March 2024

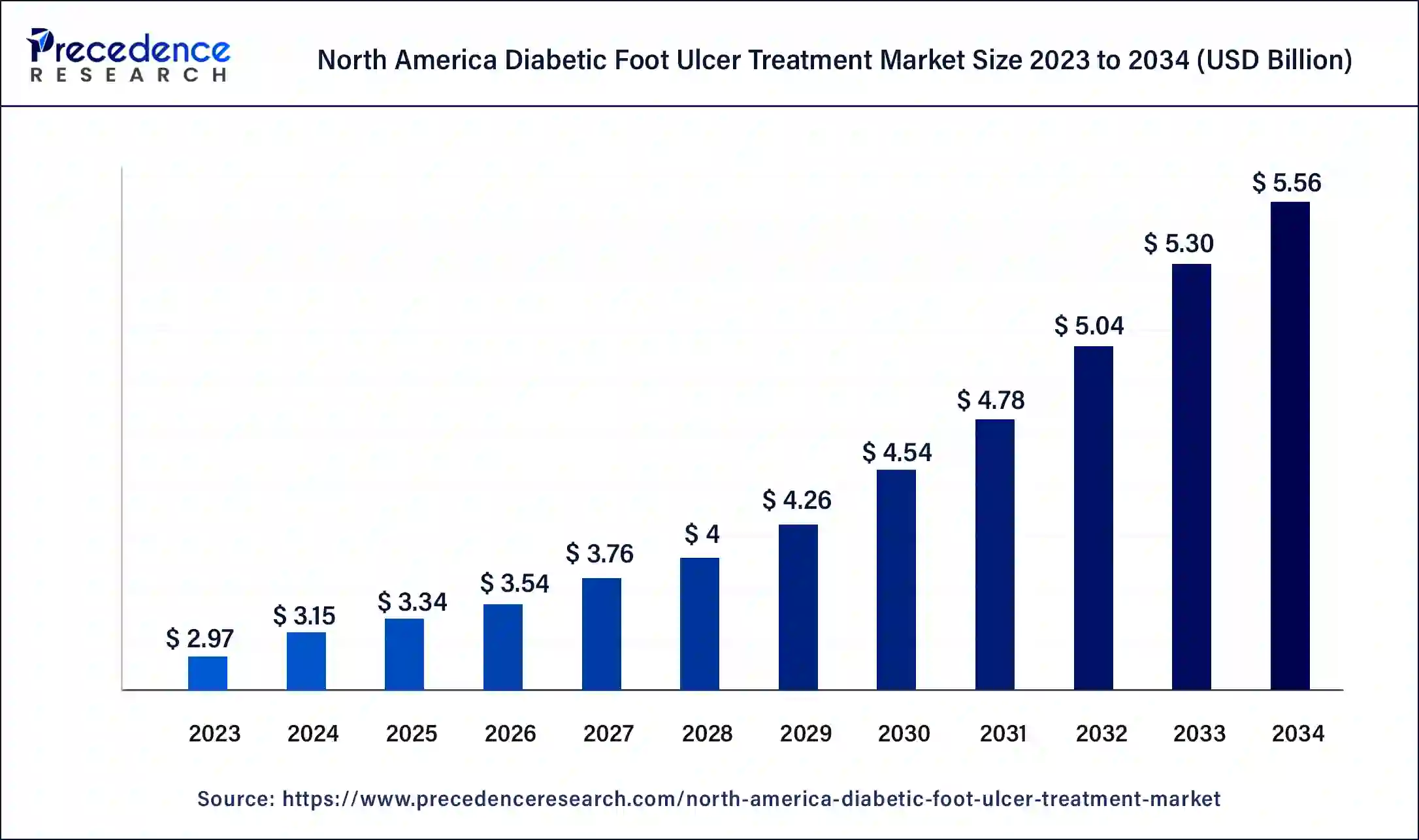

The North America diabetic foot ulcer treatment market size surpassed USD 2.97 billion in 2023 and is estimated to increase from USD 3.15 billion in 2024 to approximately USD 5.56 billion by 2034. It is projected to grow at a CAGR of 5.86% from 2024 to 2034.

