The global nanosensors market size is accounted at USD 901.78 million in 2025 and is forecasted to hit around USD 1,838.11 million by 2034, representing a CAGR of 8.25% from 2025 to 2034. The North America market size was estimated at USD 274.65 million in 2024 and is expanding at a CAGR of 8.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nanosensors market size accounted for USD 832.28 million in 2024 and is predicted to increase from USD 901.78 million in 2025 to approximately USD 1,838.11 million by 2034, expanding at a CAGR of 8.25% from 2025 to 2034.

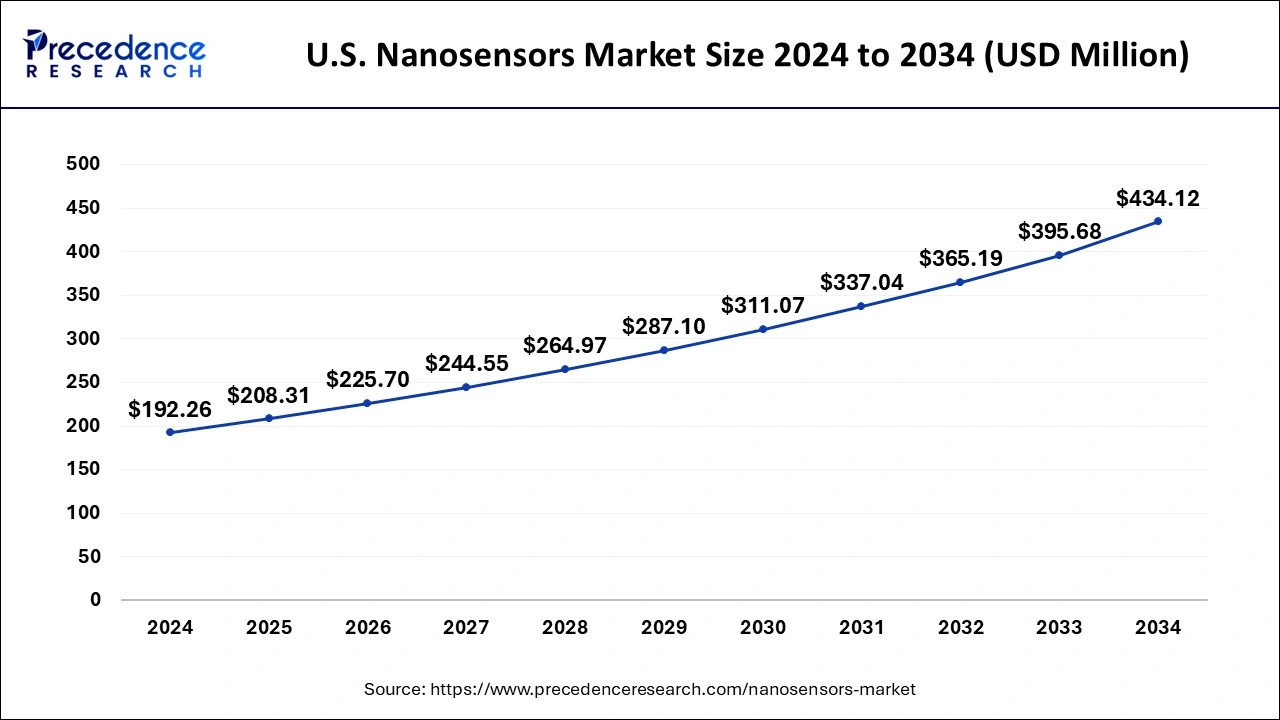

The U.S. nanosensors market size was evaluated at USD 192.26 million in 2024 and is projected to be worth around USD 434.12 million by 2034, growing at a CAGR of 8.49% from 2025 to 2034.

