December 2024

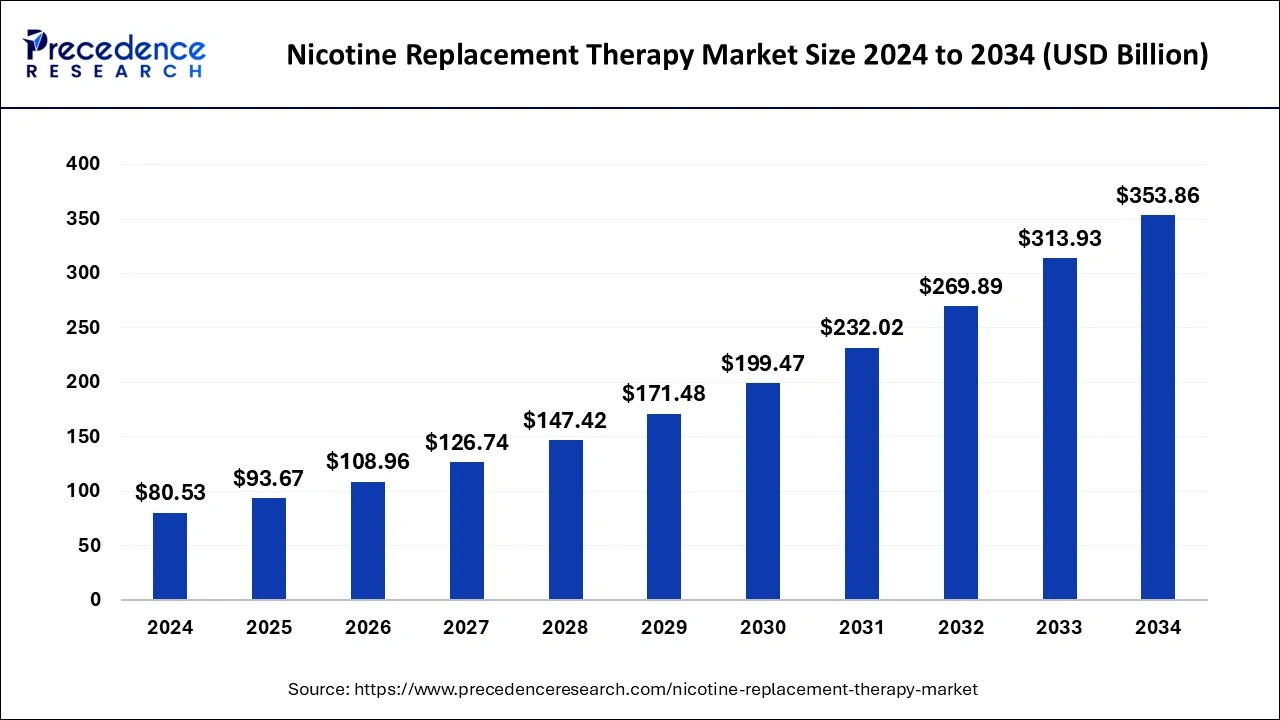

The global nicotine replacement therapy market size is calculated at USD 93.67 billion in 2025 and is forecasted to reach around USD 353.86 billion by 2034, accelerating at a CAGR of 15.95% from 2025 to 2034. The Asia Pacific nicotine replacement therapy market size surpassed USD 38.40 billion in 2025 and is expanding at a CAGR of 16.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nicotine replacement therapy market size was estimated at USD 80.53 billion in 2024 and is predicted to increase from USD 93.67 billion in 2025 to approximately USD 353.86 billion by 2034, expanding at a CAGR of 15.95% from 2025 to 2034. The rise in the number of cigarette smokers across the world is driving the growth of the nicotine replacement therapy market.

