May 2024

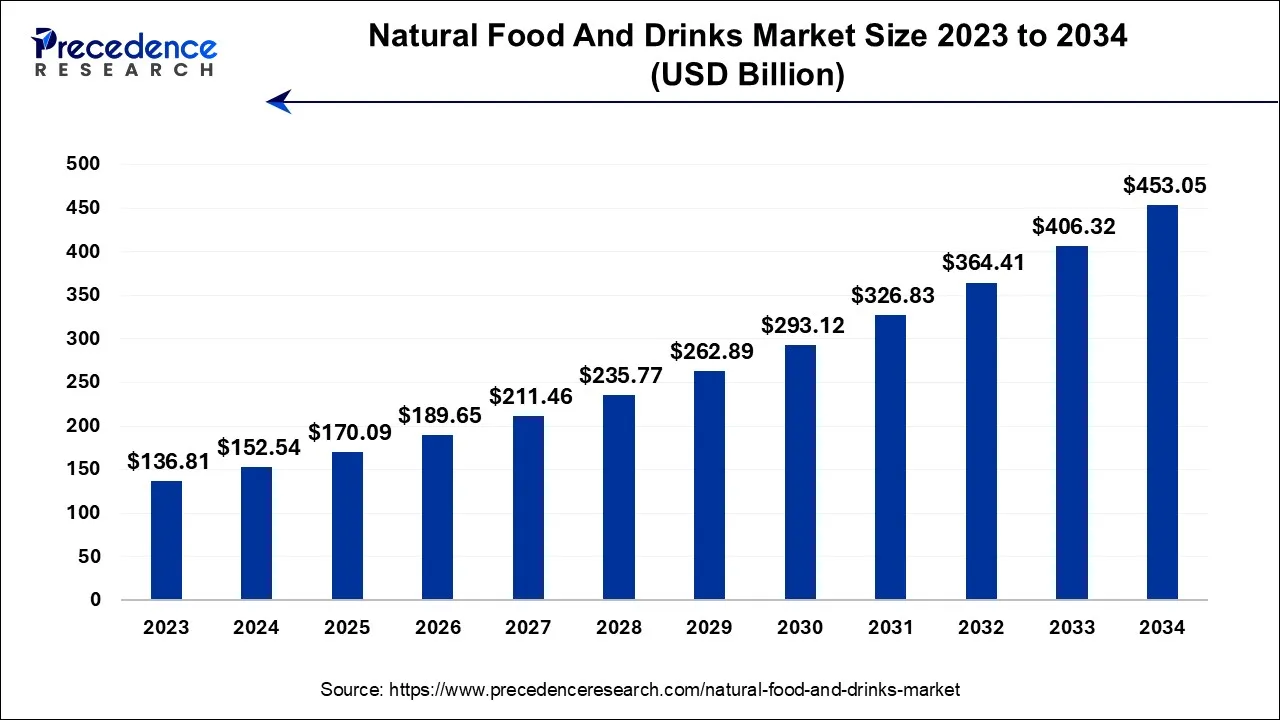

The global natural food and drinks market size is predicted to increase from USD 152.54 billion in 2024, grew to USD 170.09 billion in 2025 and is anticipated to reach around USD 453.05 billion by 2034, poised to grow at a CAGR of 11.5% between 2024 and 2034. The North America natural food and drinks market size is calculated at USD 61.02 billion in 2024 and is estimated to grow at a fastest CAGR of 11.6% during the forecast year.

The global natural food and drinks market size is calculated at USD 152.54 billion in 2024 and is projected to surpass around USD 453.05 billion by 2034, expanding at a CAGR of 11.5% from 2024 to 2034.