The North America diabetic foot ulcer treatment market size is projected to be worth around USD 5.56 billion by 2034 from USD 3.15 billion in 2024, at a CAGR of 5.86% from 2024 to 2034. The rising cases of diabetes, and advanced research and development drive the North America diabetic foot ulcer treatment market. Alongside, the well-established healthcare infrastructure is observed to promote the market’s expansion in the upcoming years.

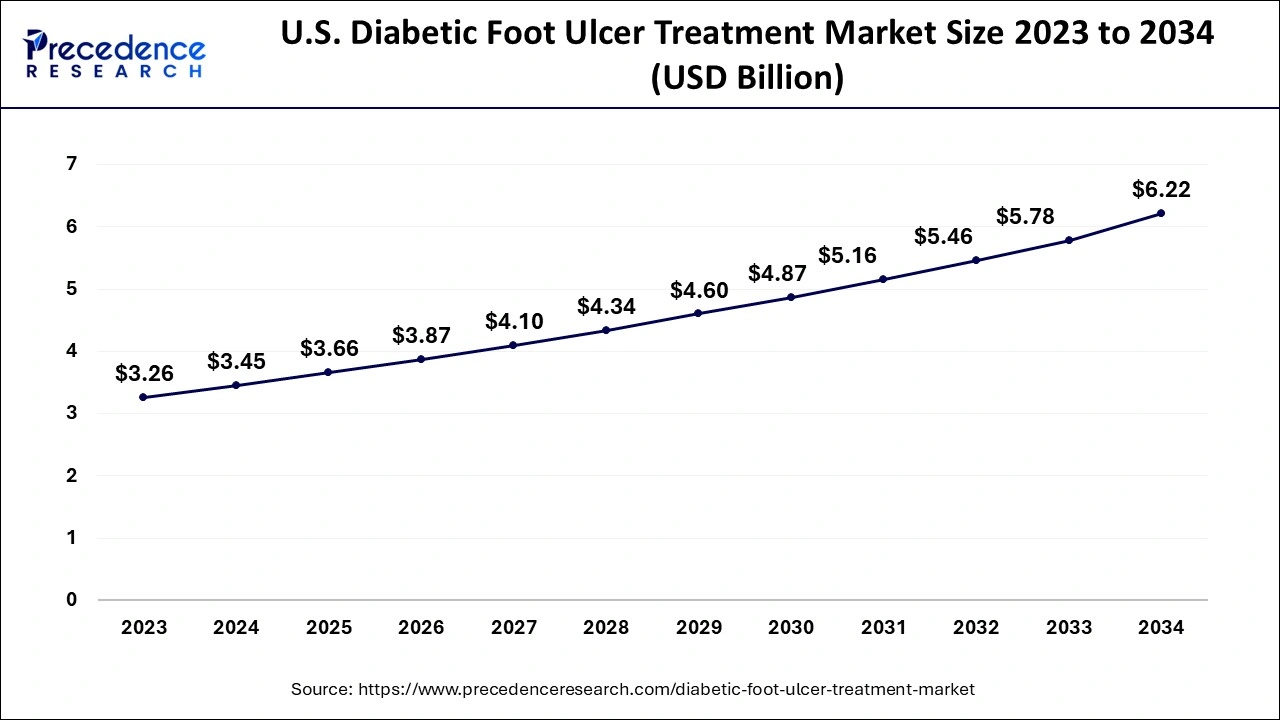

The U.S. North America diabetic foot ulcer treatment market size was exhibited at USD 2.33 billion in 2023 and is projected to be worth around USD 4.27 billion by 2034, poised to grow at a CAGR of 5.66% from 2024 to 2034.