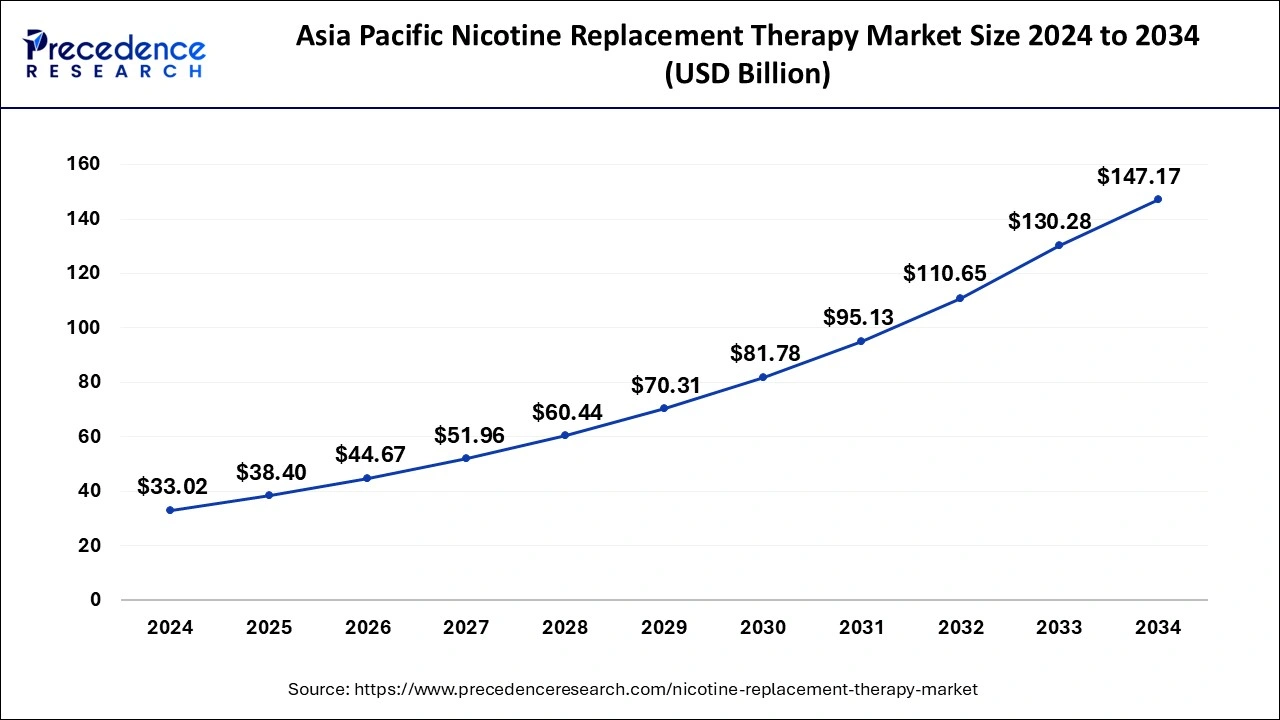

The Asia Pacific nicotine replacement therapy market size was exhibited at USD 33.02 billion in 2024 and is projected to be worth around USD 147.17 billion by 2034, poised to grow at a CAGR of 16.12% from 2025 to 2034.

