August 2024

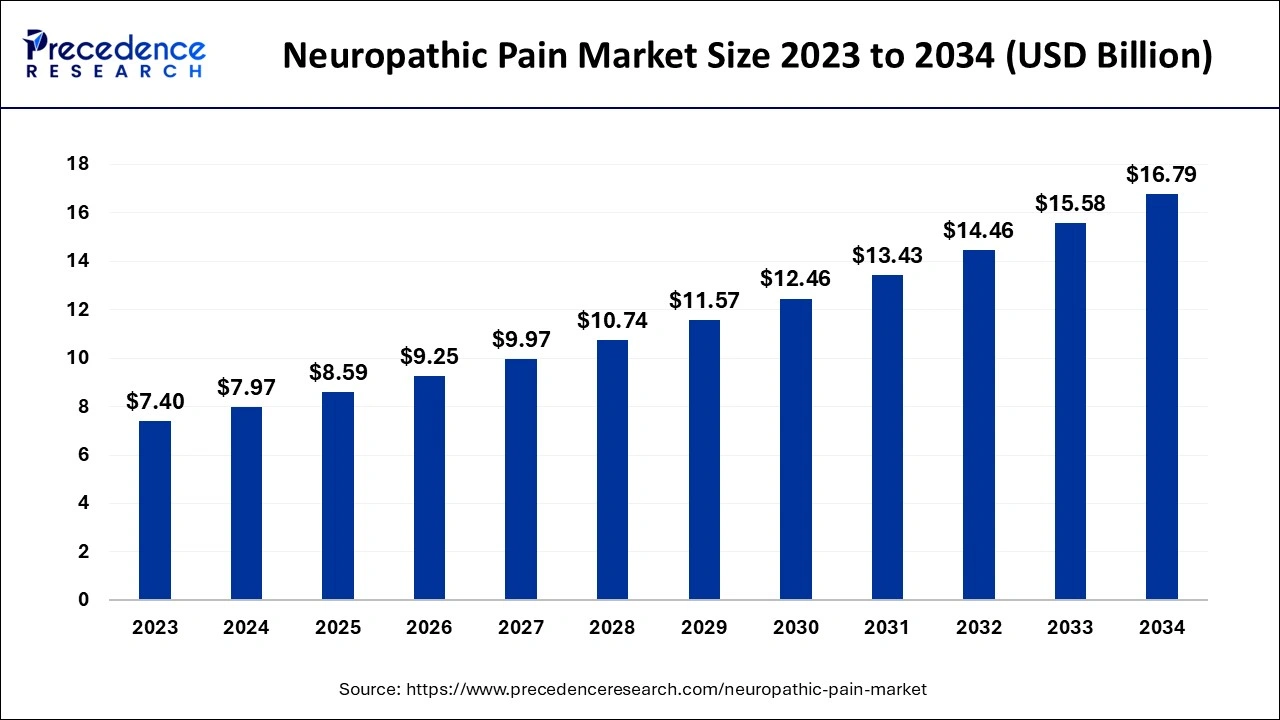

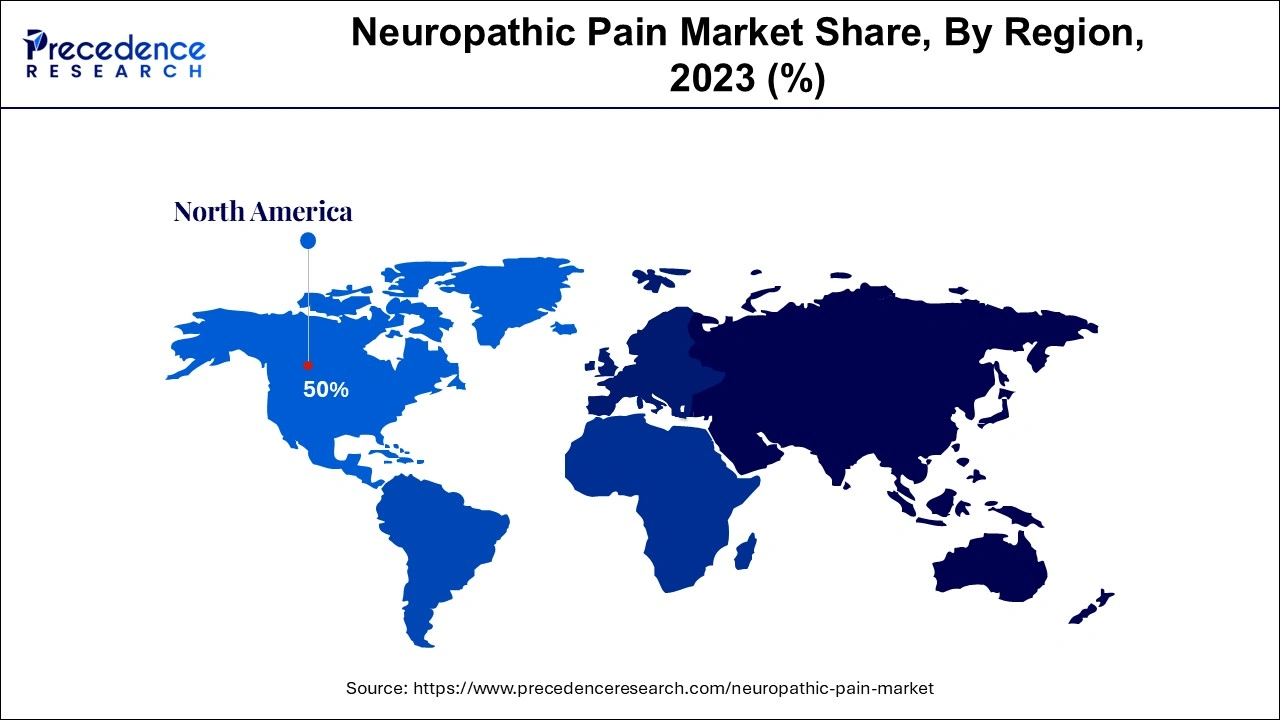

The global neuropathic pain market size is evaluated at USD 7.97 billion in 2024, grew to USD 8.59 billion in 2025 and is projected to reach around USD 16.79 billion by 2034. The market is expanding at a solid CAGR of 7.73% between 2024 and 2034. The North America neuropathic pain market size is calculated at USD 3.99 billion in 2024 and is expected to grow at a CAGR of 7.74% during the forecast year.

The global neuropathic pain market size is worth around USD 7.97 billion in 2024 and is expected to hit around USD 16.79 billion by 2034, growing at a CAGR of 7.73% from 2024 to 2034. The growing burden of neuropathic pain among patients suffering from chronic diseases is the key factor driving the neuropathic pain market growth. Also, an increase in demand for neuropathic treatment drugs coupled with the rise in government initiatives can fuel market growth further.

Artificial intelligence is transforming the chronic pain management system by offering new insights into the body's response to chronic pain. Innovative imaging methods like arterial spin labeling (ASL) and functional MRI (fMRI) are increasingly used to navigate the neural response of pain. Furthermore, AI's ability to process complex information provides customized treatment recommendations for pain management solutions.

