November 2024

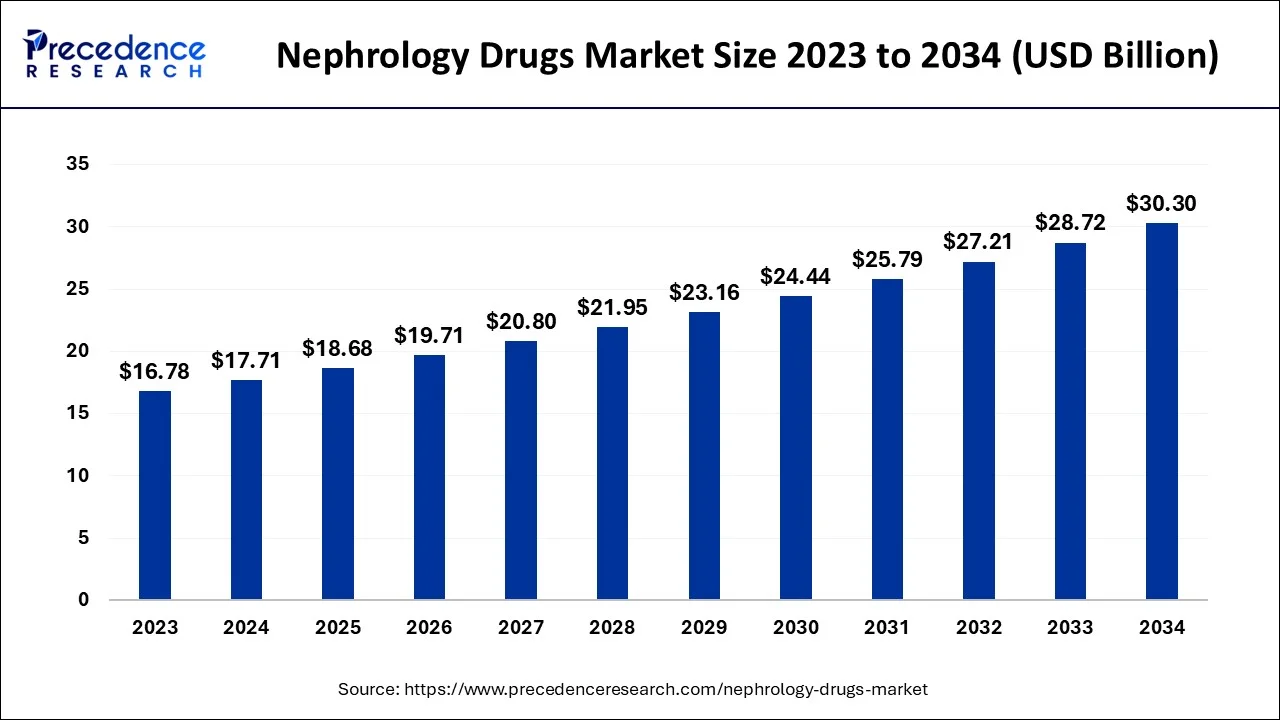

The global nephrology drugs market size accounted for USD 17.71 billion in 2024, grew to USD 18.68 billion in 2025 and is predicted to surpass around USD 30.30 billion by 2034, representing a healthy CAGR of 5.52% between 2024 and 2034. The North America nephrology drugs market size is calculated at USD 7.26 billion in 2024 and is expected to grow at a fastest CAGR of 5.63% during the forecast year.

The global nephrology drugs market size is estimated at USD 17.71 billion in 2024 and is anticipated to reach around USD 30.30 billion by 2034, expanding at a CAGR of 5.52% from 2024 to 2034.

The study of the kidney and illnesses associated with it is the focus of the medical specialty known as nephrology. Medical experts administer nephrology medications, also known as renal medicines, to treat a variety of kidney illnesses, including kidney infections and stones, as well as to promote kidney health. These medications can be given parenterally or orally.