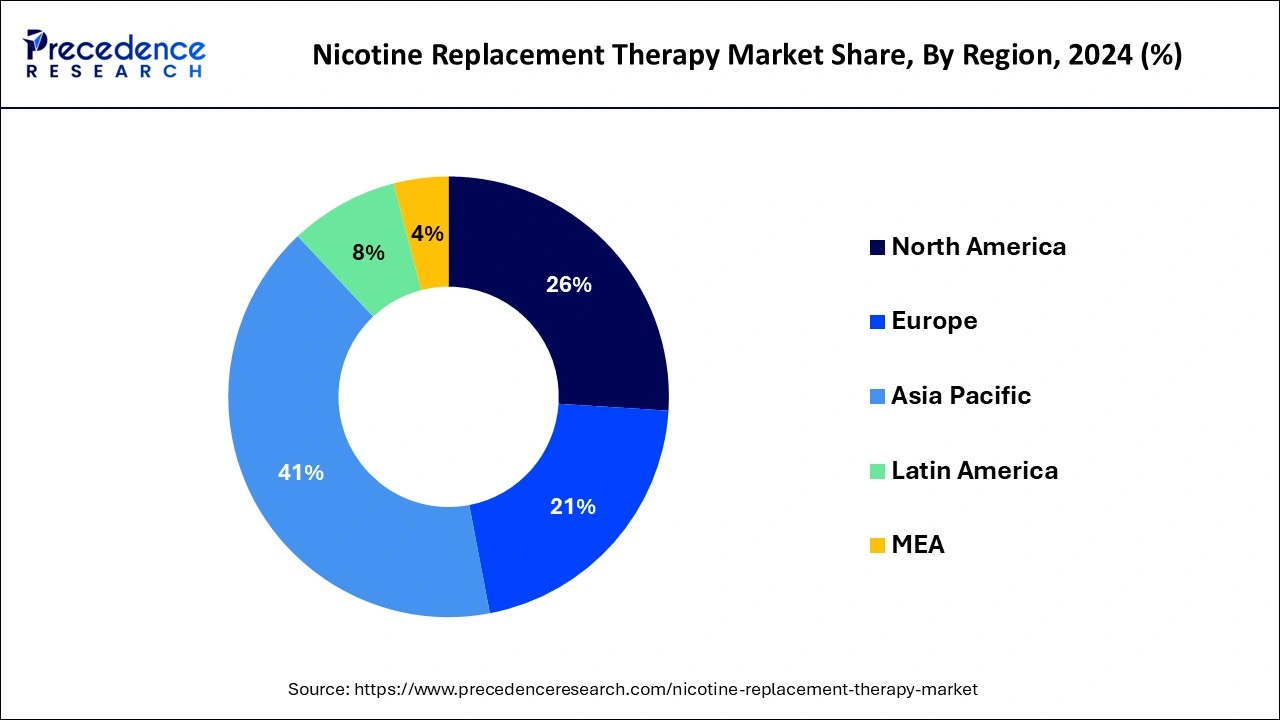

Asia Pacific held the largest nicotine replacement therapy market share in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by rising government initiatives in countries such as India, China, South Korea, Japan, and others to strengthen the healthcare sector.

The rising developments in the biopharma sector, along with the presence of several tobacco companies in India, Japan, and China, drive the nicotine replacement therapy market growth. Also, the rising advancements in science and technology, along with affordable prices of raw materials, are likely to drive market growth. Moreover, the presence of several market players such as Japan Tobacco, Rusan Pharma, Cipla, Rubicon Research, and some others are constantly engaged in developing NRT therapies and adopting several strategies such as launches, collaborations, and acquisitions, which in turn drives the growth of the nicotine replacement therapy market in this region.

North America is expected to be the fastest-growing region during the forecast period. The increasing demand for sublingual tablets and transdermal patches in this area is the primary driver of this segment's growth. The nicotine replacement therapy market is expanding as a result of growing expenditures made in the NRT industry by both governmental and private sector organizations. The market for nicotine replacement therapy has expanded as a result of the growing popularity of e-cigarettes and the rising demand for over-the-counter (OTC) NRT among consumers in the United States, Canada, Mexico, and other nations. Furthermore, the market is increasing to some part because of the rising demand for thermal tobacco products in addition to e-cigarettes to help individuals reduce their smoking behaviors.

The rise in government initiatives to stop cigarette smoking and the availability of a suitable supply chain boosts the market growth. Also, rising cases of CVDs and cancers in this region increase the demand for various nicotine replacement therapies as a preventive method, thereby driving the market growth. Additionally, the presence of several online platforms, along with growing developments in internet facilities, is expected to drive nicotine replacement therapy market growth in this region.

The presence of a well-established biopharma industry in the U.S. and Canada, along with rising development in healthcare infrastructure in this region, is driving the market growth. Moreover, presence of several local manufacturers of nicotine replacement therapy, such as Pfizer, Johnson & Johnson Private Limited, Perrigo, and some others, are engaged in manufacturing superior nicotine replacement therapies and adopting several strategies such as launches, collaborations, and acquisitions, which in turn drives the growth of the nicotine replacement therapy market in this region.