The global diabetic foot ulcer treatment market size reached USD 8.62 billion in 2023 and is expected to attain around USD 14.44 billion by 2032, poised to grow at a CAGR of 5.90% between 2024 and 2034.

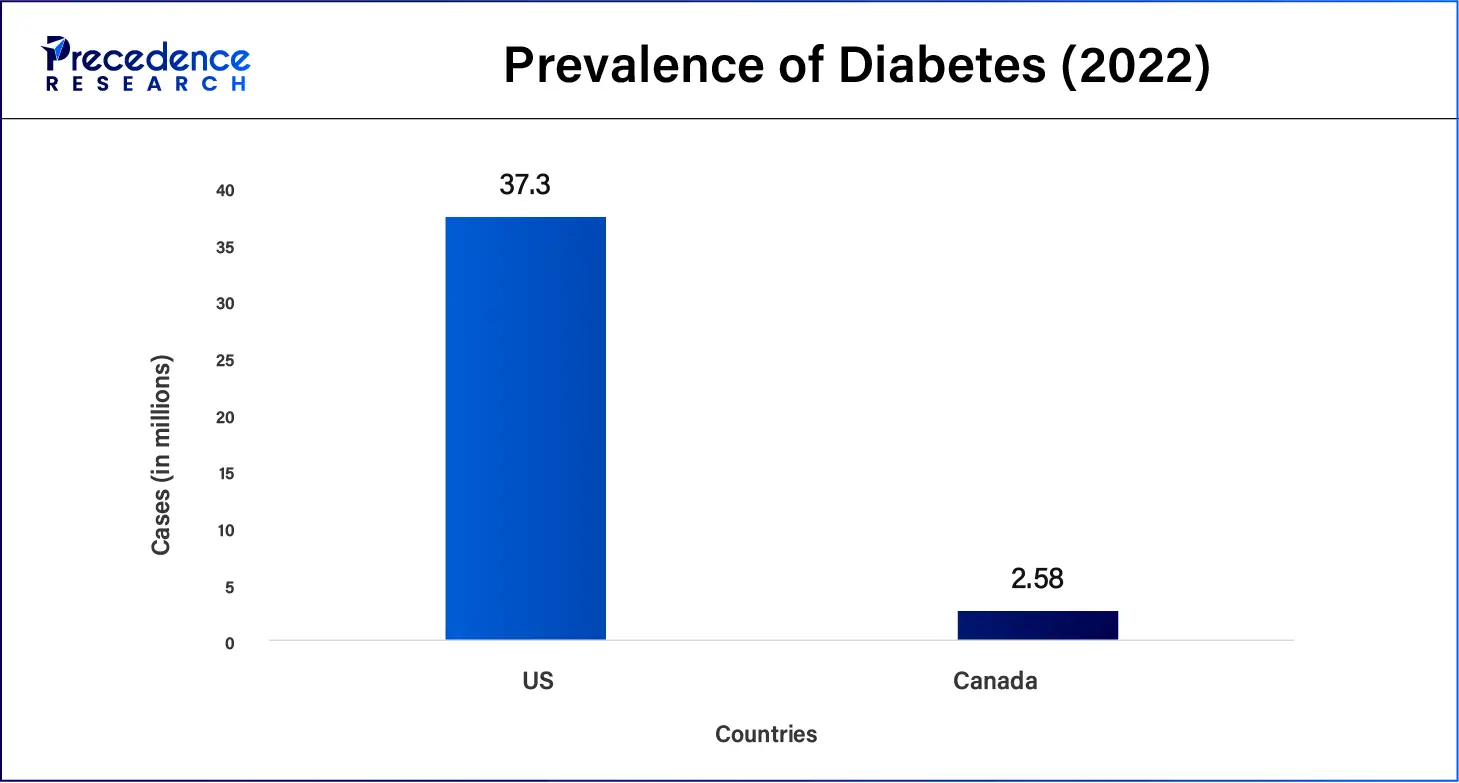

The U.S. dominated the North America diabetic foot ulcer treatment market in 2023. The rising prevalence of diabetes is a major concern for the increasing cases of DFU. Approximately 18.6 million people worldwide are diagnosed with DFU every year, with 1.6 million in the US itself. The growing research and development and the state-of-the-art healthcare facilities boost the market growth in the region. The government initiatives on combating diabetes and reimbursement policies also augment the market growth.