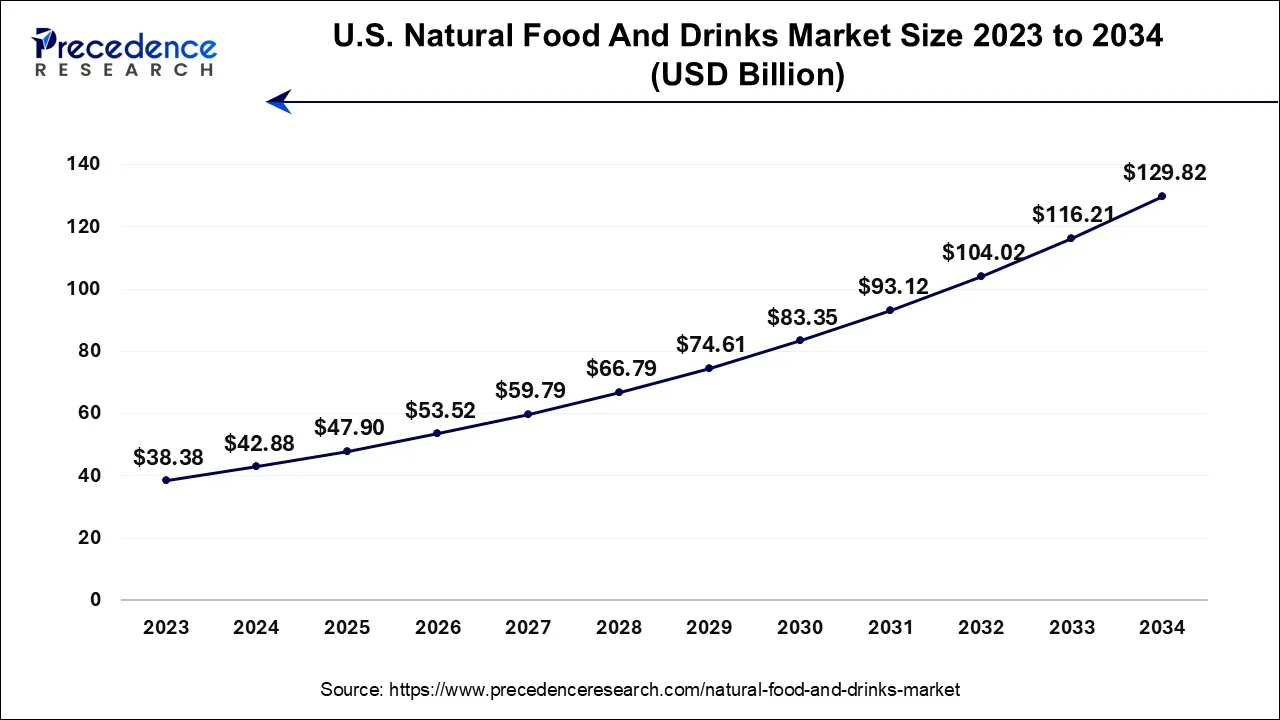

The U.S. natural food and drinks market size is exhibited at USD 42.88 billion in 2024 and is projected to be worth around USD 129.82 billion by 2034, growing at a CAGR of 11.7% from 2024 to 2034.

