October 2024

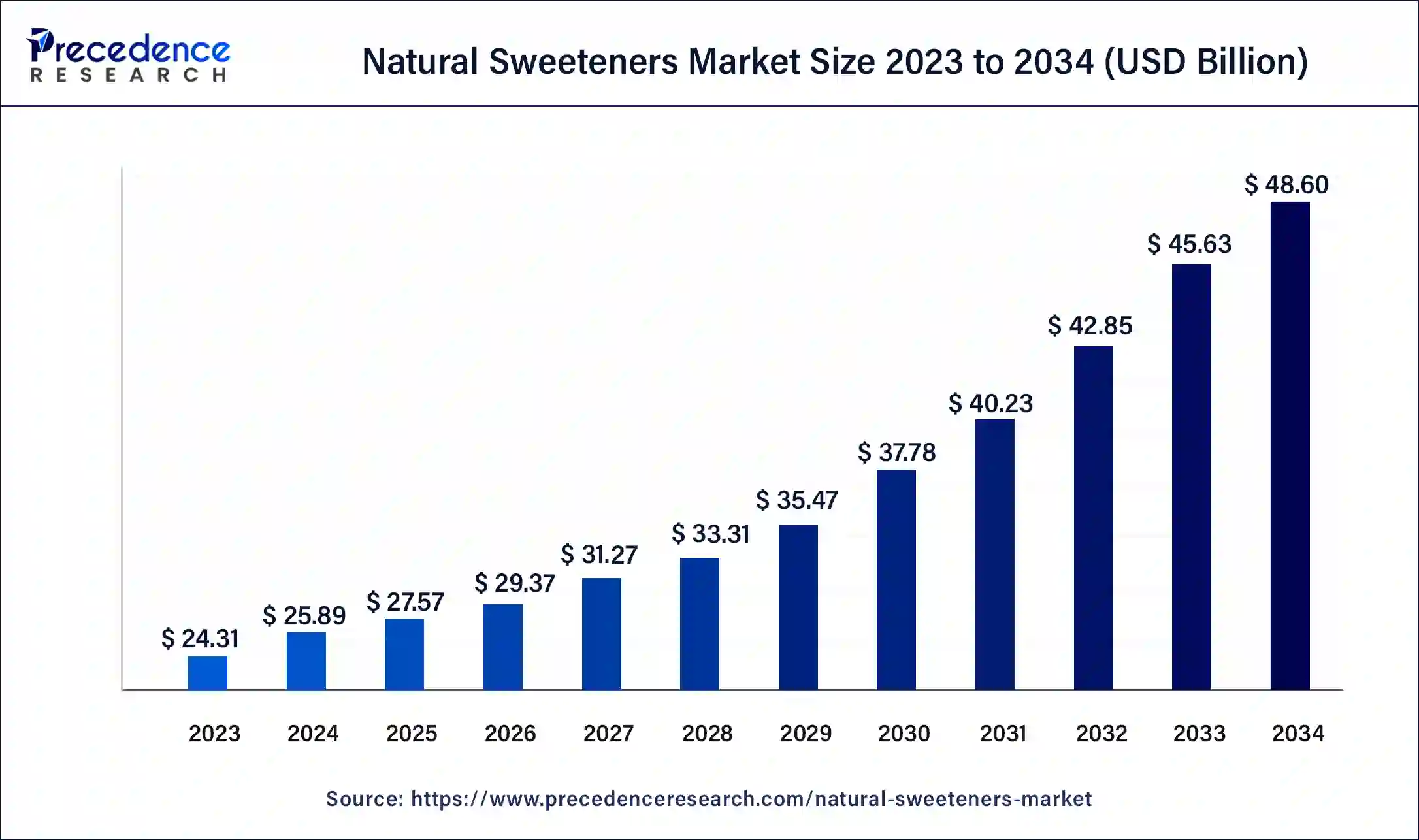

The global natural sweeteners market size surpassed USD 24.31 billion in 2023 and is estimated to increase from USD 25.89 billion in 2024 to approximately USD 48.60 billion by 2034. It is projected to grow at a CAGR of 6.50% from 2024 to 2034.