Canada is anticipated to grow the fastest during the forecast period in the North America diabetic foot ulcer treatment market. The rising prevalence of diabetes, growing research and development, state-of-the-art healthcare facilities, increasing awareness, increased collaborations, government initiatives, and investments drive the market growth. Ontario offers full coverage for off-loading devices in the Canadian province.

Diabetic foot ulcer (DFU) is a wound affecting the big toes and the balls of the feet, caused due to neuropathic and/or vascular complications in diabetic patients. These ulcers are formed due to the breaking down of skin tissue and exposing the layers underneath. DFU can be caused by anyone suffering from diabetes. About one-third of people with diabetes develop DFU once in their lifetime. DFU can be treated by wearing special shoes designed for diabetics or a brace, specialized castings, or using a wheelchair or crutches. DFU patients can be treated by applying dressings, removing dead skin or foreign objects causing foot ulcers, also known as debridement, or by physical exercises. Patients are prescribed antibiotics, antiplatelet, and anticlotting medications if the infection persists.

Major Breakthroughs Made for Ulcer Treatments

What is the role of AI in Ulcer Treatment?

The development of AI and ML technologies promotes diabetic foot ulcer treatment through improved precision and customized treatment plans. These advanced technologies facilitate the early detection of DFUs by leveraging biomarkers and promoting timely intervention. In addition, AI can also predict the healing trajectory of DFU, assess the high risk of the disease, and suggest personalized treatment options.

Also, the emergence of smartphones and smart tools simplifies the measurement process such as wound surface area and duration, thereby facilitating effective treatment. This encourages the use of telemedicine, especially for the rural population. Furthermore, AI can also assist healthcare professionals in surgeries by using robots. Therefore, enabling early detection and personalized treatment strategies by AI improves patient outcomes. AI also helps optimize healthcare resources by lowering the clinical burden and the incidence of serious consequences related to diabetic foot ulcers.

| Report Coverage | Details |

| North America Market Size by 2034 | USD 5.56 Billion |

| North America Market Size in 2023 | USD 2.97 Billion |

| North America Market Size in 2024 | USD 3.15 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.86% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Ulcer Type, Treatment, and End-user |

Increasing diabetes prevalence

The increasing prevalence of diabetes mellitus (type 1 and 2) leads to serious complications like heart disease, stroke, blindness, kidney failure, diabetic neuropathy, etc. Such severe factors are observe to act as a driver for the North America diabetic foot ulcer treatment market. Patients living with more than 10 years of diabetes have a high chance of developing DFU in their lifetime.

It has been reported that around 537 million people globally suffer from diabetes, out of which 19% to 34% develop DFU in their lifetime. Of these, approximately 20% of DFU patients are estimated to require lower-extremity amputation and 10% will die within 1 year of diagnosis. Hence, effective treatment of diabetic foot ulcers in North America is essential. Additionally, the diabetes-related health expenditure in the US was estimated to be around $412.9 billion in 2022, whereas that in Canada was estimated to be around $14.3 billion in 2021.

High Treatment Cost

Diabetic foot ulcers are one of the most severe complications of diabetes, resulting in reduced quality of life and financial burden on individuals. The high treatment costs of DFUs limit the affordability of patients. Lack of awareness among individuals combat the early diagnosis and lower screening rates, thereby limiting the treatment for DFU patients. The limited treatment regimens and high recurrence rates result in low patient adherence. All these aspects along with limited adoption in underdeveloped areas are observed to hinder the growth of North America diabetic foot ulcer treatment market.

