February 2025

Non-Destructive Testing (NDT) Market (By Offering: Equipment, Service; By Method: Visual Inspection, Surface Inspection, Volumetric Inspection, Others; By Technique: Ultrasonic Testing, Visual Inspection Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy-Current Testing, Radiographic Testing, Acoustic Emission Testing, Others; By Vertical) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

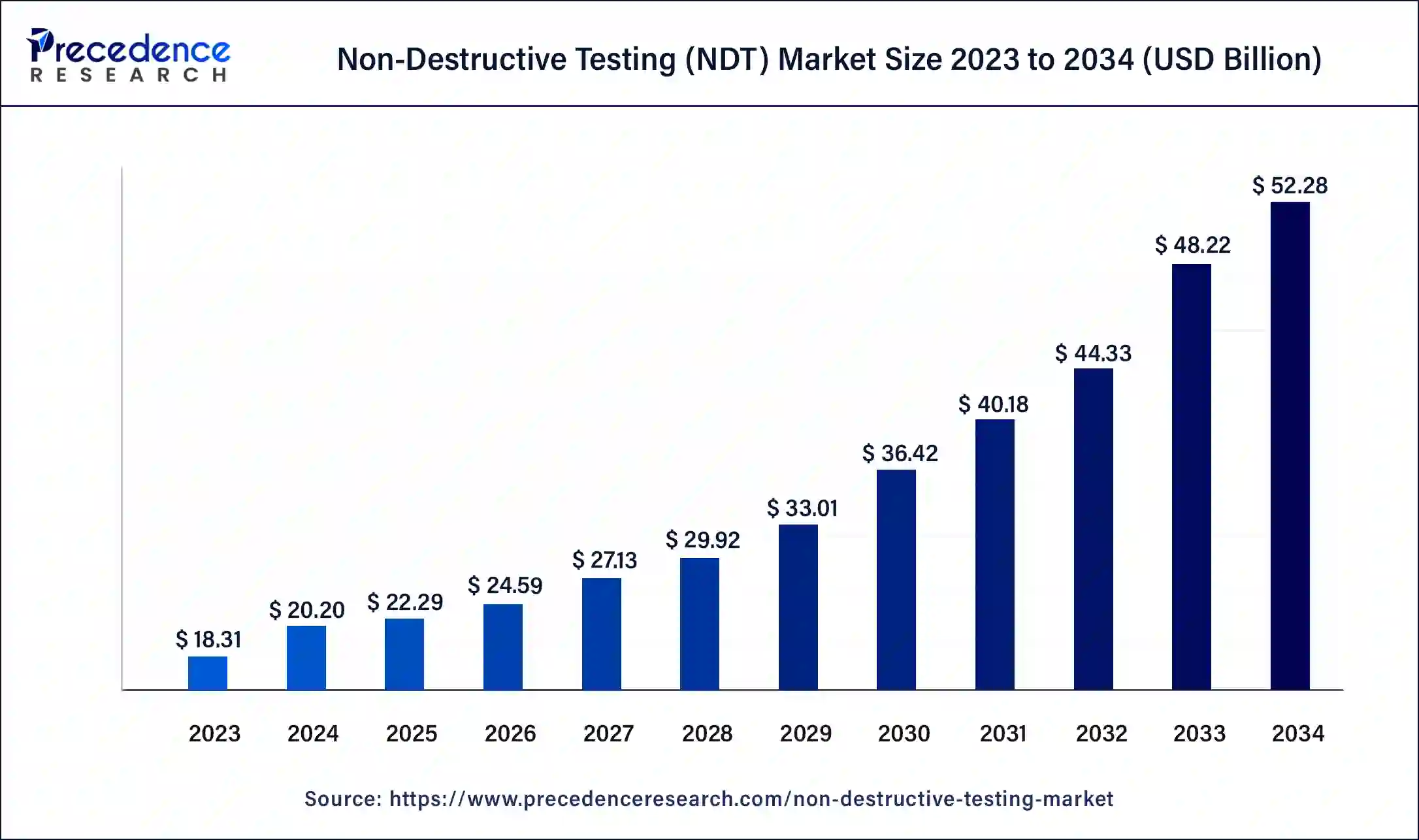

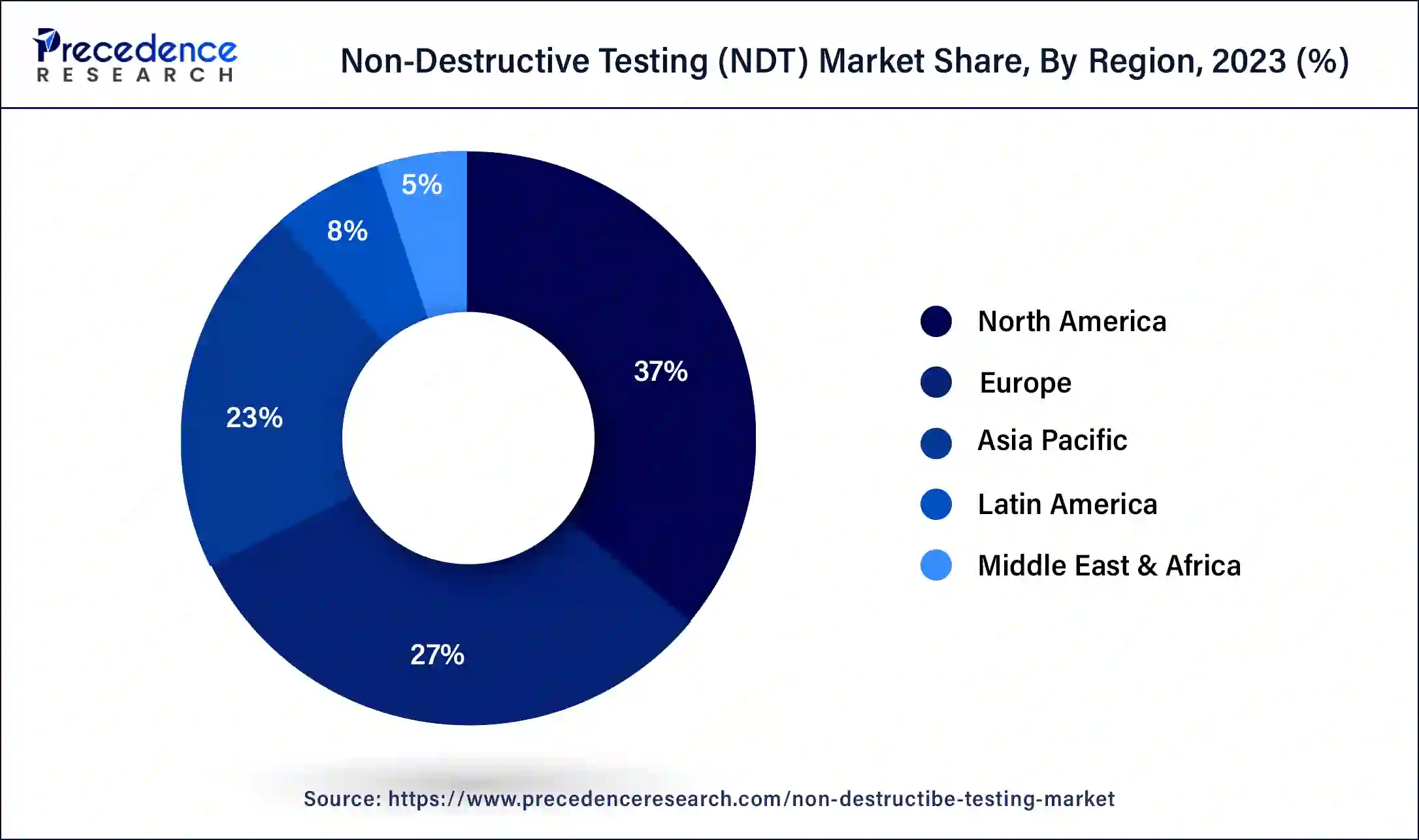

The global non-destructive testing (NDT) market size was USD 18.31 billion in 2023, accounted for USD 20.20 billion in 2024, and is expected to reach around USD 52.28 billion by 2034, expanding at a CAGR of 10% from 2024 to 2034. The North America non-destructive testing (NDT) market size reached USD 6.59 billion in 2023.

