April 2025

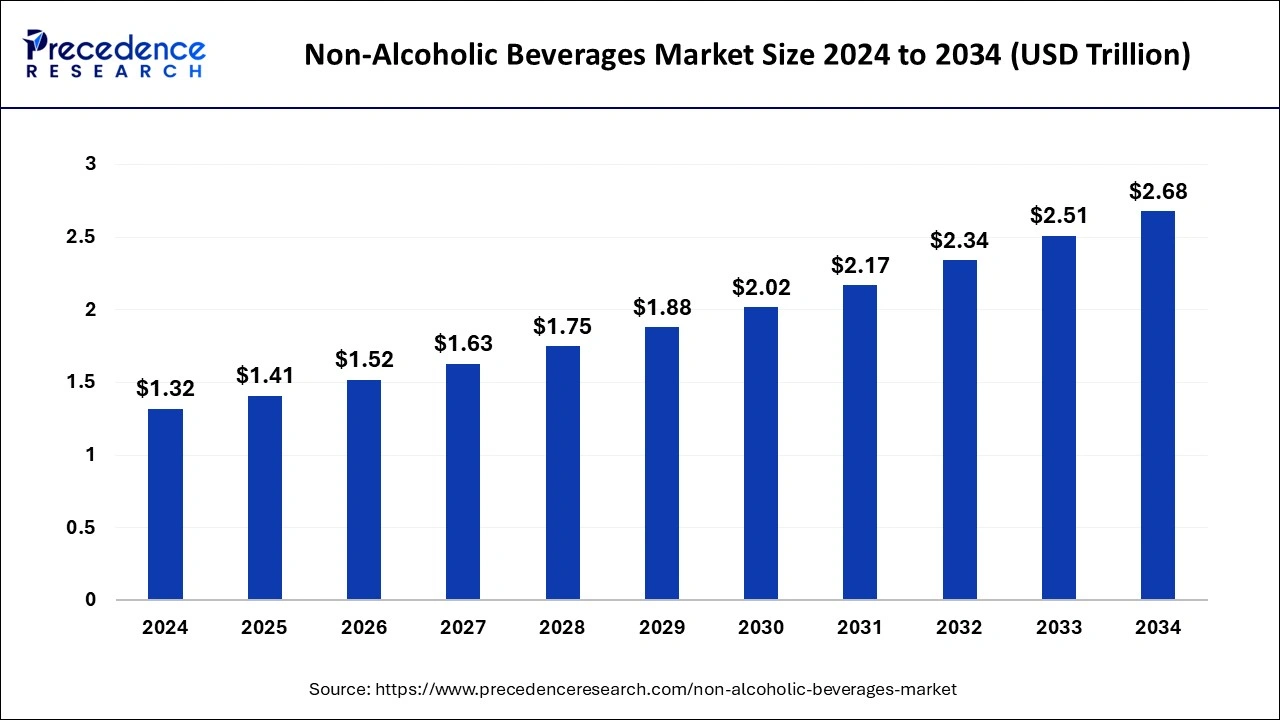

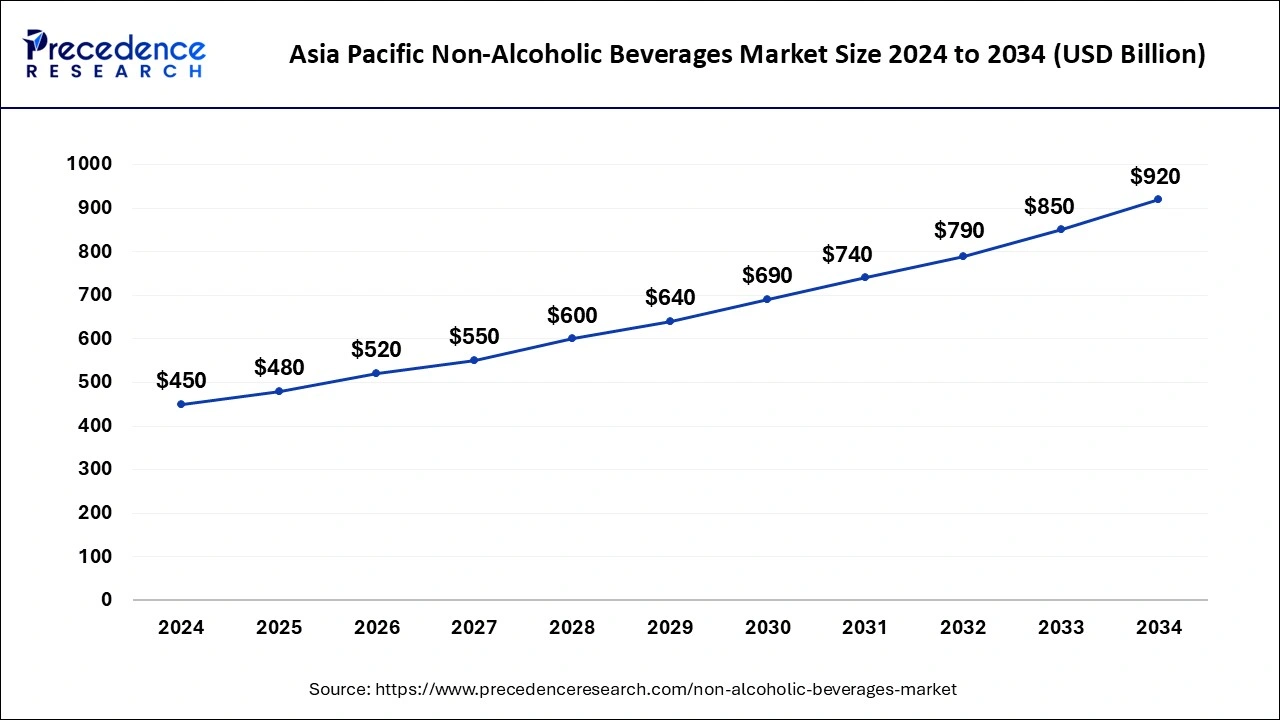

The global non-alcoholic beverages market size is calculated at USD 1.41 trillion in 2025 and is forecasted to reach around USD 2.68 trillion by 2034, accelerating at a CAGR of 7.34% from 2025 to 2034. The Asia Pacific non-alcoholic beverages market size surpassed USD 480 billion in 2025 and is expanding at a CAGR of 7.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global non-alcoholic beverages market size was estimated at USD 1.32 trillion in 2024 and is predicted to increase from USD 1.41 trillion in 2025 to approximately USD 2.68 trillion by 2034, expanding at a CAGR of 7.34% from 2025 to 2034.

The asia pacific non-alcoholic beverages market size was valued at USD 450 billion in 2024 and is predicted to increase surpass USD 920 billion by 2034, expanding at a CAGR of 7.41% from 2025 to 2034.