The nicotine replacement therapy market has grown rapidly with the developments in the healthcare industry. This industry mainly deals with providing risk-free alternatives to tobacco to people around the world. Nicotine replacement therapy is approved medically to treat people who are highly addicted to tobacco and cigarettes. This therapy involves the use of several products for treating people, mainly inhalers, gum, transdermal patches, sublingual tablets, lozenges, and some others. These products are available both online and offline. The growing number of tobacco-obsessed people, along with the rising advancements in nicotine replacement therapies, is supplementing the market growth positively. This market is expected to grow exponentially with the growth in the pharmaceutical industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 353.86 Billion |

| Market Size in 2025 | USD 93.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.95% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising cases of lung cancers and CVDs (cardiovascular diseases)

The people around the world are facing several acute and chronic diseases. These diseases are either inherited or acquired from external sources. The habit of cigarette smoking has gained serious attention in recent times for various reasons, such as anxiety, depression, psychiatric disorders, and others. Thus, a high rate of cigarette smoking among men and women can lead to serious chronic diseases such as emphysema and chronic bronchitis that increase the demand for nicotine replacement therapy as a curative measure, thereby driving the market growth.

The rising number of lung cancer cases in countries such as China, the U.S., Japan, India, and others has increased the demand for nicotine replacement therapy (NRT) for treating this disease, which in turn drives the growth of the nicotine replacement therapy market.

Also, the prevalence of several types of cardiovascular diseases, such as coronary artery disease, peripheral artery disease, carotid artery disease, and some others, has increased rapidly in recent times. These diseases are mainly caused due to excessive cigarette smoking and tobacco consumption. Thus, nicotine replacement therapy can act as a preventive measure for such diseases, thereby driving market growth. According to the American Heart Association, the number of patients suffering from cardiovascular diseases in 2020 was 28 million and is expected to reach 45 million by 2050.

Strict rules and side effects

The application of nicotine replacement therapy has gained immense attention in recent times. Although there are several applications of nicotine replacement therapy (NRT), there are several problems associated with it. Firstly, there are several government regulations that restrict the use of nicotine replacement therapy due to various problems associated with it. Secondly, this industry faces severe problems due to the side effects of this therapy, such as nausea, insomnia, headaches, vomiting, skin irritation, and throat soreness. Thus, stringent rules, along with several side effects of nicotine replacement therapy, are likely to restrain the market growth to some extent.

The growing integration of AI in the NRT industry

The nicotine replacement therapy industry has gained prominent attention due to several advantages over traditional methods. The advancements in AI technology and the growing developments of AI chatbots for the NRT industry have started recently. With the use of AI chatbots, smokers can get several suggestions on how to quit cigarette smoking. Thus, the rising integration of AI in the NRT industry is expected to create ample growth opportunities for the market players in the upcoming days.