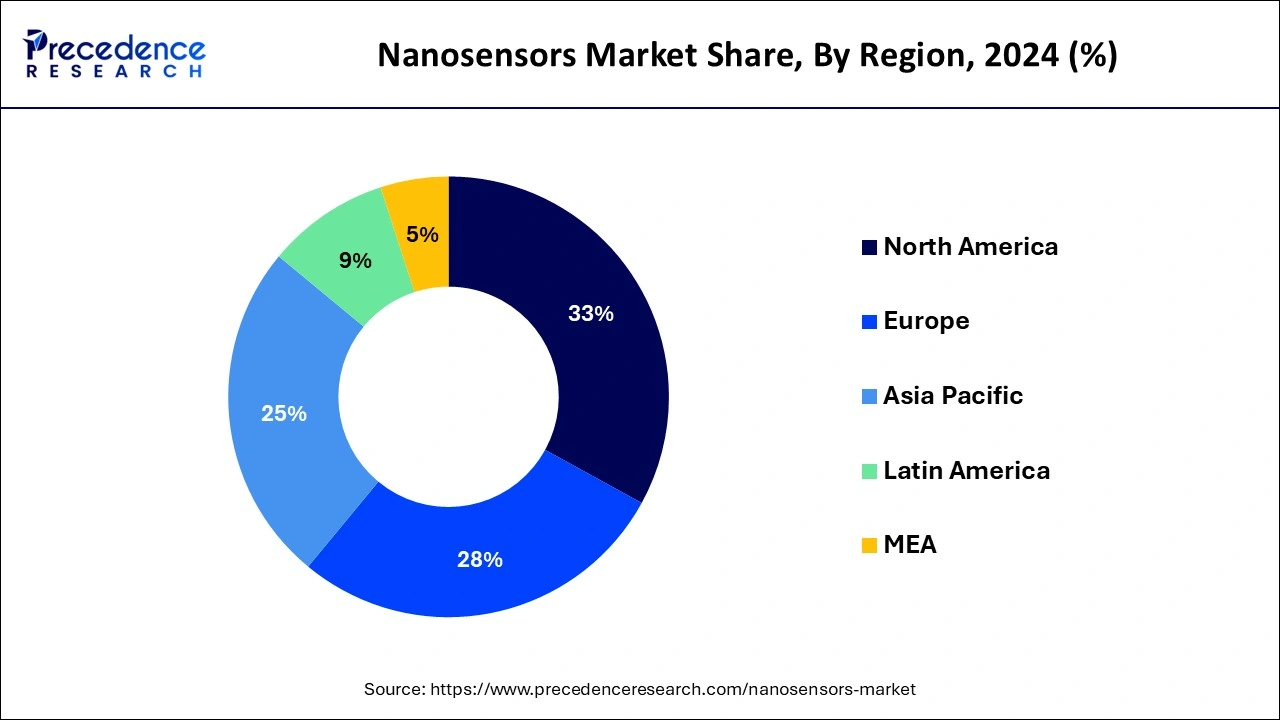

North America held the largest market share of 33% in 2024 North America's robust technology sector and its concentration of leading companies in the nanosensors market position the region as a key region of the market. With a high demand for advanced technologies and favorable regulatory frameworks, significant investments in research and development have ensued. Furthermore, the region benefits from a plethora of universities and research institutions, fostering an environment conducive to innovation and growth in the market. These factors collectively contribute to North America's prominence as a hub for technological advancement and pave the way for continued innovation and expansion in the nanosensors industry.

Asia Pacific is estimated to expand the fastest CAGR of 9.3% between 2025 and 2034. The Asia-Pacific region's nano sensors market is witnessing expansion driven by increased adoption across diverse end-user industries and heightened demand for efficient disease detection tools. As industries ranging from healthcare to manufacturing increasingly integrate nano sensors into their operations, the region experiences a surge in demand. Furthermore, the pressing need for advanced disease detection tools, particularly in densely populated countries facing healthcare challenges, fuels the growth of nano sensors in the Asia-Pacific region. This expansion underscores the region's pivotal role in driving innovation and addressing critical societal needs through the widespread application of nano sensor technology.

Nano sensors represent a significant application of nanotechnology, offering a range of capabilities in detecting biological components and environmental parameters at the nano scale. These sensors consist of nano-scale elements designed to interact with specific substances, enabling the detection and measurement of various physical and chemical parameters. Mechanical and chemical sensors are the two primary types of nano sensors. Mechanical nano sensors rely on changes in physical properties, such as size or shape, to detect alterations in their environment. For example, they can measure temperature changes, pressure variations, or mechanical stress. Chemical nano sensors, on the other hand, operate by interacting with specific molecules or chemical compounds, enabling the detection of substances such as gases, toxins, or biomarkers. Nano sensors play a crucial role in various fields, including environmental monitoring, healthcare, and industrial applications. In environmental monitoring, nano sensors can detect pollutants, toxins, and other environmental hazards with high sensitivity and precision.

