July 2024

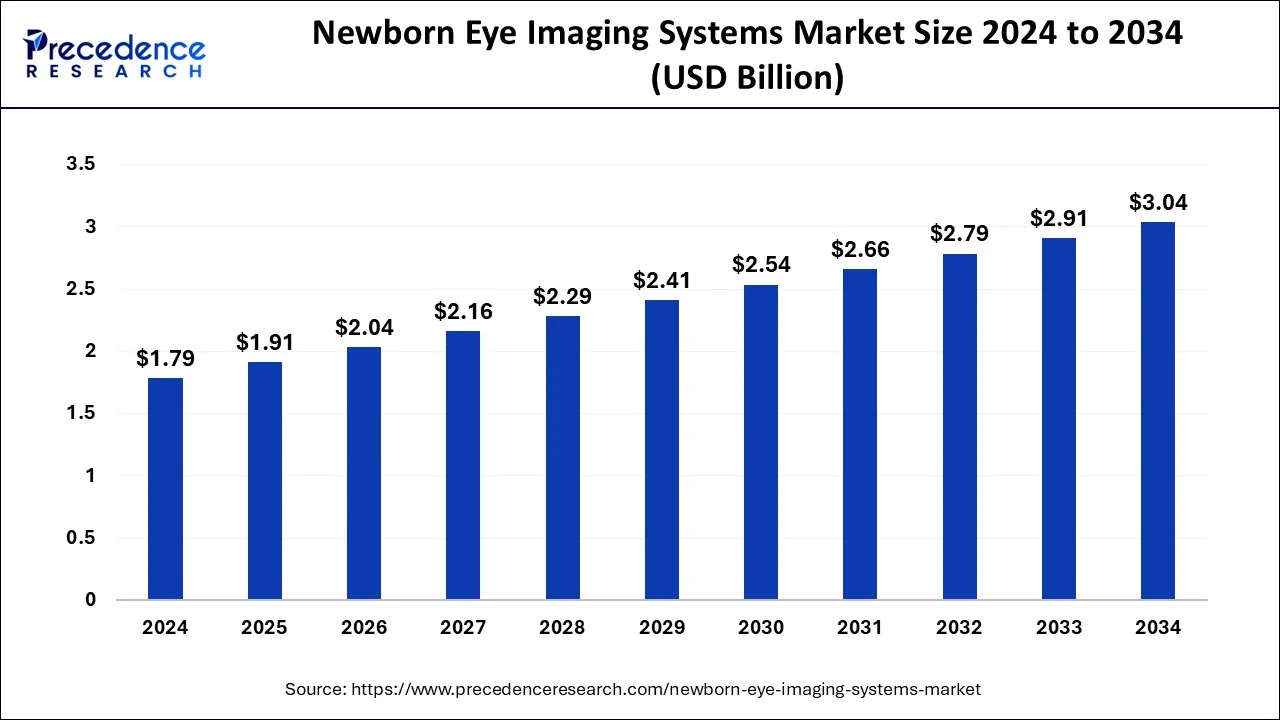

The global newborn eye imaging systems market size is calculated at USD 1.91 billion in 2025 and is forecasted to reach around USD 3.04 billion by 2034, accelerating at a CAGR of 5.30% from 2025 to 2034. The North America newborn eye imaging systems market size surpassed USD 622.32 billion in 2024 and is expanding at a CAGR of 5.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global newborn eye imaging systems market size was estimated at USD 1.79 billion in 2024 and is predicted to increase from USD 1.91 billion in 2025 to approximately USD 3.04 billion by 2034, expanding at a CAGR of 5.30% from 2025 to 2034.