The global natural sweeteners market size is anticipated to reach around USD 48.60 billion by 2034 from USD 25.89 billion in 2024, at a CAGR of 6.50% from 2024 to 2034. Growth in the market is driven by a shift in consumer preferences towards healthier foods. Consumers are also increasingly expressing a desire for natural products that are free from ‘artificial’ additives, leading to further growth in the natural sweeteners market.

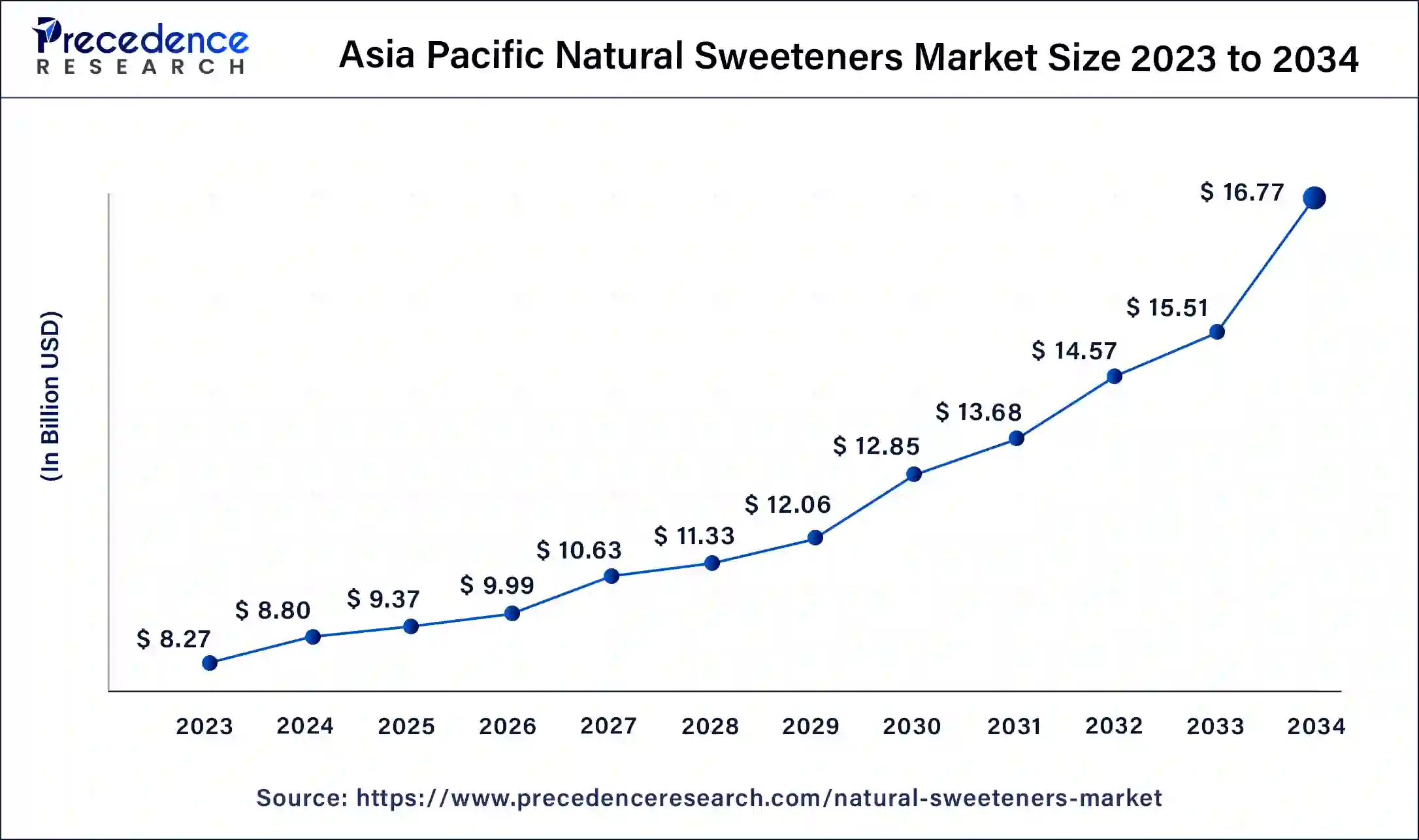

The Asia Pacific natural sweeteners market size was exhibited at USD 8.27 billion in 2023 and is projected to be worth around USD 16.77 billion by 2034, poised to grow at a CAGR of 6.63% from 2024 to 2034.