In healthcare, the nanosensors market offers services for detecting biomarkers associated with diseases at early stages, enabling timely intervention and treatment. The data collected by nano sensors provides valuable insights into the behavior of nanoparticles and the surrounding environment. This information is used for analytical purposes, including trend analysis, pattern recognition, and predictive modeling. By monitoring changes in nanoparticle behavior, nano sensors can help researchers better understand complex biological and environmental processes, leading to advancements in scientific research and technology development.

Hence, nano sensors represent a powerful tool for sensing and monitoring at the nano scale, offering unprecedented sensitivity, accuracy, and versatility in detecting biological components and environmental parameters. As nanotechnology continues to advance, nano sensors are expected to play an increasingly vital role in addressing global challenges and driving innovation across various industries.

Nanosensors Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.25% |

| Market Size in 2025 | USD 901.78 Million |

| Market Size by 2034 | USD 1,838.11 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand from the healthcare industry

The escalating demand from the healthcare industry is playing a pivotal role in bolstering the growth of the sensor market. This surge in demand is primarily driven by the healthcare sector's continuous efforts to enhance the overall delivery of healthcare services. As the healthcare industry seeks to improve patient care, optimize treatment outcomes, and streamline operational efficiencies, the adoption of sensor technology becomes increasingly crucial. One key driver of market growth is the significant demand for miniaturized healthcare products and sensors.

Miniaturization enables the development of compact, portable, and non-invasive sensor devices that can be seamlessly integrated into medical devices and wearables. These miniaturized sensors empower healthcare professionals to monitor vital signs, track disease progression, and administer personalized treatments in real-time, thereby improving patient outcomes and enhancing the quality of care. Furthermore, the expansion of the healthcare industry, fueled by factors such as population growth, aging demographics, and the increasing prevalence of chronic diseases, is driving the adoption of sensor technology across various healthcare settings.

From hospitals and clinics to home healthcare environments, sensors are being deployed to monitor patient health, track medication adherence, and facilitate remote patient monitoring, thereby improving access to healthcare services and reducing healthcare costs. Another indirect growth determinant is the growing need to reduce sensors' average detection and diagnosis time. In healthcare settings, timely and accurate detection and diagnosis of medical conditions are critical for initiating appropriate treatments and interventions. Sensor technology offers rapid and precise detection capabilities, enabling healthcare providers to diagnose conditions earlier, monitor disease progression more effectively, and intervene promptly when necessary. Hence, the convergence of these factors underscores the significant role of sensor technology in driving innovation and transformation within the healthcare industry. As healthcare organizations continue to prioritize patient-centric care and embrace digital health solutions, the demand for advanced sensor technology is expected to escalate, driving sustained growth and expansion in the nanosensors market.

Restraint: High costs associated with hi-tech nano sensors

The high costs associated with hi-tech nano sensors pose significant challenges to market growth. Fluctuations in raw material prices and limited availability in certain territories contribute to cost variability, making it difficult for manufacturers to maintain competitive pricing. Moreover, the manufacturing process for nano sensors is inherently complex, involving intricate fabrication techniques and specialized equipment. These complexities not only increase production costs but also require skilled labor and sophisticated infrastructure. The cost challenges associated with nano sensors impact various stakeholders across industries. For manufacturers, higher production costs reduce profit margins and limit investment in research and development initiatives.

Consumers may face barriers to adoption due to the prohibitive costs of hi-tech nano sensors, hindering market penetration and adoption rates. To address these challenges, industry stakeholders must focus on strategies to mitigate cost pressures and enhance cost-efficiency in manufacturing processes. This may involve sourcing raw materials from diversified suppliers, optimizing production workflows, and investing in automation and process optimization technologies. Collaborative efforts between industry players, government agencies, and research institutions are also essential to drive innovation and address cost challenges, ultimately fostering sustainable growth in the nanosensors market.

