August 2024

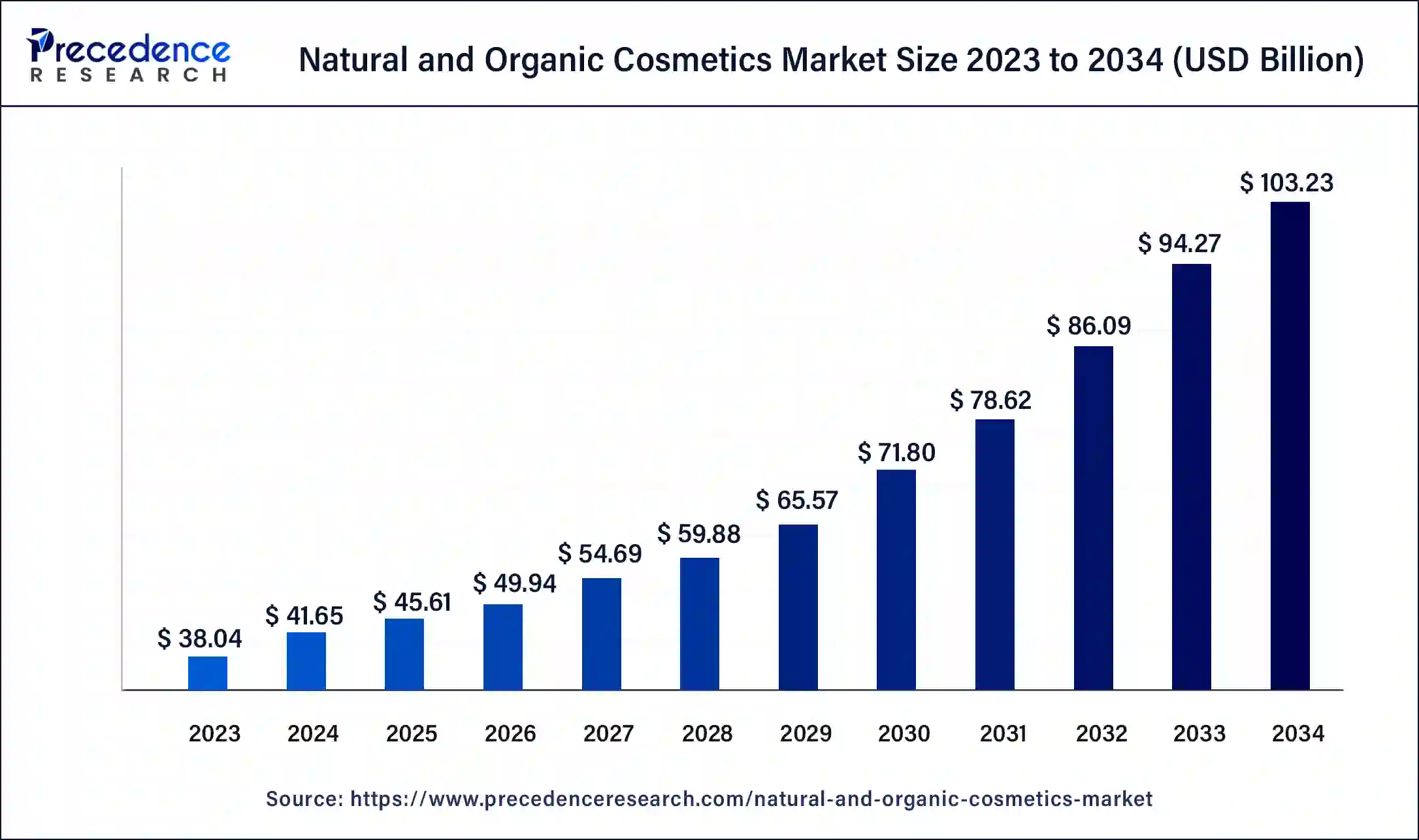

The global natural and organic cosmetics market size surpassed USD 38.04 billion in 2023 and is estimated to increase from USD 41.65 billion in 2024 to approximately USD 103.23 billion by 2034. It is projected to grow at a CAGR of 9.40% from 2024 to 2034.

