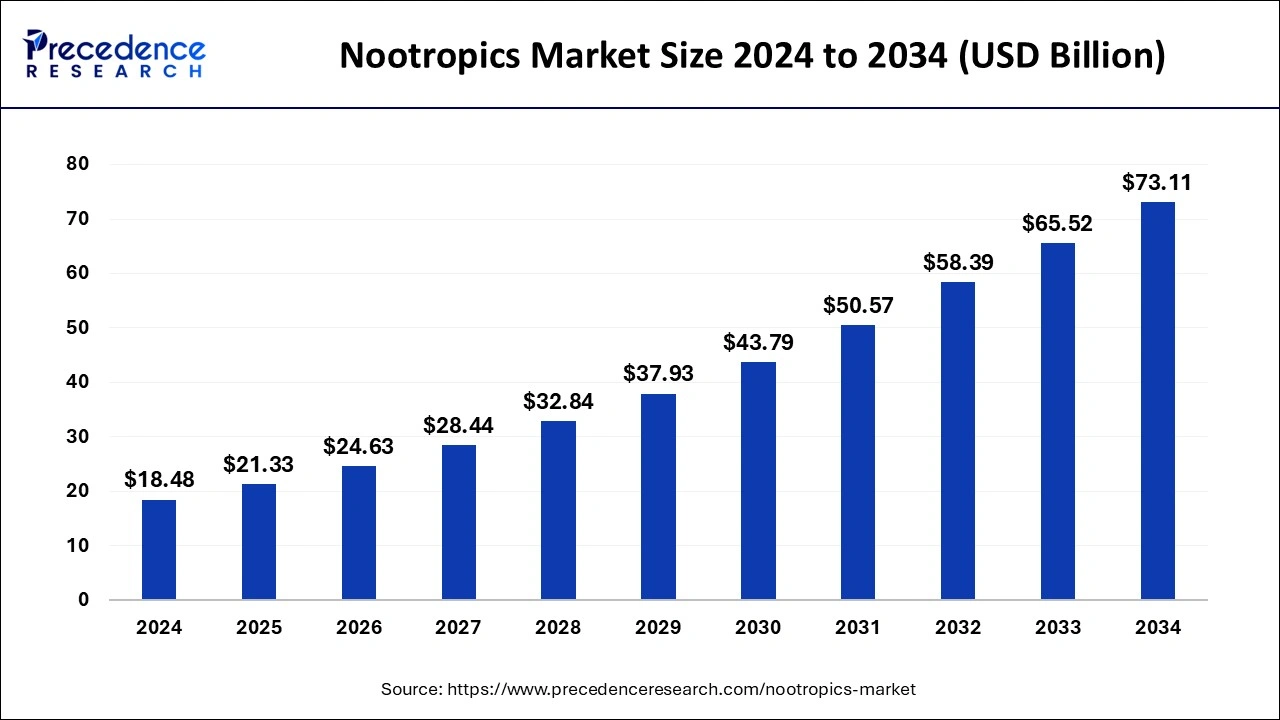

The global nootropics market size was evaluated at USD 18.48 billion in 2024 and it is projected to surpass around USD 73.11 billion by 2034, poised to grow at a CAGR of 14.74% during the forecast period 2025 to 2034.

