December 2024

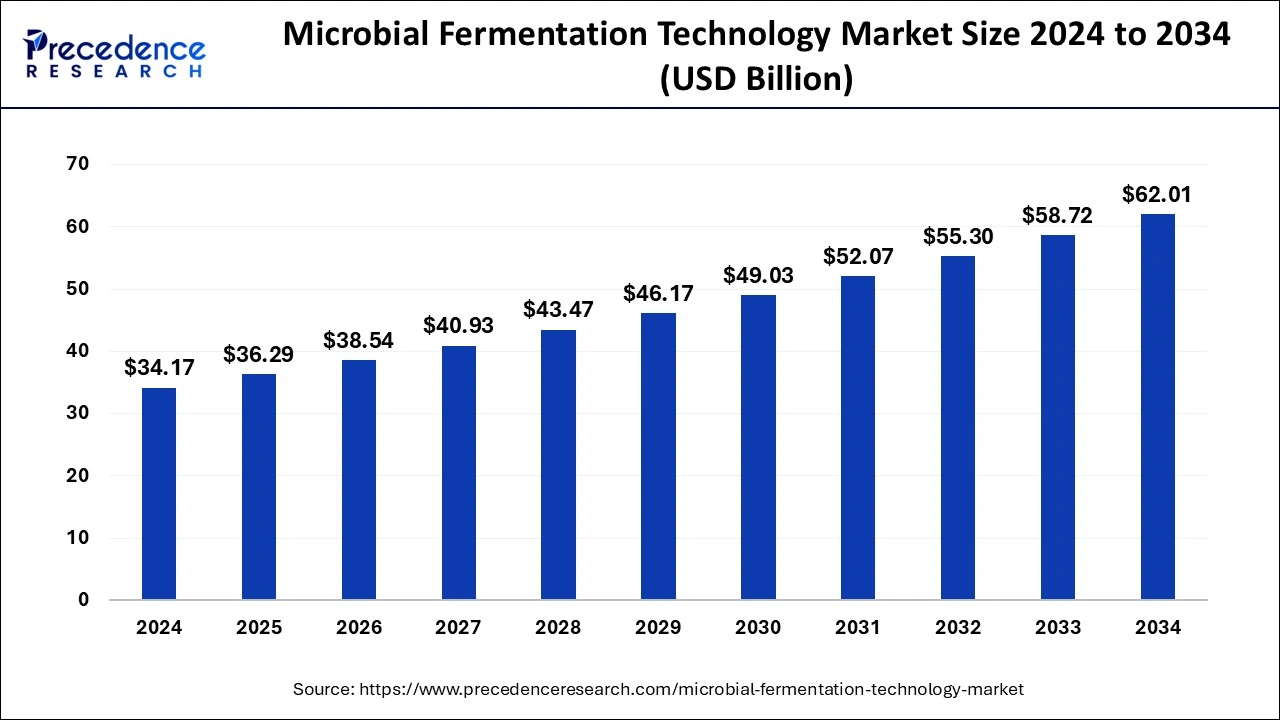

The global microbial fermentation market size is calculated at USD 36.29 billion in 2025 and is forecasted to reach around USD 62.01 billion by 2034, accelerating at a CAGR of 6.14% from 2025 to 2034. The Asia Pacific microbial fermentation market size surpassed USD 17.06 billion in 2025 and is expanding at a CAGR of 6.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microbial fermentation technology market size was accounted for USD 34.17 billion in 2024, and is expected to reach around USD 62.01 billion by 2034, expanding at a CAGR of 6.14% from 2025 to 2034.