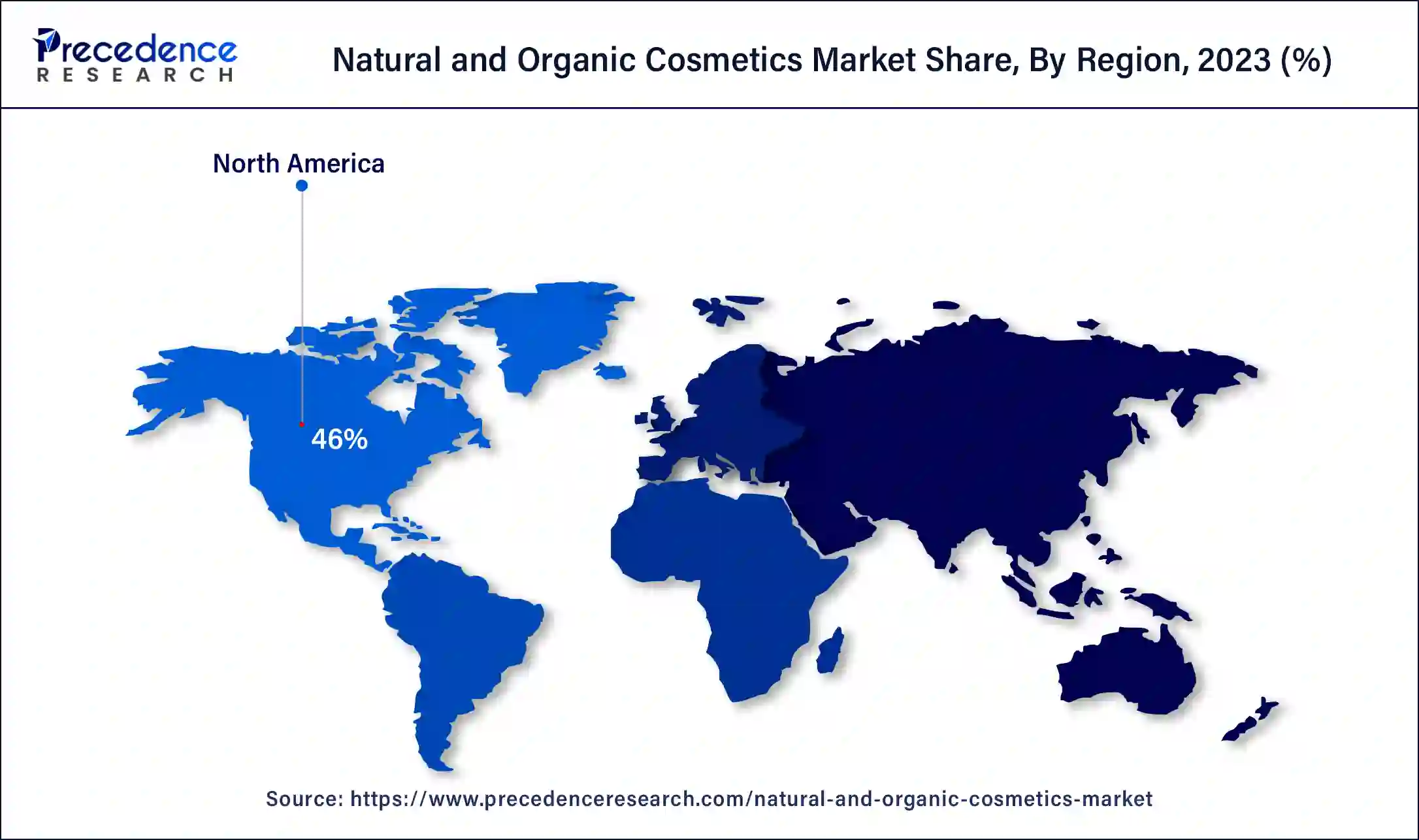

The global natural and organic cosmetics market size is projected to be worth around USD 103.23 billion by 2034 from USD 41.65 billion in 2024, at a CAGR of 9.40% from 2024 to 2034. The North America natural and organic cosmetics market size reached USD 17.50 billion in 2023. The natural and organic cosmetics market is growing due to increasing buyer’s awareness of natural and organic products, seeking products that are safe, eco-friendly, and sustainable.

