February 2025

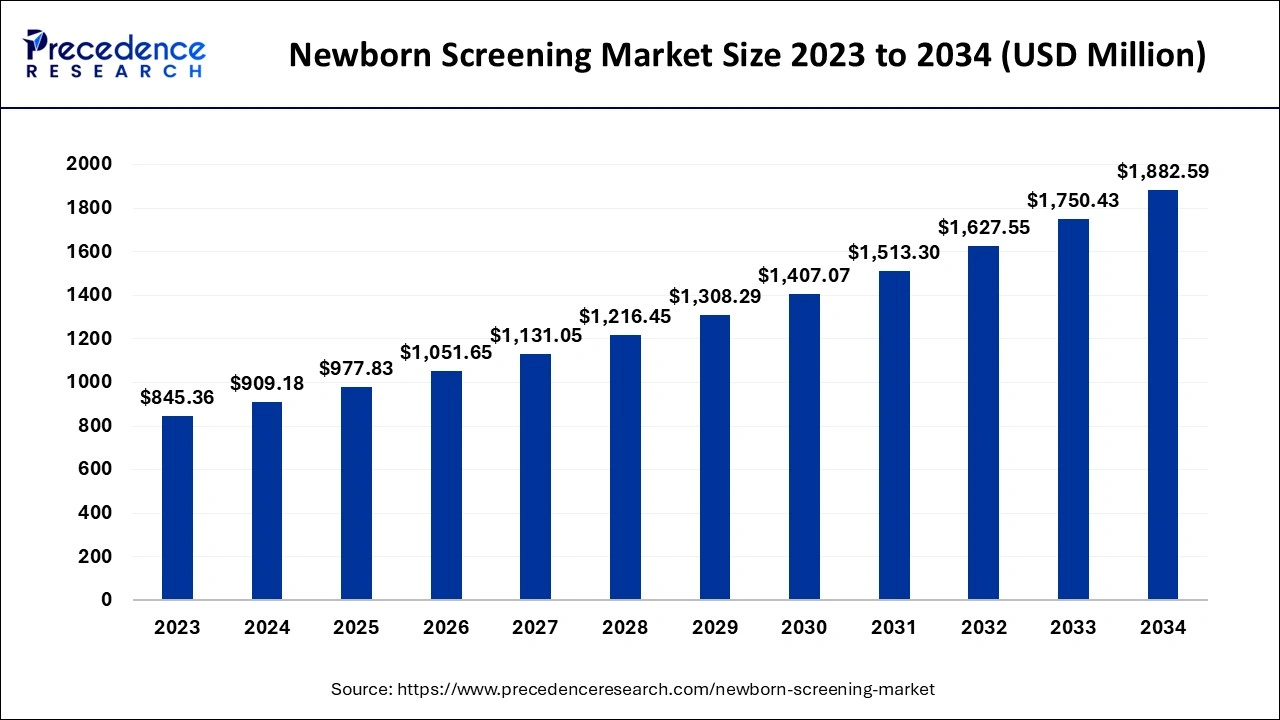

The global newborn screening market size is calculated at USD 909.18 million in 2024, grew to USD 977.83 million in 2025 and is predicted to surpass around USD 1,882.59 million by 2034, expanding at a solid CAGR of 7.55% between 2024 and 2034. The Asia Pacific newborn screening market size is valued at USD 300.94 million in 2024 and is representing a solid CAGR of 7.56% during the forecast period.

The global newborn screening market size accounted for USD 909.18 million in 2024 and is expected to reach around USD 1,882.59 million by 2034, with a CAGR of 7.55% from 2024 to 2034. The rapid increase in the number of neonatal population is playing a crucial role in the demand for the newborn screening market. This helps in early intervention by examining them for rare illnesses and early detection of any disability.