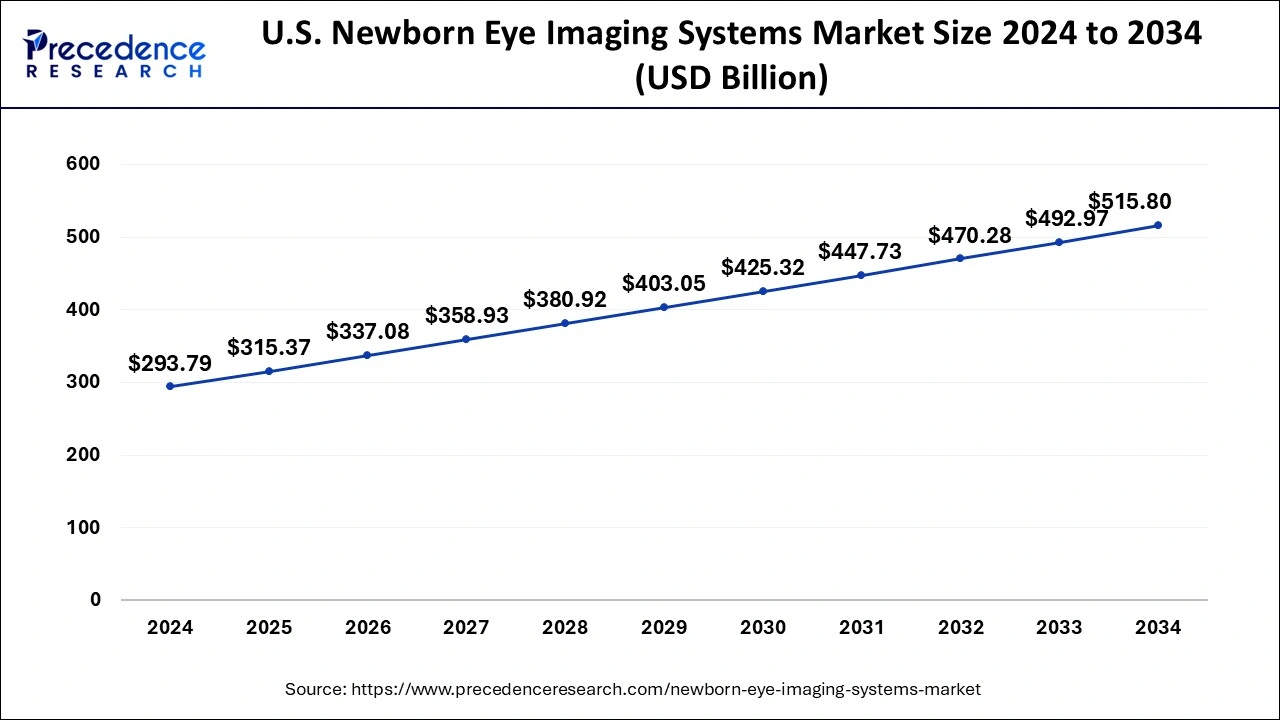

The U.S. newborn eye imaging systems market size was estimated at USD 293.79 million in 2024 and is predicted to be worth around USD 515.80 million by 2033, at a CAGR of 5.60% from 2025 to 2034.