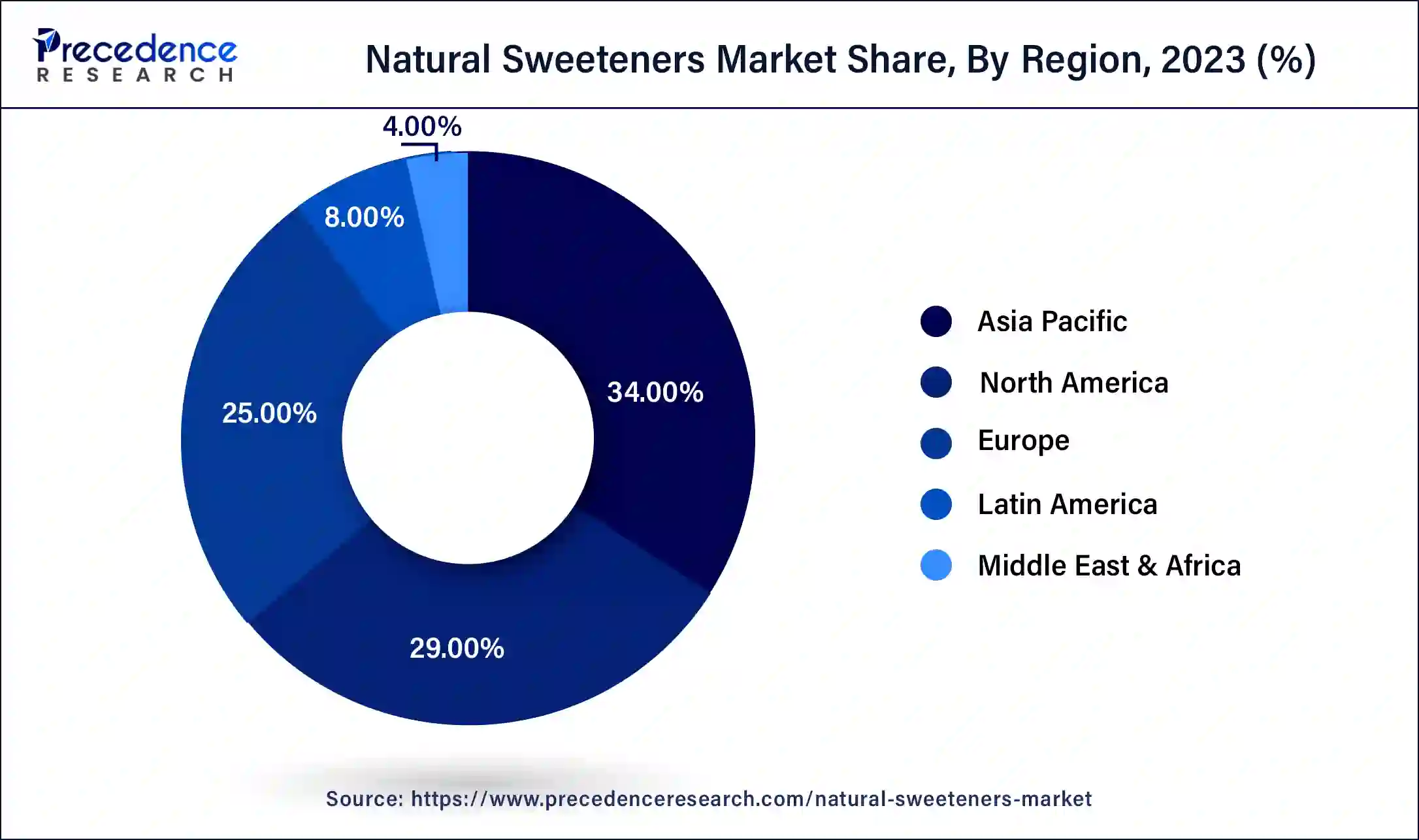

Asia Pacific made up the largest share of the natural sweeteners market in 2023. Natural sweeteners such as honey, dates, and molasses have been popular in the region since ancient times and are valued for their nutritional and medicinal properties. This has led to a shift in consumer preferences towards natural sweeteners such as stevia, coconut sugar, and fructose. Several Asian countries are also promoting innovation in natural sweeteners and implementing sugar taxes to reduce sugar consumption rates in nations like Cambodia, China, India, Laos, Malaysia, Sri Lanka, Thailand, and the Philippines. China is trying to combat its high obesity rates by starting initiatives such as Healthy China 2030 to help citizens adopt healthy diets and regular exercise regimens.

North America is expected to grow with the fastest CAGR in the natural sweeteners market during the forecast period. Consumers in the United States are increasingly demanding low-sugar and sugar-free food and beverage options to combat rising health issues such as diabetes, obesity, and tooth decay. Relatively newer natural sugars such as Allulose were first approved for use in the US over a decade ago by 2023.

Natural sweeteners are substances derived from plants added to food and beverages to make them taste sweet. These sweeteners contain some type of sugar or a sweet-tasting sugar substitute. Natural sweeteners are classified into two categories: high-potency sweeteners and bulk sweeteners. Some examples of natural sweeteners include honey, dates, stevia, sugar, sugar alcohols, maple syrup, and agave nectar. A global rise in lifestyle diseases such as diabetes is leading consumers to become more health-conscious. Consumers are becoming more aware of natural ingredients, which has caused the demand for naturally derived sweeteners to grow drastically in the past decade.