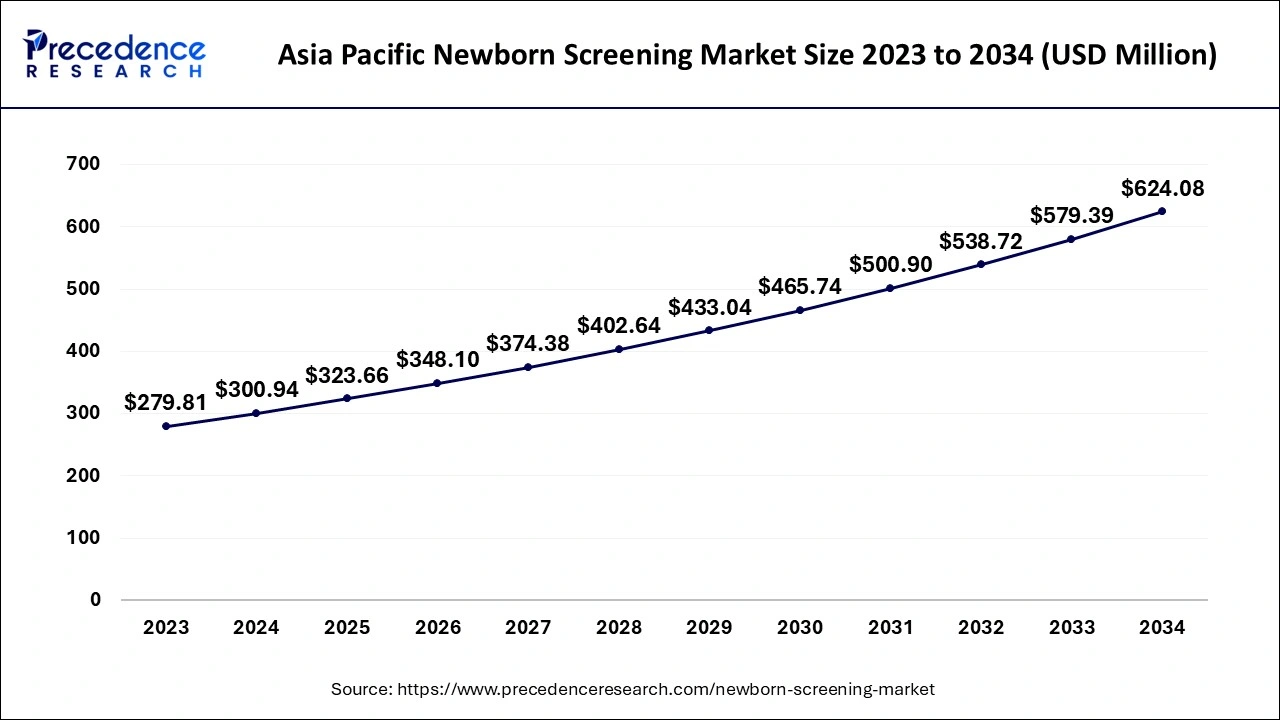

The Asia Pacific newborn screening market size is exhibited at USD 300.94 million in 2024 and is projected to be worth around USD 624.08 million by 2034, registering a notable CAGR of 7.56% from 2024 to 2034.