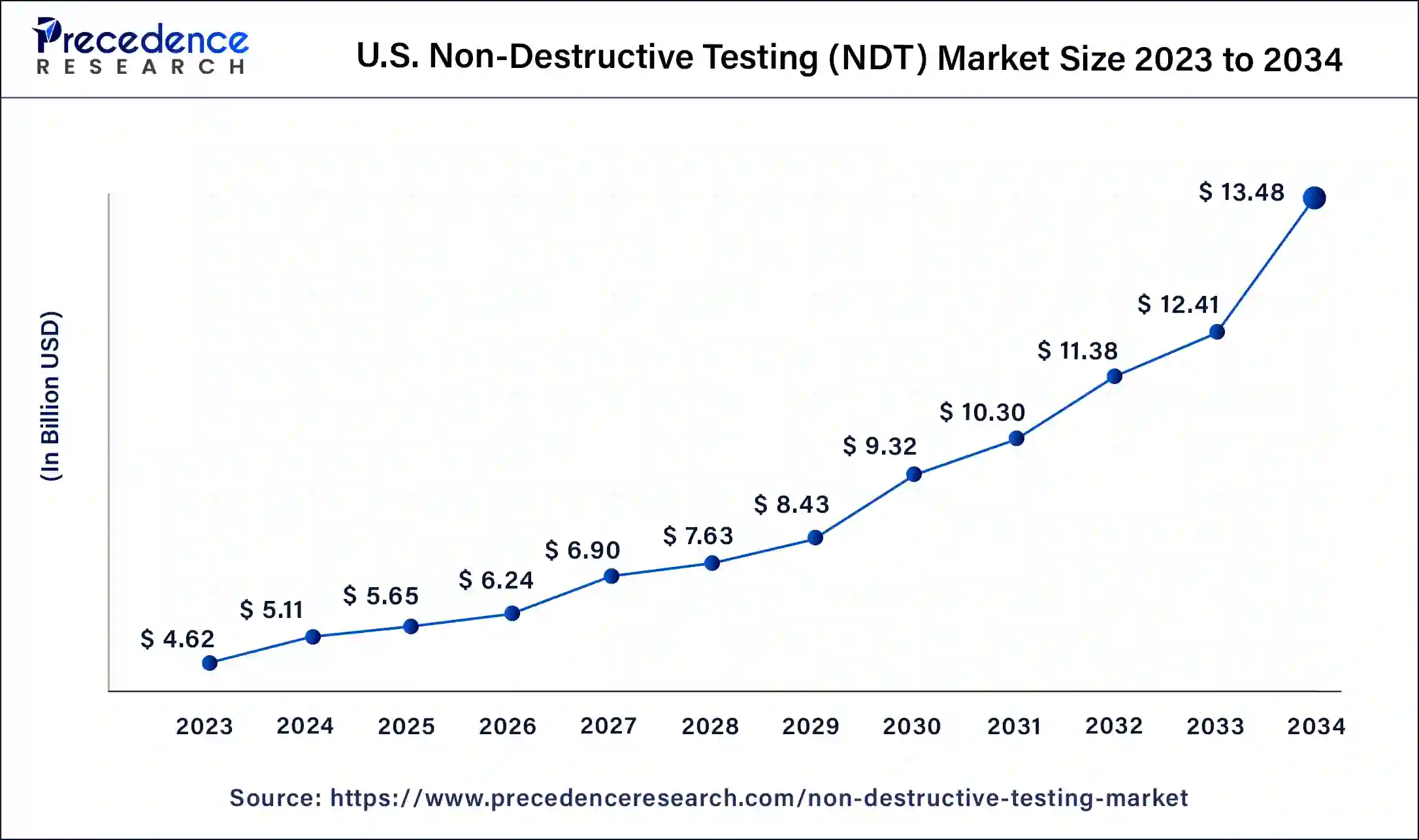

The U.S. non-destructive testing (NDT) market size was estimated at USD 4.62 billion in 2023 and is predicted to be worth around USD 13.48 billion by 2034, at a CAGR of 10.2% from 2024 to 2034.

North America has held the largest revenue share of 36% in 2023. There is a growing emphasis on infrastructure maintenance, particularly in the energy and oil & gas sectors, driving the demand for NDT services. Moreover, advancements in technology, such as digital radiography and phased array ultrasonic testing, are enhancing the accuracy and efficiency of inspections. Additionally, the aerospace and automotive industries are adopting NDT methods for quality control in the production of lightweight materials. Lastly, stringent regulatory requirements in North America are fostering innovation in NDT techniques to ensure compliance and safety across various industries.

Asia-Pacific is estimated to observe the fastest expansion. This is fueled by expanding industrial sectors, especially in countries like China and India, which are investing heavily in infrastructure development. The NDT market in this region is experiencing a shift towards advanced techniques, including digital radiography and phased array ultrasonic testing. Furthermore, stringent safety regulations and quality control requirements are driving the adoption of NDT solutions across various industries, such as aerospace, manufacturing, and energy, making Asia-Pacific a thriving hub for NDT technology and services.