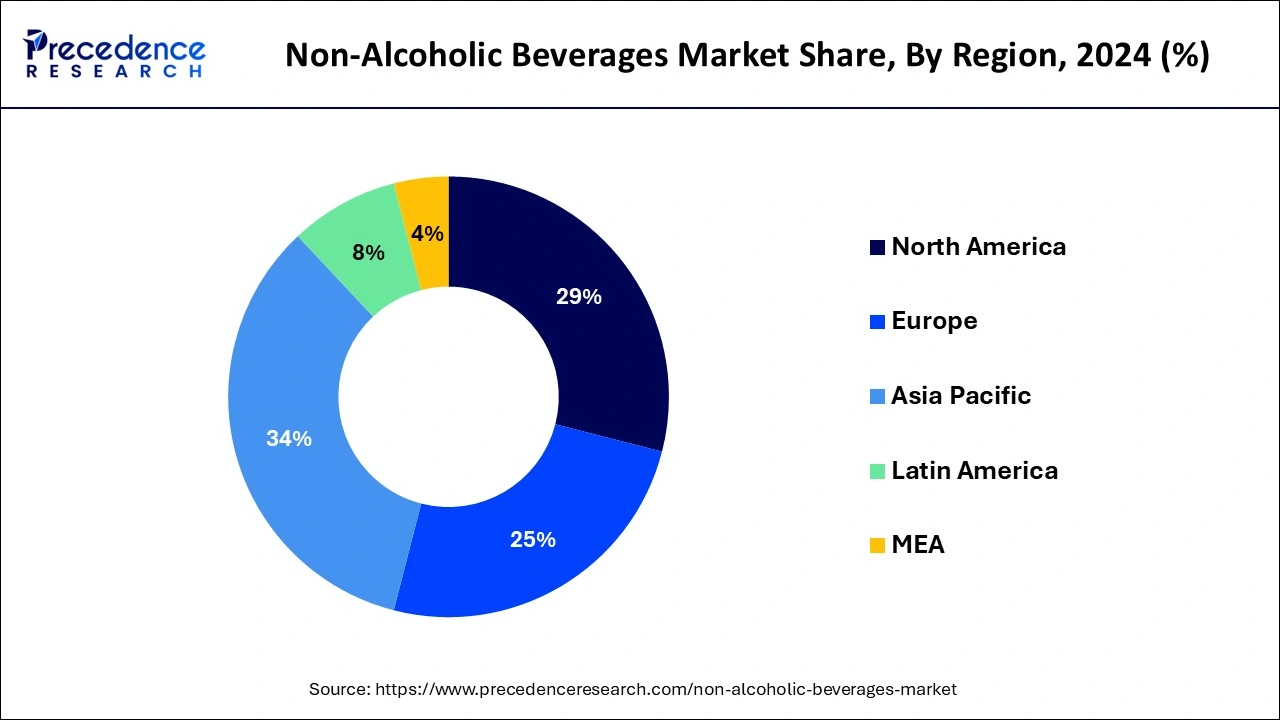

Asia pacific has traditionally dominated the non-alcoholic beverages market in 2024, with a strong presence of established brands, widespread distribution networks, and a culture of beverage consumption deeply rooted in the region’s history. The popularity of soft drinks, juices, and bottled water has contributed to North America’s market leadership, driven by factors such as convenience, lifestyle preferences, and marketing strategies. Additionally, the region’s affluent population and high disposable income levels have supported premiumization trends, encouraging the growth of innovative and upscale non-alcoholic beverages.

China's non-alcoholic beverages market trends

China is a major contributor to the non-alcoholic beverages market. The increasing disposable incomes and large population in the nation increase demand for non-alcoholic beverages. The growing shift towards healthier alternatives and the growing middle-class population help in the market growth. Increasing concerns about lifestyle diseases and the availability of non-alcoholic beverages drive the growth of the market. The growing focus on health benefits increases demand for non-alcoholic beverages, contributing to overall market growth.

India’s non-alcoholic beverages market trends

India is significantly growing in the non-alcoholic beverages market. The growing health consciousness increases demand for low-sugar beverages, fruit juices, and many more, which helps in the market growth. The changing consumer preference and availability of affordable options increase demand for non-alcoholic beverages. The growing urbanization and the growing young population in the region fuel demand for non-alcoholic beverages, supporting overall market growth.

On the other hand,North America is emerging as a key player in the non-alcoholic beverages market, fueled by several factors. One significant driver is the region’s large and increasingly affluent population, coupled with rapid urbanization and changing consumer lifestyles. As disposable incomes rise and dietary preferences evolve, there’s a growing demand for healthier and more diverse beverage options. Moreover, the region’s rich culinary heritage and cultural diversity provide a fertile ground for innovation and the introduction of unique flavors and ingredients in non-alcoholic beverages.

Furthermore, increasing awareness of health and wellness concerns and government initiatives promoting healthy lifestyles have further propelled the growth of the non-alcoholic beverages market in Asia Pacific. Consumers are seeking alternatives to sugary and alcoholic drinks, driving demand for functional beverages, natural juices, and herbal teas. Additionally, the booming e-commerce sector in the region has facilitated greater accessibility and availability of non-alcoholic beverages, allowing companies to reach a wider audience and capitalize on emerging market opportunities. As a result, Asia Pacific is poised to become a significant player in the global non-alcoholic beverage industry, presenting lucrative opportunities for manufacturers, distributors, and investors alike.

United States India’s non-alcoholic beverages market trends

The United States is a key contributor to the non-alcoholic beverages market. The growing health-conscious population and growing demand for functional beverages increase the demand for non-alcoholic beverages. The availability of non-alcoholic beverages across various platforms, like even soda fountains, retail channels, online platforms, and convenience stores, helps in the market growth. The strong focus on health and wellness fuels demand for non-alcoholic beverages. The presence of key players like PepsiCo and Nestle drives the overall growth of the market.