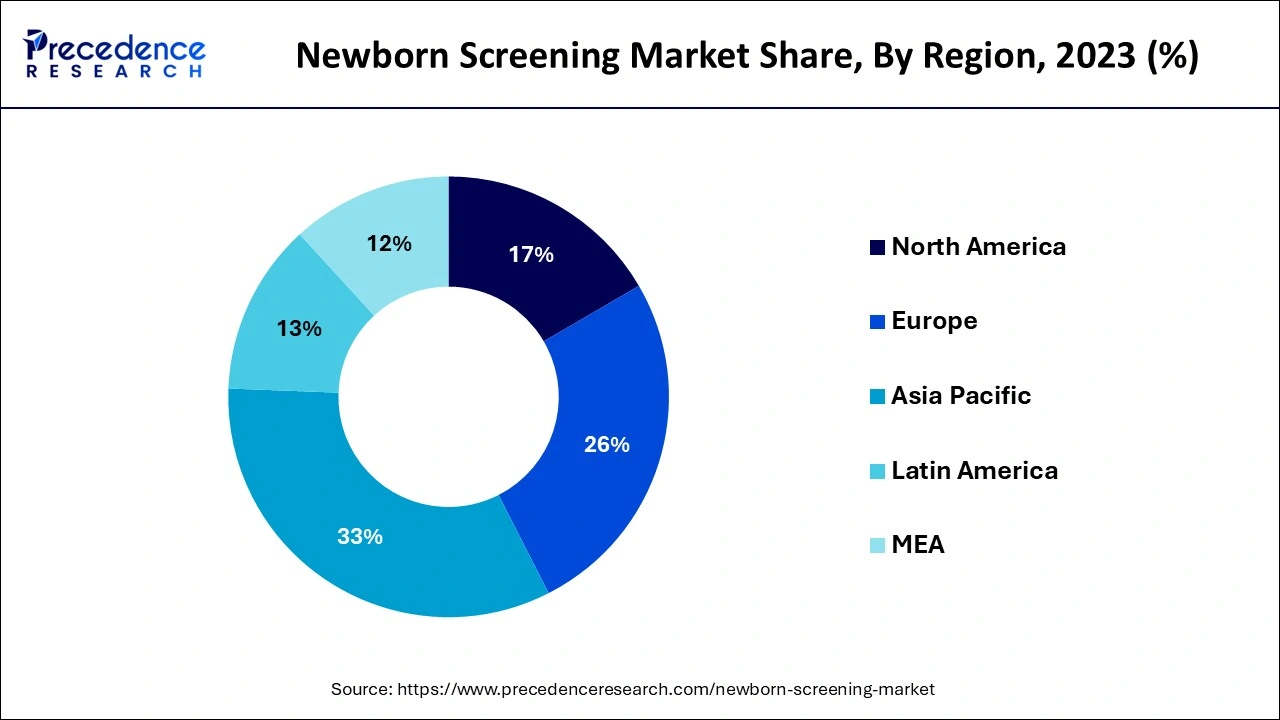

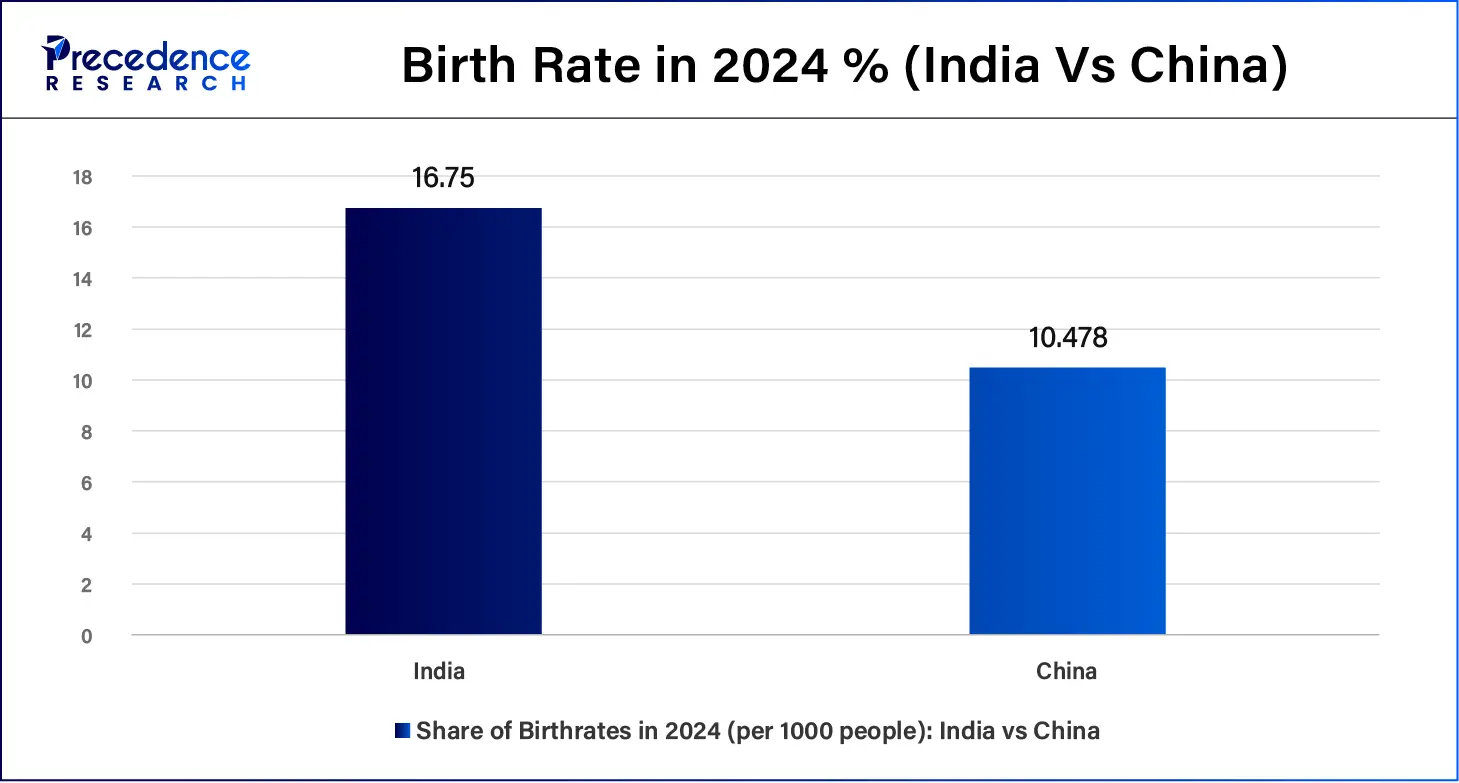

Asia Pacific dominated the global newborn screening market in 2023. The dominance of the region is attributed to the higher birth rate in countries like India and China, which generates the need for newborn screening in the region. Their governments are also focusing on adopting these technologies in their healthcare infrastructure, which would allow the public to access these screening tests for their newborn children. The rising internet penetration and increasing social media usage in the region are also playing a vital role in the market. Additionally, the region is witnessing rapid urbanization, which attracts multiple investments that will help it improve its healthcare infrastructure.