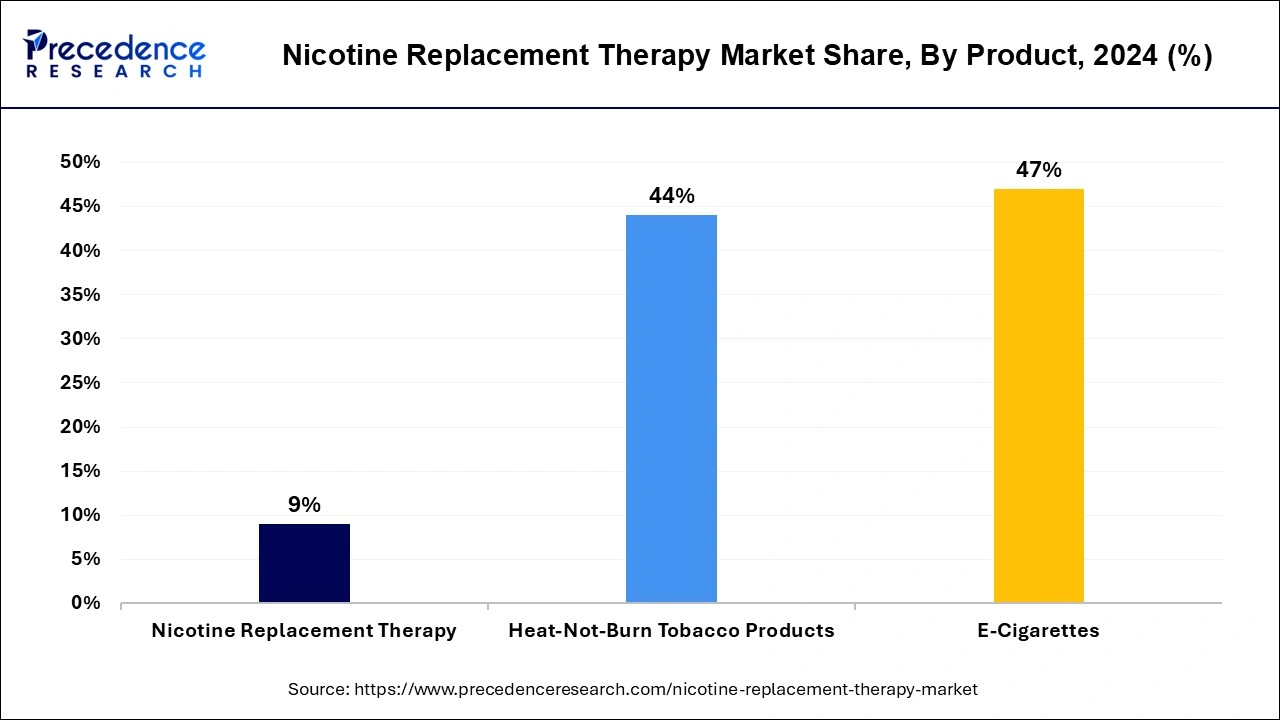

The e-cigarettes segment held the largest nicotine replacement therapy market share in 2024. The growth of this segment is generally driven by the rising number of cigarette smokers around the world. Also, the growing awareness of e-cigarettes being safer than real cigarettes, along with the availability of e-cigarettes with added flavors such as menthol, mint, and others, boosts the market growth. Moreover, the rise in the number of vape shops coupled with rising developments in e-cigarette technologies such as pod systems and squonk mods is likely to drive the market growth. Additionally, several NRT companies are constantly engaged in developing cost-effective e-cigarettes with superior efficacy and adopting several strategies such as launches, approvals, partnerships, and others, which in turn are expected to drive the growth of the nicotine replacement therapy market.

The heat-not-burn tobacco products segment is estimated to be the fastest-growing segment during the forecast period. This segment is generally driven by the rising demand for effective therapies to quit smoking. Also, the rising application of heat-not-burn products to lower tobacco intensity is boosting market growth. Moreover, several NRT companies are launching various heat-not-burn tobacco or heated tobacco products that help to reduce the effect of tobacco among smokers, which is likely to drive the growth of the nicotine replacement therapy market.

The offline segment dominated the nicotine replacement therapy market in 2024. The growth of this segment is generally driven by the growing demand for e-cigarettes among the youth. Also, the rise in the number of pharmacies across the world, along with growing development in retail chains, boosts the market growth. Moreover, the increasing availability of NRT products in retail pharmacies, along with the rising partnerships among hospitals and pharmacies, has driven the market growth. Additionally, the rise in government investments in strengthening the retail pharma sector is likely to boost market growth.

The online segment is expected to be the fastest-growing segment during the forecast period. This segment is generally driven by the rising proliferation of smartphones around the world. Also, the growing adoption of online platforms for people to purchase medicines fosters market growth. Moreover, the rise in the number of e-commerce sites that deal with NRT therapies is likely to boost market growth. The most popular e-commerce companies include Amazon, Alibaba, Walmart, eBay, and others.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

January 2025

July 2024