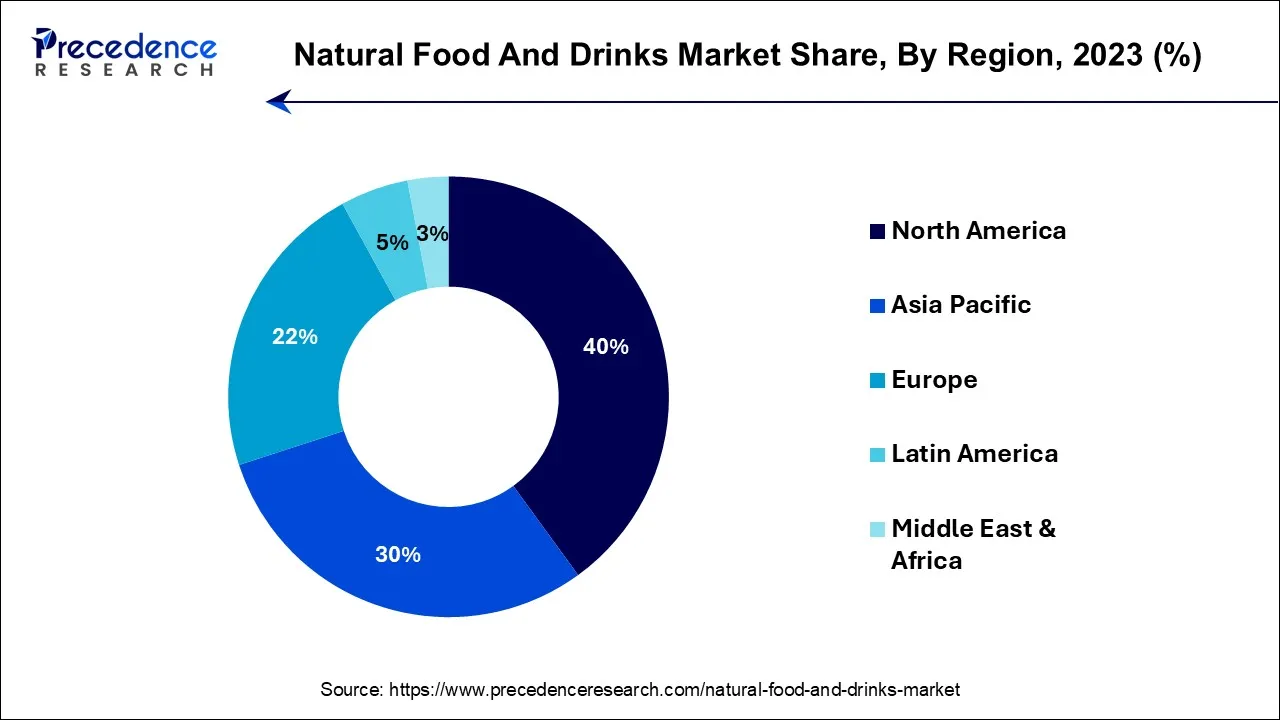

North America has held the largest revenue share of 40% in 2023. North America commands a substantial share in the natural food and drinks market due to a confluence of factors. Firstly, a robust health and wellness culture prevails, with consumers increasingly opting for natural, wholesome choices. Additionally, stringent food safety regulations and labeling standards enhance consumer trust in natural products. The region also witnesses a surge in demand for organic and non-GMO items, bolstering the natural market. Moreover, the well-established distribution infrastructure and the presence of key market players contribute to North America's dominant position, making it a pivotal hub for the natural food and drinks industry.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific commands substantial growth in the natural food and drinks market due to several key factors. The region's vast and diverse consumer base, including health-conscious individuals and those embracing traditional and natural diets, drives demand for these products.

Additionally, Asia Pacific boasts rich agricultural resources, allowing for the production of a wide range of natural ingredients. The market benefits from increasing urbanization and rising disposable incomes, which facilitate the adoption of healthier food and beverage choices. Furthermore, governmental initiatives promoting sustainable agriculture and clean eating contribute to the market's significant growth in the region.

Natural foods and beverages are untouched, minimally processed items that are devoid of artificial additives, preservatives, and synthetic flavorings or colorants. They are derived from nature and experience limited to no alterations before consumption. Natural foods include fresh fruits, vegetables, nuts, seeds, whole grains, and lean meats, which are intrinsically rich in vital nutrients, vitamins, and minerals, offering an array of health advantages. These products are frequently acknowledged for their inherent wholesomeness and nutritional superiority compared to heavily processed alternatives.

Natural beverages encompass a diverse range of choices, such as pure fruit juices, herbal teas, and unadulterated water. They are free from supplementary sugars, artificial sweeteners, or other chemical compounds commonly found in many commercially manufactured drinks. Choosing natural food and beverages aligns with a preference for a diet that closely aligns with nature, underscoring purity and the absence of chemical intervention. Opting for natural options can be a pivotal element of a health-conscious way of life, fostering overall well-being and diminishing the intake of potentially harmful substances frequently found in highly processed foods and beverages.

| Report Coverage | Details |

| Market Size by 2034 | USD 453.05 Billion |

| Market Size in 2024 | USD 152.54 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.5% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Packaging, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Allergen-free and dietary preferences

The surge in allergen-free and specific dietary preferences is propelling the growth of the natural food and drinks market. The increasing prevalence of food allergies and sensitivities has ignited a burgeoning demand for products devoid of allergens such as gluten, dairy, and nuts. Consumers with these dietary constraints are actively seeking trustworthy alternatives, fostering the evolution and accessibility of natural products tailored to their specific needs.

Furthermore, dietary inclinations like veganism, keto, and paleo diets have gained traction, primarily due to their perceived health advantages and ethical considerations. These dietary choices often dovetail with the consumption of unadulterated, whole foods, further amplifying the market for natural products. Manufacturers are responding to these shifting preferences by pioneering and crafting natural products that eschew common allergens and align with a spectrum of dietary preferences. This diversification of product offerings not only accommodates a broader consumer base but also underscores the adaptability and inclusivity of the natural food and drinks market, making it increasingly enticing to a diverse array of consumers with distinct dietary prerequisites.