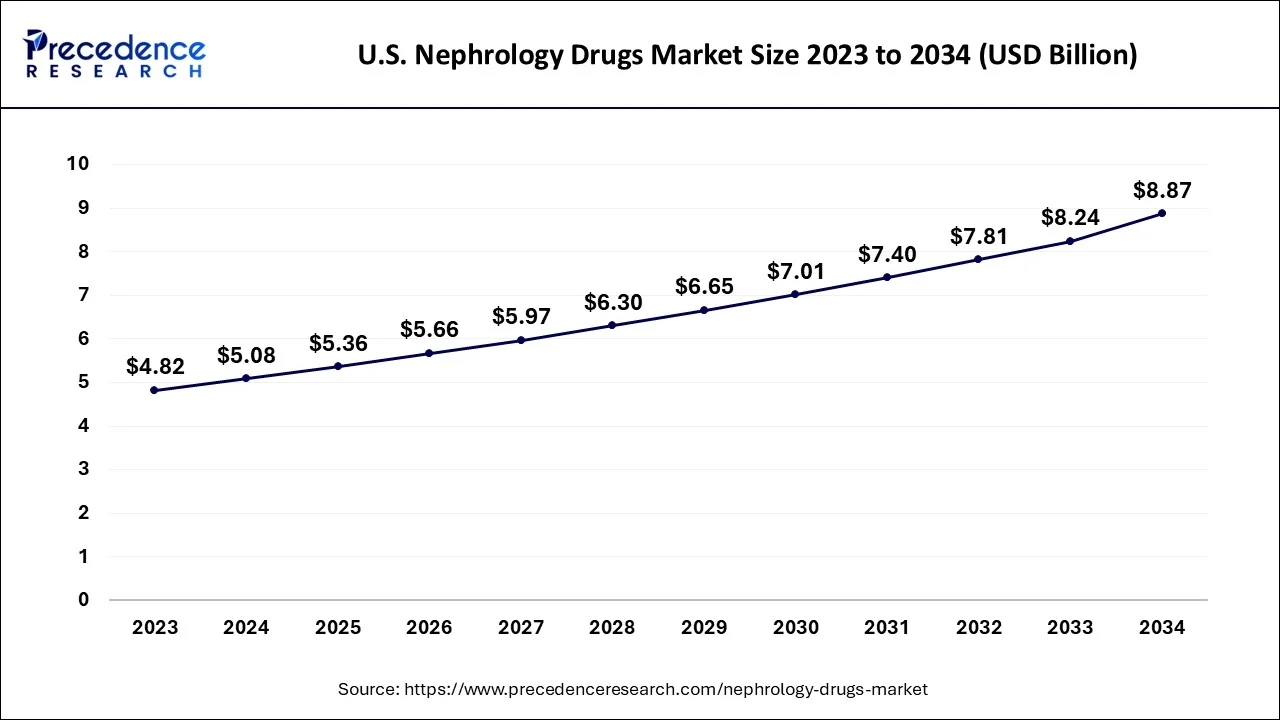

The U.S. nephrology drugs market size is estimated at USD 5.08 billion in 2024 and is expected to be worth around USD 8.87 billion by 2034, rising at a CAGR of 5.70% from 2024 to 2034.

