February 2025

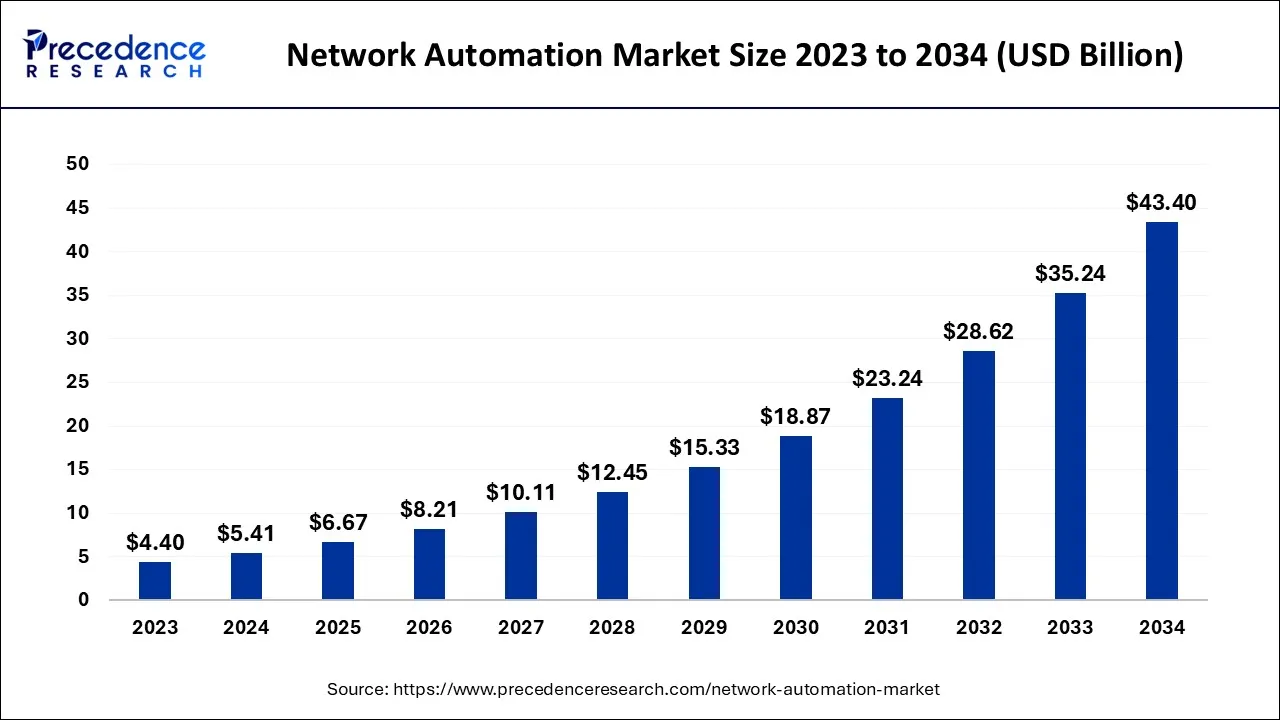

The global network automation market size accounted for USD 5.41 billion in 2024, grew to USD 6.67 billion in 2025, and is expected to be worth around USD 43.40 billion by 2034, poised to grow at a CAGR of 23.15% between 2024 and 2034. The North America network automation market size is predicted to increase from USD 2.22 billion in 2024 and is estimated to grow at the fastest CAGR of 23.3% during the forecast year.

The global network automation market size is expected to be valued at USD 5.41 billion in 2024 and is anticipated to reach around USD 43.40 billion by 2034, expanding at a CAGR of 23.15% over the forecast period from 2024 to 2034.