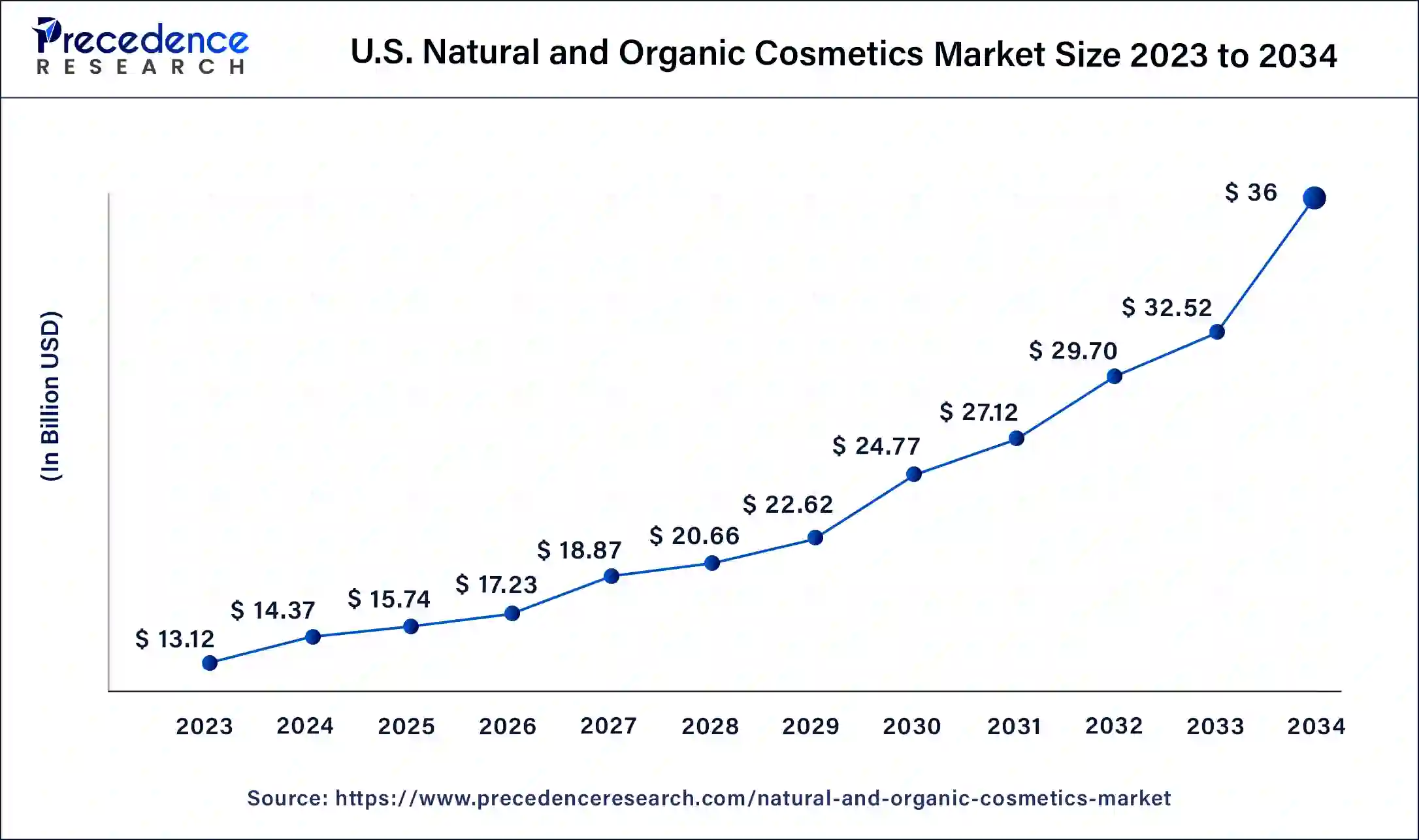

The U.S. natural and organic cosmetics market size was exhibited at USD 13.12 billion in 2023 and is projected to be worth around USD 36 billion by 2034, poised to grow at a CAGR of 9.61% from 2024 to 2034.

North America led the global natural and organic cosmetics market in 2023. High income and increasing focus on personal grooming are the major factors driving the demand for beauty and personal care products in North America. Additionally, companies are investing in digital and social media advertisements to expand the online presence of their brands. Some major players in the North American beauty and personal care products market are L'Oréal SA, Estée Lauder Companies Inc., Coty Inc., Unilever PLC, and Procter & Gamble Company.

Asia Pacific is expected to attain the fastest rate of growth in the natural and organic cosmetics market during the forecast period. Speeded urbanization, growing urban population, and modernization have grown the demand for natural and organic cosmetics. E-commerce in Asia Pacific performed better than in most other regions during the pandemic with the accelerating digitalization of the region’s economies. Additionally, the influence of social media and influencers in countries like China, India, Japan, and South Korea has played a significant role in natural beauty trends, further accelerating the growth of the market.