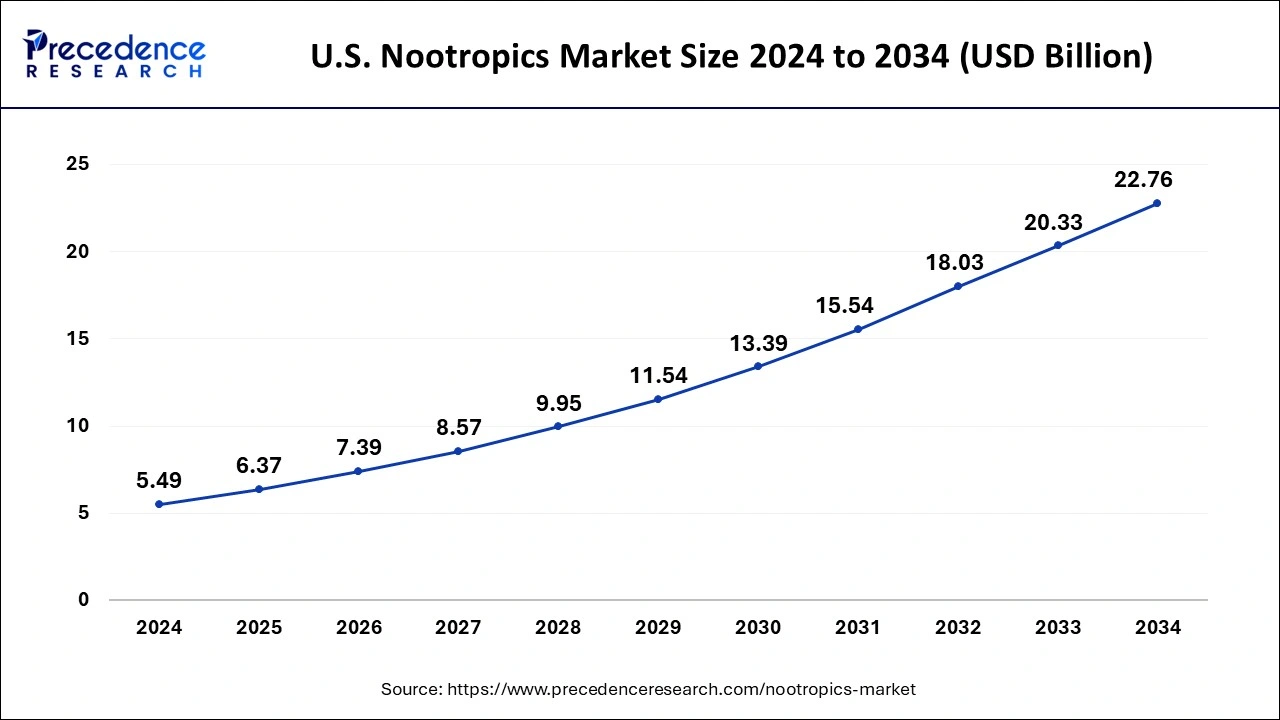

The U.S. nootropics market size reached USD 5.49 billion in 2024 and is anticipated to be worth around USD 22.76 billion by 2034, poised to grow at a CAGR of 15.28% from 2025 to 2034.