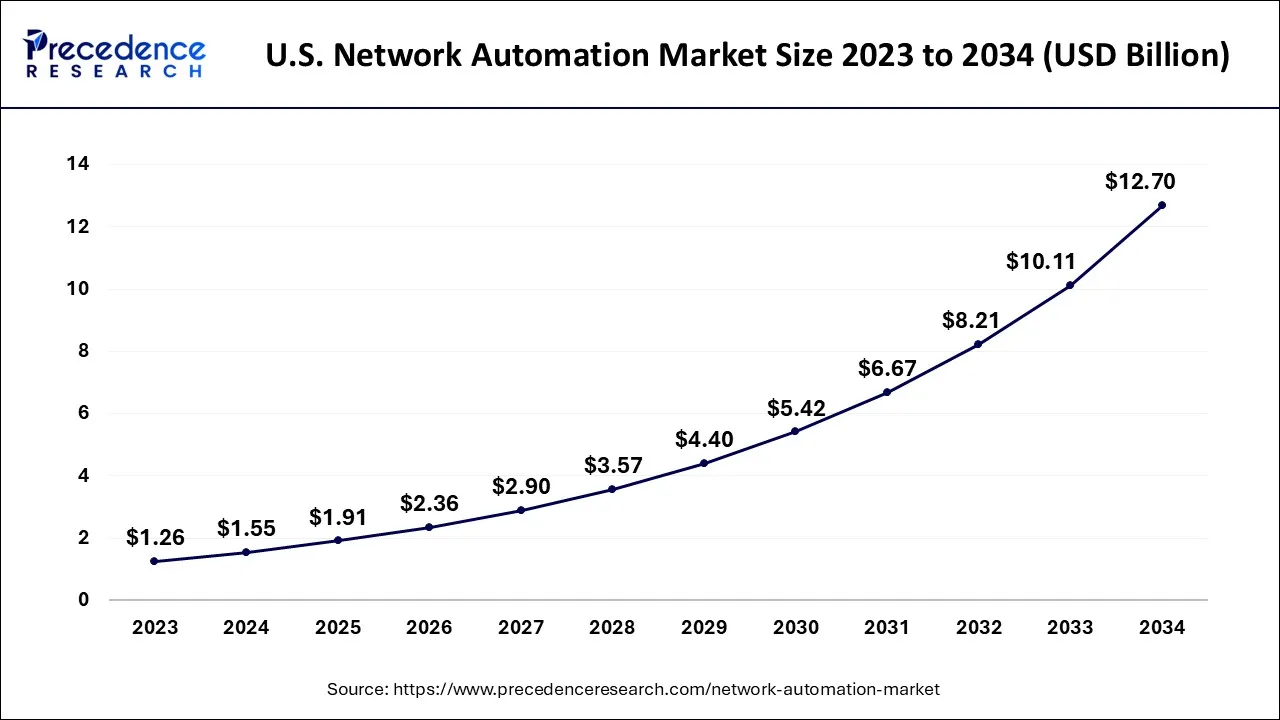

The U.S. network automation market size is exhibited at USD 1.55 billion in 2024 and is projected to be worth around USD 12.70 billion by 2034, growing at a CAGR of 23.39% from 2024 to 2034.