Limited market size

Challenges related to taste and texture act as significant impediments to the natural food and drinks market's expansion. This restraint arises from the fact that many consumers are accustomed to the consistent taste and texture characteristics found in processed or artificially flavored products. Transitioning to natural alternatives can be challenging because these products often exhibit variations in their taste and texture, driven by factors such as seasonality and minimal processing.

For instance, whole-grain bread may present a denser texture and a nuttier taste, which can be distinct from the softer and milder characteristics of conventional white bread. Similarly, natural sweeteners like honey and maple syrup may introduce unique flavors that differ from the more neutral profile of refined sugar. To overcome this restraint, manufacturers need to focus on enhancing the taste and texture of natural products, making them more appealing and familiar to a wider audience, all while preserving their inherent health benefits and natural attributes.

Agricultural sector

The clean label movement is actively creating opportunities in the natural food and drinks market by fostering increased consumer demand for products that boast transparency, simplicity, and wholesome ingredients. This movement has spurred the development of natural products that align with the "clean label" criteria, which includes minimal and easily understandable ingredient lists, free from artificial additives or preservatives. Consumers are increasingly seeking products that are free from synthetic chemicals and look for terms they can recognize on ingredient lists, such as whole grains, real fruits, and natural sweeteners.

As a result, there's an expanding market for natural food and drink options that meet these expectations, catering to health-conscious individuals who prioritize the quality and purity of what they consume. Manufacturers are responding by reformulating and innovating to offer clean label alternatives, seizing the opportunity to establish themselves as trustworthy and transparent brands in an evolving and discerning market.

