April 2025

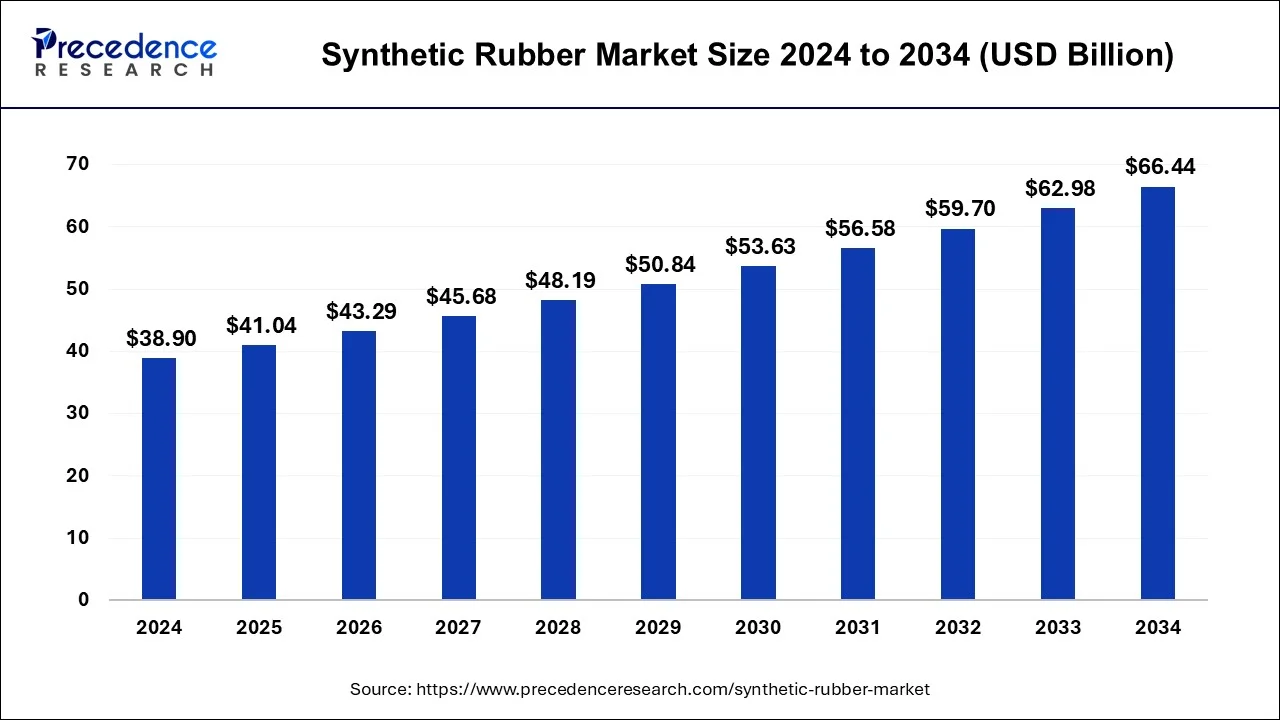

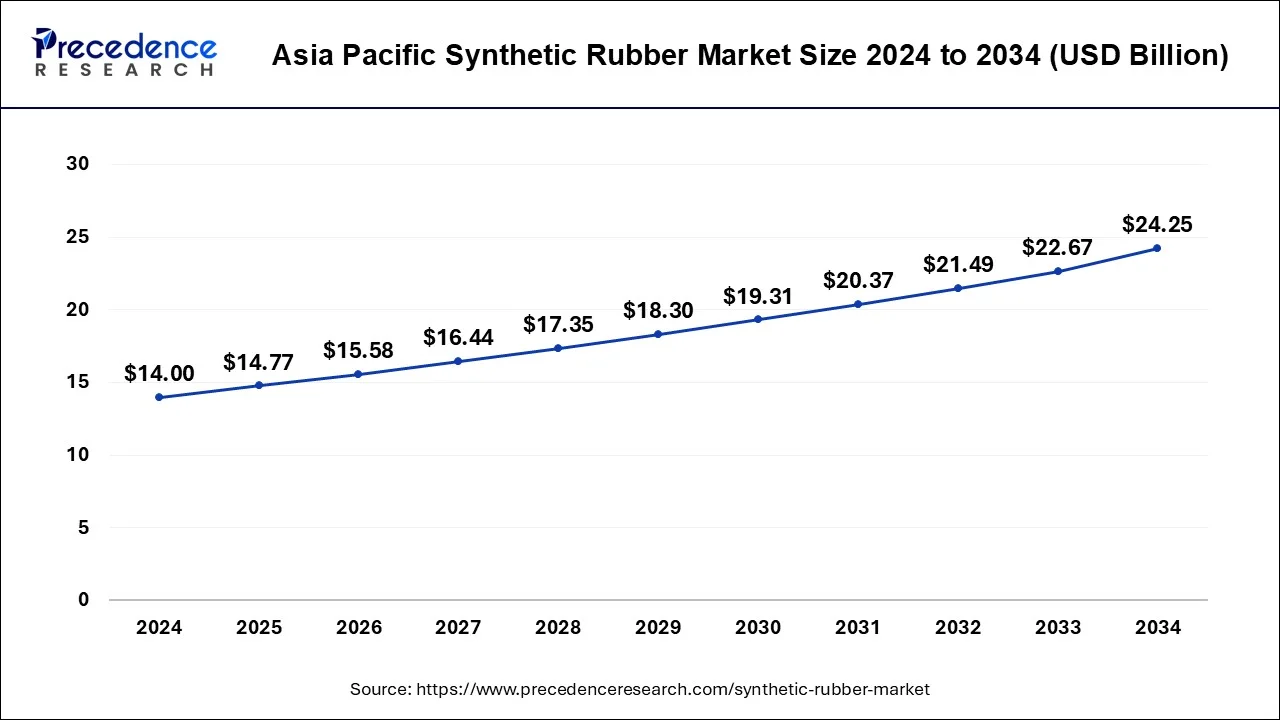

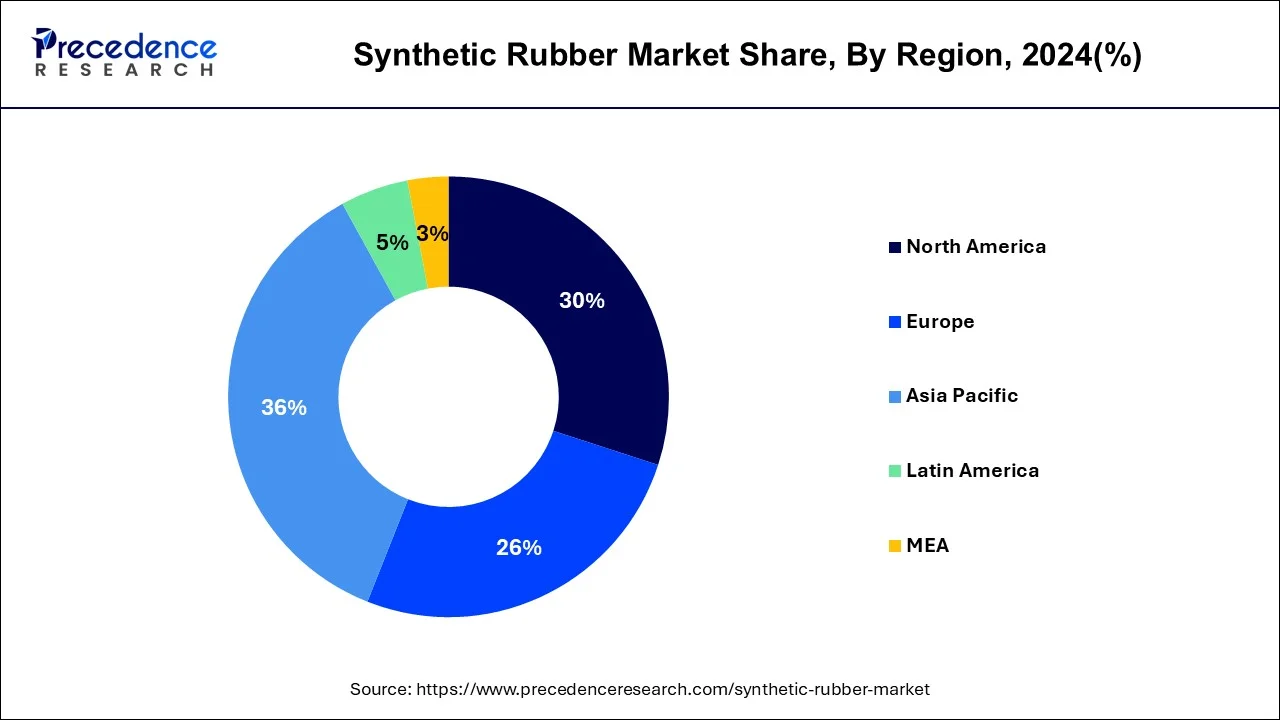

The global synthetic rubber market size is calculated at USD 41.04 billion in 2025 and is forecasted to reach around USD 66.44 billion by 2034, accelerating at a CAGR of 5.50% from 2025 to 2034. The Asia Pacific synthetic rubber market size surpassed USD 14.77 billion in 2024 and is expanding at a CAGR of 5.63% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global synthetic rubber market size was estimated at USD 38.90 billion in 2024 and is predicted to reach around USD 66.44 billion by 2034, expanding at a CAGR of 5.50% from 2025 to 2034. The evolving and expanding automotive sector is expected to keep fueling the demand for the synthetic rubber market during the forecast period.