Europe is observed to grow at a considerable growth rate in the upcoming period, propelled by an increasing awareness of health and a transition towards wellness-oriented lifestyles. Consumers are looking for substitutes to conventional sugary drinks, resulting in a growing demand for low-calorie, organic, and functional beverages. The market is seeing innovative flavor profiles and eco-friendly packaging that appeal to both health-conscious and environmentally-aware consumers. Nations such as Germany, France, and the UK are enthusiastically embracing plant-based drinks, infused waters, and non-dairy options. Moreover, regulations encouraging lower sugar consumption further drive the move towards non-alcoholic alternatives throughout the region.

Germany is witnessing a significant change in beverage consumption habits, marked by an increasing preference for functional and health-oriented non-alcoholic drinks, including vitamin-infused water, kombucha, and plant-based beverages. Both local and global brands are innovating with clean-label ingredients and sustainable packaging to align with shifting consumer expectations. The growing acceptance of alcohol-free versions of traditional drinks, such as beers and aperitifs, highlights lifestyle changes and a greater focus on wellness.

The non-alcoholic beverages market refers to the industry involved in the production, distribution, and sale of beverages that do not contain alcohol. These beverages are consumed for various purposes, including hydration, refreshment, enjoyment, and as alternatives to alcoholic drinks. The non-alcoholic beverages market encompasses a wide range of products, each catering to different consumer preferences and needs.

A popular category of non-alcoholic beverages is mocktails. These beverages are gaining popularity as sophisticated alternatives to traditional cocktails, as they mimic the flavors and presentation of alcoholic drinks but omit the alcohol content. They are suitable for designated drivers, pregnant individuals, or anyone choosing to abstain from alcohol. Mocktails offer a creative and enjoyable option for social gatherings and special events, providing a delightful drinking experience without the effects of alcohol.

One category of non-alcoholic beverages includes soft drinks, which encompass carbonated drinks like cola, lemon-lime soda, and ginger ale. These beverages are often sweetened and flavored, providing a refreshing and effervescent experience. Soft drinks are commonly consumed on their own or used as mixers in cocktails, offering versatility in both casual and social settings.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.34% |

| Market Size in 2025 | USD 1.41 Trillion |

| Market Size by 2034 | USD 2.68 Trillion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Distribution, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Premiumization and flavor innovation in non-alcoholic beverages

In recent years, the non-alcoholic beverages market has witnessed a notable trend towards premiumization and flavor innovation. Brands are elevating the drinking experience by incorporating high-quality ingredients, crafting unique flavor profiles, and designing sophisticated packaging. This shift caters to discerning consumers who seek premium alternatives to traditional soft drinks and juices.

By focusing on quality and craftsmanship, beverage companies are appealing to consumers’ desire for indulgence and sophistication in their beverage choices. This premiumization trend not only enhances the perceived value of non-alcoholic beverages but also fosters a sense of exclusivity and luxury in the market.

Rising demand for alcohol alternatives in non-alcoholic beverages

The rise of mindful drinking and the sober curious movement has fueled a growing demand for alcohol alternatives in the non-alcoholic beverages market. Consumers are increasingly seeking non-alcoholic options that mimic the taste and experience of popular alcoholic drinks such as beers, wines, and spirits.

In response to the shifting trends, beverage companies are innovating to create non-alcoholic versions of these beverages, utilizing techniques to replicate the flavors and aromas while omitting the alcohol content. This trend provides individuals with alternatives to traditional alcoholic beverages, catering to those looking to reduce their alcohol consumption or abstain from it entirely. Moreover, the availability of alcohol alternatives expands the beverage market, offering greater choice and inclusivity for consumers with diverse preferences and lifestyles.

Environmental sustainability

One significant restraint in the non-alcoholic beverage market is the challenge of environmental sustainability. As consumer awareness of environmental issues continues to grow, there is increasing pressure on beverage companies to minimize their environmental footprint. This includes reducing plastic packaging, minimizing water usage, and sourcing ingredients responsibly.