Integration of Cell and Gene Therapy

The conventional treatment regimen fails to provide complete relief from the DFUs. Hence, several researchers are investigating the effect of cell and gene therapy for therapeutic intervention. Cell and gene therapy have provided promising results in patients, promoting its widespread use. This regenerative medicine promotes angiogenesis, cell proliferation, and collagen deposition, and ameliorates neuro-ischemia and inflammation. With the technological advancements, such integration is observed to offer sustainable opportunities to the North America diabetic foot ulcer treatment market.

It has been found that growth factors are actively involved in DFU pathogenesis, hence targeting them can prove to be an effective strategy. Cell and gene therapy enhances the delivery efficiency of growth factors. At present, there are around 36 clinical trials, assessing the role of cell and gene therapy in treating DFUs. Hence, cell and gene therapy has a huge potential in the future for the effective treatment of DFU.

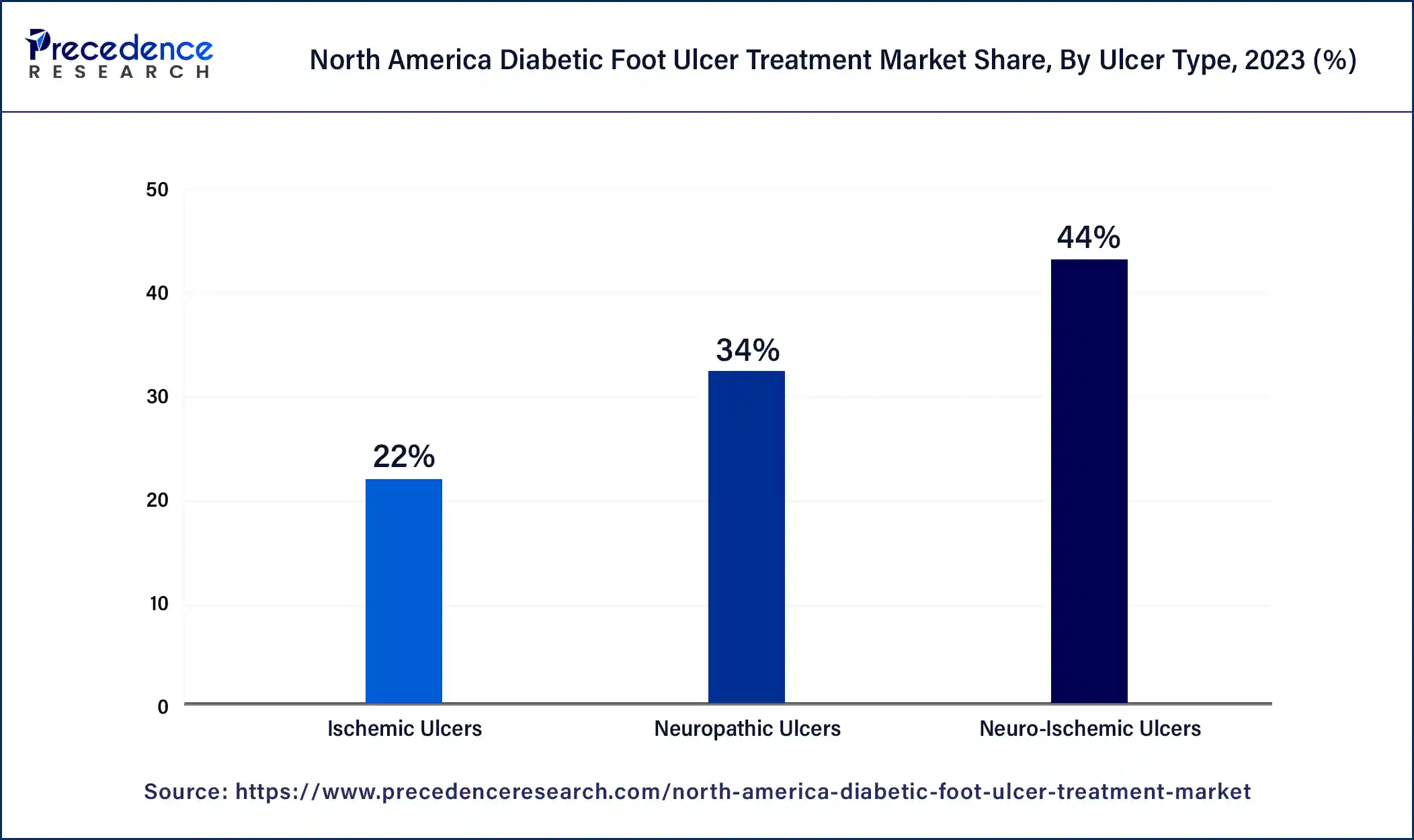

The neuro-ischemic ulcers segment dominated North America diabetic foot ulcer treatment market in 2023. Neuro-ischemic ulcers are a combination of peripheral neuropathy and ischemia, i.e., loss of neuronal sensations and blood flow, respectively. It is estimated that around 15-20% of diabetic patients develop peripheral artery disease after 10 years of diagnosis, and nearly 45% of diabetic patients develop peripheral artery disease after 20 years. The emergence of neuro-ischemic ulcers is increasing gradually among diabetic patients. They develop on toe tips and beneath overly thick toenails. However, they possess a high risk as they are incurable, infectious, and lead to amputation, and death. Hence, the increasing cases of neuro-ischemic ulcers, their severity, and growing research and development augment the market growth.

The neuropathic ulcers segment is estimated to grow fastest during the fastest period. Neuropathic ulcers affect the nerves of the feet and legs that carry touch, temperature, and pain messages. They are caused by trauma or pressure that goes undetected due to a lack of sensation around pressure points. Neuropathic ulcers are the most prevalent type of ulcer, affecting up to 50% of diabetic patients during their lifetime. This further drives the market growth.