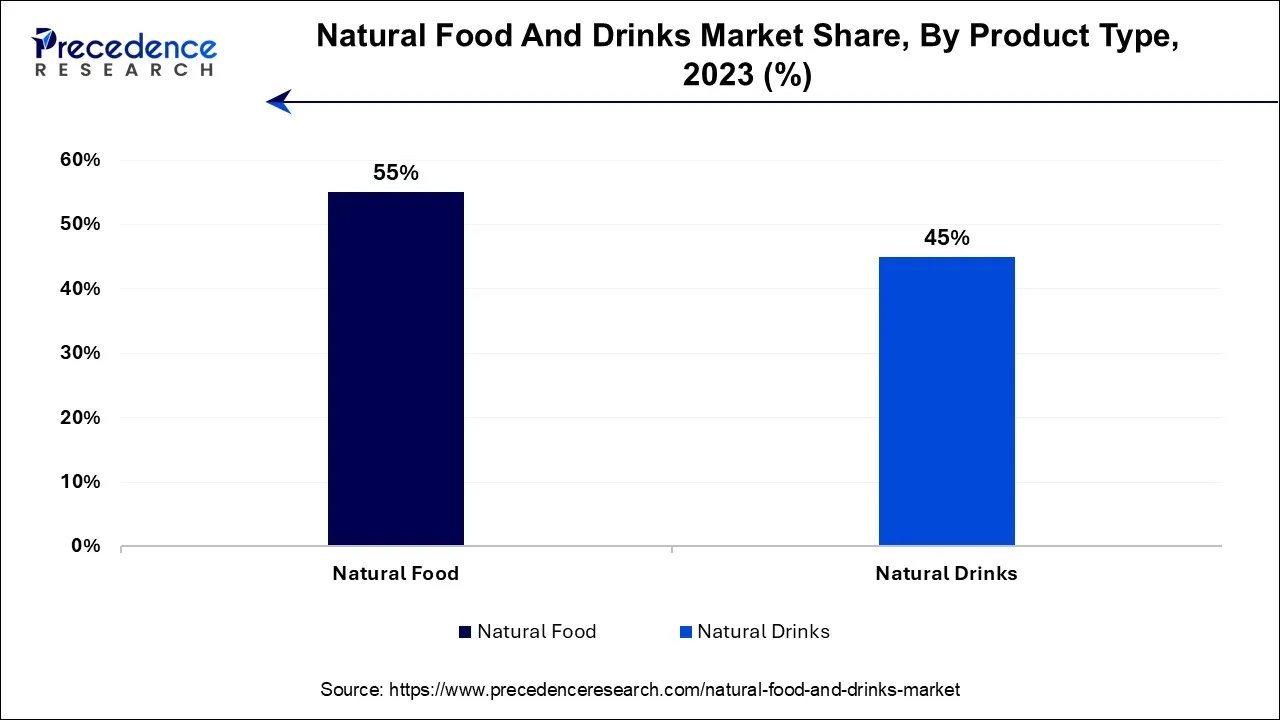

The natural food, aviation, and transport (mat) insurance segment has held a 55% revenue share in 2023. The natural food segment holds a major share in the natural food and drinks market due to increasing consumer awareness and a growing focus on health and wellness. Consumers are actively seeking alternatives to processed and artificial foods, gravitating towards natural, minimally processed, and whole food options.

The natural food segment offers a wide variety of choices, including fresh produce, grains, lean proteins, and dairy products, which align with these consumer preferences. This segment's appeal is further boosted by its association with clean-label products, sustainable sourcing, and adherence to dietary preferences, making it a dominant force in the market.

The natural drinks segment is anticipated to expand at a significant CAGR of 11.2% during the projected period. The natural drinks segment dominates the growth of the natural food and drinks market due to its strong appeal to health-conscious consumers. This segment includes pure fruit juices, herbal teas, and water, offering refreshing and nutritious choices that align with clean label preferences.

These beverages provide a straightforward means of consuming natural ingredients without any additives, making them a preferred option for individuals prioritizing a healthy lifestyle. The shift away from sugary and artificially flavored drinks in favor of natural alternatives has propelled this segment's growth, capitalizing on the demand for transparent and health-enhancing choices.

The cans segment had the highest market share of 60% in 2023. Cans play a significant role in the natural food and drinks market, mainly due to their practical and environmentally responsible packaging. They excel at preserving products by shielding them from factors like light and air, ensuring prolonged freshness. Cans are celebrated for their lightweight and durable nature, making them convenient for on-the-go consumption. They are also highly recyclable, aligning with eco-friendly initiatives and contributing to reduced environmental impact.

This is particularly advantageous for natural food and drinks that lack artificial preservatives. As a result, cans are a preferred and trusted choice within the market, catering to both convenience and sustainability.

The paperboard segment is anticipated to expand fastest over the projected period. The dominance growth of paperboard packaging in the natural food and drinks market can be attributed to its eco-friendly nature. Paperboard aligns with the preferences of environmentally conscious consumers looking for natural products. It's a renewable and biodegradable material that can be easily recycled, reducing its impact on the environment.

Additionally, paperboard offers excellent protection for natural foods, preserving their freshness and quality. The growing focus on sustainable and responsible packaging choices has propelled paperboard to the forefront, as it not only safeguards the integrity of natural products but also resonates with the broader trend of eco-conscious consumer preferences.

The business segment had the highest market share of 31% in 2023. The Supermarkets/Hypermarkets segment holds a significant share of the natural food and drinks market due to its widespread presence and consumer convenience. These retail outlets offer a diverse range of natural products under one roof, making it easy for customers to access a variety of options.

Moreover, the large shelf space and marketing capabilities of supermarkets and hypermarkets facilitate better visibility and promotion of natural products. Consumers trust these established stores for their quality, making them a preferred choice. Additionally, the ability to physically inspect and compare products contributes to the segment's dominance in the natural food and drinks market.

The others segment is anticipated to expand fastest over the projected period. The others distribution channel segment dominates the growth of the natural food and drinks market due to its multifaceted and innovative character. This category encompasses unconventional and emerging avenues such as farmer's markets, niche specialty stores, and direct-to-consumer sales, which have garnered favor among consumers in search of genuine and unprocessed products.

Furthermore, the ascent of e-commerce and online retail falls within this category, providing a convenient platform for consumers to access a broad array of natural offerings. The adaptability and diversity of the others segment enables it to cater to the ever-evolving tastes and demands of consumers who are in pursuit of distinctive and naturally sourced food and beverage alternatives.

Segments Covered in the Report

By Product Type

By Packaging

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

August 2024

September 2024

January 2025