The excessive use of single-use plastic bottles in the production and distribution of non-alcoholic beverages contributes to plastic pollution and environmental degradation. In response, some companies are exploring alternative packaging materials like biodegradable bottles or switching to refillable containers to reduce waste. Despite efforts to improve sustainability practices, achieving comprehensive environmental sustainability remains a complex and ongoing challenge for the non-alcoholic beverages market.

Expanding market potential

The non-alcoholic beverage market presents a sustained future, driven by changing consumer preferences and lifestyle trends. For instance, the rising demand for healthier beverage options has spurred the development of functional drinks fortified with vitamins, minerals, and botanical extracts. Companies like OLIPOP and Recess are capitalizing on this trend by offering innovative beverages that promote gut health and relaxation.

Additionally, the increasing popularity of alcohol alternatives, exemplified by brands like Seedlip and Athletic Brewing Company, demonstrates the potential for non-alcoholic beverages to capture market share from traditional alcoholic drinks, catering to the growing number of consumers embracing mindful drinking and sobriety.

Diversification and Innovation

Non-alcoholic beverages offer ample opportunities for diversification and innovation, allowing companies to differentiate themselves in a competitive market. For example, the emergence of premium non-alcoholic cocktails, or mocktails, has created a new avenue for creativity and sophistication in beverage offerings.

Brands like Curious Elixirs and Kin Euphorics are pioneering this category with artisanal blends of herbs, spices, and adaptogens, providing consumers with upscale alternatives to traditional cocktails. By continuously innovating and introducing novel flavors and formulations, companies can capitalize on evolving consumer preferences and stay ahead of market trends in the dynamic landscape of non-alcoholic beverages.

By product, the functional beverages segment held the largest share of the non-alcoholic beverages market in 2024. This is attributed to changing trends and preferences wherein consumers increasingly seek beverages that offer health benefits beyond basic hydration. Functional beverages include products fortified with vitamins, minerals, antioxidants, probiotics, and other bioactive ingredients to support specific health goals such as immune health, energy enhancement, and stress reduction.

The sparkling water and seltzers segment is expected to witness substantial growth during the forecast period. Consumers are looking for healthier alternatives to sugary soft drinks and alcoholic beverages. This has resulted in a surge in the popularity of sparkling water and seltzers. These beverages offer refreshing carbonation and often come in a variety of flavors, appealing to consumers seeking a bubbly and flavorful alternative to traditional sodas and juices. Additionally, the market for flavored sparkling water and seltzers has expanded rapidly, driven by innovations in flavor profiles and packaging formats.

In the non-alcoholic beverage industry, two segments experiencing significant growth are online platforms and direct-to-consumer channels. The online platforms segment held the dominating share of the market in 2024. Online platforms offer convenience and accessibility, allowing consumers to explore a wide range of non-alcoholic beverages from the comfort of their homes. With the rise of e-commerce and digitalization, online sales of non-alcoholic beverages have surged, providing companies with opportunities to reach a broader audience and expand their market presence.

On the other hand, the direct-to-consumer channels segment was found to be another highly influential segment for the forecast period. Direct-to-consumer channels enable beverage companies to establish closer connections with their customers, offering personalized experiences and exclusive products, driving growth and loyalty in the rapidly evolving landscape of non-alcoholic beverages.

The health-conscious consumer segment held the dominating share of the non-alcoholic beverages market in 2024. Health-conscious consumers are increasingly seeking beverages that align with their wellness goals, opting for options with natural ingredients, low sugar content, and functional benefits. Brands offering beverages enriched with vitamins, antioxidants, and botanical extracts cater to this segment’s demand for nutritious and rejuvenating options.

The fitness enthusiasts segment is expected to witness a significant rate of expansion during the forecast period. Fitness enthusiasts prioritize hydration and performance-enhancing beverages that support their active lifestyles. Products like electrolyte-infused waters, protein shakes, and sports drinks are gaining popularity in this segment, providing essential hydration, replenishment, and energy without the need for alcohol or artificial additives.

The growth in these segments reflects a broader shift towards healthier living and mindful consumption, driving innovation and diversification in the non-alcoholic beverages market to meet the evolving needs of health-conscious and active consumers.

By Product

By Distribution

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

May 2025

May 2025

May 2025