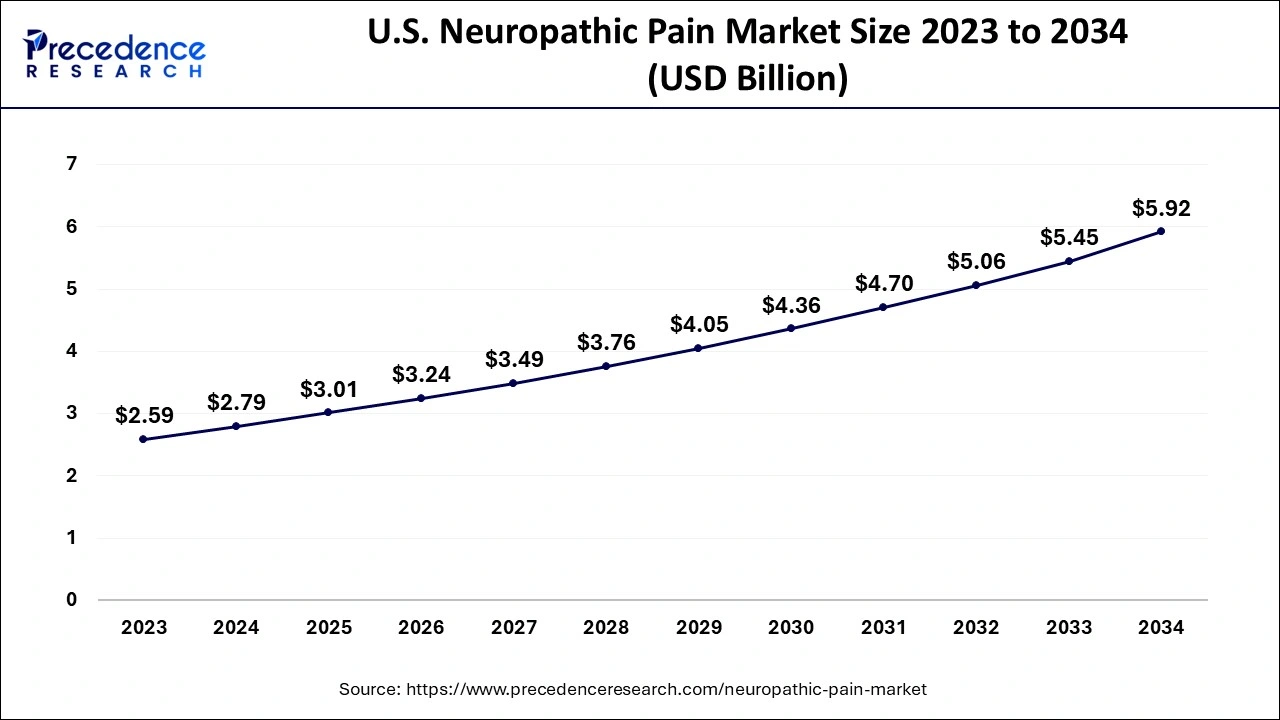

The U.S. neuropathic pain market size is exhibited at USD 2.79 billion in 2024 and is projected to be worth around USD 5.92 billion by 2034, growing at a CAGR of 7.80% from 2024 to 2034.

North America dominated the global neuropathic pain market in 2023. The region's dominance can be attributed to the strong presence of major market players like Azurity, Almatica, Viatrsi Inc., etc. The region also witnesses the high prevalence of cancer and other chronic diseases like diabetes, which leads to neuropathy pain. Strategic initiatives, new product launches, and collaborations also contributed to the market expansion in the region.

Asia Pacific is anticipated to grow at a significant rate in the neuropathic pain market over the projected period. The growth of the region can be driven by an increase in clinical trial activities coupled with a surge in research and development followed by innovative product launches in emerging economies such as India and China. Furthermore, the increasing awareness regarding the effective therapeutics that control pain effectively can raise the demand for neuropathic pain treatment drugs in the region.

The neuropathic pain market is an industry for products and services associated with the treatment of neuropathic pain, a chronic condition that can occur due to disease or damage to the nervous system. Common symptoms of this pain are numbness, feelings of coldness or burning, needles, and pins., anticonvulsants, Opioids, antidepressants, and Capsaicin are some of the most common types of medications used to control neuropathic pain.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.79 Billion |

| Market Size in 2024 | USD 7.97 Billion |

| Market Size in 2025 | USD 8.59 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.73% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Drug Class, Application, Route of Administration, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing shift toward patient-centric care

The rising shift towards more individualized medication in the neuropathic pain market fuels specialized treatment approaches. Healthcare providers are prioritizing the patient's preferences and need to develop holistic and more effective strategies. In addition, the increasing focus on detailed chronic pain management programs optimizes holistic interventions and interdisciplinary approaches.