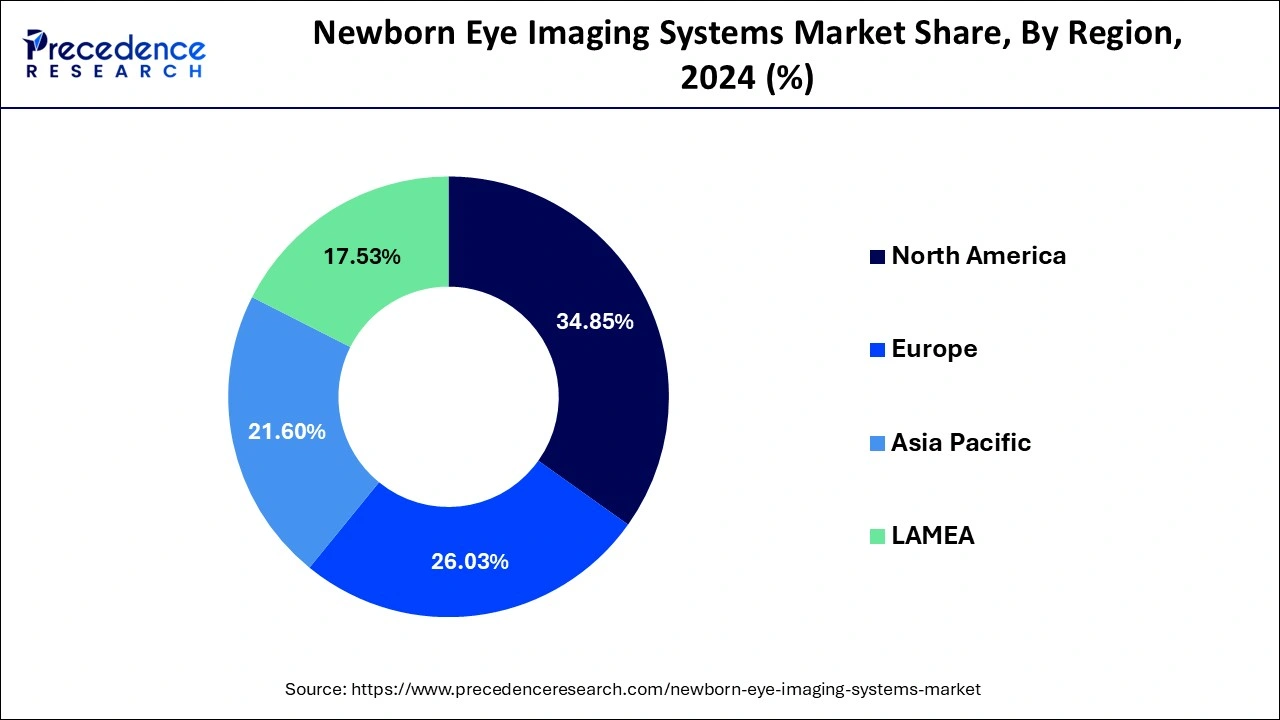

North America accounted for the largest revenue share of over 34.85% in 2024. The global dominance of North America can be attributed to the rising prevalence of eye diseases such as diabetic retinopathy and glaucoma. An increasing number of newborns are suffering from eye disorders and looking for minimally invasive treatments. According to the Boston Children's Hospital, in 2022, around 250 children in the United States were diagnosed with retinoblastoma, a type of cancer.

It primarily affects children under the age of five, with the highest incidence occurring between the infant stages and the age of two. Retinoblastoma can develop in either eye but is found in both eyes in approximately 25 to 30% of cases. Furthermore, the increasing adoption of AI is propelling this region's growth. In the United States, AI has effectively diagnosed a blindness-causing disease in premature newborns.

Europe gained a significant share of around 25.84% in 2023 and will grow at a CAGR of 6.32% in the forecast period. Germany had the largest share, followed by the United Kingdom and France. The rising prevalence of ROP is driving the expansion of this region. ROP is a Vaso proliferative retinal condition that primarily affects premature infants. ROP has become the leading cause of preventable childhood blindness in this region, owing to the increased survival of premature newborns. According to the Europe PMC Funders' Group, ROP is a blinding disease that affects premature children.

Most vision problems that cause adolescent blindness can be treated if detected early through comprehensive newborn screening. Some of the common eye disorders are retinopathy of prematurity (ROP), ocular development, strabismus, visual acuity, color vision, visual functions, and visual fields. These disorders require an eye imaging system for detection and treatment. Over the years, there have been significant advancements in both design and technology.

Such advances have applications in most pediatric retinal illnesses, whereas new device designs are frequently limited to adult use. The rising number of pediatric retinal operations, the increasing prevalence of eye disorders of different etiologies, and technological advancements in product development are all expected to boost product demand and thus drive the growth of the newborn eye imaging systems market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Market Size in 2024 | USD 1.79 Billion |

| Market Size in 2025 | USD 1.91 Billion |

| Market Size by 2034 | USD 3.04 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease Type, Device Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing expenditure on healthcare

Growing healthcare expenditure in various economies significantly impacts the constant growth of the newborn eye imaging systems market. The COVID-19 outbreak highlighted the importance of the healthcare industry and its links to other economic sectors.

According to National Health Expenditure data, hospital expenditures increased 6.4% to $1,270.1 billion in 2020, up from 6.3% in 2019. Furthermore, rising awareness and spending on neonatal care and screening procedures to prevent a wide range of disorders are driving market growth. For instance, on March 30, 2022, the World Health Organization issued its first global guidelines to support women and newborns in the postnatal period.