Cosmetic, personal care, and perfume products are the products that are referred to as the formulations of natural or synthetic substances that should be applied to the human skin, hair, or nails with the intention of cleaning, perfuming, or reshaping the physical appearance. An organic cosmetic is a natural cosmetic, as defined, that contains a minimum percentage of ingredients produced from organic agriculture, which organic production is feasible and must be organic to at least the tune of 95%.

Natural and organic cosmetics are cosmetic products that contain only natural elements or their natural derivative or the substances allowed for preservation. The utilization of natural resources alone does not imply the health and safety of the final products. The resultant cosmetic products are governed by the same legal requirements as any other cosmetic products.

How is AI shaping the Natural and Organic Cosmetics Market?

The beauty industry is fast-growing and innovative, focusing on the advancement of technology in its service provision and solutions to skin and beauty issues. Skincare and beauty are areas of interest that benefit from one of the most contemporary technological growths identified as artificial intelligence (AI). AI has the capability of changing the fashion and beauty industry and enabling the consumer to have easier access to their preferred products.

There are several research objectives for the use of AI in the beauty industry. The beauty benefits are personalization of beauty solutions, virtual try-on, increased reliability of beauty solutions, predictive analysis, alternate approaches in product development, better customer experience satisfaction, and sustainability.

| Report Coverage | Details |

| Market Size by 2034 | USD 103.23 Billion |

| Market Size in 2023 | USD 38.04 Billion |

| Market Size in 2024 | USD 41.65 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.40% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Distribution Channel, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Changing consumer preferences towards organic cosmetic products

Consumers are becoming more aware of the perceived benefits of natural/organic cosmetic products apart from the increase in the number of natural/organic cosmetics offered through the major retailing channels. The increasing consumer’s sensitivity towards natural and organic products affects the increase in overall demand for the use of natural and ecologically clean materials in the production of cosmetics. This opens up possibilities for exporters of natural cosmetic ingredients even if a natural/organic cosmetic that contained the exporter’s ingredient was not certified itself.

Over time, consumers are waking up to the effects of personal care products on the environment and the environment itself in terms of packaging used and the raw materials that are used during the production of personal care products, which include dangerous environmental effects, and this drives consumers towards natural cosmetics proteins that are environmentally friendly and obtained from environmentally sustainable sources.

Limited shelf life of natural cosmetics

The shelf life of natural cosmetics can vary depending on several factors, such as the type of formulation used in the cosmetics, the ingredients used while preparing the cosmetics, and how the cosmetics are packed and stored. It may also be noted that while natural cosmetics are usually available with a relatively short effective period, this information is given on the packaging.

Conventional cosmetics contain preservatives produced through synthetic chemistry, which are toxic and detrimental to the human body. Fresh, natural products can spoil, and when they are used on the skin after expiry, they may prove wrong as their safe efficacy is compromised. These factors limit the growth of the natural and organic cosmetics market.

Rising sales through e-commerce platforms

Traditionally, cosmetic businesses are known to rely heavily on direct, in-person store sales mainly to attract new consumers and retain the existing ones. With the rise of digitalization and the expansion of digital commerce, cosmetics companies have begun establishing a strong presence alongside the leading e-commerce industries.

As stated in the report published by TRAI on the Indian Telecom Services Performance Indicators for the period Jan to Mar 2023, the internet user base in the country was more than 880 million in Mar 2023 except for telecom users number which was more than 1,172 million.