Side effects of treatment

Side effects associated with traditional neuropathic pain treatments like opioids and other antidepressants hinder the growth of the neuropathic pain market. Patients' unwillingness to follow this line of treatment due to its potential adverse reactions impacts the overall expansion of the market. However, this approach constrained the flow of investment in this line of treatment and boosted demand for safer therapeutic alternatives.

The development of topical patches

The development of topical patches is the new trend in the neuropathic pain market. The topical patches provide a multimodal approach to neuropathic pain management with less absorption and an enhanced safety profile compared to traditional solutions. Furthermore, Researchers have discovered numerous solutions for topical use, such as capsaicin, anti-inflammatory drugs, tricyclic antidepressants, and ketamine, which can be utilized in combination with other drugs.

The anticonvulsant segment dominated the neuropathic pain market in 2023. This dominance can be attributed to the growing demand for innovative pain management solutions for diabetic neuropathy coupled with the easy availability of anticonvulsant drugs like Horizant, Gralise, Lyrica, etc. Additionally, this drug can also treat conditions such as migraine, anxiety, fibromyalgia, and restless leg syndrome.

The tricyclic antidepressant (TCA) segment is expected to grow at the fastest rate in the neuropathic pain market over the forecast period. The growth of the segment can be linked to the increasing consumption of this drug in the treatment of chronic pain, insomnia, bedwetting, and anxiety disorders. However, TCA has some side effects such as urinary retention and cardiac arrhythmias. Some commonly prescribed TCAs are imipramine, desipramine, amitriptyline, and doxepin.

The chemotherapy-induced neuropathy segment led the neuropathic pain market in 2023. The dominance of the segment can be credited to the increasing prevalence of cancer across the globe, which leads to a surge in the amount of patients undergoing chemotherapy treatment. Also, more healthcare professionals prefer chemotherapy treatments as the first line of action to cure cancer and related diseases.

The diabetic neuropathy segment is anticipated to grow at the fastest rate in the neuropathic pain market over the projected period. This growth can be driven by the rising focus of biotechnology and pharmaceutical companies on the development of reliable and more effective therapeutics. Furthermore, this neuropathy pain can be controlled with topical treatments and a combination of different medications.

The oral segment dominated the global neuropathic pain market in 2023. The dominance of the segment is due to the increasing availability of a number of oral therapeutics for effective pain management such as Pregabalin, Amitriptyline, Gabapentin, and Tramadol-acetaminophen. The oral route of administration is the most convenient way to take these drugs, which have the least side effects when administered orally.

The parenteral segment is expected to show the fastest growth in the neuropathic pain market during the forecast period. The growth of the segment is driven by the growing emphasis of the biopharmaceutical and pharmaceutical industries on the research and development of effective therapeutics. Parenteral drugs such as ceftriaxone and lidocaine are primarily used to treat neuropathic pain. These drugs work by blocking the pain sensory receptors in the body.

The retail pharmacy segment led the global neuropathic pain market. The dominance of the segment is linked to the escalating need for topical nerve pain medicines like AneCream5 and Elavil, which are available easily in retail pharmacies. Furthermore, retail pharmacies offer a wide range of analgesic drugs to treat the neuropathy pain prescribed by medical professionals.

The online pharmacy segment is estimated to grow at the fastest rate in the neuropathic pain market over the projected period. The growth of the segment can be credited to the growing availability of off-label drugs and prescriptions on online pharmacy channels. In addition, the growing preference for patients to purchase products easily without visiting the pharmacy stores is also contributing to the segment's growth further.

By Drug Class

By Application

By Route of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

October 2024

October 2024

March 2025