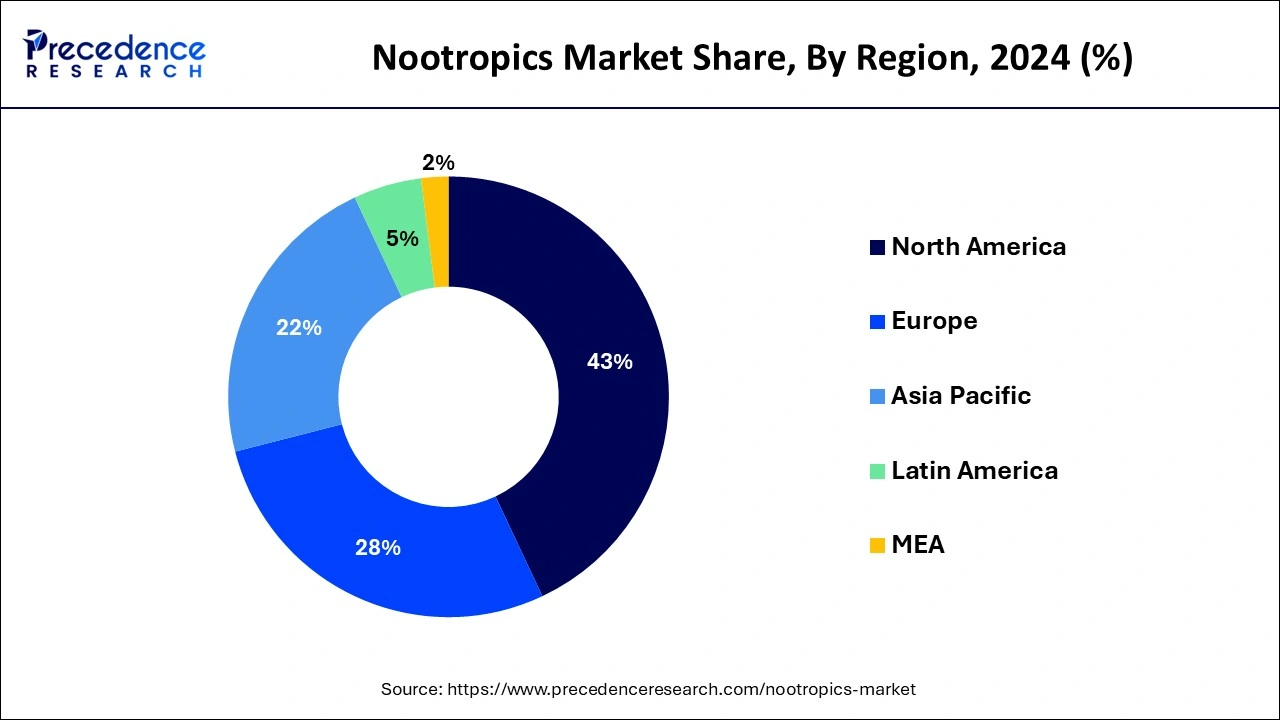

North America dominated the nootropics market in 2024. The nootropics market is dominated by North America, especially the United States and Canada. The region's flourishing health and wellness industry and culture, which places a high importance on cognitive function, has created a considerable market for nootropic products. Products that claim to enhance concentration, memory, and mental clarity appeal to customers in North America.

European consumers seek holistic approaches to well-being, making nootropic products appealing as part of their overall wellness routines. The region's history of valuing herbal remedies and alternative medicine aligns well with the use of natural nootropic ingredients.

The Asia-Pacific region experiences increasing interest in nootropics, driven by factors like urbanization, changing lifestyles, and rising disposable incomes. Countries such as Japan and South Korea are at the forefront of adopting nootropic products due to their advanced technological landscapes and wellness-focused cultures. Traditional herbal medicines and natural remedies also influence the acceptance of nootropics with natural ingredients.

Latin American countries and Middle Eastern nations are gradually exploring nootropic products, driven by evolving lifestyle trends and increased attention to mental well-being.

Nootropics are medicines that are thought to improve cognitive abilities including memory, creativity, motivation, and general mental performance. The company are often referred to as smart pharmaceuticals or cognitive enhancers. The compounds in question can range widely from natural molecules to synthetic medications to nutritional supplements. The nootropics market is witnessing a dynamic shift in consumer preferences, driven by several prominent trends. One of these trends is the increasing demand for nootropics derived from natural sources such as herbal extracts, adaptogens, and vitamins. This inclination aligns seamlessly with the broader movement towards embracing natural and holistic wellness solutions.

The nootropics landscape is changing with the rise of personalized approaches and stacking techniques among users. Many individuals are exploring tailored combinations of different nootropics, known as "stacking," to achieve specific cognitive effects. Customised nootropic mixes and supplement combinations are growing more popular as a result, catering to specific individual demands. The COVID-19 pandemic's profound impact on mental health has spurred a renewed interest in nootropics aimed at promoting wellness and stress relief. Consumers are seeking nootropics that claim to alleviate stress and anxiety and promote relaxation. Notable ingredients like ashwagandha, L-theanine, and Rhodiola rosea have gained popularity for their potential stress-reducing effects.

Legal and ethical issues have gained prominence in the context of these movements. Global differences in the regulatory environment for nootropics have sparked debates regarding their safety, legality, and moral propriety. Finding a balance between making it easier for consumers to obtain cognitive-enhancing medications and maintaining their safety is an important factor. Tech-integrated solutions have emerged as a result of an exciting combination of technology and nootropics. This emergence combines software, wearables, and applications that offer cognitive training alongside nootropic supplementation. The following all-encompassing method of cognitive improvement highlights the rising demand for comprehensive methods of improving cognitive function.

In North America, the United States and Canada held prominent positions due to their robust health and wellness industries, extensive consumer awareness, and active research endeavours, resulting in a substantial market share. European countries such as the United Kingdom, Germany, and France significantly contributed to the market. This contribution can be attributed to their health-conscious populations and escalating interest in cognitive well-being.

The Asia-Pacific region was experiencing a surge in interest, driven by factors like urbanization, evolving lifestyles, and rising disposable incomes. Countries like Japan and South Korea led the charge in the adoption of nootropic products. Even in regions outside of these primary markets, there was notable growth. Although comparatively smaller, these regions were witnessing increased awareness of nootropics as consumer preferences shifted towards prioritising cognitive enhancement.

The nootropics market continues to evolve, and staying informed about these trends and market dynamics is essential for understanding the landscape's current state and its potential future trajectory. The combination of widespread consumer awareness, a growing health and wellness sector, and active research and development efforts in the area of cognitive enhancement, the United States maintained a substantial portion of the market.

A growing focus on cognitive health is emerging as a crucial component of general wellbeing. More and more people are realizing how important cognitive function and mental clarity are to leading a fulfilling life. In response to this increased awareness, nootropics have become a hot topic as potential tools for improving cognitive abilities. Modern lives frequently involve high levels of stress and intense work obligations.

