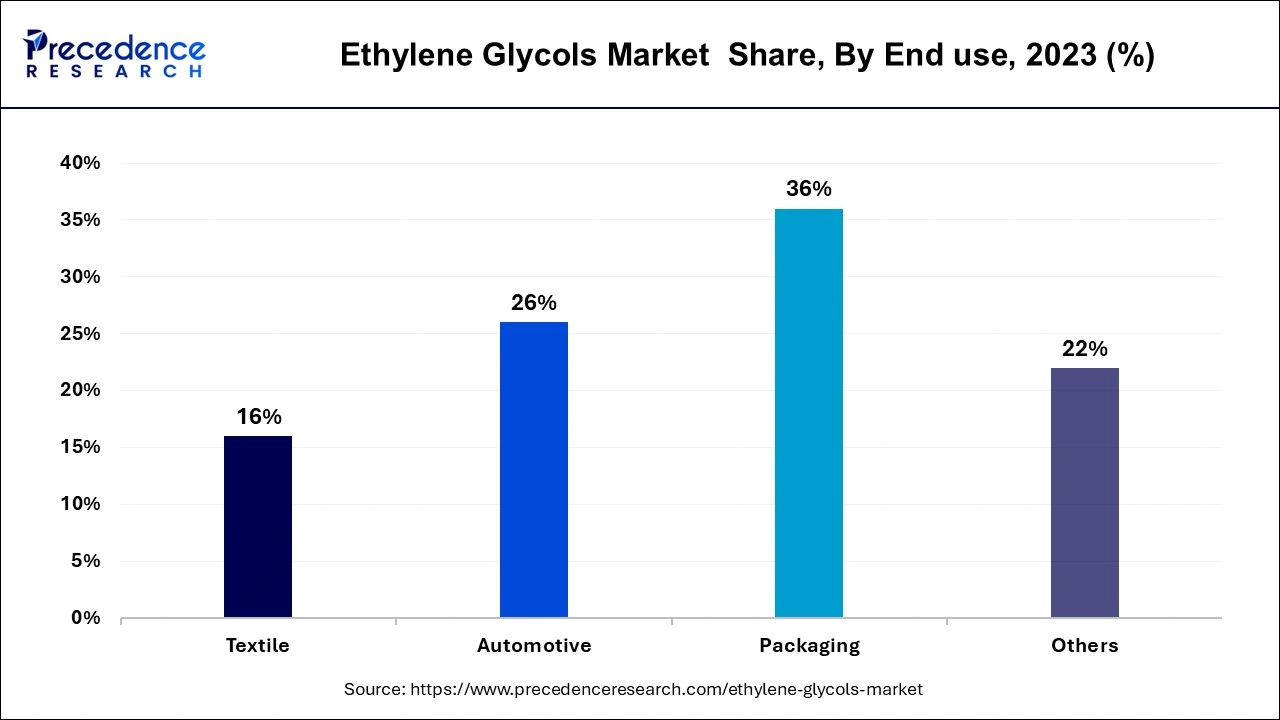

The increasing need for ethylene glycol in polyester manufacturing is the key factor boosting the Ethylene Glycols market growth. Polyester is widely utilized in the textile industry because of its wrinkle resistance, durability, and affordability. Furthermore, the increasing consumption of packaged goods is fuelled by rising urbanization and changes in consumer lifestyles, driving the demand for PET and enabling its strong presence in the market.

The Triethylene Glycol (TEG) derivative segment led the global Ethylene Glycols market in 2023. The dominance of the segment can be attributed to the increasing use of TEG in different industries, such as chemical production, plastics, and natural gas processing, because of its unique properties. In addition, its high boiling point, low volatility, and moisturizing controlling properties make it a primary choice for applications like hygroscopic processes. And natural gas dehydration.

The Monoethylene Glycol (MEG) derivative segment is anticipated to grow at the fastest rate in the Ethylene Glycols market over the forecast period. The growth of the segment can be linked to the increased manufacturing of polyethylene terephthalate, which is produced from mono-ethylene glycol. However, MEG is the primary base material in the textile industry for producing polyester, which is utilized in different applications, including upholstery, clothing, and carpets, because of its desirable properties, like superior strength, durability, and resistance to shrinking.

The PET application segment dominated the Ethylene Glycols market. The dominance of the segment can be credited to the growing use of PET (polyethylene terephthalate) in packaging materials, particularly in the food and beverage (F&B) industry. The requirement for PET is propelled by the increasing consumption of packaged foods across the globe, which is fuelled by urbanization and the convenience offered by packaged food.

The Polyester fibers segment is anticipated to grow at the fastest rate in the Ethylene Glycols market over the projected period. The growth of the segment is due to various e characteristics offered by this fiber such as durability, high strength, and resistance. These properties make them a prime choice for numerous applications. Furthermore, polyester fibers are more cost-effective than natural fibers, including cotton or wool, which improves their overall value proposition.

The packaging segment led the global Ethylene Glycols market in 2023. This is because the consumer goods market has witnessed a substantial surge due to changes in consumer lifestyles. Which in turn results in increasing demand for PET packaging options. Ethylene glycol is also a main element in the manufacturing of PET resins that are utilized in packaging applications like containers, bottles, and films.

The automotive segment is estimated to grow at a significant rate in the Ethylene Glycols market over the studied period. The growth of the segment can be driven by the increasing use of ethylene glycol as an antifreeze in automobile cooling systems which is necessary for maintaining engine functions and overall longevity. Additionally, ethylene glycol is utilized in the aerospace industry for crafting lucrative solutions for aircraft.

Segments Covered in the Report

By Derivative Type

By Application

By End use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

October 2024