Sweeteners such as stevia and sugar alcohols are often added to food items and marketed as ‘sugar-free’ or ‘diet,’ acting as further incentives for growth in the natural sweeteners market. Growth in the market is restricted by the challenges of balancing taste and health benefits and navigating regulatory food and health safety rules across different regions. However, recent product innovations and demand from untapped markets are creating opportunities in the market.

How Artificial Intelligence is Transforming the Natural Sweeteners Market

Artificial intelligence is transforming the natural sweeteners market in numerous ways. For the sweetener market, startups such as Shiru are enabling protein marketplaces. These enable businesses to use AI and machine learning to identify and test proteins from high-intensity sweeteners. Platforms such as e-Sweet are being developed for automatic prediction of sweeteners and their corresponding relative sweetness, enabling experimental food scientists to exploit the current machine-learning methods to boost the discovery of more sweeteners with low or zero calorie content.

| Report Coverage | Details |

| Market Size by 2034 | USD 48.60 Billion |

| Market Size in 2023 | USD 24.31 Billion |

| Market Size in 2024 | USD 25.89 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.50% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing consumer awareness around healthy eating

In the past decade, there has been a spike in the incidence of lifestyle diseases such as diabetes, pushing consumer awareness around healthy eating. Many consumers are also becoming increasingly aware of the trace nutrients found in natural sweeteners and their benefits. Over half of the consumers are switching to healthy eating, reducing consumption of processed foods and sugar, fat, and salt. Consumer demand for all-natural ingredients is pushing the use of natural sweeteners in the bakery and confectionary industries. This has shifted consumer preferences towards clean-label products, driving growth in the natural sweeteners market.