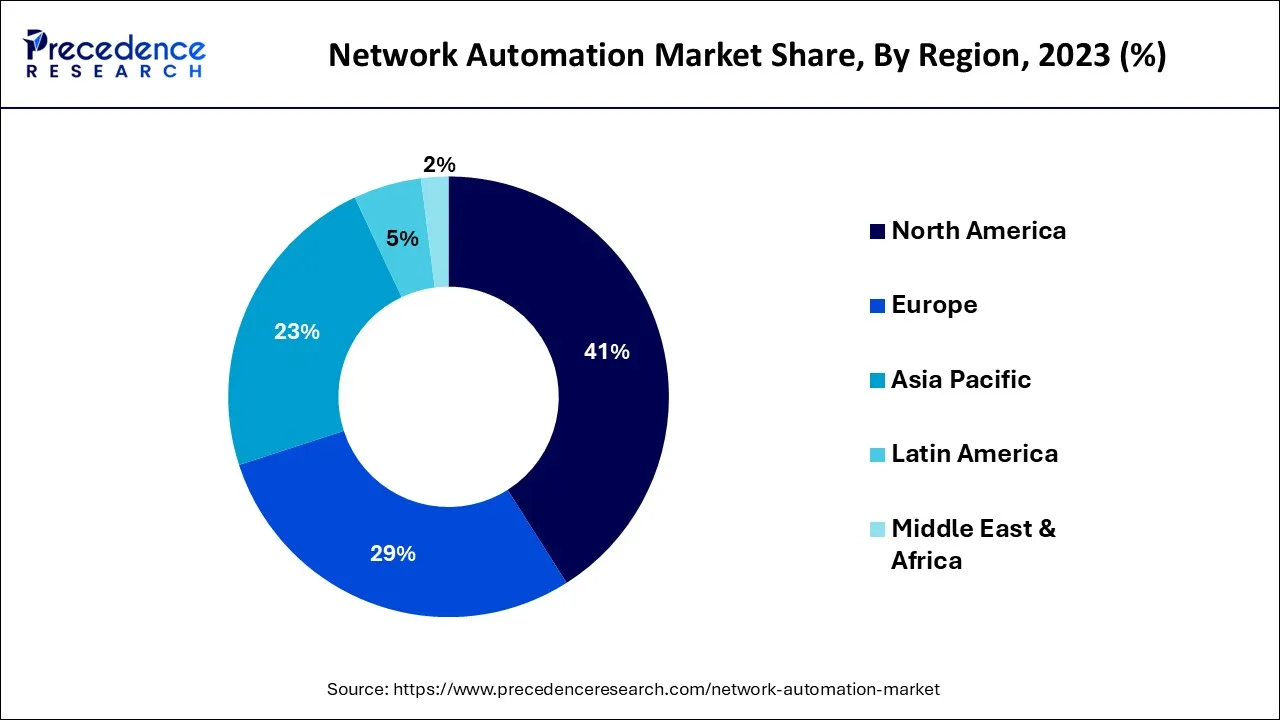

North America holds a significant market share of around 41% and is expected to grow faster during the forecast period. Some factors driving market growth in the region include an increase in the number of data centers, a rapid shift of SMEs toward digitalization, and increased investment in 5G projects.

Asia Pacific market is expected to reach at a CAGR of 24.1% over the forecast period. Several businesses in the United States intend to deploy highly efficient wireless communication solutions to increase network capacity. This would assist in boosting the efficiency of employees who use digital data and cutting-edge software.

Market Overview

The process of using software to automate network and security provisioning and management to maximize network efficiency and functionality constantly is known as network automation. Network automation is frequently used in conjunction with network virtualization. It offers improved operational efficiency, reduced probability of errors, and lower operating expenses. Moreover, surging investments in automation solutions and growing implementation of virtual solutions-defined infrastructure are the factors opening opportunities for market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.41 Billion |

| Market Size by 2034 | USD 43.40 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 23.15% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Components, By Network Type, By Deployment Mode, By End-User, By Organization Size, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for data center networks

The growing popularity of cloud computing and advanced applications such as telehealth, ultra-HD streaming video, virtual reality (VR) streaming, rising stock trading, and connected vehicle safety applications are resulting in a significant shift in data center infrastructure and traffic. According to this sequence, hardware manufacturers emphasize network hardware and release equipment that meets these specifications.

This exponential growth in the data center market necessitates improved operations, processing speeds, and security through data center automation software and hardware. Data centers increasingly use artificial intelligence to improve every aspect of their operations, along with network efficiency, dependability, efficiency, and security. This will propel the network automation market forward during the forecast period.

Security threats

One of the primary reasons impeding market growth is some companies' insecurity that automated systems will overlook security threats or enforce too many constraints on the network. Furthermore, implementing automated solutions or procedures in the organization necessitates hiring professionals or training existing network teams, both of which increase the company's expenses. In addition, no new automation regulations or standards have been established.

Without clearly defined standards, all networking vendors may develop different configuration commands, making infrastructure management even more complicated for the networking team. It may occasionally result in configuration errors, resulting in an instant network breakdown. For example, in June 2019, a software bug caused a significant outage in Google due to a runaway automation process.

Technological advances

As a result of technological advancement, numerous industries have undergone digital transformation, increasing the number of network applications. This has significantly increased network and system complexity, requiring the installation of automation for potential performance and fueling network automation market growth. At present, intent-based networking skills help businesses keep up with digital and cloud-based change demands even though comprehensive automated solutions for network management tools and technologies will be available in the future.