Integration of Artificial Intelligence (AI) in this industry is anticipated to give the synthetic rubber industry a boost. AI technology helps drives advancement in material science as well automation processes. With AI technology, manufacturing processes can be optimized, precision of production can be improved, material formulation can become better along with helping the research and development efforts work efficiently. AI technology goes a long way in reducing costs, minimizing human errors, optimization of processes, improvement in suppl chain etc. Combined with other technologies like Internet of Things (IoT), smart manufacturing systems can be implemented with the help of AI. Such advancements in technology are expected to expand the synthetic rubber market in the coming years.

The Asia Pacific synthetic rubber market size was evaluated at USD 14.00 billion in 2024 and is predicted to be worth around USD 24.25 billion by 2034, rising at a CAGR of 5.63% from 2025 to 2034.

Because nitrile rubber and styrene-butadiene rubber are becoming more and more popular, both long-established companies and newcomers are anticipated to look for chances in China, Australia, and India. The rise of the footwear industry and the escalating infrastructure projects bode well for the future of the region. Due to increased manufacturing of various grades of non-automotive items and tyres, the Asia Pacific synthetic rubber industry will experience rapid expansion.

On the heels of expanding nitrile rubber demand across industrial products applications, the forecast for the synthetic rubber industry in Europe will be positive. Additionally, the heavy foot traffic of tyres, hoses, and belts across Germany, the U.K., France, and Italy will be beneficial for local economy. Artificial rubber has also become more popular in footwear and non-tire automotive uses.

Following the penetration of electrical & electronic and tyre throughout the U.S. and Canada, industry players anticipate that North America will provide attractive growth potential. The development of industrial rubber items and improvements to tyres will promote regional growth. It's important to note that the man-made rubber will mostly benefit the construction and aircraft industries.

The imposition of stringent movement restrictions and lockdowns during the COVID-19 pandemic, the synthetic rubber industry saw a decrease in both volume and value. This caused a serious interruption in industrial facilities and supply lines. As a result, the market for synthetic rubber has been significantly impacted by the decline in output in the automotive and other industries caused by the scarcity of raw materials, primarily latex, as a result of the postponed trade activities.

The growth of the automotive accessory and component industries is directly influenced by the expansion of the automobile industry. Rubber and rubber products are employed in the automotive sector for a variety of applications, including flat seals, O rings, adhesives & sealants, suspension systems, vehicle anti-vibration systems, and fluid transfer systems. In addition, a number of parts found in the engine compartment, including engine seals and hoses for air conditioning systems, are made of premium synthetic rubber. Thus, the market for synthetic rubber is being driven by the expanding automobile sector.

In May 2020, Iowa State University researchers said that they had discovered a new method that might significantly boost the longevity of perovskite cells, leading to a rise in the consumption of solar panels. Perovskite models are known for being cheap, however they are frequently not particularly robust. Contrarily, this new research conclusion means that durability won't be a problem.

| Report Coverage | Details |

| Market Size in 2024 | USD 38.90 Billion |

| Market Size by 2034 | USD 66.44 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form Type, Type, End Use Industry, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand from the automotive industry

Increase in shift towards eco-friendly tires

The synthetic rubber industry was dominated by ethylene propylene diene monomer (EPDM), and this dominance is predicted to persist from 2025 through 2034. The most popular and practical form of synthetic rubber is EPDM, which has a wide range of uses including wire and cable connections, insulators, accumulator bladders, diaphragms, radiator and heater hoses, window and door seals, and more. Extremely heat- and oxidation-resistant, this rubber. It is indestructible at temperatures as high as 150 degrees.

Additionally, it offers good resistance against damp and humidity. Furthermore, the roofing material EPDM is utilised to fix leaks. Liquid EPDM is combined with a pre-measured bottle catalyst to produce a highly special chemical cross link that results in a really robust connection. The demand for EPDM is rising as a consequence of the aforementioned causes, which is further anticipated to accelerate the expansion of the synthetic rubber market over the course of the projected year.

The market for synthetic rubber was led by the transportation industry in 2024, and it is expected to continue to develop at an 8.3% CAGR from 2024 to 2034. The major user of synthetic rubber, which is used to make tyres, is the transportation sector. Synthetic rubber is ideal for creating items that are utilised in transportation because of its durability, elasticity, and flexibility. The need for synthetic rubber is anticipated to rise as investments in the automotive, aerospace, marine, and other industries rise.

UK Business Minister Paul Scully reported a nearly £90 million (US$101.4 million) investment in five aerospace projects in March 2021 under the Aerospace Technology Institute (ATI) Program. Invest India reports that 118 marine projects worth $7.7 billion have been authorised during the past four years. Therefore, it is projected that increasing transportation sector investments would further fuel market expansion.

By Form Type

By Type

By End Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

November 2024

February 2025