Increased consumer consciousness around the side effects of artificial sweeteners.

International medical organizations are recommending individuals not to use sugar substitutes in the long run because of their health-related complications. This has caused increasing awareness of the side effects of artificial sweeteners among consumers. Thus driving the natural sweeteners market.

Studies into natural sweeteners are revealing side effects

Some natural sweeteners have been linked to side effects such as increased risk of heart disease, stroke, fatty liver disease, kidney issues, digestive issues, and blood clotting. Studies on agave have shown that high fructose may lead to increased triglycerides and the risk of fatty liver disease. A 2023 study linked erythritol, a sugar alcohol, to a higher risk of heart attack, stroke, and blood clotting. Other sugar alcohols, such as Xylitol, have also been linked to digestive issues, including gas, diarrhea, or general digestive discomfort, especially in children. Popular natural sweetener stevia has also been linked to an increased heart attack and stroke risk. Along with these side effects, some sweeteners are reported to have an unpleasant aftertaste and are expensive to produce. These factors are restricting growth in the natural sweeteners market.

Development of new sweeteners

Advances in biotechnological research have led to the establishment of new production methods, such as plant cell culture or microbial fermentation, to spur commercial-scale production of natural sweeteners. Emerging ingredients such as chicory root inulin and ‘modified’ sugar from plant-based sources are the two key innovations in natural sugar-reduced solutions. In the natural sweeteners market, researchers are also looking into the production of natural sugar substitutes in yeast. Several synthetic biology and metabolic engineering strategies, such as increasing the availability of substrates, alleviating the catabolite repression, and optimizing the redox balance, are being utilized in the production of natural sugar substitutes in yeast.

The other types segment dominated the natural sweeteners market in 2023. Honey is a natural product produced by honeybees from the nectar of flowers. Humans have used honey for nearly 5500 years, with most ancient civilizations, including the Greeks, Chinese, and Egyptians, consuming honey for its medicinal properties. Several studies have shown that honey has antioxidant, anti-inflammatory, antibacterial, anti-diabetic, respiratory, gastrointestinal, cardiovascular, and nervous system protective effects. Honey is a popular natural sweetener due to its food safety, taste, solubility, and reasonable cost.

The stevia segment is expected to grow with the fastest CAGR in the natural sweeteners market during the forecast period. Stevia is extracted from the leaves of the Stevia rebaudiana Bertoni (Asteraceae) plant native to South America. However, due to increased demand, it is currently growing in some countries in Europe and Asia. Stevia is popular among diabetic patients due to its non-significant calorie contribution yet sweet taste. Countries like Japan have been using stevia extracts for more than 30 years. Stevia has seen growing popularity over the past four years, with product availability in over 35 countries since 2010.

The beverage segment accounted for the largest share of the natural sweeteners market in 2023. The beverage industry, in particular, has adopted natural sweeteners. Tate & Lyle, ED&F Man/Unavoo Food Technologies Ltd, and Cargill have all developed natural high-intensity sweeteners for use in beverages.

The bakery segment is set to grow at the fastest rate in the natural sweeteners market during the forecast period between 2024 and 2033. The baking industry has historically used natural sweeteners such as honey and maple syrup for their unique browning, flavor, and moisture characteristics. Other natural sweeteners such as agave nectar, coconut sugar, date sugar, and jaggery sugar are also being widely adopted in the baking industry to achieve desired product qualities and a clean label.

The food & beverage industry dominated the natural sweeteners market in 2023. Sugars are widely used to sweeten foods and beverages. However, with growing health concerns, natural sweeteners are being used to replace sugar in the industry. Stevia and monk fruit are also being more commonly used to replace sugar in the food industry today. Newer ingredients such as chicory root inulin and ‘modified’ sugar from plant-based sources are being used in the food and beverage industry, with companies such as Cargill, CoSucra, and Sensus adopting them.

Segments Covered in the Report

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

May 2024

September 2024

November 2024