Furthermore, the adoption of software-defined networks, such as software-defined wide-area networks (SD-WANSs), has allowed network automation tools to progress from operationally focused point products that address change management and setup to policy and orchestration tools. Data centers are currently under pressure to reduce operating costs while supporting many devices, so they emphasize efficiency, ease, and automation in configuration management and employ automated solutions. Network vendors are expanding their assistance for open-source platforms and systems operators use for routine tasks such as configuration monitoring and data refresh. As a result, such advancements in network automation create profitable opportunities for market players.

In 2023, the solutions segment accounted for the largest market share and it is expected to reach at a CAGR of 21.5%. SD-WAN and network cloud computing solutions, intent-based networking solutions/platforms, configuration management tools, and other network automation tools comprise the solution segment.

The adoption of network automation solutions by communication service providers (CSPs) to accelerate the delivery of this software and applications can be attributed to the growth of the solution segment. An efficient network automation solution must be multi-level, allowing everything from virtual machines to system management to network discovery as needed by an enterprise. Network automation is a critical step in implementing a networking solution that becomes smarter, more flexible, and repeatedly adopts and protects the network. Solutions for network automation include network automation tools and intent-based networking.

Furthermore, key market players are incorporating advanced solutions to meet the needs of end users. The growing adoption of connected devices and the increasing demand for network bandwidth drive the growth of this market. These solutions prevent service-level agreement (SLA) violations, increase network uptime, and decrease mean time to repair (MTTR). The benefits of network automation mentioned above encourage CSPs to invest in R&D to enable low-cost and effective solutions, which are expected to provide lucrative opportunities for the market.

The services segment is poised to hit at a CAGR of 25.3% over the forecast period 2024 to 2034.

In 2023, the cloud segment accounted for the highest market share and it is expected to reach at a CAGR of 21.2% over the forecast period. By leveraging cloud computing capabilities, cloud network automation enables quick and secure network configuration. Furthermore, the cloud deployment model scales the capacity of a solution to handle massive network application traffic. Small businesses can collect and analyze data with the help of these solutions, which improves customer service.

The cloud deployment segment is poised to grow at a CAGR of 24.7% over the forecast period 2024 to 2034. Due to the numerous benefits the cloud deployment model provides, the demand for cloud-based network automation solutions is currently outpacing that of on-premises counterparts. Cloud computing is becoming more popular among small and medium-sized businesses. Several businesses are gradually shifting to cloud infrastructure, which is expected to expand in the coming years. The advantages of cloud infrastructure, such as ease of adoption, low reliance on in-house infrastructure, scalability, and simple installation of network automation solutions, contribute to the segment's rapid growth.

Based on organization size, the global market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. In 2023, the small and medium-sized enterprises (SMEs) segment accounted for the largest market share. The increasing use of cloud technology has accelerated the adoption of SDN technology among SMEs. Due to financial constraints, SMEs tend to prefer the market's cloud-based solutions. These organizations have gradually begun to adopt technologically advanced products that improve business functionality while using limited resources. Network automation can help SMEs save money on network infrastructure while also reducing the time spent resolving network issues by determining the state of the network at any point in time.

Based on vertical, the global network automation market is segmented into information technology, banking, financial services, insurance (BFSI), manufacturing, healthcare, energy and utilities, education, and others. The information technology (IT) segment is poised to hit at a CAGR of 23.3% over the forecast period. There are numerous computing, storage, and network devices in data centers. As a result, data centers must deal with difficulties in configuring and managing these multi-vendor devices. Network scaling has also enhanced the OPEX for establishing IT departments and rising to respond to changing business needs. These factors have prompted IT departments to make significant investments in network infrastructure maintenance, fueling the growth of the network automation market.

The manufacturing segment is poised to hit at a CAGR of 24.7% over the forecast period 2024 to 2034.

Segments Covered in the Report

By Components

By Network Type

By Deployment Mode

By End-User

By Organization Size

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

January 2025

January 2025