Innovation in analytical chemistry

Nano sensors represent a groundbreaking innovation in analytical chemistry, particularly in the field of biomolecular analysis. Unlike traditional methods such as gas chromatography or high-performance liquid chromatography (HPLC), nano sensors offer unparalleled advantages in monitoring lgG affinity distributions, weakly affined hyper-mannosylation, and other complex features of biomolecules.

One of the key advantages of nano sensors is their ability to provide highly sensitive detection of biomolecular interactions. Nano sensors leverage nanoscale materials and surfaces, which offer a large surface area-to-volume ratio and unique physical and chemical properties. This enables them to detect molecular interactions with exceptional sensitivity, even at low concentrations, surpassing the capabilities of traditional analytical techniques.

Moreover, nano sensors enable real-time, on-site detection, eliminating the need for time-consuming sample preparation and laboratory analysis. This rapid detection capability is particularly valuable in applications where timely decision-making is critical, such as medical diagnostics, environmental monitoring, and food safety. Furthermore, nano sensors offer cost-effective solutions for biomolecular analysis. Traditional analytical methods often require expensive equipment, reagents, and skilled personnel, making them inaccessible to many laboratories and industries. In contrast, nano sensors can be fabricated using cost-effective materials and manufacturing processes, reducing overall operational costs and increasing accessibility. The ability of nano sensors to offer sensitive, on-site, quick, and low-cost detection directly influences demand across various industries. As the demand for rapid and accurate biomolecular analysis continues to grow, fueled by advancements in personalized medicine, environmental sustainability, and food safety regulations, the market for nano sensors is poised for significant expansion.

The electrochemical segment held the highest market share of 45% in the nanosensors market in 2024. The dominance of the electrochemical nano sensor segment is anticipated due to its versatility in detecting a diverse array of substances and chemicals. With applications spanning environmental monitoring, food and beverage testing, and medical diagnostics, these sensors cater to a wide range of industries. As demand escalates across these sectors for precise and efficient detection methods, electrochemical nano sensors emerge as a preferred choice. Their adaptability, sensitivity, and reliability position them as indispensable tools in various industrial processes, thereby propelling the growth trajectory of the nanosensors market in the foreseeable future.

The electromagnetic segment is anticipated to witness rapid growth at a significant CAGR of 8.9% during the projected period. The robust growth within the nanosensors market due to its unique capabilities and applications. These sensors harness electromagnetic principles to detect and analyze a broad spectrum of substances and materials with exceptional precision and sensitivity. As industries increasingly rely on advanced sensing technologies for diverse applications such as healthcare, environmental monitoring, and industrial processes, the demand for electromagnetic Nano sensors continues to surge. Their ability to offer real-time data, non-invasive monitoring, and high accuracy makes them indispensable across various sectors, driving their adoption and contributing significantly to the growth of the nanosensors market.

The healthcare segment has held a 29.5% market share in 2024. The healthcare sector is poised to dominate the nanosensors market throughout the forecast period, driven by the escalating demand for portable, compact, and highly accurate diagnostic sensing systems. With a growing emphasis on patient-centric care and personalized medicine, there is an increasing need for innovative diagnostic tools that offer enhanced precision and usability. Nanosensors play a pivotal role in addressing these requirements by providing real-time data, non-invasive monitoring, and improved accuracy in diagnostics. As healthcare providers prioritize efficiency and accuracy in patient diagnostics, the adoption of nanosensors is expected to surge, consolidating the healthcare sector's dominance in the market.

The defense & military segment is anticipated to witness significant growth of 9.4% over the projected period. The defense and military segment in the nanosensors market is experiencing significant growth due to increasing investments in defense technologies and the growing emphasis on enhancing national security measures. Nanosensors offer several advantages to defense and military applications, including their ability to detect chemical, biological, radiological, and explosive threats with high sensitivity and specificity. Additionally, nanosensors enable the development of lightweight, portable, and versatile sensing platforms that can be integrated into various defense systems and equipment. As defense agencies worldwide prioritize modernization and innovation, the demand for nanosensors in defense and military applications is expected to continue rising steadily.

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client