North America is anticipated to register the fastest growth in the newborn screening market during the forecast period from 2024 to 2034. The reason behind the rapid growth of the region is attributed to the availability of advanced technologies in countries like the United States and Canada, which focus on improving newborn screening equipment. The governments in the region are also among the major reasons behind the rapid growth as they impose rules and regulations.

Newborn screening refers to a health screening program designed to identify the health conditions of newborns. The purpose of this test is to detect any health condition in the newborn that can be treated before they show any symptoms. These conditions can include hormonal, metabolic, and genetic disorders, which can also lead to death if not cured within time. These tests are mostly conducted 24-48 hours after the birth of the child and include taking blood samples from the newborn's heel and then testing it in the laboratory.

How can AI Help in the Newborn Screening Market?

The emergence of artificial intelligence (AI) in the healthcare sector has significantly helped the growth of the newborn screening market. AI analyses huge datasets that can help detect potential health conditions according to symptoms. AI has also improved the audio and visual equipment used during newborn screening. The emergence is also expected to eliminate the human need without affecting the productivity of the work.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,882.59 Million |

| Market Size in 2024 | USD 909.18 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.55% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Test Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing birthrates in developing countries

The rising birth rate in developing countries is one of the major drivers for the newborn screening market. This is leading to attention to improving health screening for newborns, which will lead to an increase in the adoption of equipment and workforce. The increasing availability of these technologies is expected to drive the attention of the public.

Rising prevalence of neonatal disorders

There has been an increase in the number of genetic and metabolic disorders in newborns, like cystic fibrosis and congenital hypothyroidism, which is influencing the adoption of the newborn screening market services. Many companies are focusing on advancements that help detect neonatal disorders, which has led to the increasing demand for newborn screening. These advancements have led to increasing market growth due to the broader screening processes.

Higher screening costs due to limited availability

The newborn screening market has marked significant growth in the developed regions, but there are still some factors that could potentially hamper the market growth. Many states in underdeveloped and developed countries have limited availability of healthcare infrastructure, which makes screening unaffordable for low-income families due to the higher costs.

Increasing awareness among parents

Increasing education about newborns is resulting in increasing understanding among the parents regarding the benefits of screening which helps in detecting neonatal disorders at an early stage. Digitalization is also contributing significantly towards engaging parents and individuals, which will help in the growth of the newborn screening market. Additionally, the increasing technologies in medical screening for newborns are increasing the reliability of the individuals who put their children under these tests.

Increasing government initiatives

The rising genetic disorder cases among newborns has led to the increasing focus of governments towards promoting the newborn screening market. Many governments are conducting health screening programs that focus on early diagnosis of neonatal disorders. The increasing healthcare opportunities are also attracting funding through public-private partnerships.