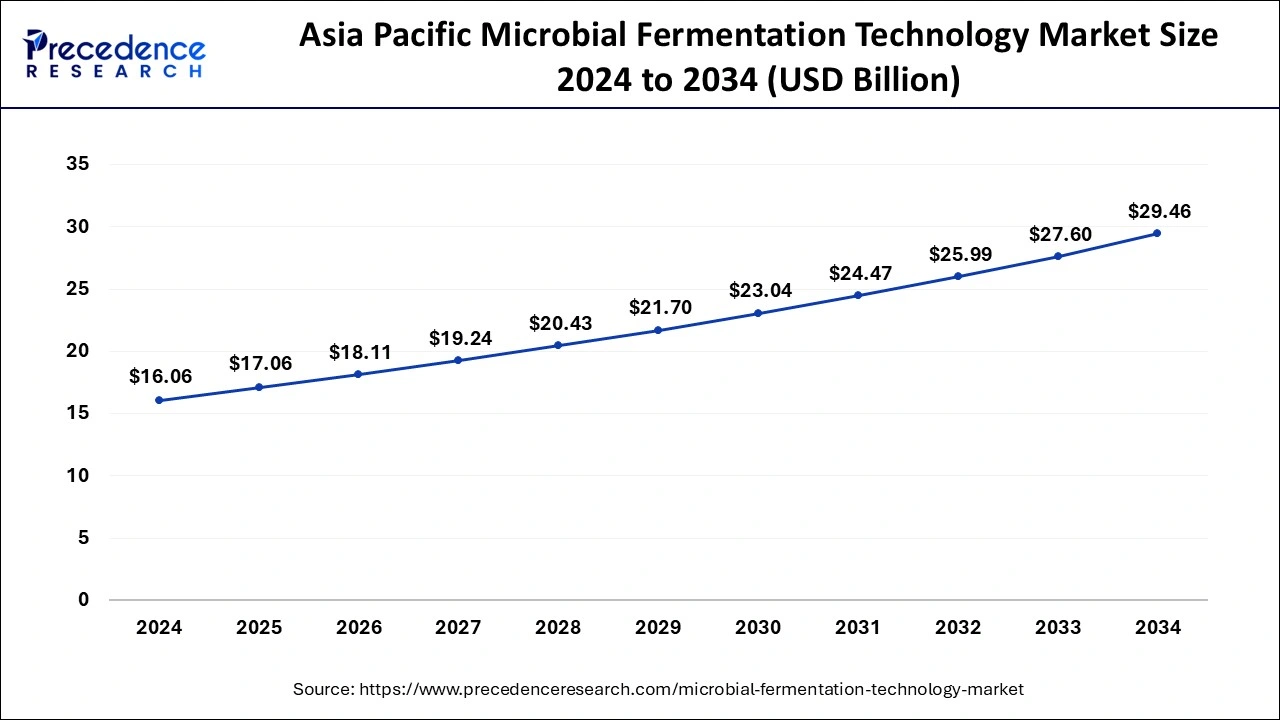

The Asia Pacific microbial fermentation technology market size was estimated at USD 16.06 billion in 2024 and is predicted to be worth around USD 29.46 billion by 2034, at a CAGR of 6.25% from 2025 to 2034.