The rise of stress-related problems has increased demand for remedies that can reduce anxiety and tension and promote relaxation. Nootropics with stress-relieving abilities have become popular choices as treatments for coping with these contemporary pressures. Consumers are actively searching for ways to improve their mental acuity at a time of heightened competitiveness and a knowledge-driven culture. Nootropics are now seen as useful aids that can improve memory, attention, creativity, and general cognitive performance.

As a result, they appeal to a wide range of demographics, including professionals, students, and individuals of all ages. Technology and nootropics have combined to create ground-breaking solutions that seamlessly combine cognitive exercise and nootropic dosage. This combination, which includes software, wearables, and apps, offers customers a thorough method for cognitive improvement. This compatibility with modern aspirations for integrated solutions emphasises how technology and cognitive empowerment work in concert.

As consumers engage in the practice of "stacking," or combining multiple nootropics to produce customised cognitive benefits, personalization has pervaded the nootropics industry. Customised nootropic mixes and supplement combinations have emerged as a result of this rising need for individualised solutions, skilfully meeting the varied and demands of people.

Nootropics are rising remarkably in popularity as consumers take a holistic approach to health and wellbeing, and they are becoming an essential part of an all-encompassing lifestyle. Through combining nootropics with other wellness practises like exercise, mindfulness, and diet, one may achieve general well-being on several levels. The ongoing progress in cognitive enhancement research has led to the identification of novel nootropic substances and a deeper understanding of their underlying processes. Consumer trust in certain nootropics' efficacy rises as scientific data supporting their potential advantages mounts, fuelling the nootropics market's expansion. Nootropics are broadening their appeal to include a larger audience beyond their initial affiliation with academics and high-performance individuals. People from many walks of life are considering nootropics as tools to strengthen brain health and improve daily functioning as knowledge grows and stigma fades.

A complex web of elements is what is driving the growth of the nootropics industry. These include heightened awareness of cognitive health, rising stress levels, the desire for improved mental performance, technology integration, personalization trends, aspirations for holistic wellness, advancements in research, and the growing acceptance of nootropics among various population segments.

| Report Coverage | Details |

| Market Size in 2025 | USD 21.33 Billion |

| Market Size by 2034 | USD 73.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.74% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | By Form and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Personalization trends

Consumer preferences and product development strategies are being shaped by personalization trends, which are a big market driver for nootropics. As customers want for more specialized solutions in several areas of their life, including health and wellness, the idea of customization has gained traction. Customization centers on adapting experiences and goods to match individual demands. The market for nootropics is being driven by demand and innovation by personalization trends.

Limited scientific evidence

The limited scientific evidence serves as a notable restraint within the nootropics market, influencing consumer perceptions, industry growth, and regulatory considerations. This restraint stems from the fact that while Nootropics hold promise as cognitive enhancers, the extent of their effectiveness and potential long-term impacts remains inadequately substantiated by robust clinical research.

E-Commerce expansion

The market for nootropics offers a substantial opportunity for e-commerce growth, which will transform the way nootropic goods are promoted, delivered, and accessible. A combination of shifting consumer habits and the growing popularity of internet purchasing, this trend has gathered steam.

Regulatory hurdles

The complex and dynamic regulatory environment that controls the development, promotion, and distribution of goods for cognitive improvement is a substantial barrier to the market for nootropics. These challenges might vary greatly between various jurisdictions and influence the development of the market, customer confidence, and product innovation.

In 2024, the capsules and tablets segment dominated the nootropics market. In view of their mobility, ease, and ability to provide exact dosages, capsules and tablets have long been preferred options for nootropic usage. The encapsulation of nootropic compounds ensures accurate dosage, making it easier for consumers to incorporate them into their daily routines. This form appeals to individuals seeking a quick and straightforward method of cognitive enhancement without the need for preparation. Capsules and tablets are particularly popular among busy professionals, students, and those looking to enhance focus and memory during demanding periods.

Powdered Nootropics offer a versatile and customizable approach to cognitive enhancement. This form provides users with the flexibility to mix nootropic compounds into various beverages, such as water, smoothies, or juices. The powder format allows for more personalized dosing, enabling consumers to experiment with different combinations and tailor their cognitive support based on individual needs. Powdered nootropics often attract wellness enthusiasts who prioritize holistic approaches and enjoy incorporating nootropics into their dietary routines.