Market Overview

The non-destructive testing (NDT) market is a niche industry dedicated to the examination and evaluation of material, component, and structural integrity without causing harm. It employs various techniques like ultrasound, radiography, and magnetic particle testing to achieve non-invasive inspections. The non-destructive testing market serves diverse sectors such as aerospace, manufacturing, construction, and healthcare, ensuring safety, quality control, and regulatory compliance. With an increasing emphasis on safety and quality assurance, the NDT market is experiencing steady growth, driven by technological advancements and stringent industry standards.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 10% |

| Market Size in 2023 | USD 18.31 Billion |

| Market Size in 2024 | USD 20.20 Billion |

| Market Size by 2034 | USD 52.28 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Offering, By Method, By Technique, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Diverse material usage, including composites and advanced alloys, has surged market demand for the non-destructive testing (NDT) industry. These materials often require specialized testing methods due to their unique properties. NDT techniques must evolve to accommodate this diversity, driving demand for innovative solutions that can effectively inspect and assess the integrity of these modern materials. This demand has resulted in continuous growth and expansion within the NDT market as industries increasingly rely on these techniques to maintain safety and quality standards.

Moreover, Safety and Quality Assurance are driving unprecedented demand for the non-destructive testing (NDT) market. Industries prioritize safety to prevent catastrophic failures, ensuring the well-being of both personnel and the public. High-quality standards are essential for product reliability and compliance with stringent regulations. NDT techniques offer a non-invasive means to identify flaws and defects in materials and structures, contributing significantly to safety and quality control efforts. This surge in demand is further propelled by industries' recognition of NDT as a proactive measure, ultimately reducing operational risks, minimizing downtime, and safeguarding their reputation in the market.

The cost of advanced equipment poses a significant restraint on the non-destructive testing (NDT) market. While cutting-edge NDT technologies offer enhanced accuracy and efficiency, their high price tags can deter smaller businesses from investing in these advanced solutions. This cost barrier can limit accessibility and adoption, particularly in industries with tighter budgets. As a result, companies may opt for less advanced, more affordable NDT alternatives, potentially compromising the quality and comprehensiveness of inspections. Addressing this challenge requires industry players to explore cost-effective options and promote the affordability and scalability of advanced NDT equipment to foster broader market demand.

Moreover, the restraints of accuracy and reliability can impact on the market demand for non-destructive testing (NDT). Inaccurate or unreliable NDT results can lead to erroneous conclusions about the integrity of materials and structures, potentially compromising safety and quality assurance efforts. Industries reliant on NDT require meticulous attention to calibration, operator training, and adherence to rigorous standards to ensure dependable results. The perceived risk of unreliable inspections may discourage some businesses from fully embracing NDT solutions, particularly in safety-critical sectors, thus limiting the overall market demand for NDT services and technologies.

Predictive maintenance is a powerful driver for the non-destructive testing (NDT) market. As industries increasingly adopt predictive maintenance strategies, NDT plays a pivotal role in identifying potential equipment failures and defects before they escalate. This proactive approach minimizes downtime, extends asset lifespan, and reduces operational costs. NDT technologies are essential for monitoring the health of critical machinery and infrastructure, ensuring their reliability and safety. The growing recognition of NDT as a core component of predictive maintenance programs propels the demand for NDT services and technologies, making it an indispensable asset for industries seeking to optimize operations and reduce disruptions.

Moreover, Data Analytics and Integration are catalysts for increased market demand in the non-destructive testing (NDT) industry. By harnessing data from NDT processes and integrating it with other manufacturing and maintenance systems, companies gain deeper insights into their assets' health and performance. This data-driven approach enhances predictive maintenance capabilities, reduces downtime, and optimizes operational efficiency. Industries are increasingly recognizing the value of such integrated solutions, spurring demand for NDT services and technologies. Furthermore, as data analytics and integration continue to evolve, NDT providers have the opportunity to offer innovative, value-added solutions that further fuel market growth.