Lack of skilled and experienced staff

There is a need for a more clinical and skilled workforce in newborn eye imaging systems and trained ophthalmic photographers. Thus, new technologies must be designed, and healthcare providers with minimal training can use that. Most imaging requires large tabletop systems, but there is also a demand for portable imaging devices such as hand-held OCT and intra-operative OCT.

Furthermore, as reimbursements for imaging have decreased, the amount of time retina professionals spend on each patient has reduced. Many doctors now spend 5 to 10 minutes per patient gathering patient history, examining, analyzing, interpreting imaging, responding to patient questions, informing, and treating the patient.

Advances in newborn eye imaging systems technology

Emerging imaging technologies, such as artificial intelligence (AI) and deep learning, have the potential to screen large populations, including infants, for retinal disorders in a resource-constrained environment. Clinical studies have demonstrated AI's effectiveness in detecting the existence of various vision-threatening conditions such as age-related macular degeneration, diabetic retinopathy, retinopathy of prematurity, and neurological disorders such as Alzheimer's.

Furthermore, smartphones are used primarily as fundus cameras due to specialized adaptors. It is the least expensive method of photographing a retina. In numerous studies, the smartphone-based retinal camera has produced results comparable to those of a desktop fundus camera. Most smartphone-based retinal cameras have a field of vision of 30 to 45 degrees. For instance, the Volk iNview is an ophthalmic camera that uses an Apple iPhone or iPod to capture wide-angle digital color images of the retina (fundus). Volk iNview is a hybrid product that combines a mobile app (Apple App Store) and an indirect ophthalmoscopic lens attachment.

