June 2023

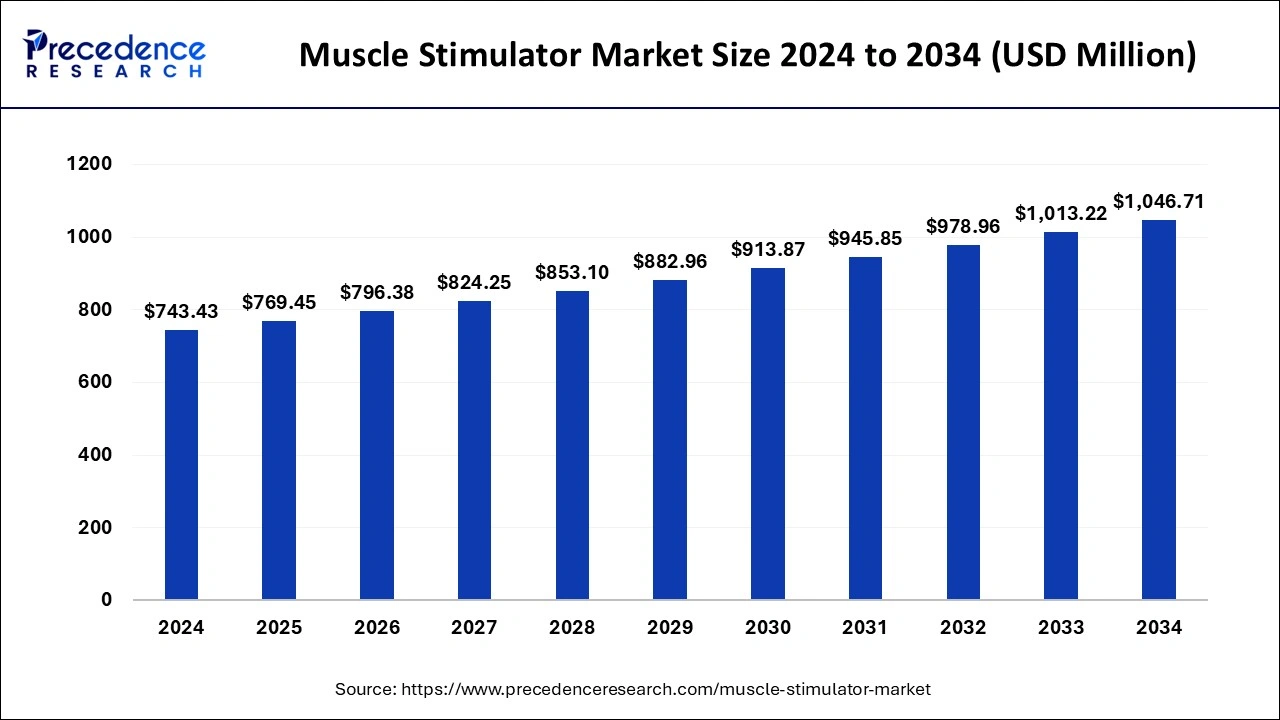

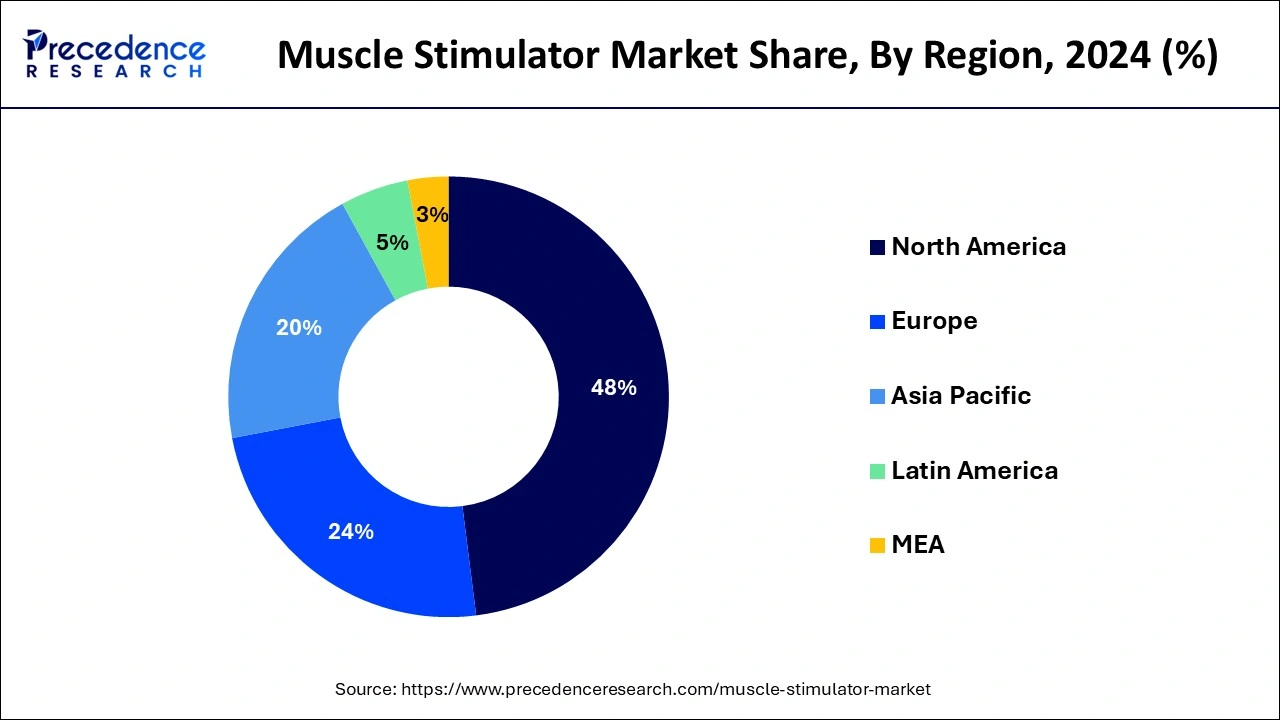

The global muscle stimulator market size is estimated at USD 769.45 million in 2025 and is forecasted to worth around USD 1046.71 million by 2034, accelerating at a CAGR of 3.48% from 2025 to 2034. The North America muscle stimulator market size crossed USD 356.85 million in 2024 and is expanding at a CAGR of 3.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global muscle stimulator market size was accounted for USD 743.43 million in 2024, and is expected to reach around USD 1046.71 million by 2034, expanding at a CAGR of 3.48% from 2025 to 2034. The market growth is attributed to increasing demand for non-invasive therapeutic solutions and advancements in muscle stimulation technologies.

Integrating artificial intelligence (AI) algorithms monitor muscle activity and adjust simulation parameters in real time, which further enhances patient outcomes. AI also helps in the predictive maintenance of muscle stimulators to reduce their downtime and enhance their efficiency. Furthermore, machine learning (ML) algorithms boost the capabilities of muscle stimulators and help develop new ones.