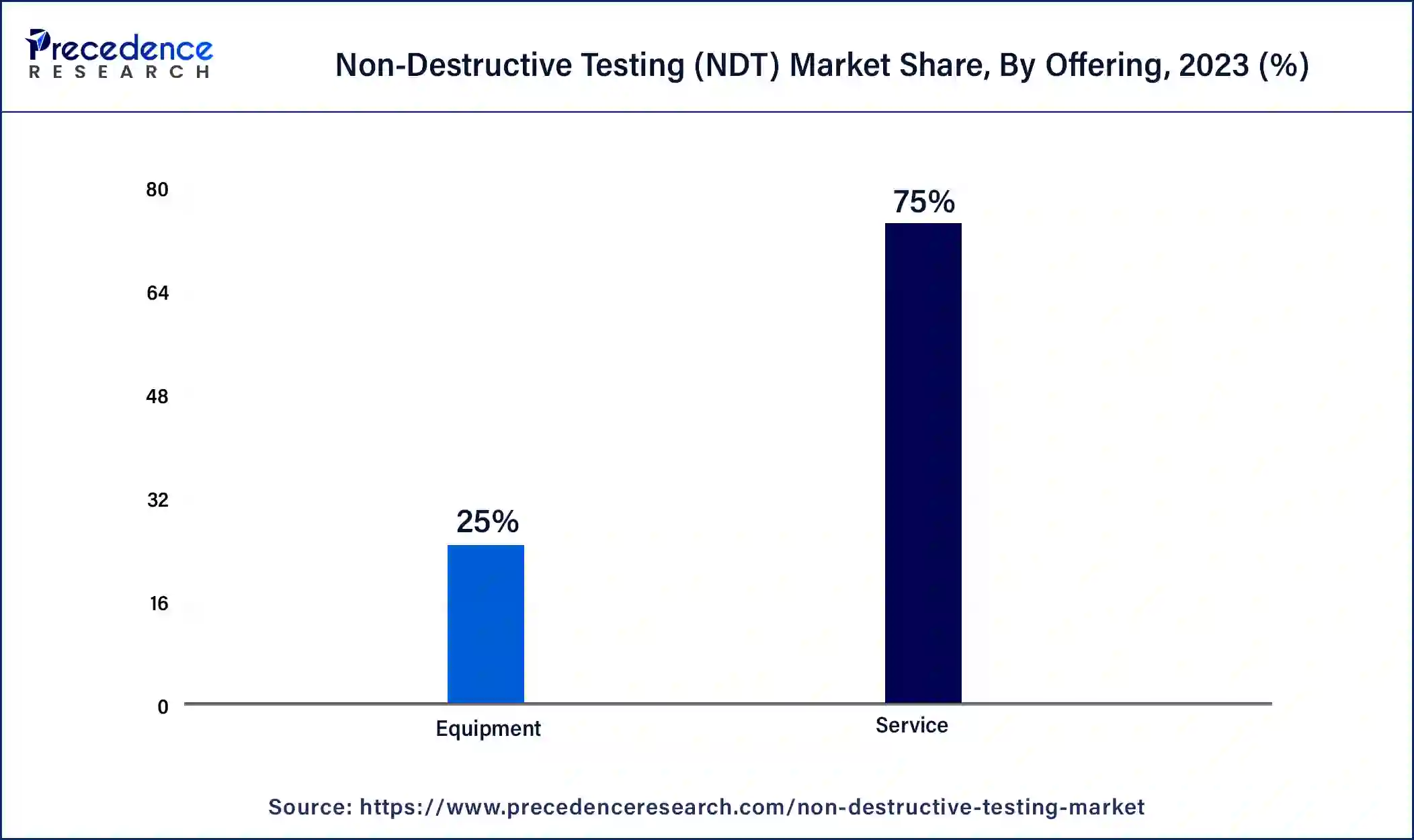

According to the offering, the service segment has held 75% revenue share in 2023. Non-destructive testing (NDT) services encompass a range of techniques and inspections employed across industries to assess the integrity of materials, components, and structures without causing damage. These services ensure safety, quality control, and regulatory compliance, with methods like ultrasound, radiography, and magnetic particle testing. Key trends in the NDT market include the integration of advanced technologies such as AI and automation, growing demand for eco-friendly NDT methods, and the expansion of NDT into emerging markets. Additionally, there's a focus on data analytics, predictive maintenance, and diversification of NDT applications to meet evolving industry needs.