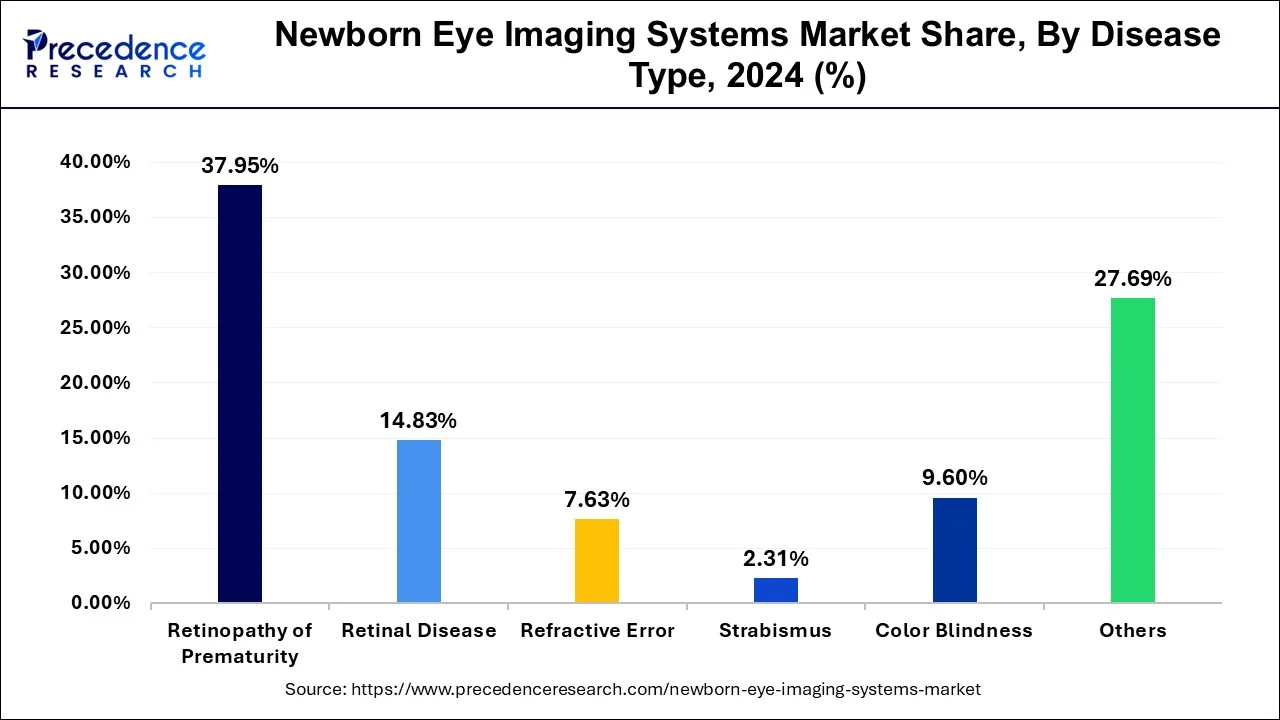

The retinopathy of prematurity (ROP) segment dominated the market in 2024 with a revenue share of over 37.95%. Retinopathy of prematurity (ROP) is the leading cause of preventable infant blindness worldwide. Access to care, a need for doctors knowledgeable about ROP, and difficulties with reliable documentation are all barriers to ROP screening and subsequent evaluation and management. These challenges are manageable, and digital retinal imaging can help us understand the condition's pathophysiology.

Technological advancements have enabled the development of new non-mydriatic and mydriatic cameras with larger fields of vision and equipment that can simultaneously use optical coherence tomography (OCT), fluorescein angiography, and OCT angiography. Telemedicine programs have used imaging to expand ROP screening to infants in rural areas.

The retinal disease segment is expected to grow at a CAGR of 5.5% over the forecast period. The retina is a layer of tissue at the back of the eye that detects light and transmits images to the brain, and retinal diseases impact this vital tissue. Some retinal conditions can be treated early, while others can be slowed or controlled to protect vision. Typical retinal issues include retinal tears, retinal detachment, retinopathy, epiretinal membranes (ERMs), macular holes, and macular degeneration. The growing prevalence of these issues will drive segment growth.

The basic device segment contributed the maximum revenue of around 55.38% in 2024. The basic device captures an image of a newborn baby's eye, including pupil dilation and the retina. It also provides information on optic nerve function, corneal thickness, anterior chamber depth, etc. Hospitals use basic devices to diagnose eye diseases.

The wireless device segment is expected to grow at a CAGR of 5.9% from 2025 to 2034. Most wireless devices capture images or videos of the eye's interior. These devices have numerous advantages, such as their use anywhere and anytime. They are also beneficial for photographing difficult-to-reach areas, such as the back of the eye. Wireless devices have several advantages over other types of devices, making them an essential tool for procedures such as visual acuity testing, glaucoma screening, and intraocular pressure measurement, as well as others.

Newborn Eye Imaging Systems Market Revenue, By Device Type, 2022-2024 (USD Million)

| By Device Type | 2022 | 2023 | 2024 |

| Basic Device | 859.62 | 924.66 | 988.99 |

| Wireless Device | 676.35 | 736.24 | 796.85 |

The hospital segment generated the largest revenue share of over 38.59% in 2024 and is estimated to reach hundreds of millions by 2034. The hospital performs several eye care procedures and treatments using cutting-edge medical equipment from well-known manufacturers, and the market grows as new eye care equipment is launched. Newborn eye imaging systems are used in hospitals for various therapeutic and diagnostic purposes, such as cataracts, glaucoma, cornea, pediatric ophthalmology, and oculoplastic.

The systems include the specialized application of devices to provide primary care, monitoring, and treatment to newborns and infants with eye-related problems such as ROP, amblyopia, strabismus, and other disorders. This newborn eye imaging system detected a variety of eye diseases in the hospital.

Additionally, the ophthalmology & diagnosis center segment is anticipated to grow at a CAGR of 5.7% over the forecast period. The specialty medical field known as ophthalmology is concerned with eye health. The physiology, anatomy, and disorders that may affect the eyes are all covered in the ophthalmology & diagnosis center. The Ophthalmology & Diagnosis Centre has been successfully diagnosing patients with retinal conditions, optic nerve diseases (e.g., glaucoma), strabismus (i.e., misalignment of the eyes), and other eye diseases.

Newborn Eye Imaging Systems Market Revenue, By End-User, 2022-2024 (USD Million)

| By End User | 2022 | 2023 | 2024 |

| Hospital | 590.71 | 639.88 | 689.23 |

| Ophthalmology Diagnosis Centers | 409.48 | 444.48 | 479.73 |

| Ambulatory Surgical Centers | 293.16 | 319.76 | 346.83 |

| Others | 242.62 | 256.79 | 270.05 |

By Disease Type

By Device Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

October 2024

September 2024

January 2025