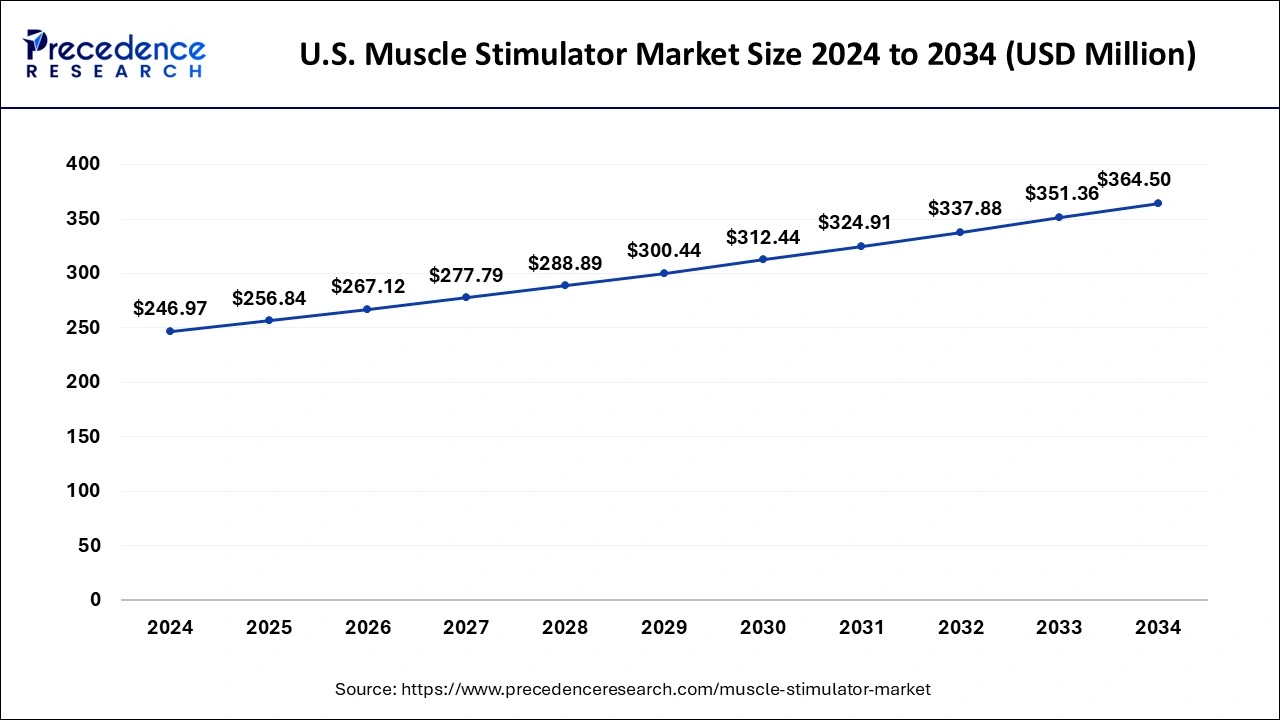

The U.S. muscle stimulator market size was estimated at USD 246.97 million in 2024 and is predicted to be worth around USD 364.50 million by 2034, at a CAGR of 3.97% from 2025 to 2034.

North America dominates the market in 2024 and is probably going to keep up with its situation over the analysis period. The presence of key members, huge speculations by legislatures for the advancement and improvement of clinical gadgets, and the early display of novel muscle triggers are enhancing the development of the region. Besides, the high buying force of customers and expanded reception of trend-setting innovations and inventive clinical gadgets are additionally expected to drive the development.

The Asia Pacific is expected to be the fastest developing area during the forecast period. Developing mindfulness connected with wellbeing and wellness, growing reception of agony the executives' treatments, and rising utilization of brilliant gadgets for keeping up with wellbeing are the key development energizers of the area. Additionally, expanding instances of sports wounds in this area are ready to work up the interest for muscle triggers during the period of analysis.

Muscle stimulators are electric devices that are used to treat muscle pain and spasms. Muscle stimulators' primary priorities are enhancing muscle motility, blood flow, muscle trimming, and muscular power muscle motility, blood flow, muscle trimming, and muscular power. Muscles can be made to contract and relax by supplying or conducting electrical currents outside of the mortal body. It has been created in such a manner that electronic equipment is used to transport the current to a requested area of the body in mortal people through a series of operators/electrodes that are nothing but adhesive pads.

Patients with a wide range of physiological disorders affecting respiratory, cardiovascular, neurological, intestinal, and skeletal muscle function find it difficult and complex to recover from long-term therapy (ICU) for COVID-19 in these cases muscle stimulators help work normally and back to the daily routine. Small electrical impulses are employed in the skeletal muscle as part of a procedure called neuromuscular stimulation (NMES) to induce contractions when people find it difficult or impossible to do work. NMES has been linked to advantages such as increased muscle and bone strength, enhanced blood flow, and decreased edema. Moreover, COVID-19 patients utilize simulators to control their pain, therefore the category is anticipated to expand as a result of the pandemic.

| Report Coverage | Details |

| Market Size in 2025 | USD 769.45 Million |

| Market Size by 2034 | USD 1046.71 Million |

| Growth Rate from 2025 to 2034 | CAGR of 3.48% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Modality, Application, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Popularity of Fitness and Rehabilitation Programs

The growing popularity of fitness routines and rehabilitation programs among health-conscious individuals is anticipated to fuel market growth. Global health concerns were in the spotlight in 2023, with 56% of the adult population practicing exercise consistently compared to the 2020 report, which recorded 50%, as stated by WHO. Adults are engaging in regular physical exercises, which calls for adopting new forms of fitness products such as muscle stimulators. As of a January 2024 commentary, 18.4% of individuals aged 16 and older in the UK reported having a long-term musculoskeletal (MSK) condition. This figure has increased since 2022 but is lower compared to 2019. The rise in MSK conditions highlights the need for physical therapy and the development of related therapeutic products. Furthermore, the increase in the number of physiotherapy sessions worldwide further fuel the market in the coming years.