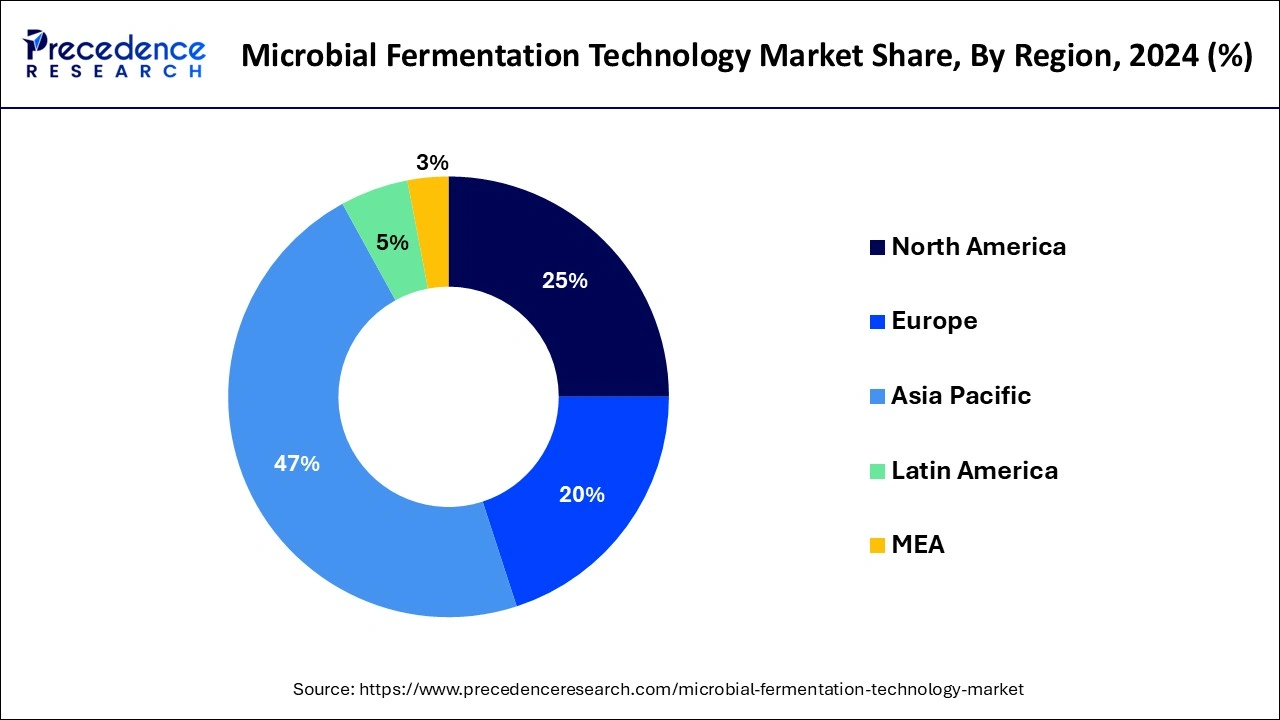

Asia-Pacific will be dominating the microbial fermentation technology market during the projection period. The increasing demand for pharmaceuticals, chemicals, and food & beverages accelerates the growing demand for microbial fermentation in the Asia-Pacific region—the rising investment in research and development of the microbial fermentation technology market. New approaches such as Indian industrial biotechnology is exploring that include harnessing microorganisms to produce value-added bioactive ingredients such as organic acids, industrial enzymes, single-cell proteins (SCP), and bulk chemicals, which have played a predominant role in the overall development of biotechnology after biopharmaceuticals.

The Asia-Pacific region is expected to be the fastest-growing market for microbial fermentation technology due to the increasing demand for food and beverages, pharmaceuticals, and industrial enzymes. China and India are the key markets in this region due to their large population and growing economy, which provide opportunities for growth in the food and pharmaceutical industries thereby expanding the microbial fermentation technology market.

North America is expected to witness significant growth in the forecast period. The growing engagement of companies in research and product development in biology coupled with the presence of a substantial number of contract development organizations in the region. The robust regulatory framework is another critical factor in shaping the North American market. The U.S. FDA attempts to work and improve guidelines regarding the development, approval, legal practice, promotion, and surrounding biopharmaceutical products.

The North American region is considered as a huge market for microbial fermentation technology. The increasing demand for pharmaceuticals, industrial enzymes, and biofuels drives the growth of this market. The United States is the largest market in this region due to significant players in the industry, such as Novozymes, DSM, and DuPont.

Microbial fermentation is the anaerobic metabolic process to induce chemical changes in the presence of enzymes. Energy is extracted from carbohydrates. Microbial fermentation has several applications, including preparing antibiotics and manufacturing bread, curd, yogurt, and pickles in producing beverages such as wine, beer, alcoholic biofuels, tanning of leather, curing tea, etc. Out of the numerous applications, it dominates the food, beverages, and pharmaceutical industries, which fuels the growth of the microbial fermentation technology market.

Key microbial fermentation technology market players include Novozymes A/S, DowDuPont Inc., and Chr. Hansen Holding A/S, DSM, Evonik Industries AG, and Givaudan SA. These companies invest in research and development to develop new and innovative products and technologies to meet the growing demand for sustainable solutions.

In September 2022, Cyclone Engineers, Cargill, and Genomatica, united on a project to increase bioreactor fermentation performance. The National Biotechnology and Biomanufacturing Initiative permitted US$ 2.5 million to hold up this research.