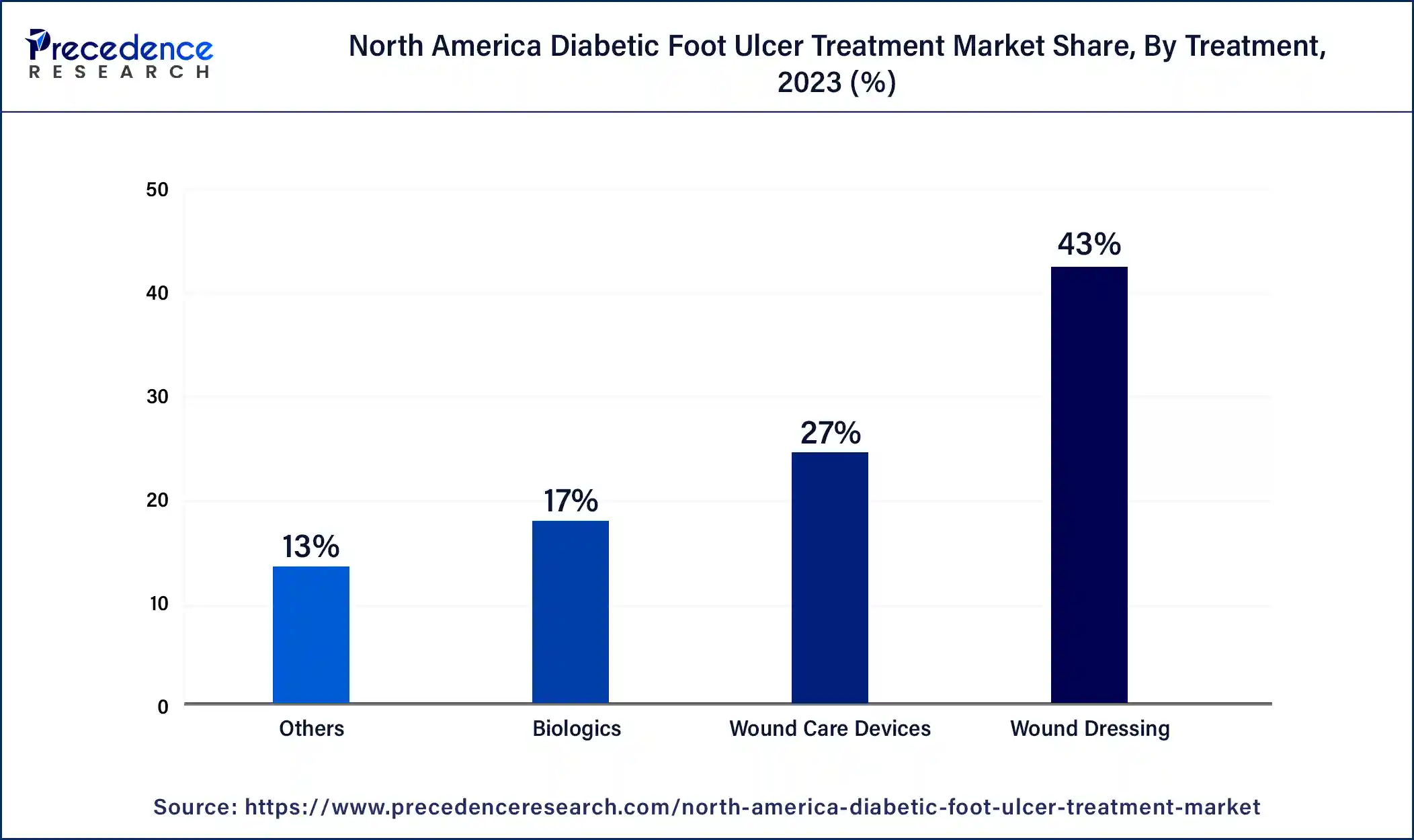

The wound dressing segment dominated North America diabetic foot ulcer treatment market in 2023. Wound dressing is the most common choice for DFU patients. The wound is generally cleaned with saline and a topical gel or antibiotic ointment is applied and wrapped with a clean gauze dressing. Dressings alleviate symptoms, provide wound protection, and encourage healing. They are also cost-effective, hence preferred by a larger population. The different types of dressings include non-adhesive dressings, foam and alginate dressings, hydrogels, inadine and silver dressings, and occlusive dressings. Physicians prescribe the type of dressing depending on the severity of the patient.

The wound care devices segment is estimated to grow fastest during the forecast period. The devices offer advanced care and relief from the symptoms. The wound care devices include therapeutic footwear, brace, specialized castings, wheelchairs, or walking aids for “off-loading”. WHO has released guidelines for promoting assistive technology and rehabilitation services for people living with diabetes and its related complications. These aspects augment the growth of the market.