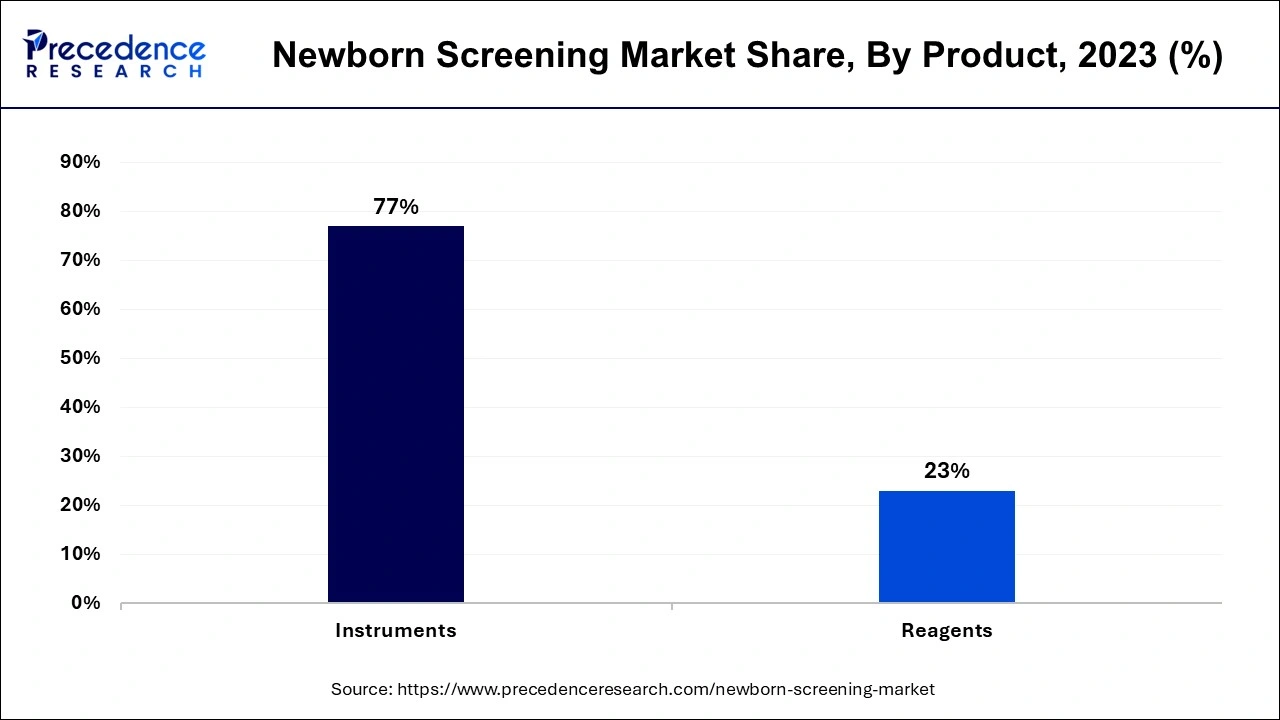

The instruments segment stood the dominant in the newborn screening market in 2023. Instruments in newborn screening refer to the medical devices that are used for newborn screening. They include pulse oximeters, hearing screening devices, and mass spectrometers, which perform various tasks during the screening process. The dominance of these instruments is attributed to their high demand in hospitals and clinics. Healthcare professionals use these devices to treat multiple disorders in children. The rising need for these instruments in the healthcare setting is leading to a rapid expansion in production.

The reagents segment is expected to register significant growth in the newborn screening market during the forecast period of 2024 to 2034. Reagents in the market refer to chemical substances used in screening procedures mainly to detect endocrine and metabolic disorders in newborns. The rising growth of the segment is attributed to the rising cases of metabolic and endocrine disorders, which is driving the need for more reagents in newborn screening. The rising prevalence of various disorders and conditions among newborns is leading to an enhanced focus on producing solutions for the diseases.

The tandem mass spectrometry segment marked its dominance over the newborn screening market in 2023. Tandem mass spectrometry refers to an analytical technique that can cover multiple compounds at a single time. It is a highly used technique for detecting metabolism errors in newborns. Covering multiple tests in this technique leads to an increasing preference for the technology due to its cost-effectiveness. The increasing consumer preference for the technology is leading to its adoption by many healthcare providers. Many companies are also increasing their focus on enhancing this technique.

The electrophoresis segment is anticipated to grow at the fastest rate in the newborn screening market during the forecast period. Electrophoresis is a lab-based technique that separates DNA and proteins, which helps diagnose genetic blood disorders like thalassemia and sickle cell anemia. The growth of the segment is also attributed to rising hemoglobin disorders that raise the need for electrophoresis. This is leading towards improving the cost-effective techniques that also provide better outcomes through these tests.

The dry blood spot test segment registered the largest share of the newborn screening market in 2023. Dry blood spot test (DBS) refers to a test that includes taking blood drops of the newborns on a filter paper, which are dried and then analyzed in the laboratory. This test helps in detecting metabolic disorders, hormonal disorders, and other genetic disorders. The dominance of the segment is attributed to the rising number of multiple disorder detections done in this test using a simple process. This is also considered to be the traditional test method for testing newborns. This also makes it affordable for low-income people, which helps target multiple audiences.

The hearing screen segment is anticipated to stand out with significant growth in the newborn screening market from 2024 to 2034. Hearing screening refers to tests like otoacoustic emissions that measure the sound waves in the ears and detect hearing conditions. Tests like auditory brainstem response detect the response of the brain and the hearing nerve to the sound. This is one of the biggest factors that is considered to be important in newborns. This has also led to an increasing focus on improving these tests, which could help enhance the test outcomes. Many governments are promoting these tests through screening programs.

Segments Covered in the Report

By Product

By Technology

By Test Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024

September 2024

September 2024