Product Insights

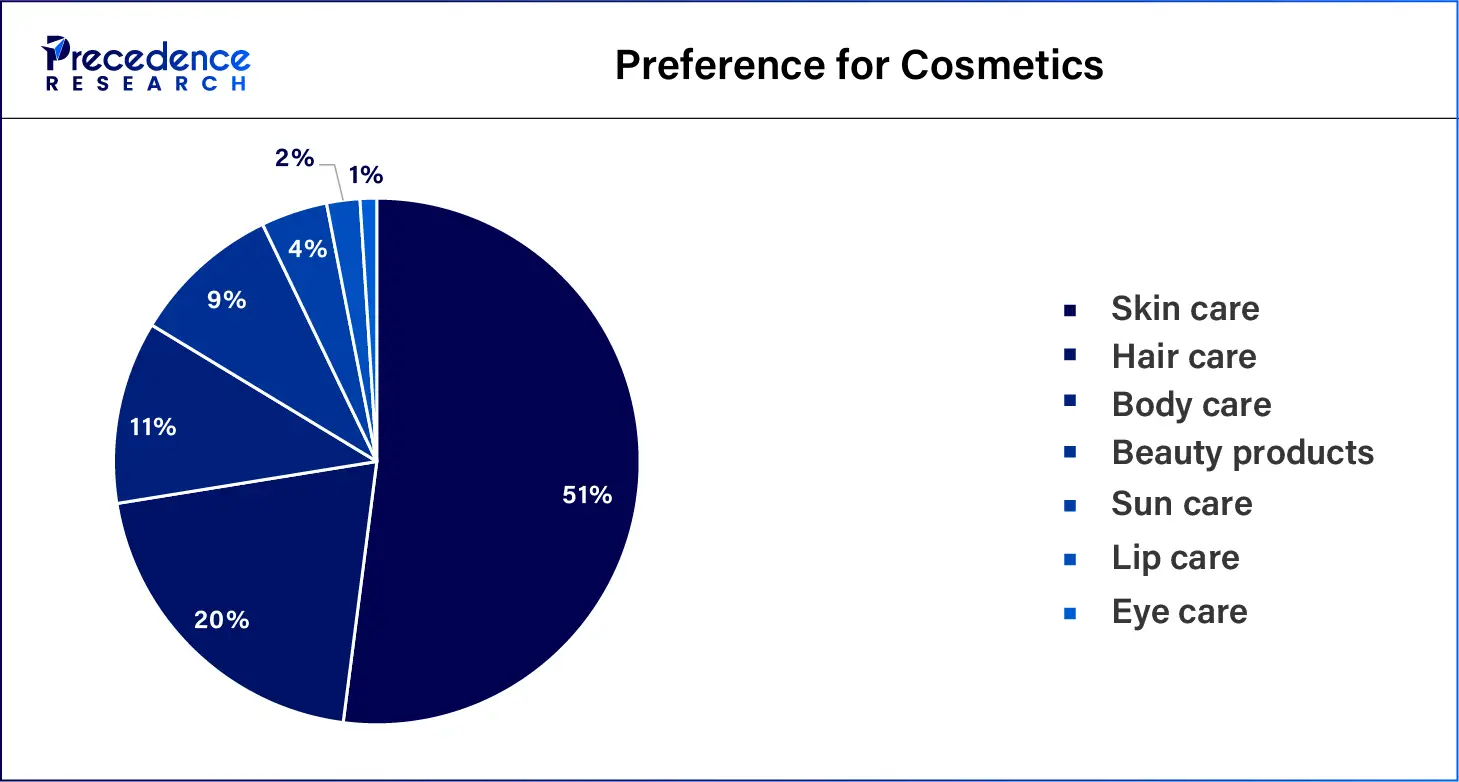

By product type, the skin care segment held the largest share of the natural and organic cosmetics market in 2023. Organic beauty treatments and organic cosmetics are natural remedies for regular chemical beauty treatments and programs that are based on organic products coming from plants, animals, or minerals. They can have no parabens, sulfates, phthalates, or other chemicals that are potentially harmful to the skin or cause skin irritation. Organic skincare products may also be comprised of natural antioxidants and vitamins, which may benefit the skin by nourishing it. The usage of organic skin care products is gradually creeping into the cosmetics trade.

The hair care segment is expected to grow with the highest CAGR in the natural and organic cosmetics market during the forecast period. Natural hair care products are those products that are made from 100% natural items like extracts from natural products and natural oils. All these ingredients are mild and will not harm the hair and scalp. They are, therefore, suitable for all hair types, especially those that have sensitive or damaged hair that has undergone some chemical processes.

The store-based segment accounted for a significant share of the natural and organic cosmetics market in 2023. Thus, it can be stated that online shopping is becoming popular because it is simple and convenient. This is so due to the influence of two electronic networks, namely e-commerce and e-business. E-commerce enhances the extent of advertising of businesses' products and services. It also assists in fine management of marketing of products or services in the market. Natural and organic beauty brands are off and running with e-commerce, supported by own-brand company websites and multi-brand retail sites that offer the right venues for product sales and, most importantly, consumer education.

By distribution channel, the non-store-based segment is expected to grow rapidly in the natural and organic cosmetics market during the forecast period. By maintaining a comprehensive record of feature history, the offline store contributes to the reproducibility of models and allows data scientists to identify trends, perform time-based analyses, and uncover insights. The offline store is typically implemented as a column-oriented store, which offers benefits in terms of storage efficiency, query performance, cost, and scalability. The offline store features the historical values of features, permitting proficient and scalable access to large volumes of historical feature data for model training and batch inference.