The increasing demand for fermented food & beverage products and growing consumer health consciousness propel the growth of the microbial fermentation technology market. The advantage offered by microbial fermentation technology of providing longer shelf life to food products supports the market’s growth. Growing demand for natural and organic food products as the growing demand for natural and organic food products is driving the microbial fermentation technology market because this technology is crucial in the production of natural and organic food products. It involves use of microorganisms like bacteria, yeasts, and fungi to transform food substances into desirable outcomes, such as cheese, yogurt, vinegar, and alcoholic beverages.

Consumers are increasingly concerned about their food's safety and quality and are willing to pay more for natural and organic products. Microbial fermentation technology enables the production of food products free from synthetic additives, preservatives, and other harmful chemicals. This makes them healthier and more appealing to consumers. Furthermore, microbial fermentation technology allows food manufacturers to produce food products with unique flavors, textures, and nutritional profiles.

For instance, probiotics produced through microbial fermentation have been shown to improve gut health and boost the immune system. This has led to an increase in demand for fermented foods and beverages, especially among health-conscious consumers. The microbial fermentation technology market is expected to grow as consumers demand more natural and organic food products.

| Report Coverage | Details |

| Market Size in 2025 | USD 36.29 Billion |

| Market Size by 2034 | USD 62.01 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.14% |

| Largest Market | North America |

| Fastest Growing MarketAsia-Pacific | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of infectious disease

Infections, usually respiratory tract infections, urinary tract infections, surgical site infections, gastrointestinal infections, and bloodstream infections are caused by microbes such as bacteria and fungi, ranging from mild to severe. The rising prevalence of infectious diseases has increased the demand for more fermented microbial products like antibiotics and vaccines to treat patients from infections, further expanding the market worldwide.

Microorganisms such as Salmonella and Mycobacterium bovis BCG are used in the production of vaccines, and after the fermentation, it is easier to cultivate the microbes to produce vaccines. As the demand for antibiotics along with the rising development for novel drugs grows, the growth of microbial fermentation technology market is expected to grow.

High cost of production

In many parts of the world, particularly in developing countries the specialized instruments and facilities needed for fermentation are expensive as the fermenter needs sterilization using high-pressure steam between batches. Inadequate funding from the government and minimal knowledge about the proper handling of microorganisms create a gap and hinder market growth. The cost of raw materials required for fermentation, such as sugars, insulin, starch and other supplements, can be a significant cost driver.

Sometimes, these materials may be difficult or expensive to source, leading to supply chain challenges and higher costs. Running a fermentation plant requires ongoing costs such as labor, utilities, maintenance, and quality control. These costs can add up quickly and may be higher for facilities that require specialized expertise or operate under stringent regulatory requirements. Once fermentation is complete, additional processing steps may be necessary to isolate and purify the desired product. These downstream processing steps can be complex and expensive and require specialized equipment and expertise.

Increasing focus on healthcare research

Healthcare research is vital because it provides a platform for disease trends, advanced and easy detection, risk factors, treatment, clinical trials, cost & care, and health transformation, which was absent in the last decade. With the growing demand for healthcare products such as vaccines, interferons, antibiotics, insulin, and growth hormones, there is a rise in the production of these medicinal products. The advancements in healthcare information-based data are promoting the growth of personalized medicine, which is beneficial for the patient to get cured rather than dealing with the whole generic population. This eventually boosts the development of the microbial fermentation technology market.

During the projection period, the antibiotics segment is expected to dominate the microbial fermentation technology market. The rising pharmaceutical sales will boost the production of antibiotics and subsequently drive the medical industry, propelling the demand for fermentation chemicals. There need to be more viable alternatives. While there are other antimicrobial agents available, such as disinfectants and bacteriophages, these tend to be less effective or more expensive than antibiotics. In addition, many of these alternatives have not been as extensively studied as antibiotics, so their long-term effects on fermentation still need to be understood.