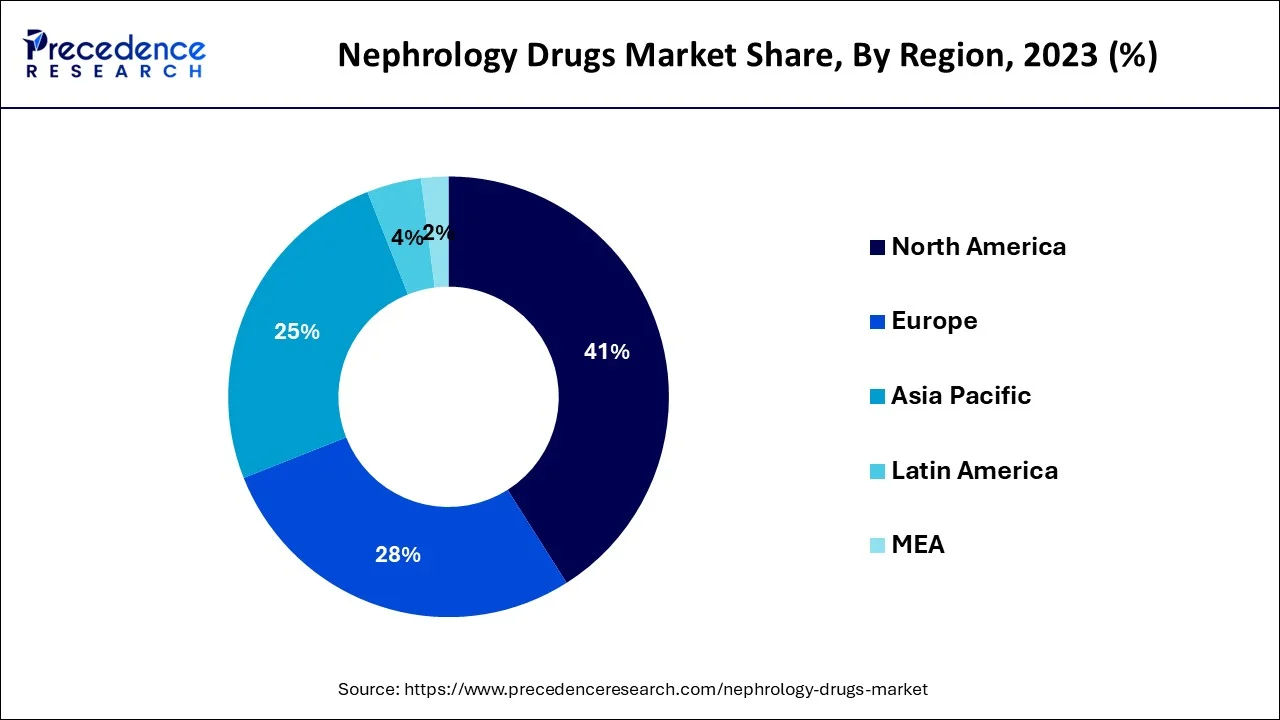

Due to the rising obesity rate and the rising number of diabetes patients, two significant factors driving the market for nephrology pharmaceuticals in the United States, North America held the largest market share in 2023. The nephrology medication industry was significantly boosted by increased support from governmental and healthcare institutions.

In the United States, chronic kidney disease affects more than 20 million individuals each year, according to the Centers for Disease Control and Prevention. In terms of sales, Europe remained the second-largest market for nephrology medications. The main factor in Europe was the high incidence of chronic renal disease. According to the prediction, Asia-Pacific saw the fastest growth rate from 2024 to 2034.

The critical factors in the Asia-Pacific region are the increasing prevalence of diabetes and cardiovascular diseases, emerging healthcare infrastructure and regulations, population growth, development, per capita income, and healthcare spending, as well as increased government initiatives and public awareness

Due to the rising incidence of kidney disease among millennials worldwide, the market for nephrology pharmaceuticals is anticipated to have impressive development over the forecast period. Increased awareness of the frequency of kidney disorders, changes in lifestyle, and an increase in occurrences of diabetes and hypertension are some of the reasons driving the growth of the worldwide nephrology pharmaceuticals market. The ability of nephrology pharmaceuticals to treat conditions like chronic kidney disease and acute renal illness significantly aids in the market's expansion.

Additionally, growing public knowledge of kidney disorders and increased funding for research, development, and innovation support market expansion on a worldwide scale. The alarming increase in kidney failure cases, the rise in the frequency of different chronic nephrology disorders, the adoption of an unhealthy lifestyle, and the increase in the number of older people are the main reasons fueling the growth of the nephrology pharmaceuticals market.

Additionally, a rise in alcohol consumption, an increase in kidney disease diagnostic tests, an increase in the population who are obese, an increase in R&D activities for the introduction of new drugs and improvements to existing drugs, and emerging technology in developing economies are all contributing to the market's expansion.

The government has implemented several steps to support regulatory affairs in obtaining licenses for innovative pharmaceuticals and insurance plans that are opening up attractive potential in the market for nephrology drugs. Additionally anticipated to contribute to the expansion of the nephrology medicines market during the analysis period is the rising elderly population worldwide.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.71 Billion |

| Market Size by 2034 | USD 30.30 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Second Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Drug Class, By Route of Administration and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing kidney disease cases to accelerate market growth

The rapid growth of the nephrology drugs market share is anticipated to be fueled by the millennial generation's rapidly rising incidence of kidney diseases like kidney failure and kidney fibrosis, which are brought on by changes in lifestyle, such as reduced physical activity and unhealthy eating patterns. Different kidney diseases, like kidney infections, affect many people worldwide.

For instance, the National Kidney Foundation's 2018 data shows that every year, about 37 million Americans, or 15% of the country's population, are affected by kidney disease. Therefore, the first line of treatment for managing and halting the spread of any serious kidney-related diseases is nephrology medication prescribed by medical professionals. Additionally, it is anticipated that the market for nephrology drugs will grow in the coming years due to the growing geriatric population worldwide.