The emergence of nootropic-infused drinks introduces a convenient and on-the-go solution for cognitive enhancement. Pre-formulated drinks offer a hassle-free experience, as consumers can simply grab a ready-to-consume beverage designed to support focus, mental clarity, and overall cognitive function. Nootropic drinks often combine cognitive-enhancing compounds with other functional ingredients like vitamins, adaptogens, and natural extracts.

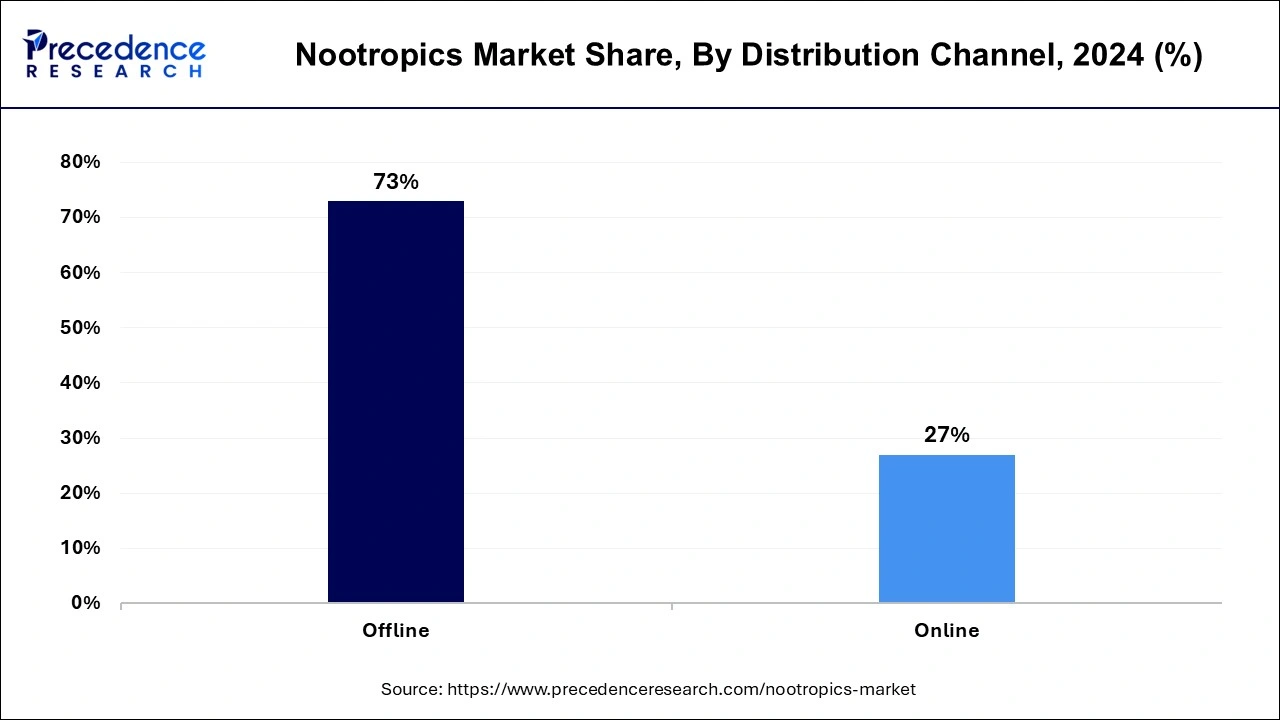

In 2024, the market for nootropics was led by the offline distribution channel segment. Offline distribution channels encompass brick-and-mortar retail locations such as health food stores, pharmacies, specialty supplement shops, and wellness centres. These physical outlets provide consumers with the advantage of in-person interactions, allowing them to seek advice from knowledgeable staff, physically examine products, and make immediate purchases. Offline distribution also fosters consumer trust through face-to-face engagement, particularly among those who value hands-on experiences and personalized guidance when selecting Nootropics. Offline channels often create opportunities for nootropic brands to participate in local events, workshops, and seminars, further reinforcing their presence within the health and wellness community.

Online distribution has emerged as a dominant force in the nootropics market, propelled by the digital age and changing consumer shopping patterns. E-commerce platforms, brand websites, and online marketplaces provide consumers with the convenience of researching, comparing, and purchasing nootropic products from the comfort of their homes. The online realm facilitates transparent access to product information, consumer reviews, and educational resources, enabling consumers to make informed decisions.

By Form

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client