The equipment segment is anticipated to expand at a significant CAGR of 12.8% during the projected period. Equipment in the non-destructive testing (NDT) market refers to specialized tools and technologies used to assess the integrity of materials and structures without causing damage. These include ultrasound machines, X-ray radiography systems, magnetic particle testing equipment, and more. In recent trends, the NDT market has witnessed a surge in the adoption of digital and automated NDT solutions, incorporating artificial intelligence and machine learning for data analysis. These advancements improve inspection speed, accuracy, and reliability. Additionally, portable and handheld NDT equipment has gained popularity for its versatility in various industries, contributing to the market's continued growth.

Based on the method, the volumetric Inspection is anticipated to hold the largest market share of 32% in 2023. Volumetric Inspection in the non-destructive testing (NDT) market refers to a method that examines the internal structure and integrity of an object or material using techniques such as computed tomography (CT), radiographic testing, or ultrasonic testing. This approach provides three-dimensional insights, making it crucial for detecting hidden defects in various industries. Recent trends in Volumetric Inspection include the adoption of advanced imaging technologies for higher resolution and speed, the integration of artificial intelligence for automated defect recognition, and the use of portable, handheld devices for increased mobility and versatility in on-site inspections. These trends are enhancing the accuracy and efficiency of NDT assessments, driving market growth.

On the other hand, the Surface Inspection segment is projected to grow at the fastest rate over the projected period. Surface Inspection in Non-Destructive Testing (NDT) involves the examination of the outermost layer of materials or structures to detect defects, corrosion, or irregularities without causing harm. This method employs various techniques such as visual inspection, optical imaging, and eddy current testing. The NDT market is witnessing a trend towards more advanced and automated surface inspection methods, integrating artificial intelligence and machine learning for enhanced defect detection and data analysis. These technologies improve accuracy and efficiency, making surface inspection in NDT an increasingly vital component of quality control across industries.

In 2023, the Ultrasonic Testing (UT) segment had the highest market share of 36.8% on the basis of the installation. Ultrasonic testing (UT) is a non-destructive testing (NDT) technique that employs high-frequency sound waves to assess the integrity of materials and structures. UT involves sending ultrasonic waves into a material, and by analyzing their reflections, it can detect defects like cracks, voids, or thickness variations. In the NDT market, UT is experiencing significant trends, including the adoption of phased-array ultrasonics, which offers enhanced inspection capabilities, and the integration of digital technologies for data analysis, enabling more precise and efficient inspections, ultimately contributing to increased safety and quality assurance across industries.

The acoustic emission testing (AE) segment is anticipated to expand at the fastest rate over the projected period. Acoustic Emission Testing (AE) is a non-destructive testing (NDT) technique that assesses structural integrity by detecting high-frequency acoustic signals generated within materials under stress. This method is valuable for identifying hidden defects, monitoring equipment, and assessing structural health. In the NDT market, AE is witnessing notable trends driven by advancements in sensor technology, allowing for more precise and real-time data collection. Additionally, the integration of AI and machine learning is enhancing AE's capabilities for predictive maintenance, offering industries a proactive approach to asset management and safety, further fueling its adoption and growth.

The Oil & Gas segment held the largest revenue share of 31.9% in 2023. In the Oil & Gas sector, non-destructive testing (NDT) refers to the critical process of inspecting and evaluating the integrity of equipment, pipelines, and infrastructure without causing damage. NDT methods, such as ultrasonic testing, radiography, and magnetic particle testing, play a pivotal role in preventing leaks, ensuring safety, and maintaining operational efficiency. Recent trends in the Oil & Gas NDT market include a growing emphasis on advanced NDT techniques like phased array ultrasonics and computed tomography for enhanced accuracy. Additionally, there's a focus on remote monitoring and robotics to conduct inspections in challenging environments, improving the industry's overall safety and productivity.

The cyber security sector is anticipated to grow at a significantly faster rate, registering a CAGR of 15.6% over the predicted period. The automotive industry encompasses the entire process of designing, manufacturing, and marketing vehicles. Within the Non-Destructive Testing (NDT) market specific to the automotive sector, the central objective revolves around guaranteeing the quality and safety of critical automotive elements. This includes the assessment of components like welds, engine parts, and vehicle body structures. Trends in the automotive NDT market include the increasing use of advanced NDT techniques like phased array ultrasonic testing for detecting defects more precisely. Additionally, as electric vehicles gain prominence, NDT is vital for assessing the integrity of battery components. Furthermore, automation and robotics are being incorporated to streamline inspection processes, enhancing efficiency and accuracy in the automotive industry's NDT practices.

Segments Covered in the Report:

By Offering

By Method

By Technique

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

April 2024

February 2025

April 2025