Despite their widespread use, some concerns exist about the overuse of antibiotics in microbial fermentation technology. Overuse of antibiotics can lead to the development of antibiotic-resistant bacteria, which can pose a severe threat to human health. There is also a risk that antibiotics used in fermentation may end up in the final product, which could pose a health risk to consumers. The demand for fermentation chemicals is expected to increase for manufacturing antibiotics and steroids, thereby scaling up the microbial fermentation technology market.

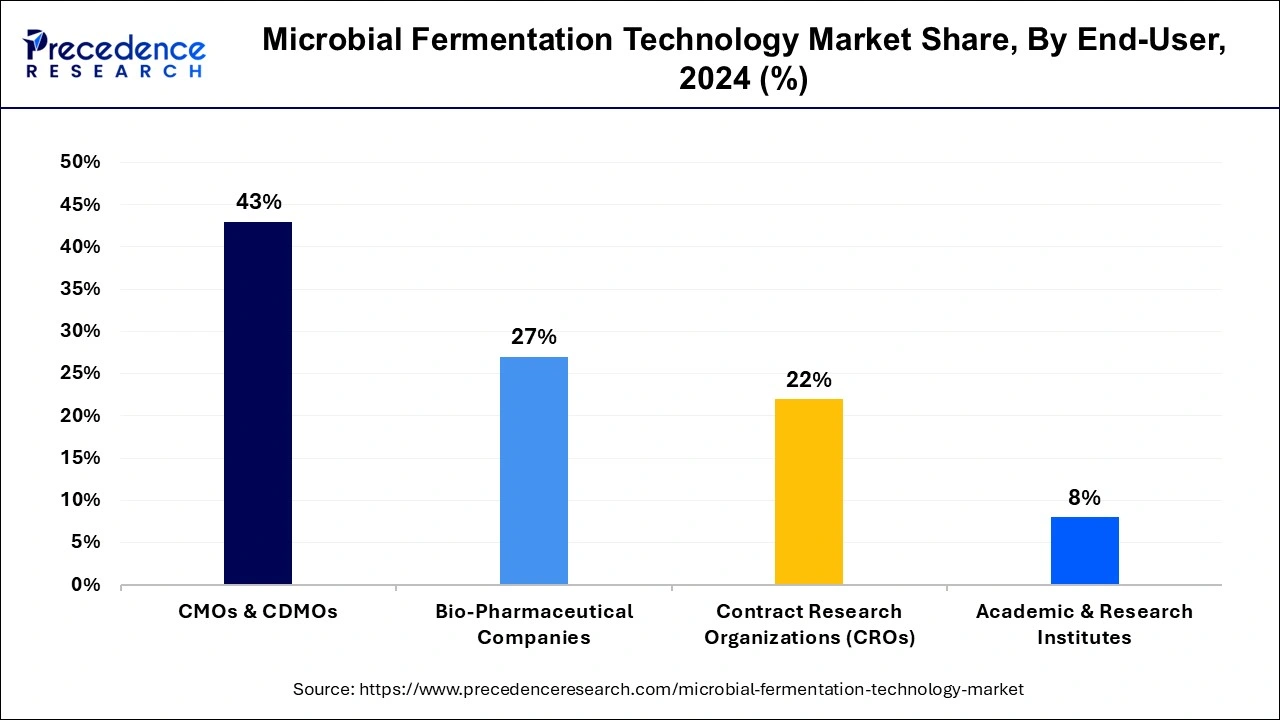

The CMOs & CDMOs dominate the end user segment throughout the forecast period. CMOs and CDMOs are rapidly becoming brilliant options for biotherapeutics makers as most of the innovation in the bioprocess space are done by smaller firms with a capacity constraint, a need for more trained professionals, and resources for commercializing these products. They have the flexibility to work with a wide range of clients, from startups to established companies, and can tailor their services to meet each client's specific needs.

CMOs and CDMOs offer customized solutions and also have a deep understanding of the regulatory environment for microbial fermentation-based products and can help their clients navigate the complex regulatory landscape. This is particularly important for companies new to the market or operating in a new geographic region, eventually expanding the market growth.

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

September 2023

September 2024