Kidney disorders are not widely known, which could impede market expansion

Lack of knowledge about kidney disorders is anticipated to be the main factor limiting the growth of the nephrology drugs market. Even though government initiatives to increase public awareness of chronic kidney disease (CKD), including the distribution of clinical practice guidelines and recommendations for patients with CKD or its risk factors, local awareness campaigns like World Kidney Day, and free screening programs for high-risk individuals like the Kidney Early Evaluation Program (KEEP), awareness of CKD is still unacceptably low.

For instance, in March 2018, a cross-sectional study for the evaluation of chronic kidney disease revealed that people in Australia have very little knowledge of chronic kidney disease (CKD), with only half of the participants knowing that medications can help to slow the progression of chronic kidney disease. This study was published in BMC Public Health. Furthermore, 23.4% of all participants with chronic kidney disease knew that herbal supplements don't work to cure the condition.

Over the forecast period, product launches and approvals are anticipated to fuel market expansion

Major market players concentrate on innovative product launches and approvals to diversify their product offerings and increase their market presence internationally. For instance, Farxiga will be authorized in the United States in April 2021 to treat individuals with or without type 2 diabetes who are at risk of developing chronic kidney disease. For the treatment of anemia brought on by chronic kidney disease, GSK was granted the first regulatory approval for Duvroq (daprodustat) in Japan in April 2020.

Mimpara (cinacalcet), a medication for secondary hyperparathyroidism (HPT), has been given the green light by the European Commission (EC) to be used more widely in children aged three and older who are on dialysis and whose secondary HPT is not sufficiently managed by the standard of care therapy.

Additionally, Amgen, Inc.'s Parsabiv (etelcalcetide), approved for treating secondary hyperparathyroidism in adult people with chronic kidney disease receiving hemodialysis, obtained FDA clearance in February 2017.

Angiotensin-converting enzyme (ACE) inhibitors lower blood pressure by relaxing the veins and arteries. An angiotensin II substance constricts blood vessels and is not produced by the body when angiotensin-converting enzyme inhibitors (ACE inhibitors) are utilized. This restriction can lead to a high level of blood pressure, which makes the heart work harder. Hormones that increase blood pressure are likewise produced by angiotensin II.

Due to a growth in the incidence of different cardiovascular and hypertension problems, changing lifestyles, and other factors, the ACE inhibitors sector now leads the worldwide nephrology medicines market by pharmacological class. Globally, cardiovascular illnesses are the leading cause of mortality.

According to estimates, 17.9 million deaths worldwide in 2019 were attributable to CVDs, or 32% of all fatalities. Eighty-five percent of these fatalities were due to a heart attack or stroke. More than 75 percent of CVD fatalities occur in low- and middle-income nations.

Thirty-eight percent of the 17 million premature fatalities (under the age of 70) brought on by non-communicable illnesses in 2019 were attributable to cardiovascular disorders. ACE inhibitors treat or prevent kidney disease (nephropathy) in people with diabetes or high blood pressure.

The oral sub-segment is predicted to have the quickest market growth rate and produce $14,154.7 million in revenue by 2032. The non-invasive medication delivery route of oral pharmaceuticals is to blame for the change in income of the sub-segment. Oral medication administration is quite convenient for patients, especially elderly persons. Additionally, it is projected that the increased incidence of renal illnesses, such as kidney failure, would accelerate market expansion throughout the forecasted year.

The hospital pharmacies sub-segment is anticipated to dominate the worldwide market and generate $11,049.0 million over the projected period. The expansion of the sub-segment is due to an increase in the number of patients with chronic renal disease who visit hospitals. The hospitalization rate has risen with the rise in renal disease incidence. Due to their proximity to the hospital, patients find it convenient to obtain the necessary nephrology medications at hospital pharmacies. These elements are expected to increase market revenues significantly.

The sub-segment of retail pharmacies is predicted to grow and produce $9,010.9 million in sales by 2030. Due to the increase of retail pharmacy outlets worldwide, the sub-segment is anticipated to develop impressively. Since they are readily available everywhere and the pharmacist goes over dosage instructions with the customers, many people prefer to buy their medications from retail pharmacies. Such elements are likely to boost market expansion during the anticipated time frame.

By Drug Class

By Route of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

March 2025

March 2025