The rising usage of muscle stimulators among physiotherapists and advancements in medical devices are also driving the market growth. Additionally, increasing outer muscle problems are anticipated to support market growth. Wrong body pose, absence of wellness exercises, and unhealthy eating routines cause outer muscle problems.

Limited Awareness and Accessibility in Rural Areas

Limited awareness and accessibility in rural areas are likely to restrain the muscle stimulator market, particularly in underserved regions. Rural areas have a low adoption rate, as people in these areas are not fully aware of such devices. The United Nations Department of Economic and Social Affairs (2023) has indicated that more than half the rural-based healthcare providers in developing countries lack the facilities and resources to avail of state-of-the-art therapeutic tools such as muscle stimulators. Lack of infrastructure, low health care, and weak training of health care personnel also limit this restraint, thereby limiting the market growth.

High Demand for Non-invasive Pain Management Solutions

High demand for non-invasive pain management solutions is likely to create immense opportunities in the market. Transcutaneous electrical nerve stimulation (TENS) is beneficial for arthritis and other chronic muscular pain conditions without any side effects as a muscle stimulator. As stated by the CDC, in 2023, 24.3% of adults experienced chronic pain, while 8.5% had chronic pain that frequently limited their life or work activities. Therefore, non-surgical treatments are becoming a growing area of interest.

The Transcutaneous Electrical Nerve Stimulation (TENS) segment held the major share in 2024 and is expected to keep up with its predominance over the analysis period. The developing pervasiveness of joint inflammation and growing sports wounds are a portion of the unmistakable variables enlarging the market development. As per the Centers for Disease Control and Prevention (CDC), in 2017, around 54.4 million U.S. grown-ups were determined to have joint pain. This number is expected to be 78 million by 2040. This developing pervasiveness of joint pain is supposed to drive development over the projected period.

On the other hand, Neuromuscular Electrical Stimulation (NMES) is supposed to be the fastest developing section during the study period. This muscle trigger is for the most part used to reestablish or supplant engine capacities in patients who experienced upper engine neuron harm because of stroke or Spinal Cord Injury (SCI). As per the factsheet introduced by the National Spinal Cord Injury Statistical Center in 2019, in the U.S. around 17,730 instances of SCI are enlisted consistently and at present, 291,000 individuals are experiencing this condition. As the commonness of SCI is expanding, the interest in NMES is expected to increase over the study period.

The portable devices market has the largest share in 2024 and is assessed to witness the most remarkable CAGR of 4.4% during the forecast period. Versatile muscle triggers are utilized broadly for forestalling muscle decay, unwinding muscle fits, overseeing persistent agony because of joint inflammation, and expanding blood flow. Also, many central participants in the market are offering different creative triggers under this portion.

For example, the organization NeuroMetrix, Inc. offers a versatile help with discomfort pack, which is a TENS unit that fits like support on patients and gives the feeling of relief from discomfort. The organization Zynex, Inc. is offering JetStream, a versatile framework that can be utilized at home for treatment. OMRON Corporation is as of now giving a little measured compact electrotherapy TENS gadget that can be utilized for giving help with sore and throbbing muscles. These elements are expected to drive the worldwide muscle trigger market development over the estimated period.

Pain management applications have a major market share of 56% in 2024. Developing utilization of muscle triggers for overseeing intense and constant agony and developing pervasiveness of joint inflammation is the central point expected to drive the portion market over the analysis period.

This section is expected to develop at a huge rate inferable from expanding geriatric population that experiences muscle torment and the developing commonness of constant torment. For example, as per the CDC, in 2016 20.4% of grown-ups in the U.S., were experiencing ongoing torment, and 0.8% of U.S. grown-ups had a high effect of ongoing torment. A comparable circumstance is pervasive in numerous European and Asian nations. This developing commonness of persistent agony is expected to drive market development over the forecast period.

The physiotherapy facilities segment holds the market with the highest share and is expected to witness the most significant CAGR of 4.7% during the period of analysis. Developing the inclination of physiotherapists toward triggers when contrasted with manual procedures is the main reason for the development of these segments.

On the other hand, increasing patient visits for looking for exciting treatments and the accessibility of these treatments at a reasonable expense at physiotherapy centres are the central point expected to drive the market development. Likewise, the clinical repayment given to patients looking for these treatments is additionally expected to drive segment development over the study period.

By Product Type

By Modality

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2023