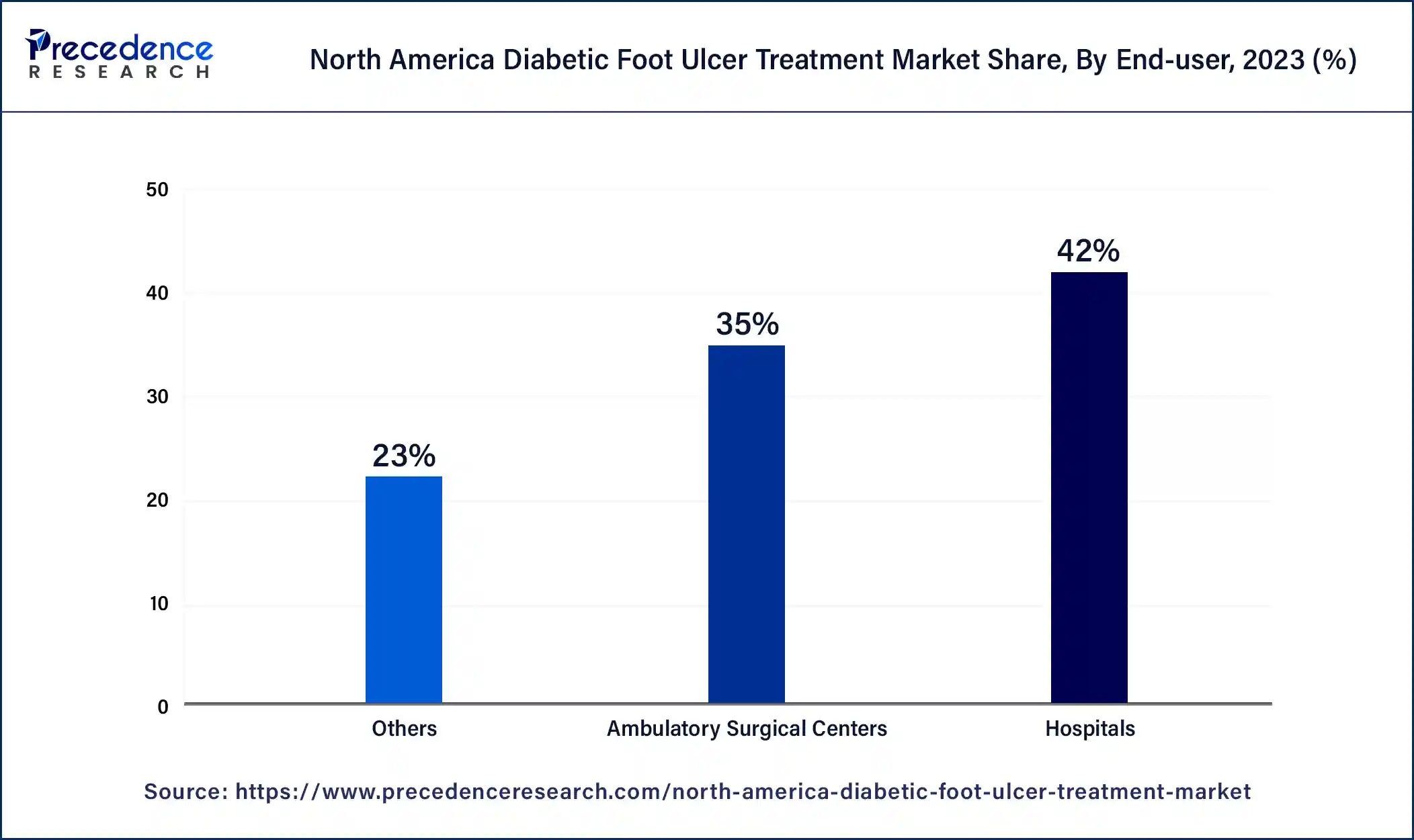

The hospital segment dominated the North America diabetic foot ulcer treatment market in 2023. Hospitals offer a multidisciplinary approach to DFU, integrating the expertise of diabetologists, nutritionists, podiatrists, physiotherapists, etc. Hospitals provide a wide range of services from diagnosis to complete treatment with the availability of special instruments and equipment making it a preferred choice for patients. Additionally, the advancements in surgical instruments encourage patients to prefer hospitals.

The ambulatory surgical centers segment is estimated to grow fastest during the forecast period. Ambulatory surgical centers (ASC) are modern healthcare facilities specializing in same-day surgical care. They revolutionize the outpatient experience for millions of Americans by offering patients a more convenient option to hospital-based outpatient operations. They offer numerous surgical interventions including pain and podiatry. The lower cost and reduced time of patient admission encourage the use of ASC among individuals.

Segments Covered in the Report

By Ulcer Type

By Treatment

By End-user

By Country

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

December 2024

January 2025

March 2025