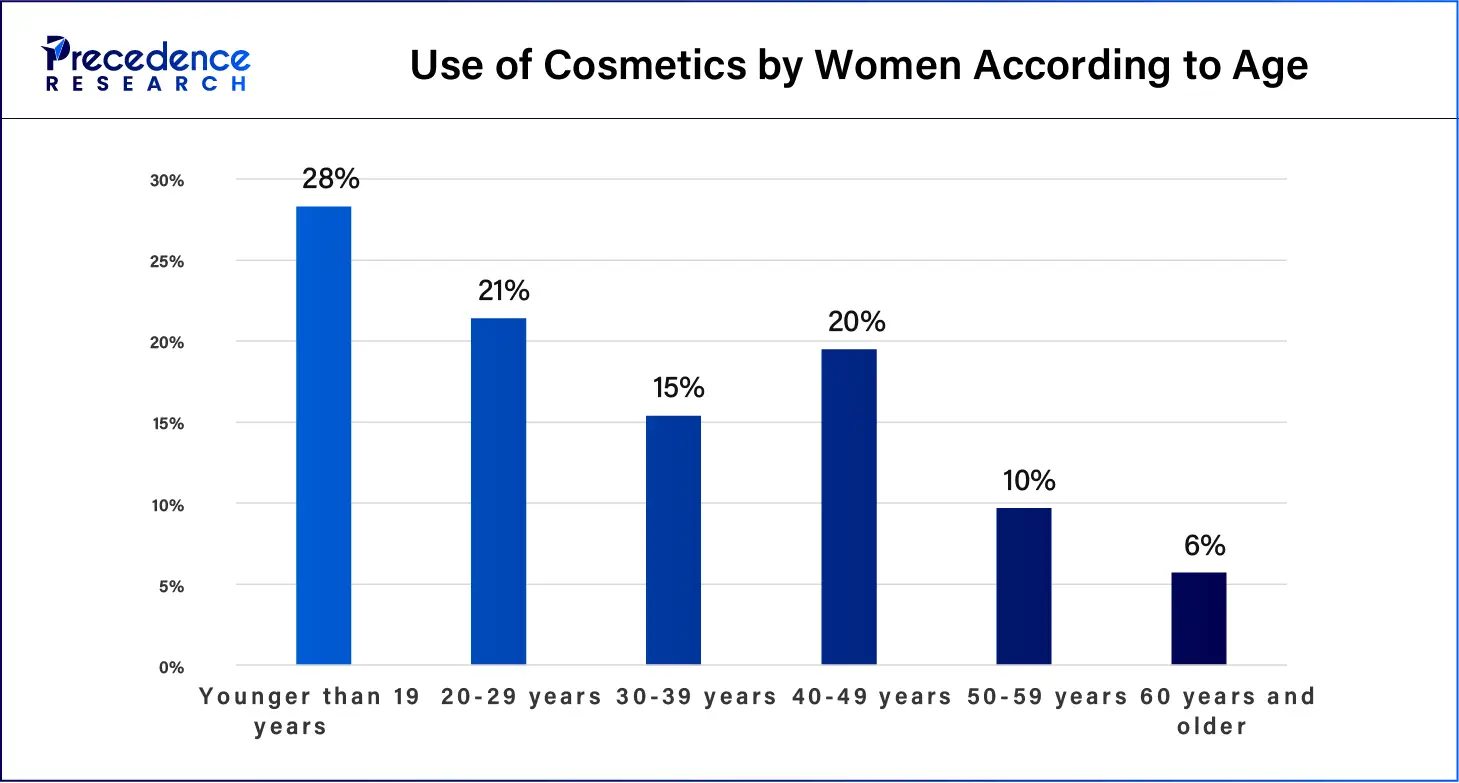

The female segment dominated the natural and organic cosmetics market in 2023. Rising awareness of beauty products, increasing personal grooming premium, altering consumption patterns, and enhanced purchasing power of women are forecasted to boost. Advertisements and reference groups majorly influence women. Women are interested in natural and herbal products and treatments, and they don’t mind spending extra, though they are price-sensitive.

The male segment is expected to grow at the fastest rate in the natural and organic cosmetics market during the forecast period. The increasing demand for gender-specific products such as shaving creams, shampoos, face masks and peels, and conditioners by men is expected to positively impact the market. The growing use of products like creams, face wash, and serums has resulted from an increase in product launches in the men's skincare segment. Gen-Z consumers prefer gender-neutral beauty products.

Segments Covered in the Report

By Product Type

By Distribution Channel

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

November 2024

October 2024

September 2024